Using Return-To-Work Income while on Maternity Leave to buy a home IS possible in Canada.

Using Return-To-Work Income while on Maternity Leave to buy a home IS possible in Canada.

Are you on maternity leave and trying to buy a home, but the bank will not use your income? This is a common reason home buyers find us on the internet or their realtors send them to us.

We CAN use your FULL RETURN TO WORK SALARY as qualifying income, if you have a “return to work date” that is less than 12 months away from your home purchase possession date.

Big-6 banks do not do this and we have no idea why. It frustrates everyone, and broker lenders have no issue with it.

Mortgage Mark Herman, Top-Best Calgary mortgage broker near me.

And while we are it – our lenders also use CCB – Canadian Child tax Benefit – for all children aged UNDER 16, when the mortgage starts.

Big-6 banks don’t use this … not sure why that is.

What else about Broker Lenders?

Broker lenders are all secure, and many are publicly traded, and all are audited by the same staff the investigate all of the Big-6 banks.

Broker lenders also have payout penalties that are 500% to 800% LESS than the way Big-6 banks do it. Here are the links for that specific data on my blog:

- General explanation: http://markherman.ca/payout-penalties-how-the-big-5-banks-get-you/

- Details of all the lenders and their specific math: http://markherman.ca/fixed-rate-mortgage-penalties-larger-than-ever/

Broker lenders ALWAYS renew you are best rates, while Big-6 banks know that 86% of mortgages that renew will take the 1st offer so they “bump the rate” on you. Then you have to call in/ go in to chisel them down.

- At broker lenders, they expect you to call us to check the rates and we would jump at the chance to move you to a different lender and get paid again … so you get best rates with broker banks.

There is lots more to … call to find out.

Mortgage Mark Herman, licensed in Alberta since 2004.

403-681-4376

Details of Canadian Economic & Housing Market Performance, as at Dec 7, 2022

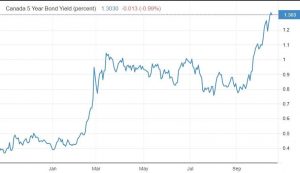

Bank of Canada increased Consumer Prime to 6.45% – exactly as expected for the last 5 months. January 25th is the next BoC interest rate announcement & I hope it is a 0.25% increase and then holds there for all of 2023. We will see…

Mortgage Mark Herman, Best Calgary mortgage broker with a Master’s degree in Finance.

Today, the Bank of Canada increased its overnight benchmark interest rate 50 basis point to 4.25% from 3.75% in October. This is the 7th time this year that the Bank has addressed inflation and means the policy rate is now as high as it has been in 15 years.

We summarize the Bank’s observations below, including its forward-looking comments on the need/likelihood of future rate increases below:

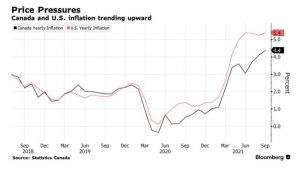

Canadian inflation

- CPI inflation remained at 6.9% in October, with many of the goods and services Canadians regularly buy showing large price increases

- Measures of core inflation “remain around 5%”

- Three-month rates of change in core inflation have come down, “an early indicator that price pressures may be losing momentum”

Canadian Economic and housing market performance

- GDP growth in the third quarter was stronger than expected, and the economy continued to operate “in excess demand”

- The labor market remains “tight” with unemployment near historic lows

- While commodity exports have been strong, there is growing evidence that tighter monetary policy is restraining domestic demand: consumption moderated in the third quarter

- Housing market activity continues to decline

- Data since the October Monetary Policy Report supports the Bank’s outlook that growth will essentially stall” through the end of this year and the first half of 2023

Global inflation and economic performance

- Inflation around the world remains high and broadly based

- Global economic growth is slowing, although it is proving more resilient than was expected at the time of the Bank’s October Monetary Policy Report

- In the United States, the economy is weakening but consumption continues to be solid and the labor market remains “overheated”

- The gradual easing of global supply bottlenecks continues, although further progress could be disrupted by geopolitical events

Outlook

Although the Bank’s commentary noted that price pressures that are driving high inflation may be losing momentum, it went on to say that inflation is “still too high” and that short-term “inflation expectations remain elevated.” In the Bank’s view, the longer that Canadian consumers and businesses expect inflation to be above the Bank’s 2% target, “the greater the risk that elevated inflation becomes entrenched.”

