Prime Rate Holding, July 1st Expected Reduction & Real Estate Economic Data

The Bank of Canada cited the ongoing risk of inflation for its decision to maintain its overnight benchmark interest rate at 5.0%.

Below are the Bank of Canada’s observations, including its forward-looking comments on the state of the economy, inflation and interest rates.

Canadian inflation

- CPI inflation ended the year at 3.4% and the Bank expects inflation to remain close to 3% during the first half of 2024 “before gradually easing” and returning to the Bank’s 2% target in 2025

- Shelter costs remain “the biggest contributor to above-target inflation”

- While a slowdown in demand is said by the Bank to be reducing price pressures in a broader number of CPI components and corporate pricing behavior continues to normalize, core measures of inflation are not showing sustained declines.

Canadian economic performance and outlook

- The Bank notes that the Canadian economy has “stalled” since the middle of 2023 and believes growth will likely remain close to zero through the first quarter of 2024

- Consumers have pulled back their spending in response to higher prices and interest rates, and business investment has contracted

- With weak growth, supply has caught up with demand and the economy now looks to be operating in modest excess supply

- Labour market conditions have eased, with job vacancies returning to near pre-pandemic levels and new jobs being created at a slower rate than population growth. However, wages are still rising around 4% to 5%

Global economic performance and outlook

- Global economic growth continues to slow, with inflation easing “gradually” across most economies

- While growth in the United States has been stronger than expected, it is anticipated to slow in 2024, with weakening consumer spending and business investment

- In the euro area, the economy looks to be in a mild contraction

- In China, low consumer confidence and policy uncertainty will likely restrain activity

- Oil prices are about $10 per barrel lower than was assumed in the Bank’s October Monetary Policy Report (MPR)

- Financial conditions have eased, largely reversing the tightening that occurred last autumn

- The Bank now forecasts global GDP growth of 2.5% in 2024 and 2.75% in 2025 compared to 2023’s 3% pace

- With softer growth this year, inflation rates in most advanced economies are expected to come down slowly, reaching central bank targets in 2025

Outlook

The Bank believes that Canadian economic growth will strengthen gradually “around the middle of 2024.” Furthermore, it expects household spending will likely “pick up” in the second half of 2024, and exports and business investment should get a boost from recovering foreign demand.

Taking all of these factors and forecasts into account, the Bank’s Governing Council decided to hold its policy rate at 5% and to continue to “normalize” the Bank’s balance sheet.

The Bank’s statement went on to note that Council “is still concerned about risks to the outlook for inflation, particularly the persistence in underlying inflation” and wants to see “further and sustained easing in core inflation.” The Bank also said it continues to focus on the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behaviour.

As it has said consistently over the past year, the Bank will remain “resolute in its commitment to restoring price stability for Canadians.”

Although the Bank did not say it, the bottom line is we will have to wait and see what comes next.

Next touchpoint

March 6, 2024 is the Bank’s next scheduled policy interest rate announcement.

Updated: Using Disability Income to Qualify for a Canadian Mortgage: 2024

NOTE: this post has been updated in August 2024.

CAN DISABILITY INCOME BE USED TO QUALIFY FOR A CANADIAN MORTGAGE?

YES, it is possible to use disability income to qualify for a pre-approval or a full mortgage approval.

IMPORTANT:

We are ONLY able to use disability income AS A “TOP UP” WHEN YOU ARE BUYING WITH ANOTHER PERSON

- who has standard/ T4 employment income OR qualifies as SELF-EMPLOYED

- AND your file needs more income to “top-up” the qualification amount to get to your target mortgage amount.

Unfortunately, we are not able to use:

- Disability income where it is more than 50% of the income needed to qualify for the mortgage.

- AISH income – the lenders deem provincial supplements as to “risky” and only use “federal programs.”

- If either of these are your situation, we recommend going to an ATB Branch, not online but a BRANCH.

Below are a few clarifications on the typical disability incomes that the banks can use.

- Not all banks accept all types of disability income so we use a few different lenders to ensure we have all your bases covered.

NEXT STEP

Call or send me an email with your contact data so we can have a chat on the phone if you are needing to use a “TOP-UP” via disability income for your purchase.

