Canada #3 Place to Live in the World

This is pretty interesting. I think we could be higher if the winters were not so long and cold.

Mark Herman; Calgary, Alberta Mortgage Broker

Canada Ranks #3 in Legatum Prosperity Index 2013

Published the Tuesday 26 November 2013 by Gwen at 15:00 in Business, Canada, Education, Health, News, | No comment .

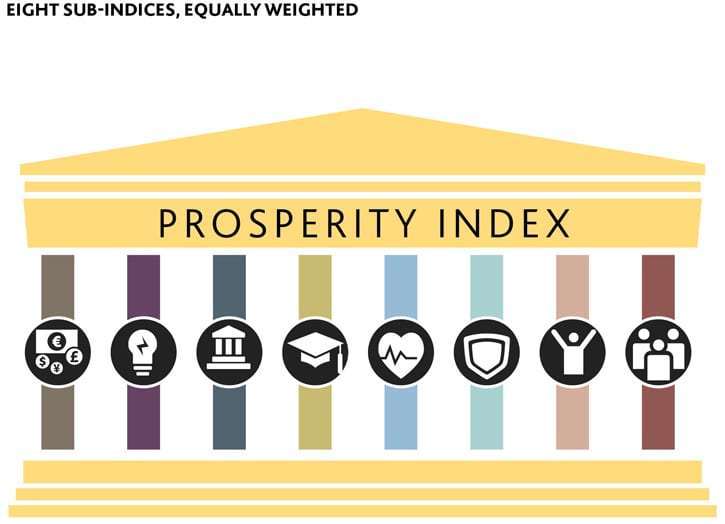

The Legatum Prosperity IndexTM 2013 is out, and Canada ranks 3rd in the world for its overall prosperity, right behind Norway and Switzerland. The country’s ranking leaped from 6th to 3rd in just one year, thus confirming its position as the leader of the Americas region.

For five years now, the Legatum Institute has been compiling and comparing data of 142 countries in order to draw one of the most accurate and comprehensive portraits of prosperity around the world. Their vision is that prosperity should include not only objective economic indicators, but also subjective evaluations of well-being and development indicators as perceived by the population.

With an impressive balance between scientific rigor and user-friendly design (just play with the interactive map and shuffleboard), the website provides great insights on prosperity to both the expert and the neophyte.

In this changing, post 2008 economic crisis, post Arab Spring world, Canada’s prosperity is exemplary on economic stability and human development alike. Below is a digest of Canada’s data, grouped by LI sub-indexes and revealing the key elements that make Canada the third most prosperous country in the world.

Personal freedom: Canada ranks 1st

- 94.1% of the population believes it’s a good place to live for immigrants (and ethnic minorities)

- 91.8% is satisfied with their freedom of choice

Education: Canada ranks 3rd

- The teacher to pupils ratio is 1:12

- 79.1% of the population is satisfied with quality of education

Economy: Canada ranks 4th

- 1.5% inflation

- 74.6% of the population has confidence in financial institutions

- 89.4% has access to adequate food and shelter

- 86.5% is satisfied with their living standards

- 45.8% thinks it’s a good time to find a job

Social capital: Canada ranks 6th

- 42.2% of the population has volunteered in the past month

- 68.5% has donated money to charity

- 65% has helped a stranger

- 94.8% says they can rely on others in times of need

Safety & Security: Canada ranks 7th

- 12.3% of the population had property stolen last year

- 84.3% feels safe to walk alone at night

Governance: Canada ranks 8th

- 67.4% of the population has confidence in the honesty of elections

- 44% believes business/government corruption is widespread

Health: Canada ranks 11th

- Health expenditure is $4520 per capita

- Immunization rate against infectious diseases is 95%

- Life expectancy is 80.9 years

Entrepreneurship & Opportunity: Canada ranks 16th

- Business start-up costs 0.4% of GNI per capita

- 78.5% of population thinks it’s a good place for entrepreneurs to start a business

- Innovation: Canada earns twice as much in royalties than the world’s average

Adapted from The Legatum Institute website.

Prime could double by end fo 2015.

