BMO & CIBC: Not on list of Top-11 banks in Canada

Wow hey??

Who would guess that 2 of Big-6 banks that millions of Canadians “think they have a financial relationship with” did not even make the list of the Top-11 banks in Canada.

It is surprising the amount of customers that call us looking to “beat their bank’s mortgage rate” when they should be looking at if they should even be doing mortgage business at their main personal bank.

Mortgage Mark Herman, Calgary Alberta new home buyer and mortgage renewal specialist of 21 years.

We recommend that they also look at the T’s & C’s – Terms and Conditions – to their own bank’s mortgages to find:

- Payout penalties that are 500% to 800% – yes, 5x to 8x the amount of payout penalties at broker banks.

- Their renewal rates are usually always at rates higher than what Broker Banks offer – because Broker Banks know the broker that placed you there will jump at the chance to move them to a different bank, for a better/ market rate, and then we get paid again. Big-6 banks don’t have to worry about that because you are usually not aware of market rates.

- SELF-employed mortgage holders are often “worked over by the Big-6 banks” whereas, Broker Banks are more than happy doing tons for self-employed business owners.

Here’s the full list of Canada’s best banks for 2025, according to Forbes:

- Tangerine

- Simplii Financial

- RBC

- PC Financial

- Vancity

- EQ Bank

- TD

- Scotiabank

- National Bank

- Desjardins

- ATB Financial

footnote: link action here https://www.narcity.com/best-banks-in-canada-forbes-2025

New Housing Rules for 1st First-Time Buyers and New Builds

If you’re a first-time home buyer or looking to purchase a new build, this affects you.

Here’s a quick summary of the changes coming in December 2024:

What’s New?

30-Year Amortizations Now Available for First-Time Buyers and New Build Purchases

- First-time home buyers can now access 30-year amortizations for insured mortgages.

- This increases the amount you qualify for by about 9% or lowers your monthly payment about the same.

- 30-Year Amortization for New Builds – Technically, this took effect on August 1, 2024, and is available to everyone, not just First-Time Homebuyers.

Price Cap Increase for Insured Mortgages

- The price cap (purchase price) for insured mortgages has been raised from $999,999 to $1,499,999 million.

- EG: if you were to purchase a home today priced at $1.1 million, your minimum down payment to qualify for a mortgage would be 20% or $220,000. After December 15th, the minimum down payment required decreases to $85,000.

- If that $1.1 million dollar home also has a self contained suite, you can use the rent or “potential” rent that suite will generate to help qualify for a bit more of a mortgage too.

The Fine Print

Down payment – Great news, minimum requirements stay the same:

- 5% on the portion up to $500,000

- 10% on the portion between $500,000 and $1.5 million

* Previously, the down payment on a $1.5 million home for a First-Time Home buyer was $300,000.

FTHB’s can now get into that same home with $125,000.

This will undoubtedly take some pressure off the Bank of Mom and Dad.

Effective Date

These changes will apply to mortgage insurance applications submitted on or after December 15, 2024. The key word here is ‘submitted.’ Your offer will need to be timed just right if you wish to take advantage of the new 30-year amortization.

Potential Impacts on the Housing Market:

We are in an interesting position right now. On one hand, lenders are competing for new business in what could be described as a ‘rate war.’

Additionally, with First-Time Home Buyers (FTHB) set to qualify for 30-year amortizations after December 15th, we can expect an uptick in demand.

Historically, higher demand leads to higher prices and rate decreases cause an equal and opposite increase in home prices.

Buy or Sell – Now or Later?

While there’s no crystal ball, consider these possibilities:

- Buy Now: Prices are expected to rise once the new rules take effect, so purchasing before December could mean less competition and potentially lower prices.

- Sell Later: If your home is priced between $1 million and $1.5 million, waiting until after December 15th could attract more qualified buyers and possibly higher offers.

More details will emerge as lenders and insurers prepare to offer the new 30-year amortization, such as how lenders will view the minimum down payment.

If you want to discuss how these changes might impact your plans to buy or sell, feel free to reach out!

