Net Migration to Alberta – #’s here.

the CORE reason home prices in Calgary will be going up for the next 4 years, and are 100% supported and will not be coming down is summed up in this article right here.

https://www.cbc.ca/news/canada/calgary/alberta-population-records-2023-to-2024-data-1.7157110

Summary of the Main Reasons Home Prices are Supported:

- BC and Ontario home prices are DOUBLE Calgary home prices

- 4 million New Canadians on the way here in the next 5 years.

- We hatched the largest 20 – 29 year old population Canada has EVER had, and they are moving out of their parent’s basements and buying their own homes.

- Alberta does NOT have PST

- Alberta does not have a 1% “welcome to the neighborhood tax” when buying property.

After researching the above data points we can confidently say all 5 of these stacked factors will cause home prices to increase is all price ranges for the next few years.

Mortgage Mark Herman, licensed as a top Alberta Mortgage Broker for 21 years and 1 year in BC

Why to Buy Your Home Now; Vancouver Island, Winter, 2024

Summary

We expect to see multiple & competing offers, with NO Financing Conditions for all home types, priced from $400k to $1.1M, starting now, and growing to “full-scale crazy- town” by May.

Use this time before May 2024 to take advantage of slight & short term softening of the market before:

- News of lower mortgage interest rates ignites a powder keg of sidelined, eager, competitive buyers.

- Prices continue to climb due to continued competition from 4 million New Canadian immigrants for the few homes on the market; for the next 4 years!

- Housing will remain in super-tight supply with inventory pre-sold before it gets to market.

Shameless Advertisement … then the data

Your #1 concern should be: how does my offer win among 5, 10 or 20 others?

Will you have the confidence in your broker or bank to write a No Condition or Lo Condition Offer?

We support NO CONDITION & LOW CONDITION OFFERS!

-

- with 100% pre-underwritten approvals and

- 9am to 11 pm live phone support – with me & your realtor – when writing your offer to ensure it works.

To take your 1st step to a FULLY Pre-Undewritten, Pre-Approval; that could go NO Conditions, if needed – click here.

DETAILS

1. Mortgage Rates

Have Decreased Already – but on the down low.

Without media attention, About 20 tiny reductions have already happened for FIXED RATES.

- Fixed rates have been slowly and quietly decreasing from Post-COVID 20 year highs; they were ~7% and are now ~5%

- Most people are only aware of the 10x Prime rate increases in a row post-COVID in 2023/23

- Prime has held steady at 7.2% since then,

- 1st Prime reduction expected in July and it has already been “100% priced-in” by the stock market.

- Inflation and the Consumer Price Index came in at 2.9% and is now back inside the target range of 1.0% to 3.0%.

Why the Rush?

1A. Joe Public is now correctly thinking;

-

the slight extra interest cost of buying now with marginally higher mortgage rates and some actual inventory selection to choose from; far, far, far out weighs …

- the small increase in buying power from lower rates that is sure to come with

- massive price increases when buying in the frenzy starts after the BoC rate cuts hit the news.

1B. 50% of “Exhausted Buyers” plan to re-enter the market when rates drop

A recent survey, half (51%) of those who put their home purchase plans on hold, now say they will re-enter the market when they hear that rates have dropped.

- A rate decline of just o.25% would be enough to bring 10% of those Exhausted Buyers back,

- A rate decline of 1.00% would bring back 23% of those sidelined.

- the Prime rate (for variable rates) is expected to go down 2%, and fixed rates could easily sneak down another 1.5% yet too.)

1C. AUTO_RATE_FLOAT_DOWN helps

In a decreasing rate environment, if the rates goes down AFTER you sign, you still AUTOMATICALLY get the lower rate right up until 5 business days before you move in.

See the GRITTY details of WHY THE VARIABLE RATE IS THE WAY TO GO HERE

- The Variable lets you take advantage the rates going down over the next 28 months, right now. It goes you an option to not take a fixed rate at near 10-year highs.

2. Home Pricing

Home prices on Vancouver Island are FULLY SUPPORTED, and will NOT be dropping at all, due to continuous demand from record setting immigration for the next 5 years.

- Remember in 2022, during COVID when “buyers were acting irrationally” and then home prices went up $500k over 1 year?

- That is about to happen again!

