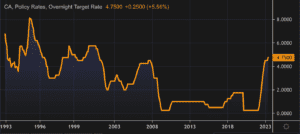

Canadian Prime Rate Drops to 4.5%

Horray – the rates are dropping.

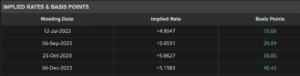

We expect to see a total of 2 MORE rate reductions of 0.25% each in 2024.

5 x o.25% reductions are expected in 2025 making the variable the better way to go right now.

Mortgage Mark Herman

DATA

Encouraged by underling trends in the Canadian economy, the Bank of Canada today cut its overnight policy interest rate by 0.25% to 4.50%.

This is the second incremental reduction we’ve seen in as many months and while both cuts have been modest, they are moving Canada toward less restrictive monetary policy.

We summarize the Bank’s rationale for this decision by summarizing its observations below, including its forward-looking comments for signs of what may happen next.

Canadian inflation including shelter inflation

- Inflation measured by the Consumer Price Index moderated to 2.7% in June after increasing in May

- Broad inflationary pressures are easing, and the Bank’s preferred measures of core inflation have been below 3% for several months and the breadth of price increases across components of the CPI is now near its historical norm

- Shelter price inflation remains high, driven by rent and mortgage interest costs, and is still the biggest contributor to total inflation

- Inflation is also elevated in services that are closely affected by wages, such as restaurants and personal care

Canadian economic performance and outlook

- Economic growth “likely” picked up to about 1.5% through the first half of 2024, however, with robust population growth of about 3%, the economy’s potential output is still growing faster than GDP, which means excess supply has increased

- Household spending, including both consumer purchases and housing, has been “weak”

- There are signs of slack in the labour market with the unemployment rate rising to 6.4% and with employment continuing to grow more slowly than the labour force and job seekers taking longer to find work

- Wage growth is showing some signs of moderating, but remains elevated

- GDP growth is forecast to increase in the second half of 2024 and through 2025, reflecting stronger exports and a recovery in household spending and business investment as borrowing costs ease

- Residential investment is expected to grow robustly

- With new government limits on admissions of non-permanent residents, population growth should slow in 2025

Global economic performance and outlook

- The global economy is expected to continue expanding at an annual rate of about 3% through 2026

- While inflation is still above central bank targets in most advanced economies, it is forecast to ease gradually

- In the United States, an anticipated economic slowdown is materializing, with consumption growth moderating and US inflation appearing to resume its downward path

- In the euro area, growth is picking up following a weak 2023

- China’s economy is growing modestly, with weak domestic demand partially offset by strong exports

- Global financial conditions have eased, with lower bond yields, buoyant equity prices, and robust corporate debt issuances

- The Canadian dollar has been relatively stable and oil prices are around the levels assumed in the Bank’s April’s Monetary Policy Report

Summary comments and outlook

The Bank forecasts that Canadian GDP will grow at 1.2% in 2024, 2.1% in 2025, and 2.4% in 2026 and that a strengthening economy will gradually absorb excess supply through 2025 and into 2026.

As a result of an easing in broad price pressures, the Bank expects inflation to move closer to 2%, its long-stated goal. As a result, the Bank’s Governing Council decided to reduce the policy interest rate by 25 basis points.

It further noted that while ongoing excess supply is lowering inflationary pressures, price pressures in some important parts of the economy—notably shelter and some other services—are “holding inflation up.”

Accordingly, the Bank said it is carefully assessing these “opposing forces.” Monetary policy decisions therefore will be guided by incoming information and the Bank’s assessment of the implications for the inflation outlook.

Once again, the statement noted in conclusion that the Bank remains “resolute in its commitment to restoring price stability for Canadians.”

Next Up

The Bank returns on September 4th with its next monetary policy announcement.

Prime now 6.95% from 7.20%: BoC reduces its benchmark interest rate to 4.75%

Today, the Bank of Canada reduced its overnight policy interest rate by 0.25% to 4.75%. This welcome and widely expected decision comes on the heels of evidence pointing to a deceleration of the rate of inflation.

SUMMARY:

The “overnight rate” being quoted is the rate that Banks borrow from each other at, not consumer Prime, which is confusing.

Canadian Consumer Prime has just been reduced from 7.20% to 6.95% – this only affects Variable Rate mortgages.

Fixed rates remain unchanged because they track the Canadian Mortgage Bond Rates which are different, and similar.

