RBC Mortgage Payout Penalties Skyrocket in 2025

Details of the recent actions RBC has taken to INCREASE THE PAYOUT PENALTY for their own customers.It shows that Big-6 Banks are not your best -mortgage- friend. Brokers Are!Mortgage Mark Herman, Top Calgary Alberta mortgage broker

If you’re seeking a textbook case of banks giving consumers the short end of the stick, look no further.

The nation’s biggest mortgage lender, RBC, just slashed its posted rates.

“RBC’s move is the biggest move to increase penalties (IRDs) since its posted rates peaked on September 20, 2023,” says Matt Imhoff, founder of Prepayment Penalty Mentor.

For those fluent in the dark arts of interest rate differential (IRD) charges, this spells disaster for anyone daring to escape their RBC mortgage shackles early. Here’s precisely how grim it gets…

This is what RBC did to its posted rates today (Friday):

- 5 Year: -30 bps

- 4 Year: -25 bps

- 3 Year: -35 bps

- 2 Year: -85 bps

- 1 Year: -55 bps

- 6 Month: -55 bps

Anyone attempting to break a 2, 5, 7, or 10-year RBC mortgage now is potentially in for a world of penalty hurt due to these changes.

By way of example, if you’re an originator poaching a $500,000 RBC 4.4% 3-year fixed originated in July 2024, that client would be staring down a penalty of approximately $17,500, Imhoff says.

That’s up almost $10,000 in one day—simply because RBC slashed the comparison rate (its 2-year posted rate in this case).

In other words, the 255 bps “discount” from posted that this customer got in 2024 is now like a financial boomerang, coming back to hit them hard Imhoff says.

“This IRD is significantly higher than it should be, and that’s the risk of going with a bank where posted rates are elevated.”

