Advice on Mortgage Renewals Before April 2026 from an MBA

Questions on what product to pick for your upcoming mortgage renewal.

Here are the reasons that we like the 5 year fixed for Canadian mortgage renewals over the next few months.

(renewals from now, February 2nd until April 1st.)

This data is recent and should be good for the next few months.

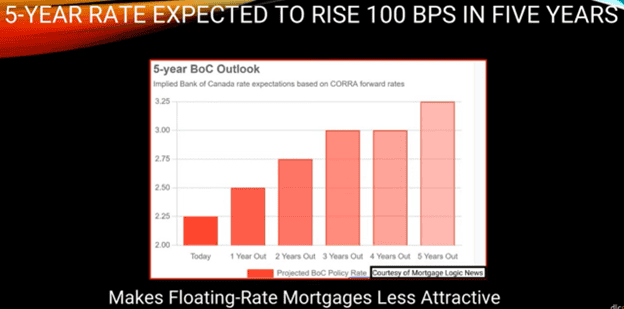

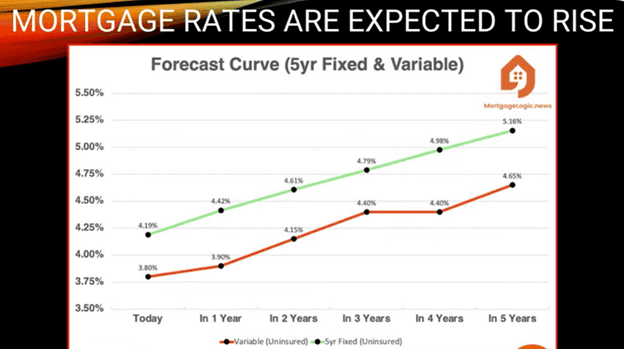

Below are the graphs that show that rates are trending up and are on the increase.

Q: Why are rates trending up?

A: Because Trump policy is generally inflationary, and add in the “cost of uncertainty” due to changing tariffs and other world political issues we have an increasing rate environment.

Big Picture Perspective

I also look at from this perspective, rates were close to 4% BEFORE Covid in 2020, and we are now back to about the same; 3.99% for a 3-year fixed and 4.25% to 4.54% for a 5 year fixed rate term.

- Comparing these rates, there is not much room for rates to go down; maybe .5%, half a percent.

- But there is lots of room for them to go up.

What if things get out of hand and rates are at 6% or 7%?

When I started out in 2004, my first customer’s rate was 8.99% and they were happy it did not start with a 9. (You always remember your first deal.)

Summary

The rates for the 3 year fixed and the 5 year fixed are similar so take the 5 year and know you are getting a good rate at the bottom of the rate cycle.

If you take the 3 year and rates DO go up, and you then renew 2 years sooner into what could be 6% or 7% rate environment (when you could have had 2 more years at 4.zz%.) You will be pretty upset as your new monthly payment would now be higher even though your balance is lower.

If you take the 3 year fixed and the rates stay low then you gain a slightly lower payment ($25/ month) over the first 3 years.

Most of our customers agree the safer bet is less expensive when you factor in how sound you will sleep at night.

Mortgage Mark Herman, best Calgary broker for mortgage renewals and advice.

Variable Rate or Fixed Rate for Renewals in 2026?

Here is what a math-based, mortgage broker with 21 years of experience and an MBA in finance looks at when deciding what to do for my own mortgage renewal.

This is a super common question as there are still 1,800,000 Canadian mortgage renewals to come before summer 2027, with the same 1.8M renewals completed since 2025.

Numbers at the top, words at the bottom.

Numbers

Variable Rate in 2024 = 6.20%

(Prime – .90% = 7.2% – .9% = 6.2% rate.)

-2.75% rate drops = 3.45% today, Jan 2026.

Variable Rate in 2026 = 3.75% today

(Prime – .70% = 4.45% – .7% = 3.75% rate.)

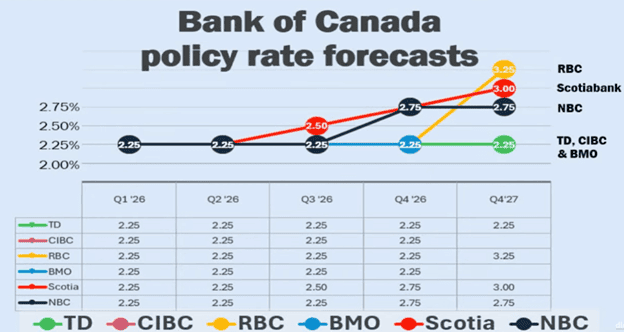

No rate drops expected, 2x .25% increases expected = 3.75% + .5 = 4.25% by the end of 2026.

