Probably the end of Mortgage Rate Reductions for Canada

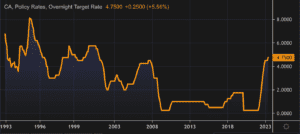

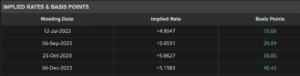

Expert opinions on Bank of Canada interest rate cuts are shifting. A growing number of market watchers are backing away from their predictions of two more reductions this year. Several are now saying the Bank has likely reached the end of the current trimming cycle.

Back in April we said that Prime is probably going to stay where it is now; discounting the expected 4 more reduction to 0.

that looks to have come true.

5-year fixed is the way to go to side-step all the world’s recent happenings .

Mortgage Mark Herman, best Calgary mortgage broker near me.

The central bank held its trend-setting Policy Rate at 2.75% for a second time in its decision on June 4. Since then, inflation numbers and Gross Domestic Product readings have given the BoC reasonable grounds to stand pat.

Statistics Canada’s latest figures for GDP show it declined by 0.1% in April compared to March. Much of that decline was led by the manufacturing sector, which is falling victim to U.S. tariffs and trade uncertainty. A similar reduction is forecast for May. While many economists admit the slowdown shows the economy is softening, they say it is not on the verge of collapse. GDP is 1.3% higher that it was a year earlier.

The other key factor in the Bank’s rate decisions, inflation, held steady at 1.7% in May. That headline number is actually below the Bank’s target of 2.0% and would normally suggest there is room for a further rate cut. However, that is a little deceiving.

Headline inflation (aka the Consumer Price Index) continued to be skewed by the elimination of the consumer carbon tax. As well, core inflation, which is the BoC’s preferred measure, remains stuck at 3.0%, which is the high end of the Bank’s desired inflation range.

The Bank finds itself trying to balance economic growth against the risk of rising inflation. The Bank’s next interest rate announcement is set for July 30.

Canadian Mortgage Economic Data, June 4th, 2025

The Bank of Canada announced today that it is keeping its benchmark interest rate at 2.75%, unchanged from April (and March) of 2025.

As noted under “Rationale”, the Bank appears to be in a holding pattern until it gains more information on the direction of US trade policy and its impact on Canada.

Below, is a summary of the Bank’s observations and its outlook.

Summary – the 5-year fixed is the best option for June 2025 and July 2025 so far. ensure you get a rate hold are rates are creeping up.

Mortgage Mark Herman, top Calgary Mortgage Broker for First Time Buyers

Canadian Economic Performance, Housing, Employment and Outlook

- Economic growth in the first quarter came in at 2.2%, slightly stronger than the Bank had forecast, while the composition of GDP growth was largely as expected

- The pull-forward of exports to the United States and inventory accumulation boosted activity, with final domestic demand “roughly flat”

- Strong spending on machinery and equipment held up growth in business investment by more than expected

- Consumption slowed from its very strong fourth-quarter pace, but continued to grow despite “a large drop” in consumer confidence

- Housing activity was down, driven by a sharp contraction in resales; government spending also declined

- The labour market has weakened, particularly in trade-intensive sectors, and unemployment has risen to 6.9%

- The economy is expected to be considerably weaker in the second quarter, with strength in exports and inventories reversing and final domestic demand remaining subdued

Canadian Inflation

- Inflation eased to 1.7% in April, with the elimination of the federal consumer carbon tax shaving 0.6 percentage points off the Consumer Price Index

- Excluding taxes, inflation rose 2.3% in April, slightly stronger than the Bank had expected

- The Bank’s preferred measures of core inflation, as well as other measures of underlying inflation, moved up

- Recent surveys indicate that households continue to expect that tariffs will raise prices and many businesses say they intend to pass on the costs of higher tariffs

- The Bank will be watching all of these indicators closely to gauge how inflationary pressures are evolving

Global Economic Performance

- While the global economy has shown resilience in recent months, this partly reflects a temporary surge in activity to get ahead of tariffs

- In the United States, domestic demand remained relatively strong but higher imports pulled down first-quarter GDP

