Thinking twice when handing your mortgage over to a bank adviser

Great story below of a recent Scotiabank advisor messing up a deal so bad that it ended up disqualifying a buyer from getting a special at 3.69% insured mortgage when market rates are 4.45%.

Bank advisors mess up all the time and I hear about it all the time. Maybe 15% of our deals get to us from bank mess ups.

In the story cut and paste below these buyers just would have ended up with a a higher rate but their deal wold still work… this one caused a 1 year delay.

Let me tell you a mortgage story…

We had a customer that we helped sheppard past 3 or 4 fiery hoops getting his mortgage ready for approval with a bumpy past we were smoothing over. Then 1 day he calls and says a met a bank mortgage rep at a gas station, that bank rep “guaranteed” him getting approved so our customer applied and … surprise – worse than a decline, CMHC declined him.

CMHC was the only lender that would do his specific deal, for the mess he was in, and/ but CMHC NEVER forgets – anything. All the insurers retain all data for ever. So he now had to wait another 12 months to get insurer approval. The delay in the end was 12 additional months that he had to wait before he could buy.

So … Think twice before handing over your mortgage to a bank adviser

Mark Herman, Best mortgage broker in Calgary Alberta for new home buyers.

Opinion: Think twice before handing your mortgage to a bank adviser – CMT News

Written by Ross Taylor, Mortgage Strategies, Opinion,

Let me tell you a story.

Recently, a major chartered bank ran a very competitive promotion: 3-year fixed rates at 3.69% for insured files and 3.99% for conventional files. Needless to say, these rates were popular, business was booming, both for the bank and for brokers working with them.

We had pre-approved a young couple earlier in the year, but when it came time to seek approval on a home they had made a successful offer on, they first went directly to their local branch to withdraw funds from their First Home Savings Account (FHSA).

When a branch adviser steps in

During that visit, the branch financial adviser offered to handle their mortgage as well. He convinced them there was no need to come back to our team, he had it all under control.

They also explored options at another bank, but the rates they were offered were mediocre. Our promo was still the best rate in town.

The deal gets declined, and there’s no second chance

But here’s the twist. After the financial adviser submitted their deal, it was declined. He escalated the deal to senior management, but again was given a firm no.

When they came back to us and told me the news, I was shocked. I couldn’t understand why they were declined. On paper, this was a strong file. Solid income, great credit, and their debt service ratios were within reasonable bounds.

Misinterpreting income cost them the deal

I asked if they were told why they were turned down, and they said, “because our debt service ratios were over the 39/44 limit.”

Now, their pay stubs were a bit complicated, I’ll give you that. But we had their T4s, and I could easily make a case for either using a two-year average or taking their current full-time salary. Both would have worked. You just had to know how to interpret the documentation properly.

I contacted our Business Relationship Manager at the bank and asked if I could re-submit the file. After all, it had been declined, and I felt confident we could get it approved with the correct interpretation of income. But the answer was a firm no.

Why bank policy closed the door

The bank’s position was that I wouldn’t want another broker or branch employee taking one of our approved files and trying to submit it again. And while I understand the sentiment, this wasn’t the same thing. This wasn’t poaching a win, it was salvaging a decline.

But rules are rules, and because the file had already been escalated and declined by the branch, there was no path forward for me to resubmit it — even if I knew how to fix it.

What’s the lesson here? Be careful who you trust with your mortgage

This story isn’t about one bank being better than another. It’s about understanding that not all mortgage advisers are created equal. When you walk into a branch, you’re often speaking to a generalist. They might have good intentions, but they don’t always have the same level of mortgage-specific training or experience as a full-time mortgage broker.

And the consequences of that can be enormous. In this case, the clients lost out on a great rate and had to start over, simply because it seems their adviser didn’t fully understand how to package their income. And once the file was declined, there was likely no second chance.

The bottom line

Mortgages are complex, especially if your income is even slightly non-standard. Getting declined not only wastes time, it can actually prevent you from accessing the best deals, even if you’re fully qualified. Before you hand over your file to someone behind a desk at your local branch, ask yourself: do they really specialize in mortgages?

Because once a file is escalated and declined at the bank level, it may close off options you didn’t even know you had.

Make sure you’re putting the biggest financial transaction of your life in the right hands.

Canadian Mortgage with American Income, 2025

Yes, that headline is true!!

August 15, 2025

We finally have an “A lender” in the Canadian mortgage broker space that will allow a buyer’s USA/ American income to be used.

Quick summary of the details.

- 30% down

- 80% of USA salary to be used, income based on USA tax docs

- Almost any standard residential property in Canada

- “A lender,” at A rates, no lender fee, no broker fee, underwritten the same as all Canadian mortgages

- No funny business here. This is a normal mortgage, that you would want. The same as what expect from any of the Big-6 banks in Canada.

For more data or to ask about a deal, contact Mortgage Mark Herman, on his cell phone. He usually answers his own phone; from 9 am to 9 pm MST daily.

Data points below summarize key criteria and parameters for an “A-lender” in the Canadian mortgage broker channel that accepts US income.

Borrower Eligibility

- Citizenship: any (US, Canadian, or other)

- Canadian residency: no minimum length of stay required

- Tax history: two consecutive years of US tax filings (no CRA filings needed – its true!)

