Rates increasing from 111-year, all-time lows now or soon!

Below is a great blurb on what is happening with yo-yo predictions of the future of mortgage rates. Get pre-approved now, consider locking-in if you were going to OR redo your mortgage now for the last of these low rates!

OPINION:

The laws of gravity dictate that what goes up must come down but I’m afraid, when it comes to the laws of economics and interest rates, what goes down must come up. Ultra-low interest rates are only a short-term solution and not sustainable in the long run. This is something which all economists agree on. Unfortunately this is the point where the common consensus ends and opinions diverge. The issue which is most divisive amongst the experts at the moment is exactly when these rate hikes will begin. As recently as a month ago many experts were predicting that rates would remain at their current levels until as late as March of 2012. A tumultuous week in the markets has seen many of these experts revise their predictions, with many now citing September as the month to bring a halt to the rate freeze.

Surprising inflationary reports for May demonstrated the fastest annual rate in eight years. While Mark Carney previously highlighted the transient threat of rising gas prices, which witnessed a 30% rise, gas prices were not alone in driving the inflation. Even the core rate, which strips out the more volatile prices of food and fuel, rose to a rate of 1.8%, quickly racing towards the Bank of Canada’s 2% target rate. With Canadian inflation now standing at 3.7%, exceeding those of Australia (3.3%); Mexico (3.3%); Chile (3.3%) and Columbia (3.0%) the calls for increased rates have grown ever louder. The fact that these countries all have short-term rates exceeding 4%, while Canada’s lingers at 1% only strengthens the case for a rate increase.

This week also saw a dramatic surge in 5 year bond yields. On Monday the yield had fallen to 2%, leading many to speculate that lenders would be forced to further drop fixed rates, which have already been subject to a series of slashes in the last few months. However these calls were short-lived as yields rebounded strongly in the face of the inflation report combined with renewed hopes that the European Central Bank could be able to prevent the default of Greek debt.

So what does this mean for your mortgage?

It means that if you are looking for pre-approval for a purchase or refinance there has never been a better time to secure your rate with Mortgage Mark while rates are still low. For those of you in a variable rate we’d like to reassure you that we still think this is still a good option. However our variable rate clients should prepare their finances and make sure they will be able to handle a potential increase to their payments coming in September. If you would like further details on any of the information listed here we implore you to call Mark Direct at 403-681-4376 for our sound, unbiased mortgage advice.

Don’t be afraid to leave your bank for a better rate

Don’t be afraid to leave your bank for a better rate

Jay LaPrete

A new survey from CMHC says the vast majority of Canadians renew their mortgages with their original lender, but you can save thousands over the life of a mortgage by looking at competing rates from competing institutions and mortgage brokers.

Garry Marr, Financial Post · Jun. 23, 2011 | Last Updated: Jun. 27, 2011 7:47 AM ET

Are the banks doing an incredible job of retaining customers or are Canadians just too lazy to shop around when renewing their mortgages?

One finding of a survey by Canada Mortgage and Housing Corp. released this week was that 89% of consumers renewing their mortgage stay with the same financial institution. And 68% stay when they are doing a refinancing.

“They stay with the lender because of rate and they leave the lender because of service,” says Pierre Serré, vice-president, insurance product and business development, with CMHC.

Consumers are more aggressive shoppers when they are seeking a mortgage to buy their first home than they are upon renewal. Only 57% of first-time buyers took out their mortgage with their existing financial institution.

Rob McLister, a mortgage broker and editor of Canadian Mortgage Trends, says the banks are doing more to retain customers but there is a pretty good chance you won’t get the best deal if you renew automatically.

“Most of the time people do some rudimentary research before they go back to their lender. Not so long ago people would just take the renewal letter, sign it and send it back. It still happens but not as much anymore,” he says.

Mr. McLister says the banks “are not as stupid” now and when they send out renewal rates they have special offers. The posted rate on a five-year fixed closed mortgage today is 5.39% but he’ll see clients get offers in the mail as low as 4.04% in a renewal letter. The problem is a broker could probably get you 3.59% — meaning you just left 45 basis points on the table.