Variable Rate Beats BOTH 3-year & 5-year Fixed Terms

The Variable is the best way to go right now and this blue link has all the details in PDF: VARIABLE RATE beats both 3-year fixed & 5-year fixed terms

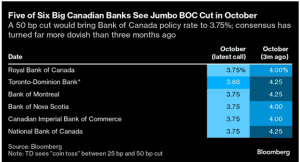

Data point 1: Variable rates should be coming down 2% in the next 13.5 months, with a “jumbo reduction” of 0.5% (1/2%) expected on Wednesday, Oct 23rd – by 5 of the 6 Big Banks.

Data point 2: Historically, fixed rates only go down about 40% of the reductions to Prime, so fixed rates will not be going down anywhere near as much or as fast as the Variable.

Data point 3: Just a 1% rate reduction is expected to “reactivate” at least half of buyers who previously stopped shopping due to “buyer fatigue.”

Data point 4: As interest rates come down, prices INCREASE because most buyer’s need to go to their max mortgage when buying.

Graphic details of expected rate reductions and the dates of expected changes, in PDF: VARIABLE RATE beats both 3-year fixed & 5-year fixed terms

Our favorite customer quote so far in October:

I am not locking in 3-year money nor 5-year money today, when the Bank of Canada has made it clear rates are coming down 2% in the next 15 months.

Mortgage Mark Herman, Top Calgary Alberta Mortgage Broker near me.

The End of Prime Rate Increases, January, 2024, Canada

Horray, today The Bank of Canada didn’t just put rate hikes on the back burner today; it unplugged the stove!

The Bank is now “confident enough” that inflation is on the right track to not publicly dwell on rate hike risk any longer. That was today’s message from Senior Deputy Governor Carolyn Rogers after the BoC left its overnight rate at 5%.

Instead, the Bank says it’s now shifting its focus to “how long” the overnight rate needs to marinate “at the current level.”

Summary:

No more increases to the Canadian Prime Rate of Interest – at 7.2% today, after 10 increases in 2023.

Back in August I said Prime should start to come down in June – still the best guess – and

will come down by o.25% every 3 months, so one-quarter-percent decrease every calendar / fiscal quarter (3 months)

for a total of 2% less than today so … Prime should end up at 5.2% in 30 months, which is June 2026.

Mortgage Mark Herman, top Calgary Alberta and BC mortgage broker

“We need to give these higher interest rates time to do their work,” Macklem said, offering no clues on how long he’ll let the rate hike stew simmer. The forward market thinks it’ll take another 4 – 6 months. Historically, rates have plateaued at peak levels for anywhere from a few months to 17 months. So far, it’s been only 6.

The Bank says that higher rates can’t be completely ruled out, but it’s very rare for the Bank of Canada to hike a bunch, pause 5+ months, hike more, pause 5+ months more, and then hike again.

When Will Canadian Mortgage Rates Begin to Fall?

Last week, the Bank of Canada held its policy rate at 5%. The decision was expected given slowing in the economy and modest improvement to core inflation measures.

The Bank is likely at the end of its tightening cycle. How soon it eases rates – and how low will rates go in the near to medium term – is the question #1

ANSWER: The general view from market economists is that we could see some easing of the overnight rate by mid-2024.

Question #2: How low. how far will Prime come down?

ANSWER: Prime is expected to come down a total of 2%.

DETAILS of Prime Cuts

- Prime is 7.2% now / November 2nd, 2023,

- Prime is expected to get down to to 5.2% or a bit lower, like 4.75% – 5.25% range by the end 2025; which looks like this:

- June/ July 2024, 1st Prime cuts = 6 months

- Prime reduction by o.25% every quarter = 1% less / year for the next 2 years = 24 months

- so these together = 30 months.

With Prime coming down, now is the time for you to take advantage of the Variable Rate reductions.

Variable Rates via brokers are at Prime – o.9%, while the Big-6 banks rates are Prime – o.15%.

YES, broker rates are 6x better than at the Big-6 lenders, o.9 – o.15 = o.75% better. It’s true!

