Advice on Mortgage Renewals Before April 2026 from an MBA

Questions on what product to pick for your upcoming mortgage renewal.

Here are the reasons that we like the 5 year fixed for Canadian mortgage renewals over the next few months.

(renewals from now, February 2nd until April 1st.)

This data is recent and should be good for the next few months.

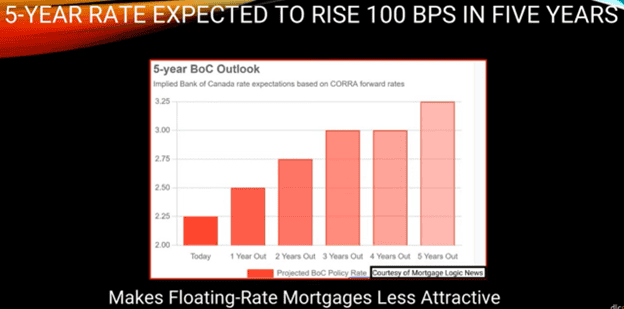

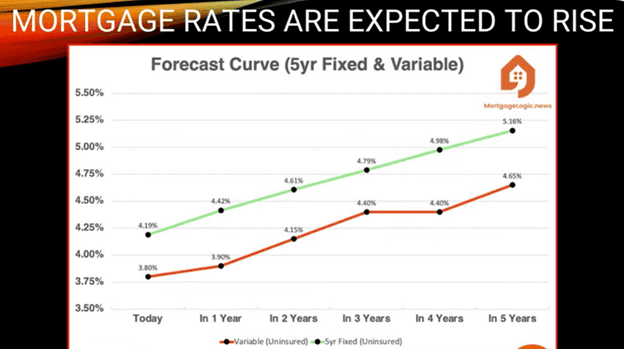

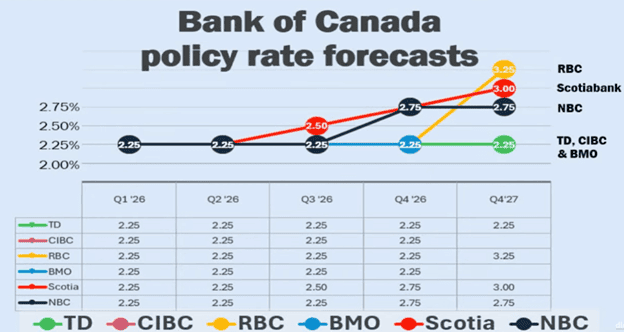

Below are the graphs that show that rates are trending up and are on the increase.

Q: Why are rates trending up?

A: Because Trump policy is generally inflationary, and add in the “cost of uncertainty” due to changing tariffs and other world political issues we have an increasing rate environment.

Big Picture Perspective

I also look at from this perspective, rates were close to 4% BEFORE Covid in 2020, and we are now back to about the same; 3.99% for a 3-year fixed and 4.25% to 4.54% for a 5 year fixed rate term.

- Comparing these rates, there is not much room for rates to go down; maybe .5%, half a percent.

- But there is lots of room for them to go up.

What if things get out of hand and rates are at 6% or 7%?

When I started out in 2004, my first customer’s rate was 8.99% and they were happy it did not start with a 9. (You always remember your first deal.)

Summary

The rates for the 3 year fixed and the 5 year fixed are similar so take the 5 year and know you are getting a good rate at the bottom of the rate cycle.

If you take the 3 year and rates DO go up, and you then renew 2 years sooner into what could be 6% or 7% rate environment (when you could have had 2 more years at 4.zz%.) You will be pretty upset as your new monthly payment would now be higher even though your balance is lower.

If you take the 3 year fixed and the rates stay low then you gain a slightly lower payment ($25/ month) over the first 3 years.

Most of our customers agree the safer bet is less expensive when you factor in how sound you will sleep at night.

Mortgage Mark Herman, best Calgary broker for mortgage renewals and advice.

Summary of Mortgage Rule Changes

Key Mortgage Rule Updates

30-year amortization for insured mortgages

Starting December 15, 2024, 30-year amortizations will be available for insured mortgages. This option is open to first-time homebuyers and those purchasing newly built homes, including condos.

Higher insured mortgage limits

Applications for insured mortgages will now be accepted for properties valued under $1.5 million, giving more buyers access to high-value homes with lower down payment requirements.

