Prime to be at 4% by 2012

BoC rate to reach two per cent by year end: RBC

By | 11/03/2011 2:00:00 PM | 0 comments

As part of its economic outlook for 2011, RBC projects that the Bank of Canada overnight rate will rise from one per cent to two per cent by year-end.

The gradual pace of rate increases combined with anchored inflation expectations will result in less upward pressure on long-term interest rates, added the Economic Outlook released by RBC Economics.

On the back of solid net exports in the final quarter of 2010, Canada’s economy finished the year on a high note recording stronger than expected gains. The biggest support for the economy came from net exports, which added a full 4.5 percentage points to the quarterly growth rate. Continued consumer spending also played a vital role in driving overall GDP, marking the fastest increase in spending since late 2007.

RBC expects real GDP to increase at 3.2 per cent in 2011, as U.S. demand for Canadian exports increases. Growth in 2012 is forecast to rise by 3.1 per cent.

The report also stated labour market conditions will remain firm in 2011and disposable income is expected to post a 4.1 per cent gain that will provide continued support to consumer spending.

“Consumers’ earlier confidence in taking on increasing amounts of debt was based on a combination of lower interest rates, a strengthening labour market and a 4.6 per cent rise in disposable income,” explained Craig Wright, senior vice-president and chief economist, RBC Wright. “An expected slowing in the housing market, rising interest rates and tightening mortgage lending standards all add up to a levelling out in consumer debt relative to income.”

At the provincial level, RBC forecasts Saskatchewan will lead the country in growth this year. Alberta is expected to return to a top three placing, closely trailing growth in Newfoundland and Labrador. Ontario and Manitoba will hover close to the national average while both Quebec and British Columbia will fall slightly below. Nova Scotia, New Brunswick and Prince Edward Island are still projected to lag behind at the lower end of the scale for 2011.

ALBERTA HOUSING MARKET MOST AFFORDABLE IN CANADA: RBC ECONOMICS

TORONTO, Feb. 24 /CNW/ – Alberta’s housing market officially became the most affordable in Canada in the fourth quarter of 2010, according to the latest Housing Trends and Affordability report released today by RBC.

Thanks to lower mortgage rates and further softening in home prices, RBC’s Affordability Measures for Alberta fell yet again in the fourth quarter, by 1.0 to 2.4 percentage points, extending their long strings of declines since late 2007.

“Alberta saw a notable downswing in demand for housing last spring and early summer, giving buyers the upper hand and pushing prices down,” said Robert Hogue, senior economist, RBC. “Alberta’s reign as the most affordable housing market may be short lived, however. Demand has shown more vigour in recent months, alongside a provincial economy that is gaining more traction, and Alberta’s market has become better balanced. We expect that this will stem price declines this year and erase a potential offset to the negative effect of a projected rise in interest rates on affordability.”

The RBC Housing Affordability Measures for Alberta, which capture the province’s proportion of pre-tax household income needed to service the costs of owning a home, eased across all housing categories in the fourth quarter. The measure for the benchmark detached bungalow moved down to 30.9 per cent (a drop of 2.4 percentage points from the previous quarter), the standard condominium to 20.3 per cent (down 1.0 percentage points) and the standard two-storey home to 34.4 per cent (down 2.2 percentage points).

The RBC report notes that gradual and steady improvements in Calgary’s housing demand have recently started to bolster market conditions as home resales increased appreciably since June which helped trim down the slack that kept buyers in the driver’s seat.

A return to more balanced market conditions in Calgary, however, did not succeed in reversing the tide in the fourth quarter of 2010 as home prices continued to weaken for the most part in the fourth quarter. Nonetheless, this contributed to further material improvement in affordability. The RBC Measures for Calgary again fell the most among Canada’s largest urban markets, declining by 0.9 to 3.1 percentage points.

“Affordability in the Calgary area is now the best in almost six years and this attractive level of affordability will support further increases in demand as the local economy picks up steam in the year ahead,” added Hogue.

Elsewhere in the country, a majority of provinces saw improvements in affordability in the fourth quarter. Only the standard two-storey benchmark became less affordable in Ontario and Quebec, as did the standard condominium apartment in Quebec and the Atlantic region.

The RBC Housing Affordability Measure, which has been compiled since 1985, is based on the costs of owning a detached bungalow, a reasonable property benchmark for the housing market in Canada. Alternative housing types are also presented including a standard two-storey home and a standard condominium. The higher the reading, the more costly it is to afford a home. For example, an affordability reading of 50 per cent means that homeownership costs, including mortgage payments, utilities and property taxes, take up 50 per cent of a typical household’s monthly pre-tax income.