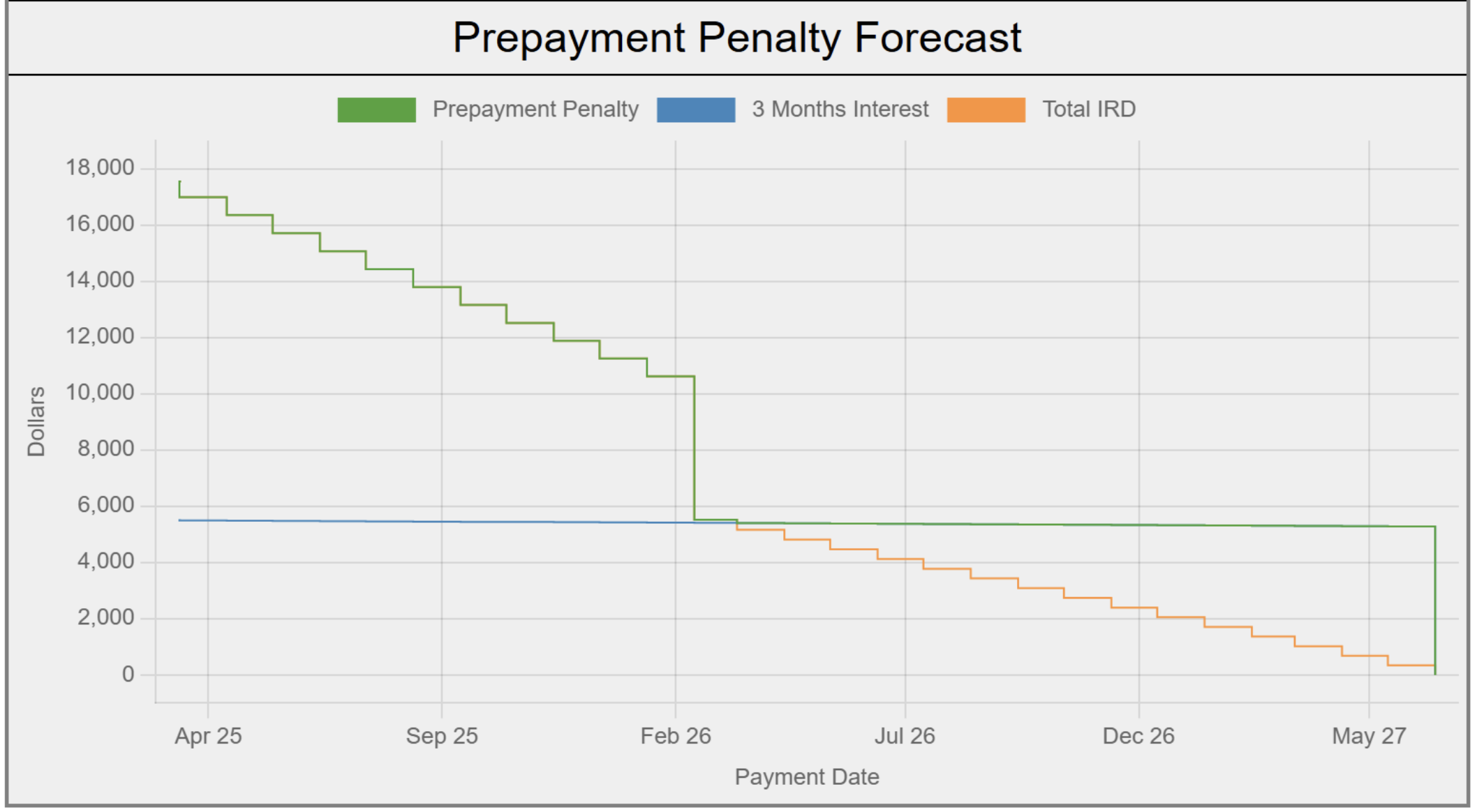

In the above example, the client’s only option to avoid more than a three-month interest penalty would be to ride out their RBC term until they have just 1.41 years remaining (per the chart below).

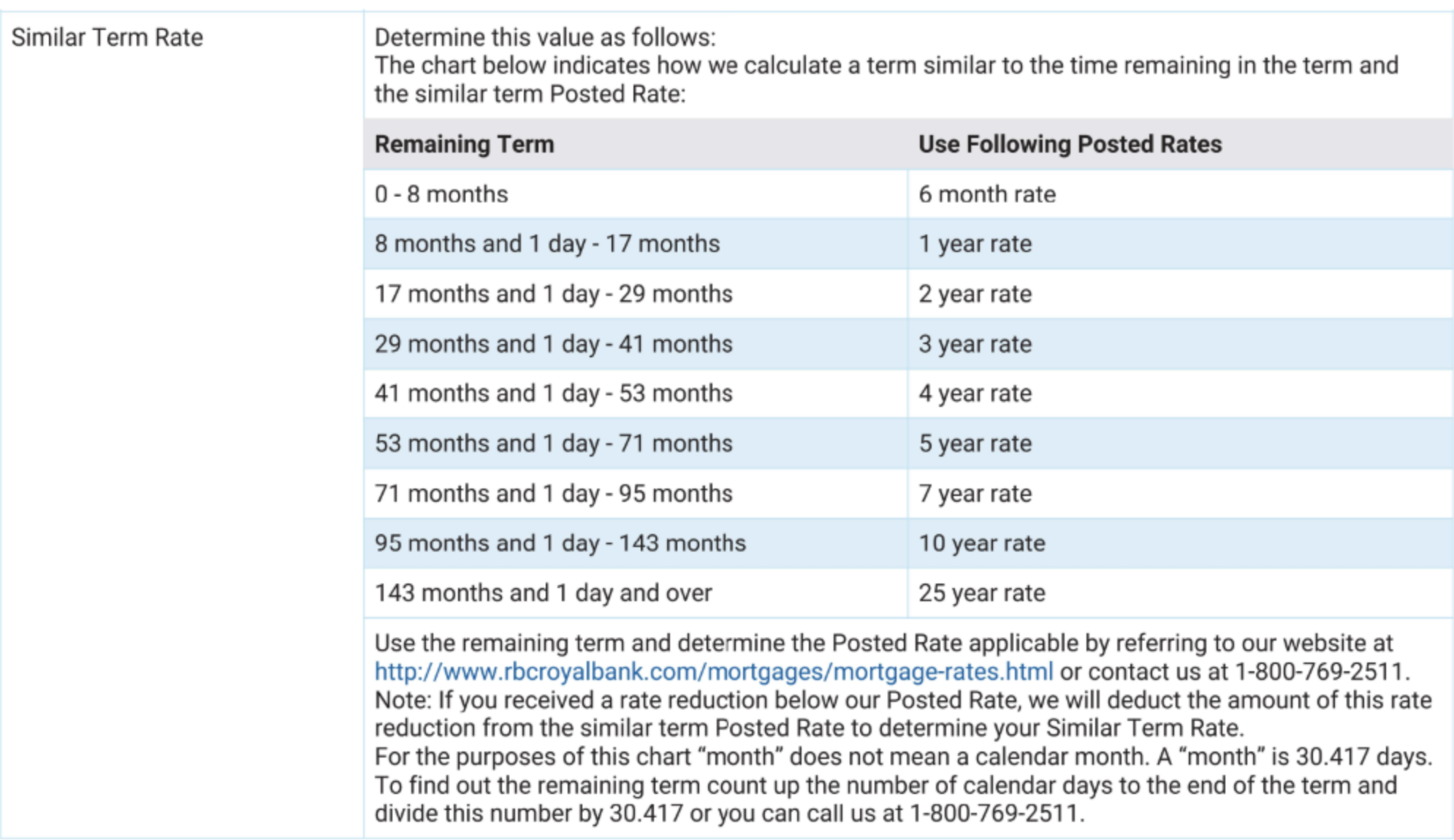

To virtually ensure a three-month interest penalty, a customer needs to be just eight months shy of their mortgage’s maturity, as illustrated in the RBC table below.