- I answer from 9-9 x 363, am in the office from 10 – 6:30 most days, best time to call is between 11 am – 3 pm.

- No need to pre-book, just call!

- (How different is that?)

Long-term & Short-term Disability Pension/Insurance

If the borrower has a non-taxable income, the Bank, CMHC and Sagen allow the income to be grossed-up.

- Less than $30,000, this income may be increased by 25%

- At least $30,000, this income may be increased by 35%

Long-term disability: 100% of long-term disability income can be used.

Provide one of the following:

- Letter from the organization or from QPP confirming long-term or permanent disability. If the letter is outdated (over 120 days), current bank statements confirming the deposits are being made to the borrower’s account are also needed

- T4A(P) confirming disability income.

Short-term disability: 100% of the employment income can be used for short-term disability.

Provide the following:

- A letter from the employer confirming the borrower’s return date, position and salary with a verbal confirmation from the employer to ensure the date on the letter is correct. If the return date cannot be confirmed, the disability income can be used for qualifications.

Pension & Retirement Income/Life Annuity

Retirement pensions are fixed incomes, CPP (Canada Pension Plan), OAS (Old Age Security), GIS (Guaranteed Income Supplement), provincial pension plans and private/corporate pensions and must be Canadian pension and evident on Canadian tax return.

IF you are Splitting Retirement Income: In the case where the pension income is shared for tax purposes, the transferring spouse/common-law partner must be on file and only the amount that has not been transferred/split is admissible.

Provide the most recent two documents of the following depending on the source of the declared retirement income:

- Most recent NOA supported by T1 General

- RL-2 Slip

- T4A, T4A(P)

- Letter from the initiating party confirming the yearly pension amount

- Letter from the organization confirming income and permanency of income

- Copy of current bank statement showing the automatic deposit

- Copy of current monthly cheque stub

For CPP, OAS, QPP and GIS, only one relevant document for each source is required from the list above.

RRIF

Income from a RRIF is admissible if there is proof that the portfolio generates a sustainable income amount for the length of the term.

This is a tough one to nail down as the portfolio has to be sustainable and not “drained” over the term of the loan, as in, there will still be a substantial balance in 5 years, if the mortgage is a 5-year term.

Provide the following:

- The most recent NOA supported by T1 General

- Recent RRIF statement to show that the borrower has sufficient assets to support the indicated income for the length of the term

First Nations

This is a non-taxable income. The income can be grossed-up as follows:

- Less than $30,000, this income may be increased by 25%

- At least $30,000, this income may be increased by 35%

Provide the following:

- Copy of the status card needed.

“We use disability income all the time in our practice to top-up mortgage amounts and have access to the banks and lenders that allow it’s use.

Mortgage Mark Herman, top Calgary Alberta and BC mortgage broker, for 21 years.

Underlying Economic data on BoC holding Prime rate the same, December 5, 2023

Bank of Canada holds its policy interest rate steady, updates its outlook

Against the backdrop of a decelerating economy and growing calls for less restrictive monetary policy, the Bank of Canada made its final scheduled interest rate decision of the year today.

That decision – to keep its overnight policy interest rate at 5.00% – was broadly expected. What was not entirely expected (or welcome) was the Bank’s statement that it is “still concerned” about risks to the outlook for inflation and “remains prepared to raise” its policy rate “further” if needed.

The Bank’s observations are captured in the summary below.

Since August, we have been saying the VARIABLE RATE mortgage is the way to go, and this proves we were right on the money.

Mortgage Mark Herman, top Calgary Alberta and Victoria BC mortgage broker

Inflation facts and housing market commentary

- A slowdown in the Canadian economy is reducing inflationary pressures in a “broadening range” of goods and services prices

- Combined with a drop in gasoline prices, this contributed to easing of CPI inflation to 3.1% in October

- However, “shelter price inflation” picked up, reflecting faster growth in rent and other housing costs along with the continued contribution from elevated mortgage interest costs

- In recent months, the Bank’s preferred measures of core inflation have been around 3.5-4%, with the October data coming in towards the lower end of this range

- Wages are still rising by 4-5%

Canadian economic performance

- Economic growth “stalled through the middle quarters of 2023 with real GDP contracting at a rate of 1.1% in the third quarter, following growth of 1.4% in the second quarter