CANADIAN HOMEOWNERSHIP COSTS EASE FOR SECOND CONSECUTIVE QUARTER: RBC ECONOMICS

This is great news.

TORONTO, Feb. 24 /CNW/ – Canada’s housing affordability continued to improve in the fourth quarter of 2010, thanks in part to slight decreases in five-year fixed mortgage rates and minimal home price appreciation across the country, according to the latest Housing Trends and Affordability report released today by RBC Economics Research.

“Some of the stress that had been building in the housing market between 2009 and the first half of 2010 has been relieved, but tensions persist overall and the recent improvement in affordability is likely to be short-lived,” said Robert Hogue, senior economist, RBC. “We expect that the Bank of Canada will resume its rate hike campaign this spring and with borrowing costs set to climb further in the next two years, housing affordability will erode across the country. That said, we don’t expect this to derail the housing market because of rising household income and job creation from the sustained economic recovery.”

The RBC Housing Affordability Measure captures the proportion of pre-tax household income needed to service the costs of owning a specified category of home. During the fourth quarter of 2010, measures at the national level fell between 0.4 and 0.8 percentage points across the housing types tracked by RBC (a decrease represents an improvement in affordability).

The detached bungalow benchmark measure eased by 0.8 of a percentage point to 39.9 per cent, the standard condominium measure declined by 0.4 of a percentage point to 27.6 per cent and the standard two-storey home decreased 0.4 percentage points to 46.0 per cent.

“We expect affordability measures will rise gradually in the next three years or so while monetary policy is readjusted, but will land softly thereafter once interest rates stabilize at higher levels,” added Hogue. “This pattern would be consistent with moderate yet sustained stress on Canada’s housing market. Overall, the era of rapid home price appreciation of the past 10 years has likely run its course and we believe that Canada has entered a period of very modest increases.”

A majority of provinces saw improvements in affordability in the fourth quarter, most notably in Alberta where falling home prices once again contributed to lower the bar for affording a home. Only the standard two-storey benchmark became less affordable in Ontario and Quebec, as did the standard condominium apartment in Quebec and the Atlantic region.

RBC’s Housing Affordability Measure for a detached bungalow in Canada’s largest cities is as follows: Vancouver 68.7 per cent (down 0.4 percentage points from the last quarter), Toronto 46.8 per cent (down 0.5 percentage points), Montreal 41.3 per cent (down 0.4 percentage points), Ottawa 38.7 per cent (up 0.5 percentage points), Calgary 34.9 per cent (down 3.1 percentage points) and Edmonton 31.0 per cent (down 2.4 percentage points).

The RBC Housing Affordability Measure, which has been compiled since 1985, is based on the costs of owning a detached bungalow, a reasonable property benchmark for the housing market in Canada. Alternative housing types are also presented including a standard two-storey home and a standard condominium. The higher the reading, the more costly it is to afford a home. For example, an affordability reading of 50 per cent means that homeownership costs, including mortgage payments, utilities and property taxes, take up 50 per cent of a typical household’s monthly pre-tax income.

Highlights from across Canada:

- British Columbia: Buying a home in B.C. became slightly more affordable in the fourth quarter of 2010, due primarily to a small drop in mortgage rates. After experiencing some declines in the previous quarter, home prices rose modestly for most housing categories; condominium apartments bucked the trend, however, and depreciated slightly. Prices were supported by a tightening in market conditions with home resales picking up smartly following substantial cooling in the spring and summer that saw sellers lose their edge in setting property values. Demand and supply in the province are judged to be quite balanced at this point. RBC’s Affordability Measures fell between 0.8 and 1.0 percentage points in the fourth quarter which came on the heels of much more substantial drops (1.7 to 4.8 percentage points) in the third quarter. Notwithstanding these declines, affordability remains poor and will weigh on housing demand going forward.

- Alberta: Alberta officially became the most affordable provincial market in the country in the fourth quarter, according to the RBC Measures which fell once again by 1.0 to 2.4 percentage points, extending their declines since late-2007. In addition to the lower mortgage rates, the further depreciation of home prices contributed to lowering homeownership costs. Property values were negatively affected by a substantial downswing in demand in the spring and early summer, which put buyers in the drivers’ seat. The significant improvement in affordability is near the end of its line, however, as demand has shown more vigour in recent months – alongside a provincial economy that is gaining more traction – and the market has become better balanced. RBC expects that this will stem price declines this year, thereby removing a potential offset to the negative effect of projected rise in interest rates on affordability.

