Prime rates should go up in July

This only affects variable rate mortgages and there are 2 increases to Prime expected for 2018, this one and one in December – depending on how the economy goes.

This only affects variable rate mortgages and there are 2 increases to Prime expected for 2018, this one and one in December – depending on how the economy goes.

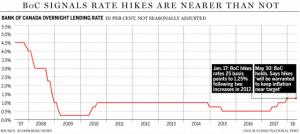

- The Bank of Canada is expected to raise interest rates on July 11th.

- They normally increase Prime by 0.25% at a time, Prime is 3.45% now and should then go to 3.70%.

- The Central bank also emphasized that the increase will be needed to contain inflation.

This makes the 5-year fixed rates look much better as rates are slowly going back to 4% – the Theoretical Minimum

Mark Herman, Top Calgary Alberta Mortgage Broker

Some will wonder what stopped the Bank of Canada from raising interest rates today. It does seem likely that policy makers struggled with the decision, as they had little bad to say about the economy.

The reason for the delay is the same as it’s been since the start of the year: U.S. President Donald Trump. Canada’s central bank remains concerned that U.S. trade-and-tax policy will weigh on Canadian business investment, so much so that it is prepared to risk a little inflation by waiting for more clarity.

Few thought the central bank would raise interest rates on May 30. Poloz had been clear that he was comfortable with inflation running a little faster than the target rate of 2 per cent. He also said last month that hard evidence on investment would be a crucial variable and no such information has yet been published.

The central bank had been wary that its three interest-rate increases since last summer would choke domestic spending. But households seem to be coping just fine, which means the Bank of Canada can resume pushing interest rates higher.

Here is the link for the entire article: http://business.financialpost.com/news/economy/bank-of-canada-holds-interest-rate-at-1-25

Should you look at 7 and 10 year terms?

With rates on the rise, is it worth a 2nd look at longer term mortgages?

Data:

- Rates have substantially increased over the last 6 of months. We have seen 3 prime rate increases with more on the horizon.

- Fixed rate mortgages have also followed suit due to bond market instability and the increases are noticeable.

- Consumer sentiment has rapidly moved from Variables rates to longer term Fixed rates of 5, 7, and 10 years.

The long-term trend for rates is up!

The advantage of Fixed rates is that they provide clients with added security and stability against this recent storm of volatility. This storm doesn’t seem to have an end in sight either with many questions still to be answered in the coming months. When will bond rates stabilize? Will global pressures continue to drive increases? Will we see a return to historical norms? What will be the impact of recent events on the Canadian economy?

Some clients are more concerned with rate trends these days it’s with good reason. Perhaps the interim answer to all this instability and volatility is to start looking long “term”. 7 & 10 year terms to be specific.

Longer term mortgages like a 7 & 10 year term help insulate clients against potential increases in the short to long-term as well as provide safety and consistency with mortgage payments that won’t fluctuate with the markets volatility.

We don’t have to go back very far (6-7yrs) to a time when 10 year mortgages were a very popular and attractive option. During that period of time many case studies show this product didn’t work out for those borrowers who selected those 10 year terms, however there was a major difference between that period of time and today. 6-7 years ago we were in a more stable rate environment and there was very little difference between the 5 & 10 year rates at the time. Shortly after this period, rates quickly dropped to even further all-time lows.

Compare those details to our current market situation where rates have now bottomed, and it becomes quickly apparent rates have been continually rising with more sustained increases forecasted.

If security is your top key, lets talk about a 7 or 10 year mortgage option today.

Mortgage Mark Herman

Top Calgary Alberta Mortgage Broker

403-681-4376

Collateral Charge Mortgage – a big deal

Collateral charge mortgage registration … is a big deal in most circumstances.

Collateral charge mortgage registration … is a big deal in most circumstances.

Short Version

- This is a method of registering your mortgage currently used by nearly every Chartered Bank / Big-6 Banks at this time.

- You are unlikely to avoid it if you are at a Big-6 Bank so it is important to understand the ramifications.

- Avoiding having your mortgage held by the same institution as the balance of your debts such as; credit cards, over drafts, unsecured credit lines, car loans, etc. This is worth serious consideration. See the bold summary in the last paragraph below.

- Have your mortgage as a stand alone piece of a bank-relationship if you must place it with a Bank

- Ask about more information re ‘Monoline‘ lenders; broker lenders that do not register this way.