All the more reason to take the 5 year fixed rate. Here is some fuel for the fire of fixed rates- which have never been this low! Below you can read the boring data we digest daily to give you the best un-biased opinion on your mortgage.

Does your banker do this for you – no way!

Mark Herman, Calgary Alberta Mortgage Broker.

—

OECD calls for Bank of Canada rate to more than double to 2.25% by end of 2015

OTTAWA — Just last month, the Bank of Canada dropped a mini-bombshell by adopting a neutral position on interest rates, after long insisting that any eventual move would be up.

That left open the real possibility the central bank may, instead, lower borrowing costs — at least until the struggling economy regains its momentum.

Textbook economics would say that deflation should have already arrived at our doorstep.

Now, the global think-tank that helps guide countries along a growth path says Canada’s central bank may actually resume its course for higher rates — beginning as early as next year — as that economic momentum returns and inflation starts to pick up speed.

“With spare capacity narrowing by the end of 2015, monetary policy tightening may need to begin by late 2014 to avoid a build-up of inflationary pressures,” the Organization for Economic Cooperation and Development said Tuesday.

The first move above the bank’s current 1% lending level — where it has been since September 2010 — will likely come in the fourth quarter of 2014, the Paris-based organization said in the report, and continue rising to 2.25% by the end of 2015.

Many economists have been expecting the first move, if it is up, to come in the first quarter of 2015.

“The pause in the economic recovery since early 2012 has continued this year,” the OECD said its economic outlook for Canada, part of a larger global report.

“Exports have been weaker than expected, possibly reflecting shifts in trade linkages and on-going competitiveness challenges. This, together with declining corporate profits, has depressed business investment.”

The OECD said this “suggests that investment growth will remain low in the near term, with firms using existing capacity more intensively.”

But exports and business investment should begin turning around through 2014 and 2015, leading to growth of 2.3% next year and 2.6% a year later, it said. In 2012, the Canadian economy edged ahead by 1.7% and the organization is forecasting the same pace this year.

“Projected growth should be enough to absorb the small degree of remaining excess capacity by end-2015, and the inflation rate should increase to near the [Bank of Canada’s] 2% target rate.”

The OECD, which has 34 member nations with both advanced and emerging economies, is predicting the world economy will expand by 2.7% this year, followed by 3.6% growth in2014.

The United States, which will remain Canada’s biggest trading partner for the foreseeable future despite free-trade deals in other regions, should grow by 1.7% this year and ramp up 2.9% in 2014.

The eurozone has managed two quarters of modest growth so far this year, after emerging from a long recession. But the OECD predicts another contraction — of 0.4% — this year, before returning to growth of 1% in 2014.

“The main risks to the projections are ongoing uncertainty about the U.S. economy and the potential for renewed tensions in sovereign-debt markets and the financial sector in the euro area,” the OECD said.

“Both factors could reduce exports and tighten financial conditions, reducing economic growth.”

The report also warned that a “disorderly correction” in Canada’s real estate market and the impact on highly indebted households “would depress consumption and residential construction and, in an extreme case, could threaten financial stability.”

That is a concern shared by the Finance Department and Bank of Canada. Both have cautioned consumers not to binge on the current cheap-credit environment. The concern is that households could be caught in a spiral of rising interest payments and shrinking equity in their homes if the market turns cold.

Last week, Finance Minister Jim Flaherty said he was prepared to tighten lending rules on home purchases — as he has four times in four years — if too many Canadian are seen getting in over their heads with mortgage debt.

Meanwhile, on the same day the central bank surprised analysts by dropping its rate-increase bias, governor Stephen Poloz and his policy team downgraded their outlook for the economy.

In its quarterly Monetary Policy Report, released on Oct. 23, the bank said Canada’s economy will likely grow by 1.6% this year, down from its July outlook of 1.8%. For 2014, the estimate was cut to 2.3% from 2.7%, while the forecast for 2015 is now 2.6%, down from 2.7%

Averge YYC home prices to be > $500,000 in 2017

I have had many people ask what home prices are going to do over the next 4 or 5 years. Well here are the numbers!

Remember, if Alberta were a country our growth would be the same as the world leader – China! – Mark Herman, Calgary Alberta Mortgage Broker.

