Bank of Canada holds benchmark interest rate steady & updates 2022 economic outlook

Summary:

- Prime did not change today, Jan 26, and the Bank of Canada (BoC) clearly said they are planning on starting the needed rate increases at the next meeting in 6 weeks, on Wednesday March 2nd.

- The Market has “priced in” between 4 and 6 increases in 2022, each by .25%, and between 2 and 4 increases in 2023, each by .25%

- There may be fewer increases if inflation returns to the target of 2% from today’s 40 year high of about 5%.

- The USA is seeing record 7% inflation and Canada usually gets dragged along with the US numbers so that balances the possibility of fewer increases.

- Mortgage Strategy – secure a fully underwritten, pre-approval, with a 120- day rate hold, from a person, not an online “60-second-mortgage-app” as soon as you think you may be buying in the next 2 years.

- To start a mortgage application with us, click here, and we will call you with in 24-hours to get things going.

DETAILS:

This morning in its first scheduled policy decision of 2022, the Bank of Canada left its target overnight benchmark rate unchanged at what it describes as its “lower bound” of 0.25%. As a result, the Bank Rate stays at 0.5% and the knock-on effect is that borrowing costs for Canadians will remain low for the time being.

The Bank also updated its observations on the state of the economy, both in Canada and globally, leaving a strong impression that rates will rise this year.

More specifically, the Bank said that its Governing Council has decided to end its extraordinary commitment to hold its policy rate at the effective lower bound and that looking ahead, it expects “… interest rates will need to increase, with the timing and pace of those increases guided by the Bank’s commitment to achieving” its 2% inflation target.

These are the other highlights of today’s BoC announcement.

Canadian economy

- The economy entered 2022 with considerable momentum, and a broad set of measures are now indicating that economic slack is absorbed

- With strong employment growth, the labour market has tightened significantly with elevated job vacancies, strong hiring intentions, and a pick up in wage gains

- Elevated housing market activity continues to put upward pressure on house prices

- Omicron is “weighing on activity in the first quarter” and while its economic impact will depend on how quickly this wave passes, the impact is expected to be less severe than previous waves

- Economic growth is then expected to bounce back and remain robust over the Bank’s “projection horizon,” led by consumer spending on services, and supported by strength in exports and business investment

- After GDP growth of 4.5% in 2021, the Bank expects Canada’s economy to grow by 4% in 2022 and about 3.5% in 2023

Canadian inflation

- CPI inflation remains “well above” the Bank’s target range and core measures of inflation have edged up since October

- Persistent supply constraints are feeding through to a broader range of goods prices and, combined with higher food and energy prices, are expected to keep CPI inflation close to 5% in the first half of 2022

- As supply shortages diminish, inflation is expected to decline “reasonably quickly” to about 3% by the end of 2022 and then “gradually ease” towards the Bank’s target over the projection period

- Near-term inflation expectations have moved up, but longer-run expectations remain anchored on the 2% target

- The Bank will use its monetary policy tools to ensure that higher near-term inflation expectations do not become embedded in ongoing inflation

Global economy

- The recovery is strong but uneven with the US economy “growing robustly” while growth in some other regions appears more moderate, especially in China due to current weakness in its property sector

- Strong global demand for goods combined with supply bottlenecks that hinder production and transportation are pushing up inflation in most regions

- Oil prices have rebounded to well above pre-pandemic levels following a decline at the onset of the Omicron variant of COVID-19

- Financial conditions remain broadly accommodative but have tightened with growing expectations that monetary policy will normalize sooner than was anticipated, and with rising geopolitical tensions

- Overall, the Bank projects global GDP growth to moderate from 6.75% in 2021 to about 3.5% in 2022 and 2023

January Monetary Policy Report

The key messages found in the BoC’s Monetary Policy Report published today were consistent with the highlights noted above:

- A wide range of measures and indicators suggest that economic slack is now absorbed and estimates of the output gap are consistent with this evidence

- Public health measures and widespread worker absences related to the Omicron variant are slowing economic activity in the first quarter of 2022, but the economic impact is expected to be less severe than previous waves

- The impacts from global and domestic supply disruptions are currently exerting upward pressure on prices

- Inflationary pressures from strong demand, supply shortages and high energy prices should subside during the year

- Over the medium term, increased productivity is expected to boost supply growth, and demand growth is projected to moderate with inflation expected to decline gradually through 2023 and 2024 to close to 2%

- The Bank views the risks around this inflation outlook as roughly balanced, however, with inflation above the top of the Bank’s inflation-control range and expected to stay there for some time, the upside risks are of greater concern

Looking ahead

The Bank intends to keep its holdings of Government of Canada bonds on its balance sheet roughly constant “at least until” it begins to raise its policy interest rate. At that time, the BoC’s Governing Council will consider exiting what it calls its “reinvestment phase” and reducing the size of its balance sheet. It will do so by allowing the roll-off of maturing Government of Canada bonds.

