RBC: charged 15 month payout penalty

The Big-6 banks love your money, not your sparkling personality.

This article is old and still shows the same calculations.

RBC charges homeowner $8900 penalty, or 15 months interest charge!

We get calls on high payout penalties all the time. The answer is broker lenders have payouts that are about 30% as much as the Big-6 banks.

Mortgage Mark Herman, top Calgary mortgage broker.

Why CoronaVirus = Lower Mortgage Rates

This link does a great job explaining why rates are coming down right now for mortgages.

https://www.cbc.ca/news/business/coronavirus-mortgage-rates-canada-1.5443071

Summary:

- Events that could cause a stock market crash tend to also cause a “flee to safety” and the 5-year Canadian Mortgage Bond is that safety net.

- When investors buy these bonds the demand goes up so the bonds pay less as everyone wants them.

- The lower cost of the bond means a lower interest rate on your mortgage

This should be a short term blip, so if you are buying a home take advantage of it quickly

Mark Herman, top Calgary mortgage broker

Details of the FTHBI – First Time Home Buyer Incentive

The First-Time Home Buyer Incentive (FTHBI) officially starts on September 2, 2019. Introduced help first-time home buyers, the FTHBI will provide shared equity loans of 5% toward the down payment of a resale home, and 5% or 10% for newly-built homes.

The idea is that by boosting the size of buyers’ down payments, the FTHBI lowers the monthly mortgage payment and is some relief on the costs of home ownership.

Details of Qualification

To qualify for the FTHBI, home buyers must satisfy the following:

- At least one person in the household must be a first-time home buyer, meaning they have not owned a home, or dwelled in a home owned by their spouse, over the last four years. (An exception is made for buyers who’ve had a breakdown of marriage or common-law relationship.)

- Buyers must have a minimum of 5% down payment from “own resources” to qualify for a CMHC insured mortgage.

- Buyers’ combined household income cannot exceed $120,000. This includes the income of any guarantors co-signing on the mortgage, as well as any rental income generated if part of the home is tenanted out.

- The buyers’ Mortgage-to-Income Ratio (MTI) cannot exceed 4x their income, including the portion that’s provided by the FTHBI. This means the maximum down payment for a resale home cannot exceed 14.99%, and 9.99% for a new build.

Details of How It Works

The funds provided are registered as a second mortgage on title, and don’t incur interest.

This second mortgage must be paid back in full when the first insured mortgage matures at 25 years or when the home is sold, whichever comes first. Homeowners may pay it back as a lump sum early without penalty. (Details of how the value at the time of payout are yet to be released.)

Because it is a shared equity mortgage, the amount to be paid back fluctuates along with the value of the home over time: if the home’s assessed value rises, the loan repayment will increase by the same percent. However, the same will occur if the home has lost value by the time it is sold or the mortgage matures.

There are more details on the last post on savings including this chart below: http://markherman.ca/updates-to-cmhc-first-time-buyer-incentive-program/

Savings Over Time

This is a handy chart to see the savings on the monthly payment when using the program.

OVERALL

The program looks to be a helper for saving on payments and that is a great thing.

Mark Herman, Top& Best Calgary Mortgage Broker

Why you don’t want your mortgage at your main bank

The Big-5 banks do not love you, they love your money, and now they can “trap” you in their mortgages if you fail the Stress Test.

Highlights of the last post are below. The post from January is here: http://markherman.ca/how-the-big-5-banks-trap-you-in-their-mortgages/

The new mortgage rules – called the B20 – allow the banks to renew you at almost any rate they want – or at least not a competitive one – if your credit, income, or debts should mean you can’t change banks.

If your mortgage is at your main bank they can see:

- your pay and income going into your accounts

- debt balances on your credit report

- what your credit score is

- your debt payments

- your home/ rental addresses so they can accurately guess at your home value.

ALL THIS MEANS they can calculate if you can pass the new “Stress Test.”

If you can’t pass it then they know you can’t change banks, are you are now totally locked into them for your renewal. They can renew you at POSTED RATES … 5.34%, not actual discounted rates they offer everyone, today (June 2019) about 2.99%.

The GOOD NEWS is broker banks do not do any of this … so having your mortgage at your main bank only helps them “grind you” later on. …. so how convenient is having your mortgage at your bank now?