Mortgage Mark Herman; Best Top Calgary Mortgage Broker for first time home buyers.

When might rates begin to fall?

The Bank’s latest Monetary Policy Report (MPR) also provides signals that we can monitor to gauge when rates could start declining.

When interest rates rise, one of the main ways monetary policy affects the economy is through reduced consumer spending on durable goods, like appliances, furniture and cars. Prices for durable goods, except for cars, have dropped from 5.4% to -0.4%, while prices for semi-durable goods, like food and clothing, have decreased from 4.3% to 2.1%. We’re still experiencing delays in delivering cars. As a result, manufacturers are concentrating on selling more expensive vehicles with higher margins and are offering fewer discounts from list prices.

Inflation in service prices, excluding shelter, has slowed from 5.1% to 1.5%. If bond rates begin to drop, we will see a gradual decline in mortgage costs. The challenge will be rental costs, which are soaring due to the very limited availability of rentals and the continuous influx of newcomers. Increasing housing supply is key to reducing rental prices. However, that is a problem that will take years to resolve given the significant shortage of housing.

Currently, the Bank is concerned about inflation expectations, corporate pricing behaviour, and wage growth. As noted in its Monetary Policy Report, “As excess demand eases, inflation is expected to slow. At the same time, inflation expectations should also fall, businesses’ pricing behaviour should normalize, and wage growth should moderate. So far, progress has occurred but somewhat more slowly than anticipated.”

The Bank will be careful to ensure that inflation expectations inconsistent with its 2% target are not embedded in corporate pricing and wage expectations. A slowing economy should help to lower those expectations.

The general view from market economists is that we could see some easing of the overnight rate by mid-2024.

NERD STUFF: Maintaining a restrictive rate policy

The Bank can maintain a restrictive policy even without increasing rates any further, simply by keeping rates at their current level. With the overnight rate at 5% and an inflation rate of 3.8%, the real policy rate is 1.2%. This rate is restrictive, since it is higher than the neutral real rate of interest, which the Bank estimates to be between 0 and 1%.

The neutral real rate of interest is the level of interest that neither stimulates nor restrains economic growth. In other words, it is the rate at which the economy is in balance, with stable prices and full employment. Therefore, when the real rate of interest is restrictive, we would expect GDP to slow.

In its recent Monetary Policy Report (MPR), the Bank is forecasting economic growth to average less than 1% over the next few quarters, while potential output growth is expected to average 2%, mainly due to population growth and increased labor productivity. This should lead to a negative output gap (low demand and a surplus of products) and lower inflation.

Canadian Economic Forecast – Nov- Mortgage related use

Bank of Canada holds its interest rate steady, publishes updated economic forecasts

On October 25th, the Bank of Canada announced that it would maintain its Canadian Prime Rate stays at 7.3% – stating that there is “growing evidence” that past interest rate increases are dampening economic activity and relieving price pressures.

This decision provides some comfort to borrowers who have seen their mortgage costs rise steadily since March of 2022. As for real relief – in the form of rate cuts – the Bank demurred, noting that its preferred measures of core inflation show “little downward momentum.” Consequently, the Bank said it is holding this policy rate and continuing its current policy of quantitative tightening.

We capture the Bank’s observations and its latest economic forecasts in the summary below.

Inflation facts and outlook

- In Canada, inflation measured by the Consumer Price Index (“CPI”) has been volatile in recent months: 2.8% in June, 4.0% in August, and 3.8% in September

- Higher interest rates are moderating inflation in many goods that people buy on credit, and this is spreading to services

- Food inflation is easing from very high rates; however, in addition to elevated mortgage interest costs, inflation in rent and other housing costs remains high

- Near-term inflation expectations and corporate pricing behavior are normalizing only gradually, and wages are still growing around 4% to 5%

- The Bank’s preferred measures of core inflation show little downward momentum

Canadian housing and economic performance

- There is growing evidence that past interest rate increases are dampening economic activity and relieving price pressures

- Consumption has been subdued, with softer demand for housing, durable goods and many services