Long Version

The Financial Consumer Agency of Canada website provides the following definition;

Collateral Charge (a.k.a ‘All-indebtedness’) – A type of mortgage whose features may include the ability to potentially borrow additional funds, subject to your lender’s approval, without the need to discharge your mortgage, register a new one and pay legal fees. If you want to switch your existing mortgage to a different lender at the end of your term other lenders will not accept the transfer of your mortgage. This means you may/ probably will need to pay fees to discharge your existing mortgage and register a new one in order to change lenders. The fee for this is the lawyer charge incurred.

The 1 Benefit:

The (potential) win for the client is avoiding new legal fees for securing a line of credit or increasing the mortgage balance in the future. This assumes the choice was made to register the mortgage for either the ‘125% of the value‘ option or a maximum amount greater than the actual mortgage amount. If that was not the case and you chose to register the mortgage with a collateral charge lender for ONLY the mortgage amount then the upside is actually quite limited.

Some Of the Negatives:

The ‘all indebtedness’ mortgage brings any other debts held by that specific lender under the umbrella of the registered security against the Real Estate. In other words co-signing a credit card or car loan for somebody (who then stops making payments) carries a risk of a foreclosure action against your property as a remedy for what was perceived to be an unrelated debt. Read that last sentence again. Yes, your home is on the line for any other form of debt held by the same institution as your mortgage.

It is also (potentially) costly to transfer the mortgage to a new lender come renewal, in particular if the mortgage balance is under $200,000. However the topic of transferring 2, 3, or even 5 years down the road is less pressing. I would suspect most readers are still wrapping their heads around the concept of a $5,000.00 Visa balance potentially triggering a foreclosure action – which it very well can. (I have seen this occur in the case of two clients, admittedly, also rare.)

Transfer costs are becoming less of an issue as we currently have at least two lenders stepping up to offer a ‘no-fee switch’ program for collateral charge mortgages at renewal time. Your choice of lenders is limited and the rate for this is not “best rates” as the new lender is paying for the cost of the change “under the covers.”

Following is the key point around this topic, in my opinion;

Yes, this is a far reaching method of registration with serious ramifications. However as nearly all institutions (most likely the clients current bank as well) now register in this fashion it is perhaps a key consideration that one should in fact not have all their banking, credit cards, and small loans with the same institution as their mortgage. Rather splitting accounts between two separate institutions, and ideally having their mortgage held with a third financial institution is altogether more prudent. Think ‘Church & State’. Mortgage with Lender A, consumer debt/trade lines with Lender B, and perhaps any Business accounts with Lender C.

If all banking as done at ABC bank, and the mortgage is placed with XYZ lender we then eliminate exposure to the potential darkest side of a Collateral Charge mortgage. The Collateral Charge itself is not an evil thing, it is a policy that exists with nearly all Big-6 Banks, but NOT standard with Broker Lenders. It is designed, as one may expect, to protect the interests of the Financial Institution over and above those of the clients. Once aware of theses potential ramifications one can then structure their finances in such a way that the reach of a collateral charge is in fact quite limited.

What the Dept. of Finance said about it …

The Department of Finance -DoF – has noted that the Big-6 are NOT disclosing this clearly enough. This point alone should be the alarm. Here is what the DoF has said …

“The impacts of having a collateral charge mortgage may differ from traditional mortgages. For instance, switching between lenders may be more difficult. To make an informed choice, consumers need sufficient information to clearly understand the costs and consequences of collateral charge mortgages relative to traditional mortgages. The Government will require enhanced disclosure, better equipping borrowers to understand these impacts’

This topic deserves more attention than it typically gets at the time of the initial mortgage planning, please take a few minutes to discuss it.

CONTACT US

We answer from 9-9 x 365 and are the Top Calgary Alberta Mortgage Brokers. Call to discuss if you would like more on this.

Mark Herman, Calgary Mortgage Broker.

403-681-4376

Fixed-Rate Mortgage Penalties: Larger Than Ever! ALL the MATH DETAILS here!

UPDATED Jan 6, 2026.

This may be my best (and most detailed) breakdown of mortgage payout penalties I have written over the last 22 years of mortgage brokering. I talk about these penalties every day and refer back to this post weekly.

—

Many people are unaware the Big-6 banks, and all the banks you can walk into, calculate the payout penalties at much, MUCH higher amounts than mono-lines (mortgage broker lenders are called this as they only do 1 thing – mortgages.)

The cost of how penalties are calculated is even more concerning when fixed-mortgage rates stay flat or rise slightly over an extended period – exactly what is happening right now.

Summary:

- You could be looking at an extra $7,000 in penalty cost on a $250,000 mortgage, or an extra $11,200 on a $400,000 mortgage, that is broken two years early with any Big-6 lender.