Stress test simplification

In line with OSFI’s guidance, current stress test requirements will continue for insurable, uninsurable, and uninsured applications. Eligible insured transfers and switches will remain qualified at the contract rate.

How these changes benefit you

✔️ Reduced monthly payments

Extending amortizations to 30 years will lower monthly payments, helping clients manage affordability amidst rising living costs and fluctuating interest rates.

It usually works out to reduce your payment by 9% or lets yo buy 9% more home (increases the mortgage amount but about 9%.)

✔️ Expanded opportunities for buyers

Higher insured mortgage limits make it possible for more Canadians to purchase homes in competitive urban markets like Toronto and Vancouver for up to $1,500,000 with 5% down on the 1st 500k and 10% down payment on the balance.

This set of mortgage rule changes should make it easier for buyers to get into a home now.

More importantly, it lets buyers purchase up to $1.5M with $125k down, where before they would have topped out at $1m with $75k down payment.

- Mortgage Mark Herman, top best Calgary mortgage broker,

- 403,681-4376

Typical income documentation requirements – Canadian mortgage

Below are the typical income documentation requirements for each type of income.

-

Salaried employees & commission income

Salaried

Salaried and hourly employees may need to supply:

- A job letter and a recent pay stub to show consistent salary

If your hours aren’t guaranteed or if there is a lot of overtime, you may also be asked for a 2-year income history.

Commissioned

Commissioned salespeople typically need the same documents as a salaried employee except they may also need to provide:

- 2 years of T1 Generals with corresponding NOA’s – Notice of Assessments to establish a 2-year income average.

-

Self-employed: Incorporated & Sole Proprietor

Incorporated

Self-employed clients who are incorporated and can provide traditional income verification may need to supply:

- Most current T1 General including statements of business activities. To establish a stable income, but also so a lender can see your sources of income.

- Confirmation of no taxes owed

- Accountant prepared company financials supported by business bank statements. To establish your company is in good financial standing and to compare the income level being pulled out of the company is sustainable.

- Current corporate search to confirm business ownership.

Sole Proprietor

Self-employed clients who are sole proprietors and can provide traditional income verification may need to supply:

- Most current T1 General including statements of business activities. To establish a stable income, and so a lender can see their sources of income.

- Confirmation no taxes owed

- One of the following: Business license/registration, trade license, or GST registrations/returns to prove business ownership/partnership

Alternative provable income & other documentation

Alternative provable income verification

This is a proprietary, specialized approach using gross-ups and add-backs available.

Alternative verification of income can be provided via the following documents:

Sole proprietor/partnership

- Most current T1 General

- Confirmation no taxes owed

- Recent financial statements or statement of business activities to indicate a level of income

- One of the following: business license/registration, trade license, or GST registrations/returns to prove business ownership/partnership

Incorporated or limited company

- Most current accountant prepared financials or corporate T2s

- Most current T1 General and confirmation no taxes owed

- Corporate search/articles of incorporation – for business ownership

- Six months of bank statements

Gross-ups and add-backs approach is considered in this instance.

Other documentation

There are other income sources that can help your client’s application get approved.

-

-

- Canada Child Benefit (CCB)

- Alimony/child support

- Government and/or private pension

- Rental property income

- EI benefit for maternity leave

-

Buying a Rental property — this is the income documentation needed.

You can verify rental income via the following:

- Full T1 Generals showing net rental income

- If not reported in T1 General, market rent from an approved appraiser

Verified Income

- A job letter and recent paystub. If the client’s hours aren’t guaranteed, underwriter may also ask for a 2-year income history.

Alternative Proveable Income

Proprietary, specialized approach using gross-ups and add-backs.

Sole Proprieter

- Most current T1 General

- Confirmation no taxes owed

- Recent financial statements or statement of business activities supported by business bank statements

- One of the following: business license/registration, trade license or GST registration/returns

Incorporated or limited company

- Most current accountant prepared financials or corporate T2s

- Most current T1 Generals and confirmation no taxes owed

- Corporate search/articles of incorporation

- Six months bank statements

Prime to be 2% LOWER in 15 months, Dates of drops, Variable rate wins: Fall 2024

Yes, with the writing on the wall for the coming Prime rate decreases the Variable rate is the way to go.

Variable rates are based on Consumer Prime, which moves the exact same as the Bank of Canada’s “overnight rate.” The decreases in the overnight rate will be the same for Consumer Prime and they are below.