- Weaker demand and higher borrowing costs are weighing on business investment

- A surge in Canada’s population is easing labour market pressures in some sectors while adding to housing demand and consumption

- In the labour market, recent job gains have been below labour force growth and job vacancies have continued to ease; however, the labour market remains “on the tight side” and wage pressures persist

- Overall, a range of indicators suggest that supply and demand in the economy are now “approaching balance”

Global economic performance and outlook

- The global economy is slowing and growth is forecast to moderate further as past increases in policy interest rates and the recent surge in global bond yields weigh on demand

- The Bank projects global GDP growth of 2.9% this year, 2.3% in 2024 and 2.6% in 2025. While this outlook is little changed from the Bank’s July Monetary Policy Report, the composition has shifted, with the US economy proving stronger and economic activity in China weaker than expected

- Growth in the Euro area has “slowed further”

- Inflation has been easing in most economies, as supply bottlenecks resolve and weaker demand relieves price pressures but underlying inflation is persisting, meaning central banks must “continue to be vigilant”

- Oil prices are higher than the BoC assumed in July, and the war in Israel and Gaza is a new source of geopolitical uncertainty

Summary and Outlook

The BoC noted that after averaging 1% over the past year, economic growth is expected to remain “weak” for the next year before increasing in late 2024 and through 2025. Near-term weakness in growth reflects both the broadening impact of past increases in interest rates and slower foreign demand. The subsequent economic “pickup” will be driven by household spending as well as stronger exports and business investment in response to improving fore

ign demand. Spending by governments contributes materially to growth over the forecast horizon. Overall, the Bank expects the Canadian economy to grow by 1.2% this year, 0.9% in 2024 and 2.5% in 2025.

In the Bank’s October projection, CPI inflation is expected to average about 3.5% through the middle of next year before gradually easing to 2% in 2025. Inflation is expected to return to the Bank’s target about the same time as policymakers forecast in their July 2023 projection, “but the near-term path is higher because of energy prices and ongoing persistence in core inflation.”

As for what to expect going forward, the Bank had this to say about interest rates: “With clearer signs that monetary policy is moderating spending and relieving price pressures, Governing Council decided to hold the policy rate at 5% and to continue to normalize the Bank’s balance sheet. However, Governing Council is concerned that progress towards price stability is slow and inflationary risks have increased, and is prepared to raise the policy rate further if needed.”

The message is therefore clear: the Bank wants to see downward momentum in core inflation before it changes tack, and continues to be focused on the “balance between demand and supply in the economy, inflation expectations, wage growth and corporate pricing behaviour.”

Once again, the Bank ended its communique with a familiar phrase: it remains “resolute in its commitment to restoring price stability for Canadians.”

What’s next?

The Bank’s final (scheduled) interest rate announcement of 2023 takes place December 6th and we will follow immediately after with our next executive summary.

BoC Holds Canadian Prime at 6.7% on April 12th – Good News!

Today, April 12, 2023, the Bank of Canada held its policy interest rate at 4.50%, a welcome outcome for borrowers after almost a year of constant increases, and a timely confidence-builder for the real estate industry as it enters the spring market.

The Bank also issued its latest Monetary Report with updated risk assessments and base-case projections for inflation.

We highlight the Bank’s latest observations below.

Inflation acts and outlook

- In Canada, the Consumer Price Index (CPI) inflation eased to 5.2% in February, and the Bank’s preferred measures of core inflation were just under 5%

- The Bank expects Canadian CPI inflation to “fall quickly” to around 3% in the middle of 2023 and then decline more gradually to the 2% target by the end of 2024

- Recent data is reinforcing Governing Council’s “confidence” that inflation will continue to decline in the next few months

- Similarly, in many countries, inflation is easing in the face of lower energy prices, normalizing global supply chains, and tighter monetary policy

- At the same time, labour markets remain “tight” and measures of core inflation in many advanced economies suggest persistent price pressures, especially for services

Canadian economic performance and outlook

- Domestic demand is still exceeding supply and the labour market remains tight

- Economic growth in the first quarter looks to be stronger than was projected in January, on a “bounce” in exports and solid consumption growth