There has also been about 40 “silent” fixed rate reductions of o.o5% each in 2024 that the press did not cover.

Mortgage Mark Herman, Top best Calgary Alberta mortgage broker specializing in 1st time buyers

Below we examine the Bank’s rationale for this move by summarizing its observations below, including its all-important outlook comments that are sure to shape market expectations for the remainder of the year.

Canadian inflation

- Inflation measured by the Consumer Price Index (CPI) eased further in April to 2.7%

- The Bank’s preferred measures of core inflation also slowed and three-month indicators suggest continued downward momentum

- Indicators of the breadth of price increases across components of the CPI have moved down further and are near their historical average, however, shelter price inflation remains high

Canadian economic performance and housing

- Economic growth resumed in the first quarter of 2024 after stalling in the second half of last year

- At 1.7%, first-quarter GDP growth was slower than the Bank previously forecast with weaker inventory investment dampening activity

- Consumption growth was solid at about 3%, and business investment and housing activity also increased

- Labour market data show Canadian businesses continue to hire, although employment has been growing at a slower pace than the working-age population

- Wage pressures remain but look to be moderating gradually

- Overall, recent data suggest the economy is still operating in excess supply

Global economic performance and bond yields

- The global economy grew by about 3% in the first quarter of 2024, broadly in line with the Bank’s April Monetary Policy Report projection

- The U.S. economy expanded more slowly than was expected, as weakness in exports and inventories weighed on activity

- In the euro area, activity picked up in the first quarter of 2024 while China’s economy was also stronger in the first quarter, buoyed by exports and industrial production, although domestic demand remained weak

- Inflation in most advanced economies continues to ease, although progress towards price stability is “bumpy” and is proceeding at different speeds across regions

- Oil prices have averaged close to the Bank’s assumptions, and financial conditions are little changed since April

Summary comments and outlook

The Bank cited continued evidence that underlying inflation is easing for its decision to change its policy interest rate. More specifically, it said that “monetary policy no longer needs to be as restrictive.”

Also welcome was the Bank’s statement that “recent data” have “increased our confidence that inflation will continue to move towards” its 2% target.

However, it also added this to its outlook: “Nonetheless, risks to the inflation outlook remain. Governing Council is closely watching the evolution of core inflation and remains particularly focused on the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behaviour.”

And has it has been doing for some time, it said the Bank “remains resolute in its commitment to restoring price stability for Canadians.”

Next up

The Bank returns on July 24th with its next monetary policy announcement – I think they will do another 0.25% reduction at the next meeting and they will continue to reduce at every meeting for the next 3 meetings this year.

Prime Rate Holding, July 1st Expected Reduction & Real Estate Economic Data

The Bank of Canada cited the ongoing risk of inflation for its decision to maintain its overnight benchmark interest rate at 5.0%.

Below are the Bank of Canada’s observations, including its forward-looking comments on the state of the economy, inflation and interest rates.

Canadian inflation

- CPI inflation ended the year at 3.4% and the Bank expects inflation to remain close to 3% during the first half of 2024 “before gradually easing” and returning to the Bank’s 2% target in 2025

- Shelter costs remain “the biggest contributor to above-target inflation”

- While a slowdown in demand is said by the Bank to be reducing price pressures in a broader number of CPI components and corporate pricing behavior continues to normalize, core measures of inflation are not showing sustained declines.

Canadian economic performance and outlook

- The Bank notes that the Canadian economy has “stalled” since the middle of 2023 and believes growth will likely remain close to zero through the first quarter of 2024

- Consumers have pulled back their spending in response to higher prices and interest rates, and business investment has contracted

- With weak growth, supply has caught up with demand and the economy now looks to be operating in modest excess supply

- Labour market conditions have eased, with job vacancies returning to near pre-pandemic levels and new jobs being created at a slower rate than population growth. However, wages are still rising around 4% to 5%

Global economic performance and outlook

- Global economic growth continues to slow, with inflation easing “gradually” across most economies

- While growth in the United States has been stronger than expected, it is anticipated to slow in 2024, with weakening consumer spending and business investment

- In the euro area, the economy looks to be in a mild contraction

- In China, low consumer confidence and policy uncertainty will likely restrain activity

- Oil prices are about $10 per barrel lower than was assumed in the Bank’s October Monetary Policy Report (MPR)

- Financial conditions have eased, largely reversing the tightening that occurred last autumn

- The Bank now forecasts global GDP growth of 2.5% in 2024 and 2.75% in 2025 compared to 2023’s 3% pace

- With softer growth this year, inflation rates in most advanced economies are expected to come down slowly, reaching central bank targets in 2025

Outlook

The Bank believes that Canadian economic growth will strengthen gradually “around the middle of 2024.” Furthermore, it expects household spending will likely “pick up” in the second half of 2024, and exports and business investment should get a boost from recovering foreign demand.