Given these economic signals, the Bank’s Governing Council stated that it “will be considering whether the policy interest rate needs to rise further to bring supply and demand back into balance and return inflation to target.”

It concluded its statement with a familiar refrain: “We are resolute in our commitment to achieving the 2% inflation target and restoring price stability for Canadians.”

Analysts and commentators will seek to interpret those outlook comments for signs that the Bank has reached or believes it is close to reaching the terminal point in its current rate-hike cycle. For now, that remains a question of debate and speculation that will turn on future economic signals.

Next Touchpoint

January 25th is the next BoC interest rate announcement. I hope it is a 0.25% increase and then holds there for all of 2023. We will see…

Nov 26 Analysis of Rate Increases by Dr. Sherry Cooper – Dominion Staff Economist

Our Staff Economist, Dr. Sherry Cooper, has this to say about the Details of the latest Rate Increase.

|

|

|

|

|

|

|

|

Canadian Prime Rate is now 5.95% – Mortgage Rate Analysis to End of 2022

Bank of Canada increased benchmark interest rate to 3.75%

Today, the Bank of Canada increased its overnight benchmark interest rate 50 basis point to 3.75% from 3.25% in September. This is the sixth time this year that the Bank has tightened money supply to quell inflation, so far with limited results.

Some economists had assumed the increase this time around would be higher, but the BoC decided differently based on its expert economic analysis. We summarize the Bank’s observations below, including its all-important outlook:

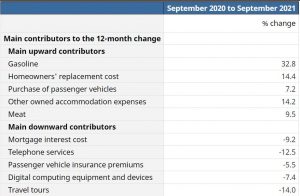

Inflation at home and abroad

- Inflation around the world remains high and broadly based reflecting the strength of the global recovery from the pandemic, a series of global supply disruptions, and elevated commodity prices

- Energy prices particularly have inflated due to Russia’s attack on Ukraine

- The strength of the US dollar is adding to inflationary pressures in many countries

- In Canada, two-thirds of Consumer Price Index (CPI) components increased more than 5% over the past year

- Near-term inflation expectations remain high, increasing the risk that elevated inflation becomes entrenched

Economic performance at home and abroad

- Tighter monetary policies aimed at controlling inflation are weighing on economic activity around the world

- In Canada, the economy continues to operate in excess demand and labour markets remain tight while Canadian demand for goods and services is “still running ahead of the economy’s ability to supply them,” putting upward pressure on domestic inflation

- Canadian businesses continue to report widespread labour shortages and, with the full reopening of the economy, strong demand has led to a sharp rise in the price of services

- Domestic economic growth is “expected to stall” through the end of this year and the first half of next year as the effects of higher interest rates spread through the economy

- The Bank projects GDP growth will slow from 3.25% this year to just under 1% next year and 2% in 2024

- In the United States, labour markets remain “very tight” even as restrictive financial conditions are slowing economic activity

- The Bank projects no growth in the US economy “through most of next year”

- In the euro area, the economy is forecast to contract in the quarters ahead, largely due to acute energy shortages

- China’s economy appears to have picked up after the recent round of pandemic lockdowns, “although ongoing challenges related to its property market will continue to weigh on growth”

- The Bank projects global economic growth will slow from 3% in 2022 to about 1.5% in 2023, and then pick back up to roughly 2.5% in 2024 – a slower pace than was projected in the Bank’s July Monetary Policy Report

Canadian housing market

- The effects of recent policy rate increases by the Bank are becoming evident in interest-sensitive areas of the economy including housing

- Housing activity has “retreated sharply,” and spending by households and businesses is softening

Outlook

The Bank noted that its “preferred measures of core inflation” are not yet showing “meaningful evidence that underlying price pressures are easing.” It did however offer the observation that CPI inflation is projected to move down to about 3% by the end of 2023, and then return to its 2% target by the end of 2024. This presumably would be achieved as “higher interest rates help re-balance demand and supply, price pressures from global supply chain disruptions fade and the past effects of higher commodity prices dissipate.”