Calgary resale home average prices to balloon to more than half a million dollars

Report says average to hit $517,016 in 2017

CALGARY – The average price for a resale home in Calgary will balloon to more than half a million dollars by 2017, according to a new real estate report released Tuesday.

The Conference Board of Canada’s Autumn Metropolitan Housing Outlook, commissioned by Genworth Canada, said the average price for all residential property in Calgary will grow from $431,760 this year to $517,016 in 2017.

“Calgary is facing a lack of inventory in particular areas,” said Tanya Eklund, a realtor with RE/MAX Real Estate (Central) in Calgary.

“Buyers looking for land for redevelopment and homes for renovation have been in very short supply and have driven up pricing due to multiple offers and low inventory. Low interest rates, strong unemployment rates, low vacancy rates and an overall strong economy have also added to strength in the Calgary market.”

Calgary’s economy and housing demand continue to thrive as energy sector activity remains healthy. Rising GDP is spurring employment growth,” said the report.

“On the resale housing market front, solid sales will lead to sound price gains this year and next. The new housing market is benefitting from strong absorptions, which are trimming unsold stocks of new units and fostering new construction. The medium term also looks decent.

“Ongoing economic growth will continue to produce gains in resale sales and prices and keep housing starts above their 20-year average. Good housing affordability, measured against local incomes, is an ongoing benefit to this market and allows single-family starts to maintain a high market share compared with other cities covered in this report.”

The report said summertime flooding in Calgary will limit Calgary’s GDP to 3.3 per cent growth in 2013, modest by recent standards. Output will rise a slightly faster 3.4 per cent in 2014, spurred by government-funded rebuilding efforts.

The job market will continue to expand, with annual growth of 2.4 per cent this year and 2.8 per cent in 2014 cutting the unemployment rate from 4.9 per cent this year to 4.6 per cent in 2014. Economic health should continue between 2015 and 2017, with GDP expanding roughly three per cent and employment rising about two per cent each year, it said.

“Calgary’s strong economic fundamentals allowed its resale market to largely shrug off the floods. Seasonally-adjusted sales and the average resale price actually rose during June, the flood month, and have subsequently advanced,” said the report.

“Price growth is accelerating, although increases remain far below boom-era advances. We expect the market to remain balanced and price growth to stay healthy in 2014 and over the following few years.”

The report’s forecast for average prices over the next few years and annual growth rate are:

2013: $431,760, 4.7%

2014: $451,798, 4.6%

2015: $473,470, 4.8%

2016: $497,139, 5.0%

2017, $517,016, 4.0%

Forecast for sales in the resale market for the next few years and annual growth rate are:

2013, 28,111, 5.5%

2014, 28,793, 2.4%

2015, 29,418, 2.2%

2016, 30,027, 2.1%

2017, 30,620, 2.0%

“Unsurprisingly, Calgary’s resale prices are rising briskly. Year-over-year growth has averaged a solid 4.6 per cent in the latest four quarters, including a first quarter jump near eight per cent,” said the report. “These increases will lift Calgary’s average price 4.7 per cent in 2013, the largest gain since 2007 and finally exceeding that year’s peak value. Similar price growth is expected between 2014 and 2016, with a slight tapering in growth to four per cent in 2017.

“These increases will slightly erode local housing affordability. Principle and interest charges on Calgary’s average resale home were under 16 per cent of average household income the last two years and are expected to remain there in 2013. But house prices will rise faster than incomes, pushing the ratio to roughly 20 per cent by 2017. This remains decent, as affordability is better only in Edmonton, Ottawa, and Winnipeg among the cities in this report.”

The report said buoyant housing demand is also energizing the new home market. Absorption of new units averaged 11,200 units in the four quarters to the second quarter of 2013, up 25 per cent from a year earlier. This included a surge to an annualized 15,000 units in the second quarter, the most since 2008. This strength will lift absorptions to a full-year total of 12,140 units in 2013, up 25 per cent from 2012. Another increase of nearly six per cent in absorptions is expected for 2014, but still trailing the peak of 13,700 units reached in 2008.