Consider this is the reason why Vancouver Island is in such demand …

- Every day, somewhere in Canada, say about 100 people retire and “sell all their things” and plan to move West, to the Island, and retire in Canada’s only temperate rain-forest. The #1 location choice for retirees.

- Right now the high interest rates are slowing the asset sales for these retirees to “move their high value assets” and move West including: primary and rental homes, cabins, businesses, vehicles and boats.

- When interest rates come down, buyers will better afford loans on these assets, and the above items will sell. The “tidal wave” of backlog retirees will all “move West to the Island” for the weather and retirement in a rush.

- With plentiful CASH reserves to haphazardly throw down on their last home purchase, completing their dream; and frustrating yours.

Prices are expected to further INCREASE for the next 5 years due to these data points below:

3. Current homes prices well below national average:

For 2023: Calgary; up 4%, Halifax; up 3%, Victoria; up 1%

- All other cities in Canada are down 18% to 21%‘; which really means Victoria is really up about 22-ish%.

- [data point here]

4. Peek New-to-Canada Immigration

Overall Canada’s population growth is 3.1% – 6x higher than the USA at o.5%.

- 1.2 million new Canadians arrived in 2022 – highest growth of all the G20.

- 4 million new Canadians are on the way before 2027; where will they live?

- That’s 2x Canada’s already hefty overall population increase, which also broke records.

- “We have never seen the young adult population growing anywhere nearly this fast before,” an analyst wrote. “Putting additional pressure on rents now, and in the medium term, it will put pressure on home prices.”

- See the red-blue graph below

5. Renting in the Wild West

37% of Canadian households are renters.

- New renters are on the scene from an unprecedented rise in working age population – up 874,000 in 2023

- Rent inflation was 8.2% in October 2023 – highest in over 40 years.

- The difference between rent inflation and “standard inflation” is the highest in 60+ years.

Costs to build a home are up 51% since 2020.

- High costs for all inputs, scarcity of skilled construction workers, higher mortgage interest rates for builder’s financing, supply-chain bottlenecks from COVID. (See the graphics below.)

- Forest fires from 2020 to 2023 have reduced the supply of lumber.

- 100,000 new construction workers are needed in Canada.

- Most will be “temporary foreign workers” also hoping to become citizens and buy the same home supply they are producing.

- Construction wages were up 11.5% in 2023.

{Lots of fantastic graphs go here.

For a copy of the actual report in PDF, please request from me in email.}

What about COMPETING / Multiple Offers?

- We do Lo/No CONDITION OFFERS with Pre-underwritten, Pre-approvals that actually work.

- And I answer my phone from 9-9 x 360 so you can win your competing deals at the last second.

- Banks don’t offer this service. We have been doing this since “the Rush of 2007” when home prices were going up $1000/ day. This will be similar.

Why Buy Your Home Today: Data Points, Alberta, Winter, 2024

|

Acceptable Sources of Down Payment for a home Canada, 2024

This seems to be the topic of this week … what can I use for down payment on my home?

All banks DO ACCEPT these approved methods to gather down payment for a home.

Acceptable Sources of Down Payment:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ineligible Sources of Down Payment

|

|

|

|

|

|

|

|

The new Tax-Free First Home Savings Account (FHSA) and the

FTHBI – First Time Home Buyer Incentive were the government matches your down payment up to 5% ARE both great ideas!

Mortgage Mark Herman, top Calgary Alberta Mortgage Broker since 2004!

Underlying Economic data on BoC holding Prime rate the same, December 5, 2023

Bank of Canada holds its policy interest rate steady, updates its outlook

Against the backdrop of a decelerating economy and growing calls for less restrictive monetary policy, the Bank of Canada made its final scheduled interest rate decision of the year today.

That decision – to keep its overnight policy interest rate at 5.00% – was broadly expected. What was not entirely expected (or welcome) was the Bank’s statement that it is “still concerned” about risks to the outlook for inflation and “remains prepared to raise” its policy rate “further” if needed.

The Bank’s observations are captured in the summary below.

Since August, we have been saying the VARIABLE RATE mortgage is the way to go, and this proves we were right on the money.