Taking all of these factors and forecasts into account, the Bank’s Governing Council decided to hold its policy rate at 5% and to continue to “normalize” the Bank’s balance sheet.

The Bank’s statement went on to note that Council “is still concerned about risks to the outlook for inflation, particularly the persistence in underlying inflation” and wants to see “further and sustained easing in core inflation.” The Bank also said it continues to focus on the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behaviour.

As it has said consistently over the past year, the Bank will remain “resolute in its commitment to restoring price stability for Canadians.”

Although the Bank did not say it, the bottom line is we will have to wait and see what comes next.

Next touchpoint

March 6, 2024 is the Bank’s next scheduled policy interest rate announcement.

When Will Canadian Mortgage Rates Begin to Fall?

Last week, the Bank of Canada held its policy rate at 5%. The decision was expected given slowing in the economy and modest improvement to core inflation measures.

The Bank is likely at the end of its tightening cycle. How soon it eases rates – and how low will rates go in the near to medium term – is the question #1

ANSWER: The general view from market economists is that we could see some easing of the overnight rate by mid-2024.

Question #2: How low. how far will Prime come down?

ANSWER: Prime is expected to come down a total of 2%.

DETAILS of Prime Cuts

- Prime is 7.2% now / November 2nd, 2023,

- Prime is expected to get down to to 5.2% or a bit lower, like 4.75% – 5.25% range by the end 2025; which looks like this:

- June/ July 2024, 1st Prime cuts = 6 months

- Prime reduction by o.25% every quarter = 1% less / year for the next 2 years = 24 months

- so these together = 30 months.

With Prime coming down, now is the time for you to take advantage of the Variable Rate reductions.

Variable Rates via brokers are at Prime – o.9%, while the Big-6 banks rates are Prime – o.15%.

YES, broker rates are 6x better than at the Big-6 lenders, o.9 – o.15 = o.75% better. It’s true!

Mortgage Mark Herman; Best Top Calgary Mortgage Broker for first time home buyers.

When might rates begin to fall?

The Bank’s latest Monetary Policy Report (MPR) also provides signals that we can monitor to gauge when rates could start declining.

When interest rates rise, one of the main ways monetary policy affects the economy is through reduced consumer spending on durable goods, like appliances, furniture and cars. Prices for durable goods, except for cars, have dropped from 5.4% to -0.4%, while prices for semi-durable goods, like food and clothing, have decreased from 4.3% to 2.1%. We’re still experiencing delays in delivering cars. As a result, manufacturers are concentrating on selling more expensive vehicles with higher margins and are offering fewer discounts from list prices.

Inflation in service prices, excluding shelter, has slowed from 5.1% to 1.5%. If bond rates begin to drop, we will see a gradual decline in mortgage costs. The challenge will be rental costs, which are soaring due to the very limited availability of rentals and the continuous influx of newcomers. Increasing housing supply is key to reducing rental prices. However, that is a problem that will take years to resolve given the significant shortage of housing.

Currently, the Bank is concerned about inflation expectations, corporate pricing behaviour, and wage growth. As noted in its Monetary Policy Report, “As excess demand eases, inflation is expected to slow. At the same time, inflation expectations should also fall, businesses’ pricing behaviour should normalize, and wage growth should moderate. So far, progress has occurred but somewhat more slowly than anticipated.”

The Bank will be careful to ensure that inflation expectations inconsistent with its 2% target are not embedded in corporate pricing and wage expectations. A slowing economy should help to lower those expectations.

The general view from market economists is that we could see some easing of the overnight rate by mid-2024.

NERD STUFF: Maintaining a restrictive rate policy

The Bank can maintain a restrictive policy even without increasing rates any further, simply by keeping rates at their current level. With the overnight rate at 5% and an inflation rate of 3.8%, the real policy rate is 1.2%. This rate is restrictive, since it is higher than the neutral real rate of interest, which the Bank estimates to be between 0 and 1%.