As a consequence of elevated inflation and current inflation expectations, as well as ongoing demand pressures in the economy, the Bank’s Governing Council said to expect that “the policy interest rate will need to rise further.”

The level of such future rate increases will be influenced by the Bank’s assessments of “how tighter monetary policy is working to slow demand, how supply challenges are resolving, and how inflation and inflation expectations are responding.”

In case there was any doubt, the Bank also reiterated its “resolute commitment” to restore price stability for Canadians and said it will continue to take action as required to achieve its 2% inflation target.

NEXT RATE INCREASE

December 7, 2022 is the BoC’s next scheduled policy interest rate announcement. We will follow the Bank’s commentary and outlook closely and provide an executive summary here the same day.

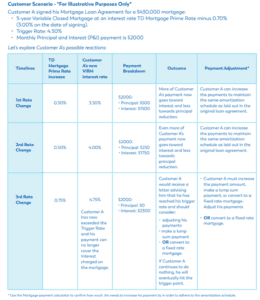

Trigger Point for Canadian Variable Rate Mortgages Explained, with Example

You have likely heard – or will soon be hearing – a lot of talk about “trigger rates” and “trigger points”. More importantly, you are probably hearing “trigger point” together along with more changes in the Bank of Canada rate and you need expert guidance.

Let’s start with a few definitions:

- Variable Rate Mortgage (VRM) – prime changes, rate changes. When interest rates change, typically, your mortgage payment will stay the same.

- Adjustable Rate Mortgage (ARM) – prime changes, rate changes. Unlike variable rate, your mortgage payment will change when interest rates change.

- Trigger Rate – When interest rates increase to the point that regular principal and interest payments no longer cover the interest charged, interest is deferred, and the principal balance (total cost) can increase until it hits the trigger point.

- Trigger Point – When the outstanding principal amount (including any deferred interest) exceeds the original principal amount. The lender will notify the customer and inform them of how much the principal amount exceeds the excess amount (Trigger Point). The client then typically has 30 days to make a lumpsum payment; increase the amount of the principal and interest payment; or convert to a fixed rate term.

NOW, WHICH MORTGAGES WILL BE AFFECTED FIRST?

Quick answer, VRMs from March 2020 to March 2022.

During the month of March 2020, the prime rate dropped three times in quick succession from 3.95% to 2.45%, and variable-rate mortgages arranged while prime was 2.45% have the lowest payments. The lower the interest rate was, the lower the trigger rate, and the faster your client may hit this negative amortization.

WHAT TO DO

When this happens, customers are contacted by the lender and generally have three ways they can proceed:

- Make a lump-sum payment against the loan amount

- Convert with a new loan at a fixed-rate term

- Increase their monthly payment amount to pay off their outstanding principal balance within their remaining original amortization period

Below is a customer scenario so you can see how this could play out.

WHY ARE DEBT SERVICING RATIOS IMPORTANT WHEN APPLYING FOR A MORTGAGE?

HOW ARE DEBT SERVICING RATIOS CALCULATED?

There are two ratios you need to worry about—gross debt servicing (GDS) and total debt servicing (TDS)

Gross debt servicing (GDS)

This is the maximum amount you can afford for shelter costs each month. It’s your monthly housing costs divided by your monthly income.

Total debt servicing (TDS)

This is the maximum amount you can afford for debt payments each month. It’s your monthly debt and housing costs divided by your monthly income.

If too much of your income is already going to housing costs and debt payments, according to your lender, you may not be able to afford to take on more debt.

WHAT DOES DEBT SERVICE RATIO MEAN AND WHY IS IT IMPORTANT?

