Approved: Mortgage with U.S. Income, Remote Work & Gifted Down Payment (CMHC Deal)

Cross-Border Mortgage Approved: U.S. Income + Gift Funds + CMHC

This Mortgage Deal Looked Impossible (But CMHC Approved It Anyway)

We recently completed a mortgage deal that even I assumed is impossible.

We got it done — and now that we’ve successfully navigated the process, we’re ready to help more buyers in similar situations.

This file was a great example of how the right strategy, documentation, and lender experience can turn a complicated deal into a clean approval.

Mortgage Mark Herman, Best Alberta, Canada mortgage broker for Americans buying in Canada.

The Buyers

This purchase involved two applicants:

-

Buyer #1: Canadian citizen, stay-at-home mom, currently with no income

-

Buyer #2: Permanent resident (PR), employed as a lawyer for a U.S. company, paid in U.S. dollars

Files like this can get tricky quickly, especially when one borrower has no income and the other is employed outside of Canada.

The Property

This was a primary residence purchase.

The buyers also had no other properties, which helped strengthen the application and simplify insurer review.

The Biggest Challenge: U.S. Income + Remote Work

The income-earning borrower worked for an American employer and was able to work 100% remotely.

The key detail? Their employment letter confirmed remote work was permanent, not temporary.

The documentation included:

-

Employment letter confirming permanent remote work status

-

U.S. income documents (W-2 and 1040)

-

A clear written narrative summarizing income and filing history

When borrowers are paid in U.S. dollars, lenders and insurers need to clearly understand consistency, deductions, and income stability. Presentation matters.

Down Payment Structure

The buyers had a 15% down payment, structured as follows:

-

5% from their own funds

-

10% gifted from a family member in the United States

Gifted down payments are common, but cross-border gifted funds require extra documentation and clean sourcing. We made sure everything was properly verified and acceptable for insurer guidelines.

CMHC Approval (Including an American Credit Report)

This mortgage was approved through CMHC, and one of the most interesting parts of the deal was that CMHC accepted an American Equifax credit bureau report.

That’s something many buyers don’t realize is even possible — but in the right scenario, it can absolutely work.

Why This Deal Was Unique

This was not a typical mortgage approval.

It required:

-

Cross-border income verification

-

Review of U.S. tax documents

-

Confirmation of permanent remote employment

-

Gifted down payment verification from the U.S.

-

Credit review using an American credit bureau report

-

Proper structuring and presentation for insurer underwriting

But in the end, the deal was approved — and the buyers are now homeowners.

The Takeaway

If you’re a Canadian citizen or PR earning U.S. income, working remotely, or receiving gifted funds from outside Canada, you may still qualify for a mortgage — even if your situation feels complicated.

A bank “no” doesn’t always mean the deal is dead. It often just means it needs the right approach.

Need Help With a Complex Mortgage File?

If you’re buying in Canada but your income, credit, or down payment involves the U.S., I can help you structure it properly from the start.

Mark(at)MaMaRv.ca

Or call/text directly to discuss your options.

Advice on Mortgage Renewals Before April 2026 from an MBA

Questions on what product to pick for your upcoming mortgage renewal.

Here are the reasons that we like the 5 year fixed for Canadian mortgage renewals over the next few months.

(renewals from now, February 2nd until April 1st.)

This data is recent and should be good for the next few months.

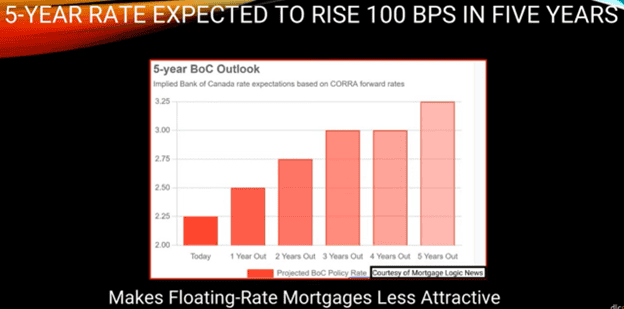

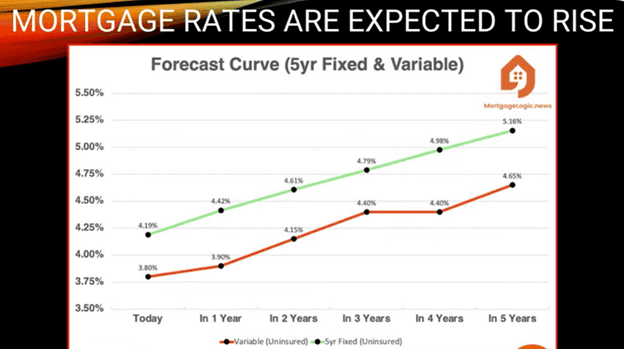

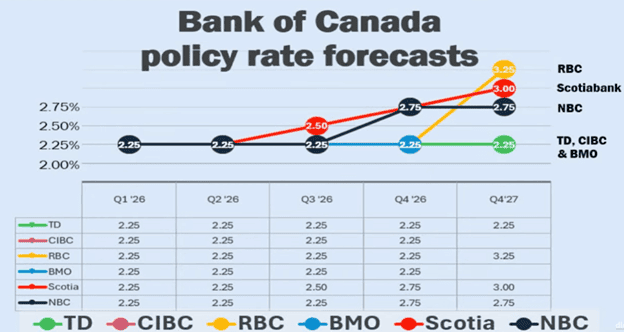

Below are the graphs that show that rates are trending up and are on the increase.

Q: Why are rates trending up?

A: Because Trump policy is generally inflationary, and add in the “cost of uncertainty” due to changing tariffs and other world political issues we have an increasing rate environment.

Big Picture Perspective

I also look at from this perspective, rates were close to 4% BEFORE Covid in 2020, and we are now back to about the same; 3.99% for a 3-year fixed and 4.25% to 4.54% for a 5 year fixed rate term.

- Comparing these rates, there is not much room for rates to go down; maybe .5%, half a percent.

- But there is lots of room for them to go up.

What if things get out of hand and rates are at 6% or 7%?

When I started out in 2004, my first customer’s rate was 8.99% and they were happy it did not start with a 9. (You always remember your first deal.)

Summary

The rates for the 3 year fixed and the 5 year fixed are similar so take the 5 year and know you are getting a good rate at the bottom of the rate cycle.

If you take the 3 year and rates DO go up, and you then renew 2 years sooner into what could be 6% or 7% rate environment (when you could have had 2 more years at 4.zz%.) You will be pretty upset as your new monthly payment would now be higher even though your balance is lower.

If you take the 3 year fixed and the rates stay low then you gain a slightly lower payment ($25/ month) over the first 3 years.

Most of our customers agree the safer bet is less expensive when you factor in how sound you will sleep at night.

Mortgage Mark Herman, best Calgary broker for mortgage renewals and advice.