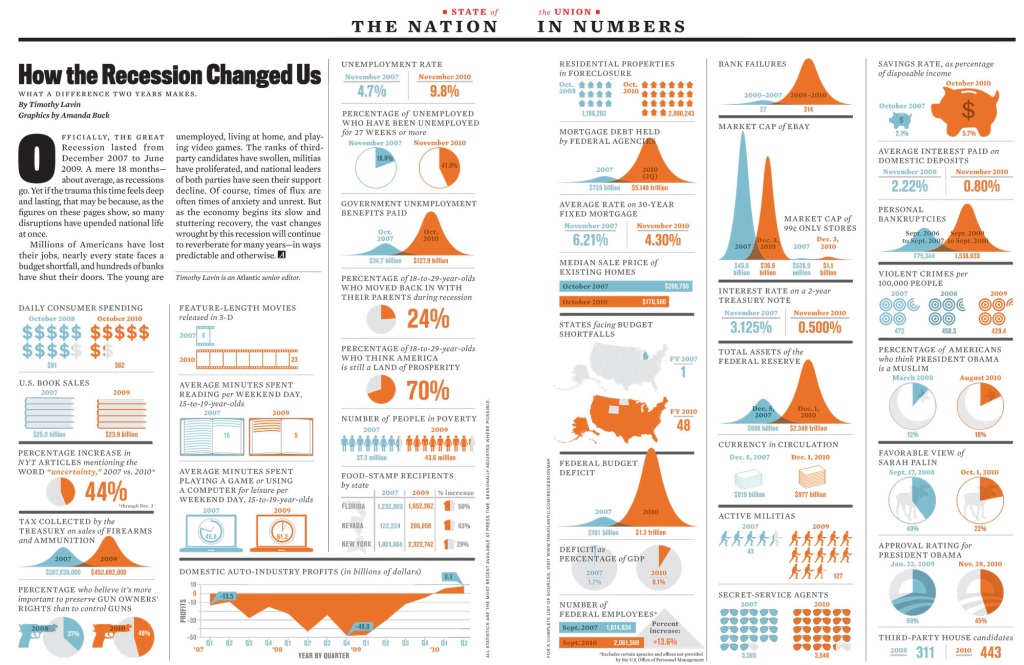

How the recession changed us

Below is a very cool graph on how the worst recession of our life times has changed the American life-style. Click on it to make it nice and big.

ORES Real Estate Index For January 2011

COMMENT: This is a very cool index I found that compares most investments to real estate. It is interesting right now as gold is at an all time high, oil is back up and Canadian real estate has held most of its value and is coming back.

- Wednesday, 16 February 2011 10:09

- Brian Madigan LL.B.

Here is the “ORES REAL ESTATE INDEX” which tracks the average resale prices of single family homes and condominiums in the Greater Toronto Area (GTA). It also tracks certain benchmark comparisons such as the price of oil and gold, as well as the Consumer Price Index.

In addition, the stock market indices for Toronto, and the three largest US markets are also compared.

For ease of comparison, everything we look at is worth 100 points on the Index as of 1 January 2005. That time period compares favourably with the five year average used as a standard benchmark comparison in the mutual fund industry.

As of 31 January 2011, here is the Index representing average prices:

Real Estate

132.15…..GTA single family homes

130.87…..All condos in GTA

139.34…..Downtown Central Condos

122.53…..East condos

131.35…..West condos

124.97…..North condos

Other market comparisons

310.23…..gold (price per ounce)

206.98…..oil (price per barrel)

147.24…..TSX index

132.15…..ORES Index single family homes

111.59 …..CPI index

130.92…..NASDAQ index

113.37……Dow Jones index

108.88……S&P Index

Using the Index

Just a quick note on reading the information. Have a look at the ORES Index for Real Estate (single family homes). As of the end of January, the index stood at 132.15. That’s a 32.15% increase in 73 months. That means the increase is 0.404% monthly, or it could also be expressed as 5.28% annually. The performance here is shown without annual compounding for the sake of simplicity.

The other statistics are reported in a similar fashion for the ease of comparison.