Income Documentation

- W-2 forms (equivalent to Canadian T4 slips)

- IRS Form 1040 (equivalent to Canadian T1 returns)

- US Tax Return Transcripts or Notices of Assessment (NOA – Notice of Assessment)

- All documents must cover the most recent two-year period

Income & Loan Parameters

- Income recognized: up to 80% of gross US salary

- Income types accepted: salary only (sorry, the bank can’t use fee-for-service, or self-employed/ BFS income)

- Maximum loan-to-value ratio (LTV): 70%, means 30% down payment

- Credit underwriting conforms to Canadian mortgage regulations

Property Types

- Primary residence

- 2nd home / Secondary or vacation home and even…

- Rental or investment property

Notes

- No requirement for employer size, industry, or Canadian work history

- Simplified process: bypass CRA income filings entirely

- Ideal for US-based clients relocating, investing, or holding dual residences

We used to run into a few of these deals ever year, and now we see one every month so we found a lender that can do this business for our realtor partners.

The buyers only need 30% down, and the bank will use 80% of their USA salary as the income.

Mark Herman, top Calgary Alberta and Vancouver Island mortgage broker

RBC Mortgage Payout Penalties Skyrocket in 2025

Details of the recent actions RBC has taken to INCREASE THE PAYOUT PENALTY for their own customers.It shows that Big-6 Banks are not your best -mortgage- friend. Brokers Are!Mortgage Mark Herman, Top Calgary Alberta mortgage broker

If you’re seeking a textbook case of banks giving consumers the short end of the stick, look no further.

The nation’s biggest mortgage lender, RBC, just slashed its posted rates.

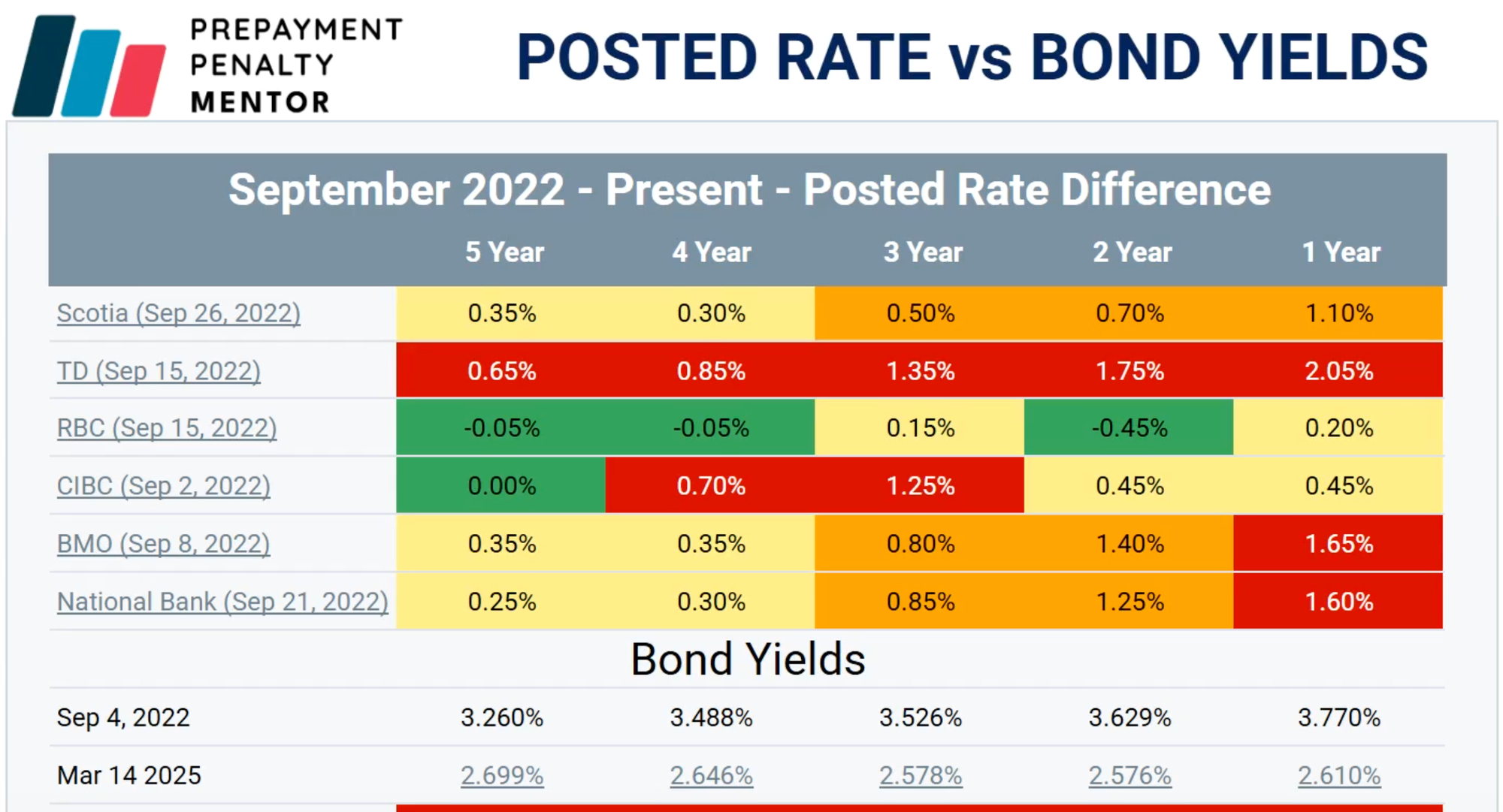

“RBC’s move is the biggest move to increase penalties (IRDs) since its posted rates peaked on September 20, 2023,” says Matt Imhoff, founder of Prepayment Penalty Mentor.