So Sept 4, 2024, Prime will go from 6.7% to 6.45%

Canadian Consumer Prime – what Variable Rates are based on – will be these rates here.

If your “discount is Prime – 0.95%” then your rate would be this number below – 0.95%. And as you can see, this is way better than the 3-year fixed at 4.84% or the 5- year fixed at 4.69% today.

- September 4, 2024: 6.45%

- October 23, 2024: 6.20%

- December 11, 2024: 5.95%

- January 2025: 5.70%

- March 2025: 5.45%

- April 2025: 5.20%

- June 2025: 4.95%

- September 2025: 4.70%

- October 2025: 4.45%

- December 2025: 4.20%

Article is here: Bank of Canada’s policy interest rate could dip to 2.75% by late 2025:

forecast:: https://dailyhive.com/vancouver/bank-of-canada-policy-interest-rate-forecast-2025-credit-1

Predictions of the article for the rate drops: Credit 1’s Bank of Canada policy interest rate forecast, as updated on August 26, 2024:

-

- September 4, 2024: 4.25%

- October 23, 2024: 4.0%

- December 11, 2024: 3.75%

- January 2025: 3.5%

- March 2025: 3.5%

- April 2025: 3.25%

- June 2025: 3.25%

- September 2025: 3.0%

- October 2025: 2.75%

- December 2025: 2.75%

Acceptable Sources of Down Payment for a home Canada, 2024

This seems to be the topic of this week … what can I use for down payment on my home?

All banks DO ACCEPT these approved methods to gather down payment for a home.

Acceptable Sources of Down Payment:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ineligible Sources of Down Payment

|

|

|

|

|

|

|

|

The new Tax-Free First Home Savings Account (FHSA) and the

FTHBI – First Time Home Buyer Incentive were the government matches your down payment up to 5% ARE both great ideas!

Mortgage Mark Herman, top Calgary Alberta Mortgage Broker since 2004!

Prime Rate Holding, July 1st Expected Reduction & Real Estate Economic Data

The Bank of Canada cited the ongoing risk of inflation for its decision to maintain its overnight benchmark interest rate at 5.0%.

Below are the Bank of Canada’s observations, including its forward-looking comments on the state of the economy, inflation and interest rates.

Canadian inflation

- CPI inflation ended the year at 3.4% and the Bank expects inflation to remain close to 3% during the first half of 2024 “before gradually easing” and returning to the Bank’s 2% target in 2025

- Shelter costs remain “the biggest contributor to above-target inflation”

- While a slowdown in demand is said by the Bank to be reducing price pressures in a broader number of CPI components and corporate pricing behavior continues to normalize, core measures of inflation are not showing sustained declines.

Canadian economic performance and outlook

- The Bank notes that the Canadian economy has “stalled” since the middle of 2023 and believes growth will likely remain close to zero through the first quarter of 2024

- Consumers have pulled back their spending in response to higher prices and interest rates, and business investment has contracted

- With weak growth, supply has caught up with demand and the economy now looks to be operating in modest excess supply

- Labour market conditions have eased, with job vacancies returning to near pre-pandemic levels and new jobs being created at a slower rate than population growth. However, wages are still rising around 4% to 5%

Global economic performance and outlook

- Global economic growth continues to slow, with inflation easing “gradually” across most economies

- While growth in the United States has been stronger than expected, it is anticipated to slow in 2024, with weakening consumer spending and business investment

- In the euro area, the economy looks to be in a mild contraction

- In China, low consumer confidence and policy uncertainty will likely restrain activity

- Oil prices are about $10 per barrel lower than was assumed in the Bank’s October Monetary Policy Report (MPR)

- Financial conditions have eased, largely reversing the tightening that occurred last autumn

- The Bank now forecasts global GDP growth of 2.5% in 2024 and 2.75% in 2025 compared to 2023’s 3% pace

- With softer growth this year, inflation rates in most advanced economies are expected to come down slowly, reaching central bank targets in 2025

Outlook

The Bank believes that Canadian economic growth will strengthen gradually “around the middle of 2024.” Furthermore, it expects household spending will likely “pick up” in the second half of 2024, and exports and business investment should get a boost from recovering foreign demand.

Taking all of these factors and forecasts into account, the Bank’s Governing Council decided to hold its policy rate at 5% and to continue to “normalize” the Bank’s balance sheet.