Lenders use ratios to assess risk and understand if you will be able to make your payments on a mortgage. Generally, lenders like to see a GDS ratio around 32% and a TDS ratio that is no greater than 40%. If the ratios are higher, that does not mean you won’t qualify for a mortgage, but you may end up paying a higher interest rate.

In general, the better your debt servicing ratios and credit score, the lower your interest rate will be. This is because lenders view you as more reliable and it shows that you manage your money well and make your payments on time. Even if you need to refinance now, at a slightly higher rate, you can look at getting into a lower rate in a couple of years, when you mortgage term is up for renewal.

Your debt servicing ratio also lets you know how well you’re managing your budget. If your TDS ratio is over 44%, you are spending too much of your income on debt already and you may be unable to borrow without a co-signer. A co-signer’s credit history and income is factored in with yours. This gives the lender some reassurance that the payments will be made because the co-signer is as responsible for the mortgage as you are.

CALCULATING YOUR PERSONAL DEBT SERVICING RATIOS

Start by adding up your monthly debt payments. Include those fixed costs that you must pay every month:

| Housing costs | Debt costs |

● Rent or mortgage payments● Property taxes● Heat● 50% of condo fees |

● Loan payments, such as car, student, or personal loans● Credit cards (3% of the outstanding balance)● Outstanding bill payments not on a credit card (dental, medical, repairs)● Interest charges for line of credit payments● Spousal or child support payments |

Next add up your monthly income:

- Pay cheque (before taxes)

- Retirement or pension payments

- Benefits payments

- Spousal or child support

- Rental income

- Any other monthly income

Formulas:

Gross debt servicing ratio |

Total debt servicing ratio |

Housing Cost———————— x 100 Total income |

Housing Costs + Debt Costs————————————- x 100 Total income |

Examples:

Your income (before taxes) is $6,500 per month. You have a monthly mortgage payment of $1,400, property taxes of $ $300, and $ $100 for heat. Your GDS ratio is calculated as $1,800/$6,500 x 100 = 27.69%

Your income (before taxes) is $6,500 per month. You spend $300 for your car payment. You have $2,500 in credit card debt, and 3% of the outstanding balance is $75 for a total of $375 per month. Your TDS ratio is calculated as $2,175÷ $6,500 x 100 = 33.46%.

To learn more about specific mortgage approval ratios, check out this handy article.

Note: If you have a two-income household, include the debt payments and income for both of you. This is important because you have more income between you, and you share the cost for some of the debt.

TIPS FOR LOWERING YOUR DEBT SERVICING RATIOS

There are two basic ways to improve your debt servicing ratios—increase your income or reduce your debt.

Increasing your income is not always possible, although it could include a raise at work, finding a new job with better pay, or taking a second job. If you do find yourself with a little extra cash—maybe you received a year-end bonus—consider using it to pay down your debt.

Paying down your debt and not adding to it is the best way to improve your debt servicing ratio. Here are a few ideas to get you started:

- Avoid making new purchases, especially if you need to use your credit card to make the purchase.

- Create a budget and see where you can cut expenses. Apply those savings to your debt.

- Call your credit card company and try renegotiating a lower interest rate. With a lower rate, more of your payment will be applied to what you owe

- If you have money sitting in an account that is not earning much interest, consider applying it toward your debt, which tends to have a higher interest rate.

- Explore options to refinance equity from your home to pay off debt (work with your mortgage broker to form a plan).

DEBT SERVICING RATIOS AND YOUR CREDIT SCORE

Your debt servicing ratios do not directly affect your credit score but carrying a large amount of debt can negatively affect both. And lenders will look at both when assessing your mortgage application. The good news is that reducing your debt improves your credit score as well as your debt servicing ratios. Work with your mortgage broker to create a plan on how you will reduce your debt and improve your ratios. This informative credit video may be useful, straight from a seasoned underwriter.