- Higher interest rates are clearly restraining spending: consumption growth in the last two quarters was close to zero, and business investment has been volatile but essentially flat over the past year

- Exports and inventory adjustment “subtracted” from GDP growth in the third quarter, while government spending and new home construction provided a boost

- The labour market continues to ease: job creation has been slower than labour force growth, job vacancies have declined further, and the unemployment rate has risen modestly

- Overall, these data and indicators for the fourth quarter suggest the economy is “no longer in excess demand”

Global economic performance and outlook

- The global economy continues to slow and inflation has eased further

- In the United States, growth has been stronger than expected, led by robust consumer spending, but is “likely to weaken in the months ahead” as past policy rate increases work their way through the economy

- Growth in the euro area has weakened and, combined with lower energy prices, has reduced inflationary pressures

- Oil prices are about $10-per-barrel lower than was assumed in the Bank’s October Monetary Policy Report

- Financial conditions have also eased, with long-term interest rates “unwinding” some of the sharp increases seen earlier in the autumn. The US dollar has weakened against most currencies, including Canada’s

Summary and Outlook

Despite (or in the Bank’s view because of) further signs that monetary policy is moderating spending and relieving price pressures, it decided to hold its policy rate at 5% and to continue to normalize its balance sheet.

The Bank also noted that it remains “concerned” about risks to the outlook for inflation and remains prepared to raise its policy rate further if needed. The Bank’s Governing Council also indicated it wants to see further and sustained easing in core inflation, and continues to focus on the balance between demand and supply in the economy, inflation expectations, wage growth, and “corporate pricing behaviour.”

Once again, the Bank repeated its mantra that it “remains resolute in its commitment to restoring price stability for Canadians.” As a result, we will have to wait until next year for any sign of rate relief.

What’s next?

The Bank’s next interest rate announcement lands on January 24, 2024.

In the meantime, please feel free to call me and discuss financing options that will empower you in this economic cycle, and the ones ahead.

Canadian Mortgage Data – Nov 14

There has been a little relief for mortgage shoppers in recent days.

- Fixed-rates have come down slightly, led by declining yields for government bonds.

- Variable-rate mortgages appear to be maintaining their discounts and most market watchers believe the Bank of Canada has reached the top of this rate-hiking cycle.

The Bank, however, continues to warn that Canadians should be preparing for interest rates to remain higher for longer. Senior Deputy Governor Carolyn Rogers made that point again during a recent speech in Vancouver, saying it is important to adjust proactively to that possibility. Rogers cited a number of global considerations for higher rates including: China and other developing nations joining the worldwide economy; a decline in attractive investment opportunities for businesses; and an overall, international, adjustment to higher rates.

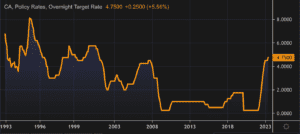

It is also useful to remember that central banks around the world have been working to normalize interest rates that have been at historic lows since the 2008 financial crisis.

Rogers offered some reassurance that Canadians are adjusting to higher rates. Household credit growth has dropped to its slowest pace since the early ’90s. Delinquency rates on credit cards and other consumer loans are only slightly above pre-pandemic levels. Mortgage delinquencies are below pre-pandemic levels, and that is despite about 40% of all mortgage holders having already renewed at higher rates, with bigger payments.

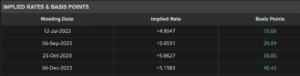

As to when interest rates might actually start falling? The BoC’s Q3 survey of “Market Participants” suggests they are adjusting to the higher-for-longer scenario. Based on the median response they are expecting a quarter point drop in April, 2024. That is a month later than expectations expressed in the Bank’s Q2 survey.

Finally some good news for buyers.

Buy soon before everyone that did not buy sees this data and tries to by tool

Mortgage Mark Herman – top, best Calgary mortgage broker

When Will Canadian Mortgage Rates Begin to Fall?

Last week, the Bank of Canada held its policy rate at 5%. The decision was expected given slowing in the economy and modest improvement to core inflation measures.

The Bank is likely at the end of its tightening cycle. How soon it eases rates – and how low will rates go in the near to medium term – is the question #1

ANSWER: The general view from market economists is that we could see some easing of the overnight rate by mid-2024.