- US inflation has ticked down but remains above 2%, with the price effects of tariffs still to come

- In Europe, economic growth has been supported by exports, while defence spending is set to increase

- China’s economy has slowed as the effects of past fiscal support fade; more recently, high tariffs have begun to curtail Chinese exports to the US

- Since financial market turmoil in April, risk assets have largely recovered and volatility has diminished, although markets remain sensitive to US policy announcements

- Oil prices have fluctuated but remain close to their levels at the time of the April Monetary Policy Report

Rationale

With uncertainty about US tariffs still high, the Canadian economy softer but not sharply weaker, and some unexpected firmness in recent inflation data, the Bank’s Governing Council decided to hold the policy rate steady “as we gain more information on US trade policy and its impacts.

Looking Ahead: Uncertainty Remains High

The Bank noted that since its April Monetary Policy Report, the US administration has continued to increase and decrease various tariffs. China and the United States have stepped back from extremely high tariffs and bilateral trade negotiations have begun with a number of countries. However, the Bank said the outcomes of these negotiations “are highly uncertain,” tariff rates are well above their levels at the beginning of 2025, and new trade actions are still being threatened. Uncertainty remains high.

As a result, the Bank says it is proceeding carefully, with particular attention to the risks and uncertainties facing the Canadian economy. These include: the extent to which higher US tariffs reduce demand for Canadian exports; how much this spills over into business investment, employment and household spending; how much and how quickly cost increases are passed on to consumer prices; and how inflation expectations evolve.

Final comments

Today’s announcement ended with the following statement from the Bank’s Governing Council: “We are focused on ensuring that Canadians continue to have confidence in price stability through this period of global upheaval. We will support economic growth while ensuring inflation remains well controlled.”

Next scheduled BoC rate announcement

The Bank is scheduled to make its fifth policy interest rate decision of 2025 on July 9th.

Bank of Canada Lowers Consumer Prime to 4.95%

The Bank of Canada lowers its benchmark interest rate to 2.75%

In the face of significant geopolitical tensions, the Bank of Canada announced today that it has lowered its policy interest rate by 25 basis points. This marks the seventh reduction since June of 2024.

Below, we summarize the Bank’s commentary.

Canadian Economic Performance and Housing

- Canada’s economy grew by 2.6% in the fourth quarter of 2024 following upwardly revised growth of 2.2% in the third quarter

- This “growth path” is stronger than was expected when the Bank last reported in January 2025

- Past cuts to interest rates have boosted economic activity, particularly consumption and housing

- However, economic growth in the first quarter of 2025 will likely slow as the intensifying trade conflict weighs on sentiment and activity

- Recent surveys suggest a sharp drop in consumer confidence and a slowdown in business spending as companies postpone or cancel investments

- The negative impact of slowing domestic demand has been partially offset by a surge in exports in advance of tariffs being imposed

- The Canadian dollar is broadly unchanged against the US dollar but weaker against other currencies

Canadian Inflation and Outlook

- Inflation remains close to the Bank’s 2% target

- The temporary suspension of the GST/HST lowered some consumer prices, but January’s Consumer Price Index was “slightly firmer” than expected at 1.9%

- Inflation is expected to increase to about 2.5% in March with the end of the tax break

- The Bank’s preferred measures of core inflation remain above 2%, mainly because of the persistence of shelter price inflation

- Short-term inflation expectations have risen in light of fears about the impact of tariffs on prices

Canadian Labour Market

- Employment growth strengthened in November through January and the unemployment rate declined to 6.6%

- In February, job growth stalled

- While past interest rate cuts have boosted demand for labour in recent months, there are warning signs that heightened trade tensions could disrupt the recovery in the jobs market

- Meanwhile, wage growth has shown signs of moderation

Global Economic Performance, Bond Yields and the Canadian Dollar

- After a period of solid growth, the US economy looks to have slowed in recent months, but US inflation remains slightly above target

- Economic growth in the euro zone was modest in late 2024

- China’s economy has posted strong gains, supported by government policies

- Equity prices have fallen and bond yields have eased on market expectations of weaker North American growth

- Oil prices have been volatile and are trading below the assumptions in the Bank’s January Monetary Policy Report

Rationale for a rate cut

While the Bank offered that economic growth came in stronger than it expected, the pervasive uncertainty created by continuously changing US tariff threats is restraining consumers’ spending intentions and businesses’ plans to hire and invest. Against this background, and with inflation close to the 2% target, the Bank decided to reduce its policy rate by 25 basis points.

