Data on those negative amortization mortgages

Queston 1: What about all these (negative amortizing) mortgages that will now take 71 years to pay off?

Answer:

Yes, they are called VRMs – Variable rate Mortgages – and we don’t really offer/sell /even talk about them for that exact reason – what if the rates rates jump? And they did.

We do offer ARMs – Adjustable Rate Mortgage – and we do recommend as of August 2023 because:

- Rates have topped and are slowly on the way down right now so the rate will go down

- The current rate starts lower than the 1, 2, 3, and 4 year fixed right now; and ARM rates should be below the 5-year fixed by Fall of 2024.

Question 2: What is the difference between VRM and ARM?

- With an ARM – adjustable rate mortgage – the amount of your payment will go up and down based on the changes of the prime lending rate

- The VRM – Variable rate mortgage – your mortgage payment amount always remains the same. It does not go up and down with changes in the prime lending rate. And when rates jump to 4x what they were when your loan started, then you are not even paying interest any more, and end up at 70 years left to pay it off.

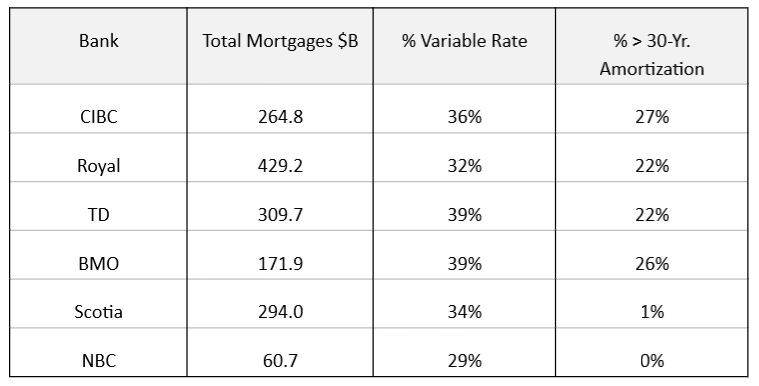

As the article below states, VRMs are mostly from BMO, CIBC, Royal Bank and TD.

ARMs – Adjustable rate mortgages – are what we offer, they can’t have a negative amortiztion and we don’t have any customers that were affected with negative loans.

Mortgage Mark Herman, best top Calgary mortgage broker

Concern over rise in negative amortization mortgages

On October 30th, the Bank also highlighted concern over negatively amortizing mortgages. Negative amortization occurs when a borrower’s monthly mortgage payment is less than the interest due on the loan and the outstanding mortgage balance grows over time rather than declining. This phenomenon is mostly associated with variable rate mortgages.

Those who bought or refinanced homes during the pandemic, when interest rates were at their lowest, heavily opted for variable rate mortgages (VRMs). In Canada, most VRMs come with fixed payments, where the interest portion is determined by the prevailing prime lending rate, while the rest is used to repay the principal. As a result, the Bank of Canada’s series of rate hikes – from 0.25% to 5% – has propelled growth in negative amortization mortgages with terms exceeding 30 years.

As of July 31, negative amortization mortgages were 24% of total mortgage portfolios (insured and uninsured) for BMO, CIBC, Royal and TD. This is equivalent to $277 billion in mortgages – up from virtually nil a year ago. National and Scotia mainly offer adjustable-rate mortgages – as rates change the mortgage payment changes to keep the amortization period fixed – so both banks have negligible exposure to negative amortization within their mortgage portfolios.

Variable Rate Exposure (as of July 31, 2023)

Source: Fitch Ratings

Canada’s banking regulator, the Office of the Superintendent of Financial Institutions (OFSI), has announced regulatory changes to address risks related to mortgages in negative amortization. Effective early next year, banks will be required to maintain a higher amount of capital, reflecting the elevated risk associated with mortgages in negative amortization when the loan-to-value ratio (LTV) surpasses 65% (i.e. when the outstanding mortgage balance is 65% or more of the value of the underlying property). The proposed changes are designed to incentivize banks to reduce the volume of mortgages that could potentially go into negative amortization.

Mortgage repayment trends

To assess how borrowers are reacting to the increase in rates, the prepayment report for floating rate 5-year mortgage-backed securities (MBS) pools, published by CMHC, serves as a valuable tool. Although it doesn’t pinpoint individual issuers, the report offers a comprehensive look at trends within the banks’ variable-rate mortgage (VRM) portfolio.

Report data indicates that borrowers with VRMs have been effectively managing impacts of rising rates by making partial principal payments or transitioning to fixed-rate mortgages. Enforcement activity, which is undertaken when a borrower is unable to make mortgage payments, has been minimal, which suggests that despite the rise in rates, defaults have remained low.

Also, the majority of non-amortizing mortgages, where payments are covering interest only, were recorded between November 2022 and February 2023. This is a positive sign that banks have taken measures to limit the growth of these mortgages.

One caution is around borrowers whose mortgage rates have exceeded the trigger point – that is, the rate at which the regular payment is no longer enough to cover the full amount of interest accrued since the last payment. These borrowers might encounter payment shock when their loans mature and are re-underwritten based on the original amortization but at higher rates and with larger principal amounts.

Those who were first-time homebuyers with high loan-to-value ratios, purchasing at or close to peak prices in 2020 or 2021, could face significant challenges during renewal, particularly if their equity position has been significantly eroded. Similar to Fitch, we anticipate that delinquency rates will not rise in 2024, remaining within the expected range of 0.2-0.25%.

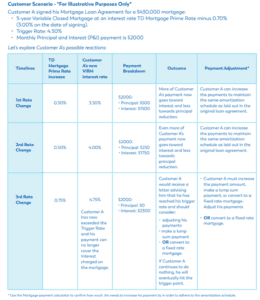

Trigger Point for Canadian Variable Rate Mortgages Explained, with Example

You have likely heard – or will soon be hearing – a lot of talk about “trigger rates” and “trigger points”. More importantly, you are probably hearing “trigger point” together along with more changes in the Bank of Canada rate and you need expert guidance.

Let’s start with a few definitions:

- Variable Rate Mortgage (VRM) – prime changes, rate changes. When interest rates change, typically, your mortgage payment will stay the same.

- Adjustable Rate Mortgage (ARM) – prime changes, rate changes. Unlike variable rate, your mortgage payment will change when interest rates change.

- Trigger Rate – When interest rates increase to the point that regular principal and interest payments no longer cover the interest charged, interest is deferred, and the principal balance (total cost) can increase until it hits the trigger point.

- Trigger Point – When the outstanding principal amount (including any deferred interest) exceeds the original principal amount. The lender will notify the customer and inform them of how much the principal amount exceeds the excess amount (Trigger Point). The client then typically has 30 days to make a lumpsum payment; increase the amount of the principal and interest payment; or convert to a fixed rate term.

NOW, WHICH MORTGAGES WILL BE AFFECTED FIRST?

Quick answer, VRMs from March 2020 to March 2022.

During the month of March 2020, the prime rate dropped three times in quick succession from 3.95% to 2.45%, and variable-rate mortgages arranged while prime was 2.45% have the lowest payments. The lower the interest rate was, the lower the trigger rate, and the faster your client may hit this negative amortization.

WHAT TO DO

When this happens, customers are contacted by the lender and generally have three ways they can proceed:

- Make a lump-sum payment against the loan amount

- Convert with a new loan at a fixed-rate term

- Increase their monthly payment amount to pay off their outstanding principal balance within their remaining original amortization period

Below is a customer scenario so you can see how this could play out.