Continued instability will lead to more rate increases later.

5-year Fixed Rates

5.09% in 2024

4.24% today – 2026

Analysis

Variable wins by .5% today, but fully expect 2 x o.25% increase in 2026 to make the rate the same as fixed rates are today, Jan 2026.

Fixed rates are now, and will continue to slowly rise, as Trump policy is highly inflationary.

If you take a variable now, and then go to lock it in later, when variable rates / prime rates start to increase, the rate you lock in at will be higher than today.

Summary

Rates look to have bottomed out right now, from looking many data points.

Fixed rates are ½% higher than the variable rates today – Jan 2026.

Then what? In 2024 I was able to precisely layout the next 18 months and predicted every rate increase exactly as it played out. Right now it is not possible to guess what will happen next month so Variable has higher risk and will probably pay more later as the rates increase as expected.

200 Word Summary

Canada’s variable-rate mortgage borrowers have enjoyed significant relief since the Bank of Canada (BoC) began cutting interest rates in 2024, but that momentum is expected to slow—and probably reverse – in 2026.

The BoC delivered 2.75% of rate cuts through 2024–2025, bringing the policy rate down to 2.25%. This helped push insured variable mortgage rates below 4%, down from around 7% in mid-2024.

However, the BoC now views inflation risks as too elevated to justify further cuts, and rate relief for variable-rate borrowers is “mostly behind us.”

The bank’s baseline forecast suggests the BoC’s policy rate could rise back toward its long-term neutral level of 2.75%, which would push variable mortgage rates up by roughly 0.5% in 2026, with additional increases probable in 2027.

Meanwhile, fixed mortgage rates have fallen less dramatically because they are tied to longer-term bond yields, which rebounded in late 2025. Borrowers have increasingly favored 3-year fixed and 5-year fixed terms, anticipating improved renewal conditions ahead when they renew later.

Bottom line: 2026 could prove challenging for variable-rate borrowers. The era of large variable-rate relief seems to be ending, and 2026 may test borrowers who relied on those lower rates — especially if the BoC keeps rates steady or reverses course

Looking at all of this, in March, I will be renewing into the 5-year fixed so I can sleep at night.

Mortgage Mark Herman, MBA, Top Calgary mortgage broker for 21 years.

Croatia Bare Boat trip for Defected

This is what I was able to come up with from AI assistance. I know what today might be the cheapest day to buy tickets so I wanted to get this out.

—

Awesome — this is exactly the kind of pre-festival sailing that makes Defected Croatia legendary. I put together:

- a practical 5–7 day bareboat (with skipper) itinerary that finishes at/near Tisno for the festival (Defected Croatia runs 29 July–3 Aug 2026, The Garden Resort, Tisno).

- which airport(s) to use from North America (pros & cons), and

- a realistic cost breakdown (boat, skipper, APA/provisions, fuel, marina fees, transfers, and flights) with conservative ranges and example per-person math for a group.

I assumed you want to sail into the Tisno / Murter / Kornati area (best for reaching the festival and boat parties). If your group size or preferences differ, you can still use these numbers as a template.

Best airport(s) to fly into

Preferred — Split (SPU). Split has the biggest number of charter bases and marinas nearby (easy transfers to the central Dalmatian marinas and a short drive to Sibenik/Murter area). Split also has steadily improved long-haul/seasonal connections from North America/Europe for summer 2026 (more flight options = usually cheaper tickets and easier luggage handling for a sailing group).

Close alternative — Zadar (ZAD). Zadar is usually a slightly shorter drive to Tisno / Murter than Split (est. ~50–75 km; ~50–75 min drive depending on route), so it’s a sensible choice if you find a better flight into ZAD. Good option if price/connection is better.

Why not Dubrovnik or Zagreb for this festival? Both are further from Tisno (Dubrovnik is much farther south; Zagreb is inland and requires a long drive), so only use them if you want to see those cities first or have a cheap/one-stop fare.

Recommendation summary: Fly into Split if you prioritize charter options and flight availability. Fly into Zadar if you want the shortest transfer to Tisno or find significantly cheaper flights.

—

Where to pick up the boat (bases / marinas)

For the Tisno / Defected area the most common charter bases are on Murter island (Marina Betina, Jezera, Hramina) and nearby marinas at Pirovac / Vodice / Šibenik. These are the most convenient for reaching Tisno and the Kornati / Murter anchorages. If you fly Split, many charters will also let you pick up boats from Marina Kaštela (Split) but that’s a longer reposition to Tisno.