Outlook

The Bank notes that the Canadian economy entered 2025 “in a solid position,” with inflation close to its 2% target and “robust” GDP growth. However, heightened trade tensions and tariffs imposed by the United States will likely slow the pace of economic activity and increase inflationary pressures in Canada. The economic outlook continues to be subject to more-than-usual uncertainty because of the rapidly evolving policy landscape.

Final comments

The Bank noted that monetary policy “cannot offset the impacts of a trade war.” What monetary policy “can and must do” is ensure that higher prices do not lead to ongoing inflation.

The Bank said it will carefully assess: i) the timing and strength of both the downward pressures on inflation from a weaker economy and ii) the upward pressures on inflation from higher costs. It will also closely monitor inflation expectations.

It ended its statement by saying it is committed to maintaining price stability for Canadians.

More scheduled BoC news

The Bank is scheduled to make its third policy interest rate decision of 2025 on April 16th.

Prime to be 2% LOWER in 15 months, Dates of drops, Variable rate wins: Fall 2024

Yes, with the writing on the wall for the coming Prime rate decreases the Variable rate is the way to go.

Variable rates are based on Consumer Prime, which moves the exact same as the Bank of Canada’s “overnight rate.” The decreases in the overnight rate will be the same for Consumer Prime and they are below.

So Sept 4, 2024, Prime will go from 6.7% to 6.45%

Canadian Consumer Prime – what Variable Rates are based on – will be these rates here.

If your “discount is Prime – 0.95%” then your rate would be this number below – 0.95%. And as you can see, this is way better than the 3-year fixed at 4.84% or the 5- year fixed at 4.69% today.

- September 4, 2024: 6.45%

- October 23, 2024: 6.20%

- December 11, 2024: 5.95%

- January 2025: 5.70%

- March 2025: 5.45%

- April 2025: 5.20%

- June 2025: 4.95%

- September 2025: 4.70%

- October 2025: 4.45%

- December 2025: 4.20%

Article is here: Bank of Canada’s policy interest rate could dip to 2.75% by late 2025:

forecast:: https://dailyhive.com/vancouver/bank-of-canada-policy-interest-rate-forecast-2025-credit-1

Predictions of the article for the rate drops: Credit 1’s Bank of Canada policy interest rate forecast, as updated on August 26, 2024:

-

- September 4, 2024: 4.25%

- October 23, 2024: 4.0%

- December 11, 2024: 3.75%

- January 2025: 3.5%

- March 2025: 3.5%

- April 2025: 3.25%

- June 2025: 3.25%

- September 2025: 3.0%

- October 2025: 2.75%

- December 2025: 2.75%

Canadian Prime Rate Drops to 4.5%

Horray – the rates are dropping.

We expect to see a total of 2 MORE rate reductions of 0.25% each in 2024.

5 x o.25% reductions are expected in 2025 making the variable the better way to go right now.

Mortgage Mark Herman

DATA

Encouraged by underling trends in the Canadian economy, the Bank of Canada today cut its overnight policy interest rate by 0.25% to 4.50%.

This is the second incremental reduction we’ve seen in as many months and while both cuts have been modest, they are moving Canada toward less restrictive monetary policy.

We summarize the Bank’s rationale for this decision by summarizing its observations below, including its forward-looking comments for signs of what may happen next.