Your debt servicing ratios give lenders information about your ability to repay the money you borrowed while your credit score provides information about the way you manage credit. Do you make payments on time? Do you have a history of borrowing and repaying money?

Now that you know how a lender is going to assess your mortgage application, you can take the necessary steps to lower your debt servicing ratios and get that mortgage approved!

Mortgage Mark Herman, Top Calgary Alberta mortgage broker

Canadian Economic Data Points Affecting Mortgages

Below are the Bank of Canada’s updated comments on the state of the economy, the Bank and singled out the unprovoked invasion of Ukraine by Russia as a “major new source of uncertainty” that will add to inflation “around the world,” and have negative impacts on confidence that could weigh on global growth.

These are the other highlights.

Canadian economy and the housing market

- Economic growth in Canada was very strong in the fourth quarter of 2021 at 6.7%, which is stronger than the Bank’s previous projection and confirms its view that economic slack has been absorbed

- Both exports and imports have picked up, consistent with solid global demand

- In January 2022, the recovery in Canada’s labour market suffered a setback due to the Omicron variant, with temporary layoffs in service sectors and elevated employee absenteeism, however, the rebound from Omicron now appears to be “well in train”

- Household spending is proving resilient and should strengthen further with the lifting of public health restrictions

- Housing market activity is “more elevated,” adding further pressure to house prices

- First-quarter 2022 growth is “now looking more solid” than previously projected

Canadian inflation and the impact of the invasion of Ukraine

- CPI inflation is currently at 5.1%, as the BoC expected in January, and remains well above the Bank’s target range

- Price increases have become “more pervasive,” and measures of core inflation have all risen

- Poor harvests and higher transportation costs have pushed up food prices

- The invasion of Ukraine is putting further upward pressure on prices for both energy and food-related commodities

- Inflation is now expected to be higher in the near term than projected in January

- Persistently elevated inflation is increasing the risk that longer-run inflation expectations could drift upwards

- The Bank will use its monetary policy tools to return inflation to the 2% target and “keep inflation expectations well-anchored”

Global economy

- Global economic data has come in broadly in line with projections in the Bank’s January Monetary Policy Report

- Economies are emerging from the impact of the Omicron variant of COVID-19 more quickly than expected, although the virus continues to circulate and the possibility of new variants remains a concern

- Demand is robust, particularly in the United States

- Global supply bottlenecks remain challenging, “although there are indications that some constraints have eased”

Looking ahead

As the economy continues to expand and inflation pressures remain elevated, the Bank’s Governing Council made a clear point of telling Canadians to expect interest rates to rise further.

More on Food Security – Interesting data points on the War in Ukraine

Prices for food commodities like grains and vegetable oils reached their highest levels ever last month largely because of Russia’s war in Ukraine and the “massive supply disruptions” it is causing, threatening millions of people in Africa, the Middle East elsewhere with hunger and malnourishment, the United Nations said Friday.

The UN Food and Agriculture Organization said its Food Price Index, which tracks monthly changes in international prices for a basket of commodities, averaged 159.3 points last month, up 12.6% from February. As it is, the February index was the highest level since its inception in 1990.

FAO said the war in Ukraine was largely responsible for the 17.1% rise in the price of grains, including wheat and others like oats, barley and corn. Together, Russia and Ukraine account for around 30% and 20% of global wheat and corn exports, respectively.

While predictable given February’s steep rise, “this is really remarkable,” said Josef Schmidhuber, deputy director of FAO’s markets and trade division. “Clearly, these very high prices for food require urgent action.”

The biggest price increases were for vegetable oils: that price index rose 23.2%, driven by higher quotations for sunflower seed oil that is used for cooking. Ukraine is the world’s leading exporter of sunflower oil, and Russia is No. 2.

List of Data Needed for Lo/No Condition Offers

Documents needed for Low/ No Condition Offers are below.

