Variable Rate Beats BOTH 3-year & 5-year Fixed Terms

The Variable is the best way to go right now and this blue link has all the details in PDF: VARIABLE RATE beats both 3-year fixed & 5-year fixed terms

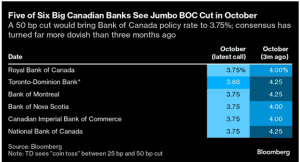

Data point 1: Variable rates should be coming down 2% in the next 13.5 months, with a “jumbo reduction” of 0.5% (1/2%) expected on Wednesday, Oct 23rd – by 5 of the 6 Big Banks.

Data point 2: Historically, fixed rates only go down about 40% of the reductions to Prime, so fixed rates will not be going down anywhere near as much or as fast as the Variable.

Data point 3: Just a 1% rate reduction is expected to “reactivate” at least half of buyers who previously stopped shopping due to “buyer fatigue.”

Data point 4: As interest rates come down, prices INCREASE because most buyer’s need to go to their max mortgage when buying.

Graphic details of expected rate reductions and the dates of expected changes, in PDF: VARIABLE RATE beats both 3-year fixed & 5-year fixed terms

Our favorite customer quote so far in October:

I am not locking in 3-year money nor 5-year money today, when the Bank of Canada has made it clear rates are coming down 2% in the next 15 months.

Mortgage Mark Herman, Top Calgary Alberta Mortgage Broker near me.

When Will Canadian Mortgage Rates Begin to Fall?

Last week, the Bank of Canada held its policy rate at 5%. The decision was expected given slowing in the economy and modest improvement to core inflation measures.

The Bank is likely at the end of its tightening cycle. How soon it eases rates – and how low will rates go in the near to medium term – is the question #1

ANSWER: The general view from market economists is that we could see some easing of the overnight rate by mid-2024.

Question #2: How low. how far will Prime come down?

ANSWER: Prime is expected to come down a total of 2%.

DETAILS of Prime Cuts

- Prime is 7.2% now / November 2nd, 2023,

- Prime is expected to get down to to 5.2% or a bit lower, like 4.75% – 5.25% range by the end 2025; which looks like this:

- June/ July 2024, 1st Prime cuts = 6 months

- Prime reduction by o.25% every quarter = 1% less / year for the next 2 years = 24 months

- so these together = 30 months.

With Prime coming down, now is the time for you to take advantage of the Variable Rate reductions.

Variable Rates via brokers are at Prime – o.9%, while the Big-6 banks rates are Prime – o.15%.

YES, broker rates are 6x better than at the Big-6 lenders, o.9 – o.15 = o.75% better. It’s true!

Mortgage Mark Herman; Best Top Calgary Mortgage Broker for first time home buyers.

When might rates begin to fall?

The Bank’s latest Monetary Policy Report (MPR) also provides signals that we can monitor to gauge when rates could start declining.

When interest rates rise, one of the main ways monetary policy affects the economy is through reduced consumer spending on durable goods, like appliances, furniture and cars. Prices for durable goods, except for cars, have dropped from 5.4% to -0.4%, while prices for semi-durable goods, like food and clothing, have decreased from 4.3% to 2.1%. We’re still experiencing delays in delivering cars. As a result, manufacturers are concentrating on selling more expensive vehicles with higher margins and are offering fewer discounts from list prices.

Inflation in service prices, excluding shelter, has slowed from 5.1% to 1.5%. If bond rates begin to drop, we will see a gradual decline in mortgage costs. The challenge will be rental costs, which are soaring due to the very limited availability of rentals and the continuous influx of newcomers. Increasing housing supply is key to reducing rental prices. However, that is a problem that will take years to resolve given the significant shortage of housing.

Currently, the Bank is concerned about inflation expectations, corporate pricing behaviour, and wage growth. As noted in its Monetary Policy Report, “As excess demand eases, inflation is expected to slow. At the same time, inflation expectations should also fall, businesses’ pricing behaviour should normalize, and wage growth should moderate. So far, progress has occurred but somewhat more slowly than anticipated.”

The Bank will be careful to ensure that inflation expectations inconsistent with its 2% target are not embedded in corporate pricing and wage expectations. A slowing economy should help to lower those expectations.

The general view from market economists is that we could see some easing of the overnight rate by mid-2024.

NERD STUFF: Maintaining a restrictive rate policy

The Bank can maintain a restrictive policy even without increasing rates any further, simply by keeping rates at their current level. With the overnight rate at 5% and an inflation rate of 3.8%, the real policy rate is 1.2%. This rate is restrictive, since it is higher than the neutral real rate of interest, which the Bank estimates to be between 0 and 1%.

The neutral real rate of interest is the level of interest that neither stimulates nor restrains economic growth. In other words, it is the rate at which the economy is in balance, with stable prices and full employment. Therefore, when the real rate of interest is restrictive, we would expect GDP to slow.

