New Housing Rules for 1st First-Time Buyers and New Builds

If you’re a first-time home buyer or looking to purchase a new build, this affects you.

Here’s a quick summary of the changes coming in December 2024:

What’s New?

30-Year Amortizations Now Available for First-Time Buyers and New Build Purchases

- First-time home buyers can now access 30-year amortizations for insured mortgages.

- This increases the amount you qualify for by about 9% or lowers your monthly payment about the same.

- 30-Year Amortization for New Builds – Technically, this took effect on August 1, 2024, and is available to everyone, not just First-Time Homebuyers.

Price Cap Increase for Insured Mortgages

- The price cap (purchase price) for insured mortgages has been raised from $999,999 to $1,499,999 million.

- EG: if you were to purchase a home today priced at $1.1 million, your minimum down payment to qualify for a mortgage would be 20% or $220,000. After December 15th, the minimum down payment required decreases to $85,000.

- If that $1.1 million dollar home also has a self contained suite, you can use the rent or “potential” rent that suite will generate to help qualify for a bit more of a mortgage too.

The Fine Print

Down payment – Great news, minimum requirements stay the same:

- 5% on the portion up to $500,000

- 10% on the portion between $500,000 and $1.5 million

* Previously, the down payment on a $1.5 million home for a First-Time Home buyer was $300,000.

FTHB’s can now get into that same home with $125,000.

This will undoubtedly take some pressure off the Bank of Mom and Dad.

Effective Date

These changes will apply to mortgage insurance applications submitted on or after December 15, 2024. The key word here is ‘submitted.’ Your offer will need to be timed just right if you wish to take advantage of the new 30-year amortization.

Potential Impacts on the Housing Market:

We are in an interesting position right now. On one hand, lenders are competing for new business in what could be described as a ‘rate war.’

Additionally, with First-Time Home Buyers (FTHB) set to qualify for 30-year amortizations after December 15th, we can expect an uptick in demand.

Historically, higher demand leads to higher prices and rate decreases cause an equal and opposite increase in home prices.

Buy or Sell – Now or Later?

While there’s no crystal ball, consider these possibilities:

- Buy Now: Prices are expected to rise once the new rules take effect, so purchasing before December could mean less competition and potentially lower prices.

- Sell Later: If your home is priced between $1 million and $1.5 million, waiting until after December 15th could attract more qualified buyers and possibly higher offers.

More details will emerge as lenders and insurers prepare to offer the new 30-year amortization, such as how lenders will view the minimum down payment.

If you want to discuss how these changes might impact your plans to buy or sell, feel free to reach out!

Variable Rate Beats BOTH 3-year & 5-year Fixed Terms

The Variable is the best way to go right now and this blue link has all the details in PDF: VARIABLE RATE beats both 3-year fixed & 5-year fixed terms

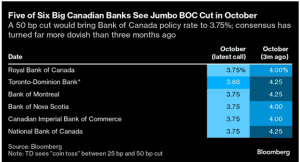

Data point 1: Variable rates should be coming down 2% in the next 13.5 months, with a “jumbo reduction” of 0.5% (1/2%) expected on Wednesday, Oct 23rd – by 5 of the 6 Big Banks.

Data point 2: Historically, fixed rates only go down about 40% of the reductions to Prime, so fixed rates will not be going down anywhere near as much or as fast as the Variable.

Data point 3: Just a 1% rate reduction is expected to “reactivate” at least half of buyers who previously stopped shopping due to “buyer fatigue.”

Data point 4: As interest rates come down, prices INCREASE because most buyer’s need to go to their max mortgage when buying.

Graphic details of expected rate reductions and the dates of expected changes, in PDF: VARIABLE RATE beats both 3-year fixed & 5-year fixed terms

Our favorite customer quote so far in October:

I am not locking in 3-year money nor 5-year money today, when the Bank of Canada has made it clear rates are coming down 2% in the next 15 months.

Mortgage Mark Herman, Top Calgary Alberta Mortgage Broker near me.