The Bank’s statement went on to note that Council “is still concerned about risks to the outlook for inflation, particularly the persistence in underlying inflation” and wants to see “further and sustained easing in core inflation.” The Bank also said it continues to focus on the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behaviour.

As it has said consistently over the past year, the Bank will remain “resolute in its commitment to restoring price stability for Canadians.”

Although the Bank did not say it, the bottom line is we will have to wait and see what comes next.

Next touchpoint

March 6, 2024 is the Bank’s next scheduled policy interest rate announcement.

Updated: Using Disability Income to Qualify for a Canadian Mortgage: 2024

NOTE: this post has been updated in August 2024.

CAN DISABILITY INCOME BE USED TO QUALIFY FOR A CANADIAN MORTGAGE?

YES, it is possible to use disability income to qualify for a pre-approval or a full mortgage approval.

IMPORTANT:

We are ONLY able to use disability income AS A “TOP UP” WHEN YOU ARE BUYING WITH ANOTHER PERSON

- who has standard/ T4 employment income OR qualifies as SELF-EMPLOYED

- AND your file needs more income to “top-up” the qualification amount to get to your target mortgage amount.

Unfortunately, we are not able to use:

- Disability income where it is more than 50% of the income needed to qualify for the mortgage.

- AISH income – the lenders deem provincial supplements as to “risky” and only use “federal programs.”

- If either of these are your situation, we recommend going to an ATB Branch, not online but a BRANCH.

Below are a few clarifications on the typical disability incomes that the banks can use.

- Not all banks accept all types of disability income so we use a few different lenders to ensure we have all your bases covered.

NEXT STEP

Call or send me an email with your contact data so we can have a chat on the phone if you are needing to use a “TOP-UP” via disability income for your purchase.

- I answer from 9-9 x 363, am in the office from 10 – 6:30 most days, best time to call is between 11 am – 3 pm.

- No need to pre-book, just call!

- (How different is that?)

Long-term & Short-term Disability Pension/Insurance

If the borrower has a non-taxable income, the Bank, CMHC and Sagen allow the income to be grossed-up.

- Less than $30,000, this income may be increased by 25%

- At least $30,000, this income may be increased by 35%

Long-term disability: 100% of long-term disability income can be used.

Provide one of the following:

- Letter from the organization or from QPP confirming long-term or permanent disability. If the letter is outdated (over 120 days), current bank statements confirming the deposits are being made to the borrower’s account are also needed

- T4A(P) confirming disability income.

Short-term disability: 100% of the employment income can be used for short-term disability.

Provide the following:

- A letter from the employer confirming the borrower’s return date, position and salary with a verbal confirmation from the employer to ensure the date on the letter is correct. If the return date cannot be confirmed, the disability income can be used for qualifications.

Pension & Retirement Income/Life Annuity

Retirement pensions are fixed incomes, CPP (Canada Pension Plan), OAS (Old Age Security), GIS (Guaranteed Income Supplement), provincial pension plans and private/corporate pensions and must be Canadian pension and evident on Canadian tax return.

IF you are Splitting Retirement Income: In the case where the pension income is shared for tax purposes, the transferring spouse/common-law partner must be on file and only the amount that has not been transferred/split is admissible.

Provide the most recent two documents of the following depending on the source of the declared retirement income:

- Most recent NOA supported by T1 General

- RL-2 Slip

- T4A, T4A(P)

- Letter from the initiating party confirming the yearly pension amount

- Letter from the organization confirming income and permanency of income

- Copy of current bank statement showing the automatic deposit

- Copy of current monthly cheque stub

For CPP, OAS, QPP and GIS, only one relevant document for each source is required from the list above.

RRIF

Income from a RRIF is admissible if there is proof that the portfolio generates a sustainable income amount for the length of the term.

This is a tough one to nail down as the portfolio has to be sustainable and not “drained” over the term of the loan, as in, there will still be a substantial balance in 5 years, if the mortgage is a 5-year term.

Provide the following:

- The most recent NOA supported by T1 General

- Recent RRIF statement to show that the borrower has sufficient assets to support the indicated income for the length of the term

First Nations

This is a non-taxable income. The income can be grossed-up as follows:

- Less than $30,000, this income may be increased by 25%

- At least $30,000, this income may be increased by 35%

Provide the following:

- Copy of the status card needed.

