New to Canada Mortgage Program and Stats

Below are some interesting numbers of New to Canada residents.

We specialize in New to Canada programs as there are many in’s and out’s with the details.

Because New to Canada people do not have the standard 2 years of Canadian credit history here to buy a home, there are special programs that help them buy as soon as they have a full-time, perminant job.

The Short Version of what is needed:

- a full time permanent job position and either

- 5% down payment from your own savings if you have a foreign credit report OR

- 10% down from own savings if you do not have a foreign credit report

Give us a call to discuss the details of how this program may work for you!

Mortgage Mark Herman, Top Calgary Alberta Mortgage Broker, 403-681-4376

Facts and figures 2013 – Immigration overview: Permanent residents

Canada – Permanent residents by source country

| Source country | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 |

| People’s Republic of China | 36,620 | 42,584 | 33,518 | 27,642 | 30,037 | 29,622 | 30,391 | 28,503 | 33,024 | 34,126 |

| India | 28,235 | 36,210 | 33,847 | 28,742 | 28,261 | 29,457 | 34,235 | 27,509 | 30,932 | 33,085 |

| Philippines | 14,004 | 18,139 | 18,400 | 19,837 | 24,888 | 28,573 | 38,617 | 36,765 | 34,314 | 29,539 |

| Pakistan | 13,399 | 14,314 | 13,127 | 10,124 | 8,994 | 7,217 | 6,811 | 7,468 | 11,227 | 12,602 |

| Iran | 6,348 | 5,837 | 7,480 | 6,974 | 6,475 | 6,580 | 7,477 | 7,479 | 7,533 | 11,291 |

| United States of America | 6,990 | 8,394 | 9,613 | 9,463 | 10,190 | 8,995 | 8,142 | 7,675 | 7,891 | 8,495 |

| United Kingdom and Colonies | 7,533 | 7,258 | 7,140 | 8,216 | 8,979 | 8,876 | 8,724 | 6,204 | 6,195 | 5,826 |

| France | 4,391 | 4,429 | 4,002 | 4,290 | 4,532 | 5,051 | 4,646 | 4,080 | 6,280 | 5,624 |

| Iraq | 1,796 | 2,226 | 1,788 | 2,406 | 3,543 | 5,450 | 5,941 | 6,196 | 4,041 | 4,918 |

| Republic of Korea | 5,352 | 5,832 | 6,215 | 5,920 | 7,294 | 5,874 | 5,537 | 4,589 | 5,315 | 4,509 |

Slight mortgage rate increase on the way?

We watch lots of technial things to see where rates are going. One of those is the CMB – Canadain Mortgage Bond.

Today, the benchmark government of Canada five year bond yield ended the week at 0.79%, up from 0.73% the previous week.

that means that fixed rates may move up from their 2.74 – 2.79% soon.

Get your rate hold / applicastion in!

Mark Herman, AMP, B. Comm., CAM, MBA-Finance

WINNER: #1 Franchise for Funded $ Mortgage Volume at Mortgage Alliance Canada, 2013 and 2014!

Direct: 403-681-4376

Accredited Mortgage Professional | Mortgage Alliance | Mortgages are Marvelous

Toll Free Secure E-Fax: 1-866-823-1279 | E-mail: mark.herman@shaw.ca |Web: http://markherman.ca/

More bad news about collateral loans

More collateral info in the press. As we have been saying for more than a year now; collateral loans can trap you later. Leverage the expertise of a person who has dealt with mortgages all day for more than 10 years when deciding what is best for you.

Short version of the article below: it is going to cost you about $2,500 to get out of a mortgage with a collateral charge when the term is done. That is not a “payout penalty” but the cost to re-register your mortgage later at a different bank when they try to renew you at a higher rate at the end of your term.

Mark Herman, top Calgary Alberta Mortgage Broker for Renewals

Search "collateral" in this blog search bar to see the other articles on this topic.

A collateral mortgage can trap you: Roseman

You may want to change lenders at the end of a mortgage term. But with a collateral mortgage, your freedom to move will be constrained.

Your residential mortgage is coming up for renewal. Your lender won’t match the competition, so you decide to get a better rate elsewhere.

Moving a mortgage at the end of a three-year or five-year term is no big deal. The new provider usually covers any transfer fees.

But switching is more costly if you have a collateral mortgage. You must hire a lawyer and pay about $1,000 to discharge the mortgage before you can move to a new lender.

Since 2010, TD Canada Trust has sold only collateral mortgages. Tangerine Bank (formerly ING Direct) changed to collateral mortgages in 2011. National Bank also offers them.