- While the Bank’s Business Outlook Survey suggests acute labour shortages are starting to ease, wage growth remains elevated relative to productivity growth

- Strong population gains are adding to labour supply and supporting employment growth while also boosting aggregate consumption

- Softening foreign demand is expected to restrain exports and business investment

- Overall, GDP growth is projected to be weak through the remainder of this year before strengthening gradually next year, implying the Canadian economy will move into excess supply in the second half of this year

- The Bank now projects Canada’s economy will grow by 1.4% this year – an improvement over its last forecast of 1% growth – 1.3% in 2024 (a downgrade from its last forecast of 2% for 2024) and then pick up to 2.5% in 2025

Canadian housing market

- Housing market activity remains subdued

- As more households renew their mortgages at higher rates and restrictive monetary policy works its way through the economy more broadly, consumption is expected to moderate this year

Global economic performance and outlook

- The Bank’s April Monetary Policy Report projects global growth of 2.6% in 2023 – an improvement over its last forecast of 2% offered in January – and then fall to 2.1% in 2024 (lower than it last forecast of 2.5%), and rise to 2.8% in 2025

- Recent global economic growth has been stronger than anticipated with performance in the United States and Europe surprising on the upside

- However, growth in those regions is expected to weaken as tighter monetary policy continues to feed through those economies

- In particular, US growth is expected to “slow considerably” in the coming months, with particular weakness in sectors that are important for Canadian exports

- Activity in China’s economy has rebounded, particularly in services

- Overall, commodity prices are close to their January levels

Outlook

While holding the line on interest rates, the Bank also noted in today’s announcement that it is continuing its policy of quantitative tightening and remains “resolute in its commitment to restoring price stability for Canadians.” There was nothing new in that statement. However, it also posited that getting inflation the rest of the way back to 2% “could prove to be more difficult because inflation expectations are coming down slowly, service price inflation and wage growth remain elevated, and corporate pricing behaviour has yet to normalize.”

As it sets monetary policy going forward, the Bank’s Governing Council indicated that it will be “particularly focused” on these indicators, and the evolution of core inflation as it gauges the progress of returning CPI inflation back to its 2% target.

The Bank also said it continues to assess whether monetary policy is “sufficiently restrictive” to relieve price pressures and “remains prepared to raise the policy rate further if needed” to return inflation to its 2% target.

Next Announcement is …

We will have to wait until April 20th to get the next CPI reading to gauge progress in one of the Bank’s determining indicators and June 7th for the Bank’s next scheduled policy interest rate announcement.

Inflation is slowing and that is great news for Canadian home buyers

Mortgage Mark Herman, Top Calgary Alberta Mortgage Broker

Bank of Canada increases its benchmark interest rate to 4.50%

Today, the Bank of Canada increased its overnight benchmark interest rate 25 basis point to 4.50% from 4.25% in December. This is the eighth time since March 2022 that the Bank has tightened money supply to address inflation.

While the headline increase will certainly make news, it is the Bank’s accompanying commentary on its future moves that will capture the most attention. We summarize the Bank’s observations below, including its forward-looking comments on the potential for future rate increases.

Canadian inflation

- Inflation has declined from 8.1% in June to 6.3% in December, reflecting lower gasoline prices and, more recently, moderating prices for durable goods

- Despite this progress, Canadians are still “feeling the hardship” of high inflation in their essential household expenses, with persistent price increases for food and shelter

- Short-term inflation expectations remain elevated and while year-over-year measures of core inflation are still around 5%, 3-month measures have come down, suggesting that core inflation has “peaked”

Canadian economic and housing market performance

- The Bank estimates Canada’s economy grew by 3.6% in 2022, slightly stronger than was projected in the Bank’s Monetary Policy Report in October, however it projects that growth is expected to “stall through the middle of 2023,” picking up later in the year

- Canadian GDP growth of about 1% is forecast for 2023 and rising to about 2% in 2024, little changed from the Bank’s October outlook