In its recent Monetary Policy Report (MPR), the Bank is forecasting economic growth to average less than 1% over the next few quarters, while potential output growth is expected to average 2%, mainly due to population growth and increased labor productivity. This should lead to a negative output gap (low demand and a surplus of products) and lower inflation.

The Virus & Deferring: Another reason not to have your mortgage at your bank

Another reason not to have your mortgage at your main bank…

Many home owners have all their banking in one place for convenience but this is another “trap.” If everything is at your favorite bank, they can see:

- from your pay deposits if you are still working, or are receiving EI payments.

- what your debts and minimum payments are,

- your savings & checking balances, what your Line-of-credit is, and your credit score.

- they know the value of your home and the mortgage amount.

With all of this data on hand, the bank can decline your deferral and suggest that you use more funds from savings or line-of-credit to make the payments.

Mortgage Mark Herman, Top Calgary Mortgage Broker

Someone who has lost their job, or has reduced pay, due to the virus, is not going to react well to having their bank tell them to continue to make payments from savings or LOCs.

The Deferral Trap

If you have the ability to not defer and can continue to make the payments it will keep you out of the “Deferral Trap.” The “Trap” is when all the payments that were deferred, and the interest not yet paid, needs to be repaid or the lender could renew you at any rate they want; like posted rates. The only way you could change banks and/or still get a competitive rate would be to catch up all the owed funds.

Up to the Banks to allow you to defer … or not.

The mortgage insurers are leaving it to the lenders to decide if they will defer payments or not and the banks have not published any guidelines on how they are going to deal with this. Reviews so far range from, “super-easy, no questions asked, deferred for 6 months” to the other end of the spectrum with “your mortgage is too new” or if you have not been laid off, have not tested positive for Covid-19, or your credit is not good enough, or they want to redo the entire mortgage application, then it is their choice to allow the deferral. The way around this would be to contact your mortgage insurer directly to see if you can work through them if your bank is not cooperating.

the WORST: Mortgages @ Big-6 Banks

This blog summarizes why getting a mortgage from 1 of the Big-6 banks is the worst idea:

- Rates are higher; ranging form .25% to .55% higher

- Terms & Conditions are no where near as good:

- Collateral charges: http://markherman.ca/?s=collateral

- payout penalties: http://markherman.ca/?s=payout+penalties

Here is the article that is fully correct:

Big Banks vs. Broker Lenders:

Always talk to a mortgage broker before buying, or renewing or refinancing your mortgage

Mark Herman; Top Calgary, Alberta Mortgage Broker

How the Big-5 Banks Trap You in Their Mortgages

- what your credit score is

- your pay and income going into your accounts

- your debt payments

- other debt balances on your credit report

- your home/ rental addresses so they can accurately guess at your home value.

Highlights of the article link below are:

Canada’s biggest banks are tightening their grip … as new rules designed to cut out risky lending make it harder for borrowers to switch lenders … the country’s biggest five banks … are reporting higher rates of renewals by existing customers concerned they will not qualify for a mortgage with another bank.

“B-20 has created higher renewal rates for the big banks, driving volumes and goosing their growth rates,” said Eight Capital analyst Steve Theriault. “It’s had the unintended consequence of reducing competition.”

Royal Bank of Canada (RBC), the country’s biggest lender, said last month that mortgage renewal rates [are up …] due in part to the B-20 regulations and also to improvements it has made to make it easier for customers to renew.

Ron Butler, owner of Toronto-based brokerage Butler Mortgage, said the changes leave borrowers with less choice.

“Even if they are up-to-date with their repayments, borrowers may find they don’t qualify with other lenders so they’re stuck with their bank at whatever rate it offers,” he said.

Senior Canadian bankers such as RBC … and TD … voiced their support for the new rules prior to their introduction, saying rising prices were a threat to Canada’s economy.

While analysts say RBC and TD are expected to benefit from higher-than-normal retention rates in 2019, not everyone is sure borrowers will benefit.

“The banks are becoming more sophisticated in targeting borrowers who would fail the stress test and they can charge them higher rates at renewal knowing they can’t move elsewhere,” Butler said.

Link to the full article is here: https://business.financialpost.com/news/fp-street/canadas-big-banks-tighten-grip-on-mortgage-market-after-rule-changes

We saw the “Mortgage Renewal Trap” coming long ago when the Stress Test was announced. It is more important than ever to consider Mortgage Broker Lenders for your mortgage now.

Mark Herman, Top Calgary Alberta Mortgage Broker.

The Details: What you need to know about “discount mortgages.”

Grandma always said, “The price is the price, but the details are the details!”

There are discounted and restricted mortgage rates out there but they do not share the details of their disadvantages up front with you.