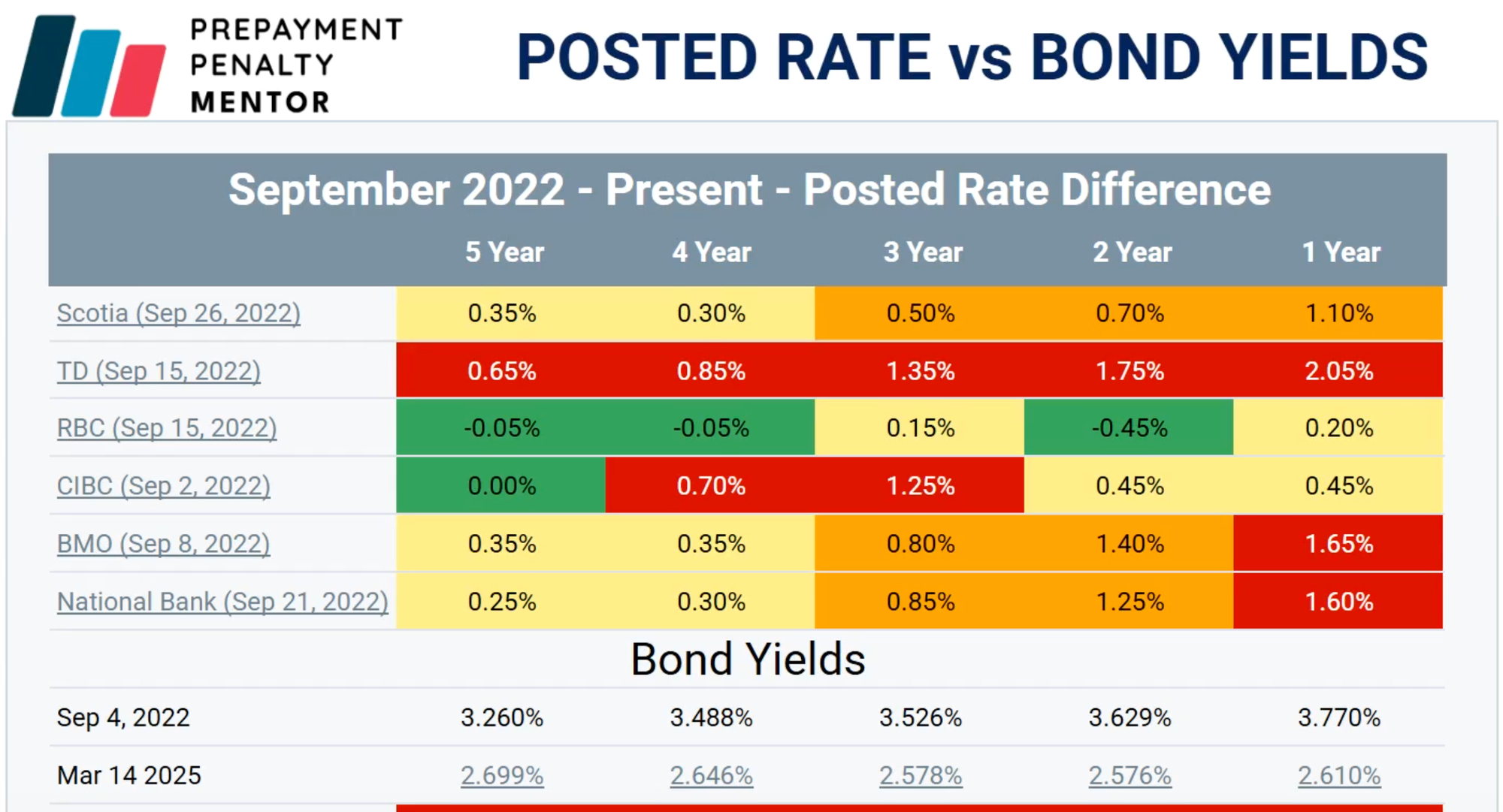

Watch out for TD customers

As Matt’s table below shows, TD’s posted rates are well above where they typically reside relative to bond yields. As a result, “I believe this sets the stage for what TD will inevitably do,” he says.