For those fluent in the dark arts of interest rate differential (IRD) charges, this spells disaster for anyone daring to escape their RBC mortgage shackles early. Here’s precisely how grim it gets…

This is what RBC did to its posted rates today (Friday):

- 5 Year: -30 bps

- 4 Year: -25 bps

- 3 Year: -35 bps

- 2 Year: -85 bps

- 1 Year: -55 bps

- 6 Month: -55 bps

Anyone attempting to break a 2, 5, 7, or 10-year RBC mortgage now is potentially in for a world of penalty hurt due to these changes.

By way of example, if you’re an originator poaching a $500,000 RBC 4.4% 3-year fixed originated in July 2024, that client would be staring down a penalty of approximately $17,500, Imhoff says.

That’s up almost $10,000 in one day—simply because RBC slashed the comparison rate (its 2-year posted rate in this case).

In other words, the 255 bps “discount” from posted that this customer got in 2024 is now like a financial boomerang, coming back to hit them hard Imhoff says.

“This IRD is significantly higher than it should be, and that’s the risk of going with a bank where posted rates are elevated.”

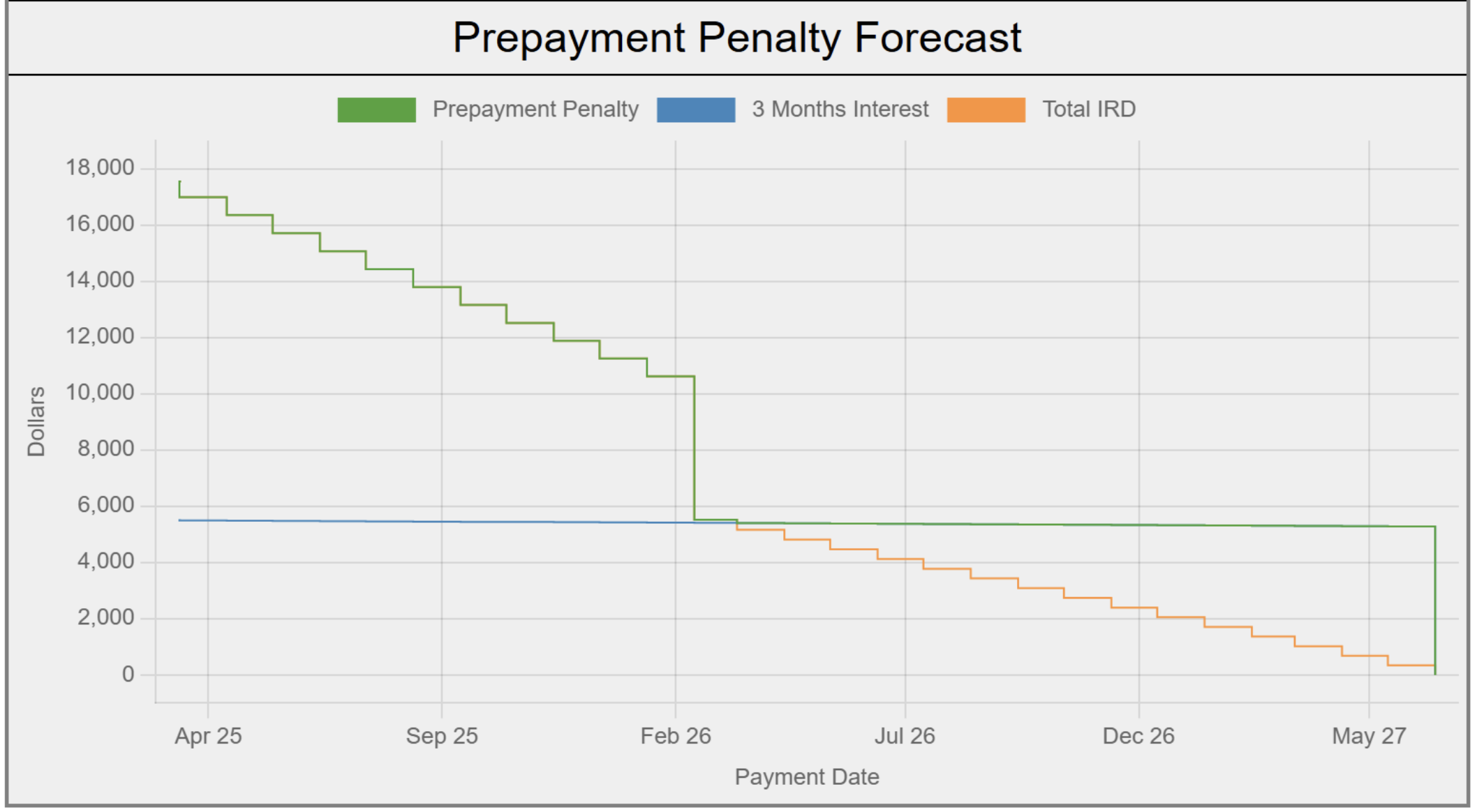

In the above example, the client’s only option to avoid more than a three-month interest penalty would be to ride out their RBC term until they have just 1.41 years remaining (per the chart below).