- Restricted or Limited Products / Bait & Switch

People will not even sign a 3 year cell- phone contact any more but they will try to save $15 a month on a restricted mortgage; which could cost them $30,000 as a payout penalty – BUYER BEWARE is what the regulators say.

Brokers often advertise these products to get you to call them and then they switch you into a “regular product” if you are lucky – or you get a “restricted product” that you probably do not want if you know all the details.

Discount mortgages called “limited” or “restricted” and often have:

- No rate holds

- Only monthly payments

- Only 1 statement a year

- No on-line administration = call centre only

- Only 5/5 extra repayment option – most broker lenders are 15/15 + 2x or 20/20

- The 1st number is the % of the original mortgage amount you can repay every year without penalty

- The 2nd number is the increase in monthly payment in % you can do without penalty.

- The 2x = double the payment!

- And they use the bank payout penalty calculations – as below in the Dirty Trick – AND in addition to that penalty, a 3% fee of the entire mortgage balance added to the penalty!

- This could easily end up at $30,000.

The other main “Details” that are not often disclosed are:

2.Collateral Charge

To keep you from leaving the bank for a lower rate when you renew later, the banks register your mortgage as a collateral charge – which is the same as an “I owe you” / IOU for the home. Other banks will not take another banks IOU for a mortgage; which means:

- A lawyer will have to re-register your mortgage at land titles; $1000.

- An appraisal is needed as the registration is usually for more than the value of the home; $450

- http://blog.markherman.ca/?s=collateral

- This means on renewal you will not get the best rates because it will cost you about $1500 – $2500 to move banks – even after your term is over.

3. The “Dirty Trick” of how the banks calculate your payout penalty

- If you have to move or break your mortgage the payout calculation is usually way lower at a broker-only bank than any of the big banks. The big banks all calcualte the penatly the same way now – to their advantage, not yours.

- http://blog.markherman.ca/2015/08/26/payout-penalties-how-the-big-5-banks-get-you/

To avoid these products, or to disucss what your personal situation may be, call us any time at 403-681-4376.

Mark Herman, Top Calgary, Alberta, mortgage broker for renewals, first time home buyers and home purchases.

4 Reasons Canadian Mortgage Rates Are Going to go up Soon

Here is a great summary of what is causing mortgage rates to be nosing up in the near future. They really should have gone up by now but the anticipated “Spring housing market rush” competition with the banks is holding them down.

Mark Herman, top Calgary, Alberta mortgage broker for home purchases and mortgage renewals

The latest round of economic data has real-estate watchers returning their focus to interest rates.

- Activity in the bond market and the latest employment numbers are fueling predictions there will be a bump in fixed-rate borrowing costs in the near future.

- Employment improvements are generally seen as a harbinger of inflation. That, along with other domestic and international considerations, is pushing up government bond yields, which in turn drive fixed mortgage rates.

- There is also the notion that the big, trend-setting lenders will be looking to move rates up to bolster profits.

- As well, Bank of Canada Governor Stephen Poloz has hinted he might be willing to let inflation run in order to avoid hiking the policy rate. That would also put upward pressure on government bond yields.

The graph we watch to show us this is here:

Variable Rates:

- As for variable-rate mortgages, the betting is there will not be a Bank of Canada increase until the middle of 2016, holding variable rates in place for the foreseeable future.

Bank Payout Penalties: The math behind “how they get you!”

This is a great article with the perfect math example.

Remember, there is also the catch of the collateral charge by the big banks that makes it cost about $2500 to leave your bank when your term is up.

Add these 2 things together and the better overall deals are from mortgage brokers.

Mark Herman, Top Calgary, Alberta Mortgage Broker for renewals and home purchases.

by: Angela Calla, AMP.

When choosing between mortgages, knowing how different lenders calculate penalties can be essential. The market and your needs easily shift during the term of your mortgage and the last thing you want is a painful penalty in order to get out early.

Penalty formulas differ radically, depending on the lender. A major bank, for example, will have a considerably higher penalty than a broker-only wholesale lender. Advice on how to avoid painful penalties is a key benefit of working with a mortgage broker.

You need to ask one important question right off the bat: What rates does the lender use to calculate its penalty? The actual discounted rates that people pay, or some artificially high posted rate? Hopefully the former.