“We use disability income all the time in our practice to top-up mortgage amounts and have access to the banks and lenders that allow it’s use.

Mortgage Mark Herman, top Calgary Alberta and BC mortgage broker, for 21 years.

Winning Variable Rate Strategy: end-2023

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Data on July 1, 2022 Prime Increase to 3.7%

Today, the Bank of Canada showed once again that it is seriously concerned about inflation by raising its overnight benchmark rate to 1.50% – making Consumer Prime 3.70%

This latest 50 basis point increase follows a similar-sized move in April and is considered the fastest rate hike cycle in over two decades.

Everyone STAY COOL!

Says Mortgage Mark Herman, top Calgary Alberta Mortgage Broker.

With it, the Bank brings its policy rate closer to its pre-pandemic level.

In rationalizing its 3rd increase of 2022, the Bank cited several factors, most especially that “the risk of elevated inflation becoming entrenched has risen.” As a result, the BoC will use its monetary policy tools to return inflation to target and keep inflation expectations well anchored.

These are the highlights of today’s announcement.

Inflation at home and abroad

- Largely driven by higher prices for food and energy, the Bank noted that CPI inflation reached 6.8% for the month of April, well above its forecast and “will likely move even higher in the near term before beginning to ease”

- As “pervasive” input pressures feed through into consumer prices, inflation continues to broaden, with core measures of inflation ranging between 3.2% and 5.1%

- Almost 70% of CPI categories now show inflation above 3%

- The increase in global inflation is occurring as the global economy slows

- The Russian invasion of Ukraine, China’s COVID-related lockdowns, and ongoing supply disruptions are all weighing on activity and boosting inflation

- The war has increased uncertainty, is putting further upward pressure on prices for energy and agricultural commodities and “dampening the outlook, particularly in Europe”

- U.S. labour market strength continues, with wage pressures intensifying, while private domestic U.S. demand remains robust despite the American economy “contracting in the first quarter of 2022”

- Global financial conditions have tightened and markets have been volatile

Canadian economy and the housing market

- Economic growth is strong and the economy is clearly “operating in excess demand,” a change in the language the Bank used in April when it said our economy was “moving into excess demand”

- National accounts data for the first quarter of 2022 showed GDP growth of 3.1%, in line with the Bank’s April Monetary Policy Report projection

- Job vacancies are elevated, companies are reporting widespread labour shortages, and wage growth has been “picking up and broadening across sectors”

- Housing market activity is moderating from exceptionally high levels

- With consumer spending in Canada remaining robust and exports anticipated to strengthen, growth in the second quarter is expected to be “solid”

Looking ahead

With inflation persisting well above target and “expected to move higher in the near term,” the Bank used today’s announcement to again forewarn that “interest rates will need to rise further.”

The pace of future increases in its policy rate will be guided by the Bank’s ongoing assessment of the economy and inflation.

In case there was any doubt, the Bank’s message today was clear: it is prepared to act more forcefully if needed to meet its commitment to achieve its 2% inflation target.

July 13, 2022 is the date of the BoC’s next scheduled policy announcement.

Rates and Prices Trending Up Due to Inflation and War

Mid-March Commentary: Rates and Prices Trending Up Due to Inflation! and War!!

On March 2nd, 2022, the Bank of Canada made its most anticipated decision on interest rates since the pandemic began. After weeks of speculation and anticipation of an increase, central bankers finally pulled the trigger and moved their overnight rate higher.

For the 1st time since the pandemic began to hurt the economy in March 2020, the Bank raised its overnight benchmark rate by .25% and the knock-on effect is that borrowing costs for Canadians will rise modestly although by historical norms, remain low.

In its updated comments on the state of the economy, the Bank and singled out the unprovoked invasion of Ukraine by Russia as a “major new source of uncertainty” that will add to inflation “around the world,” and have negative impacts on confidence that could weigh on global growth.