“Healthy new-unit take-up fuelled a big jump in housing starts to 13,186 units in 2012, more than double the recessionary trough in 2009, but well off peak levels of the last decade,” it said. “We expect starts to ease a modest 2.7 per cent in 2013 as an 11 per cent dip in multiple starts slightly outweighs a seven per cent gain in single-detached starts. For 2014, rebounding multiple starts will fuel a five per cent increase in total starts despite relatively unchanged single-detached construction.

“In the medium term, we expect housing starts to ease slightly, as both single-family and multiple construction dip. By 2017, we expect 11,400 units to get under way; this would slightly outpace the 20-year average of housing starts. While multiple starts are expected to increase their market share, they are forecast to make up only 52 per cent of total starts between 2013 and 2017.”

Calgary housing boom pushing prices to all-time high

Below in blue I have highlighted the most important part of this and paste it here too: “the Calgary numbers we’re seeing today show this is the strongest and healthiest housing market since the 2006 boom,” he said. “That said, this isn’t the boom — and that’s a good thing.”

As always, sustained growth – as high as China if Alberta were a country – has people moving here and they have to live somewhere. Check out my other blog posts for more on this topic. Mark Herman

Single-family homes average more than half a million dollars

CALGARY – Calgary’s booming housing market is pushing average prices to record levels as single-family home sales so far this year are averaging well above half a million dollars.

“The residential real estate market is holding strong for sellers,” said Grace Yan, a Calgary realtor with RE/MAX Real Estate (Central).

“It usually slows down for Christmas season but we are realizing that it remains at a steady rise. We are still finding a shortage of listings, lots of activity with shorter days on the market. We are finding from fixer uppers, inner-city properties to turnkey luxury high-end homes in demand. We anticipate the steady market to continue to heat up for the new year.”

As of Thursday, according to the Calgary Real Estate Board, the average MLS sale price for all residential property in the city so far this year has been $457,123. The annual record is $428,649 set last year. In 2004, average sale prices in the city were $227,269.

So far this year, the average MLS sale price for a single-family home is $517,598. The annual record price of $481,259 was set last year. In 2004, the average was $251,558.

On Friday the Canadian Real Estate Association released its latest MLS data for October showing that Calgary had the best year-over-year gain in the country in the MLS Home Price Index.

CREA said prices in Calgary, for homes tracked by the index, rose by 8.17 per cent from last year while the national average of 11 markets surveyed was up by 3.52 per cent.

Scott Bollinger, broker with the ComFree Commonsense Network, said there was a little softness in the market last year because of the introduction of tighter mortgage rules.

“But the Calgary numbers we’re seeing today show this is the strongest and healthiest housing market since the 2006 boom,” he said. “That said, this isn’t the boom — and that’s a good thing. 2006 was marked by some things we’re not seeing today — a massive inventory crunch, irrational exuberance and confidence that the market would stay strong indefinitely, and almost unthinkable economic growth. We saw six and seven per cent growth in 2006.

“Our economy today is growing at a nice, measured, healthy rate — three, three-and-a-half per cent. So we’re still seeing confidence, but it’s not the same extreme. There’s a collective memory in this city of the boom, so I think this strength we’re seeing is more sustainable. Houses are still selling quicker, but they’re nowhere near the frenzied pace we saw in 2006, when the average time on market dipped to 20 days.”

In October, Calgary had 2,510 MLS sales, up 19.3 per cent from last year. Alberta registered 5,588 sales, up 16.1 per cent, and Canada had 39,039 MLS sales for an annual hike of 8.3 per cent.

Average sale prices in October and their year-over-year increase were: Calgary, $436,216, 4.2 per cent; Alberta, $377,084, 3.8 per cent; and Canada, $391,820, 8.5 per cent.

Calgary’s real estate market is showing no signs of slowing down in November. Month-to-date including Thursday, there have been 830 MLS sales in the city, up 34.30 per cent from the same period a year ago, according to CREB. The average sale price has also climbed by 7.47 per cent to $463,126.

Doug Porter, chief economist with BMO Capital Markets, said there are two notable splits developing in Canada’ housing market – larger cities are hot, while smaller cities are generally not, and sales in the West are strong, but are weakening in much of the East.

