Bank of Canada holds benchmark interest rate steady & updates 2022 economic outlook

Summary:

- Prime did not change today, Jan 26, and the Bank of Canada (BoC) clearly said they are planning on starting the needed rate increases at the next meeting in 6 weeks, on Wednesday March 2nd.

- The Market has “priced in” between 4 and 6 increases in 2022, each by .25%, and between 2 and 4 increases in 2023, each by .25%

- There may be fewer increases if inflation returns to the target of 2% from today’s 40 year high of about 5%.

- The USA is seeing record 7% inflation and Canada usually gets dragged along with the US numbers so that balances the possibility of fewer increases.

- Mortgage Strategy – secure a fully underwritten, pre-approval, with a 120- day rate hold, from a person, not an online “60-second-mortgage-app” as soon as you think you may be buying in the next 2 years.

- To start a mortgage application with us, click here, and we will call you with in 24-hours to get things going.

DETAILS:

This morning in its first scheduled policy decision of 2022, the Bank of Canada left its target overnight benchmark rate unchanged at what it describes as its “lower bound” of 0.25%. As a result, the Bank Rate stays at 0.5% and the knock-on effect is that borrowing costs for Canadians will remain low for the time being.

The Bank also updated its observations on the state of the economy, both in Canada and globally, leaving a strong impression that rates will rise this year.

More specifically, the Bank said that its Governing Council has decided to end its extraordinary commitment to hold its policy rate at the effective lower bound and that looking ahead, it expects “… interest rates will need to increase, with the timing and pace of those increases guided by the Bank’s commitment to achieving” its 2% inflation target.

These are the other highlights of today’s BoC announcement.

Canadian economy

- The economy entered 2022 with considerable momentum, and a broad set of measures are now indicating that economic slack is absorbed

- With strong employment growth, the labour market has tightened significantly with elevated job vacancies, strong hiring intentions, and a pick up in wage gains

- Elevated housing market activity continues to put upward pressure on house prices

- Omicron is “weighing on activity in the first quarter” and while its economic impact will depend on how quickly this wave passes, the impact is expected to be less severe than previous waves

- Economic growth is then expected to bounce back and remain robust over the Bank’s “projection horizon,” led by consumer spending on services, and supported by strength in exports and business investment

- After GDP growth of 4.5% in 2021, the Bank expects Canada’s economy to grow by 4% in 2022 and about 3.5% in 2023

Canadian inflation

- CPI inflation remains “well above” the Bank’s target range and core measures of inflation have edged up since October

- Persistent supply constraints are feeding through to a broader range of goods prices and, combined with higher food and energy prices, are expected to keep CPI inflation close to 5% in the first half of 2022

- As supply shortages diminish, inflation is expected to decline “reasonably quickly” to about 3% by the end of 2022 and then “gradually ease” towards the Bank’s target over the projection period

- Near-term inflation expectations have moved up, but longer-run expectations remain anchored on the 2% target

- The Bank will use its monetary policy tools to ensure that higher near-term inflation expectations do not become embedded in ongoing inflation

Global economy

- The recovery is strong but uneven with the US economy “growing robustly” while growth in some other regions appears more moderate, especially in China due to current weakness in its property sector

- Strong global demand for goods combined with supply bottlenecks that hinder production and transportation are pushing up inflation in most regions

- Oil prices have rebounded to well above pre-pandemic levels following a decline at the onset of the Omicron variant of COVID-19

- Financial conditions remain broadly accommodative but have tightened with growing expectations that monetary policy will normalize sooner than was anticipated, and with rising geopolitical tensions

- Overall, the Bank projects global GDP growth to moderate from 6.75% in 2021 to about 3.5% in 2022 and 2023

January Monetary Policy Report

The key messages found in the BoC’s Monetary Policy Report published today were consistent with the highlights noted above:

- A wide range of measures and indicators suggest that economic slack is now absorbed and estimates of the output gap are consistent with this evidence

- Public health measures and widespread worker absences related to the Omicron variant are slowing economic activity in the first quarter of 2022, but the economic impact is expected to be less severe than previous waves

- The impacts from global and domestic supply disruptions are currently exerting upward pressure on prices

- Inflationary pressures from strong demand, supply shortages and high energy prices should subside during the year

- Over the medium term, increased productivity is expected to boost supply growth, and demand growth is projected to moderate with inflation expected to decline gradually through 2023 and 2024 to close to 2%

- The Bank views the risks around this inflation outlook as roughly balanced, however, with inflation above the top of the Bank’s inflation-control range and expected to stay there for some time, the upside risks are of greater concern

Looking ahead

The Bank intends to keep its holdings of Government of Canada bonds on its balance sheet roughly constant “at least until” it begins to raise its policy interest rate. At that time, the BoC’s Governing Council will consider exiting what it calls its “reinvestment phase” and reducing the size of its balance sheet. It will do so by allowing the roll-off of maturing Government of Canada bonds.