Observations (on the Index)

As we use index, there are several notable comments:

• Commodity prices are just commodity prices

• There is no other “extra return” for commodities

• The same is true for the CPI

• The CPI is a benchmark to see whether you are keeping pace with inflation, that number is 111.59 (It has been modest and appears under control)

• For a realistic performance goal, you should aim for CPI plus 3.5% annually

• Stocks provide dividends in cash or extra stock. This return is additional to that shown in the stock market indices

• The stock market Indexes only measure the survivors. So, in 2009, both GM and Chrysler would have been dropped due to the bankruptcies

• If you held GM and Chrysler, you lost everything, but two new companies moved in to replace them in the Indexes

• Real estate offers a return in terms of occupancy. You can rent out the property and receive income, or occupy the property and enjoy it yourself

• Actually, I should have mentioned that if you held gold bullion, you could sit in a room, count it, and enjoy that experience too. I’m not quite sure how to measure that. You’ll have to ask King Midas or Goldfinger!

Comparative Observations Using the New Index

• Gold was the best performer, but reached its peak of 324.61 earlier In January

• Oil was the most volatile, (yes it dropped in half over our measurement period)

• Real estate was the most stable, with solid predictable returns at about 5.28% annually

• single family homes continue to show a better overall return than condos

• Our own stock market posted reasonable gains, and is now ahead of single family homes over the measurement period, however, don’t forget that the TSX is still well off its highs

• All three US stock market indicators now show positive numbers.

Conclusion

For steady, predictable, measured gains pick real estate. It’s a solid performer with lower risk (less volatility) and generally moving in a positive direction.

And remember, when it comes to real estate, it’s never “wiped out” completely, like GM or Chrysler stock. So, unless you’re sitting on the edge of a tsunami, you’ll still own something when the storm is over.

For a benchmark of success, there’s 1,000 years of history to point to a rate of return in real estate being about the equivalent of 5% per annum, simple interest (non-compounded). That means that real estate doubles in value every 20 years. There are a lot of companies (now bankrupt, including CanWest Global, and many US Banks) that would have been happy with that return.

One guys thoughts on the Western Economies

If you are a student of economics then this is “interesting.” If not then it will make no sense at all.

I think he is accurate in summarizing where “hidden inflation” will come from at the end of the post.

Stephen Johnston; Partner & CIO – Agcapita Farmland Investment Partners

As Kierkegaard elegantly pointed out, “There are two ways to be fooled: One is to believe what isn’t so; the other is to refuse to believe what is so.”

The problem of being fooled “by believing what isn’t so” appears to be endemic in mainstream economic circles. Increasingly, we see the panic of central bankers and politicians in the thrall of the mistaken belief that the mere act of printing money can conjure wealth and sustainable growth into existence that this nostrum has stopped working.

In simple terms the powers that be in the west have been fooled by Keynesian dogma that:

– nominal increases in GDP represent growth;

– printing money increases nominal GDP; therefore

– printing money must generate growth.

Surely, this is to believe what isn’t so. A simple example of the fallacy this represents is Frederic Bastiat’s parable of the “broken window”. To paraphrase Bastiat, if all the windows in the country were suddenly broken there might be an increase in nominal GDP as the reconstruction took place but we should not be fooled into believing that this has made us wealthier.

Keynesians would argue that business activity has been stimulated, jobs were created and the economy benefited. In his own version of the “broken window” Keynes famously advocated burying newly printed money and paying people to dig it up as a way to stimulate the economy.

With all due respect to Lord Keynes, this belief is in the process of being exposed as the mirage it has always been. The true measure of the wealth of an economy is the pool of productive capital. Currency is merely the measuring stick. In our broken window example, the pool has been maintained but without the reconstruction it could have been increased – therefore the net effect, taking into account both “the seen and the unseen” in Bastiat’s words, is actually a loss of wealth.

If printing money does not create productive capital then how can you explain its perennial appeal amongst the banking and political classes?

For politicians, printing money is desirable for two reasons. Firstly, it acts as an unseen tax. One which few voters understand and for which even fewer are likely to blame the political class, at least in the beginning. Secondly, by reducing the value of the currency, the measuring stick I mentioned above, politicians are able to fool many of the voters that their wealth has increased, but of course no such thing has happened.

For members of the privileged banking class the appeal of printing money is that they are best positioned to take advantage of the confusion between the measurement of the pool of capital and the actual pool of capital itself. In simple terms, they can exchange the declining currency for productive assets while artificially low interest rates finance these activities at minimal cost.

So in general while printing money creates no new wealth in the form of productive capital, a significant amount of wealth can be misappropriated silently by the banking and political classes. For the rest of us, the relentless expansion of the money supply offers no true benefits and the very real danger that it is our wealth that is misappropriated.