“When judged by total sales volumes, a measure that combines both price changes and the number of units sold, the hottest markets this year are Calgary, Edmonton, and, against all expectations, Vancouver,” he said. “All three have reported double-digit volume increases, the only cities in that category.”

Mortgages could get tougher soon = buy sooner

Boring data below – and we also have *secret* data that the government is going to make things harder for home buyers = buy sooner if you can before the program you may need no longer exists. This is true ESPECIALLY for SELF EMPLOYED people.

Jim Flaherty vows to intervene in housing market again if needed

Canada’s finance minister says he’ll intervene in the housing market for a fifth time, if that’s what’s needed, to head off any bubble.

“We have to watch out for bubbles – always – in markets around the world, including our own Canadian residential real estate market, which I keep a sharp eye on,” Jim Flaherty said today in Edmonton, where he unveiled his fall economic and fiscal update, The Globe and Mail’s Carrie Tait reports.

“And I’ve intervened four times in the last several years, and I’ll intervene again if I have to to make sure we don’t create a housing bubble.”

Mr. Flaherty’s latest move came in the summer of 2012, when he tightened mortgage insurance rules and deliberately sparked a slump in the residential real estate market.

The effect of that has faded, however, and, as The Globe and Mail’s Tara Perkins has reported, sales have rebounded, at least partly because of expectations of higher interest rates.

Canada’s housing market is seen by some groups as among the frothiest in the world, though most economists do not expect a U.S.-style meltdown.

Mr. Flaherty’s comments highlight the continuing concern among policy makers over the strength of Canada’s real estate market as families continue to juggle record debt burdens.

Indeed, the Canadian Real Estate Association is expected later this week to report another month of strong home sales in October, somewhere in the area of 12 per cent.

Canada revises its numbers

As for his fall update, Mr. Flaherty now forecasts a budget surplus of at least $3.7-billion for fiscal 2015-16, the year of the next election, The Globe and Mail’s Bill Curry reports.

Spending cuts, control of public sector wages and asset sales helped push the government to that projection from an initial forecast of just $800-million.

The government now also forecasts a 2013-14 deficit of $17.9-billion and a 2014-15 shortfall of $5.5-billion.

Going forward, the 2015-16 surplus would widen to $5-billion in 2016-17, $5.7-billion a year later and $9.8-billion in 2018-19.

“The emphasis placed on responsible fiscal management has made Canada a recognized leader on the international economic stage,’ the government said in the document.

“Canada’s total government net debt level, which includes the federal, provincial/territorial and local governments as well as the net assets of the Canada Pension Plan and Quebec Pension Plan, is the lowest of any G7 country, standing at less than half the G7 average in 2012, at 34.7 per cent of GDP.”

The Canadian government relies on private sector forecasts for its economic assumptions, the average of which calls for economic growth of 1.7 per cent this year, 2.4 per cent next and 2.6 per cent in 2015. Mark Herman, Calgary Alberta Mortgage Broker.

Calgary top-rated market for overall real estate prospects

Calgary top-rated market for overall real estate prospects

This is great news for buyers … you are buying a home and a great investment – not the case for other provinces.

As we have always been saying … Alberta’s in-bound migration and strong job market will support home prices.

Did you know that Alberta is short 25,000 jobs in the oil field right now? That is going to continue for the medium term! – Mark Herman

Strong economic and employment growth forecast

CALGARY – For the second year in a row, Calgary is the top-rated market in Canada for overall real estate prospects, according to a survey of industry experts.

Calgary kept the top spot with the highest ratings for prospects in three categories – investment, development and homebuilding, said the Emerging Trends in Real Estate report by PwC and the Urban Land Institute.

“The Calgary economy continues to post solid gains, despite the disruption caused by summer flooding,” said the report. “The energy industry, primarily oil, remains strong and will continue to benefit from economic growth around the world.

“Locally, energy and energy service companies have dominated office demand. Economic activity is being supported by growth in both the goods and services sectors. Manufacturing and construction will lead the goods sector, and personal services and transportation and warehousing are the key drivers on the service side.”

The report is based on a survey of over 1,000 industry experts including investors, fund managers, developers, property companies, lenders, brokers, advisers and consultants.