On a $250,000 mortgage at 4.04% paid monthly and amortized over 25 years, the monthly payment would be $1,320.48, with the interest cost during a five-year term at $47,014.79. Chop the rate down to 3.59% and the monthly payment drops to $1,260.09 ,with the interest over the five years falling to $41,658.85.

If you were crazy enough, or lazy enough, to take the posted rate, you would pay $1,510.01 monthly for the same mortgage and your interest cost would jump to $63,201.92.

Let’s just say it pays to shop around. So why don’t more people do it?

There is a perception that it’s difficult to switch banks, plus it will cost you some money to switch. Yes, it’s a hassle but for $5,000-plus, count me in. As for the costs, the bank you are switching to will often cover your legal costs. Even if it doesn’t or say you face a discharge fee of $300, that’s small price to pay upfront.

Mr. McLister says if you change the terms of your mortgage and refinance, it could cost you as much $700 to switch, something you would have to do if you have a home-equity line of credit or have a collateral charge on your mortgage.

Elton Ash, regional executive vice-president with Re/Max of Western Canada and a long-time realtor, says for most people if the customer service is good, they stay.

“Unless the lender has really screwed up, they stay,” says Mr. Ash says. “It’s like realtors, not all of them charge the same fee. There are lots of discounters out there but it’s based on service levels more than costs and fees, if it’s relatively competitive.”

The banks are more competitive these days for existing customers. Part of the reason is it can cost a financial institution up to 30 basis points to attract a new customer, so why not just spend the money on retaining existing customers?

“We start calling customers in advance to remind them their mortgage is coming up,” says John Turner, director of mortgages at Bank of Montreal. “It is an increasingly competitive marketplace and customers are shopping. It’s in our interest to advise the customer of their options. That could include refinancing the mortgage overall.”

Farhaneh Haque, regional manager of mobile mortgage specialists with Toronto-Dominion Bank, says her bank starts calling customers as much as 120 days before renewal to discuss options.

“This all about relationships, they are not going to up and leave for a five-basis-point difference,” Ms. Haque says.

She’s right. A 0.05 percentage point is not a great reason to sever your relationship. But renewal time is a great time to test your relationship with your bank and get it to show you some love — or a better rate.

Financial Post

gmarr@nationalpost.com

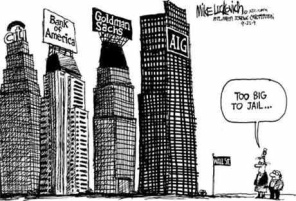

Too Big To Fail

Too Big To Fail

This is a re-post of a great blurb by Boris Bozic, President of MERIX, a broker only lender. He is a pretty smart gent and his light and direct points are worth the 3 minutes it takes to read this.

28 Jun

This was a term we were all too familiar with back in August and September of 2008. It is also the name of a new HBO movie which chronicles what transpired at the beginning of the sub-prime mortgage meltdown. HBO assembled an outstanding cast, and given the subject matter the movie was rather entertaining. I would highly recommend watching the movie. It is a good reminder to all of us that the term boom and bust is as applicable today as it always has been.

This was a term we were all too familiar with back in August and September of 2008. It is also the name of a new HBO movie which chronicles what transpired at the beginning of the sub-prime mortgage meltdown. HBO assembled an outstanding cast, and given the subject matter the movie was rather entertaining. I would highly recommend watching the movie. It is a good reminder to all of us that the term boom and bust is as applicable today as it always has been.

In typical Hollywood fashion, a liberal bias amounting to revisionist history, the movie tried to blame George W. Bush and Ronald Reagan for the meltdown, and all other evil things. The truth is you can go back to the Jimmy Carter administration, and the passing of the Community and Reinvestment Act. That work of art stated that home ownership was a right, and not a privilege. This is where the slippery slope began. Then old Slick Willie, aka “which way are the political winds blowing today because that’s what I’ll stand for”, Bill Clinton, put that program on steroids. Suffice to say the responsibility for the meltdown, and the nuclear fueling of the problem, is equal parts Republican and Democratic.