Highlights of the article link below are:

Canada’s biggest banks are tightening their grip … as new rules designed to cut out risky lending make it harder for borrowers to switch lenders … the country’s biggest five banks … are reporting higher rates of renewals by existing customers concerned they will not qualify for a mortgage with another bank.

“B-20 has created higher renewal rates for the big banks, driving volumes and goosing their growth rates,” said an analyst. “It’s had the unintended consequence of reducing competition.”

Royal Bank of Canada (RBC), said last month that mortgage renewal rates [are up …] due in part to the B-20 regulations.

Ron Butler said, “Even if they are up-to-date with their repayments, borrowers may find they don’t qualify with other lenders so they’re stuck with their bank at whatever rate it offers,” he said.

Senior Canadian bankers such as RBC … and TD … voiced their support for the new rules prior to their introduction, saying rising prices were a threat to Canada’s economy.

While analysts say RBC and TD are expected to benefit from higher-than-normal retention rates in 2019, not everyone is sure borrowers will benefit.

“The banks are becoming more sophisticated in targeting borrowers who would fail the stress test and they can charge them higher rates at renewal knowing they can’t move elsewhere,” Butler said.

Variable rates to hold steady for 2019

Here is the latest on changes to the Prime rate for variable mortgages. The news is good as Prime is now expected to stay the same for the balance of 2019!

Remember:

- Variable rates can be locked in at any time for what the rates are on the day you lock in on.

- The maximum payout fee for is 3 months of interest

Rate hike disappears over the horizon

The likelihood of a Bank of Canada interest rate increase appears to be getting pushed further and further beyond the horizon.

The Bank is expected to remain on the sidelines again this week when it makes its scheduled rate announcement on Wednesday.

A recent survey by Reuters suggests economists have had a significant change of heart about the Bank’s plans. Just last month forecasters were calling for quarter-point increase in the third quarter with another hike next year. Now the betting is for no change until early 2020. There is virtually no expectation there will any rate cut before the end of next year.

The findings put the Bank of Canada in line with the U.S. Federal Reserve and other major central banks. World economies have hit a soft spot largely due to trade uncertainties between China and the United States.

This is good news for variables

Mark Herman, Top Calgary Mortgage Broker

Moving to YYC: How to buy ASAP

Moving to Calgary and Buying a Homes As Soon As Possible

This is a common question, and as usual, the way the banks / lenders want things done is exactly the opposite of what works in real life, for real people, like you.

You Want: To buy a home in Calgary, move the family in, get settled and then start the new job – RIGHT! That makes the most sense.

The Lenders want:

- You to have 1 full-cycle payslip BEFORE then will fund your mortgage and

- You to be completed the 90 day probation if you have a probationary clause in your new employment

Why?

PAYSLIP: The first full-cycle pay-slip – meaning 2 full weeks of pay – critically needs to match your employment letter / job offer at 40.00 hours; or whatever it is that you are guaranteed for pay. If it does not match, then your income is not guaranteed, and the lenders want to see guaranteed pay.

39.97 hours is not 40.00 hours; it means the 40 hours is not guaranteed and the lenders often decline to fund your mortgage.

PROBATION: In Alberta, you can be let go for no reason in the first 90 days of employment – even if you are NOT on probation. It does not matter if there is/not a reason, it is the law.

Obviously, if you just moved here, bought a home and are let go, the odds of you moving back are high. And the bank is left in the risky position of losing money on the home or making an early CMHC claim. Which is why they want to see either: NO probation, or a shortened & completed probation period, or a completed probation period.

Work-Arounds:

- Workaround 1: We recommend and often see new employees specifically asking for no or short probation periods. You are taking the risk moving here, the employer is often willing to waive the probation – which can be the key to speeding a home purchase.

- Workaround 2: Depending on how your math works out, you may be able to carry 2 mortgages at 1 time. There are 2nd Home Programs that can work for situations like this, but again, the math is different for everyone.

How to make the move as smooth as possible

The smoothest way to buy a home when relocating is to start the job first. Ask for the employer to waive or shorten the probation period. Then rent, stay with friends, or anything that works for the first 2 or 3 weeks. Then when you have a full-cycle pay slip you can buy a home that works for you and take possession as soon as possible is a much smoother transaction. Otherwise you are “trying to push a rope up a hill” and the bank’s don’t like that at all.

We see issues with people buying too soon all the time. Forcing the system often backfires on new home owners. The resulting brain damage is not worth trying to do the transaction backwards in the eyes of the banks.