The ratings of other Canadian cities in order following Calgary are: Edmonton, Saskatoon, Vancouver, Toronto, Winnipeg, Ottawa, Halifax and Montreal.

The report said economic activity in Calgary is projected to grow at a 3.3 per cent rate in 2013 and a 3.4 per cent rate in 2014. Employment growth is expected to slow but remain good through the end of this year and into 2014, growing at 2.4 per cent and 2.8 per cent, respectively.

#Mortgage RATES to stay low for a while yet – that is great news!

Below is the technical, boring stuff we read to see where rates are going for you. Just ask us for the short version.

Short version is that the Bank of Canada is going to leave the rates the same for a while yet – like a year.

Long boring version is below.

Canadian Dollar Down in Wake of BOC Dropping Tightening Bias

TORONTO–The Canadian dollar is lower Thursday morning as it struggles with the implications of the Bank of Canada’s erasure of its tightening bias amid a broader retreat in commodity currencies.

The U.S. dollar was at C$1.0409 Thursday, from C$1.0384 late Wednesday, according to data provider CQG.

Its high for the session so far at C$1.0419 fell just shy of resistance around the C$1.0420 area.

The Australian and New Zealand dollars are also lower Thursday amid concerns about monetary policy and banking system liquidity in China. Any threat to economic growth in China puts pressure on commodities and commodity-linked currencies because Chinese demand for commodities is a key support for the asset class.

But the Canadian dollar is also grappling with the implications of the Bank of Canada’s decision on Wednesday to drop its 18-month-old tightening bias, a move some analysts believe could prompt a new round of weakness in the Canadian unit as it undermines the perception the Bank will raise interest rates before other advanced economies.

Currency strategists at UBS said in a report the Bank’s move derailed a rally they had expected to see in the currency.

“Having felt conditions were ripe for a CAD rally, we were taught a harsh lesson on Wednesday by the BOC: never ever underestimate the determination of a small, open economy’s central bank to defy expectations for a positive outlook,” they said.

The tightening effect on the Canadian economy from any gain in the Canadian dollar is simply too big for the Bank of Canada to risk, and the bank wanted to keep policy steady in order to retain maximum policy flexibility, UBS said.

Write to Don Curren at don.curren@wsj.com

YYC & YEG set to lead ALL of Canada for growth

Calgary and Edmonton and all of Alberta continue to grow = housing price support, which is pretty much the theme to 50% of the data I post. Alberta is the only province that is continually growing and we would be competing with China’s growth rate if Alberta were a country.

—

Edmonton housing market overtakes Calgary in investment ranking

Both cities poised to lead Canadian economic growth

CALGARY — Edmonton has overtaken Calgary as the top community in Alberta to invest in residential real estate.

The ranking was done by the Real Estate Invesment Network and released Saturday. Edmonton was second behind Calgary on last year’s list.

“Before the flood hit, Calgary’s real estate market was performing right in tune to the underlying economic fundamentals. Not too hot, not too cold,” said Don Campbell, senior analyst of the REIN Research Institute. “After the floods hit, the rental as well as the housing markets over-performed the underlying fundamentals and have pushed it into the too hot level, but this situation should not last longer than 12 months. We continue to experience zero vacancy rates, strong in-migration, one of the strongest job creation economies in the country. So slowdown of the effect of the post-flood transaction bump will not be felt negatively in the market due to the pent-up demand. Good news overall for Calgary’s market for the coming years.

“Calgary did not, in essence, lose its No. 1 ranking. It is still one of the top places in North America for property investment. However, Edmonton grabbed the No. 1 ranking because it is behind Calgary in its residential and industrial recovery curve. This means that Edmonton’s market, beginning at a lower position in the real estate cycle, should slightly outperform the returns a homeowner or investors will experience in Calgary, which is already 12 to 18 months ahead on the cycle.”

Campbell said both cities are poised to be economic leaders in Canada in 2014 and 2015 and therefore the forecast for in-migration and housing demand remains very strong.

The ranking for other Alberta communities are: 3. Airdrie; 4. Leduc; 5. St. Albert; 6. Red Deer; 7. Fort Saskatchewan; 8. Fort McMurray; 9. Grande Prairie; 10. Lloydminster; 11. Okotoks; and 12. Lethbridge.