—

6-day (5–7 day flexible) sample itinerary — built for chill sailing, anchor bays and boat parties

This is a 6-day example that’s easy on sleepers/crew and keeps hops to ~1–4 hours sailing per day. Distances/times are approximate — keep it flexible for weather.

Day 0 (arrival day) — Fly into Split or Zadar, transfer to your base (Murter / Betina / Jezera). Provision, meet the boat and skipper, safety briefing, overnight in the marina. (If you arrive early you can overnight in Split/Zadar then transfer next morning.)

Day 1 — Murter (Betina/Jezera) → Levrnaka / southern Kornati (anchor)

Short hop into the Kornati archipelago; swim, snorkel, small beach party vibe. (1–3 hours sailing depending on exact start.)

Day 2 — Levrnaka → Kornat / Telašćica (Dugi Otok)

Explore the rugged Kornati islands, anchor in a protected cove. Consider a dinghy swim or small shore walk. (2–4 hours).

Day 3 — Telašćica Bay (Dugi Otok) → Sali / Žut / Kornati villages

Visit salt lake & cliffs in Telašćica; overnight near Žut or Sali (great small restaurants). (Short hops + plenty of time ashore.)

Day 4 — Sali area → Šibenik channel / Kaprije / Zlarin

Work your way back toward the mainland, pick a quieter island for an evening barbecue ashore. (2–3 hours.)

Day 5 — Head toward Murter/Tisno area — anchor near Tisno or return to marina

Relax, pack, enjoy a last swim. If the festival boat parties are running, you can position near Tisno / The Garden Resort. (Short sail.)

Day 6 — Return boat to base (morning), handover and transfer to The Garden Resort (Tisno) for Defected

Drop the boat on time, transfer (short taxi/shuttle) to The Garden Resort. Enjoy the festival.

If you want 5 or 7 days: compress or add an extra island day (e.g., add Žut, Kornati more exploration, or Krka waterfalls day trip by car from Šibenik).

—

Typical charter + trip costs — realistic, cited estimates & example per-person math

I show a conservative example for a 7-day bareboat + skipper (skippered) arrangement and for group splitting. Actual prices depend on boat size, season (late July = high season), and how many people share costs.

Key price inputs (sources):

Base weekly bareboat charter average (Croatia, mid/high season): ~€3,000–€5,000 / week for typical 40–50ft yachts (price varies by boat class).

Skipper: €150–€250 per day (peak summer can be toward top end). So for 7 days that’s about €1,050–€1,750.

APA (Advance Provisioning Allowance) to cover fuel, food, park fees, marina dues, etc.: ~20–30% of the base charter (typical guidance). (Example: 25% of €4,000 = €1,000).

Fuel, marina & extras: often covered from the APA, but expect fuel & marinas to be a few hundred euros total depending on itinerary.

Security deposit: refundable, commonly €1,000–€3,500 held at base.

Flights (North America → Split / Zadar)

Ballpark round-trip economy fares in summer: US$700–1,500+ per person depending on city, routing and timing. (Transatlantic availability is increasing in 2026 — check direct seasonal routes; new services were announced for 2026). Use the low end if you book early / use connections; high end if last-minute or peak dates.

Sample budgeting scenarios (I’ll give an example for clarity; keep in mind these are estimates to help planning):

—

Example A — mid-range charter plan (group of 12 people) — 7 days (one yacht, skipper)

Base charter (week): €4,000.

Skipper: €1,050 (7 days × €150/day).

APA (25%): €1,000 (used for fuel, provisions, marina fees — any unused is usually returned).

Final cleaning / tourist tax / minor extras: €200.

TOTAL CHARTER COST (all) = €4,000 + €1,050 + €1,000 + €200 = €6,250.

Per person (12 people) = €6,250 / 12 = €521 (~US$560) each for the boat week (including skipper/APA estimate).

Add flights (example): US$1,000 avg → US$1,000 (~€930 depending on FX) per person.

Add transfers (shared minivan from Split to Murter/Tisno): €20–€40 per person (shared).

Grand approximate cost per person = Boat €521 (~US$560) + Flights US$1,000 + Transfers €30 (~US$33) + Festival ticket €294 (~US$320) = ~US$1,913 (rough order). (The festival ticket price for 2026 is listed around €293.99 / ~US$340 at time of posting).