The neutral real rate of interest is the level of interest that neither stimulates nor restrains economic growth. In other words, it is the rate at which the economy is in balance, with stable prices and full employment. Therefore, when the real rate of interest is restrictive, we would expect GDP to slow.

In its recent Monetary Policy Report (MPR), the Bank is forecasting economic growth to average less than 1% over the next few quarters, while potential output growth is expected to average 2%, mainly due to population growth and increased labor productivity. This should lead to a negative output gap (low demand and a surplus of products) and lower inflation.

Canadian Economic Forecast – Nov- Mortgage related use

Bank of Canada holds its interest rate steady, publishes updated economic forecasts

On October 25th, the Bank of Canada announced that it would maintain its Canadian Prime Rate stays at 7.3% – stating that there is “growing evidence” that past interest rate increases are dampening economic activity and relieving price pressures.

This decision provides some comfort to borrowers who have seen their mortgage costs rise steadily since March of 2022. As for real relief – in the form of rate cuts – the Bank demurred, noting that its preferred measures of core inflation show “little downward momentum.” Consequently, the Bank said it is holding this policy rate and continuing its current policy of quantitative tightening.

We capture the Bank’s observations and its latest economic forecasts in the summary below.

Inflation facts and outlook

- In Canada, inflation measured by the Consumer Price Index (“CPI”) has been volatile in recent months: 2.8% in June, 4.0% in August, and 3.8% in September

- Higher interest rates are moderating inflation in many goods that people buy on credit, and this is spreading to services

- Food inflation is easing from very high rates; however, in addition to elevated mortgage interest costs, inflation in rent and other housing costs remains high

- Near-term inflation expectations and corporate pricing behavior are normalizing only gradually, and wages are still growing around 4% to 5%

- The Bank’s preferred measures of core inflation show little downward momentum

Canadian housing and economic performance

- There is growing evidence that past interest rate increases are dampening economic activity and relieving price pressures

- Consumption has been subdued, with softer demand for housing, durable goods and many services

- Weaker demand and higher borrowing costs are weighing on business investment

- A surge in Canada’s population is easing labour market pressures in some sectors while adding to housing demand and consumption

- In the labour market, recent job gains have been below labour force growth and job vacancies have continued to ease; however, the labour market remains “on the tight side” and wage pressures persist

- Overall, a range of indicators suggest that supply and demand in the economy are now “approaching balance”

Global economic performance and outlook

- The global economy is slowing and growth is forecast to moderate further as past increases in policy interest rates and the recent surge in global bond yields weigh on demand

- The Bank projects global GDP growth of 2.9% this year, 2.3% in 2024 and 2.6% in 2025. While this outlook is little changed from the Bank’s July Monetary Policy Report, the composition has shifted, with the US economy proving stronger and economic activity in China weaker than expected

- Growth in the Euro area has “slowed further”

- Inflation has been easing in most economies, as supply bottlenecks resolve and weaker demand relieves price pressures but underlying inflation is persisting, meaning central banks must “continue to be vigilant”

- Oil prices are higher than the BoC assumed in July, and the war in Israel and Gaza is a new source of geopolitical uncertainty

Summary and Outlook

The BoC noted that after averaging 1% over the past year, economic growth is expected to remain “weak” for the next year before increasing in late 2024 and through 2025. Near-term weakness in growth reflects both the broadening impact of past increases in interest rates and slower foreign demand. The subsequent economic “pickup” will be driven by household spending as well as stronger exports and business investment in response to improving fore

ign demand. Spending by governments contributes materially to growth over the forecast horizon. Overall, the Bank expects the Canadian economy to grow by 1.2% this year, 0.9% in 2024 and 2.5% in 2025.

In the Bank’s October projection, CPI inflation is expected to average about 3.5% through the middle of next year before gradually easing to 2% in 2025. Inflation is expected to return to the Bank’s target about the same time as policymakers forecast in their July 2023 projection, “but the near-term path is higher because of energy prices and ongoing persistence in core inflation.”

As for what to expect going forward, the Bank had this to say about interest rates: “With clearer signs that monetary policy is moderating spending and relieving price pressures, Governing Council decided to hold the policy rate at 5% and to continue to normalize the Bank’s balance sheet. However, Governing Council is concerned that progress towards price stability is slow and inflationary risks have increased, and is prepared to raise the policy rate further if needed.”

