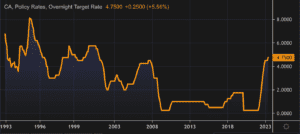

Canadian Prime Rate Drops to 4.5%

Horray – the rates are dropping.

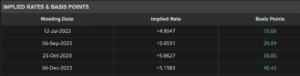

We expect to see a total of 2 MORE rate reductions of 0.25% each in 2024.

5 x o.25% reductions are expected in 2025 making the variable the better way to go right now.

Mortgage Mark Herman

DATA

Encouraged by underling trends in the Canadian economy, the Bank of Canada today cut its overnight policy interest rate by 0.25% to 4.50%.

This is the second incremental reduction we’ve seen in as many months and while both cuts have been modest, they are moving Canada toward less restrictive monetary policy.

We summarize the Bank’s rationale for this decision by summarizing its observations below, including its forward-looking comments for signs of what may happen next.

Canadian inflation including shelter inflation

- Inflation measured by the Consumer Price Index moderated to 2.7% in June after increasing in May

- Broad inflationary pressures are easing, and the Bank’s preferred measures of core inflation have been below 3% for several months and the breadth of price increases across components of the CPI is now near its historical norm

- Shelter price inflation remains high, driven by rent and mortgage interest costs, and is still the biggest contributor to total inflation

- Inflation is also elevated in services that are closely affected by wages, such as restaurants and personal care

Canadian economic performance and outlook

- Economic growth “likely” picked up to about 1.5% through the first half of 2024, however, with robust population growth of about 3%, the economy’s potential output is still growing faster than GDP, which means excess supply has increased

- Household spending, including both consumer purchases and housing, has been “weak”

- There are signs of slack in the labour market with the unemployment rate rising to 6.4% and with employment continuing to grow more slowly than the labour force and job seekers taking longer to find work

- Wage growth is showing some signs of moderating, but remains elevated

- GDP growth is forecast to increase in the second half of 2024 and through 2025, reflecting stronger exports and a recovery in household spending and business investment as borrowing costs ease

- Residential investment is expected to grow robustly

- With new government limits on admissions of non-permanent residents, population growth should slow in 2025

Global economic performance and outlook

- The global economy is expected to continue expanding at an annual rate of about 3% through 2026

- While inflation is still above central bank targets in most advanced economies, it is forecast to ease gradually

- In the United States, an anticipated economic slowdown is materializing, with consumption growth moderating and US inflation appearing to resume its downward path

- In the euro area, growth is picking up following a weak 2023

- China’s economy is growing modestly, with weak domestic demand partially offset by strong exports

- Global financial conditions have eased, with lower bond yields, buoyant equity prices, and robust corporate debt issuances

- The Canadian dollar has been relatively stable and oil prices are around the levels assumed in the Bank’s April’s Monetary Policy Report

Summary comments and outlook

The Bank forecasts that Canadian GDP will grow at 1.2% in 2024, 2.1% in 2025, and 2.4% in 2026 and that a strengthening economy will gradually absorb excess supply through 2025 and into 2026.

As a result of an easing in broad price pressures, the Bank expects inflation to move closer to 2%, its long-stated goal. As a result, the Bank’s Governing Council decided to reduce the policy interest rate by 25 basis points.

It further noted that while ongoing excess supply is lowering inflationary pressures, price pressures in some important parts of the economy—notably shelter and some other services—are “holding inflation up.”

Accordingly, the Bank said it is carefully assessing these “opposing forces.” Monetary policy decisions therefore will be guided by incoming information and the Bank’s assessment of the implications for the inflation outlook.

Once again, the statement noted in conclusion that the Bank remains “resolute in its commitment to restoring price stability for Canadians.”

Next Up

The Bank returns on September 4th with its next monetary policy announcement.

Prime Rate Holding, July 1st Expected Reduction & Real Estate Economic Data

The Bank of Canada cited the ongoing risk of inflation for its decision to maintain its overnight benchmark interest rate at 5.0%.

Below are the Bank of Canada’s observations, including its forward-looking comments on the state of the economy, inflation and interest rates.

Canadian inflation

- CPI inflation ended the year at 3.4% and the Bank expects inflation to remain close to 3% during the first half of 2024 “before gradually easing” and returning to the Bank’s 2% target in 2025

- Shelter costs remain “the biggest contributor to above-target inflation”

- While a slowdown in demand is said by the Bank to be reducing price pressures in a broader number of CPI components and corporate pricing behavior continues to normalize, core measures of inflation are not showing sustained declines.