—

Example B — larger group (say 16 people) — same charter numbers

If the same yacht can actually accommodate (often you’d need larger vessel or two boats for 16 people), but suppose you split across two boats or a catamaran that fits more:

Total charter/fixed costs rise (larger boat or two boats), but per person often drops slightly. For two similar boats totaling €8,000 + skipper(s)/APA, divide by 16 → could be ~€450–550 per person for boats. Exact numbers depend on vessel(s) chosen.

—

Other cost considerations

If you need two boats for 10+ people (many monohulls sleep 6–8), budgets need to be doubled accordingly — catamarans and bigger yachts cost more. Check sleeping capacity before booking.

Provisioning per person (food/drinks): if not entirely via APA, budget €30–€60 per person per day for meals/drinks if you eat ashore and drink a fair amount.

Marina fees / national park fees: included in APA generally but expect modest fees at some harbors or National Park day permits.

Cancellation insurance / travel insurance (strongly recommended) — variable cost but plan ~US$50–150 pp.

Damage waiver or deposit insurance can reduce the need to block a large security deposit. Ask charter company

—

Quick booking advice / logistics (practical)

- Book boats early (high season July end = peak for charters and festival). Many bases sell out or require larger deposits months ahead.

- Check yacht capacity vs sleeping berths — if your group is large (10–20 people per your earlier planning), you will likely need either a big catamaran or two yachts. Pricing rises accordingly.

- Get a skipper unless your crew is fully experienced and certificated — local waters, narrow channels and crowded marinas in high season make the skipper a very good call.

- Plan pickup/dropoff times so you can hand back the boat the morning you need to get to the festival — or drop the boat a day earlier and stay ashore near Tisno. Transfers from Murter/Tisno to The Garden Resort are short.

—

Short checklist / next actions I can do for you right now

(1) I can build a tailored cost estimate for your exact group size (say 10, 12, 16 or 20) and preferred number of sailing days (5 vs 7).

(2) I can search for specific available yachts (by base: Murter or Split) for your week (for example 22–28 July 2026 arriving in time for Defected) and show sample quotes.

(3) or I can map an exact 6-day sail route with suggested anchorages and estimated sail times (NM / hours) between each stop.

Tell me which of those you want me to do next and I’ll pull specific quotes and options (I can look at actual available yachts and shuttle prices for your dates). (No need to confirm the festival dates — I used the announced Defected Croatia 29 July–3 Aug 2026 dates for planning.)

—

If you tell me the exact number of people (e.g., 12 or 16) and whether you prefer one big catamaran vs two monohulls, I’ll run the specific yacht price search & give a tight per-person quote and a day-by-day GPS-friendly route.

Mortgage Renewals – 2.75 million Canadian Mortgage Renewals Before 2028!!

Mortgage Stress Test: Why It’s Protecting Homeowners Ahead of the 2026 Renewal Wave

If you locked in your mortgage around 2% five years ago, you probably remember grumbling about the federal “stress test.” At the time, qualifying at 5.25% felt unnecessary — almost punitive. Fast forward to today, and that very safeguard is proving to be one of the smartest policies in Canadian housing finance.

The Renewal Wave Is Coming

According to the latest CMHC report, Canada is heading into a busy period of mortgage renewals:

- 750,000 mortgages will renew in the second half of 2025

- Over 1 million more in 2026

- 940,000 in 2027

Even though the Bank of Canada has cut rates nine times since its peak tightening cycle, borrowing costs remain much higher than they were during the pandemic lows. In fact, the average five-year fixed uninsured mortgage rate in July 2025 was still 67% higher than five years earlier.

“Banks are ready for the almost 3 million mortgage renewals before 2028. Lets get you a strategy on how to get the best rates on your renewal. Its a quick 10 minute phone call and we usually send you back to your own bank with the data you need to get a better rate from them OR we can move you to a bank that does get you better rates.”

Mortgage Mark Herman, Top Calgary Mortgage Broker for renewal advice

Stress Test Success

Here’s the good news: borrowers who qualified at 5.25% back in 2020 are now proving resilient. The stress test ensured they could handle payments at rates much higher than what they actually received. That foresight is paying off:

- National mortgage delinquency rates fell in Q2 2025 — the first decline since 2022.

- While Ontario and BC saw arrears climb (reflecting higher property values and loan sizes), the overall system is holding steady.

- Fears of a “renewal cliff” have eased, thanks to both the stress test and recent rate cuts.

What This Means for You

If your mortgage is coming up for renewal in 2026, now is the time to plan. Options like refinancing, adjusting amortization, or exploring different products can help smooth the transition. The stress test gave you a buffer — but proactive planning will maximize your financial flexibility.