Calgary’s home prices continue to climb in September

Another article showing that the underlying fundamentals of continued in-migration and job growth – of quality jobs – supports the Calgary home market.

Calgary housing market sizzles in September

MLS sales and prices continue to climb

CALGARY — Calgary’s red-hot housing market continued to sizzle in September as MLS sales and prices followed an upward trend.

According to the Calgary Real Estate Board, total MLS sales in the city of 1,923 during the month were up 19.44 per cent from a year ago.

The average sale price rose by 8.27 per cent to $454,352 while the median price was up 8.78 per cent to $402,500.

Calvin Buss, involved in real estate marketing and sales, said job creation and in-migration are fuelling the current market.

“The international in-migration is getting stronger and stronger. And if you look at the number of people that came out of Ontario over the last six months into Alberta, it’s just staggering,” said Buss who has his home for sale in Edworthy Park at $4.49 million. The home is situated in the middle of a forest overlooking the Bow River and the downtown.

“In Calgary we have a tight market. We’ve had good markets over the last two years. And that’s tightened everything up. And then you get all that in-migration coming based on jobs. You start to get things really tightening up. Like the vacancy rate downtown doesn’t have any elasticity to help absorb these people so they’re forced into the marketplace. And the marketplace only has a certain capacity.”

Calgary is in a sellers’ market which is good news for people like Buss who have their homes for sale.

In September, there were 2,796 new listings in the Calgary market, up 4.33 per cent from a year ago but active listings at the end of the month were down by 23.08 per cent to 3,922.

Scott Bollinger, broker for the ComFree Commensense Network, said the jump in prices isn’t too surprising when you look at the underlying factors, which include a tight inventory, a close-to-zero-vacancy rental market converting many would-be renters into potential buyers, and the fact the economy’s humming along.

“What is a little surprising is that the numbers of new listings aren’t keeping pace with big jumps in prices and sales,” said Bollinger. “I think Calgarians know this is a seller’s market. It has been for months. So that tells me that population growth and demand are simply outpacing supply. Speculators who sat for years on second and third properties, waiting for a hot market, have already sold.”

Days on the market to sell in September fell from 45 a year ago to 36, which represented a 20 per cent decline.

“The economy continues to support factors that are driving housing demand forward,” said Richard Cho, senior market analyst in Calgary for Canada Mortgage and Housing Corp. “Employment in Calgary has trended up, with many full-time jobs also created.

“Latest reports also show that net migration to Alberta has been strong as well. After two quarters, net migration in Alberta has increased over 40 per cent from last year. Sales thus far are up compared to 2012 levels, and that is not expected to change by the end of the year.”

Ben Brunnen, a Calgary economic consultant, said the local real estate market should perform well this fall with a favourable economic outlook, a tight rental market and strong population growth the key factors.

“Alberta has been one of the most resiliant economies in Canada, and this gives buyers confidence,” said Brunnen.

“At the same time, supply remains tight with limited inventory to meet demand and builders trying to catch up. For the economy as a whole, strong real estate prices give homeowners confidence, and this could help boost consumer spending in Alberta.”

CREB said single-family home sales in September of 1,354 were up 20.25 per cent from last year while the average price rose by 9.25 per cent to $512,359. Condo apartment sales increased by 17.39 per cent to 324 with the average price up by 4.38 per cent to $298,765. Condo townhouse sales were up 17.79 per cent to 245 while the average sale price increased by 2.95 per cent to $339,534.

“Tight market conditions have supported price growth in the Calgary market,” said Ann-Marie Lurie, CREB’s chief economist. “But the pace of unadjusted monthly growth has eased in September.

“While prices show strong year-over-year gains, if the level of new listings continues to improve relative to sales activity, prices should level off for the remainder of the year.”

Why Alberta Does NOT have a housing bubble; or What is supporting Alberta home prices …

The article below echoes the theme of many of my posts – Inbound migration to Alberta is supporting home prices. Our growth at 6% is 1% less than India – the world leader. My new favorite quote is below, “Alberta actually has the dynamics or properties you’d normally see in emerging economies.”