Canadian inflation including shelter inflation

- Inflation measured by the Consumer Price Index moderated to 2.7% in June after increasing in May

- Broad inflationary pressures are easing, and the Bank’s preferred measures of core inflation have been below 3% for several months and the breadth of price increases across components of the CPI is now near its historical norm

- Shelter price inflation remains high, driven by rent and mortgage interest costs, and is still the biggest contributor to total inflation

- Inflation is also elevated in services that are closely affected by wages, such as restaurants and personal care

Canadian economic performance and outlook

- Economic growth “likely” picked up to about 1.5% through the first half of 2024, however, with robust population growth of about 3%, the economy’s potential output is still growing faster than GDP, which means excess supply has increased

- Household spending, including both consumer purchases and housing, has been “weak”

- There are signs of slack in the labour market with the unemployment rate rising to 6.4% and with employment continuing to grow more slowly than the labour force and job seekers taking longer to find work

- Wage growth is showing some signs of moderating, but remains elevated

- GDP growth is forecast to increase in the second half of 2024 and through 2025, reflecting stronger exports and a recovery in household spending and business investment as borrowing costs ease

- Residential investment is expected to grow robustly

- With new government limits on admissions of non-permanent residents, population growth should slow in 2025

Global economic performance and outlook

- The global economy is expected to continue expanding at an annual rate of about 3% through 2026

- While inflation is still above central bank targets in most advanced economies, it is forecast to ease gradually

- In the United States, an anticipated economic slowdown is materializing, with consumption growth moderating and US inflation appearing to resume its downward path

- In the euro area, growth is picking up following a weak 2023

- China’s economy is growing modestly, with weak domestic demand partially offset by strong exports

- Global financial conditions have eased, with lower bond yields, buoyant equity prices, and robust corporate debt issuances

- The Canadian dollar has been relatively stable and oil prices are around the levels assumed in the Bank’s April’s Monetary Policy Report

Summary comments and outlook

The Bank forecasts that Canadian GDP will grow at 1.2% in 2024, 2.1% in 2025, and 2.4% in 2026 and that a strengthening economy will gradually absorb excess supply through 2025 and into 2026.

As a result of an easing in broad price pressures, the Bank expects inflation to move closer to 2%, its long-stated goal. As a result, the Bank’s Governing Council decided to reduce the policy interest rate by 25 basis points.

It further noted that while ongoing excess supply is lowering inflationary pressures, price pressures in some important parts of the economy—notably shelter and some other services—are “holding inflation up.”

Accordingly, the Bank said it is carefully assessing these “opposing forces.” Monetary policy decisions therefore will be guided by incoming information and the Bank’s assessment of the implications for the inflation outlook.

Once again, the statement noted in conclusion that the Bank remains “resolute in its commitment to restoring price stability for Canadians.”

Next Up

The Bank returns on September 4th with its next monetary policy announcement.

Prime now 6.95% from 7.20%: BoC reduces its benchmark interest rate to 4.75%

Today, the Bank of Canada reduced its overnight policy interest rate by 0.25% to 4.75%. This welcome and widely expected decision comes on the heels of evidence pointing to a deceleration of the rate of inflation.

SUMMARY:

The “overnight rate” being quoted is the rate that Banks borrow from each other at, not consumer Prime, which is confusing.

Canadian Consumer Prime has just been reduced from 7.20% to 6.95% – this only affects Variable Rate mortgages.

Fixed rates remain unchanged because they track the Canadian Mortgage Bond Rates which are different, and similar.

There has also been about 40 “silent” fixed rate reductions of o.o5% each in 2024 that the press did not cover.

Mortgage Mark Herman, Top best Calgary Alberta mortgage broker specializing in 1st time buyers

Below we examine the Bank’s rationale for this move by summarizing its observations below, including its all-important outlook comments that are sure to shape market expectations for the remainder of the year.