The movie is a great reminder of how perilously close we came to an economic meltdown. How our standard of living was at the precipice. If you think this is hyperbole, because this was really a US issue, the reality is that this carcinogen (sub-prime mortgages) infected world markets. I can’t help but to think about the auto worker in Windsor and Detroit, the welder in Germany, the machinist in France, all, asking the same question: “Tell me again why my pension has taken a hit because of some mortgage problem?” No one from Wall Street could explain what happened in laymen terms. The average person cares little about default swaps, derivatives and mortgage-backed securities. All the layman cares about is finding out who the hell let this happen. That question has still gone unanswered.

The movie doesn’t deal with the who. The movie played up of the part about the moral dilemma the government faced. Who did the government decide to bail out, AIG, and who did they allow to fail, Bear Stearns and Lehman Brothers. All very fascinating and dramatic. But after watching the movie I couldn’t help but ask myself the following question: “How the hell has no one gone to prison over this?” I’m all for a free market system, and the pursuit of wealth, but reckless endangerment of our economy and standard of living should not go unpunished. There were individuals and institutions who knew full well they were passing on toxic assets. They were passing on the risk so they didn’t care. They could care less about the consequences. Yet none of the perpetrators of this ingenious fraud has ever been charged or convicted. You would think at least a couple of them should be experiencing the joys of being passed around in prison for a carton of smokes.

New Virtual Closings for lawyers – the next thing on the way

Innovation In Unlikely Places – Introducing V-Close by Vanguard Law Group

- Sunday, 26 June 2011 13:42

Change is often the end result of something. Once in a while, change is introduced to create not only new results, but an entirely new direction.

Change is often the end result of something. Once in a while, change is introduced to create not only new results, but an entirely new direction.

Enter V-Close, the new virtual document signing service, for clients needing to sign documentation for a Real Estate purchase or sale transaction, born not only from the evolution of technology, but of an understanding of the preferences of the market for convenience, over all other benefits.

Innovation in Unlikely Places

Sanjay Soni, Managing Partner with Vanguard Law Group, recognizes the irony of the wave of change coming from a law group. In fact, the company’s tag line reflects the tongue in cheek nature of the birth place of this evolution: “Innovative Law Firm? Oxymoron? Not Anymore!”

Soni explains: “People are used to technology and access to information in certain parts of the economy, and in certain services. They are not used to it when it comes to legal services- in fact it is quite the opposite. “

“When people think of law firms, technology and innovation is not what comes to their head. We are going after a market that we think is quite untapped. Technology is around you all the time, every day- but when you think about having to go into a lawyer’s office that is not what comes in to your head.”

Much like in the Real Estate and Mortgage Industries, for Soni clients are not only who you do business with, they are why you are doing business at all, and refers to this as the impetus for the advances they have made “My philosophy is very simple: Unless you get clients, you don’t get paid…We wanted to bring a customer centric focus to a law firm… How do we do this? How do we make clients feel like they are getting value out of what they pay for, and really mean it?”

So then, in these client-centric industries, it is about understanding the value of an offering, and making the client aware of it.

What is V-Close?

Education and understanding are some of the cornerstones of communication- necessary for any productive relationship. For Real Estate and Mortgage Professionals, the question might be, why this service, and how does it work- so that they can support clients in weighing their options.

It’s simple really. For a fee comparable to traditional document signing, you essentially sit in your living room, or whatever location suits you, at a designated time, and await the arrival of the Commissioner of Oath.

Says Soni,” The way it works is that we have a secure video link between ourselves, and one of our remote commissioning agents. All of our commissioning agents are Commissioners of Oath, registered with the Attorney General’s office to Vanguard Law Group. “

“They have very modern laptops with dual flat screens. They go into a client’s home after an appointment has been set up. They will turn on their computers and establish a secure wireless link with our central office here in Mississauga, and at that point the clients can see me, and I can see them, and we go over the purchase or sale documents together. Once I’ve finished the explanation of a specific page, we get the clients to sign on a physical piece of paper that the commissioners have with them at the time of signing.”

Demographic Spread

One challenge that Realtors and Mortgage Professionals encounter is a one-size-fits all attitude to technology, as well to servicing the needs of their clients from different generations. Different generations have different needs, understanding, comfort level and expectations when it comes to technology.

What is common among clients though, is the appeal of an idea that they are empowered to pick and choose service in a location and a time that puts them first.

