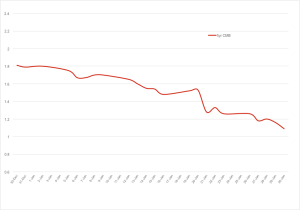

1 Graph Shows Why Mortgage Rates Are Lower in Jan 2015

The graph below shows why rates have found what we think is a short term low. This will not last forever so be sdure to get a rate hold now!

30 day Canadian Mortgage Bond (CMB) trend – below

Graph Summary

The banks get their money for mortgages from the CMB … this is a short term oddity right now. This trend will change soon and is from:

- the quick drop in oil prices

- the surprise rate cut from the Bank of Canada on Prime

- and other world economic activity.

Market Summary

The Bank of Canada has certainly shaken things up with its surprise 0.25 bps rate cut. Even more so because Governor Stephen Poloz has left the door open for a further cut.

Poloz explained that the BoC trimmed its rate as “insurance” for the broader economy in light of the fallout from falling oil prices. He went on to say the Bank was prepared to take out more insurance.

Concerns about unemployment, slowing economic growth and deflation have obviously trumped past worries about record high household debt-to-income ratios.

However, it is not a sure bet that the lower central bank rate will inflate the Canadian real estate bubble. Canadians have established a history of using lower rates to pay down debt, rather than adding to it.

All this from Calgary’s top mortgage broker, Mark Herman

Interest rate predictions are tough

I found this in a retirment planning post ….

Every year since 2009, experts have predicted that “rates have nowhere to go but up,” only to be confronted with what seems to be perpetually low rates.

Most pundits predict rates will finally start to rise again in mid 2015, but the recent surprise rate cut by the Bank of Canada (from 1% to 0.75%) suggests how futile trying to predict the timing of such a change can be.

Central banks’ zero interest rate policies have resulted in “real” (net of inflation) returns of zero or even less-than-zero after income tax, except for outliers like Russia.

In December, Switzerland even began charging savers for the right to deposit funds!

This post from 2013

http://blog.markherman.ca/2013/07/11/how-low-are-interest-rates-really-here-is-the-big-picture/

Now for the big picture…

Short version: rates are the lowest of all time … like a 496 year low. Is that low enough?

“in July 2012, 10-year yields in the US thus reached with 1.39% the lowest level since the beginning of records in the year 1790.

In the Netherlands – which provide the longest available time series for bond prices – interest rates fell to a 496 year low.

In the UK, ‘base rates’ are currently at the lowest level since the founding of the Bank of England in 1694.

In numerous countries (Germany, Switzerland), short term interest rates even fell into negative territory.”

Mark Herman, Mortgage Alliance, Top Calgary Alberta Mortgage Broker, and #1 mortgage brokerage in Canada for 2013 AND 2014!!!

Wisdom from Kevin O’Leary, interst rates increases and housing demand

Kevin O’Leary – AKA Mr. Wonderful and self-proclaimed star of Dragon’s Den and Shark Tank – was speaking at our real estate conference yesterday. Surprisingly, he also used to be a professor at Ryerson’s School of Business so he does know more about what he is talking about then you would expect he does.

The short version of his talk – which was way better than expected.

The good news is hiding

- Corporate earnings for the last ¼ of 2014 are being reported this week and they are all good or great, coming off of one of their best years ever! Companies have increased sales and have lots of cash; unless you are an oil company.

- Overall the S&P should be up 7% for 2015 – with lots of volatility – so hold on tight.

Housing

- Even if demand reduces due to less people buying because of the drop in oil prices OR from an increase in interest rates, pricing should stay stable. Alberta will still have in-bound migration and those people still need places to live.

- Demand should stay stable as long as any interest rate increases are less than 1.2% from today’s rates. That is not expected to happen for another 2 – 3 years.

- Big banks are buying solid real estate and less bonds now. An example is a billion dollar building in New York selling at a cap rate of about 1%. That means that the return on the investment is expected to about 1% on a billion dollars. This is much lower than almost any bond and shows the reasoning that real estate is a great investment in today’s changing markets.

Interest Rates

- Today the US 30-year bond fell to a record low, surpassing the previous record low of set in July, 2012.

- The US 10-year bond is almost at record lows as well.

- The problems in the market are not real estate but for long term bonds – like the 30-year bond above – lost about 30% of its expected return.

- 6 of the big banks expectations are for interest rates to begin to rise in October by about 1/4% – the same as what the Bank of Canada said 2 months ago. See previous Blog post from October 22 here: http://blog.markherman.ca/2014/10/22/1138/

- The interest rate increase prediction was before oil fell so interest rates may not increase and stay the same for longer than expected above.

BONUS – 3 Keys to Business Success on the Dragon’s Den

He also shared a few studies on the companies in the Dragon’s Den. They all showed all the companies that boomed all had this in common:

- Their business model could be fully explained in 90 seconds or less

- The owners were able to explain why they were the ones to be able to execute the business model better than anyone else and

- They knew the numbers to their business cold – pricing, costs, revenue, economics, IRR, etc.