Canadian inflation

- Inflation measured by the Consumer Price Index (CPI) eased further in April to 2.7%

- The Bank’s preferred measures of core inflation also slowed and three-month indicators suggest continued downward momentum

- Indicators of the breadth of price increases across components of the CPI have moved down further and are near their historical average, however, shelter price inflation remains high

Canadian economic performance and housing

- Economic growth resumed in the first quarter of 2024 after stalling in the second half of last year

- At 1.7%, first-quarter GDP growth was slower than the Bank previously forecast with weaker inventory investment dampening activity

- Consumption growth was solid at about 3%, and business investment and housing activity also increased

- Labour market data show Canadian businesses continue to hire, although employment has been growing at a slower pace than the working-age population

- Wage pressures remain but look to be moderating gradually

- Overall, recent data suggest the economy is still operating in excess supply

Global economic performance and bond yields

- The global economy grew by about 3% in the first quarter of 2024, broadly in line with the Bank’s April Monetary Policy Report projection

- The U.S. economy expanded more slowly than was expected, as weakness in exports and inventories weighed on activity

- In the euro area, activity picked up in the first quarter of 2024 while China’s economy was also stronger in the first quarter, buoyed by exports and industrial production, although domestic demand remained weak

- Inflation in most advanced economies continues to ease, although progress towards price stability is “bumpy” and is proceeding at different speeds across regions

- Oil prices have averaged close to the Bank’s assumptions, and financial conditions are little changed since April

Summary comments and outlook

The Bank cited continued evidence that underlying inflation is easing for its decision to change its policy interest rate. More specifically, it said that “monetary policy no longer needs to be as restrictive.”

Also welcome was the Bank’s statement that “recent data” have “increased our confidence that inflation will continue to move towards” its 2% target.

However, it also added this to its outlook: “Nonetheless, risks to the inflation outlook remain. Governing Council is closely watching the evolution of core inflation and remains particularly focused on the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behaviour.”

And has it has been doing for some time, it said the Bank “remains resolute in its commitment to restoring price stability for Canadians.”

Next up

The Bank returns on July 24th with its next monetary policy announcement – I think they will do another 0.25% reduction at the next meeting and they will continue to reduce at every meeting for the next 3 meetings this year.

Prime Rate Holding, July 1st Expected Reduction & Real Estate Economic Data

The Bank of Canada cited the ongoing risk of inflation for its decision to maintain its overnight benchmark interest rate at 5.0%.

Below are the Bank of Canada’s observations, including its forward-looking comments on the state of the economy, inflation and interest rates.

Canadian inflation

- CPI inflation ended the year at 3.4% and the Bank expects inflation to remain close to 3% during the first half of 2024 “before gradually easing” and returning to the Bank’s 2% target in 2025

- Shelter costs remain “the biggest contributor to above-target inflation”

- While a slowdown in demand is said by the Bank to be reducing price pressures in a broader number of CPI components and corporate pricing behavior continues to normalize, core measures of inflation are not showing sustained declines.

Canadian economic performance and outlook

- The Bank notes that the Canadian economy has “stalled” since the middle of 2023 and believes growth will likely remain close to zero through the first quarter of 2024

- Consumers have pulled back their spending in response to higher prices and interest rates, and business investment has contracted

- With weak growth, supply has caught up with demand and the economy now looks to be operating in modest excess supply

- Labour market conditions have eased, with job vacancies returning to near pre-pandemic levels and new jobs being created at a slower rate than population growth. However, wages are still rising around 4% to 5%

Global economic performance and outlook

- Global economic growth continues to slow, with inflation easing “gradually” across most economies

- While growth in the United States has been stronger than expected, it is anticipated to slow in 2024, with weakening consumer spending and business investment

- In the euro area, the economy looks to be in a mild contraction

- In China, low consumer confidence and policy uncertainty will likely restrain activity

- Oil prices are about $10 per barrel lower than was assumed in the Bank’s October Monetary Policy Report (MPR)

- Financial conditions have eased, largely reversing the tightening that occurred last autumn

- The Bank now forecasts global GDP growth of 2.5% in 2024 and 2.75% in 2025 compared to 2023’s 3% pace

- With softer growth this year, inflation rates in most advanced economies are expected to come down slowly, reaching central bank targets in 2025

Outlook

The Bank believes that Canadian economic growth will strengthen gradually “around the middle of 2024.” Furthermore, it expects household spending will likely “pick up” in the second half of 2024, and exports and business investment should get a boost from recovering foreign demand.

Taking all of these factors and forecasts into account, the Bank’s Governing Council decided to hold its policy rate at 5% and to continue to “normalize” the Bank’s balance sheet.