Call to Action: If your mortgage is set to renew in the next 12–18 months, let’s talk strategy. As a mortgage broker, I specialize in helping clients navigate renewals, refinances, and complex lending scenarios. Call me today to review your options and make sure you’re ready for what’s ahead.

Thinking twice when handing your mortgage over to a bank adviser

Great story below of a recent Scotiabank advisor messing up a deal so bad that it ended up disqualifying a buyer from getting a special at 3.69% insured mortgage when market rates are 4.45%.

Bank advisors mess up all the time and I hear about it all the time. Maybe 15% of our deals get to us from bank mess ups.

In the story cut and paste below these buyers just would have ended up with a a higher rate but their deal wold still work… this one caused a 1 year delay.

Let me tell you a mortgage story…

We had a customer that we helped sheppard past 3 or 4 fiery hoops getting his mortgage ready for approval with a bumpy past we were smoothing over. Then 1 day he calls and says a met a bank mortgage rep at a gas station, that bank rep “guaranteed” him getting approved so our customer applied and … surprise – worse than a decline, CMHC declined him.

CMHC was the only lender that would do his specific deal, for the mess he was in, and/ but CMHC NEVER forgets – anything. All the insurers retain all data for ever. So he now had to wait another 12 months to get insurer approval. The delay in the end was 12 additional months that he had to wait before he could buy.

So … Think twice before handing over your mortgage to a bank adviser

Mark Herman, Best mortgage broker in Calgary Alberta for new home buyers.

Opinion: Think twice before handing your mortgage to a bank adviser – CMT News

Written by Ross Taylor, Mortgage Strategies, Opinion,

Let me tell you a story.

Recently, a major chartered bank ran a very competitive promotion: 3-year fixed rates at 3.69% for insured files and 3.99% for conventional files. Needless to say, these rates were popular, business was booming, both for the bank and for brokers working with them.

We had pre-approved a young couple earlier in the year, but when it came time to seek approval on a home they had made a successful offer on, they first went directly to their local branch to withdraw funds from their First Home Savings Account (FHSA).

When a branch adviser steps in

During that visit, the branch financial adviser offered to handle their mortgage as well. He convinced them there was no need to come back to our team, he had it all under control.

They also explored options at another bank, but the rates they were offered were mediocre. Our promo was still the best rate in town.

The deal gets declined, and there’s no second chance

But here’s the twist. After the financial adviser submitted their deal, it was declined. He escalated the deal to senior management, but again was given a firm no.

When they came back to us and told me the news, I was shocked. I couldn’t understand why they were declined. On paper, this was a strong file. Solid income, great credit, and their debt service ratios were within reasonable bounds.

Misinterpreting income cost them the deal

I asked if they were told why they were turned down, and they said, “because our debt service ratios were over the 39/44 limit.”

Now, their pay stubs were a bit complicated, I’ll give you that. But we had their T4s, and I could easily make a case for either using a two-year average or taking their current full-time salary. Both would have worked. You just had to know how to interpret the documentation properly.

I contacted our Business Relationship Manager at the bank and asked if I could re-submit the file. After all, it had been declined, and I felt confident we could get it approved with the correct interpretation of income. But the answer was a firm no.

Why bank policy closed the door

The bank’s position was that I wouldn’t want another broker or branch employee taking one of our approved files and trying to submit it again. And while I understand the sentiment, this wasn’t the same thing. This wasn’t poaching a win, it was salvaging a decline.

But rules are rules, and because the file had already been escalated and declined by the branch, there was no path forward for me to resubmit it — even if I knew how to fix it.

What’s the lesson here? Be careful who you trust with your mortgage

This story isn’t about one bank being better than another. It’s about understanding that not all mortgage advisers are created equal. When you walk into a branch, you’re often speaking to a generalist. They might have good intentions, but they don’t always have the same level of mortgage-specific training or experience as a full-time mortgage broker.

And the consequences of that can be enormous. In this case, the clients lost out on a great rate and had to start over, simply because it seems their adviser didn’t fully understand how to package their income. And once the file was declined, there was likely no second chance.

The bottom line

Mortgages are complex, especially if your income is even slightly non-standard. Getting declined not only wastes time, it can actually prevent you from accessing the best deals, even if you’re fully qualified. Before you hand over your file to someone behind a desk at your local branch, ask yourself: do they really specialize in mortgages?

Because once a file is escalated and declined at the bank level, it may close off options you didn’t even know you had.

Make sure you’re putting the biggest financial transaction of your life in the right hands.

Summary: RE/MAX Canada Fall 2025 Housing Market Outlook

“54% of Canadians believe this fall is a good time to strike a deal on a home.”