Question #2: How low. how far will Prime come down?

ANSWER: Prime is expected to come down a total of 2%.

DETAILS of Prime Cuts

- Prime is 7.2% now / November 2nd, 2023,

- Prime is expected to get down to to 5.2% or a bit lower, like 4.75% – 5.25% range by the end 2025; which looks like this:

- June/ July 2024, 1st Prime cuts = 6 months

- Prime reduction by o.25% every quarter = 1% less / year for the next 2 years = 24 months

- so these together = 30 months.

With Prime coming down, now is the time for you to take advantage of the Variable Rate reductions.

Variable Rates via brokers are at Prime – o.9%, while the Big-6 banks rates are Prime – o.15%.

YES, broker rates are 6x better than at the Big-6 lenders, o.9 – o.15 = o.75% better. It’s true!

Mortgage Mark Herman; Best Top Calgary Mortgage Broker for first time home buyers.

When might rates begin to fall?

The Bank’s latest Monetary Policy Report (MPR) also provides signals that we can monitor to gauge when rates could start declining.

When interest rates rise, one of the main ways monetary policy affects the economy is through reduced consumer spending on durable goods, like appliances, furniture and cars. Prices for durable goods, except for cars, have dropped from 5.4% to -0.4%, while prices for semi-durable goods, like food and clothing, have decreased from 4.3% to 2.1%. We’re still experiencing delays in delivering cars. As a result, manufacturers are concentrating on selling more expensive vehicles with higher margins and are offering fewer discounts from list prices.

Inflation in service prices, excluding shelter, has slowed from 5.1% to 1.5%. If bond rates begin to drop, we will see a gradual decline in mortgage costs. The challenge will be rental costs, which are soaring due to the very limited availability of rentals and the continuous influx of newcomers. Increasing housing supply is key to reducing rental prices. However, that is a problem that will take years to resolve given the significant shortage of housing.

Currently, the Bank is concerned about inflation expectations, corporate pricing behaviour, and wage growth. As noted in its Monetary Policy Report, “As excess demand eases, inflation is expected to slow. At the same time, inflation expectations should also fall, businesses’ pricing behaviour should normalize, and wage growth should moderate. So far, progress has occurred but somewhat more slowly than anticipated.”

The Bank will be careful to ensure that inflation expectations inconsistent with its 2% target are not embedded in corporate pricing and wage expectations. A slowing economy should help to lower those expectations.

The general view from market economists is that we could see some easing of the overnight rate by mid-2024.

NERD STUFF: Maintaining a restrictive rate policy

The Bank can maintain a restrictive policy even without increasing rates any further, simply by keeping rates at their current level. With the overnight rate at 5% and an inflation rate of 3.8%, the real policy rate is 1.2%. This rate is restrictive, since it is higher than the neutral real rate of interest, which the Bank estimates to be between 0 and 1%.

The neutral real rate of interest is the level of interest that neither stimulates nor restrains economic growth. In other words, it is the rate at which the economy is in balance, with stable prices and full employment. Therefore, when the real rate of interest is restrictive, we would expect GDP to slow.

In its recent Monetary Policy Report (MPR), the Bank is forecasting economic growth to average less than 1% over the next few quarters, while potential output growth is expected to average 2%, mainly due to population growth and increased labor productivity. This should lead to a negative output gap (low demand and a surplus of products) and lower inflation.

Canadian Economic Forecast – Nov- Mortgage related use

Bank of Canada holds its interest rate steady, publishes updated economic forecasts

On October 25th, the Bank of Canada announced that it would maintain its Canadian Prime Rate stays at 7.3% – stating that there is “growing evidence” that past interest rate increases are dampening economic activity and relieving price pressures.

This decision provides some comfort to borrowers who have seen their mortgage costs rise steadily since March of 2022. As for real relief – in the form of rate cuts – the Bank demurred, noting that its preferred measures of core inflation show “little downward momentum.” Consequently, the Bank said it is holding this policy rate and continuing its current policy of quantitative tightening.

We capture the Bank’s observations and its latest economic forecasts in the summary below.