Mortgage Mark Herman, top Calgary Alberta and Victoria BC mortgage broker

Inflation facts and housing market commentary

- A slowdown in the Canadian economy is reducing inflationary pressures in a “broadening range” of goods and services prices

- Combined with a drop in gasoline prices, this contributed to easing of CPI inflation to 3.1% in October

- However, “shelter price inflation” picked up, reflecting faster growth in rent and other housing costs along with the continued contribution from elevated mortgage interest costs

- In recent months, the Bank’s preferred measures of core inflation have been around 3.5-4%, with the October data coming in towards the lower end of this range

- Wages are still rising by 4-5%

Canadian economic performance

- Economic growth “stalled through the middle quarters of 2023 with real GDP contracting at a rate of 1.1% in the third quarter, following growth of 1.4% in the second quarter

- Higher interest rates are clearly restraining spending: consumption growth in the last two quarters was close to zero, and business investment has been volatile but essentially flat over the past year

- Exports and inventory adjustment “subtracted” from GDP growth in the third quarter, while government spending and new home construction provided a boost

- The labour market continues to ease: job creation has been slower than labour force growth, job vacancies have declined further, and the unemployment rate has risen modestly

- Overall, these data and indicators for the fourth quarter suggest the economy is “no longer in excess demand”

Global economic performance and outlook

- The global economy continues to slow and inflation has eased further

- In the United States, growth has been stronger than expected, led by robust consumer spending, but is “likely to weaken in the months ahead” as past policy rate increases work their way through the economy

- Growth in the euro area has weakened and, combined with lower energy prices, has reduced inflationary pressures

- Oil prices are about $10-per-barrel lower than was assumed in the Bank’s October Monetary Policy Report

- Financial conditions have also eased, with long-term interest rates “unwinding” some of the sharp increases seen earlier in the autumn. The US dollar has weakened against most currencies, including Canada’s

Summary and Outlook

Despite (or in the Bank’s view because of) further signs that monetary policy is moderating spending and relieving price pressures, it decided to hold its policy rate at 5% and to continue to normalize its balance sheet.

The Bank also noted that it remains “concerned” about risks to the outlook for inflation and remains prepared to raise its policy rate further if needed. The Bank’s Governing Council also indicated it wants to see further and sustained easing in core inflation, and continues to focus on the balance between demand and supply in the economy, inflation expectations, wage growth, and “corporate pricing behaviour.”

Once again, the Bank repeated its mantra that it “remains resolute in its commitment to restoring price stability for Canadians.” As a result, we will have to wait until next year for any sign of rate relief.

What’s next?

The Bank’s next interest rate announcement lands on January 24, 2024.

In the meantime, please feel free to call me and discuss financing options that will empower you in this economic cycle, and the ones ahead.

Canadian Mortgage Data – Nov 14

There has been a little relief for mortgage shoppers in recent days.

- Fixed-rates have come down slightly, led by declining yields for government bonds.

- Variable-rate mortgages appear to be maintaining their discounts and most market watchers believe the Bank of Canada has reached the top of this rate-hiking cycle.

The Bank, however, continues to warn that Canadians should be preparing for interest rates to remain higher for longer. Senior Deputy Governor Carolyn Rogers made that point again during a recent speech in Vancouver, saying it is important to adjust proactively to that possibility. Rogers cited a number of global considerations for higher rates including: China and other developing nations joining the worldwide economy; a decline in attractive investment opportunities for businesses; and an overall, international, adjustment to higher rates.

It is also useful to remember that central banks around the world have been working to normalize interest rates that have been at historic lows since the 2008 financial crisis.

Rogers offered some reassurance that Canadians are adjusting to higher rates. Household credit growth has dropped to its slowest pace since the early ’90s. Delinquency rates on credit cards and other consumer loans are only slightly above pre-pandemic levels. Mortgage delinquencies are below pre-pandemic levels, and that is despite about 40% of all mortgage holders having already renewed at higher rates, with bigger payments.

As to when interest rates might actually start falling? The BoC’s Q3 survey of “Market Participants” suggests they are adjusting to the higher-for-longer scenario. Based on the median response they are expecting a quarter point drop in April, 2024. That is a month later than expectations expressed in the Bank’s Q2 survey.

Finally some good news for buyers.

Buy soon before everyone that did not buy sees this data and tries to by tool

Mortgage Mark Herman – top, best Calgary mortgage broker

Data on those negative amortization mortgages

Queston 1: What about all these (negative amortizing) mortgages that will now take 71 years to pay off?

Answer:

Yes, they are called VRMs – Variable rate Mortgages – and we don’t really offer/sell /even talk about them for that exact reason – what if the rates rates jump? And they did.