In the spirit of Bastiat, ask yourself if the central banks increased the global money supply 20-fold overnight would we have more farmland, more oil wells, more factories, more of anything other than decimal places in our currency? The nominal price of all these things would likely increase but the size of the capital pool has not changed. How do the money printing programs currently underway differ from this in anything but magnitude?

Unfortunately, the perverse consequences of printing money do not stop with the misappropriation of wealth from the inflatees to the inflators. A policy of artificially low interest rates serves to sustain or create additional mal-investments – investments that cannot generate sufficient returns, and in many cases over the last decade ANY returns, to justify their existence. The failure to liquidate mal-investments allows the economic problems they cause to multiply and the inevitable accounting to be that much more devastating. Artificially low interest rates also fool the market into believing that capital is plentiful and that consumption can continue at unsustainable levels with severe consequences for the real economy. The word consume means “to expend, to use up, to waste or squander”. Always remember that consumption represents the diversion of productive capital into non-productive uses – i.e. the destruction of capital. Savings, on the other hand, are the only source of capital to create productive assets.

I do not believe that the aggressive expansion of the money supply in the west will have a beneficial effect on the real economy – i.e. will not increase the pool of productive capital in any meaningful way. However, I do believe it will fuel inflation and speculative activities. Of course, more inflation and speculation are exactly the opposite of what western economies need. We cannot all make our livings selling condos, stocks and bonds to each other – someone has to produce something and production requires genuine capital.

But this Frankenstein, finance driven economy appears to be exactly what our governments and central bankers are trying to keep alive. The west has become a vast inflation-creating machine in order to support the impaired banking and housing sectors. According to data published by analyst Mike Hewitt, since the dot.com crash in 2001 and the onset of aggressive low interest policies, the global money (M0) supply has increased over 170%. Some, fooled by government inflation data ask – “but where is all the inflation?” Fortunately for us, the Renminbi peg and OPEC petro-dollar recycling have been escape routes for a large amount of western money/inflation creation and heavily massaged government inflation data has helped disguise the rest.

As fast as we have been creating money in the west, China and OPEC have been importing and storing it on their balance sheets in the form of developed world sovereign debt. Some observers even argue that China will indefinitely accumulate western debt in order to maintain its peg against our inherently weak currencies. I believe that this is wishful thinking and once again it is to be fooled into believing what isn’t so merely because something hasn’t happened to date. When the emerging economies are forced to take serious steps to check domestic inflation – which for example is already starting to happen in China – they will stop purchasing our debt and even start selling it, at which point decades of stored western inflation could be returned to us in a very short period of time indeed.

In general, my investment premise remains that sustained real growth is unlikely to take place in the developed world until we stop engaging in capital destroying activities. Worse, our depleted and declining capital pool, combined with an enormous expansion of the monetary base and expanding government is creating a high probability of an extended period of stagflation in the west.

This is not to say that I take a universally pessimistic view of possible future returns. I believe that exposure to inflation-hedging assets with strong macro fundamentals and underlying cash generating capability, ideally in sectors exposed to growth outside of developed markets, will continue to be a fruitful area to search for outperformance over the long-term. My personal preference remains agriculture and energy.

Kind Regards

Stephen Johnston

ALBERTA’S ECONOMY SET FOR STRONG GROWTH IN 2011 WITH BOOST FROM ENERGY SECTOR: RBC ECONOMICS

Comment – this is some of the data that was used in my MARKet Update / Buyers Report. Feel free to download it for free on my site here: http://markherman.ca/Rate2.ubr

ALBERTA’S ECONOMY SET FOR STRONG GROWTH IN 2011 WITH BOOST FROM ENERGY SECTOR: RBC ECONOMICS

TORONTO, Dec. 15 /CNW/ – Alberta’s economy continues to recover from its severe recession with real GDP set to grow 3.4 per cent in 2010 and then galloping to a solid 4.3 per cent in 2011, according to the latest Provincial Outlook report from RBC Economics. In 2011, RBC projects that Alberta’s economic growth will be second only to Saskatchewan, representing the fastest growth in the province since 2006.

Alberta’s strong forecast is owed to improvements in a number of areas, particularly the booming energy sector and increased job creation since spring which helped to bring down the stubbornly high unemployment rate.

“Improvements in the employment market helped reverse the net migration outflow to other provinces that earlier slowed population growth to the lowest rate in 15 years,” said Craig Wright, senior vice-president and chief economist, RBC. “These are the kinds of turnarounds that will spread the recovery more widely throughout Alberta’s economy next year.”

