Here is the near term expectations of mortgage interest rates.

Short version:

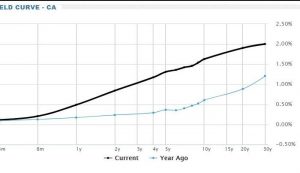

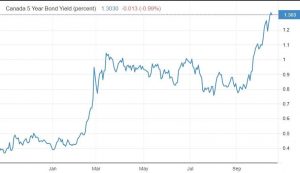

- 5 Year fixed are going up and never getting back down to where they are now.

- Variables are also great – right now they are Prime – 1% or 2.45% – 1% = 1.45%, and as below, should stay there until 2023! Almost 20 more months!

Both of these are awesome options right now.

Mortgage Mark Herman, Top Calgary Alberta mortgage broker for 1st time home buyers

THE DATA:

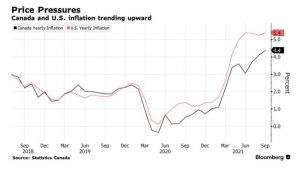

Bond traders believe inflation is going to be rising over the coming months and have been demanding increased bond yields. That has led to increasing interest rates for bonds and, consequently, increasing rates for the fixed-rate mortgages that are funded by those bonds.

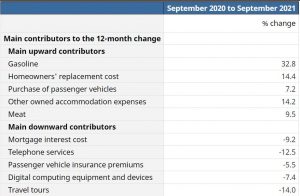

The traders say the COVID-19 vaccine rollout and plans for vast infrastructure spending – particularly in the U.S. – are boosting expectations of a broad recovery and an increase in inflation. Better than expected GDP growth in Canada and shrinking unemployment in the U.S. would tend to support those expectations.

This, however, puts the traders at odds with the central banks in both Canada and the United States.

The Bank of Canada and the U.S. Federal Reserve also expect inflation will climb as the pandemic fades and the economy reopens. There is a pent-up demand for goods and services, after all. The central banks see that as transitory, though, and appear to be looking past it. The U.S. Fed has gone so far as to alter its inflation target from 2% to an average of 2%, over time, thereby rolling any post-pandemic spikes into the bigger, longer-term calculations.

The Bank of Canada and the Fed have committed to keeping interest rates low, probably through 2023. Both say inflation will have to be sustained before interest rate moves are made to contain it. The integrated nature of the Canadian and American economies means it is unlikely the BoC will move on interest rates before the U.S. Fed.