For Employees:

Employment Data

- Employment letter ** – order from payroll or HR

- 2 x recent pay slips

Tax Data

- Last 2 years of your NOAs – Notice of Assessments – you get them back after you pay your federal income taxes

- Last 2 years T4’s – to verify continued employment in your industry

Confirmation of down payment

90 days of detailed account history is needed – by way of:

- 3 months of on-line bank statements (print-out to PDF and email is perfect) showing funds on deposit AND / OR

- For RRSP/ TFSA funds: 3 x monthly account statements OR at least 2 statements, 3 months apart OR a year-end summary and recent statement.

- If your name is not on the statements please print the “welcome page” that should show your name AND last few digits of the account numbers so they can be cross referenced.

** Employment letter – A letter of employment is needed that includes the following:

- Addressed to: Whom It May Concern:

- Position,

- Length of time with employer,

- Status: either Fulltime or Part-time; “with XX hours per month guaranteed,”

- Salary: Annual base salary, hourly pay,

- Any applicable bonuses,

- Contact information for the author of the employment letter – many lenders will call to verify information,

- Letter to be on company letterhead,

- Letter to be signed by writer.

For SELF-EMPLOYED

Tax Data

- Last 2 years of your NOAs – Notice of Assessments – you get them back after you pay your PERSONAL income taxes

- Last 2 years T4’s – if you T4 yourself, if you don’t T4 yourself you will not have these.

Your accountant may have these and can usually forward them to us in PDF if you ask them too:

- Last 2 years of T1 Generals – a copy of the actual PERSONAL tax return that was sent to RevCan

- Specifically with the “schedule of business of activities”

If you are incorporated, also add:

- Articles of Incorporation

- Last 2 years of financials – balance sheet, cash flow, income statment, with Notes to Readers.

Confirmation of down payment – by way of:

- 3 months of on-line bank statements (print-out to PDF and email is perfect) showing funds on deposit AND / OR

- For RRSP/ TFSA funds, at least 2 statements, 3 months apart showing funds on deposit in your name on the print outs.

- If your name is not on the statements please print the “welcome page” that should show your name AND last few digits of the account numbers so they can be cross referenced.

- All the funds in both your personal and business bank accounts count as your own funds – for mortgage math – so you don’t have to move money between accounts when we are qualifying you. We can discuss this in more detail.

What Are the Risks Of Unconditional Offers When Buying A Home?

The process of buying a home and completing a real estate transaction typically centers on the offer. After finding the home you want to buy, you’ll need to submit an offer, which the seller will review before signing off on it.

But in addition to the typical clauses that are included in an offer, buyers have the option to insert “conditions” to the offer. Without these conditions, the offer will be deemed “unconditional,” and in this case, the contract will be legally binding for both parties.

There are some inherent risks with unconditional offers that buyers should be aware of. Let’s review what unconditional offers are, and how they may leave you vulnerable in some cases.

SUMMARY:

- We recommend “no condition offers” if you have the cash to buy as “Plan B.”

- We do recommend the Financing Conditions to be at least:

- “subject to lender approval of appraisal value and lender approval of property standards” and

- if less than 20% down, subject to CMHC/default insurer acceptance.

Why?

-

-

- Any of these could stop a mortgage at a specific lender: preserved wood foundations, near a busy commercial location, too near flood zone or flood fringe for the lender, aluminum wiring, Poly B plumbing, condo docs not accepted -if condo.

-

Common House Offer Conditions

There are dozens of examples of conditions that buyers can insert into their offers, but many are not often used. That said, there are certain conditions that are very commonly added to offers, including the following:

Financing Condition

Most home purchases require some form of financing to help buyers come up with the money to buy a home. But getting a mortgage requires an application and approval process. Before buyers seal the deal on a contract, they should ensure that they are able to secure a mortgage to finance the purchase.

Financing conditions are among the more common ones inserted into offers and give buyers and their mortgage lenders some time to work through the mortgage process. If they cannot get approved for financing, the buyer will be able to back out of the deal.

Home Inspection Condition

A home inspection is another common condition, which provides the buyer with a certain amount of time to have the subject property inspected by a professional home inspector. If there are any major issues that are discovered, the buyer can address them with the seller. Otherwise, the buyer can back out of the deal if they find the home inspection report unsatisfactory.