Having a collateral mortgage affects your ability to transfer your mortgage to a new lender and your ability to borrow additional funds. It can also affect your ability to discharge the mortgage after repaying the loan in full.Many people don’t know the difference between a conventional and a collateral mortgage, since the information is buried in the fine print of a detailed agreement.

Last August federal Finance Minister Joe Oliver announced an agreement with eight major banks, under which they would voluntarily disclose general information about collateral mortgages at their websites by Sept. 1, 2014, and in their branches by Nov. 30, 2014.

Finally, the banks would provide specific information to consumers who were entering into a new mortgage agreement by Jan. 31, 2015.

Has voluntary disclosure worked? I found almost nothing when checking the banks’ websites. But the Canadian Bankers Association’s website has an article, “Mortgage Security,” to which individual members can provide links.

With a conventional charge, only the amount of the actual mortgage loan is registered against your home. If you borrow $250,000, the lender will register a $250,000 amount as a liability on your property.

With a collateral charge, an amount higher than the actual mortgage loan may be registered against your home. If you borrow $250,000, the lender can choose to register a $300,000 or $400,000 amount.

This allows you to get an extra $50,000 to $100,000 at a later date, secured by the mortgage, without having to discharge the loan and go through a costly refinancing. However, you must meet certain conditions in order to borrow more money.

“You will need to apply and be approved by the lender for the increased amount, based on the current criteria of the lender, your ability to repay the mortgage loan and verification that your home’s value supports the mortgage loan request,” says the CBA.

Dan Faubert, an Ottawa mortgage broker, wrote a blog post last August about thepitfalls of a collateral mortgage. He used the example of John Smith (not his real name), who was denied a loan to fix up his home.

The man owned a home worth $375,000. He had $25,000 left on his mortgage and a $250,000 balance on his home equity line of credit — a total debt of $275,000.

Unfortunately, he didn’t know the bank had registered a $375,000 mortgage against his home. Most collateral mortgages are registered at 100 per cent of the property’s value and some go up to 125 per cent, depending on the lender.

Smith wanted $25,000 to renovate. He was planning to sell his house. But since he was retired and had a lower income than when he borrowed the money, he didn’t qualify for a bank loan.

Faubert couldn’t get him any more money, nor could any other mortgage broker, since the collateral mortgage was registered for 100 per cent of the property’s value.

Smith had borrowed $275,000 and his home was worth $375,000, but there was no equity against which to register a mortgage. It is a dilemma that could face other Canadians who carry a mortgage with them into retirement.

“Any mortgage with any bank that has multiple products in one mortgage is also registered as a collateral mortgage,” says Faubert, who recommends asking lenders for an explanation before agreeing to new financing.

I predict the trend to collateral mortgages will spread. Banks benefit by making it more difficult — or impossible, in some cases — to switch lenders before a mortgage is discharged.

Oliver should check the banks’ voluntary disclosure under the agreement announced last year. Customers need to know in clear terms, explained by a real person and not just in fine print, about a key change to the standard mortgage contract.

http://www.thestar.com/business/2015/02/17/a-collateral-mortgage-can-trap-you-roseman.html

Data on why oil prices collapsed

Below is the entire Forbes article and link it.

Summary is there was too much oil and the prices came down. Prices should slowly go back to about $70 a barrel – which is just fine. This is great news!

Mark Herman, Top Calgary Alberta mortgage broker for mortgage renewals

The Facts Behind Oil’s Price Collapse

http://www.forbes.com/sites/brucemccain/2015/02/09/the-facts-behind-oils-price-collapse/

The dramatic drop we have seen in oil prices over the last few months has many economic forecasters worried about future growth. The problem with declining oil prices is that too much of a good thing can turn frightening. Someone who goes on a modest diet and loses five pounds over the course of a month might be elated. Someone who loses 75 pounds under those same circumstances would worry they have a serious illness. Conceivably, the precipitous fall in oil prices could mean that the global economy’s health has started to fail. While that would account for the drop in oil prices, most leading indicators do not confirm that economic diagnosis.

Tight monetary policy typically plays a major role in economic downturns, and global policy is still incredibly supportive for the economy. Economic weakness in Europe and Japan have certainly contributed to the falling price of oil and have underscored fears about global growth. Yet a profound economic downturn seems very unlikely, even in those areas. World economic growth certainly has been, and remains, historically sluggish. Even so, the current and prospective levels of global economic growth do not seem to warrant the drastic change in the price of oil we have witnessed.