We do offer ARMs – Adjustable Rate Mortgage – and we do recommend as of August 2023 because:

- Rates have topped and are slowly on the way down right now so the rate will go down

- The current rate starts lower than the 1, 2, 3, and 4 year fixed right now; and ARM rates should be below the 5-year fixed by Fall of 2024.

Question 2: What is the difference between VRM and ARM?

- With an ARM – adjustable rate mortgage – the amount of your payment will go up and down based on the changes of the prime lending rate

- The VRM – Variable rate mortgage – your mortgage payment amount always remains the same. It does not go up and down with changes in the prime lending rate. And when rates jump to 4x what they were when your loan started, then you are not even paying interest any more, and end up at 70 years left to pay it off.

As the article below states, VRMs are mostly from BMO, CIBC, Royal Bank and TD.

ARMs – Adjustable rate mortgages – are what we offer, they can’t have a negative amortiztion and we don’t have any customers that were affected with negative loans.

Mortgage Mark Herman, best top Calgary mortgage broker

Concern over rise in negative amortization mortgages

On October 30th, the Bank also highlighted concern over negatively amortizing mortgages. Negative amortization occurs when a borrower’s monthly mortgage payment is less than the interest due on the loan and the outstanding mortgage balance grows over time rather than declining. This phenomenon is mostly associated with variable rate mortgages.

Those who bought or refinanced homes during the pandemic, when interest rates were at their lowest, heavily opted for variable rate mortgages (VRMs). In Canada, most VRMs come with fixed payments, where the interest portion is determined by the prevailing prime lending rate, while the rest is used to repay the principal. As a result, the Bank of Canada’s series of rate hikes – from 0.25% to 5% – has propelled growth in negative amortization mortgages with terms exceeding 30 years.

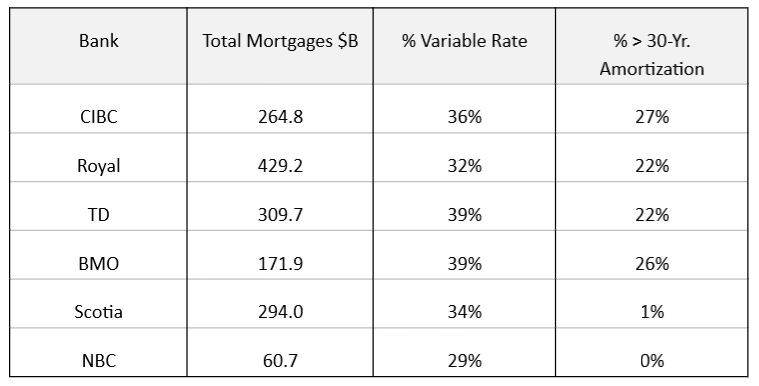

As of July 31, negative amortization mortgages were 24% of total mortgage portfolios (insured and uninsured) for BMO, CIBC, Royal and TD. This is equivalent to $277 billion in mortgages – up from virtually nil a year ago. National and Scotia mainly offer adjustable-rate mortgages – as rates change the mortgage payment changes to keep the amortization period fixed – so both banks have negligible exposure to negative amortization within their mortgage portfolios.

Variable Rate Exposure (as of July 31, 2023)

Source: Fitch Ratings

Canada’s banking regulator, the Office of the Superintendent of Financial Institutions (OFSI), has announced regulatory changes to address risks related to mortgages in negative amortization. Effective early next year, banks will be required to maintain a higher amount of capital, reflecting the elevated risk associated with mortgages in negative amortization when the loan-to-value ratio (LTV) surpasses 65% (i.e. when the outstanding mortgage balance is 65% or more of the value of the underlying property). The proposed changes are designed to incentivize banks to reduce the volume of mortgages that could potentially go into negative amortization.

Mortgage repayment trends

To assess how borrowers are reacting to the increase in rates, the prepayment report for floating rate 5-year mortgage-backed securities (MBS) pools, published by CMHC, serves as a valuable tool. Although it doesn’t pinpoint individual issuers, the report offers a comprehensive look at trends within the banks’ variable-rate mortgage (VRM) portfolio.

Report data indicates that borrowers with VRMs have been effectively managing impacts of rising rates by making partial principal payments or transitioning to fixed-rate mortgages. Enforcement activity, which is undertaken when a borrower is unable to make mortgage payments, has been minimal, which suggests that despite the rise in rates, defaults have remained low.