- Mortgage broker lenders still calculate the payout “the old way” – to your advantage!

Short Version:

Fixed-rate mortgage penalties are almost always calculated based on “the greater of three months interest or interest-rate differential (IRD)”. But there are key differences in the actual rates lenders use to calculate your IRD.

- These differences are magnified in a flat or slightly rising interest-rate environment.

- This is a big deal as the IRD calculations used by the banks below can trigger a penalty that is more than 5 times what you would be charged at a wide range of other lenders.

Long Version – hold on this is MATH!

Let’s say your current mortgage balance is $250,000 on a five-year fixed rate mortgage at 2.59%. We’ll also assume that you are three years into your term (with two years remaining) and that interest rates are the same when you break your mortgage as they were when you first got your loan.

First, we calculate the cost of three month’s interest, which we can quickly determine is $1,619.

Here is the formula we use to arrive at that number:

2.59% x $250,000 x 3/12 = $1,619

We then compare this cost to the cost of your IRD penalty, which will almost always be calculated using one of three methods: Standard, Discounted or Posted.

- The Standard IRD Penalty (used by Mortgage Broker Banks)

When using a standard IRD penalty calculation, your lender starts by taking the difference between your contract rate (2.59%) and their current rate that most closely matches your remaining term. Since you have two years left on your mortgage, that would be the lender’s two-year fixed rate (we’ll use 2.29%, which is widely available today). The difference between these two rates is 0.30%.

The lender multiplies this difference (0.30%) by your mortgage balance ($250,000) and the time remaining on your mortgage (expressed as the number of months remaining on your mortgage divided by twelve).

Here is the complete formula: (3.29% – 2.99%) x $250,000 x (24/12) = $1,500

And here is a table which explains where each number in the formula came from:

Standard IRD Calculation

2.59% = Your contract rate

2.29% = current rate the most closely matches your remaining term

$250,000 = remaining mortgage balance

24 = months remaining

$1,500 = IRD Penalty charged

That’s it; the standard IRD calculation. It is used by a wide range of lenders who compete with each other to offer borrowers the best mortgage rates available.

In this case the cost of three months’ interest ($1,619) is greater than the lender’s Standard IRD calculation ($1,500), so you would have to pay $1,619 to break your mortgage.

AND here is where the differences are: well-known lenders have tweaked their IRD calculations to skew the interest rates used in their formulas heavily in their favour, and as you will now see, that can have a huge impact on the size of your penalty.

- The Discounted Rate IRD Penalty (Used by RBC, BMO, TD, Scotia and National Bank)

When using the Discounted Rate Penalty, the lender takes your contract rate and compares it to the posted rate that most closely matches your remaining term MINUS the original discount you got off of their five-year posted rate (which in this case is 2.05%). Here is the contract wording taken straight from TD’s website. Key section is underlined:

{Your contract rate will be reduced by] the current interest rate that we can now charge for a mortgage term offered by us with the term closest to your remaining term. The interest rate will be our posted interest rate for the term minus the most recent discount you received.}

In other words, this lender will take the discount they gave you off of their five-year posted rate and apply that same discount to the posted two-year rate they use in your penalty calculation.

This tweak makes a big difference to the cost of your penalty and is blatantly one-sided because lenders don’t discount shorter-term fixed-rate mortgages nearly as deeply as they do their five-year terms (.30% vs. 2.05% using this same lender’s rate sheet as of today).

The table below shows you the key numbers used to calculate the Discounted Rate IRD penalty:

Discounted –Rate IRD Calculation

2.59% = Your contract rate

2.84% = current rate the most closely matches your remaining term

2.05% = discount you received on your original Contract Rate

0.79% = 2-year rate used to calculate your penalty

$250,000 = remaining mortgage balance

24 = months remaining

$9,000 = IRD Penalty charged

Yes, Ouch!

But fasten your seat belt because other major lenders dig even deeper into your wallet. The Grand Daddy of them all is the Posted Rate IRD Penalty.

- The Posted Rate IRD Penalty – the Real Pain (Used by CIBC)

Here is a breakdown of CIBC’s posted-rate penalty calculation:

In this variation, the lender calculates your IRD penalty using the five-year posted rate that they were offering when you got your mortgage. Here is a sample of the wording used to explain how the penalty is calculated (taken from CIBC’s website). Underlined, key sections:

The interest rate differential amount is the difference between the Interest on the Prepaid Amount for the remainder of the term at the posted rate at the time you took out the mortgage, and interest on the Prepaid Amount for the Remainder of the Term using a Comparable Posted Rate. Interest is calculated at the interest rate posted by [the lender] for a mortgage product similar to your mortgage product on the date the payout statement is prepared.