What is unique about this product is that it appeals across generations, for different reasons, as Soni points out, and the limitations from a demographic point of few are few. “We look at every individual who is over 19 as a customer, which is kind of neat. As long as you are selling, refinancing or purchasing a home, we have the service for you.”

This is demographic reach in action, with seniors happy that they don’t have to venture out of their homes (often a challenge for the most hale and hearty with Canadian winters), and for Gen X & Gen Y, they are drawn in by the technology itself.

“This is for every client. We’ve seen that the older demographic may not be into computers so much, however, they are into convenience. They actually understand the value of this to their time. The trade-off from the technology perspective is really their busy lives, and the convenience that this offers. “

“For the younger demographic, they may be first time homebuyers, so they may not realize the hassle involved with going into a lawyer’s office, but they get it from a technology perspective. “

Convenience is the catalyst

Pick an industry, any industry, and you will see clear evidence of evolution driven by delivering customers what they want. And in this age of instant information and convenient access to just about everything at hours that suit consumers, it only makes sense to be open for business when business is there.

To really understand a clients’ needs and wants, one must almost break down processes, working backwards, to understand its’ genesis- rather than just simply trying to market the end result.

As Soni agrees, when you start and finish with the client’s needs, the possibilities are profound.

“I think there is much broader application with what we are doing than just the legal industry… We’re not springing into different areas, but I had a meeting with my accountant the other day to sign paperwork, and the thought went through my head, why am I in your office? I’m signing this paperwork- I can be signing this on the bottom screen, while I can see you on the top screen.”

“There are tremendous implications here, if people think about what they do, and they break down the process of what they are doing and look at what the technological substitute might be, I think there is very wide application in the Real Estate Industry. Anywhere where you need to sign a piece of paper, it should be in an electronic format- and if you need to consult with someone, then you can basically do what we are doing.”

Soni says too, that they have begun to build upon their own design.” We have realized that we have the infrastructure in place- we can actually now create a draft will, based on a checklist, and send it to the customer and then go over the final doing exactly the same process- so now you can do a will at the same time as you are signing mortgage documentation.”

Bricks and Mortar Optional

Part of introducing and selling change, is dealing with objections- and objections and scepticism are not uncommon, especially in the areas of technology- as many consumers are afraid of things like fraud, identity theft and of compromising personal information.

Soni suggests that one must recognize these objections, and address them gently, offering alternatives, and assures too that in theory, there are no differences between a traditional document signing, and a V-Close.

“There is no difference on the other side. If they need to ask questions, they ask questions. If identification needs to be taken, it’s taken by the commissioning agents.

Everything is recorded, which actually enhances the process. From a fraud perspective, it is actually better, we think, than the process today. The Commissioner is key in all of this… We can basically replicate the experience from the office in your own home.”

What’s in it for Realtors?

In this competitive industry, Realtors are always trying to boost value in their relationships with their clients, as a means of standing out from the crowd. Soni says that V-Close offers an opportunity to do just that: “The value add for the agent is to say- You are busy people…Here is a law firm that not only has the technology, but will actually make it easier for you, where you don’t have to take any time off of work, or you don’t have to take any time in the evening… the experience that they have will be

unrivalled by other experiences that they might have- and that is simply based on their busy lives, and the conveniences that we offer.”

Service comes down to facilitation and ease, and Soni gives an example:”Last week- we had an actual signing in two cities at the same time. Father and Son were both on title on the home. The father was in Ottawa, the son was in Toronto. We had two Commissions at the same time, one in Ottawa, one in Toronto- and then I linked them in on my screen. They signed in two cities at the same time, and I did the explanation to both of them. ”

In client-centric business, sometimes there are challenges in meeting clients needs, and in coming up with new ways to over deliver- in ways that the client does not even expect. What this opportunity represents is a chance to give more to your clients, by anticipating their needs before they do. In knowing about the options, and presenting them with a solution that they don’t expect, perhaps because they don’t even know the technology exists, you communicate your own value, and set your service apart.

Canadian economy still near the top of G7

Great news below for anyone thinking of buying their 1st home, an investment property or worried about their job.

OTTAWA – Canada will continue to outperform most economically advanced countries over the next two years, even as the pace slows and risks mount, the IMF says.