The Bank’s statement went on to note that Council “is still concerned about risks to the outlook for inflation, particularly the persistence in underlying inflation” and wants to see “further and sustained easing in core inflation.” The Bank also said it continues to focus on the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behaviour.

As it has said consistently over the past year, the Bank will remain “resolute in its commitment to restoring price stability for Canadians.”

Although the Bank did not say it, the bottom line is we will have to wait and see what comes next.

Next touchpoint

March 6, 2024 is the Bank’s next scheduled policy interest rate announcement.

When Will Canadian Mortgage Rates Begin to Fall?

Last week, the Bank of Canada held its policy rate at 5%. The decision was expected given slowing in the economy and modest improvement to core inflation measures.

The Bank is likely at the end of its tightening cycle. How soon it eases rates – and how low will rates go in the near to medium term – is the question #1

ANSWER: The general view from market economists is that we could see some easing of the overnight rate by mid-2024.

Question #2: How low. how far will Prime come down?

ANSWER: Prime is expected to come down a total of 2%.

DETAILS of Prime Cuts

- Prime is 7.2% now / November 2nd, 2023,

- Prime is expected to get down to to 5.2% or a bit lower, like 4.75% – 5.25% range by the end 2025; which looks like this:

- June/ July 2024, 1st Prime cuts = 6 months

- Prime reduction by o.25% every quarter = 1% less / year for the next 2 years = 24 months

- so these together = 30 months.

With Prime coming down, now is the time for you to take advantage of the Variable Rate reductions.

Variable Rates via brokers are at Prime – o.9%, while the Big-6 banks rates are Prime – o.15%.

YES, broker rates are 6x better than at the Big-6 lenders, o.9 – o.15 = o.75% better. It’s true!

Mortgage Mark Herman; Best Top Calgary Mortgage Broker for first time home buyers.

When might rates begin to fall?

The Bank’s latest Monetary Policy Report (MPR) also provides signals that we can monitor to gauge when rates could start declining.

When interest rates rise, one of the main ways monetary policy affects the economy is through reduced consumer spending on durable goods, like appliances, furniture and cars. Prices for durable goods, except for cars, have dropped from 5.4% to -0.4%, while prices for semi-durable goods, like food and clothing, have decreased from 4.3% to 2.1%. We’re still experiencing delays in delivering cars. As a result, manufacturers are concentrating on selling more expensive vehicles with higher margins and are offering fewer discounts from list prices.

Inflation in service prices, excluding shelter, has slowed from 5.1% to 1.5%. If bond rates begin to drop, we will see a gradual decline in mortgage costs. The challenge will be rental costs, which are soaring due to the very limited availability of rentals and the continuous influx of newcomers. Increasing housing supply is key to reducing rental prices. However, that is a problem that will take years to resolve given the significant shortage of housing.

Currently, the Bank is concerned about inflation expectations, corporate pricing behaviour, and wage growth. As noted in its Monetary Policy Report, “As excess demand eases, inflation is expected to slow. At the same time, inflation expectations should also fall, businesses’ pricing behaviour should normalize, and wage growth should moderate. So far, progress has occurred but somewhat more slowly than anticipated.”

The Bank will be careful to ensure that inflation expectations inconsistent with its 2% target are not embedded in corporate pricing and wage expectations. A slowing economy should help to lower those expectations.

The general view from market economists is that we could see some easing of the overnight rate by mid-2024.

NERD STUFF: Maintaining a restrictive rate policy

The Bank can maintain a restrictive policy even without increasing rates any further, simply by keeping rates at their current level. With the overnight rate at 5% and an inflation rate of 3.8%, the real policy rate is 1.2%. This rate is restrictive, since it is higher than the neutral real rate of interest, which the Bank estimates to be between 0 and 1%.

The neutral real rate of interest is the level of interest that neither stimulates nor restrains economic growth. In other words, it is the rate at which the economy is in balance, with stable prices and full employment. Therefore, when the real rate of interest is restrictive, we would expect GDP to slow.