If change in the demand for oil does not account for the decline, dropping prices must reflect increased supply. It is often difficult to have a clear understanding of the total supply of oil, since many of the world’s large suppliers are not transparent about what they produce. Some question whether increasing supplies of oil from Libya or Iran may have contributed to the slide in oil prices. But few world producers have enough spare capacity to significantly alter the balance of supply and demand. While pivotal global producers have likely played a part in the price drop, the dramatic revolution in the technology of oil production provides a better explanation for the change in oil prices.

The technology of hydraulic fracturing, or “fracking,” and other technologies that allow us to access previously inaccessible energy reserves has enabled the development of significant new supplies in North America. According to the U.S. Energy Information Administration (EIA), U.S. production has risen roughly 45% over the last four years, while Canada now produces approximately 25% more than it did four years ago. Together, Canada and the United States produce some five million more barrels of oil each day than they did in 2010. In a market where a shift of one million barrels of oil per day is thought to have a significant effect on the price of oil, the productive capacity added in North America has been staggering. Total world demand has grown about 4% since 2010, which works out to about 4 million barrels of additional demand each day. North American oil production has therefore grown about 38% faster than total global demand. With that sort of dramatic shift in the supply and demand for oil, it is not surprising that oil prices have come under pressure. The energy revolution has also had a major effect on the production of natural gas, which means that the pressure on oil prices is even greater than the figures for oil alone suggest.

Yet the development of new reserves would not be expected to drive the price of oil down as quickly as prices have fallen over the last six months. Oil prices should have deteriorated more gradually, as new projects slowly came to full production. While the long-term supply-demand balance has shifted significantly as a result of new technologies, the long-term dynamics do not fully account for the speed of the price drop. Many believe that the politics of oil production account for the sharp decline of prices over the last year.

While world demand has grown 4% since 2010, the EIA shows that OPEC’s share of world supply has risen only 2% and the crude oil they supply is up only modestly. In the past, Saudi Arabia has helped maintain higher oil prices by reducing their own output when global excesses developed. In recent months, however, the Saudis have refused to reduce their production. Part of their strategy may be to force Russia and other large producers to share the cost of limiting production. But Saudi Arabia also faces a long-term problem. As North America and other parts of the world develop new sources of supply, the Saudis will have less influence over the oil markets. Saudi Arabia may therefore be willing to sell their oil at a lower price in order to slow the development of new energy resources.

Much of the new oil coming online is more expensive to develop. At the current price of oil, many of those projects no longer make economic sense. Projects are typically not cancelled immediately, but if prices remain low for an extended period of time, many higher-cost projects will be shelved. Supposedly, too, many recent projects have depended on heavy debt financing. Lenders are less likely to lend aggressively if prices remain low. Lower prices hurt all producers over the short term. But the Saudis may think they will have a much stronger long-term position if lower prices slow the development of new projects. That gives the Saudi Arabia significant incentive to allow, if not engineer, a large drop in oil prices.

If the strategy of lower oil prices is to limit new production, oil prices probably do not need to remain this low to accomplish the goal. Many think the industry will begin shelving projects if prices remain low for six months or more. After that happens, oil prices can probably rise modestly without bringing a host of higher-cost projects off the shelf. Energy analysts think the overall supply and demand for oil will allow for stable prices at around $70 a barrel. At that level, energy costs will remain below their highs of the last few years, but above where they are now. The economic impact of $70 oil will be substantial, but not as great as the effect the price of oil will have around the current level.

Economists and other analysts often compare falling oil prices to a cut in taxes because it leaves consumers more discretionary money to spend. Lower energy prices clearly leave consumers more to spend, but they also hurt other parts of the economy. It is the balance between the winners and losers within an economy that determine whether the net effect is positive or negative for the economy as a whole. While some global economies will clearly benefit from lower oil prices, the net effect in the United States will likely be less positive.

To weigh pros and cons, we first need to determine net oil usage for the economy. Although the United States now produces far more of the oil it uses, we still import about 7,200 barrels of oil per day, according to the U.S. Energy Information Administration. If the long-run price of oil falls to $70 per barrel, that means the United States would save approximately $108 billion over the course of a year relative to the $110 per barrel oil cost of oil that prevailed over the last two years. The U.S. Department of Commerce estimated that the domestic economy produced $17.4 trillion of goods and services in 2014. Based on that estimate, a $108 billion reduction of imports should add about 0.7% of potential domestic growth.