While the Bank acknowledges that COVID-19 continues to affect economic activity unevenly across sectors, the Governing Council believes that overall slack in the economy is now absorbed, “thus satisfying the condition outlined in the Bank’s forward guidance on its policy interest rate” and setting the stage for increases in 2022.

Mortgage Rate Holds are the theme for buyers in 2022

Mortgage Mark Herman, your friendly Calgary Alberta mortgage broker & New Buyer Specialist.

2022 Canadian Mortgage Rate Forecast

Why five-year variable rates will likely save money versus their fixed-rate equivalents in 2022 (and beyond).

We begin 2022 with Canadian inflation at its highest level since 2003.

Prices have been driven higher by a combination of surging demand, fueled by generous government support payments, and supply shortages tied to the pandemic.

Both the Bank of Canada (BoC) and the US Federal Reserve have been predicting that these factors will have only a transitory impact on inflation.

The term transitory means “non-permanent”, which still appears to be the correct assessment, but it also means “of brief duration”, which hasn’t been the case.

The experience of hotter and stickier inflation has caused both bond-market investors and the wider public to lose confidence in our central bankers.

That is concerning because if people lose faith in their ability to keep inflation contained, they may start accelerating their purchase plans to avoid future price increases, and any such additional increase in demand would push prices still higher. The longer inflation persists, the more likely it becomes that workers will push for higher wages to compensate for their reduced purchasing power. This engenders a self-reinforcing cycle, where the fear of higher inflation causes it to materialize.

With public confidence waning, both the BoC and the Fed had no choice but to stop using the term transitory and to turn more hawkish on monetary-policy tightening. At this point, higher mortgage rates in 2022 appear all but inevitable. But how high will they go?

The five-year Government of Canada (GoC) bond yield, which our five-year fixed mortgage rates are priced on, has already surged higher in anticipation of five quarter-point BoC rate hikes in 2022 and two more in 2023. Those are some big moves that are already priced into five-year fixed rates if you lock in today.

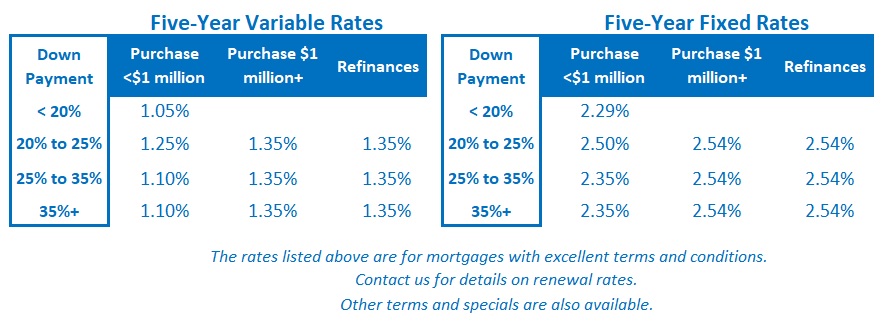

Meanwhile, for at least a little while longer, the BoC’s policy rate stands at 0.25%, and that means five-year variable mortgage rates are still available in in the low 1% range, or about 1.25% below their fixed-rate equivalents. That is a much larger buffer than normal.

The futures market is expecting that spread to disappear by the end of the year, but I am skeptical for the following five reasons:

- Omicron’s Impact Is Being Underestimated

In their initial assessment of the Omicron variant, policy makers assumed that its economic impacts would, like its typical symptoms for the vaccinated, be relatively minor.

The Fed initially predicted that Omicron would exacerbate supply shortages and put more pressure on inflation over the short term, but thus far, Fed Chair Powell has said that Omicron will not have much impact on its plans.