In its recent Monetary Policy Report (MPR), the Bank is forecasting economic growth to average less than 1% over the next few quarters, while potential output growth is expected to average 2%, mainly due to population growth and increased labor productivity. This should lead to a negative output gap (low demand and a surplus of products) and lower inflation.

Canadian Economic Forecast – Nov- Mortgage related use

Bank of Canada holds its interest rate steady, publishes updated economic forecasts

On October 25th, the Bank of Canada announced that it would maintain its Canadian Prime Rate stays at 7.3% – stating that there is “growing evidence” that past interest rate increases are dampening economic activity and relieving price pressures.

This decision provides some comfort to borrowers who have seen their mortgage costs rise steadily since March of 2022. As for real relief – in the form of rate cuts – the Bank demurred, noting that its preferred measures of core inflation show “little downward momentum.” Consequently, the Bank said it is holding this policy rate and continuing its current policy of quantitative tightening.

We capture the Bank’s observations and its latest economic forecasts in the summary below.

Inflation facts and outlook

- In Canada, inflation measured by the Consumer Price Index (“CPI”) has been volatile in recent months: 2.8% in June, 4.0% in August, and 3.8% in September

- Higher interest rates are moderating inflation in many goods that people buy on credit, and this is spreading to services

- Food inflation is easing from very high rates; however, in addition to elevated mortgage interest costs, inflation in rent and other housing costs remains high

- Near-term inflation expectations and corporate pricing behavior are normalizing only gradually, and wages are still growing around 4% to 5%

- The Bank’s preferred measures of core inflation show little downward momentum

Canadian housing and economic performance

- There is growing evidence that past interest rate increases are dampening economic activity and relieving price pressures

- Consumption has been subdued, with softer demand for housing, durable goods and many services

- Weaker demand and higher borrowing costs are weighing on business investment

- A surge in Canada’s population is easing labour market pressures in some sectors while adding to housing demand and consumption

- In the labour market, recent job gains have been below labour force growth and job vacancies have continued to ease; however, the labour market remains “on the tight side” and wage pressures persist

- Overall, a range of indicators suggest that supply and demand in the economy are now “approaching balance”

Global economic performance and outlook

- The global economy is slowing and growth is forecast to moderate further as past increases in policy interest rates and the recent surge in global bond yields weigh on demand

- The Bank projects global GDP growth of 2.9% this year, 2.3% in 2024 and 2.6% in 2025. While this outlook is little changed from the Bank’s July Monetary Policy Report, the composition has shifted, with the US economy proving stronger and economic activity in China weaker than expected

- Growth in the Euro area has “slowed further”

- Inflation has been easing in most economies, as supply bottlenecks resolve and weaker demand relieves price pressures but underlying inflation is persisting, meaning central banks must “continue to be vigilant”

- Oil prices are higher than the BoC assumed in July, and the war in Israel and Gaza is a new source of geopolitical uncertainty

Summary and Outlook

The BoC noted that after averaging 1% over the past year, economic growth is expected to remain “weak” for the next year before increasing in late 2024 and through 2025. Near-term weakness in growth reflects both the broadening impact of past increases in interest rates and slower foreign demand. The subsequent economic “pickup” will be driven by household spending as well as stronger exports and business investment in response to improving fore

ign demand. Spending by governments contributes materially to growth over the forecast horizon. Overall, the Bank expects the Canadian economy to grow by 1.2% this year, 0.9% in 2024 and 2.5% in 2025.

In the Bank’s October projection, CPI inflation is expected to average about 3.5% through the middle of next year before gradually easing to 2% in 2025. Inflation is expected to return to the Bank’s target about the same time as policymakers forecast in their July 2023 projection, “but the near-term path is higher because of energy prices and ongoing persistence in core inflation.”

As for what to expect going forward, the Bank had this to say about interest rates: “With clearer signs that monetary policy is moderating spending and relieving price pressures, Governing Council decided to hold the policy rate at 5% and to continue to normalize the Bank’s balance sheet. However, Governing Council is concerned that progress towards price stability is slow and inflationary risks have increased, and is prepared to raise the policy rate further if needed.”