The International Monetary Fund’s latest forecast presents Canada as a relative sea of tranquility amid rising global turbulence from European and U.S. debt issues, the aftermath of Japan’s natural disasters, and growing inflationary pressures.

This will result in growth in advanced countries of about 2.5 per cent this year, it says, about half a point lower than last year. And emerging economies as a group will suffer a one-point drop in growth to 6.5 per cent.

As well, the downside risks to the outlook have risen sharply since the IMF’s previous report in April.

“The balance of risks point down more,” it says. “Downside risks due to heightened potential spillovers from other further deterioration in market confidence in the euro area periphery have risen. Market concerns about possible setbacks to the U.S. recovery have also surfaced.

The report doesn’t mention Greece by name but the potential for its government to default on its massive debts — amid public opposition to austerity measures required by its lenders — have been unsettling financial markets.

“If these risks materialize, they will reverberate across the rest of the world — possibly seriously impairing funding conditions for banks and corporations in advanced economies and undercutting capital flows to emerging economies,” it adds.

Despite this, the international financial organization sees Canada trundling along with 2.9 per cent growth this year, and 2.6 per cent next, virtually unchanged since its previous forecast. Those numbers are also identical to the Bank of Canada’s call, made in April.

The projections are in line with a new forecast from the TD Bank, which also sees the global economy slowing but Canada hanging on with 2.8 per cent and 2.5 per cent growth rates this year and next.

Among G7 nations, the IMF sees only Germany doing better with an expected 3.2 per cent expansion this year, but slowing to two per cent next year.

All the forecasters point to a soft spot in the economy occurring at this very moment, in part due to supply-chain disruptions from the Japan disaster.

For Canada, the lull will result in the economy slowing to just over one per cent during this current quarter, from a strong 3.9 per cent in the first three months of 2011.

Friday’s Statistics Canada report that wholesale fell 0.3 per cent in April, in volume terms, adds to the narrative of a struggling economy.

However, the vast majority of analysts view the lull as temporary.

“The fundamental drivers of growth remain in place: overall still-accommodative macroeconomic conditions, pent-up demand for consumer durables and investment, and strong potential growth in emerging and developing economies,” concludes the IMF analysts.

The big change in the report is the IMF’s alarm about future risks. It makes clear the world has come out of the recession, but is not all the way out of the woods yet.

It warns of a heightened potential for negative consequences from the European debt crisis, and fiscal hangovers in the U.S. and Japan.

The IMF says the two economic powerhouses must get their fiscal houses in order.

“For the United States, it is critical to immediately address the debt ceiling and launch a deficit reduction plan that includes entitlement reform and revenue-raising tax reform,” the group says, offering the same advice to Japan.

Earlier this week, Finance Minister Jim Flaherty offered a similar assessment in a speech in New York, warning that not only America’s economy would be impacted by failure to address the problem, but Canada’s and the world’s.

The Canadian Press http://www.therecord.com/news/business/article/549522–canadian-economy-still-near-the-top-of-g7

10 reasons not to panic

This may calm you if the latest economic info is getting you down.

The European sovereign debt crisis, a potential hard landing in China, weak U.S. economic data, and the U.S. debt ceiling debate have provided investors with plenty to worry about. Since none of these problems look like they will be resolved in the immediate future, don’t be surprised if global financial markets continue to be in a rough patch for at least a few more weeks.

Despite the unpleasant stew that is brewing, it is not noxious enough to either derail the economic recovery or upend the market rally of 2011, says Joseph P. Quinlan, chief market strategist at U.S. Trust, Bank of America Private Wealth Management.

In a recent research note, Mr. Quinlan points out that June is often a lousy month for equities, as the Dow Jones Industrial Average has fallen for the past six years.

“Early indications are that this June will be no better,” he says. “However, beyond the daily gloom and doom, investors should not overlook the fact that the financial markets and global accounting, while facing some stiff headwinds, also have a number of significant tailwinds working in their favor.”

The strategist provided ten reasons why investors should not panic.