Inflation facts and outlook

- In Canada, inflation measured by the Consumer Price Index (“CPI”) has been volatile in recent months: 2.8% in June, 4.0% in August, and 3.8% in September

- Higher interest rates are moderating inflation in many goods that people buy on credit, and this is spreading to services

- Food inflation is easing from very high rates; however, in addition to elevated mortgage interest costs, inflation in rent and other housing costs remains high

- Near-term inflation expectations and corporate pricing behavior are normalizing only gradually, and wages are still growing around 4% to 5%

- The Bank’s preferred measures of core inflation show little downward momentum

Canadian housing and economic performance

- There is growing evidence that past interest rate increases are dampening economic activity and relieving price pressures

- Consumption has been subdued, with softer demand for housing, durable goods and many services

- Weaker demand and higher borrowing costs are weighing on business investment

- A surge in Canada’s population is easing labour market pressures in some sectors while adding to housing demand and consumption

- In the labour market, recent job gains have been below labour force growth and job vacancies have continued to ease; however, the labour market remains “on the tight side” and wage pressures persist

- Overall, a range of indicators suggest that supply and demand in the economy are now “approaching balance”

Global economic performance and outlook

- The global economy is slowing and growth is forecast to moderate further as past increases in policy interest rates and the recent surge in global bond yields weigh on demand

- The Bank projects global GDP growth of 2.9% this year, 2.3% in 2024 and 2.6% in 2025. While this outlook is little changed from the Bank’s July Monetary Policy Report, the composition has shifted, with the US economy proving stronger and economic activity in China weaker than expected

- Growth in the Euro area has “slowed further”

- Inflation has been easing in most economies, as supply bottlenecks resolve and weaker demand relieves price pressures but underlying inflation is persisting, meaning central banks must “continue to be vigilant”

- Oil prices are higher than the BoC assumed in July, and the war in Israel and Gaza is a new source of geopolitical uncertainty

Summary and Outlook

The BoC noted that after averaging 1% over the past year, economic growth is expected to remain “weak” for the next year before increasing in late 2024 and through 2025. Near-term weakness in growth reflects both the broadening impact of past increases in interest rates and slower foreign demand. The subsequent economic “pickup” will be driven by household spending as well as stronger exports and business investment in response to improving fore

ign demand. Spending by governments contributes materially to growth over the forecast horizon. Overall, the Bank expects the Canadian economy to grow by 1.2% this year, 0.9% in 2024 and 2.5% in 2025.

In the Bank’s October projection, CPI inflation is expected to average about 3.5% through the middle of next year before gradually easing to 2% in 2025. Inflation is expected to return to the Bank’s target about the same time as policymakers forecast in their July 2023 projection, “but the near-term path is higher because of energy prices and ongoing persistence in core inflation.”

As for what to expect going forward, the Bank had this to say about interest rates: “With clearer signs that monetary policy is moderating spending and relieving price pressures, Governing Council decided to hold the policy rate at 5% and to continue to normalize the Bank’s balance sheet. However, Governing Council is concerned that progress towards price stability is slow and inflationary risks have increased, and is prepared to raise the policy rate further if needed.”

The message is therefore clear: the Bank wants to see downward momentum in core inflation before it changes tack, and continues to be focused on the “balance between demand and supply in the economy, inflation expectations, wage growth and corporate pricing behaviour.”

Once again, the Bank ended its communique with a familiar phrase: it remains “resolute in its commitment to restoring price stability for Canadians.”

What’s next?

The Bank’s final (scheduled) interest rate announcement of 2023 takes place December 6th and we will follow immediately after with our next executive summary.

Persistent inflation leads the Bank of Canada to increase benchmark interest rate

UGH! The BoC whacks borrowers again.

Mark Herman, Top Calgary Alberta Mortgage Broker

Yesterday, the Bank of Canada increased its overnight interest rate to 5.00% (+0.25% from June) because of the “accumulation of evidence” that excess demand and elevated core inflation are both proving more persistent and after taking into account its “revised outlook for economic activity and inflation.”

This decision was not unexpected by analysts but is disconcerting – as is the Bank’s pledge to continue its policy of quantitative tightening.