While the Bank acknowledges that COVID-19 continues to affect economic activity unevenly across sectors, the Governing Council believes that overall slack in the economy is now absorbed, “thus satisfying the condition outlined in the Bank’s forward guidance on its policy interest rate” and setting the stage for increases in 2022.

Mortgage Rate Holds are the theme for buyers in 2022

Mortgage Mark Herman, your friendly Calgary Alberta mortgage broker & New Buyer Specialist.

2022 Canadian Mortgage Rate Forecast

Why five-year variable rates will likely save money versus their fixed-rate equivalents in 2022 (and beyond).

We begin 2022 with Canadian inflation at its highest level since 2003.

Prices have been driven higher by a combination of surging demand, fueled by generous government support payments, and supply shortages tied to the pandemic.

Both the Bank of Canada (BoC) and the US Federal Reserve have been predicting that these factors will have only a transitory impact on inflation.

The term transitory means “non-permanent”, which still appears to be the correct assessment, but it also means “of brief duration”, which hasn’t been the case.

The experience of hotter and stickier inflation has caused both bond-market investors and the wider public to lose confidence in our central bankers.

That is concerning because if people lose faith in their ability to keep inflation contained, they may start accelerating their purchase plans to avoid future price increases, and any such additional increase in demand would push prices still higher. The longer inflation persists, the more likely it becomes that workers will push for higher wages to compensate for their reduced purchasing power. This engenders a self-reinforcing cycle, where the fear of higher inflation causes it to materialize.

With public confidence waning, both the BoC and the Fed had no choice but to stop using the term transitory and to turn more hawkish on monetary-policy tightening. At this point, higher mortgage rates in 2022 appear all but inevitable. But how high will they go?

The five-year Government of Canada (GoC) bond yield, which our five-year fixed mortgage rates are priced on, has already surged higher in anticipation of five quarter-point BoC rate hikes in 2022 and two more in 2023. Those are some big moves that are already priced into five-year fixed rates if you lock in today.

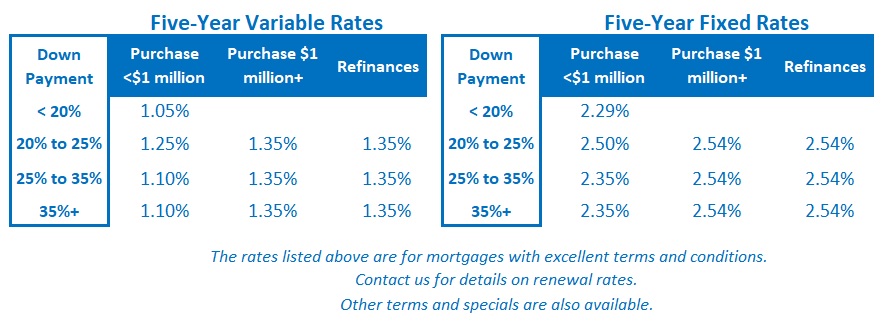

Meanwhile, for at least a little while longer, the BoC’s policy rate stands at 0.25%, and that means five-year variable mortgage rates are still available in in the low 1% range, or about 1.25% below their fixed-rate equivalents. That is a much larger buffer than normal.

The futures market is expecting that spread to disappear by the end of the year, but I am skeptical for the following five reasons:

- Omicron’s Impact Is Being Underestimated

In their initial assessment of the Omicron variant, policy makers assumed that its economic impacts would, like its typical symptoms for the vaccinated, be relatively minor.

The Fed initially predicted that Omicron would exacerbate supply shortages and put more pressure on inflation over the short term, but thus far, Fed Chair Powell has said that Omicron will not have much impact on its plans.

I predicted (here) when he made that statement in December that he would regret it, and if he doesn’t already, I expect he will soon. While Omicron’s typical medical impact on the vaccinated has been minor compared to previous COVID variants, it has still caused hospitalizations to spike and is proving quite severe in the unvaccinated.