The message is therefore clear: the Bank wants to see downward momentum in core inflation before it changes tack, and continues to be focused on the “balance between demand and supply in the economy, inflation expectations, wage growth and corporate pricing behaviour.”

Once again, the Bank ended its communique with a familiar phrase: it remains “resolute in its commitment to restoring price stability for Canadians.”

What’s next?

The Bank’s final (scheduled) interest rate announcement of 2023 takes place December 6th and we will follow immediately after with our next executive summary.

Canadian economy running too hot, BoC increases Prime by .25%

Hot Economic growth leads the Bank of Canada to increase its benchmark interest rate

Today, the Bank of Canada increased its overnight interest rate to 4.75% (+0.25% from April) because of higher-than-expected growth in Canada’s economy in the first quarter and the view that monetary policy was not yet restrictive enough to bring inflation down to target.

Leading up to today’s announcement, many economists feared that the BoC would have no choice but to raise rates in the face of persistent inflation and recent GDP growth. Their fears were founded.

To understand the Bank’s thinking on this important topic, we highlight its latest observations below:

Inflation facts and outlook

- In Canada, Consumer Price Index (CPI) inflation “ticked up in April” to 4.4%, the first increase in 10 months, with prices for a broad range of goods and services coming in higher than expected

- Goods price inflation increased, despite lower energy costs

- Services price inflation remained elevated, reflecting strong demand and a tight labour market

- The Bank continues to expect CPI inflation to ease to around 3% in the summer, as lower energy prices “feed through” and last year’s large price gains “fall out” of the yearly data

- However, with three-month measures of core inflation running in the 3.50%-4% range for several months and excess demand persisting, concerns have increased that CPI inflation could get stuck materially above the 2% target

Canadian housing and economic performance

- Canada’s economy was stronger than expected, with GDP growth of 3.1% in Q1 2023

- Consumption growth was “surprisingly strong and broad-based,” even after accounting for the boost from population gains

- Demand for services continued to rebound

- Spending on “interest-sensitive goods” increased and, more recently, “housing market activity has picked up”

- The labour market remains tight: higher immigration and participation rates are expanding the supply of workers but new workers have been quickly hired, reflecting continued strong demand for labour

- Overall, excess demand in the economy looks to be “more persistent” than anticipated

Global economic performance and outlook

- Globally, consumer price inflation is coming down, largely reflecting lower energy prices compared to a year ago, but underlying inflation remains stubbornly high

- While economic growth around the world is softening in the face of higher interest rates, major central banks are signalling that interest rates may have to rise further to restore price stability

- In the United States, the economy is slowing, although consumer spending remains surprisingly resilient and the labour market is still tight

- Economic growth has essentially stalled in Europe but upward pressure on core prices is persisting

- Growth in China is expected to slow after surging in the first quarter

- Financial conditions have tightened back to those seen before the bank failures in the United States and Switzerland

Summary and Outlook

The BoC said that based on the “accumulation of evidence,” its Governing Council decided to increase its policy interest rate, “reflecting our view that monetary policy was not sufficiently restrictive to bring supply and demand back into balance and return inflation sustainably to the 2% target.”

The Bank says quantitative tightening is complementing the restrictive stance of monetary policy and normalizing the Bank’s balance sheet.

Going forward, the Bank said it will continue to assess the dynamics of core inflation and the outlook for CPI inflation with particular focus on “ evaluating whether the evolution of excess demand, inflation expectations, wage growth and corporate pricing behaviour are consistent with achieving” its inflation target.

Once again, the Bank repeated its mantra that it “remains resolute in its commitment to restoring price stability for Canadians.”

Next up

With today’s announcement now behind us, a new round of speculation will begin in advance of the Bank’s next policy announcement on July 12th.

Odds of New Rates

Market odds now have a July 12 hike at a 61% probability, with potentially another increase by December.

Just 1 more Prime Rate increase would take the benchmark prime rate from 6.95% at the end of today to a nosebleed 7.20% (last seen in February 2001).

There may well be another Prime Rate increase on July. We have strategies to beat these rates so please call and we can sort out a situation that works for you.

BoC Holds Canadian Prime at 6.7% on April 12th – Good News!

Today, April 12, 2023, the Bank of Canada held its policy interest rate at 4.50%, a welcome outcome for borrowers after almost a year of constant increases, and a timely confidence-builder for the real estate industry as it enters the spring market.