The message is therefore clear: the Bank wants to see downward momentum in core inflation before it changes tack, and continues to be focused on the “balance between demand and supply in the economy, inflation expectations, wage growth and corporate pricing behaviour.”

Once again, the Bank ended its communique with a familiar phrase: it remains “resolute in its commitment to restoring price stability for Canadians.”

What’s next?

The Bank’s final (scheduled) interest rate announcement of 2023 takes place December 6th and we will follow immediately after with our next executive summary.

Canadian economy running too hot, BoC increases Prime by .25%

Hot Economic growth leads the Bank of Canada to increase its benchmark interest rate

Today, the Bank of Canada increased its overnight interest rate to 4.75% (+0.25% from April) because of higher-than-expected growth in Canada’s economy in the first quarter and the view that monetary policy was not yet restrictive enough to bring inflation down to target.

Leading up to today’s announcement, many economists feared that the BoC would have no choice but to raise rates in the face of persistent inflation and recent GDP growth. Their fears were founded.

To understand the Bank’s thinking on this important topic, we highlight its latest observations below:

Inflation facts and outlook

- In Canada, Consumer Price Index (CPI) inflation “ticked up in April” to 4.4%, the first increase in 10 months, with prices for a broad range of goods and services coming in higher than expected

- Goods price inflation increased, despite lower energy costs

- Services price inflation remained elevated, reflecting strong demand and a tight labour market

- The Bank continues to expect CPI inflation to ease to around 3% in the summer, as lower energy prices “feed through” and last year’s large price gains “fall out” of the yearly data

- However, with three-month measures of core inflation running in the 3.50%-4% range for several months and excess demand persisting, concerns have increased that CPI inflation could get stuck materially above the 2% target

Canadian housing and economic performance

- Canada’s economy was stronger than expected, with GDP growth of 3.1% in Q1 2023

- Consumption growth was “surprisingly strong and broad-based,” even after accounting for the boost from population gains

- Demand for services continued to rebound

- Spending on “interest-sensitive goods” increased and, more recently, “housing market activity has picked up”

- The labour market remains tight: higher immigration and participation rates are expanding the supply of workers but new workers have been quickly hired, reflecting continued strong demand for labour

- Overall, excess demand in the economy looks to be “more persistent” than anticipated

Global economic performance and outlook

- Globally, consumer price inflation is coming down, largely reflecting lower energy prices compared to a year ago, but underlying inflation remains stubbornly high

- While economic growth around the world is softening in the face of higher interest rates, major central banks are signalling that interest rates may have to rise further to restore price stability

- In the United States, the economy is slowing, although consumer spending remains surprisingly resilient and the labour market is still tight

- Economic growth has essentially stalled in Europe but upward pressure on core prices is persisting

- Growth in China is expected to slow after surging in the first quarter

- Financial conditions have tightened back to those seen before the bank failures in the United States and Switzerland

Summary and Outlook

The BoC said that based on the “accumulation of evidence,” its Governing Council decided to increase its policy interest rate, “reflecting our view that monetary policy was not sufficiently restrictive to bring supply and demand back into balance and return inflation sustainably to the 2% target.”

The Bank says quantitative tightening is complementing the restrictive stance of monetary policy and normalizing the Bank’s balance sheet.

Going forward, the Bank said it will continue to assess the dynamics of core inflation and the outlook for CPI inflation with particular focus on “ evaluating whether the evolution of excess demand, inflation expectations, wage growth and corporate pricing behaviour are consistent with achieving” its inflation target.

Once again, the Bank repeated its mantra that it “remains resolute in its commitment to restoring price stability for Canadians.”

Next up

With today’s announcement now behind us, a new round of speculation will begin in advance of the Bank’s next policy announcement on July 12th.

Odds of New Rates

Market odds now have a July 12 hike at a 61% probability, with potentially another increase by December.

Just 1 more Prime Rate increase would take the benchmark prime rate from 6.95% at the end of today to a nosebleed 7.20% (last seen in February 2001).

There may well be another Prime Rate increase on July. We have strategies to beat these rates so please call and we can sort out a situation that works for you.