Canadian economic performance and outlook

- The Bank notes that the Canadian economy has “stalled” since the middle of 2023 and believes growth will likely remain close to zero through the first quarter of 2024

- Consumers have pulled back their spending in response to higher prices and interest rates, and business investment has contracted

- With weak growth, supply has caught up with demand and the economy now looks to be operating in modest excess supply

- Labour market conditions have eased, with job vacancies returning to near pre-pandemic levels and new jobs being created at a slower rate than population growth. However, wages are still rising around 4% to 5%

Global economic performance and outlook

- Global economic growth continues to slow, with inflation easing “gradually” across most economies

- While growth in the United States has been stronger than expected, it is anticipated to slow in 2024, with weakening consumer spending and business investment

- In the euro area, the economy looks to be in a mild contraction

- In China, low consumer confidence and policy uncertainty will likely restrain activity

- Oil prices are about $10 per barrel lower than was assumed in the Bank’s October Monetary Policy Report (MPR)

- Financial conditions have eased, largely reversing the tightening that occurred last autumn

- The Bank now forecasts global GDP growth of 2.5% in 2024 and 2.75% in 2025 compared to 2023’s 3% pace

- With softer growth this year, inflation rates in most advanced economies are expected to come down slowly, reaching central bank targets in 2025

Outlook

The Bank believes that Canadian economic growth will strengthen gradually “around the middle of 2024.” Furthermore, it expects household spending will likely “pick up” in the second half of 2024, and exports and business investment should get a boost from recovering foreign demand.

Taking all of these factors and forecasts into account, the Bank’s Governing Council decided to hold its policy rate at 5% and to continue to “normalize” the Bank’s balance sheet.

The Bank’s statement went on to note that Council “is still concerned about risks to the outlook for inflation, particularly the persistence in underlying inflation” and wants to see “further and sustained easing in core inflation.” The Bank also said it continues to focus on the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behaviour.

As it has said consistently over the past year, the Bank will remain “resolute in its commitment to restoring price stability for Canadians.”

Although the Bank did not say it, the bottom line is we will have to wait and see what comes next.

Next touchpoint

March 6, 2024 is the Bank’s next scheduled policy interest rate announcement.

The End of Prime Rate Increases, January, 2024, Canada

Horray, today The Bank of Canada didn’t just put rate hikes on the back burner today; it unplugged the stove!

The Bank is now “confident enough” that inflation is on the right track to not publicly dwell on rate hike risk any longer. That was today’s message from Senior Deputy Governor Carolyn Rogers after the BoC left its overnight rate at 5%.

Instead, the Bank says it’s now shifting its focus to “how long” the overnight rate needs to marinate “at the current level.”

Summary:

No more increases to the Canadian Prime Rate of Interest – at 7.2% today, after 10 increases in 2023.

Back in August I said Prime should start to come down in June – still the best guess – and

will come down by o.25% every 3 months, so one-quarter-percent decrease every calendar / fiscal quarter (3 months)

for a total of 2% less than today so … Prime should end up at 5.2% in 30 months, which is June 2026.

Mortgage Mark Herman, top Calgary Alberta and BC mortgage broker

“We need to give these higher interest rates time to do their work,” Macklem said, offering no clues on how long he’ll let the rate hike stew simmer. The forward market thinks it’ll take another 4 – 6 months. Historically, rates have plateaued at peak levels for anywhere from a few months to 17 months. So far, it’s been only 6.

The Bank says that higher rates can’t be completely ruled out, but it’s very rare for the Bank of Canada to hike a bunch, pause 5+ months, hike more, pause 5+ months more, and then hike again.

Canadian economy running too hot, BoC increases Prime by .25%

Hot Economic growth leads the Bank of Canada to increase its benchmark interest rate

Today, the Bank of Canada increased its overnight interest rate to 4.75% (+0.25% from April) because of higher-than-expected growth in Canada’s economy in the first quarter and the view that monetary policy was not yet restrictive enough to bring inflation down to target.

Leading up to today’s announcement, many economists feared that the BoC would have no choice but to raise rates in the face of persistent inflation and recent GDP growth. Their fears were founded.