Mark Herman; top Calgary Alberta Mortgage Broker, with best rates

RBC: Mortgage Mistakes

RBC made what I think are some some pretty serious – and costly – mistakes for their customers and it is too bad … for the customers!

My 2 favorite quotes from this article are:

“My husband and I both felt pretty robbed,” she said. “I feel … it was deceptive.”

and

“Based on his reading of it, the tone of the bank’s letter to affected customers is “probably an attempt to avoid litigation, because if they took the opposite position then people would be owed money,” he said, noting the letter falls well short of an apology or acceptance of responsibility.

“There is no particular offer … to compensate or provide a small amount of money as a token of having made a mistake,” he said.”

Here is the full article:

“Always get mortgage advice from a full-time, professional, mortgage broker”

Mortgage Mark Herman; Calgary, Alberta top rated mortgage broker.

Your Banking Relationship: They leverage your mortgage to rake in credit cards profits.

Below is part of an article where the bank is sad their mortgages are down 500% from last year. At the same time they made 16% more from ramming credit cards and Lines of Credits down their mortgage customer’s throats so it’s all okay in the end. For them… and how about for you?

The blue part shows that mortgage is the key to create what customers feel is a “relationship” with the bank so they can then sell you all their high margin products.

Broker lenders only “sell” 1 thing, mortgages, so consider separating your banking and your mortgage and get the best mortgage possible – through a broker lender.

“Having your mortgage at your bank is only convenient for them to rake it in off of your credit card fees.”

Mark Herman, top Calgary mortgage broker

Here is the article:

Bloomberg News, Doug Alexander, August 23, 2018 …

Canadian Imperial Bank of Commerce’s prediction of a mortgage slowdown has come true…

Despite the mortgage slowdown, CIBC posted a 16% jump in Canadian personal and commercial banking earnings due to a “significant” expansion … and growth in credit cards and unsecured loans amid rising interest rates, Chief Financial Officer Kevin Glass said.

“Those would be the major offsets in terms of mortgage growth declining,” Glass said in a phone interview. “Mortgages are a key product for us — it’s very important from a client relationship perspective — but it’s not a high margin product, so if mortgages come off it has a far smaller impact than rate increases do, for instance.”

Brokers vs. Banks – The Differences

Love it when the newspapers do the telling for us.

Almost 40% of all mortgages are via brokers now. Up from 25% 15 years ago. There is a reason to use a broker that has been in business for 15 years or longer, like Mortgage Mark Herman of Mortgages Are Marvellous.

https://www.thestar.com/life/advice/2018/07/31/mortgage-brokers-vs-banks-the-pros-and-cons.html

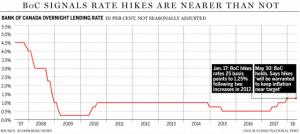

Prime rates should go up in July

This only affects variable rate mortgages and there are 2 increases to Prime expected for 2018, this one and one in December – depending on how the economy goes.

This only affects variable rate mortgages and there are 2 increases to Prime expected for 2018, this one and one in December – depending on how the economy goes.

- The Bank of Canada is expected to raise interest rates on July 11th.

- They normally increase Prime by 0.25% at a time, Prime is 3.45% now and should then go to 3.70%.

- The Central bank also emphasized that the increase will be needed to contain inflation.

This makes the 5-year fixed rates look much better as rates are slowly going back to 4% – the Theoretical Minimum

Mark Herman, Top Calgary Alberta Mortgage Broker

Some will wonder what stopped the Bank of Canada from raising interest rates today. It does seem likely that policy makers struggled with the decision, as they had little bad to say about the economy.

The reason for the delay is the same as it’s been since the start of the year: U.S. President Donald Trump. Canada’s central bank remains concerned that U.S. trade-and-tax policy will weigh on Canadian business investment, so much so that it is prepared to risk a little inflation by waiting for more clarity.

Few thought the central bank would raise interest rates on May 30. Poloz had been clear that he was comfortable with inflation running a little faster than the target rate of 2 per cent. He also said last month that hard evidence on investment would be a crucial variable and no such information has yet been published.

The central bank had been wary that its three interest-rate increases since last summer would choke domestic spending. But households seem to be coping just fine, which means the Bank of Canada can resume pushing interest rates higher.

Here is the link for the entire article: http://business.financialpost.com/news/economy/bank-of-canada-holds-interest-rate-at-1-25