1. Corporations are flush with cash

After a two-year profit boom, corporations are putting this money to work in the form of both climbing capital expenditures and hiring. At the same time, share buybacks and higher dividends are on their radars. So despite the deleveraging of U.S. households and the government’s credit limit challenge, the strong capital position of many corporations will be an important driver of the economic expansion in the medium term.

2. Unemployment numbers are misleading

The U.S. unemployment rate remains elevated at 9.1% in May 2011. However,95% of the skilled labour force is currently employed as workers with four-year college degrees or more have an unemployment rate of 4.5%. This cohort accounts for a disproportionate share of personal consumption.

3. U.S. exports are going strong

Total exports hit an all-time high of US$172-billion in March 2011. With the weak U.S. dollar and continued growth overseas, exports should remain strong over the medium term and cement America’s position as the top exporter of goods and services globally.

4. State finances are improving

The weak housing market continues to put pressure on state finances, but the worst is over for many as better-than-expected retail sales and other receipts are helping to establish a floor for their financial position.

5. The Fed isn’t changing its stance

The Fed’s second round of quantitative easing is due to conclude at the end of June, but the central bank’s benign monetary stance will be maintained well into the second half of 2011. The Fed is expected to err on the side of too-easy money rather than premature tightening, unlike the European Central Bank.

6. China will engineer a soft landing

With some US$3-trillion in reserves, the Chinese government has the wherewithal to keep growth in the 7% to 8% range in the near term. Despite challenges such as rising wages and higher food and energy costs, China’s economy may slow, but it will still grow faster than most countries again this year. It managed to post more than 9% GDP growth in 2009 as the global economy slumped.

7. Economic weakness provides relief for food and energy prices

The soft patch for global economies will help contain inflation risks and improve consumer sentiment around the world.

8. The euro crisis will be contained

The euro zone’s wealthiest member, Germany, will provide both the political will and capital to prevent Greece, Portugal or Ireland from imploding.

9. The U.S. debt ceiling will be raised

The debt ceiling has been increased more than 100 times in the past. Once this happens again, the focus will shift to tackling the U.S. federal budget deficit.

10. Everyone is not broke

Nor are they in the midst of austerity campaigns. In fact, the IMF estimates that developing nations have somewhere around US$7.5-trillion in international reserves. The deployment of these excess savings will come faster as a result of slow growth in the United States and Europe, helping the global economy maintain a growth rate of 3.5% to 4% in the near term.

http://business.financialpost.com/2011/06/16/10-reasons-not-to-panic/

Alberta renovation spending to lead country

This is great news for Calgary. It shows two things.

1. Due to the home price drops from the peak in 2007 many are choosing to renovate rather than move out of their “upside down” mortgages.

2. The Perfect Home Program allows you to include the cost of renovations in the mortgage when it is purchased. Call to discuss how this program work. It means that you can buy a home in the location YOU want and then make it YOUR Perfect Home with your own kitchen, floors, basement and all the rest.

Alberta renovation spending to lead country

1.7% growth in 2011, 4.9% in 2012.

Renovation spending in Alberta is forecast to lead the country in year-over-year growth this year and in 2012, according to a report by the Altus Group, an economic consulting firm.

The report said spending in Alberta on renovations hit $5.7 billion in 2010, which accounted for 9.5 per cent of all spending in the country. Total spending in the province was up 7.2 per cent from the previous year which was behind many other provinces for annual growth.

Canada saw 9.2 per cent growth in 2010 to $60.1 billion.

Altus Group forecasts spending to increase in Alberta by 1.7 per cent this year and by 4.9 per cent next year — both growth rates leading the nation.

For Canada, the report forecasts a 0.1 per cent decline this year followed by a 3.6 per cent hike in 2012.

“Canada’s general economic recovery continues, but at a modest pace,” said the report. “Job growth has been stronger through the recovery than after the last recession, but still suffers from weakness, particularly in terms of youth and full-time jobs. The cautiously optimistic forecast for economic growth translates into equal caution over the forecast for renovation demand.

“The good news for renovators is that weaker than expected economic growth has extended the period of very low interest rates, perhaps into 2012. Low interest rates are important for this sector both in terms of affordability for those who need to borrow to finance their renovations, as well as in keeping mortgage payments in check, thereby freeing up income for discretionary renovation spending.”