Also, the majority of non-amortizing mortgages, where payments are covering interest only, were recorded between November 2022 and February 2023. This is a positive sign that banks have taken measures to limit the growth of these mortgages.

One caution is around borrowers whose mortgage rates have exceeded the trigger point – that is, the rate at which the regular payment is no longer enough to cover the full amount of interest accrued since the last payment. These borrowers might encounter payment shock when their loans mature and are re-underwritten based on the original amortization but at higher rates and with larger principal amounts.

Those who were first-time homebuyers with high loan-to-value ratios, purchasing at or close to peak prices in 2020 or 2021, could face significant challenges during renewal, particularly if their equity position has been significantly eroded. Similar to Fitch, we anticipate that delinquency rates will not rise in 2024, remaining within the expected range of 0.2-0.25%.

Winning Variable Rate Strategy: end-2023

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

When Will Canadian Mortgage Rates Begin to Fall?

Last week, the Bank of Canada held its policy rate at 5%. The decision was expected given slowing in the economy and modest improvement to core inflation measures.

The Bank is likely at the end of its tightening cycle. How soon it eases rates – and how low will rates go in the near to medium term – is the question #1

ANSWER: The general view from market economists is that we could see some easing of the overnight rate by mid-2024.

Question #2: How low. how far will Prime come down?

ANSWER: Prime is expected to come down a total of 2%.

DETAILS of Prime Cuts

- Prime is 7.2% now / November 2nd, 2023,

- Prime is expected to get down to to 5.2% or a bit lower, like 4.75% – 5.25% range by the end 2025; which looks like this:

- June/ July 2024, 1st Prime cuts = 6 months

- Prime reduction by o.25% every quarter = 1% less / year for the next 2 years = 24 months

- so these together = 30 months.

With Prime coming down, now is the time for you to take advantage of the Variable Rate reductions.

Variable Rates via brokers are at Prime – o.9%, while the Big-6 banks rates are Prime – o.15%.

YES, broker rates are 6x better than at the Big-6 lenders, o.9 – o.15 = o.75% better. It’s true!

Mortgage Mark Herman; Best Top Calgary Mortgage Broker for first time home buyers.

When might rates begin to fall?

The Bank’s latest Monetary Policy Report (MPR) also provides signals that we can monitor to gauge when rates could start declining.

When interest rates rise, one of the main ways monetary policy affects the economy is through reduced consumer spending on durable goods, like appliances, furniture and cars. Prices for durable goods, except for cars, have dropped from 5.4% to -0.4%, while prices for semi-durable goods, like food and clothing, have decreased from 4.3% to 2.1%. We’re still experiencing delays in delivering cars. As a result, manufacturers are concentrating on selling more expensive vehicles with higher margins and are offering fewer discounts from list prices.

Inflation in service prices, excluding shelter, has slowed from 5.1% to 1.5%. If bond rates begin to drop, we will see a gradual decline in mortgage costs. The challenge will be rental costs, which are soaring due to the very limited availability of rentals and the continuous influx of newcomers. Increasing housing supply is key to reducing rental prices. However, that is a problem that will take years to resolve given the significant shortage of housing.

Currently, the Bank is concerned about inflation expectations, corporate pricing behaviour, and wage growth. As noted in its Monetary Policy Report, “As excess demand eases, inflation is expected to slow. At the same time, inflation expectations should also fall, businesses’ pricing behaviour should normalize, and wage growth should moderate. So far, progress has occurred but somewhat more slowly than anticipated.”

The Bank will be careful to ensure that inflation expectations inconsistent with its 2% target are not embedded in corporate pricing and wage expectations. A slowing economy should help to lower those expectations.

The general view from market economists is that we could see some easing of the overnight rate by mid-2024.

NERD STUFF: Maintaining a restrictive rate policy

The Bank can maintain a restrictive policy even without increasing rates any further, simply by keeping rates at their current level. With the overnight rate at 5% and an inflation rate of 3.8%, the real policy rate is 1.2%. This rate is restrictive, since it is higher than the neutral real rate of interest, which the Bank estimates to be between 0 and 1%.

The neutral real rate of interest is the level of interest that neither stimulates nor restrains economic growth. In other words, it is the rate at which the economy is in balance, with stable prices and full employment. Therefore, when the real rate of interest is restrictive, we would expect GDP to slow.