US vaccination rates and public safety measures have lagged those in Canada and most other developed countries, and that makes the country much more vulnerable to Omicron. If lockdowns are sworn off and US vaccination rates continue to lag, US hospitals may be overrun. That rising risk increases the likelihood that US economic momentum will slow and that the Fed will turn more dovish.

The approach of most Canadian provinces to Omicron has been more cautious. We have closed schools and reinstituted other lockdown restrictions to try to slow infection rates and keep our health-care system from becoming overwhelmed. That reduces our risk of health harm, but it also increases our risk of economic harm, and that, in turn, should turn the BoC more dovish.

- Inflation Will Cool More Rapidly Than the Market Expects

Our Consumer Price Index (CPI) captures price changes over the most recent twelve months.

Prices started to surge in the second half of 2021, and if inflation is going to maintain its current pace into the second half of 2022, it will take another fresh round of price spikes. This seems increasingly unlikely. Supply constraints are gradually being rectified and Omicron has already made consumers more cautious with their spending.

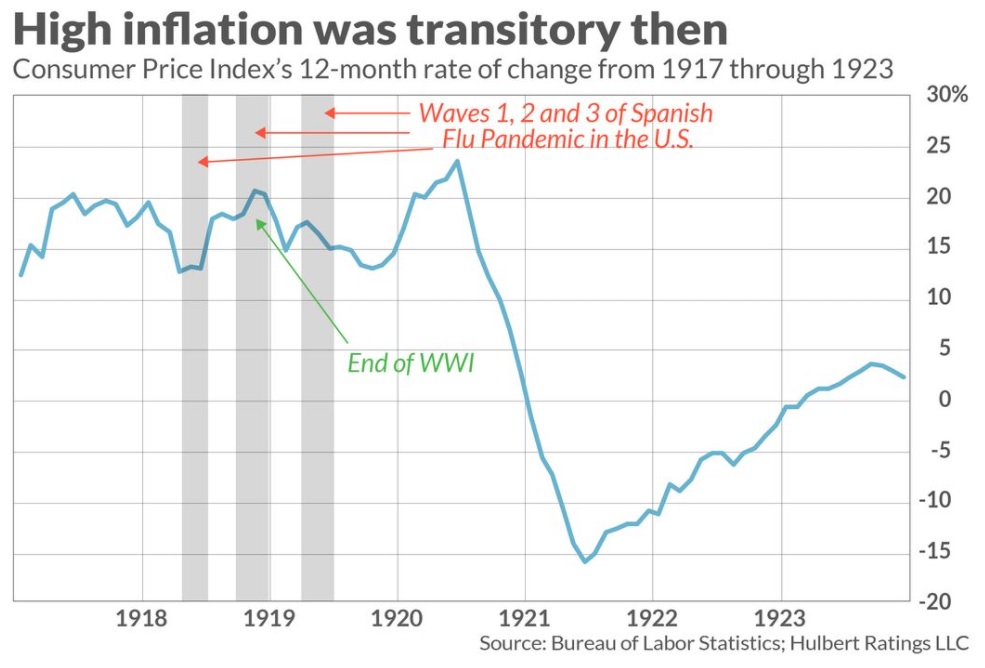

The consensus expects another demand-fueled price spike when we finally free ourselves from the pandemic’s clutches. The theory goes that consumers will spend the cash that they have built up, and that we will see a repeat of the Roaring 20s, when growth and demand surged after the Spanish flu ended.

I have already rebutted that prediction in previous posts. To summarize, the US population was much younger then, US government and household debt levels relative to GDP were miniscule compared to today, and World War I had devastated Europe’s manufacturing capacity, which made the US the world’s dominant exporter over that decade. Very different times.

But what if I’m wrong and we do see a return to the Roaring 20s? Does it follow that inflation will take off?

If past is prologue, the answer is still a firm no.

The chart below shows what happened to inflation when the Spanish Flu ended (and it went on to average less than 2% over the entire 1920s decade).

- There Will Be Much Less Stimulus in 2022

Our policy makers used record levels of fiscal stimulus to offset the pandemic’s initial economic shock.

Those stimuli created many positive short-term impacts that included elevating our GDP, increasing demand, and driving wage growth higher. But those benefits came with a cost. Both US and Canadian budget deficits have soared, driving our government debt levels still higher into the stratosphere.

In addition to being the main contributor to our economic growth in 2021, massive fiscal stimulus was also the primary driver of today’s demand-induced inflationary pressures. But that powerful stimulus has already been sharply reduced on both sides of the 49th parallel, and our governments simply cannot deploy the same largesse to offset any future shocks caused by the pandemic.