In cases where a client needs to refi, he adds that the risk of imminent posted rate changes at TD makes it too risky for brokers to get the deal approved elsewhere and then request discharge from TD. Time is money in this case.

“If a broker tries to get a payout order from TD today, TD can wait up to five business days,” Imhoff notes, adding that during that time, the penalty can go up.

In the event that early discharge makes clear sense, he says, “I am advising brokers to have their TD clients go to the branch, break the mortgage, pay the penalty while it is still on sale, and switch into an open.”

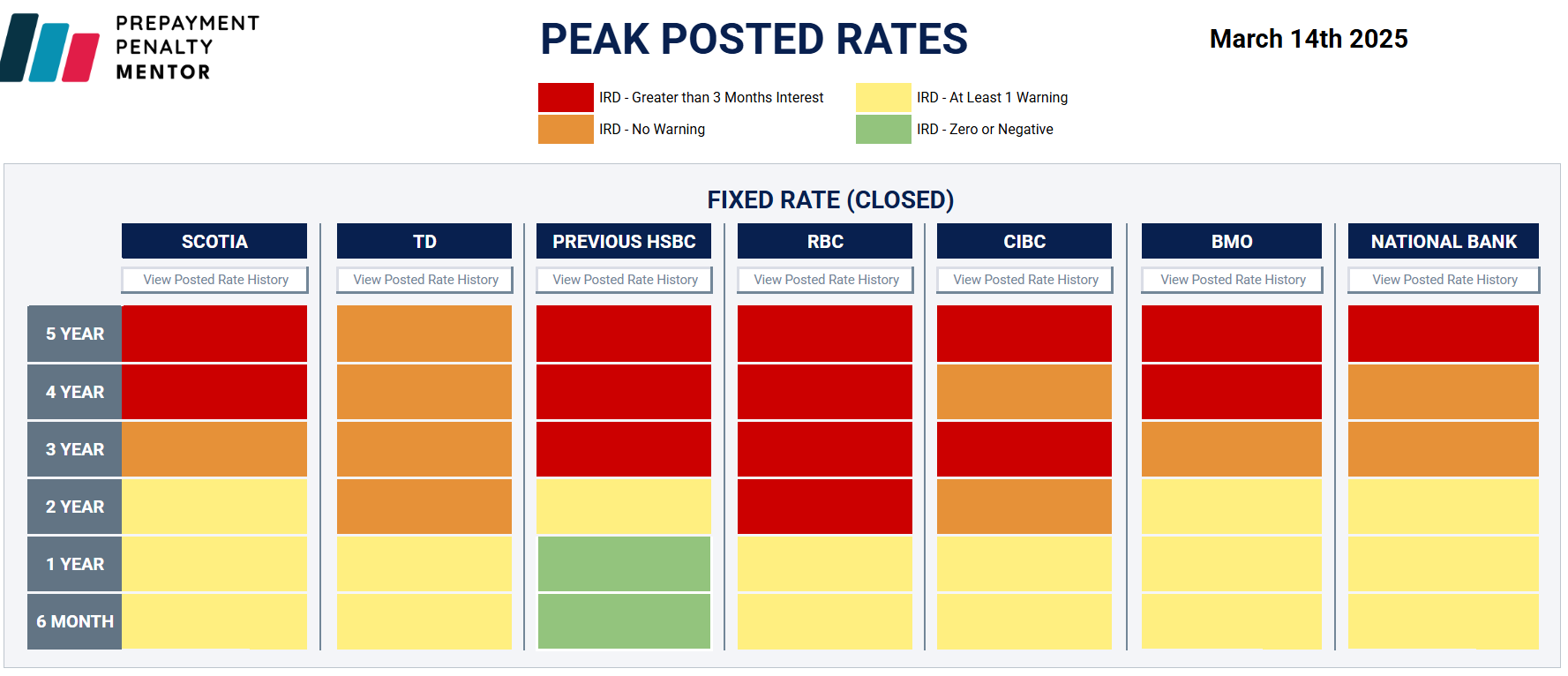

PPM has a great table (below) that also shows which terms at which banks are most prone to IRD penalties. Terms in red face IRD charges now, based on the assumptions the user enters. Terms in orange are at risk of being charged IRDs on the next posted rate drop.

It pays to know in advance when penalties make a refinance uneconomical. “There are brokers working on deals today that will never fund—all that wasted time, effort, money, just to get a payout that kills the deal.”