The Bank also issued its latest Monetary Report with updated risk assessments and base-case projections for inflation.

We highlight the Bank’s latest observations below.

Inflation acts and outlook

- In Canada, the Consumer Price Index (CPI) inflation eased to 5.2% in February, and the Bank’s preferred measures of core inflation were just under 5%

- The Bank expects Canadian CPI inflation to “fall quickly” to around 3% in the middle of 2023 and then decline more gradually to the 2% target by the end of 2024

- Recent data is reinforcing Governing Council’s “confidence” that inflation will continue to decline in the next few months

- Similarly, in many countries, inflation is easing in the face of lower energy prices, normalizing global supply chains, and tighter monetary policy

- At the same time, labour markets remain “tight” and measures of core inflation in many advanced economies suggest persistent price pressures, especially for services

Canadian economic performance and outlook

- Domestic demand is still exceeding supply and the labour market remains tight

- Economic growth in the first quarter looks to be stronger than was projected in January, on a “bounce” in exports and solid consumption growth

- While the Bank’s Business Outlook Survey suggests acute labour shortages are starting to ease, wage growth remains elevated relative to productivity growth

- Strong population gains are adding to labour supply and supporting employment growth while also boosting aggregate consumption

- Softening foreign demand is expected to restrain exports and business investment

- Overall, GDP growth is projected to be weak through the remainder of this year before strengthening gradually next year, implying the Canadian economy will move into excess supply in the second half of this year

- The Bank now projects Canada’s economy will grow by 1.4% this year – an improvement over its last forecast of 1% growth – 1.3% in 2024 (a downgrade from its last forecast of 2% for 2024) and then pick up to 2.5% in 2025

Canadian housing market

- Housing market activity remains subdued

- As more households renew their mortgages at higher rates and restrictive monetary policy works its way through the economy more broadly, consumption is expected to moderate this year

Global economic performance and outlook

- The Bank’s April Monetary Policy Report projects global growth of 2.6% in 2023 – an improvement over its last forecast of 2% offered in January – and then fall to 2.1% in 2024 (lower than it last forecast of 2.5%), and rise to 2.8% in 2025

- Recent global economic growth has been stronger than anticipated with performance in the United States and Europe surprising on the upside

- However, growth in those regions is expected to weaken as tighter monetary policy continues to feed through those economies

- In particular, US growth is expected to “slow considerably” in the coming months, with particular weakness in sectors that are important for Canadian exports

- Activity in China’s economy has rebounded, particularly in services

- Overall, commodity prices are close to their January levels

Outlook

While holding the line on interest rates, the Bank also noted in today’s announcement that it is continuing its policy of quantitative tightening and remains “resolute in its commitment to restoring price stability for Canadians.” There was nothing new in that statement. However, it also posited that getting inflation the rest of the way back to 2% “could prove to be more difficult because inflation expectations are coming down slowly, service price inflation and wage growth remain elevated, and corporate pricing behaviour has yet to normalize.”

As it sets monetary policy going forward, the Bank’s Governing Council indicated that it will be “particularly focused” on these indicators, and the evolution of core inflation as it gauges the progress of returning CPI inflation back to its 2% target.

The Bank also said it continues to assess whether monetary policy is “sufficiently restrictive” to relieve price pressures and “remains prepared to raise the policy rate further if needed” to return inflation to its 2% target.

Next Announcement is …

We will have to wait until April 20th to get the next CPI reading to gauge progress in one of the Bank’s determining indicators and June 7th for the Bank’s next scheduled policy interest rate announcement.

Inflation is slowing and that is great news for Canadian home buyers

Mortgage Mark Herman, Top Calgary Alberta Mortgage Broker

Bank of Canada increases its benchmark interest rate to 4.50%

Today, the Bank of Canada increased its overnight benchmark interest rate 25 basis point to 4.50% from 4.25% in December. This is the eighth time since March 2022 that the Bank has tightened money supply to address inflation.

While the headline increase will certainly make news, it is the Bank’s accompanying commentary on its future moves that will capture the most attention. We summarize the Bank’s observations below, including its forward-looking comments on the potential for future rate increases.