© Copyright (c) The Calgary Herald

Canada’s jobless rate falls to lowest level in two years

this is more great news.

By Julian Beltrame, The Canadian Press

OTTAWA – Canada’s unemployment rate fell to its lowest in more than two years as a combination of more self-employed workers and fewer job seekers in May pushed the key economic marker down to 7.4 per cent.

Statistics Canada said 22,300 new jobs were created last month, slightly above consensus estimates following April’s strong 58,000 jobs gain. The last time Canada’s unemployment rate was as low as 7.4 per cent was in January 2009, a few months after the economy had plunged into recession.

The finer details of the May report were less impressive, however.

The jobless rate dropped two-tenths of a point due as much to the fact that 27,500 fewer Canadians were actively looking for work as to the new jobs created.

While all the jobs were full time, they came in the less desirable self-employment category, which could indicate that many Canadians turned to creating their own employment because they were unable to find more traditional work.

“Small business is of vital importance to the Canadian economy, but job creation within this category in a soft spot for the economy (and) is always a knock against the quality of the headline gain,” Derek Holt, vice-president of economics for Scotiabank, said in a note to clients.

The number of employees in Canada actually dropped by 7,500 in May and the goods producing sector of the economy saw a pullback in employment, with manufacturing taking the biggest hit with 22,500 fewer jobs. The month also showed the public sector is starting to tighten, shedding 44,300 jobs as governments begin dealing with large deficits.

The markets treated the report as a status quo finding. The loonie barely budged after the data was released early Friday, although the currency swooned in later trading on dipping oil prices.

Holt noted that hours worked rose just 0.3 per cent and wages were only 2.2 per cent higher than last year, down from 2.6 per cent in March.

“After stripping out inflation, real wages are going nowhere and that remains bearish for consumer spending as households are simply unable to post income growth beyond covering higher fuel and grocery costs in a generalized commodity shock,” he said.

Still, analysts said any job gain following April’s strong advance is good news. It showed April was not a mirage.

“The details in this month’s job growth were not all rosy, but any gains at all were impressive given that they came on the heels of an outsized 58,000 prior-month tally and amidst signs that the economy is decelerating sharply in the second quarter,” said CIBC chief economist Avery Shenfeld .

Not to be overlooked, he added, is that private sector employers added workers, although a small number.

Another positive for the future, said Jimmy Jean of Desjardins Capital Markets, is that the factory sector is likely to recover once supply chain disruptions from the Japanese natural disaster are resolved.

The summer months will also benefit from an additional $10 million Ottawa is pumping into the summer jobs program to encourage student hiring. Labour Minister Diane Finley says government support will create 36,000 student jobs this summer.

Most economists had predicted a slowdown in job creation not only because they viewed April’s increase as an above-trend anomaly but also because other economic indicators pointed to slowing activity.

Meanwhile, consumer spending and housing have fallen off of late and, earlier in the week, the government reported that the important export sector shrank by 1.1 per cent in volume terms in April.

Despite the softness, Canada’s economy is doing far better than its southern neighbour, which in the same month created only 54,000 jobs, a tiny amount given the size of the U.S. labour force.

In the past year, Canada has more than recouped all the jobs lost during the 2008-2009 recession, creating 273,000 in the last 12 months alone, most full time and in the private sector. Meanwhile, the U.S. remains several million shy of its pre-crisis level and the jobless rate is above nine per cent.

In May, most of Canada’s employment gains came in the retail and wholesale trade industries, and in information, culture and recreation. There were losses in manufacturing and educational services, mostly of those in post-secondary institutions.

Regionally, the lion’s share of job creation came in Quebec, which saw its employment rise by 24,800, while Ontario saw a drop-off of 16,100. http://ca.finance.yahoo.com/news/Canada-jobless-rate-falls-capress-4119373303.html?x=0

Is Calgary’s boom back? Consumer confidence seen climbing ‘with a vengeance’

CALGARY – From BMWs to Bentleys to a good bottle of wine, Calgary consumers are opening their wallets in what’s being described as more than just a recovering economy – with some even willing to say the word “boom” again.

Retailer Wayne Henuset is in the thick of it, discovering his own barometer to measure what is quickly turning into a healthier marketplace.