All this from the top Calgary, Alberta mortgage broker, Mark Herman at Mortgage Alliance.

Oil Price & Mortgage Interest Rates

This is an easy way to see the relationship between oil prices and mortgage interest rates.

Mark Herman, Top Calgary Alberta mortgage broker.

The path between the price of oil and the cost of your mortgage may seem long and winding and hard to follow, but it does exist.

Oil is a major component of Canada’s economy. Energy accounts for about 25% of Canadian exports and oil is a significant part of that. Oil is now selling for about half what it was just a few months ago.

Lower oil prices mean less royalty money for governments. Low oil also means the main driver of employment in Canada – the Alberta oil patch – is likely to slow as well as energy firms cut back operations. Employment is one of the key indicators the Bank of Canada watches when determining interest rate policy.

Falling oil prices are likely to have an, overall, negative effect on Canada?s economy, exerting downward pressure on the Bank of Canada rate, and therefore variable mortgage rates. The impact on GDP and employment will likely hold down government bond yields and, in turn, fixed mortgage costs.

What the B of C says about housing prices …

The Bank of Canada (BoC) and the Economist say that Canadian housing is over valued 10% – 20%

Just days after the BoC’s highly qualified pronouncements Moody’s Analytics – an organization that some people find less than credible than the BoC – said maybe current prices can be justified by ‘structural changes’ in the market.

Here’s the constant:

- The central bank continues to caution that high household debt to income ratios are the biggest domestic threat to the Canadian economy.

- The Bank also says that the danger of that risk becoming reality, due to a jump in interest rates or a sharp downturn in the economy, is low!

That is good news says Mark Herman, Calgary Alberta mortgage broker.

Retail Sales: Alberta spends the most

“More support of Calgary and Alberta home prices; the high-value jobs in Calgary pay more and the 40,000 people a year that move to Alberta are spending that money. The numbers are mind blowing.”

Mark Herman; Calgary, Alberta mortgage broker

Jonathan Muma Nov 25, 2014 10:25:24 AM

Albertans love to shop.

That’s according to the latest report from Statistics Canada which shows retail sales are up $6.7-billion, or 7.4 % from a year ago through the first nine months of this year.

That’s the highest annual growth rate in the country.

The next closest province is British Columbia at 5.3 %, and Canada overall, retail sales grew to $42.8-billion, up 4.5% from a year ago.

http://www.660news.com/2014/11/25/alberta-leads-the-way-as-canadian-retail-sales-soar/

YYZ & YVR homes: more expensive than Rome, closing in on Paris!

This is some interesting data on the housing market in Vancouver and Toronto from one of the banks we deal with.

Mark Herman; Calgary, Alberta mortgage broker

—

Canadian home prices really are “world class”, at least in the country’s two hottest markets.

A survey shows the price for prime residential property Toronto and Vancouver has surpassed Rome and is closing in on Paris. Vancouver is at nearly $1,400 a square foot and Toronto is a little above $1,200. (Top spot is London at more than $3,600/sq. ft.)

The survey says growing foreign investment as a key reason for the rising prices because international investors consider Canadian real estate as a safe haven.

That’s backed up by high-profile Canadian economist Sal Gautieri. He also points to domestic factors: population growth in Toronto and Vancouver (and Calgary) has outpaced the national average by about 2 to 1 over the past decade; economic prospects remain good in both cities; and low financing continues to be a key factor in pricey markets.

Interest rates expected to go up October 2015 says Bank of Canada

The Bank of Canada has updated when they plan to increase rates again … about a year from now – so next October? Expect rates to go up 1% then.

Mark Herman, top Calgary, Alberta mortgage broker

The central bank further pushed back the time frame for when it reckoned the economy would reach full capacity, to the second half of 2016 from the mid-2016 estimate in July. It also delayed by one quarter to the fourth quarter of 2016 the time when it expects total and core inflation to settle at its 2 percent target.

Here is the link: http://ca.reuters.com/article/businessNews/idCAKCN0IB1NY20141022

Worried about oil prices and the Calgary housing prices?

Have a look at this TD report about the price of oil and the Canadian economy.

Highlight: TD expects the Bank of Canada to keep rates the same until mid-2015.

Link to the TD report, outlining the various outcomes of the recent fall in the price of oil.

Calgary – 5th BEST place to live in the world! – the Economist

This is why Calgary housing prices are supported by about 20,000 new arrivals a year. The in-migration will continue for a while yet … and that will support housing prices.

Three Canadian cities — Vancouver, Toronto and Calgary — have been named as some of the best places to live in the world, according to a report by The Economist.

In the annual poll ranked Vancouver as 3rd most livable city in the world; followed by Toronto at No. 4, and Calgary tied for fifth place with Adelaide, Australia.

… The Economist ranks the cities on 30 factors across various categories, including stability, health care, culture, environment, education and infrastructure.

the article is here: http://www.thestar.com/business/2014/08/19/melbourne_wins_tops_most_liveable_city_ranking_three_canadian_cities_in_top_10_list.html