I predicted (here) when he made that statement in December that he would regret it, and if he doesn’t already, I expect he will soon. While Omicron’s typical medical impact on the vaccinated has been minor compared to previous COVID variants, it has still caused hospitalizations to spike and is proving quite severe in the unvaccinated.

US vaccination rates and public safety measures have lagged those in Canada and most other developed countries, and that makes the country much more vulnerable to Omicron. If lockdowns are sworn off and US vaccination rates continue to lag, US hospitals may be overrun. That rising risk increases the likelihood that US economic momentum will slow and that the Fed will turn more dovish.

The approach of most Canadian provinces to Omicron has been more cautious. We have closed schools and reinstituted other lockdown restrictions to try to slow infection rates and keep our health-care system from becoming overwhelmed. That reduces our risk of health harm, but it also increases our risk of economic harm, and that, in turn, should turn the BoC more dovish.

- Inflation Will Cool More Rapidly Than the Market Expects

Our Consumer Price Index (CPI) captures price changes over the most recent twelve months.

Prices started to surge in the second half of 2021, and if inflation is going to maintain its current pace into the second half of 2022, it will take another fresh round of price spikes. This seems increasingly unlikely. Supply constraints are gradually being rectified and Omicron has already made consumers more cautious with their spending.

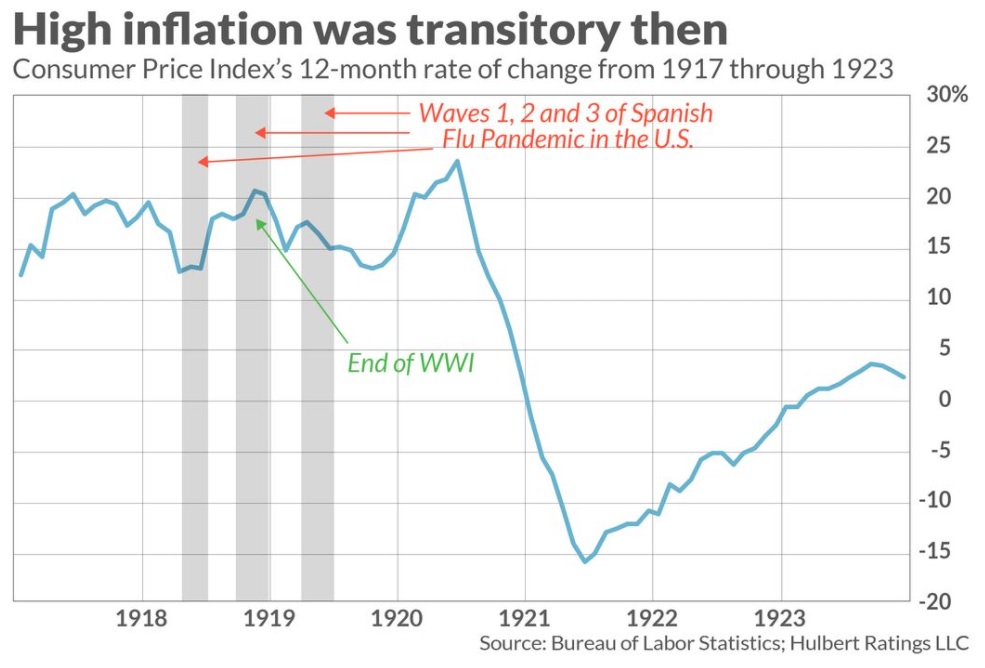

The consensus expects another demand-fueled price spike when we finally free ourselves from the pandemic’s clutches. The theory goes that consumers will spend the cash that they have built up, and that we will see a repeat of the Roaring 20s, when growth and demand surged after the Spanish flu ended.

I have already rebutted that prediction in previous posts. To summarize, the US population was much younger then, US government and household debt levels relative to GDP were miniscule compared to today, and World War I had devastated Europe’s manufacturing capacity, which made the US the world’s dominant exporter over that decade. Very different times.

But what if I’m wrong and we do see a return to the Roaring 20s? Does it follow that inflation will take off?

If past is prologue, the answer is still a firm no.

The chart below shows what happened to inflation when the Spanish Flu ended (and it went on to average less than 2% over the entire 1920s decade).

- There Will Be Much Less Stimulus in 2022

Our policy makers used record levels of fiscal stimulus to offset the pandemic’s initial economic shock.