Below is an example of how two lenders calculate the same “interest rate differential” penalty in different ways. Ask yourself, which one would save you the most money?

| Penalty #1 – Broker Lender | |

| Contract Rate (The rate you actually pay) | 4.19% |

| Current Rate (Today’s new rate, closest to your remaining term) | 3.09% |

| Differential (Contract Rate – Current Rate) | 1.10% |

| Remaining Balance | $229,000 |

| Remaining Months | 16 |

| Penalty Formula: Remaining Balance x Differential ÷ 12 x Remaining Months | $3,358.67 |

| TOTAL APPROXIMATE PENALTY | $3,358.67 |

| Penalty #2 – Major Bank | |

| Contract Rate (The rate you actually pay) | 4.19% |

| Current Posted Rate (Today’s new posted rate, closest to remaining term) | 3.39% |

| Original Posted Rate (At the time you got your mortgage) | 5.99% |

| Original Discount (That you received off the Original Posted Rate) | 1.80% |

| Differential (Contract Rate – (Current Posted Rate – Original Discount)) | 2.60% |

| Remaining Balance | $229,000 |

| Remaining Months | 16 |

| Penalty Formula: Remaining Balance x Differential ÷ 12 x Remaining Months | $7,938.67 |

| TOTAL APPROXIMATE PENALTY | $7,938.67 |

As you can see, there can be quite a difference in prepayment charges when you leave a lender early – over $4,500 in this example. And this is a modest hypothetical calculation. Bank discounts today are on the order of 2.00 percentage points off posted, instead of the 1.80 I’ve used here.

Some lenders will even charge an abnormally high penalty (like 3% of principal) despite you being close to the end of your mortgage term. They do this as a retention tool to keep you from leaving. Others will charge a “reinvestment fee” on top of the penalty, tacking on another $100 to $500 in expenses.

In short, penalties can be thousands—or even tens of thousands—higher depending on the lender’s specific calculation formula, mortgage amount, rates and time remaining until maturity. Extreme penalties are not only more expensive, they can even keep borrowers from moving because the amount eats into the money they’ve got for a down payment and closing costs.

Worse yet, some lenders have a “sale only” clause in their mortgages, meaning you can’t even leave them unless you sell the home. If you think, “Oh, that’s no big deal. I don’t plan on selling,” think again. Throughout every path in life, there are moving parts and uncertainties. When you get married, do you plan on divorcing? Likely not. Did you predict the company you were with for 20 years could downsize, or your pension would be reduced or cut? Can you guarantee your health will never throw you a curve ball?

We all want to believe that none of the above scenarios will come to pass, but they can and do. And when they do, what a relief it is to have options.

And last but not least, there is the refinance consideration. If interest rates fall 0.5-0.8%, (which may seem unlikely but is certainly a possibility) there may be opportunities to lower your borrowing costs. But you can’t do that unless you’ve got a low-cost way to renegotiate your existing contract. And as we’ve seen above, that cost is not based on just your interest rate alone.

Another example: When the rates are the same at the bank and the broker = broker deal is significantly better.

Here is what happens when the Current Posted Rate (Major Banks) = the Current Rate (Broker Lender) at 3.09%

Differential (Contract Rate – (Current Posted Rate – Original Discount)) = 2.90%

==> (4.19% – (3.09% – 1.80%)) = 2.90%

==> (4.19% – 1.29%) = 2.90%

Therefore:

Penalty Formula: Remaining Balance x Differential ÷ 12 x Remaining Months

==> $229,000 x 2.90% / 12 * 16

==> $8854.67

Moral of the story – talk to a broker and understand your penalty calculations.

You can talk to your major bank as well, although I don’t think they can spin the penalty calculation conversation into a favourable one for themselves.

My bank REALLY REALLY REALLY wants my mortgage! Really?

Does your bank really, really, really want your mortgage that badly?

Do you know why?

NOT because they make lots of money on mortgages.

NOT because the bank rep needs to fill their mortgage quota this month (this happens too.)

BECAUSE the banks have studies that if they can get you to have 3 or more products with them, your odds of leaving to go to another bank fall by 75%.

This means 2 things:

- If they can get you to have the mortgage in addition to your existing checking and savings accounts and or credit card then you will probably not leave for another bank and their cost of customer acquisition is very high.

- Then they can cross-sell you the products they really, really make money on:

- LOCs – line of credits – and more credit cards both with overdraft protection and insurance for the minimum payments if you are injured or laid-off.

- mortgage insurance – a huge profit for them as they try very hard later not to pay claims in their post-claim underwriting process

- mutual funds

- long distance phone plans

- travel insurance

- all the rest.

And 1 more VERY important thing:

Banks know that 86% of people will stay with their existing bank at mortgage renewal time. AND if you have the magic 3 products will you move your mortgage somewhere else then?

Banks expect you to chisel them down now, and when you renew they renew you at rates that are typically .25% to .75% higher than they should be. And 86% of people just sign the renewal docs and send them back. (More data from studies.)

This does NOT happen with mortgages via mortgage brokers as the banks know they have to renew you at the best possible rates or the very same broker that took the customer to that bank will be the very same broker that moves the customer to a new bank if for a better rate on renewal.

Do you want to play this game with the banks or just skip it all together?

All this advice from the top mortgage broker in Calgary Alberta, Mark Herman.