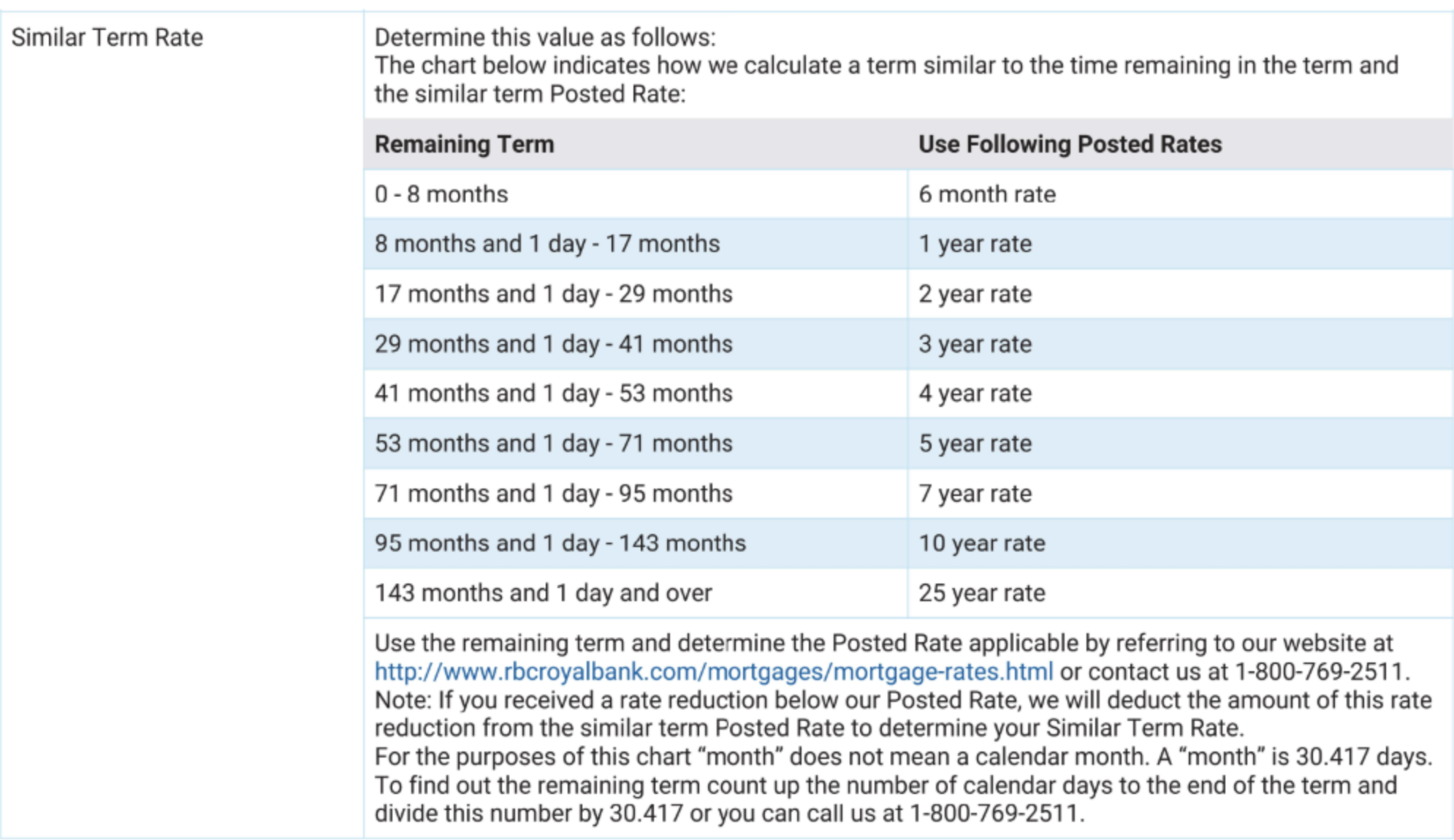

To virtually ensure a three-month interest penalty, a customer needs to be just eight months shy of their mortgage’s maturity, as illustrated in the RBC table below.

Watch out for TD customers

As Matt’s table below shows, TD’s posted rates are well above where they typically reside relative to bond yields. As a result, “I believe this sets the stage for what TD will inevitably do,” he says.

In cases where a client needs to refi, he adds that the risk of imminent posted rate changes at TD makes it too risky for brokers to get the deal approved elsewhere and then request discharge from TD. Time is money in this case.

“If a broker tries to get a payout order from TD today, TD can wait up to five business days,” Imhoff notes, adding that during that time, the penalty can go up.

In the event that early discharge makes clear sense, he says, “I am advising brokers to have their TD clients go to the branch, break the mortgage, pay the penalty while it is still on sale, and switch into an open.”