The RBC report notes Alberta’s employment sector is expected to lead the country with a rise of 2.3 per cent in 2011, up significantly from a scant 0.5 per cent in 2010. The anticipated increase represents the creation of 37,000 jobs and will usher in the highest total of new employment opportunities since 2007 which should ultimately contribute to a boost in population growth.

“With interest in developing Alberta’s oil sands growing ever higher, the gush of capital spending on megaprojects is expected to continue next year and beyond. This will pump tremendous activity into the provincial economy and act as a catalyst for both faster job growth and stronger migration from outside the province,” added Wright.

According to the RBC Economics Provincial Outlook, the impact of Alberta’s strengthening demographics will be especially positive for consumer spending in 2011 as retail sales are expected to soar to a rate of 5.6 per cent, higher than any other province. This, along with the 5.1 per cent increase in consumer spending expected this year, will go along way toward reversing the massive 8.4 per cent decline experienced in 2009.

Looking ahead to 2012, the rising tide of energy-related spending and the expanding of non-conventional oil production will continue to exert powerful lifting forces throughout the Alberta economy. RBC forecasts the province will sustain a solid pace of growth with GDP of 3.8 per cent which will keep the province near the top of Canada’s growth rankings.

The RBC Economics Provincial Outlook assesses the provinces according to economic growth, employment growth, unemployment rates, retail sales, housing stars and consumer price indexes.

Real gross domestic product rose 0.4% in November

Real gross domestic product rose 0.4% in November after growing by 0.2% in October. Oil and gas extraction led the way in November, followed by wholesale and retail trade, real estate and the finance and insurance sector. Manufacturing declined, largely as a result of temporary plant shutdowns for retooling in the motor vehicle assembly industry and shift reductions in the motor vehicle parts industry. Construction also decreased.

Mining and oil and gas extraction continue to strengthen

Oil and gas extraction grew 2.4% in November. This increase was mainly attributable to higher synthetic crude petroleum production following the completion of maintenance to upgraders. Natural gas production was unchanged.

However, support activities for mining, oil and gas extraction declined 3.4% as a result of decreases in rigging and drilling activities.

n mining, iron ore extraction grew 10.8% returning to its August level after two consecutive monthly declines.

Gains in wholesale and retail trade

Wholesale trade rose 1.5% in November on the strength of trade in machinery and equipment, farm products, building materials as well as food, beverage and tobacco products. Wholesale activity in motor vehicles fell during the month.

Retail trade advanced 1.4% in November after a slight decline the month before. It was the second largest monthly increase in 2010 after the 2.1% gain in March. Growth in November was mostly attributable to clothing and accessory stores, new car dealers as well as food and beverage stores. Retail activity at gasoline stations and home electronics stores declined.

Finance and insurance resume growth

The finance and insurance sector rose 0.7%. There were increases in the volume of trading on the stock exchanges, in personal lending and in mortgages. The sales of mutual funds declined.

Manufacturing down

Manufacturing declined 0.8% in November. Most of the decline was the result of temporary plant shutdowns for retooling in the motor vehicle assembly industry and shift reductions in the motor vehicle parts industry. Excluding the motor vehicle and associated parts industries, the manufacturing sector was down 0.2%. Output at refineries rebounded 4.6% following the end of maintenance work at various plants.

Real estate market up while construction drops

There was a widespread increase in the home resale market across the country in November, leading to a growth of 7.6% in the output of real estate agents and brokers. This marked a fourth consecutive monthly increase for this industry. However, its level of output was still 8% below that recorded in April.

Construction declined 0.4% in November. Residential building construction continued to retreat as a result of reduced demand for single and semi-detached homes. Non-residential building construction decreased 0.2% while engineering and repair work edged up 0.1%.

Canadians Better Off, Even If They Don’t Feel It

Comment – Politics aside, we are coming off of the worst economic recession of our lifetimes. Numbers below show us back to where we were before the recession started. Governments debt loads are supposed to be high, government spending was supposed to kick in to keep us going – and it did.

Canadians Better Off, Even If They Don’t Feel It

John Ivison, National Post ·

Jan. 23 marks the fifth anniversary of Stephen Harper’s 2006 election victory and in early February, he will pass Lester B. Pearson’s time in office to become Canada’s 11th longest-serving prime minister. As Mr. Harper told Postmedia News this week, it has been a roller-coaster ride: “Some days it feels like five months, and other days it seems like 50 years.”

