Mortgage Rates Up Due to Inflation

|

|

|

|

|

|

|

|

EXPLAINER: Why & Where Inflation and Canadian Mortgage Interest Rates

Best answer I have seen yet is below … it still makes the 5-year fixed the better option right now (for most people)Mortgage Mark Herman, Top Calgary Mortgage Broker

The latest significant news was good, but modest. Canada’s unemployment rate dipped to 7.5% with the creation of 94,000 jobs in July. Most of those are full-time and in the private sector.

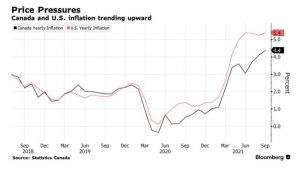

Employment levels are linked to inflation, which is a key factor watched by the Bank of Canada in setting interest rate policy which, in turn, can affect mortgage rates.

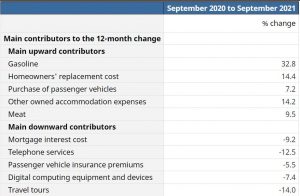

As the labour market tightens up, employers tend to offer higher wages to attract workers. That increases the cost of producing goods and services, driving inflation. As well, as more people get work and earn more money demand for goods and services increases. If that demand outpaces supply, inflation can also result.

Canada finds itself in this position now. Inflation is running high chiefly because of supply constraints caused by the pandemic. At the same time, more and more people are heading back to work.

That has some analysts forecasting the Bank of Canada will be raising rates to calm inflation. The Bank, however, has been saying otherwise.

It is also useful to watch what is happening in the United States. The two economies are tightly linked and actions in the U.S. can offer useful clues about what will happen here.

In its latest assessment of the American economy the U.S. Federal Reserve continued to down play inflation – which is running high there as well – as “transitory”. The Fed continues to look to the second half of 2023 as the most likely time for any possible rate hikes. While the Bank of Canada has said it expects rates could start rising as much as a year sooner than that, it would be unusual for the BoC to move before the Fed.

Inflation & Mortgage Interest Rates

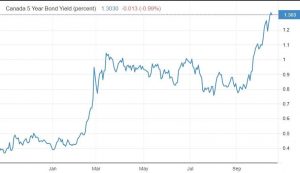

- 5 Year fixed are going up and never getting back down to where they are now.

- Variables are also great – right now they are Prime – 1% or 2.45% – 1% = 1.45%, and as below, should stay there until 2023! Almost 20 more months!

Both of these are awesome options right now.Mortgage Mark Herman, Top Calgary Alberta mortgage broker for 1st time home buyers

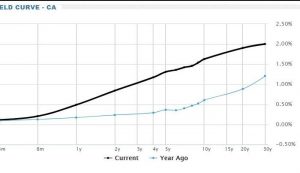

Bond traders believe inflation is going to be rising over the coming months and have been demanding increased bond yields. That has led to increasing interest rates for bonds and, consequently, increasing rates for the fixed-rate mortgages that are funded by those bonds.

The traders say the COVID-19 vaccine rollout and plans for vast infrastructure spending – particularly in the U.S. – are boosting expectations of a broad recovery and an increase in inflation. Better than expected GDP growth in Canada and shrinking unemployment in the U.S. would tend to support those expectations.

This, however, puts the traders at odds with the central banks in both Canada and the United States.

The Bank of Canada and the U.S. Federal Reserve also expect inflation will climb as the pandemic fades and the economy reopens. There is a pent-up demand for goods and services, after all. The central banks see that as transitory, though, and appear to be looking past it. The U.S. Fed has gone so far as to alter its inflation target from 2% to an average of 2%, over time, thereby rolling any post-pandemic spikes into the bigger, longer-term calculations.

The Bank of Canada and the Fed have committed to keeping interest rates low, probably through 2023. Both say inflation will have to be sustained before interest rate moves are made to contain it. The integrated nature of the Canadian and American economies means it is unlikely the BoC will move on interest rates before the U.S. Fed.