Below are the other highlights…

Canadian economy and the housing market

- Economic growth in Canada was very strong in the fourth quarter of 2021 at 6.7%, which is stronger than the Bank’s previous projection and confirms its view that economic slack has been absorbed

- Both exports and imports have picked up, consistent with solid global demand

- In January 2022, the recovery in Canada’s labour market suffered a setback due to the Omicron variant, with temporary layoffs in service sectors and elevated employee absenteeism, however, the rebound from Omicron now appears to be “well in train”

- Household spending is proving resilient and should strengthen further with the lifting of public health restrictions

- Housing market activity is “more elevated,” adding further pressure to house prices

- First-quarter 2022 growth is “now looking more solid” than previously projected

Canadian inflation and the impact of the invasion of Ukraine

- CPI inflation is currently at 5.1%, as the BoC expected in January, and remains well above the Bank’s target range

- Price increases have become “more pervasive,” and measures of core inflation have all risen

- Poor harvests and higher transportation costs have pushed up food prices

- The invasion of Ukraine is putting further upward pressure on prices for both energy and food-related commodities

- Inflation is now expected to be higher in the near term than projected in January

- Persistently elevated inflation is increasing the risk that longer-run inflation expectations could drift upwards

- The Bank will use its monetary policy tools to return inflation to the 2% target and “keep inflation expectations well-anchored”

Global economy

- Global economic data has come in broadly in line with projections in the Bank’s January Monetary Policy Report

- Economies are emerging from the impact of the Omicron variant of COVID-19 more quickly than expected, although the virus continues to circulate, and the possibility of new variants remains a concern

- Demand is robust, particularly in the United States

- Global supply bottlenecks remain challenging, “although there are indications that some constraints have eased”

Looking ahead

As the economy continues to expand and inflation pressures remain elevated, the Bank made a clear point of telling Canadians “To expect interest rates to rise further.”

The resulting quantitative tightening (which central bankers framed as “QT” rather than the previous term “QE” for quantitative easing) would complement increases in the Bank’s policy-setting interest rate. The timing and pace of further increases in the policy rate, and the start of QT, will be guided by the Bank’s ongoing assessment of the economy and its commitment to achieving a 2% inflation target.

BoC’s next scheduled policy announcement is April 13, 2022. We will update you following that announcement as always.

Rising rates: fixed or variable?

The Bank of Canada pulled the trigger on an interest rate increase, the first since October 2018 and the Bank has made it clear more increases are coming.

The upward move and the Bank’s messaging have rekindled the perennial mortgage debate: fixed or variable. The answer remains the perennial: it depends.

It depends on the borrower’s end goals, finances and their desire for stability. That last point, stability, is what leads most Canadian home buyers to opt for a 5-year, fixed-rate mortgage. But in purely financial terms – and saving money – variable-rate mortgages tend to be cheaper, and they do not have to be volatile.

In a rising rate environment, many borrowers worry about the cost of their debt going up. But right now, variable-rates are notably lower than fixed-rates and it will take several Bank of Canada increases to close the gap. In the meantime, that amounts to savings for the borrower.

Those savings – often hundreds of dollars a month – could be applied against principal. As rates rise the amount can be adjusted, thereby keeping total monthly payments the same and evening-out any volatility.

It should be remembered that fixed-rates are rising as well. They are tied to Government of Canada 5-year bond yields. Those yields have been increasing, and at least some of that is tied to increases in U.S. government bond yields. Canadian bonds tend to move in sync with American bonds, but those changes do not necessarily reflect the Canadian economy. In other words, the changes are not completely within our control.

A Few More Words on Russia Invading Ukraine

Markets were thrown into a tizzy. They plunged. But the frenzy was short lived. By the end of the day markets were back in the black.

Canada’s economic exposure to Russia and Ukraine is relatively small. Canada imported $1.2 billion from Russia in 2020; Russia imported roughly the same from Canada – less than a week’s worth of commercial traffic across the Ambassador Bridge.

The key factor in the conflict, for Canada, will likely be the price of oil, which has climbed past $100 a barrel. Rising oil prices and higher fuel costs have been a principal driver of inflation here, and inflation is the main concern of the Bank of Canada. It is currently running at 5.1%, a 30 year high, and the central bank is under growing pressure to bring it under control.

Oil is also an important part of Canada’s resource economy. Higher prices will likely lead to more production. Any embargo of Russian oil will create demand for Canadian product. That, in turn, would put more load onto Canada’s economic recovery, which is strong but hampered by pandemic labour shortages and supply-chain problems which, again, are adding to inflation pressures.

None the less, war creates uncertainty, and uncertainty triggers caution among central bankers. A recent Reuters poll of 25 economists suggests the Bank of Canada will go ahead with a quarter-point rate hike this week.