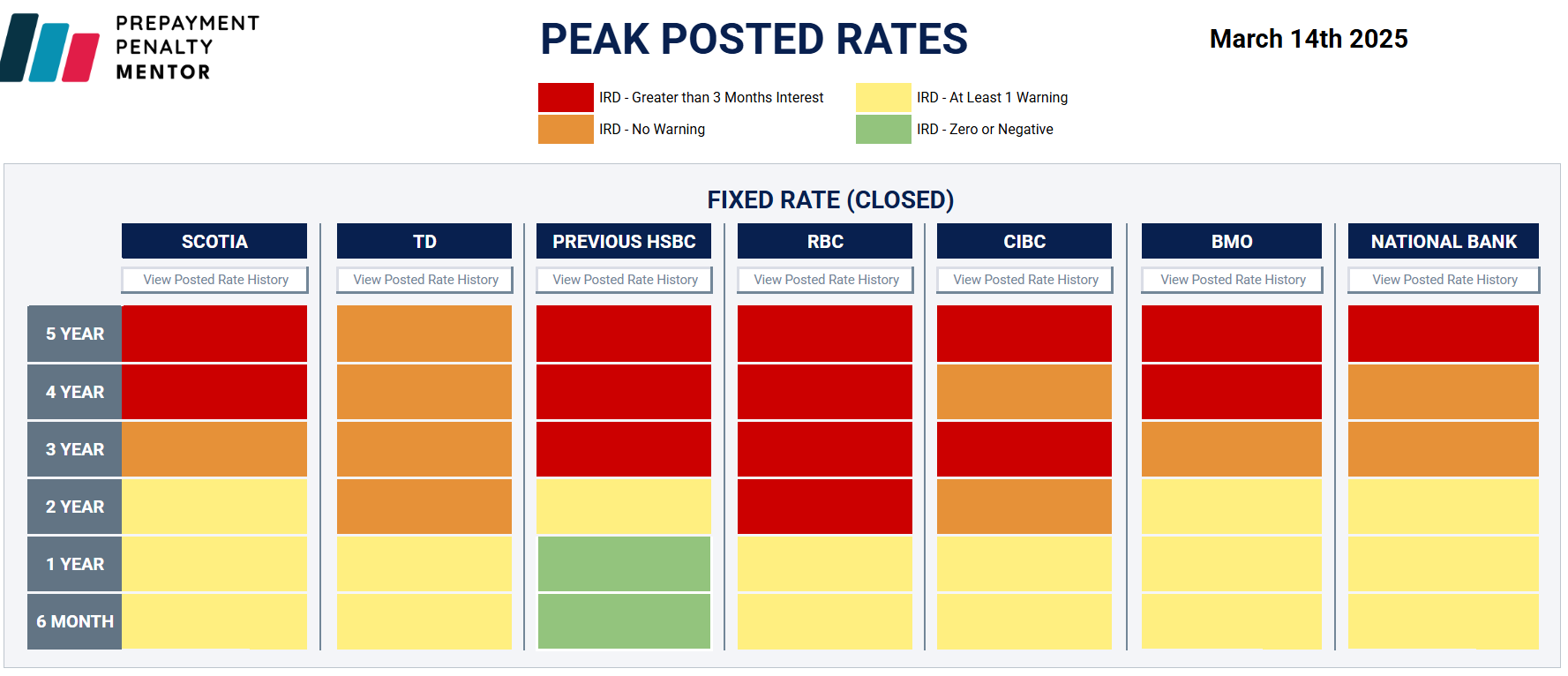

PPM has a great table (below) that also shows which terms at which banks are most prone to IRD penalties. Terms in red face IRD charges now, based on the assumptions the user enters. Terms in orange are at risk of being charged IRDs on the next posted rate drop.

It pays to know in advance when penalties make a refinance uneconomical. “There are brokers working on deals today that will never fund—all that wasted time, effort, money, just to get a payout that kills the deal.”

Bank of Canada Lowers Consumer Prime to 4.95%

The Bank of Canada lowers its benchmark interest rate to 2.75%

In the face of significant geopolitical tensions, the Bank of Canada announced today that it has lowered its policy interest rate by 25 basis points. This marks the seventh reduction since June of 2024.

Below, we summarize the Bank’s commentary.

Canadian Economic Performance and Housing

- Canada’s economy grew by 2.6% in the fourth quarter of 2024 following upwardly revised growth of 2.2% in the third quarter

- This “growth path” is stronger than was expected when the Bank last reported in January 2025

- Past cuts to interest rates have boosted economic activity, particularly consumption and housing

- However, economic growth in the first quarter of 2025 will likely slow as the intensifying trade conflict weighs on sentiment and activity

- Recent surveys suggest a sharp drop in consumer confidence and a slowdown in business spending as companies postpone or cancel investments

- The negative impact of slowing domestic demand has been partially offset by a surge in exports in advance of tariffs being imposed

- The Canadian dollar is broadly unchanged against the US dollar but weaker against other currencies

Canadian Inflation and Outlook

- Inflation remains close to the Bank’s 2% target

- The temporary suspension of the GST/HST lowered some consumer prices, but January’s Consumer Price Index was “slightly firmer” than expected at 1.9%

- Inflation is expected to increase to about 2.5% in March with the end of the tax break

- The Bank’s preferred measures of core inflation remain above 2%, mainly because of the persistence of shelter price inflation

- Short-term inflation expectations have risen in light of fears about the impact of tariffs on prices

Canadian Labour Market

- Employment growth strengthened in November through January and the unemployment rate declined to 6.6%

- In February, job growth stalled

- While past interest rate cuts have boosted demand for labour in recent months, there are warning signs that heightened trade tensions could disrupt the recovery in the jobs market

- Meanwhile, wage growth has shown signs of moderation

Global Economic Performance, Bond Yields and the Canadian Dollar

- After a period of solid growth, the US economy looks to have slowed in recent months, but US inflation remains slightly above target

- Economic growth in the euro zone was modest in late 2024

- China’s economy has posted strong gains, supported by government policies

- Equity prices have fallen and bond yields have eased on market expectations of weaker North American growth

- Oil prices have been volatile and are trading below the assumptions in the Bank’s January Monetary Policy Report

Rationale for a rate cut

While the Bank offered that economic growth came in stronger than it expected, the pervasive uncertainty created by continuously changing US tariff threats is restraining consumers’ spending intentions and businesses’ plans to hire and invest. Against this background, and with inflation close to the 2% target, the Bank decided to reduce its policy rate by 25 basis points.