Here’s a summary of the RE/MAX Canada Fall 2025 Housing Market Outlook piece, released Sept 21st:

- Pricing Trends: Residential price trends varied regionally, rising across Atlantic Canada and the Prairies, while declining in major urban centres in Ontario and British Columbia.

- National average home prices are expected to decrease by about 6.5% this fall.

- 68% of Canadians say a five- to 10-per-cent drop in property prices would make a meaningful difference in their ability to enter the market.

- Sales Activity: Home sales declined year-over-year in 62% of markets analyzed between January 1 and July 31, 2025.

- Buyer Optimism:

- 38.2% of housing markets are sitting firmly in buyer’s territory this Fall.

- 7% of Canadians say they intend to buy their first home within the next 12 months.

- 28% of Canadians planning to buy their first home in the next 12 months say they have saved at least 20 per cent for their down payment.

- 64% of Canadians say they’d feel ready if interest rates fell by 0.5 to one per cent.

- Seller Market:

- 26.4% of housing markets are expected to favour sellers this Fall.

- 8% of Canadians say they plan to sell their home in the next year, and among them, confidence is strong.

- 63% of those planning to sell believe they’ll be able to secure their asking price.

- Homeowner Sentiments:

- 92% of Canadian homeowners see their homes as a solid long-term investment.

Click here to read the full report!

Now is the perfect time to buy a home in Alberta as it is a solid BUYERS MARKET!

Mortgage Mark Herman, best first time home buying mortgage broker in Calgary Alberta

Or call me for a chat at your convenience.

Mortgage Mark Herman

#1 Mortgage Rate SPECIAL in Canada ⚡

|

|

|

How to Buy a Home in Alberta with Poly B Plumbing

Are you trying/ looking to buy a home in Alberta with Poly B plumbing?

We just completed financing on a purchase in Calgary with Poly-B throughout the home AND we managed to INCLUDE the cost to replace it it all into the mortgage too!!

Mortgage Mark Herman, best Calgary Alberta mortgage broker near me.

Action Steps

Please reach out if you would like to talk about:

- The contact for the home/fire insurance company that INCLUDES Poly B, with full replacement value of the home, as required

- Buying a home / getting a mortgage that needs Poly B replacement.

- Adding/ including the cost of a renovation into your mortgage on purchase, or on renewal, or at any time.

Summary

Homes with Poly B are priced lower accordingly due to the difficulty of getting home/fire insurance BUT there is some “good uplift to the value” if it can be fixed.

It was a rough ride but now that we have all the pieces in place, the next ones will be easier.

2 extra moving parts to a normal deal:

- Getting the quote for the replacement of the Poly B for the entire home, from a company that will do it.

- Hardest part was getting the home/fire insurance to cover 100% of the home replacement cost.

Below is the wording in the mortgage approval that came back to us on what it had to include from the mortgage lender:

- *Copy of home insurance policy – need receipt of valid fire insurance particulars for the subject property.

- **Coverage must include full replacement cost of Poly B for single family dwelling

- *** Require full disclosure to insurance provider that home contains Poly B Plumbing and endorsement.

Tricks

Sometimes the insurance companies will only cover it for 30 – 60- or 90 days; until the work is completed. Then they go back to a normal policy at normal rates. If that is the case then the bank adds this clause:

- It must be noted that Poly B will be replaced within “x” amount of days.

- (This is usually whatever the contractors timeline to having the work done is the “x-days”)

Adding the cost of the reno into the mortgage – our specialty for the last 20 years.

We have a fantastic “Perfect Home Mortgage” that allows you to add up to $40,000 easily, or with some difficulty (more questions and paperwork) up to $100,000 in renos to the mortgage.

Essentially, 1 quote is needed for the work being done, then bank send the funds for the home, and the reno to the lawyer. When the work is 100.000% complete we order an inspection of the work, and the the lawyer pays the company for the work. this usually has to be completed in 90 days.

Below is the wording from the bank for this:

- Please ensure the client knows there will be a holdback at the lawyers for the full cost of the Poly B improvement.

- It is the buyer’s responsibility to make arrangements with the contractor to either pay them direct or have lawyer directed funds once completed.

- It is a condition that an appraiser inspects and confirms the work done prior to funds being released and the cost of the inspection is paid by buyer.

ENDING…

Is this for you? Are you ready for the ride?

* Poly B, or polybutylene, is a type of plastic plumbing pipe that was commonly used in residential plumbing systems from the mid-1970s to the mid-1990s. It was initially favored for its low cost and ease of installation, but it has since been identified as a material prone to leaks and failures.