The five-year milestone has presented the Liberal leader, Michael Ignatieff, with his latest electoral gambit — to ask middle-class Canadian families whether they are better off after half a decade of the Harper government?

In fact, by almost every pocketbook metric, Canadian families are better off than they were five years ago –even if they don’t feel it.

The new strategy emerged from research carried out by the Liberals’ pollster, Michael Marzolini, as part of his firm Pollara’s annual nationwide poll of Canadians’ personal financial expectations. He found a new sense of caution and retrenchment, after optimistic expectations for 2010 were not met.

According to the Pollara poll, middle-class Canadians feel themselves under siege, with four in 10 claiming their incomes are failing to keep pace with the cost of living. They are anxious about their retirement, family debt and the value of their investments. Many Canadians believe every step forward they make is being hampered by assaults on their incomes such as new taxes and user fees. Ominously for the government, they appear less than impressed about claims Canada is doing better than its international competitors — the economy may be improving but they feel their own situation is not.

Mr. Ignatieff has leapt on the survey’s findings on his current 20-event, 11-ridings winter tour, making the claim that Canadians are worse off and the economy is weaker.

He is gambling that voters look at their own situation and calculate whether they have done well over the past five years. If the answer is yes, they will vote for the party they voted for before but, if not, he hopes they can be persuaded to switch.

Mr. Ignatieff’s central contention is that Canadians’ standard of living — as measured by GDP per person–has fallen 1.3% since the Harper government came to power.

The only problem with this for the Liberal leader is that it isn’t true — real GDP per capita did fall between 2005 and 2009, the trough of the recession, but has since recovered. If you annualize the first three quarters of 2010, the numbers show real GDP per capita is up

0.2% over the 2005 figure.

Other indicators are similarly positive.

Average hourly wages have outpaced inflation, especially for men, who now earn $4 an hour more than they did at the end of 2005.

The fiscal and monetary response to the recession has created one very real problem identified by Mr. Ignatieff — an extremely high level of indebtedness. Encouraged by cheap interest rates, Canadians now owe $1.50 for every dollar of disposable income, up from $1.08 in 2006.

Yet, national net worth per capita, which measures the health of assets like homes and investments, stood at a record high of $179,000 in the third quarter of 2010, up from $155,000 five years ago. Even at the bottom end of the socioeconomic ladder, the number of children living in low-income families fell by 250,000 between 2003 and 2008.

Retirement income is another leading concern raised by the Liberals but many more Canadians are now members of registered retirement plans than in 2005.

And the feeling that the tax burden is growing is also illusory, at least according to the Fraser Institute’s Tax Freedom Day, the day on which the average Canadian family has earned enough money to pay all taxes imposed on them by three layers of government. It advanced to June 5 in 2010, from June 23 in 2005.

These bald statistics don’t tell the whole story, of course. In the intervening years, there was a painful recession that saw unemployment spike at 8.7% in August 2009 (it is now sitting at 7.6%, still higher than the 6.8% in 2005).

Canadians remain anxious. According to Mr. Marzolini’s research, two-thirds of the population thinks we’re still in recession.

Yet, crucially, voters do not seem to blame the federal government, perhaps accepting that, if things are not noticeably better than they were five years ago, they could have been immeasurably worse.

Non-Conservatives can claim with some justification that the Harper government’s record of achievement is pretty penny ante when compared with other five-year-old administrations.

But the picture improves when you consider what didn’t happen. Mr. Harper is an incrementalist who agrees with Canada’s longest-serving prime minister, William Lyon Mackenzie King, that “it’s what we prevent, rather than what we do, that counts in government.”

The pressures of power have forced Mr. Harper, by his own admission, to make compromises he never thought he would have to make. “We spent the first three years of our government in a situation where people were saying, ‘Why don’t you take more risks? Why don’t you make more grandiose commitments? Why don’t you have a bigger more ambitious agenda on anything?’ And then all of a sudden, we’re spending the next two years dealing with a crash in the global economy and trying to operate a situation where we’re trying to protect what everybody has. So things just change constantly and you do have to be adaptable,” he told Postmedia’s Mark Kennedy this week.

There appears to be some appreciation that the Conservatives have provided solid, if stolid, government through the recession.

An Ipsos Reid poll before Christmas suggested six in 10 Canadians believe the political process is operating well and there is no need for an election. They may not vote Conservative, but they are not so disgruntled they are demanding change — at least not to the extent they have coalesced around Mr. Ignatieff or any of the other opposition leaders. This bodes well for Mr. Harper, sincegovernmentstraditionally find themselves in real trouble when the time-for-change number rises above 60%.