To understand the Bank’s thinking on this important topic, we highlight its latest observations below:

Inflation facts and outlook

- In Canada, Consumer Price Index (CPI) inflation “ticked up in April” to 4.4%, the first increase in 10 months, with prices for a broad range of goods and services coming in higher than expected

- Goods price inflation increased, despite lower energy costs

- Services price inflation remained elevated, reflecting strong demand and a tight labour market

- The Bank continues to expect CPI inflation to ease to around 3% in the summer, as lower energy prices “feed through” and last year’s large price gains “fall out” of the yearly data

- However, with three-month measures of core inflation running in the 3.50%-4% range for several months and excess demand persisting, concerns have increased that CPI inflation could get stuck materially above the 2% target

Canadian housing and economic performance

- Canada’s economy was stronger than expected, with GDP growth of 3.1% in Q1 2023

- Consumption growth was “surprisingly strong and broad-based,” even after accounting for the boost from population gains

- Demand for services continued to rebound

- Spending on “interest-sensitive goods” increased and, more recently, “housing market activity has picked up”

- The labour market remains tight: higher immigration and participation rates are expanding the supply of workers but new workers have been quickly hired, reflecting continued strong demand for labour

- Overall, excess demand in the economy looks to be “more persistent” than anticipated

Global economic performance and outlook

- Globally, consumer price inflation is coming down, largely reflecting lower energy prices compared to a year ago, but underlying inflation remains stubbornly high

- While economic growth around the world is softening in the face of higher interest rates, major central banks are signalling that interest rates may have to rise further to restore price stability

- In the United States, the economy is slowing, although consumer spending remains surprisingly resilient and the labour market is still tight

- Economic growth has essentially stalled in Europe but upward pressure on core prices is persisting

- Growth in China is expected to slow after surging in the first quarter

- Financial conditions have tightened back to those seen before the bank failures in the United States and Switzerland

Summary and Outlook

The BoC said that based on the “accumulation of evidence,” its Governing Council decided to increase its policy interest rate, “reflecting our view that monetary policy was not sufficiently restrictive to bring supply and demand back into balance and return inflation sustainably to the 2% target.”

The Bank says quantitative tightening is complementing the restrictive stance of monetary policy and normalizing the Bank’s balance sheet.

Going forward, the Bank said it will continue to assess the dynamics of core inflation and the outlook for CPI inflation with particular focus on “ evaluating whether the evolution of excess demand, inflation expectations, wage growth and corporate pricing behaviour are consistent with achieving” its inflation target.

Once again, the Bank repeated its mantra that it “remains resolute in its commitment to restoring price stability for Canadians.”

Next up

With today’s announcement now behind us, a new round of speculation will begin in advance of the Bank’s next policy announcement on July 12th.

Odds of New Rates

Market odds now have a July 12 hike at a 61% probability, with potentially another increase by December.

Just 1 more Prime Rate increase would take the benchmark prime rate from 6.95% at the end of today to a nosebleed 7.20% (last seen in February 2001).

There may well be another Prime Rate increase on July. We have strategies to beat these rates so please call and we can sort out a situation that works for you.

Canadian Prime Rate is now 5.95% – Mortgage Rate Analysis to End of 2022

Bank of Canada increased benchmark interest rate to 3.75%

Today, the Bank of Canada increased its overnight benchmark interest rate 50 basis point to 3.75% from 3.25% in September. This is the sixth time this year that the Bank has tightened money supply to quell inflation, so far with limited results.

Some economists had assumed the increase this time around would be higher, but the BoC decided differently based on its expert economic analysis. We summarize the Bank’s observations below, including its all-important outlook:

Inflation at home and abroad

- Inflation around the world remains high and broadly based reflecting the strength of the global recovery from the pandemic, a series of global supply disruptions, and elevated commodity prices

- Energy prices particularly have inflated due to Russia’s attack on Ukraine

- The strength of the US dollar is adding to inflationary pressures in many countries

- In Canada, two-thirds of Consumer Price Index (CPI) components increased more than 5% over the past year

- Near-term inflation expectations remain high, increasing the risk that elevated inflation becomes entrenched

Economic performance at home and abroad

- Tighter monetary policies aimed at controlling inflation are weighing on economic activity around the world

- In Canada, the economy continues to operate in excess demand and labour markets remain tight while Canadian demand for goods and services is “still running ahead of the economy’s ability to supply them,” putting upward pressure on domestic inflation