Lamphier: Hot air can’t bust a housing bubble that doesn’t exist

EDMONTON – If I’ve read one story about a possible U.S.-style housing bust in Canada, I’ve read a hundred.

Indeed, the Toronto-centric national media, whose world view apparently extends from the Don Valley Parkway to Highway 427, seem absolutely obsessed by the topic. Barely a week goes by without another breathless warning from some Toronto economist, columnist or TV news anchor about a looming price collapse.

It’s complete nonsense, in my opinion. For starters, there is no national housing market. Prices vary wildly from place to place, and always will. So while Toronto or Vancouver look pricey, many other cities — including Edmonton— simply don’t.

Of course, I’m just a newspaper scribbler. But when one of the world’s top economic forecasters says the gloom and doom crowd is out to lunch, well, that’s not as easy to dismiss.

Stefane Marion, chief economist and strategist at Montreal-based National Bank, was recently ranked among the top 20 forecasters in the world by U.S.-based Bloomberg Markets magazine. He’s the only Canadian to make that prestigious list.

In Marion’s view, those who insist that Canada’s house prices are “bubbly” — as Britian’s Economist magazine recently argued, and as The Globe and Mail dutifully reported — simply don’t understand what drives housing in the first place.

It’s simple demographics, he says. Canada’s population grew by 1.2 per cent in 2012, versus just 0.8 per cent in the U.S., and 0.2 per cent in the eurozone. Japan’s population, on the other hand, has shrunk for six straight years.

The big reason? Immigration. Newcomers accounted for fully 60 per cent of Canada’s population growth last year, he says, far more than the U.S. or Europe.

What’s more, 55 per cent of those newcomers are between the ages of 20 and 44, when many are launching careers, getting married, starting families, and yes, buying new homes.

Japan is at the opposite end of the spectrum. Its aging population, low birth rate and aversion to immigration curbs demand for housing. Yet the same Economist article that slammed Canada’s housing market as bubbly argues that Japan’s house prices are “undeservedly flat,” Marion says.

“If you don’t have household formation where are your home prices going to go? That’s the key right there. That’s where Canada really, really is different from other countries,” he says, notably in high-growth provinces like Alberta.

“It does explain why the new housing market or home resale market in Alberta seems to be so tight all the time. This is key. Household formation is just surging,” he says. “So it fascinates me that we have economists coming out and taking a shot at Canada and not taking that into account.”

That was one of several key insights Marion offered to local bank clients and advisers at a packed luncheon that was organized by Angus Watt, managing director, individual investor services at National Bank Financial.

Marion’s generally upbeat outlook for the Canadian and Alberta economies jives with the positive tone of Bank of Canada governor Stephen Poloz’s latest comments.

“We are now close to the tipping point from improving confidence into expanding capacity,” Poloz told a Vancouver Board of Trade audience on Wednesday.

Looking ahead, Marion says he expects those demographic trends to continue over the next five years. In the key 20-to-44-year age cohort, he expects India to lead all nations in population growth, at seven percent, followed by Canada, at four per cent. On the flip side, countries like Germany, France, Italy, Russia, China and Japan will show marked declines.

“Alberta would be just behind India, at six per cent. So that shows you how potent this growth is for Alberta. Alberta actually has the dynamics or properties you’d normally see in emerging economies.”

Turning to the oil markets, Marion says despite declining U.S. consumption, falling imports and soaring production — up an astounding 47 per cent in the U.S. since 2006 — Canada’s exports south of the border remain strong.

The biggest loser? OPEC, whose share of U.S. imports has declined from 55 per cent in 2008 to just 46 per cent last year, he says.

“By next year the U.S. will produce as much crude as it did in the 1980s, so we have to cope with this energy revolution in the U.S. . . . but Canada is shipping as much oil and petroleum products to the U.S. as all of OPEC put together. I never thought this would happen anytime soon, so that’s a big, big deal.”

As for TransCanada’s proposed $12 billion Energy East oil pipeline, which would carry Alberta bitumen to refineries in Quebec and New Brunswick, Marion says the potential economic upside for Canada is big, since it would displace higher-priced Brent crude imports from unstable countries like Algeria, Kazakhstan and Angola.

© Copyright (c) The Edmonton Journal