“Every election comes down to that — continuity or change,” said Darrell Bricker, president of Ipsos Public Affairs. “Mr. Ignatieff is trying to increase the desire for change that is a pre-condition [for a Liberal government]. But Canadians are not overwhelmingly concerned about the economy and even if they become more concerned, his opponent is leading him on the issue by 20 points.”

The Liberals insist that stress about the future has created enough volatility to give them a fighting chance. “Perceived reality is often a self-fulfilling prophesy,” said Mr. Marzolini, the Liberal pollster, as he unveiled his New Year’s poll to the Economic Club of Canada.

Mr. Ignatieff had best hope so, otherwise Mr. Harper will pass both R.B. Bennett (five years and 77 days) and John Diefenbaker (five years and 305 days) to become Canada’s ninth-longest serving prime minister before the end of this year.

Intra-provincial migration at 20-year high

Comment: This is exactly what started the boom in Calgary in 2006 when 25,000 people moved into town from all over Canada. This should drive the rental market vacancy rate down and increase rental prices. Then it will be more affordable to buy and the slack in the market will slowly get taken up; supporting home prices.

Good news for everyone in the housing industry and for home owners.

—- Nicolas Van Praet, Financial Post · Thursday, Jan. 27, 2011

MONTREAL — The number of Canadians moving to another province has punched to a high not seen in 20 years as people pack up in search of better jobs and salaries elsewhere.

Roughly 337,000 Canadians were on the move in 2010, says a report on interprovincial migration published Thursday by TD Economics. That’s 45,000 more than the year before and the most since the late 1980s. It also represents the largest share of the overall population since 1998.

“It’s a good sign in the sense that whenever you see that kind of movement, it’s an expression of a labour market that’s healing after a pretty severe recession,” said TD senior economist Pascal Gauthier, who wrote the study. “People are either returning home or moving to areas that didn’t have employment before. For those that are already employed, they’re finding potentially better prospects.”

Interprovincial migration matters because when there is a net movement of people to higher-employment and higher-productivity areas, that generates net economic output gains on a national basis. It’s also crucial for businesses because people often make big-ticket purchases when they move, which can have a significant impact on local housing and retail markets.

Canada’s situation lies in stark contrast with the United States, where census data show long-distance moves across states fell last year to the lowest level since the government began tracking them in 1948. Americans used to be a nation of big movers, with as many as one in five relocating for work every year in the 1950s. Now, experts are debating why they’ve become a nation of “hunkered-down homebodies,” as the New York Times put it.

Richard Florida, director of the Martin Prosperity Institute at the University of Toronto, says the United States is experiencing a new kind of class divide now between “mobile” people who have the resources and flexibility to pursue economic opportunity, and “stuck” citizens who are tied to places with weaker economies.

He argues the U.S. housing crisis is a big factor slowing mobility down. When the housing bubble popped, it left millions of Americans unable to sell their homes. “It’s bitterly ironic that housing, for so many Americans, has gone from being a cornerstone of their American dream to being a burden,” he wrote in a recent opinion piece.

Mr. Gauthier agrees that the housing crash is partly to blame for keeping Americans put. “There’s such a glut of supply that it’s just difficult to sell your house. In Canada, that’s not been an issue.”

In Canada, the biggest impediment to the free flow of labour between provinces and territories remains regulation as occupational requirements fall under provincial jurisdiction.

Workers in regulated professions and skilled trades, such as teachers and engineers, still face major barriers trying to work in provinces other than their own. Solving that problem will be key ahead of the looming labour force crunch, Mr. Gauthier argues.

Alberta, B.C. and Saskatchewan have seen the strongest net inflow of people of all provinces for the past three years and that will not change in the short term, the TD report forecasts. The three jurisdictions are working to implement a newly signed trade and labour mobility agreement between them that could eventually see seamless movement of workers between their borders.

TD says Ontario and Quebec will continue to lose residents to other provinces on a net basis, but the bleeding will be at a slower pace than in previous years. It says Manitoba and Prince Edward Island will be the only provinces still shedding a significant share of residents through the end of 2012.

In Manitoba’s case, it’s not that there aren’t any jobs. The province’s unemployment rate has been consistently lower than that of the rest of Canada since the 1990s. It’s that people are being lured by the prospect of higher-paying jobs in neighbouring provinces.