In its recent Monetary Policy Report (MPR), the Bank is forecasting economic growth to average less than 1% over the next few quarters, while potential output growth is expected to average 2%, mainly due to population growth and increased labor productivity. This should lead to a negative output gap (low demand and a surplus of products) and lower inflation.

Persistent inflation leads the Bank of Canada to increase benchmark interest rate

UGH! The BoC whacks borrowers again.

Mark Herman, Top Calgary Alberta Mortgage Broker

Yesterday, the Bank of Canada increased its overnight interest rate to 5.00% (+0.25% from June) because of the “accumulation of evidence” that excess demand and elevated core inflation are both proving more persistent and after taking into account its “revised outlook for economic activity and inflation.”

This decision was not unexpected by analysts but is disconcerting – as is the Bank’s pledge to continue its policy of quantitative tightening.

To understand today’s decision and the Bank’s current thinking on inflation, interest rates and the economy, we highlight its latest observations below:

Inflation facts and outlook

- In Canada, Consumer Price Index (CPI) inflation eased to 3.4% in May, a “substantial and welcome drop from its peak of 8.1% last summer”

- While CPI inflation has come down largely as expected so far this year, the downward momentum has come more from lower energy prices, and less from an easing of “underlying inflation”

- With the large price increases of last year removed from the annual data, there will be less near-term “downward momentum” in CPI inflation

- Moreover, with three-month rates of core inflation running around 3.5% to 4% since last September, “underlying price pressures appear to be more persistent than anticipated”, an outcome that is reinforced by the Bank’s business surveys, which found businesses are “still increasing their prices more frequently than normal”

- Global inflation is easing, with lower energy prices and a decline in goods price inflation; however, robust demand and tight labour markets are causing persistent inflationary pressures in services

Canadian housing and economic performance

- Canada’s economy has been stronger than expected, with more momentum in demand

- Consumption growth was “surprisingly strong” at 5.8% in the first quarter

- While the Bank expects consumer spending to slow in response to the cumulative increase in interest rates, recent retail trade and other data suggest more persistent excess demand in the economy

- The housing market has seen some pickup

- New construction and real estate listings are lagging demand, which is adding pressure to prices

- In the labour market, there are signs of more availability of workers, but conditions remain tight, and wage growth has been around 4-5%

- Strong population growth from immigration is adding both demand and supply to the economy: newcomers are helping to ease the shortage of workers while also boosting consumer spending and adding to demand for housing

Global economic performance and outlook

- Economic growth has been stronger than expected, especially in the United States, where consumer and business spending has been “surprisingly” resilient

- After a surge in early 2023, China’s economic growth is softening, with slowing exports and ongoing weakness in its property sector

- Growth in the euro area is effectively stalled: while the service sector continues to grow, manufacturing is contracting

- Global financial conditions have tightened, with bond yields up in North America and Europe as major central banks signal further interest rate increases may be needed to combat inflation

- The Bank’s July Monetary Policy Report projects the global economy will grow by “around 2.8% this year and 2.4% in 2024, followed by 2.7% growth in 2025”

Summary and Outlook

As higher interest rates continue to work their way through the economy, the BoC expects economic growth to slow, averaging around 1% through the second half of 2023 and the first half of next year. This implies real GDP growth of 1.8% in 2023 and 1.2% in 2024. The Canadian economy will then move into “modest excess supply” early next year before growth picks up to 2.4% in 2025.

In its July Monetary Policy Report, the Bank noted that CPI inflation is forecast to “hover” around 3% for the next year before gradually declining to 2% in the middle of 2025. This is a slower return to target than was forecast in its January and April projections. As a result, the Bank’s Governing Council remains concerned that progress towards its 2% inflation target “could stall, jeopardizing the return to price stability.”

In terms of what Canadians can expect in the near term, the Bank had this to say: “Quantitative tightening is complementing the restrictive stance of monetary policy and normalizing the Bank’s balance sheet. Governing Council will continue to assess the dynamics of core inflation and the outlook for CPI inflation. In particular, we will be evaluating whether the evolution of excess demand, inflation expectations, wage growth and corporate pricing behaviour are consistent with achieving the 2% inflation target. The Bank remains resolute in its commitment to restoring price stability for Canadians.”

Stay tuned

September 6th, 2023 is the Bank’s next scheduled policy rate announcement. Will there be 1x more increase?