Canadian inflation

- Inflation has declined from 8.1% in June to 6.3% in December, reflecting lower gasoline prices and, more recently, moderating prices for durable goods

- Despite this progress, Canadians are still “feeling the hardship” of high inflation in their essential household expenses, with persistent price increases for food and shelter

- Short-term inflation expectations remain elevated and while year-over-year measures of core inflation are still around 5%, 3-month measures have come down, suggesting that core inflation has “peaked”

Canadian economic and housing market performance

- The Bank estimates Canada’s economy grew by 3.6% in 2022, slightly stronger than was projected in the Bank’s Monetary Policy Report in October, however it projects that growth is expected to “stall through the middle of 2023,” picking up later in the year

- Canadian GDP growth of about 1% is forecast for 2023 and rising to about 2% in 2024, little changed from the Bank’s October outlook

- The economy remains in “excess demand” and the labour market remains “tight” with unemployment near historic lows and businesses reporting ongoing difficulty finding workers

- However, there is “growing evidence” that restrictive monetary policy is slowing activity especially household spending

- Consumption growth has moderated from the first half of 2022 and “housing market activity has declined substantially”

- As the effects of interest rate increases continue to work through the economy, spending on consumer services and business investment is expected to slow

- Weaker foreign demand will likely weigh on Canadian exports

- This overall slowdown in activity will allow supply to “catch up” with demand

Global economic performance and outlook

- The Bank estimates the global economy grew by about 3.5% in 2022, and will slow to about 2% in 2023 and 2.50% in 2024 — a projection that is slightly higher than the Bank’s forecast in October

- Global economic growth is slowing, although it is proving more resilient than was expected at the time of the Bank’s October Monetary Policy Report

- Global inflation remains high and broad-based although inflation is coming down in many countries, largely reflecting lower energy prices as well as improvements in global supply chains

- In the United States and Europe, economies are slowing but proving more resilient than was expected at the time of the Bank’s October Monetary Policy Report

- China’s abrupt lifting of pandemic restrictions has prompted an upward revision to the Bank’s growth forecast for China and “poses an upside risk to commodity prices”

- Russia’s war on Ukraine remains a significant source of uncertainty

- Financial conditions remain restrictive but have eased since October, and the Canadian dollar has been relatively stable against the US dollar

Outlook

Taking all of these factors into account, the Bank decided today’s policy rate increase was necessary and justified.

However, the Bank also offered this important piece of news: “If economic developments evolve broadly in line with (its) outlook, Governing Council expects to hold the policy rate at its current level while it assesses the impact of the cumulative interest rate increases.”

That sounds positive, but as is customary, the Bank also noted that it is prepared to increase the policy rate further if needed to return inflation to its 2% target. It also added the usual language that it “remains resolute in its commitment to restoring price stability for Canadians.”

Although the Bank did not say it, the bottom line is Canadians will have to wait and see what comes next.

Next touch point

March 8, 2023 is the Bank’s next scheduled policy interest rate announcement and we will be on hand to provide an executive summary the same day.

Canadian Residential Mortgage Market: Inflation & Interest Rates: the Lead Characters for 2023

Summary:

- The Bank of Canada (BOC) increased interest rates 7 times in 2022. Exactly as expected 16 months ago.

- Inflation is at least 5.7%; and it needs to get down to 3%

- The BoC would rather over-tighten than under-tighten

- Normally it takes 18 to 24 months for interest rate increases to work their way into the economy and we are only about 10 months into this tightening cycle

These 4 painful data points mean Prime will increase from 6.45% to 6.70% on Jan 25th.

We now expect there to be at least 1 or 2 more o.25% increases to Prime before it is expected to hold for the rest of 2023, and then begin to decrease in 2024.

Mortgage Mark Herman, Top Calgary Alberta Mortgage Broker

DATA

A lot of the recent talk in financial and real estate circles has been centering on the possibility of a pause in the Bank of Canada’s aggressive interest rate increases. Some speculate that could happen at the next rate setting, later this month, on January 25th.

The Bank raised rates 7 times last year in an effort to rein-in galloping inflation. It does seem to be working, but there are some stubborn sticking points.

Headline inflation, known as the Consumer Price Index (CPI), has dropped. It was 8.1% in July and drifted down to 6.8% in November. However, the drop from October to November was a mere one-tenth of one percentage point and the Bank’s target rate remains significantly below that, at 2.0%.

As well, the BoC’s preferred inflation measure, Core Inflation (which strips out volatile components like food and fuel), actually increased. A simple averaging of the three components that the Bank uses to measure Core Inflation came in at nearly 5.7% in November, up from 5.3% in October.