To understand today’s decision and the Bank’s current thinking on inflation, interest rates and the economy, we highlight its latest observations below:

Inflation facts and outlook

- In Canada, Consumer Price Index (CPI) inflation eased to 3.4% in May, a “substantial and welcome drop from its peak of 8.1% last summer”

- While CPI inflation has come down largely as expected so far this year, the downward momentum has come more from lower energy prices, and less from an easing of “underlying inflation”

- With the large price increases of last year removed from the annual data, there will be less near-term “downward momentum” in CPI inflation

- Moreover, with three-month rates of core inflation running around 3.5% to 4% since last September, “underlying price pressures appear to be more persistent than anticipated”, an outcome that is reinforced by the Bank’s business surveys, which found businesses are “still increasing their prices more frequently than normal”

- Global inflation is easing, with lower energy prices and a decline in goods price inflation; however, robust demand and tight labour markets are causing persistent inflationary pressures in services

Canadian housing and economic performance

- Canada’s economy has been stronger than expected, with more momentum in demand

- Consumption growth was “surprisingly strong” at 5.8% in the first quarter

- While the Bank expects consumer spending to slow in response to the cumulative increase in interest rates, recent retail trade and other data suggest more persistent excess demand in the economy

- The housing market has seen some pickup

- New construction and real estate listings are lagging demand, which is adding pressure to prices

- In the labour market, there are signs of more availability of workers, but conditions remain tight, and wage growth has been around 4-5%

- Strong population growth from immigration is adding both demand and supply to the economy: newcomers are helping to ease the shortage of workers while also boosting consumer spending and adding to demand for housing

Global economic performance and outlook

- Economic growth has been stronger than expected, especially in the United States, where consumer and business spending has been “surprisingly” resilient

- After a surge in early 2023, China’s economic growth is softening, with slowing exports and ongoing weakness in its property sector

- Growth in the euro area is effectively stalled: while the service sector continues to grow, manufacturing is contracting

- Global financial conditions have tightened, with bond yields up in North America and Europe as major central banks signal further interest rate increases may be needed to combat inflation

- The Bank’s July Monetary Policy Report projects the global economy will grow by “around 2.8% this year and 2.4% in 2024, followed by 2.7% growth in 2025”

Summary and Outlook

As higher interest rates continue to work their way through the economy, the BoC expects economic growth to slow, averaging around 1% through the second half of 2023 and the first half of next year. This implies real GDP growth of 1.8% in 2023 and 1.2% in 2024. The Canadian economy will then move into “modest excess supply” early next year before growth picks up to 2.4% in 2025.

In its July Monetary Policy Report, the Bank noted that CPI inflation is forecast to “hover” around 3% for the next year before gradually declining to 2% in the middle of 2025. This is a slower return to target than was forecast in its January and April projections. As a result, the Bank’s Governing Council remains concerned that progress towards its 2% inflation target “could stall, jeopardizing the return to price stability.”

In terms of what Canadians can expect in the near term, the Bank had this to say: “Quantitative tightening is complementing the restrictive stance of monetary policy and normalizing the Bank’s balance sheet. Governing Council will continue to assess the dynamics of core inflation and the outlook for CPI inflation. In particular, we will be evaluating whether the evolution of excess demand, inflation expectations, wage growth and corporate pricing behaviour are consistent with achieving the 2% inflation target. The Bank remains resolute in its commitment to restoring price stability for Canadians.”

Stay tuned

September 6th, 2023 is the Bank’s next scheduled policy rate announcement. Will there be 1x more increase?

Canadian economy running too hot, BoC increases Prime by .25%

Hot Economic growth leads the Bank of Canada to increase its benchmark interest rate

Today, the Bank of Canada increased its overnight interest rate to 4.75% (+0.25% from April) because of higher-than-expected growth in Canada’s economy in the first quarter and the view that monetary policy was not yet restrictive enough to bring inflation down to target.

Leading up to today’s announcement, many economists feared that the BoC would have no choice but to raise rates in the face of persistent inflation and recent GDP growth. Their fears were founded.