Now CIBC’s defence of this tactic is that they substitute posted rates for both your original rate and the rate that most closely matches your remaining term. But as we have already outlined above, this is a terrible trade that no informed person would make because Big-6 lenders must make huge discounts to their five-year posted rates to make them competitive with market five-year fixed rates, and those same discounts shrink dramatically on shorter fixed-rate terms.

If we used the same rates in this example that we used in the discounted-rate method outlined above, the posted-rate method would yield the same sized penalty. But CIBC’s posted rates tend to be higher (which they were at the time this post was written), and for that reason, their penalties earn the moniker of “The Grand Daddy of Them All”.

Here is what that small change to the wording in your contract does to your penalty:

Posted-Rate IRD Calculation

4.79% = 5-year posted rate that was offered when you got your mortgage

2.84% = current rate the most closely matches your remaining term

$250,000 = remaining mortgage balance

24 = months remaining

$9,750 = IRD Penalty charged

Long Summary – thanks for getting this far!

Don’t be Surprised. These inflated mortgage penalties generate substantial profits for the lenders who use them and when uninformed borrowers choose to negotiate directly with their lender, is it that hard to imagine that some of those lenders would word the fine print to their advantage.

To be clear, there is not a problem with mortgage penalties in principle. When you break a mortgage contract, your lender incurs costs when they unwind agreements related to your loan (these agreements can relate to hedging, servicing, secularization etc.). The penalty charged is supposed to cover these costs while also recouping part of the lender’s lost profit. Fair enough. That’s why they’re called “closed mortgages”. But is it fair for some lenders to use these early terminations as “gotcha” moments?

There is no way on earth that the average Canadian mortgage borrower has any idea that there are significant differences in the way fixed-rate mortgage penalties are calculated, and the largest Canadian lenders, who have milked that lack of awareness to their advantage for years, have been in no hurry to explain it to them.

Summary: a conscientious and well informed independent mortgage planner should be able to explain how penalties are charged by any lender they are recommending.

Payout Penalties: Nasty tricks of the Big-6 Banks – Example 1

Payout penalties – how the Big-6 banks get you, Example 1

Payout penalties – how the Big-6 banks get you, Example 1

Below is a great example of how the Big-6 banks get you on an early mortgage payout.

“The rate is the rate, but the details are the details!” said Grandma Herman.

Mark Herman

Top Alberta mortgage broker for home purchases and mortgage renewals

As you can see from the example below, the banks “discount rate recapture policy” can result in some pretty hefty added costs —$6,048 in the scenario here!

Example:

On July 31, 2015, you buy your first home and sign a five-year, fixed-term mortgage. As your family grows, you start looking at a bigger home, and after a few months of searching, you find the perfect one—on August 1, 2017.

Because of this unexpected upgrade, you now have to break your mortgage three years before it matures (you have $320,000 left on your mortgage). When you signed your current mortgage, you weren’t concerned about prepayment penalties, but as you can see below, prepayment penalties can have a significant financial impact on your bottom line.

| Your situation | |

|---|---|

| Mortgage date | July 21, 2015 |

| Date you break your mortgage | August 1, 2017 |

| How much you have left owing on your mortgage | $320, 000 |

| Your original mortgage term | 5 years |

| How many years left you have on your term | 3 years |

| Comparison | ||

|---|---|---|

| Mortgage breakage fee at the Big-5 banks | Mortgage breakage fee with Broker Banks |

|

| 5-year posted rate when you got your mortgage | 5.39% | Not applicable for the IRD calculation |

| Your actual contract rate | 4.00% | 4.00% |

| Discount | 1.39% | N/A |

| 3-year posted rate on August 1, 2013 (the day you break your mortgage) | 3.75% | 2.99% |

| IRD formula | (Contract rate – [Posted rate for remaining term – Discount from original mortgage]) x Principal outstanding x Remaining term | (Contract rate – Posted rate for remaining term) x Principal outstanding x Remaining term |

| IRD payment | $15,744 | $9,696 |

| Difference in fees | $6,048 | |

For a free mortgage check-up, or pre-approval, or compare what we can do vs. your bank, call Mark at 403-681-4376

• There is no cost to you for our services as the banks pay us for doing their work,

• You get our professional, un-biased advice & expertise on your mortgage,

• We answer our phones and emails, 7 days a week, from 9 – 9, including holidays,

• Your rate is lower with us as we deal through “broker services” at the banks.