There is a risk, however, that what people save on imported oil may not translate directly to spending in other areas. Some of the money saved on energy may go to reduce debt or increase savings and so would not produce the additional consumer spending that some are assuming. That may have been part of the reason that December retail spending showed a significant decline in spending on gasoline without a corresponding increase in other areas. At minimum, spending may not increase in other areas as quickly as energy spending declines. According to a recent report by the Ned Davis Research Group, earnings for companies outside the energy complex have historically accelerated about one quarter after oil prices trough. Perhaps consumers simply wait until the savings on energy provide enough funds to make larger purchases in other areas. Even if consumers do eventually spend energy savings, however, it may not drive faster U.S. growth. Many consumer goods are imported, so some consumer spending would not add to domestic growth.

The U.S. economy has also benefited over the last few years from enormous capital spending on new energy resources. Any reduction in capital spending caused by lower oil prices would be an offset to other increases in domestic spending. The American Petroleum Institute (API) reported in 2012 that the oil and natural gas industry invested $292 billion in new energy projects, improvements to existing projects, and enhancements of refinery and other downstream operations. In that same report, the API also noted an IHS Global Insight study that estimated $87 billion in U.S. capital spending on unconventional energy resources that same year. That spending would certainly not grind to a halt if energy prices remain low, but recent developments in North America have tended to focus on reserves that are harder to access. Sustained lower prices, therefore, may prompt U.S. developers to shelve more costly projects. . With that much capital spending exposure, it would not take a large loss of capital spending to offset a significant share of the $108 billion in estimated savings on imported oil.

A similar analytic framework would also apply to other economies around the world. Large net consumers of oil, such as Europe and Japan, should benefit. Europe imports roughly twice what the United States imports, according to the U.S. Energy Information Administration, while Japan and China import about the same amount as the United States but have smaller economies. Many of these economies have struggled to grow faster, in part because they were heavily pressured by the escalating costs of energy. Lower oil prices in the short run, and the potential for slower price increases in oil prices over the next few years, should improve economic growth for countries that consume more oil than they produce.

Countries that produce a lot of oil, however, such as Russia, many Middle Eastern countries and some countries in Latin America, will almost certainly suffer. Longer term those countries may benefit if lower prices discourage development in the United States and Canada, but reduced prices have obviously cut the economic growth that energy production provided those economies. Most other countries have not spent as heavily on energy exploration and development as the United States and Canada, but any reductions would cut growth even further.

For the world as a whole, as in the United States, confident estimates of large economic effects due to the falling price of oil seem overstated. Instead, the reduced costs of oil for consuming nations should be offset by lost oil revenue and capital spending in other countries. For that reason, the net effect of falling oil prices on total global economy should be relatively modest.

Investors are therefore probably best served to worry less about the impact of lower oil prices on overall growth and focus more on who will benefit and who will suffer. Many countries that spend heavily on imported oil have struggled economically in recent years. Europe and Japan have both posted very low rates of economic growth but have imported large amounts of oil. Lower oil prices could have a meaningful positive impact on those economies.

Some emerging economies would also benefit. China, India and other large emerging economies stand to benefit from lower oil prices. A number of important emerging markets, however, sell large amounts of oil. Russia’s economy is heavily dependent upon energy sales, and many of the Latin American economies are also leveraged to oil prices. In terms of overall proportions, energy production plays a larger role in the total economic picture within the emerging markets than in the developed international markets.

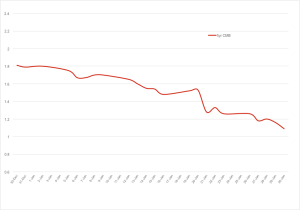

1 Graph Shows Why Mortgage Rates Are Lower in Jan 2015

The graph below shows why rates have found what we think is a short term low. This will not last forever so be sdure to get a rate hold now!

30 day Canadian Mortgage Bond (CMB) trend – below

Graph Summary

The banks get their money for mortgages from the CMB … this is a short term oddity right now. This trend will change soon and is from:

- the quick drop in oil prices

- the surprise rate cut from the Bank of Canada on Prime

- and other world economic activity.

Market Summary

The Bank of Canada has certainly shaken things up with its surprise 0.25 bps rate cut. Even more so because Governor Stephen Poloz has left the door open for a further cut.

Poloz explained that the BoC trimmed its rate as “insurance” for the broader economy in light of the fallout from falling oil prices. He went on to say the Bank was prepared to take out more insurance.

Concerns about unemployment, slowing economic growth and deflation have obviously trumped past worries about record high household debt-to-income ratios.

However, it is not a sure bet that the lower central bank rate will inflate the Canadian real estate bubble. Canadians have established a history of using lower rates to pay down debt, rather than adding to it.

All this from Calgary’s top mortgage broker, Mark Herman