Outlook

The Bank notes that the Canadian economy entered 2025 “in a solid position,” with inflation close to its 2% target and “robust” GDP growth. However, heightened trade tensions and tariffs imposed by the United States will likely slow the pace of economic activity and increase inflationary pressures in Canada. The economic outlook continues to be subject to more-than-usual uncertainty because of the rapidly evolving policy landscape.

Final comments

The Bank noted that monetary policy “cannot offset the impacts of a trade war.” What monetary policy “can and must do” is ensure that higher prices do not lead to ongoing inflation.

The Bank said it will carefully assess: i) the timing and strength of both the downward pressures on inflation from a weaker economy and ii) the upward pressures on inflation from higher costs. It will also closely monitor inflation expectations.

It ended its statement by saying it is committed to maintaining price stability for Canadians.

More scheduled BoC news

The Bank is scheduled to make its third policy interest rate decision of 2025 on April 16th.

Bank of Canada lowers benchmark interest rate to 3%

The Bank of Canada opened its monetary policy playbook for 2025 with a 0.25% reduction in its overnight rate. The 6th since June of last year.

In issuing its January Monetary Policy Report, the Bank also noted that its projections are subject to “more-than-usual uncertainty” because of the rapidly evolving policy landscape, particularly the threat of trade tariffs by the new administration in the United States.

Variable rates win, but can you handle some possibly sleepless nights if Trump’s tariffs increase fixed rates as much as 3%?

(Click to see the link to the report showing this.)

If Canada does a full retaliation to Trump’s 25% tariffs our Canadian interest rates could go up by 3%; and if there is no retaliation at all, Canadian interest rates could go down by up to 3% as well!

Mortgage Mark Herman, 20+ years of mortgage experience with an MBA from a top school & Top Calgary Alberta Mortgage Broker

Below, we summarize the Bank’s commentary.

Canadian economic performance and housing

- Past interest rate reductions have started to boost the Canadian economy

- Recent strengthening in both consumption and housing activity is expected to continue

- Business investment, however, remains weak

- The outlook for exports is supported by new export capacity for oil and gas

Canadian inflation and outlook

- Inflation measured by the Consumer Price Index (CPI) remains close to 2%, with some volatility due to the temporary suspension of the GST/HST on some consumer products

- Shelter price inflation is still elevated but it is easing gradually, as expected

- A broad range of indicators, including surveys of inflation expectations and the distribution of price changes among components of the CPI, suggest that underlying inflation is close to 2%

- The Bank forecasts CPI inflation will be around the 2% target over the next two years

Canadian labour market

- Canada’s labour market remains soft, with the unemployment rate at 6.7% in December

- Job growth, however, has strengthened in recent months, after lagging growth in the labour force for more than a year

- Wage pressures, which have proven sticky, are showing some signs of easing

Global economic performance, bond yields and the Canadian dollar

- The global economy is expected to continue growing by about 3% over the next two years

- Growth in the United States has been revised upward, mainly due to stronger consumption

- Growth in the euro area is likely to be subdued as the region copes with competitiveness pressures

- In China, recent policy actions are boosting demand and supporting near-term growth, although structural challenges remain

- Since October, financial conditions have diverged across countries with bond yields rising in the US, supported by strong growth and more persistent inflation, and bond yields in Canada down slightly

- The Canadian dollar has depreciated materially against the US dollar, largely reflecting trade uncertainty and broader strength in the US currency

- Oil prices have been volatile and in recent weeks have been about $5 higher than was assumed in the Bank’s October Monetary Policy Report

Other comments

The Bank also announced its plan to complete the normalization of its balance sheet, which puts an end to quantitative tightening. The Bank said it will restart asset purchases in early March 2025, beginning gradually so that its balance sheet stabilizes and then grows modestly, in line with growth in the economy.

It also offered further rationale for today’s decisions by saying that with inflation around 2% and the economy in excess supply, the Bank’s Governing Council decided to reduce its policy rate. It also noted that cumulative reduction in the policy rate since last June is “substantial.” Lower interest rates are boosting household spending and, in the outlook it published (see below), the economy is expected to strengthen gradually and inflation to stay close to target.

Outlook

In today’s announcement, the Bank laid out its forecast for Canadian GDP growth to strengthen in 2025. However, it was quick to also point out that with slower population growth because of reduced immigration targets, both GDP and potential growth will be “more moderate” than what the Bank previously forecast in October 2024.

To put numbers on that forecast, the Bank now projects GDP will grow by 1.8% in both 2025 and 2026. As a result, excess supply in the Canadian economy is expected to be “gradually absorbed” over the Bank’s projection horizon.

Setting aside threatened US tariffs, the Bank reasons that the upside and downside risks in its outlook are “reasonably balanced.” However, it also acknowledged that a protracted trade conflict would most likely lead to weaker GDP and higher prices in Canada and test the resilience of Canada’s economy.

The Bank ended its statement with its usual refrain: it is committed to maintaining price stability for Canadians.

2025 will bring more BoC news

The Bank is scheduled to make its second policy interest rate decision of 2025 on March 12th. I will provide an executive summary immediately following that announcement.

Summary of Mortgage Rule Changes

Key Mortgage Rule Updates

30-year amortization for insured mortgages

Starting December 15, 2024, 30-year amortizations will be available for insured mortgages. This option is open to first-time homebuyers and those purchasing newly built homes, including condos.

Higher insured mortgage limits

Applications for insured mortgages will now be accepted for properties valued under $1.5 million, giving more buyers access to high-value homes with lower down payment requirements.