The owner of Willow Park Wines and Spirits says consumer confidence has been rising “with a vengeance” since fall.

“We know this because when things are bad, people just buy wine, on sale, and bring it home.

“But when times are good, the restaurants are buying more wine from us, because people are going out more. And that’s what’s happening.”

It’s one of myriad examples that suggest Calgary is reclaiming its economic swagger, as sectors across the board enjoy a surge in consumer and investment confidence, including high-end retail, real estate, construction and, most importantly, oil and gas.

Henuset adds that during the 2008-09 recession, reduced prices and spot sales were what brought customers in.

“Now they’re not really paying attention to that as much, they’re just buying whenever,” Henuset said, adding that the pricier, highend bottles are also getting bought up more.

According to the BMO Blue Book report released this week, Alberta is expected to lead the country in real GDP growth by next year as the province’s economy starts humming again.

Real GDP is expected to expand 3.6 per cent this year before moderating to 3.4 per cent by 2012, according to BMO Capital Markets.

In Calgary, recent reports have suggested record leasing activity in the downtown office market last year, with experts saying job growth isn’t far behind.

Meanwhile, job growth has already started in the construction industry with construction giant Ledcor launching a massive recruitment campaign, with plans to hire up to 9,000 people this year in Alberta and other parts of Western Canada.

In the energy sector, industry activity is way up, says oil and gas analyst Peter Linder, with drilling activity significantly on the rise, record land sales and job prospects improving.

Alberta Energy reported this week it had sold oil and gas leases or licences on 271,000 hectares of land worth $842 million, including a whopping $107 million for a 7,900-hectare licence near Red Deer.

“All of that means more activity in the energy industry, and that means much more jobs,” said Linder.

“In fact, I think we’re on the cusp of another significant labour shortage, another boom.”

Even the lower natural gas prices that have been a hurdle in recent years will start to recover, Linder predicts.

“The second half of this year will be far, far better than the last three years.”

Ben Brunnen, chief economist with the Calgary Chamber of Commerce, explains that as oil prices recover, Calgary’s oil and gas sector is enjoying increased activity and investment confidence.

As of March 2011, 59 oilsands projects valued at nearly $100 billion were either planned or already underway in Alberta.

“And when investment is good, incomes increase here. That’s a unique perspective for Calgary because we are the head office of oil and gas,” Brunnen said.

Businesses seem to already be reaping the rewards of more disposable income.

Justin Havre, a realtor with CIR Realty, says Calgary’s real estate market is bouncing back, particularly in the luxury home market with 44 homes sold for over $1 million in Calgary alone last month.

“The luxury market is becoming really active, and it’s usually a good indicator that there’s some confidence in our economy and in Calgary investment.”

Tony Dilawri, who runs several car dealerships including Calgary BMW and the Distinctive Collection, which sells Bentleys and Aston Martins, says the luxury car market has also improved from last year.

“We’re finding consumer confidence is definitely up as people become a little more willing to spend money on their vehicles.”

BMW sales are up 20 per cent from last year, Dilawri said, adding that some 20 new and pre-owned Bentleys and Aston Martins were delivered to customers last month. Dilawri says the Calgary kind of wealth is on its way back, a swagger that’s proud, but not too boastful. Calgary is not like Montreal and Toronto, he said, filled with old money that isn’t always affected by economic shifts.

“We’re young in Alberta, and we work hard for our wealth,” he said.

“So when we get it back, we want to have some fun. We don’t want to boast, but we want to reward ourselves.”

Brunnen agreed Calgary’s economy is bouncing back, but consumers are still cautious.

“The investment is there, and the consumer confidence will come with it.”

While optimism is growing in Calgary, however, the economic mood elsewhere is guarded. Reuters reported last week the global economy is still in flux, with investors wary that the real stresses still lie ahead. European debt uncertainties and the arrest of the head of the International Monetary Fund mixed with Arab revolt and Japan’s recovery from natural disaster are all contributors.

“It is clear that some investors have decided that they need to take some risk off the table, but they do not want to take too much off,” said Andrew Milligan, head of global strategy at Standard Life Investments.

eferguson@calgaryherald.com