To understand the Bank’s thinking on this important topic, we highlight its latest observations below:

Inflation facts and outlook

- In Canada, Consumer Price Index (CPI) inflation “ticked up in April” to 4.4%, the first increase in 10 months, with prices for a broad range of goods and services coming in higher than expected

- Goods price inflation increased, despite lower energy costs

- Services price inflation remained elevated, reflecting strong demand and a tight labour market

- The Bank continues to expect CPI inflation to ease to around 3% in the summer, as lower energy prices “feed through” and last year’s large price gains “fall out” of the yearly data

- However, with three-month measures of core inflation running in the 3.50%-4% range for several months and excess demand persisting, concerns have increased that CPI inflation could get stuck materially above the 2% target

Canadian housing and economic performance

- Canada’s economy was stronger than expected, with GDP growth of 3.1% in Q1 2023

- Consumption growth was “surprisingly strong and broad-based,” even after accounting for the boost from population gains

- Demand for services continued to rebound

- Spending on “interest-sensitive goods” increased and, more recently, “housing market activity has picked up”

- The labour market remains tight: higher immigration and participation rates are expanding the supply of workers but new workers have been quickly hired, reflecting continued strong demand for labour

- Overall, excess demand in the economy looks to be “more persistent” than anticipated

Global economic performance and outlook

- Globally, consumer price inflation is coming down, largely reflecting lower energy prices compared to a year ago, but underlying inflation remains stubbornly high

- While economic growth around the world is softening in the face of higher interest rates, major central banks are signalling that interest rates may have to rise further to restore price stability

- In the United States, the economy is slowing, although consumer spending remains surprisingly resilient and the labour market is still tight

- Economic growth has essentially stalled in Europe but upward pressure on core prices is persisting

- Growth in China is expected to slow after surging in the first quarter

- Financial conditions have tightened back to those seen before the bank failures in the United States and Switzerland

Summary and Outlook

The BoC said that based on the “accumulation of evidence,” its Governing Council decided to increase its policy interest rate, “reflecting our view that monetary policy was not sufficiently restrictive to bring supply and demand back into balance and return inflation sustainably to the 2% target.”

The Bank says quantitative tightening is complementing the restrictive stance of monetary policy and normalizing the Bank’s balance sheet.

Going forward, the Bank said it will continue to assess the dynamics of core inflation and the outlook for CPI inflation with particular focus on “ evaluating whether the evolution of excess demand, inflation expectations, wage growth and corporate pricing behaviour are consistent with achieving” its inflation target.

Once again, the Bank repeated its mantra that it “remains resolute in its commitment to restoring price stability for Canadians.”

Next up

With today’s announcement now behind us, a new round of speculation will begin in advance of the Bank’s next policy announcement on July 12th.

Odds of New Rates

Market odds now have a July 12 hike at a 61% probability, with potentially another increase by December.

Just 1 more Prime Rate increase would take the benchmark prime rate from 6.95% at the end of today to a nosebleed 7.20% (last seen in February 2001).

There may well be another Prime Rate increase on July. We have strategies to beat these rates so please call and we can sort out a situation that works for you.

BoC Holds Canadian Prime at 6.7% on April 12th – Good News!

Today, April 12, 2023, the Bank of Canada held its policy interest rate at 4.50%, a welcome outcome for borrowers after almost a year of constant increases, and a timely confidence-builder for the real estate industry as it enters the spring market.

The Bank also issued its latest Monetary Report with updated risk assessments and base-case projections for inflation.

We highlight the Bank’s latest observations below.

Inflation acts and outlook

- In Canada, the Consumer Price Index (CPI) inflation eased to 5.2% in February, and the Bank’s preferred measures of core inflation were just under 5%

- The Bank expects Canadian CPI inflation to “fall quickly” to around 3% in the middle of 2023 and then decline more gradually to the 2% target by the end of 2024

- Recent data is reinforcing Governing Council’s “confidence” that inflation will continue to decline in the next few months

- Similarly, in many countries, inflation is easing in the face of lower energy prices, normalizing global supply chains, and tighter monetary policy

- At the same time, labour markets remain “tight” and measures of core inflation in many advanced economies suggest persistent price pressures, especially for services

Canadian economic performance and outlook

- Domestic demand is still exceeding supply and the labour market remains tight

- Economic growth in the first quarter looks to be stronger than was projected in January, on a “bounce” in exports and solid consumption growth

- While the Bank’s Business Outlook Survey suggests acute labour shortages are starting to ease, wage growth remains elevated relative to productivity growth

- Strong population gains are adding to labour supply and supporting employment growth while also boosting aggregate consumption