Other factors that figure into the Bank’s plans include Gross Domestic Product and unemployment. Canada’s GDP continues to grow, albeit modestly, despite rising interest rates. It increased by 0.1%, month-over-month in November. Unemployment dipped 0.1% to 5.0% in December. Both of these tend to fuel higher wages which are a key driver of inflation.

The Bank of Canada, itself, remains firmly dedicated to battling back inflation. Governor Tiff Macklem has said he would rather over-tighten than under-tighten and run the risk of having high inflation linger and become entrenched.

The U.S. central bank has made it clear it plans more rate hikes. Given the integration of the Canadian and American economies, the Bank of Canada does have to pay attention to what its American counterpart does.

The BoC will have new economic data by the time it makes its January 25th announcement. The December numbers will provide a fresh look at how well the inflation fight is going.

Normally it takes 18 to 24 months for interest rate increases to work their way into the economy and we are only about 10 months into this tightening cycle. It is reasonable to expect another 25 basis-point increase on the 25th. Given the Bank’s apparent success so far it also seems reasonable to expect a pause sometime after that.

Looking ahead to a year from now some forecasters say we might start to hear talk of interest rate cuts, which would be welcome news. Cuts would allow the BoC to move toward its, long stated, goal of normalizing rates back into the neutral range of 2.5% to 3.5%. The Bank of Canada, and central banks around the world, have been trying to do that for more than a decade – since the ’08 – ’09 financial collapse.

Details of Canadian Economic & Housing Market Performance, as at Dec 7, 2022

Bank of Canada increased Consumer Prime to 6.45% – exactly as expected for the last 5 months. January 25th is the next BoC interest rate announcement & I hope it is a 0.25% increase and then holds there for all of 2023. We will see…

Mortgage Mark Herman, Best Calgary mortgage broker with a Master’s degree in Finance.

Today, the Bank of Canada increased its overnight benchmark interest rate 50 basis point to 4.25% from 3.75% in October. This is the 7th time this year that the Bank has addressed inflation and means the policy rate is now as high as it has been in 15 years.

We summarize the Bank’s observations below, including its forward-looking comments on the need/likelihood of future rate increases below:

Canadian inflation

- CPI inflation remained at 6.9% in October, with many of the goods and services Canadians regularly buy showing large price increases

- Measures of core inflation “remain around 5%”

- Three-month rates of change in core inflation have come down, “an early indicator that price pressures may be losing momentum”

Canadian Economic and housing market performance

- GDP growth in the third quarter was stronger than expected, and the economy continued to operate “in excess demand”

- The labor market remains “tight” with unemployment near historic lows

- While commodity exports have been strong, there is growing evidence that tighter monetary policy is restraining domestic demand: consumption moderated in the third quarter

- Housing market activity continues to decline

- Data since the October Monetary Policy Report supports the Bank’s outlook that growth will essentially stall” through the end of this year and the first half of 2023

Global inflation and economic performance

- Inflation around the world remains high and broadly based

- Global economic growth is slowing, although it is proving more resilient than was expected at the time of the Bank’s October Monetary Policy Report

- In the United States, the economy is weakening but consumption continues to be solid and the labor market remains “overheated”

- The gradual easing of global supply bottlenecks continues, although further progress could be disrupted by geopolitical events

Outlook

Although the Bank’s commentary noted that price pressures that are driving high inflation may be losing momentum, it went on to say that inflation is “still too high” and that short-term “inflation expectations remain elevated.” In the Bank’s view, the longer that Canadian consumers and businesses expect inflation to be above the Bank’s 2% target, “the greater the risk that elevated inflation becomes entrenched.”

Given these economic signals, the Bank’s Governing Council stated that it “will be considering whether the policy interest rate needs to rise further to bring supply and demand back into balance and return inflation to target.”

It concluded its statement with a familiar refrain: “We are resolute in our commitment to achieving the 2% inflation target and restoring price stability for Canadians.”

Analysts and commentators will seek to interpret those outlook comments for signs that the Bank has reached or believes it is close to reaching the terminal point in its current rate-hike cycle. For now, that remains a question of debate and speculation that will turn on future economic signals.

Next Touchpoint

January 25th is the next BoC interest rate announcement. I hope it is a 0.25% increase and then holds there for all of 2023. We will see…