- Canadian businesses continue to report widespread labour shortages and, with the full reopening of the economy, strong demand has led to a sharp rise in the price of services

- Domestic economic growth is “expected to stall” through the end of this year and the first half of next year as the effects of higher interest rates spread through the economy

- The Bank projects GDP growth will slow from 3.25% this year to just under 1% next year and 2% in 2024

- In the United States, labour markets remain “very tight” even as restrictive financial conditions are slowing economic activity

- The Bank projects no growth in the US economy “through most of next year”

- In the euro area, the economy is forecast to contract in the quarters ahead, largely due to acute energy shortages

- China’s economy appears to have picked up after the recent round of pandemic lockdowns, “although ongoing challenges related to its property market will continue to weigh on growth”

- The Bank projects global economic growth will slow from 3% in 2022 to about 1.5% in 2023, and then pick back up to roughly 2.5% in 2024 – a slower pace than was projected in the Bank’s July Monetary Policy Report

Canadian housing market

- The effects of recent policy rate increases by the Bank are becoming evident in interest-sensitive areas of the economy including housing

- Housing activity has “retreated sharply,” and spending by households and businesses is softening

Outlook

The Bank noted that its “preferred measures of core inflation” are not yet showing “meaningful evidence that underlying price pressures are easing.” It did however offer the observation that CPI inflation is projected to move down to about 3% by the end of 2023, and then return to its 2% target by the end of 2024. This presumably would be achieved as “higher interest rates help re-balance demand and supply, price pressures from global supply chain disruptions fade and the past effects of higher commodity prices dissipate.”

As a consequence of elevated inflation and current inflation expectations, as well as ongoing demand pressures in the economy, the Bank’s Governing Council said to expect that “the policy interest rate will need to rise further.”

The level of such future rate increases will be influenced by the Bank’s assessments of “how tighter monetary policy is working to slow demand, how supply challenges are resolving, and how inflation and inflation expectations are responding.”

In case there was any doubt, the Bank also reiterated its “resolute commitment” to restore price stability for Canadians and said it will continue to take action as required to achieve its 2% inflation target.

NEXT RATE INCREASE

December 7, 2022 is the BoC’s next scheduled policy interest rate announcement. We will follow the Bank’s commentary and outlook closely and provide an executive summary here the same day.

Nov 2021; Mortgage Rates & Inflation Report

This just in data is when mortgage interest rates are expected to rise.

DATA JUST IN

Canada’s latest employment and inflation numbers have triggered new expectations about the next steps by the Bank of Canada and the arrival of interest rate increases.

BoC Governor Tiff Macklem continues to offer soothing words about inflation, which is current running at 4.1%. That is an 18 year high and more than double the central bank’s 2.0% target.

Macklem has repeatedly said high inflation is temporary; the result of low prices during the pandemic lock-downs, and supply chain problems that have cropped-up as the economy reopens.

Macklem points out that a key factor in long term inflation – wage growth – has not materialized. That is despite Canada returning to pre-pandemic employment levels with the addition of 157,000 jobs in September. It should be noted that the growth of Canada’s labour force during the pandemic means the country is still 276,000 jobs short of full employment. Last week however, Macklem did concede that this temporary inflation may linger for longer than initially expected.

Several prominent economists have weighed-in. Benjamin Tal cautions that inflation is a lagging economic indicator. He says the risks for long-term inflation are present and the Bank of Canada would be better to start raising rates earlier to help mitigate those risks. Doug Porter says there is a growing chance rate increases will come earlier. He expects they will happen quarterly rather than every six months. And, Derek Holt would like to see a rate hike by the end of the year, given that emergency levels of stimulus are in place while inflation is well above target.

Look for mortgage interest rates to start going up close to the end of 2021 and continue until they are back close to PRE-Covid Rates of about 3.35% for the 5-year fixed.

Mortgage Mark Herman, best Calgary mortgage broker for the masses!

TD adds interest on interest

TD is/ was the 1st and only bank to charge higher mortgage prime rate for their mortgages.

TD is now the 1st of the big banks to now charge interest on their late-interest-owed:

https://globalnews.ca/news/6451352/td-credit-cards-compound-interest/

Inverted Yield Curves, Impacts on Prime Rate Changes and Variable Rate Mortgages

Summary:

For the 2nd time in 50 years the “Yield Curve” has inverted – meaning that long term rates are now lower than short term rates. This can signal a recession is on the way.