The BoC and the Fed are in the same boat as their respective federal governments. They slashed their policy rates to the floor and used quantitative easing (QE), first to flood financial markets with liquidity and then to push bond yields lower. Those moves stimulated financial markets and helped to avoid a repeat of the Great Depression, but they did so by causing asset values to soar, and thereby raising bubble risks across the economy.

Our central bankers now feel compelled to tighten monetary policy to maintain their inflation credibility and help stave off those bubble risks, but that tightening will likely exacerbate, not alleviate, the pandemic’s negative impacts over the year ahead.

If the aggressive rate cuts that have helped asset values surge higher since 2020 are reversed, asset prices would normally reverse direction as well. If that happens, the wealth effect that caused consumers to spend more last year because they were richer (on paper) would also dissipate and cause consumers to turn more cautious.

- The Impact of Rate Hikes Will Be Magnified

Caught between the devil (inflation expectations becoming unanchored) and the deep blue sea (negative economic shocks tied to the pandemic), the BoC and the Fed are reaffirming their commitments to maintain price stability above all else.

But with much less fiscal stimulus buoying economic activity (and exacerbating inflationary pressures), with Omicron’s impacts proving more substantial than first expected, and with elevated debt levels increasing the overall cost of each rate rise, the impact of each hike will be magnified.

All that makes it likely that fewer hikes will ultimately be required to bring inflationary pressures to heel.

If we see anything close to the five BoC rate hikes the consensus is betting on, I think it will prove to be a misstep that will drive our economy into recession. If that happens, rate cuts would almost certainly follow thereafter.

- Labour Costs Will Be Contained

Despite many anecdotes to the contrary, the hard data show that wages are still largely contained in both Canada and the US, even though our employment backdrops are quite different.

In the US, average wages have risen by 4.7% year over year, but they still haven’t kept pace with overall inflation. By the Fed’s own assessment, average wages were suppressed prior to the pandemic, and some of that increase is therefore a catch up. While US employers are still experiencing labour shortages, US workers are expected to return to the labour force now that emergency benefits have expired and they are burning through their built-up cash reserves.

US wages may continue to rise, but so too should the labour-force participation rate as workers start to re-engage out of necessity.

In Canada, our employment recovery has significantly outpaced our overall economic recovery. That’s good for the hiring data but seriously bad for our productivity levels. We are employing more people to do the same amount of work, and that helps explain why our average wages have only increased by 2.9% on a year-over-year basis and why they remain well below their pre-pandemic level with no signs of any imminent breakout.

Now let’s tie all the above commentary back to the key question of whether fixed or variable mortgage rates will prove cheaper in 2022 and over the next five years.

My crystal ball doesn’t come with any guarantees, but with that said, I fundamentally believe the following:

- Omicron’s greater-than-expected impact will make both the BoC and the Fed more dovish.

- Supply challenges will continue to be overcome in the year ahead, and inflation will subside more quickly than expected.

- Demand will moderate without the powerful tailwind of fiscal stimulus.

- The impact of each rate hike will be magnified, and as such, we will need fewer of them.

- Wage growth will not push inflationary pressures materially higher.

Against that backdrop, I expect that variable mortgage rates will save money over their fixed-rate alternatives over the year ahead, and, true to their usual form, are a good bet to do so over the next five years.

It won’t be as easy for variable-rate borrowers this year, because I do expect some rate hikes to ensue, but the gap of about 1.25% over the available five-year fixed rate alternatives provides a large and significant buffer that I don’t think that will close in 2022 as the consensus predicts.

Meanwhile, GoC bond yields have spiked in anticipation of five BoC rate hikes in the year ahead, with two more the year after, and I expect these rates to move lower if and as it becomes clear that the Bank’s raising schedule will be both more gradual and less severe than the consensus forecast.

The Bottom Line: US bond yields have recently surged higher in response to the release of the Fed’s minutes from its December meeting, which revealed that it may tighten more quickly than previously forecast. GoC bond yields have risen in sympathy.

That said, all the pandemic-related news since then has been worse than expected, and that should soon put an end to the current run up. In the meantime, however, the five-year GoC bond yield has recovered to near its previous high, and if it continues its current trajectory, five-year fixed mortgage rates could move higher over at least the short term.

Five-year variable rate discounts have recently widened a little, and for the reasons outlined above, I don’t expect the BoC to increase at nearly the pace bond-market investors are currently pricing in over the year ahead.