Stress test simplification

In line with OSFI’s guidance, current stress test requirements will continue for insurable, uninsurable, and uninsured applications. Eligible insured transfers and switches will remain qualified at the contract rate.

How these changes benefit you

✔️ Reduced monthly payments

Extending amortizations to 30 years will lower monthly payments, helping clients manage affordability amidst rising living costs and fluctuating interest rates.

It usually works out to reduce your payment by 9% or lets yo buy 9% more home (increases the mortgage amount but about 9%.)

✔️ Expanded opportunities for buyers

Higher insured mortgage limits make it possible for more Canadians to purchase homes in competitive urban markets like Toronto and Vancouver for up to $1,500,000 with 5% down on the 1st 500k and 10% down payment on the balance.

This set of mortgage rule changes should make it easier for buyers to get into a home now.

More importantly, it lets buyers purchase up to $1.5M with $125k down, where before they would have topped out at $1m with $75k down payment.

- Mortgage Mark Herman, top best Calgary mortgage broker,

- 403,681-4376

Current Risks to the Canadian Mortgage Market? May 15th, 2024

Summary:

May 21, 2024 is when the inflation a report comes out and it should be the determining factor if the Canadian PRIME RATE of INTEREST is reduced from 7.2% in June or not. Maybe July. Maybe later.

Nobody is buying anything big right now, which is the idea … to reduce inflation.

Which means now is the best time to buy a home before everyone waiting for rates to drop jumps in on the 1st Prime rate reduction.

Says Mortgage Mark Herman, Calgary Alberta best/ top/ mortgage broker for first time home buyers

DATA:

Mortgage holders have been anxiously waiting for the Bank of Canada to cut interest rates. The increase of 90,400 jobs in April – 5 times what analysts expected – has heightened concerns that the Bank will continue to wait before lowering rates. 🙁

While the economy has not slowed as much as expected, there’s growing economic slack, with the jobless rate up 1 percentage point over the past year and a 24% year-over-year increase in the number of unemployed individuals, which is slowing down wage growth. The crucial factor in determining whether a rate cut will occur in June or be postponed to later this year hinges on the April CPI release scheduled for May 21st.

In the background of these deliberations, the Bank of Canada also assesses various potential risks to the economy. Last week, the Bank released its Financial Stability Report, highlighting two key risks: debt serviceability and asset valuations.

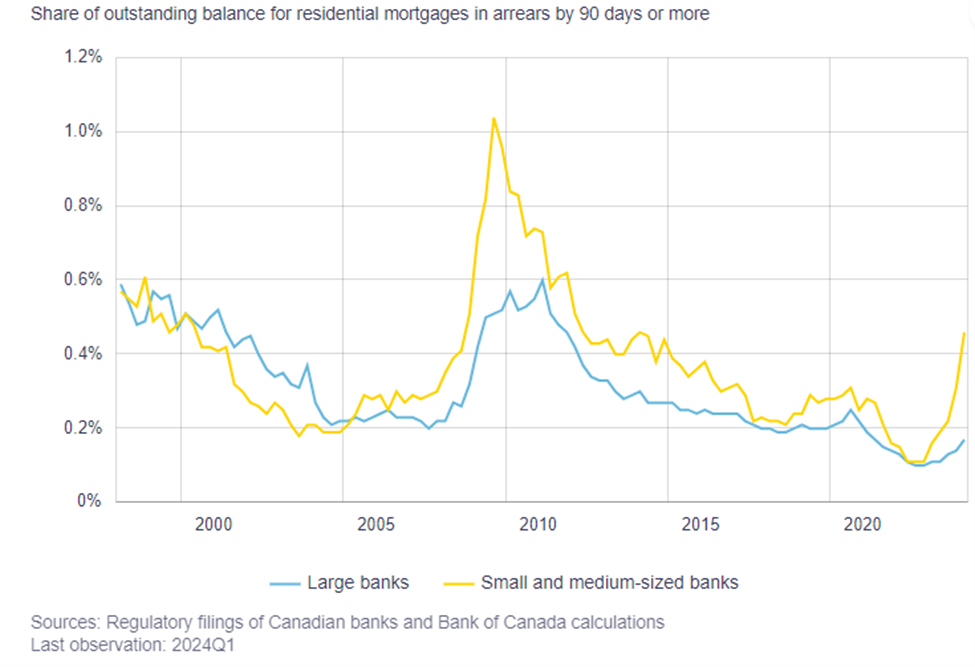

The report notes that the share of mortgage holders who are behind on their credit cards and auto loan payments, which had hit historic lows during the pandemic, has now returned to more normal levels. It also notes that smaller mortgage lenders are seeing an uptick in credit arrears. This increase isn’t surprising, given the run up in rates and the market segment that these lenders cater to. While the arrears rate is up, it remains relatively low compared to historical levels.

This overall positive portfolio performance is due to two key factors: 1) financial flexibility and 2) employment.

Canadian mortgage defaults tend to spike up during periods of rising unemployment. While the unemployment rate has risen, it remains relatively low. Additionally, mortgagors are holding higher levels of liquid assets. Before the pandemic, homeowners with a mortgage held 1.2 months of liquid reserves, which increased to 2.2 months during the pandemic and has since fallen to 1.8 months. These increased reserves provide a solid buffer for mortgagors to meet unexpected increases in expenses.