- Softening foreign demand is expected to restrain exports and business investment

- Overall, GDP growth is projected to be weak through the remainder of this year before strengthening gradually next year, implying the Canadian economy will move into excess supply in the second half of this year

- The Bank now projects Canada’s economy will grow by 1.4% this year – an improvement over its last forecast of 1% growth – 1.3% in 2024 (a downgrade from its last forecast of 2% for 2024) and then pick up to 2.5% in 2025

Canadian housing market

- Housing market activity remains subdued

- As more households renew their mortgages at higher rates and restrictive monetary policy works its way through the economy more broadly, consumption is expected to moderate this year

Global economic performance and outlook

- The Bank’s April Monetary Policy Report projects global growth of 2.6% in 2023 – an improvement over its last forecast of 2% offered in January – and then fall to 2.1% in 2024 (lower than it last forecast of 2.5%), and rise to 2.8% in 2025

- Recent global economic growth has been stronger than anticipated with performance in the United States and Europe surprising on the upside

- However, growth in those regions is expected to weaken as tighter monetary policy continues to feed through those economies

- In particular, US growth is expected to “slow considerably” in the coming months, with particular weakness in sectors that are important for Canadian exports

- Activity in China’s economy has rebounded, particularly in services

- Overall, commodity prices are close to their January levels

Outlook

While holding the line on interest rates, the Bank also noted in today’s announcement that it is continuing its policy of quantitative tightening and remains “resolute in its commitment to restoring price stability for Canadians.” There was nothing new in that statement. However, it also posited that getting inflation the rest of the way back to 2% “could prove to be more difficult because inflation expectations are coming down slowly, service price inflation and wage growth remain elevated, and corporate pricing behaviour has yet to normalize.”

As it sets monetary policy going forward, the Bank’s Governing Council indicated that it will be “particularly focused” on these indicators, and the evolution of core inflation as it gauges the progress of returning CPI inflation back to its 2% target.

The Bank also said it continues to assess whether monetary policy is “sufficiently restrictive” to relieve price pressures and “remains prepared to raise the policy rate further if needed” to return inflation to its 2% target.

Next Announcement is …

We will have to wait until April 20th to get the next CPI reading to gauge progress in one of the Bank’s determining indicators and June 7th for the Bank’s next scheduled policy interest rate announcement.

Inflation is slowing and that is great news for Canadian home buyers

Mortgage Mark Herman, Top Calgary Alberta Mortgage Broker

Using Return-To-Work Income while on Maternity Leave to buy a home IS possible in Canada.

Using Return-To-Work Income while on Maternity Leave to buy a home IS possible in Canada.

Are you on maternity leave and trying to buy a home, but the bank will not use your income? This is a common reason home buyers find us on the internet or their realtors send them to us.

We CAN use your FULL RETURN TO WORK SALARY as qualifying income, if you have a “return to work date” that is less than 12 months away from your home purchase possession date.

Big-6 banks do not do this and we have no idea why. It frustrates everyone, and broker lenders have no issue with it.

Mortgage Mark Herman, Top-Best Calgary mortgage broker near me.

And while we are it – our lenders also use CCB – Canadian Child tax Benefit – for all children aged UNDER 16, when the mortgage starts.

Big-6 banks don’t use this … not sure why that is.

What else about Broker Lenders?

Broker lenders are all secure, and many are publicly traded, and all are audited by the same staff the investigate all of the Big-6 banks.

Broker lenders also have payout penalties that are 500% to 800% LESS than the way Big-6 banks do it. Here are the links for that specific data on my blog:

- General explanation: http://markherman.ca/payout-penalties-how-the-big-5-banks-get-you/

- Details of all the lenders and their specific math: http://markherman.ca/fixed-rate-mortgage-penalties-larger-than-ever/

Broker lenders ALWAYS renew you are best rates, while Big-6 banks know that 86% of mortgages that renew will take the 1st offer so they “bump the rate” on you. Then you have to call in/ go in to chisel them down.

- At broker lenders, they expect you to call us to check the rates and we would jump at the chance to move you to a different lender and get paid again … so you get best rates with broker banks.

There is lots more to … call to find out.

Mortgage Mark Herman, licensed in Alberta since 2004.

403-681-4376