- The economy remains in “excess demand” and the labour market remains “tight” with unemployment near historic lows and businesses reporting ongoing difficulty finding workers

- However, there is “growing evidence” that restrictive monetary policy is slowing activity especially household spending

- Consumption growth has moderated from the first half of 2022 and “housing market activity has declined substantially”

- As the effects of interest rate increases continue to work through the economy, spending on consumer services and business investment is expected to slow

- Weaker foreign demand will likely weigh on Canadian exports

- This overall slowdown in activity will allow supply to “catch up” with demand

Global economic performance and outlook

- The Bank estimates the global economy grew by about 3.5% in 2022, and will slow to about 2% in 2023 and 2.50% in 2024 — a projection that is slightly higher than the Bank’s forecast in October

- Global economic growth is slowing, although it is proving more resilient than was expected at the time of the Bank’s October Monetary Policy Report

- Global inflation remains high and broad-based although inflation is coming down in many countries, largely reflecting lower energy prices as well as improvements in global supply chains

- In the United States and Europe, economies are slowing but proving more resilient than was expected at the time of the Bank’s October Monetary Policy Report

- China’s abrupt lifting of pandemic restrictions has prompted an upward revision to the Bank’s growth forecast for China and “poses an upside risk to commodity prices”

- Russia’s war on Ukraine remains a significant source of uncertainty

- Financial conditions remain restrictive but have eased since October, and the Canadian dollar has been relatively stable against the US dollar

Outlook

Taking all of these factors into account, the Bank decided today’s policy rate increase was necessary and justified.

However, the Bank also offered this important piece of news: “If economic developments evolve broadly in line with (its) outlook, Governing Council expects to hold the policy rate at its current level while it assesses the impact of the cumulative interest rate increases.”

That sounds positive, but as is customary, the Bank also noted that it is prepared to increase the policy rate further if needed to return inflation to its 2% target. It also added the usual language that it “remains resolute in its commitment to restoring price stability for Canadians.”

Although the Bank did not say it, the bottom line is Canadians will have to wait and see what comes next.

Next touch point

March 8, 2023 is the Bank’s next scheduled policy interest rate announcement and we will be on hand to provide an executive summary the same day.

Canadian Residential Mortgage Market: Inflation & Interest Rates: the Lead Characters for 2023

Summary:

- The Bank of Canada (BOC) increased interest rates 7 times in 2022. Exactly as expected 16 months ago.

- Inflation is at least 5.7%; and it needs to get down to 3%

- The BoC would rather over-tighten than under-tighten

- Normally it takes 18 to 24 months for interest rate increases to work their way into the economy and we are only about 10 months into this tightening cycle

These 4 painful data points mean Prime will increase from 6.45% to 6.70% on Jan 25th.

We now expect there to be at least 1 or 2 more o.25% increases to Prime before it is expected to hold for the rest of 2023, and then begin to decrease in 2024.

Mortgage Mark Herman, Top Calgary Alberta Mortgage Broker

DATA

A lot of the recent talk in financial and real estate circles has been centering on the possibility of a pause in the Bank of Canada’s aggressive interest rate increases. Some speculate that could happen at the next rate setting, later this month, on January 25th.

The Bank raised rates 7 times last year in an effort to rein-in galloping inflation. It does seem to be working, but there are some stubborn sticking points.

Headline inflation, known as the Consumer Price Index (CPI), has dropped. It was 8.1% in July and drifted down to 6.8% in November. However, the drop from October to November was a mere one-tenth of one percentage point and the Bank’s target rate remains significantly below that, at 2.0%.

As well, the BoC’s preferred inflation measure, Core Inflation (which strips out volatile components like food and fuel), actually increased. A simple averaging of the three components that the Bank uses to measure Core Inflation came in at nearly 5.7% in November, up from 5.3% in October.

Other factors that figure into the Bank’s plans include Gross Domestic Product and unemployment. Canada’s GDP continues to grow, albeit modestly, despite rising interest rates. It increased by 0.1%, month-over-month in November. Unemployment dipped 0.1% to 5.0% in December. Both of these tend to fuel higher wages which are a key driver of inflation.