This Means …

- Alberta will look better comparatively to Canada’s hot housing markets which should finally cool down.

- Canada’s Prime rate increases look to be on hold until Spring. This makes the variable rates now look MUCH Better. There were 3 rate increases expected and these may not materialize – making the VARIABLE rate look better.

- Broker lender’s have VARIABLE rates that range between .1% and .65% BETTER than the banks do. If you are looking at variable rates we should look further into this in more detail.

DATA BELOW …

- More on the predictions on rate increases

- WTF is an inverted Yield Curve – lifted from “the Hustle”

-

Predictions on Prime

Three interest rate hikes in 2019 — that’s what economists have been predicting for months, as part of the Bank of Canada’s ongoing strategy to keep the country’s inflation levels in check. But, according to one economist, that plan may have changed.

The BoC held the overnight rate at 1.75 percent yesterday, and released a statement a senior economist at TD, believes hints that the next hike may not come until next spring.

“We no longer expect the Bank of Canada to hike its policy interest rate in January,” he writes, in a recent note examining the BoC’s decision. “Spring 2019 now appears to be the more likely timing.”

Meanwhile the Canadian rates and macro strategist at BMO, puts the odds of a rate hike in January at 50 percent.

“While the Bank reiterated its desire to get policy rates to neutral, the path to neutral is clearly more uncertain than just a couple of months ago,” he writes, in his most recent note. “Looking ahead to January, the BoC will likely need to be convinced to hike (rather than not).”

A VIDEO ON WHY VARIABLE RATE MAY BE THE WAY TO GO FOR YOUR PLANS

- https://vimeo.com/279581066

- This video is from my colleague Dustin Woodhouse and he perfectly presents the story on the variable. He also ONLY works in the BC Lower Mainland; if you live there HE should be doing your mortgage, if you don’t WE should be.

2. WTF is an ‘inverted yield curve,’ and what does it mean for the economy?

For the first time since 2007, the 2- to 5-year US Treasury yield curve has inverted. Historically, this has served as a somewhat reliable indicator of economic downturn, which means people are freaking out, which means…

OK, hold up: What exactly is a yield curve, and why is it inverting?

‘Lend long and prosper’ (so say the banks)

In short, a yield curve is a way to gauge the difference between interest rates and the return investors will get from buying shorter- or longer-term debt. Most of the time, banks demand higher interest for longer periods of time (cuz who knows when they’re gonna see that money again?!).

A yield curve goes flat when the premium for longer-term bonds drops to zero. If the spread turns negative (meaning shorter-term yields are higher than longer maturity debt), the curve is inverted…

Which is what is happening now

So what caused this? It’s hard to say — but we prefer this explanation: Since December 2015, the Fed has implemented a series of 6 interest rate hikes and simultaneously cut its balance sheet by $50B a month.

According to Forbes, the Fed has played a major part in suppressing long-term interest rates while raising short-term interest rates.

Yield curve + inversion = economic downturn (sometimes)

The data don’t lie. A yield curve inversion preceded both the first tech bubble and the 2008 market crash.

Though, this theory has had some notable “false positives” in its lifetime — so it’s not exactly a foolproof fortune teller.

Heck, IBM found the size of high heels tends to spike during hard times. As of now, the experts who believe the sky to be falling remain in the minority.

There is lots to digest in the data above. Please feel free to contact me to discuss in more detail.

Mark Herman, 403-681-4376

Top Calgary Alberta Mortgage Broker

Residential Market Update – Mortgage Rates to stay low for a while.

A great summary of where we are today in relation to the economy and the housing market.

There have been a couple of highlights for the Canadian housing market in the past week:

- the U.S. Federal Reserve announcement that it is committed to low interest rates until 2015 and

- the latest global housing outlook that puts this country in better shape than most.

Anyone looking for a new mortgage or a mortgage renewal will likely be heartened by the American central bank’s interest rate pledge. The commitment to low rates makes it harder, but not impossible, for the Bank of Canada to move on its desire to increase rates.

However, that desire got a boost from Canada’s economic think-tank, the C.D. Howe Institute. It says the central bank needs to change the way it calculates inflation to take into account rising house prices. The institute says the current calculation keeps inflation lower than it really is and puts the Bank of Canada at risk of keeping rates too low for too long.