Using cryptocurrency to buy a home in Canada: 2025

We have been getting lots of customers asking this question with the recent rise of crypto values.

Below are ALL the details I have collected: from tax implications to AML compliance, what buyers need to know before turning digital gold into a home.

I have bitcoins for my down payment on my home!

Many Canadians now have significant Bitcoin, Ethereum or other crypto and want to use that for the down payment in a home purchase.

However, turning crypto into a viable down payment, or leveraging it as collateral, isn’t nearly as simple as it sounds.

Mortgage Mark Herman, Best Calgary Alberta mortgage broker for crypto mortgage brokers and first time home buyers

First, what is a crypto mortgage?

Crypto mortgages typically fall into one of two categories:

- Crypto-funded mortgage – the way that actually works: You sell your crypto, convert it to Canadian dollars, and use those funds as your down payment. This way also comes with some with tax consequences on the sale – but hey, your crypto may be up 15000%, and the capital gains tax is only on the amount you cash in, and it is 50% of the profit. SEE THE MATH ON THIS at the bottom.

- Crypto-backed mortgage – what everyone is asking for: You pledge your crypto as collateral without selling it. This probably helps avoid triggering capital gains tax, but requires a lender capable of assessing and managing that risk. We have not found this route to work due to enormous anti-money-laundering laws that realtors, banks, and brokers have to follow.

Version 1: Using your crypto as a mortgage down payment

This is the way that works, and the easiest way to use your crypto is to cash it in/ convert to cash, and move the funds into a Canadian bank account to “seed” or “season” for 90 days.

- This is not really needed with most other assets and we have tried so many ways to get the lenders to accept the funds held in a crypto trading platform (like Binance, NDAX or similar, but they always sound the alarm right here, send the file to “the risk desk” and then it is a battle the entire rest of the way.

Why do I need to cash it in and leave it in the bank for 90 days? It’s AML!

The “kink in the system” is that we have to show a 90 day history for the source of all down payment funds for AML – anti money laundering law compliance. Normally banks are fine with funds sitting in Wealth simple or any trading account but NOT for crypto. After getting “all the NO’s” we found this is the way to go.

What about – buying with cash and refinancing/ getting a mortgage on it later?

- When you do this in the 1st year, the banks still need to re-verify the original down payment for the original purchase so this will still be tough to do.

- And refinance rates are higher than purchase rates, and you would then also be re-registering the mortgage and registration has shot up to about $2000, from $200 over the last year in Alberta.

Version 2: which we have NOT found to work – is leveraging your crypto and pledging it without a sale.

If you want to access liquidity without selling your crypto, a crypto-backed loan is another option and here is how it is supposed to work to avoid the capital gains event.

- If this has too many moving parts, then selling your crypto and putting it into the bank for 90 days is the way to go.

- Deposit crypto as collateral

You transfer your crypto to a platform, where it is held in a secure wallet or smart contract. Platforms such as YouHodler and Ledn support this model.

- Loan-to-value (LTV) ratio

You can typically borrow between 30% and 70% of your crypto’s value. For example, pledging $10,000 worth of Bitcoin may get you a $5,000 loan.

- Disbursement

Loans are issued in fiat (e.g., CAD, USD) or stablecoins. Most do not require a credit check and can be approved quickly.

- Repayment and interest

Terms vary. Some platforms offer flexible repayment options; others require fixed schedules. Once the loan and interest are repaid, your crypto is returned.

- Liquidation risk

If the value of your crypto drops and your LTV exceeds a certain threshold, you may be required to add collateral. Otherwise, your crypto may be liquidated.

- No taxable event

Since you are borrowing, not selling, there is no capital gains tax event. This can be beneficial from a tax-planning perspective.

WHAT ALSO WORKS …

A simpler, safer alternative: using crypto ETFs for mortgage planning

For a more straightforward path, consider using crypto ETFs instead of direct crypto holdings. ETFs allow you to gain exposure to digital assets without managing wallets, keys, or exchange accounts.

Held through mainstream brokerages, including in TFSAs and RRSPs, crypto ETFs are easier for lenders to understand and verify, avoiding the friction that often comes with direct crypto assets.