The Bank of Canada, itself, remains firmly dedicated to battling back inflation. Governor Tiff Macklem has said he would rather over-tighten than under-tighten and run the risk of having high inflation linger and become entrenched.

The U.S. central bank has made it clear it plans more rate hikes. Given the integration of the Canadian and American economies, the Bank of Canada does have to pay attention to what its American counterpart does.

The BoC will have new economic data by the time it makes its January 25th announcement. The December numbers will provide a fresh look at how well the inflation fight is going.

Normally it takes 18 to 24 months for interest rate increases to work their way into the economy and we are only about 10 months into this tightening cycle. It is reasonable to expect another 25 basis-point increase on the 25th. Given the Bank’s apparent success so far it also seems reasonable to expect a pause sometime after that.

Looking ahead to a year from now some forecasters say we might start to hear talk of interest rate cuts, which would be welcome news. Cuts would allow the BoC to move toward its, long stated, goal of normalizing rates back into the neutral range of 2.5% to 3.5%. The Bank of Canada, and central banks around the world, have been trying to do that for more than a decade – since the ’08 – ’09 financial collapse.

Data on July 1, 2022 Prime Increase to 3.7%

Today, the Bank of Canada showed once again that it is seriously concerned about inflation by raising its overnight benchmark rate to 1.50% – making Consumer Prime 3.70%

This latest 50 basis point increase follows a similar-sized move in April and is considered the fastest rate hike cycle in over two decades.

Everyone STAY COOL!

Says Mortgage Mark Herman, top Calgary Alberta Mortgage Broker.

With it, the Bank brings its policy rate closer to its pre-pandemic level.

In rationalizing its 3rd increase of 2022, the Bank cited several factors, most especially that “the risk of elevated inflation becoming entrenched has risen.” As a result, the BoC will use its monetary policy tools to return inflation to target and keep inflation expectations well anchored.

These are the highlights of today’s announcement.

Inflation at home and abroad

- Largely driven by higher prices for food and energy, the Bank noted that CPI inflation reached 6.8% for the month of April, well above its forecast and “will likely move even higher in the near term before beginning to ease”

- As “pervasive” input pressures feed through into consumer prices, inflation continues to broaden, with core measures of inflation ranging between 3.2% and 5.1%

- Almost 70% of CPI categories now show inflation above 3%

- The increase in global inflation is occurring as the global economy slows

- The Russian invasion of Ukraine, China’s COVID-related lockdowns, and ongoing supply disruptions are all weighing on activity and boosting inflation

- The war has increased uncertainty, is putting further upward pressure on prices for energy and agricultural commodities and “dampening the outlook, particularly in Europe”

- U.S. labour market strength continues, with wage pressures intensifying, while private domestic U.S. demand remains robust despite the American economy “contracting in the first quarter of 2022”

- Global financial conditions have tightened and markets have been volatile

Canadian economy and the housing market

- Economic growth is strong and the economy is clearly “operating in excess demand,” a change in the language the Bank used in April when it said our economy was “moving into excess demand”

- National accounts data for the first quarter of 2022 showed GDP growth of 3.1%, in line with the Bank’s April Monetary Policy Report projection

- Job vacancies are elevated, companies are reporting widespread labour shortages, and wage growth has been “picking up and broadening across sectors”

- Housing market activity is moderating from exceptionally high levels

- With consumer spending in Canada remaining robust and exports anticipated to strengthen, growth in the second quarter is expected to be “solid”

Looking ahead

With inflation persisting well above target and “expected to move higher in the near term,” the Bank used today’s announcement to again forewarn that “interest rates will need to rise further.”

The pace of future increases in its policy rate will be guided by the Bank’s ongoing assessment of the economy and inflation.

In case there was any doubt, the Bank’s message today was clear: it is prepared to act more forcefully if needed to meet its commitment to achieve its 2% inflation target.

July 13, 2022 is the date of the BoC’s next scheduled policy announcement.