The Bank remains concerned that nearly half of all outstanding mortgages have yet to be renewed, leaving these borrowers at risk of payment shock due to the increase in interest rates. Scotiabank is an interesting case because, unlike other banks, it offers adjustable-rate mortgages (ARM) with variable payments instead of variable rate mortgages with fixed payments. Scotia has seen its 90+ days past due rate increase from 0.09% to 0.16%. During their fourth-quarter earnings call, Scotia noted that ARM borrowers have been cutting back on discretionary spending by 11% year-over-year, compared to a 5% reduction among fixed-rate clients.

The mortgage maturity profile in the Financial Stability Report suggests that we could see significant slowing in consumer discretionary spending over the next two years. While the rise in debt-servicing costs will be partially offset by income growth, we should expect to see belt tightening by mortgage holders. This poses less of a risk to the banking sector mortgage market than to the overall outlook for the economy.

Divorce & Mortgage Buy-Out Details, Canada, May 2024

Important data for separating / divorcing partners, this may help with “Buying the ex-spouse out” of a divorce, when some debts need to be rolled in.

The way most lawyers and Big-6 banks do it:

as a refinance, max loan is 80% of the appraised value of the home,

and you get refi rates – the highest – today:

- 3 year fixed 5.76%, 5 year fixed 5.59%

and usually NO debts can be rolled into the mortgage past that 80% of the home value.

with OUR WAY/ Broker way…

we do it as “a purchase after marital breakdown” which allows

max loan of 95% LTV (of the home value) – which usually makes ALL THE DIFFERENCE in a buyout situation.

- BEST RATES again: 3 year fixed 5.39%, 5 year fixed 4.99%

and usually Most/ All/ some debts can be rolled into the mortgage – at no extra cost, depending on your lending ratios.

Data from a similar file –

As long as the deal IS insurable (meaning it conforms to CMHC rules and guidelines) to get that lower rate – actually 0.6% LOWER as of today – then we need an offer to purchase too. Most lawyers do not want also write an “offer to purchase,”

If the Big-6 bank is doing it as a conventional refinance then an offer to purchase is not needed.

Banks don’t have substantially different rates for insurable and conventional like we do. (o.4 to o.9% rate difference makes a huge difference.)

So yes, we can get a separation done without an Offer to Purchase as long as at least 20% of the value stays in the home and we use refinance rates at 0.6% higher than broker best rates today.

Considering customers will leave us for 0.05% and this is 0.6% – that is >10x multiple of what customers consider “worth leaving us for” this is an important way to get divorce deals to work better for everyone.

Mortgage Mark Herman, top/ best Calgary Alberta Mortgage Broker

Why Buy Your Home Today: Data Points, Alberta, Winter, 2024

|

Prime Rate Holding, July 1st Expected Reduction & Real Estate Economic Data

The Bank of Canada cited the ongoing risk of inflation for its decision to maintain its overnight benchmark interest rate at 5.0%.

Below are the Bank of Canada’s observations, including its forward-looking comments on the state of the economy, inflation and interest rates.

Canadian inflation

- CPI inflation ended the year at 3.4% and the Bank expects inflation to remain close to 3% during the first half of 2024 “before gradually easing” and returning to the Bank’s 2% target in 2025

- Shelter costs remain “the biggest contributor to above-target inflation”

- While a slowdown in demand is said by the Bank to be reducing price pressures in a broader number of CPI components and corporate pricing behavior continues to normalize, core measures of inflation are not showing sustained declines.

Canadian economic performance and outlook

- The Bank notes that the Canadian economy has “stalled” since the middle of 2023 and believes growth will likely remain close to zero through the first quarter of 2024

- Consumers have pulled back their spending in response to higher prices and interest rates, and business investment has contracted

- With weak growth, supply has caught up with demand and the economy now looks to be operating in modest excess supply

- Labour market conditions have eased, with job vacancies returning to near pre-pandemic levels and new jobs being created at a slower rate than population growth. However, wages are still rising around 4% to 5%

Global economic performance and outlook

- Global economic growth continues to slow, with inflation easing “gradually” across most economies

- While growth in the United States has been stronger than expected, it is anticipated to slow in 2024, with weakening consumer spending and business investment

- In the euro area, the economy looks to be in a mild contraction

- In China, low consumer confidence and policy uncertainty will likely restrain activity

- Oil prices are about $10 per barrel lower than was assumed in the Bank’s October Monetary Policy Report (MPR)

- Financial conditions have eased, largely reversing the tightening that occurred last autumn

- The Bank now forecasts global GDP growth of 2.5% in 2024 and 2.75% in 2025 compared to 2023’s 3% pace

- With softer growth this year, inflation rates in most advanced economies are expected to come down slowly, reaching central bank targets in 2025

Outlook

The Bank believes that Canadian economic growth will strengthen gradually “around the middle of 2024.” Furthermore, it expects household spending will likely “pick up” in the second half of 2024, and exports and business investment should get a boost from recovering foreign demand.

Taking all of these factors and forecasts into account, the Bank’s Governing Council decided to hold its policy rate at 5% and to continue to “normalize” the Bank’s balance sheet.

The Bank’s statement went on to note that Council “is still concerned about risks to the outlook for inflation, particularly the persistence in underlying inflation” and wants to see “further and sustained easing in core inflation.” The Bank also said it continues to focus on the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behaviour.

As it has said consistently over the past year, the Bank will remain “resolute in its commitment to restoring price stability for Canadians.”

Although the Bank did not say it, the bottom line is we will have to wait and see what comes next.

Next touchpoint

March 6, 2024 is the Bank’s next scheduled policy interest rate announcement.