This just in data is when mortgage interest rates are expected to rise.

DATA JUST IN

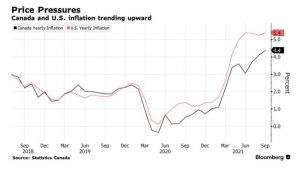

Canada’s latest employment and inflation numbers have triggered new expectations about the next steps by the Bank of Canada and the arrival of interest rate increases.

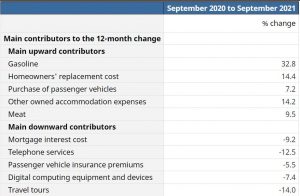

BoC Governor Tiff Macklem continues to offer soothing words about inflation, which is current running at 4.1%. That is an 18 year high and more than double the central bank’s 2.0% target.

Macklem has repeatedly said high inflation is temporary; the result of low prices during the pandemic lock-downs, and supply chain problems that have cropped-up as the economy reopens.

Macklem points out that a key factor in long term inflation – wage growth – has not materialized. That is despite Canada returning to pre-pandemic employment levels with the addition of 157,000 jobs in September. It should be noted that the growth of Canada’s labour force during the pandemic means the country is still 276,000 jobs short of full employment. Last week however, Macklem did concede that this temporary inflation may linger for longer than initially expected.

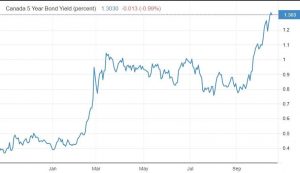

Several prominent economists have weighed-in. Benjamin Tal cautions that inflation is a lagging economic indicator. He says the risks for long-term inflation are present and the Bank of Canada would be better to start raising rates earlier to help mitigate those risks. Doug Porter says there is a growing chance rate increases will come earlier. He expects they will happen quarterly rather than every six months. And, Derek Holt would like to see a rate hike by the end of the year, given that emergency levels of stimulus are in place while inflation is well above target.

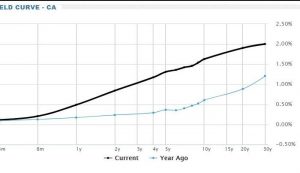

Look for mortgage interest rates to start going up close to the end of 2021 and continue until they are back close to PRE-Covid Rates of about 3.35% for the 5-year fixed.

Mortgage Mark Herman, best Calgary mortgage broker for the masses!