Leading crypto ETFs in Canada

These are some of the top crypto ETFs available to Canadian investors:

- BTCC (Purpose Bitcoin ETF): The first Canadian Bitcoin ETF, with CAD and USD options and a carbon-neutral version

- BTCQ (3iQ CoinShares Bitcoin ETF): Physically-backed BTC, held in cold storage

- FBTC (Fidelity Advantage Bitcoin ETF): Designed for registered accounts

- ETHH and ETHX (Purpose and CI Galaxy Ethereum ETFs): Offer direct ETH exposure, with or without staking

- IBIT (iShares Bitcoin ETF): Managed by BlackRock, a major global asset manager

Several ETFs now include additional exposure to AI stocks or newer crypto assets like Solana, expanding diversification options within this space.

Naturally, this is our experience and this should NOT be taken as investment advice. Ask your licensed financial adviser for their opinion before proceeding please.

SUMMARY

Can I use crypto as a down payment?

Yes, but there are strict conditions:

- You must convert the crypto to Canadian dollars

- Maintain a documented paper trail of the sale and deposit

- Be prepared to explain the origin of your funds for AML compliance

Many lenders will still be hesitant. Working with a mortgage broker familiar with these requirements and a lender that understands crypto is essential.

Is it legal and safe in Canada?

Yes, but regulatory guidance is evolving.

Lenders must comply with OSFI and FINTRAC standards, which include thorough AML and source-of-funds verification.

OSFI is expected to implement new digital asset rules in 2025, which may influence how Canadian financial institutions handle crypto-collateralized products.

Key risks to consider

- Price volatility: A drop in crypto value can lead to margin calls or liquidation

- Lender restrictions: Many banks still reject crypto-related funds

- Platform risk: Some crypto lenders have gone bankrupt

- No deposit insurance: Crypto held as collateral is not insured by CDIC

- Compliance complexity: Documentation, tax reporting, and regulatory scrutiny can be significant

How does CRA treat crypto in mortgage scenarios?

Under CRA guidelines, cryptocurrency is treated as a commodity.

Selling it to fund a down payment is a taxable event, and any capital gains must be reported.

However, borrowing against your crypto is not a disposition and does not trigger capital gains taxes, at least under current rules. Regardless, thorough documentation is critical.

Crypto-backed mortgages and crypto-collateralized loans offer new possibilities, but they’re not ideal for everyone. If you’re a crypto holder considering homeownership in Canada:

- Convert your crypto to Canadian dollars early, and let it seed for at least 90 days

- Alternatively, accumulate your crypto wealth in Exchange Traded Funds

- Document everything: sales, transfers, deposits, and sources of funds

- Work with professionals who understand both traditional lending and crypto

- Be ready to meet rigorous compliance and verification requirements

Canada’s mortgage landscape is still catching up to the digital asset world. Planning ahead is key to avoiding delays or declined applications.

Further reading and sources

Taxable Capital Gains on Bitcoin in Canada

When you dispose of Bitcoin (for example, selling or “cashing in”), the Canada Revenue Agency treats it as a commodity. If your transaction is considered a capital disposition, only 50% of the gain is taxable.

How It’s Calculated

- Adjusted Cost Base (ACB): The original purchase price (in CAD), plus any fees.

- Proceeds of Disposition: Fair market value (in CAD) on the date you sell.

- Capital Gain:

Gain=Proceeds−ACB−Disposal Fees\text{Gain} = \text{Proceeds} – \text{ACB} – \text{Disposal Fees}

- Taxable Capital Gain:

For example, if you bought Bitcoin for $10,000 CAD and later sold it for $15,000 CAD (with $100 fees), your gain is $15,000 – $10,000 – $100 = $4,900. You report half—$2,450—as taxable income.

Tax Payable

- The $2,450 is added to your total income for the year.

- The actual tax you owe equals your marginal tax rate multiplied by the taxable gain.

Municipal, provincial and federal rates all apply, so total tax varies by province and your income bracket.

Reporting & Recordkeeping

- Report on Schedule 3 (Capital Gains) of your T1 return.

- Keep detailed records: transaction dates, CAD valuations, fees and wallet addresses.

- Use reliable crypto-tax software or a professional to ensure accuracy.

Special Considerations

- If CRA deems your activity a business (frequent trading, mining, or providing services), 100% of profits may be taxed as business income.

- Capital losses can offset gains—claim them on Schedule 3 to reduce your taxable gain.

Beyond capital gains, remember that receiving Bitcoin as income (mining rewards, staking, payments) is taxed at 100% of its fair market value on receipt. Always consult a tax professional for personalized advice

Canadian Residential Market Update

Fixed rates are slowly rising due to Trump’s inflationary policies and we see that continuing until tariffs are sorted out.In the mean time, now is a great time to buy as inventory is high and rates are only .4% above where they were before Covid.Mortgage Mark Herman, Top Calgary mortgage broker specializing in 1st time buyers.