Variable Rate Beats BOTH 3-year & 5-year Fixed Terms

The Variable is the best way to go right now and this blue link has all the details in PDF: VARIABLE RATE beats both 3-year fixed & 5-year fixed terms

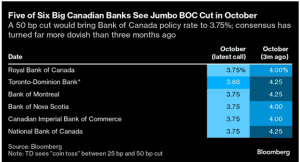

Data point 1: Variable rates should be coming down 2% in the next 13.5 months, with a “jumbo reduction” of 0.5% (1/2%) expected on Wednesday, Oct 23rd – by 5 of the 6 Big Banks.

Data point 2: Historically, fixed rates only go down about 40% of the reductions to Prime, so fixed rates will not be going down anywhere near as much or as fast as the Variable.

Data point 3: Just a 1% rate reduction is expected to “reactivate” at least half of buyers who previously stopped shopping due to “buyer fatigue.”

Data point 4: As interest rates come down, prices INCREASE because most buyer’s need to go to their max mortgage when buying.

Graphic details of expected rate reductions and the dates of expected changes, in PDF: VARIABLE RATE beats both 3-year fixed & 5-year fixed terms

Our favorite customer quote so far in October:

I am not locking in 3-year money nor 5-year money today, when the Bank of Canada has made it clear rates are coming down 2% in the next 15 months.

Mortgage Mark Herman, Top Calgary Alberta Mortgage Broker near me.