Condo Doc Review of Condo Corp. Financial Statements

In the case of a condo purchase, a review of the condo corporation’s Status Certificate is very important. The Status Certificate will detail the financial and legal health of the condo corporation.

The buyer’s lawyer will review the Status Certificate and look for any potential red flags. And if there are any, the buyer will have the opportunity to kill the deal before the condition expires if they so choose.

Sale Of Another Property

In some cases, buyers may want to make the purchase of a home conditional upon the sale of their own current home. This is more commonly seen in buyer’s markets where there is a lot of supply and not as much demand. In this case, it may take buyers a little longer to sell their homes.

Buyers who insert these conditions in their offers want to make sure that they are able to find a buyer of their own and not get stuck with two homes and two mortgages.

That said, many sellers don’t like to see these types of conditions, as it can put them at risk of the deal falling through. The time spent waiting for this condition to be filled could have been spent entertaining other potential offers that many have otherwise come through.

What Is An Unconditional Offer?

An unconditional offer is one that does not come with any conditions. There are no additional checks to be made aside from the clauses that already come with a purchase of sale agreement. Once the contract is signed off by both parties — and before the expiry date — the deal is firm and neither the buyer nor the seller can back out.

Benefits Of An Unconditional Offer

While it’s generally advised that buyers insert conditions such as a home inspection, financing, or Status Certificate review, in some cases it may be a good idea to make a “clean” offer, or one that is void of conditions. For instance, in the case of a bidding war where there are multiple buyers bidding for the same house at the same time, all buyers will want to go in with their best foot forward.

This might mean putting in an unconditional offer. These offers are more attractive to sellers because there is no waiting game that needs to take place to fulfill conditions. In some cases, sellers may even favour an unconditional offer with a slightly lower offer price than an offer with a higher offer price that has a couple of conditions that would need to be dealt with.

Risks Of Unconditional Offers

As you might imagine, there are some risks that come with unconditional offers. You’ll be left unprotected if you sign off on the contract with no opportunity to ensure all your bases are covered.

Here are a few of the risks associated with a condition-free offer:

Your Bank May Not Approve Financing

If you are unable to secure financing, you’ll be stuck with a massive financial obligation to pay for a home you do not have the money for. If you do not insert a financing condition, you won’t have the chance to make certain that you can get approved for a mortgage needed to finance the purchase.

You’ll Have to Cover Any Shortfalls in Down Payment

In the case of a bidding war, you may offer a price that’s higher than the market value of the subject property. When the property is appraised, the mortgage lender will discover that the home is not worth as much as you agreed to pay for it. As such, the lender may not approve the initial loan amount you requested.

In this case, you’ll need to bump up your down payment amount in order to make up for the difference. If your offer was not subject to a financing condition and you are not able to cover the shortfall in the extra down payment, you could risk losing your deposit and even be sued for damages.

You Could Get Stuck With A Faulty Home

If you neglect to give yourself some time to scope out the property with a professional by your side, you could inadvertently buy a “money pit” that will require a ton of money to repair.

During your initial visit to the home before you put in an offer, you may not have noticed any issues. A home inspection will give you a few hours with a home inspector to check out if there are any major problems with the home before you commit to buying it. If any are discovered, you’ll have the chance to either renegotiate a lower price with the seller, ask the seller to make the repairs, request a credit so you can make the repairs yourself, or back out of the deal altogether. But without a home inspection condition, you’ll be stuck with the house regardless.

You Could Get Stuck With A Condo That’s In Disarray

Some condo corporations may have legal issues and be in the midst of lawsuits, have reserve funds that are not enough to cover the cost of major repairs that can arise in the near future, or be poorly run. You don’t want to get stuck with a condo corporation that is mismanaged, but this is exactly what can happen if you don’t insert a Status Certificate review condition.

Mortgage Rates Up Due to Inflation

|

|

|

|

|

|

|

|