As for the global housing outlook, it shows Canadian prices continue to rise, albeit more slowly than a year ago. But around the world, countries showing price declines outnumbered gainers by more than two to one.

The iPhone’s sexy, but ‘iSave’ is far smarter

With all the hype on the new iPhone 5, this puts it a bit into perspective.

Interesting 3 minute read.

The Globe and Mail

Published Monday, Sep. 17 2012, 8:10 PM EDT

The new Apple iPhone 5 tells us a lot about why you can’t get your financial act together.

The iPhone is a brilliant device – a deluxe cellphone that has become a cultural icon. So important is the iPhone 5 that the announcement of its features and release date – it’s Sept. 21 – were treated globally as a major media event. Who doesn’t now know that the iPhone 5 is 18 per cent thinner and 20 per cent lighter than its predecessor?

A man talks on a mobile phone in front of an Apple logo outside an Apple store in downtown Shanghai in this September 3, 2012 file photo. Although Apple makes billions from new phones, a significant portion of its sales in recent years have come from dropping the price on older models once a new phone or tablet hits stores REUTERS

Apple could sell 33 million iPhone 5s globally this quarter, a tribute to the company’s gadget-building supremacy. But iPhones are also symbolic of a change in society’s attitude toward money. We now get our gratification through spending money rather than by saving it.

The savings rate in Canada has been falling for decades, more or less in line with the decline in interest rates. Today, savings accounts offer less than 1 per cent in many cases and barely 2 per cent at best. As a result, a lot of us have come to believe that saving is useless, even foolish. And so, we’ve moved on to spending.

The iPhone 5 will sell for a suggested retail price between $699 and $899 (depending on how much memory it offers), but in the past it has been possible to pay much less if you sign up for a multi-year wireless phone plan. If an iPhone sounds like an affordable luxury, ask yourself these questions:

However much the phone costs, have I contributed at least that much money, and preferably much more, to my retirement savings this year?

Have I contributed anything at all to my kids’ registered education savings plan?

Do I have any money saved that I can tap if the car’s “check engine” light comes on, if the basement floods, if the orthodontist says my kid really needs braces or if I lose my job?

If you’re covered on all of this, enjoy your new iPhone. Otherwise, you might want to reconsider that purchase because your spending and saving are out of balance.

The roughest rule of saving is that you should be putting away 10 per cent of your take-home pay for the future in a tax-free savings account or a registered retirement or education savings fund. If you’re getting a late start as a saver, your number is higher.

External factors like wage freezes and inflation can affect our ability to save, and today’s low interest rates offer no encouragement. But the biggest impediment is in our own heads. We see more value in spending than in saving.

In a way, spending by consumers is a good thing because it accounts for roughly two-thirds of our economy. But spending takes away from saving in today’s zero-sum economy, where wage growth isn’t strong enough to put us ahead of inflation. The only way to save more is to spend less.

The iPhone and similar devices make that a challenge because of the way they draw you into a web of higher spending. You could buy a cheap cellphone and your wireless phone company would probably give it to you for free if you signed up for a service plan. A basic cellphone would mean simple data needs, so you could probably get away with an inexpensive plan.

With an iPhone, you’ll pay extra to buy the phone and likely face higher monthly plan costs. And then there’s the temptation to upgrade. An iPhone 5 bought this fall could be superseded by something better within 12 months. By then, there will probably be a new iPad and, who knows, but maybe Research In Motion will have turned some heads with the new BlackBerry 10. Every new product is competition for money you could otherwise use to save or pay down debt.

You’re urged to buy things all the time via mass media, but there’s no lobby for saving. Apple had Steve Jobs on its side. Savers are stuck with Benjamin Franklin, who said that a penny saved is a penny earned.

How can we get people saving more, then? By making it automatic, not discretionary. Have money electronically diverted from your chequing account to your RRSP, TFSA, RESP or a savings account every time you get paid. Have some money left over after the bills are paid? Hello, iPhone.

————

How the savings rate has tracked in the past 50 years

(data taken from first quarter from each year)

| 1962 | 6.50% |

| 1972 | 9.80% |

| 1982 | 21.20% |

| 1992 | 12.40% |

| 2002 | 4.80% |

| 2012 | 2.90% |

Source: Statistics Canada