Those stimuli created many positive short-term impacts that included elevating our GDP, increasing demand, and driving wage growth higher. But those benefits came with a cost. Both US and Canadian budget deficits have soared, driving our government debt levels still higher into the stratosphere.

In addition to being the main contributor to our economic growth in 2021, massive fiscal stimulus was also the primary driver of today’s demand-induced inflationary pressures. But that powerful stimulus has already been sharply reduced on both sides of the 49th parallel, and our governments simply cannot deploy the same largesse to offset any future shocks caused by the pandemic.

The BoC and the Fed are in the same boat as their respective federal governments. They slashed their policy rates to the floor and used quantitative easing (QE), first to flood financial markets with liquidity and then to push bond yields lower. Those moves stimulated financial markets and helped to avoid a repeat of the Great Depression, but they did so by causing asset values to soar, and thereby raising bubble risks across the economy.

Our central bankers now feel compelled to tighten monetary policy to maintain their inflation credibility and help stave off those bubble risks, but that tightening will likely exacerbate, not alleviate, the pandemic’s negative impacts over the year ahead.

If the aggressive rate cuts that have helped asset values surge higher since 2020 are reversed, asset prices would normally reverse direction as well. If that happens, the wealth effect that caused consumers to spend more last year because they were richer (on paper) would also dissipate and cause consumers to turn more cautious.

- The Impact of Rate Hikes Will Be Magnified

Caught between the devil (inflation expectations becoming unanchored) and the deep blue sea (negative economic shocks tied to the pandemic), the BoC and the Fed are reaffirming their commitments to maintain price stability above all else.

But with much less fiscal stimulus buoying economic activity (and exacerbating inflationary pressures), with Omicron’s impacts proving more substantial than first expected, and with elevated debt levels increasing the overall cost of each rate rise, the impact of each hike will be magnified.

All that makes it likely that fewer hikes will ultimately be required to bring inflationary pressures to heel.

If we see anything close to the five BoC rate hikes the consensus is betting on, I think it will prove to be a misstep that will drive our economy into recession. If that happens, rate cuts would almost certainly follow thereafter.

- Labour Costs Will Be Contained

Despite many anecdotes to the contrary, the hard data show that wages are still largely contained in both Canada and the US, even though our employment backdrops are quite different.

In the US, average wages have risen by 4.7% year over year, but they still haven’t kept pace with overall inflation. By the Fed’s own assessment, average wages were suppressed prior to the pandemic, and some of that increase is therefore a catch up. While US employers are still experiencing labour shortages, US workers are expected to return to the labour force now that emergency benefits have expired and they are burning through their built-up cash reserves.

US wages may continue to rise, but so too should the labour-force participation rate as workers start to re-engage out of necessity.

In Canada, our employment recovery has significantly outpaced our overall economic recovery. That’s good for the hiring data but seriously bad for our productivity levels. We are employing more people to do the same amount of work, and that helps explain why our average wages have only increased by 2.9% on a year-over-year basis and why they remain well below their pre-pandemic level with no signs of any imminent breakout.

Now let’s tie all the above commentary back to the key question of whether fixed or variable mortgage rates will prove cheaper in 2022 and over the next five years.

My crystal ball doesn’t come with any guarantees, but with that said, I fundamentally believe the following:

- Omicron’s greater-than-expected impact will make both the BoC and the Fed more dovish.

- Supply challenges will continue to be overcome in the year ahead, and inflation will subside more quickly than expected.

- Demand will moderate without the powerful tailwind of fiscal stimulus.

- The impact of each rate hike will be magnified, and as such, we will need fewer of them.

- Wage growth will not push inflationary pressures materially higher.

Against that backdrop, I expect that variable mortgage rates will save money over their fixed-rate alternatives over the year ahead, and, true to their usual form, are a good bet to do so over the next five years.

It won’t be as easy for variable-rate borrowers this year, because I do expect some rate hikes to ensue, but the gap of about 1.25% over the available five-year fixed rate alternatives provides a large and significant buffer that I don’t think that will close in 2022 as the consensus predicts.

Meanwhile, GoC bond yields have spiked in anticipation of five BoC rate hikes in the year ahead, with two more the year after, and I expect these rates to move lower if and as it becomes clear that the Bank’s raising schedule will be both more gradual and less severe than the consensus forecast.

The Bottom Line: US bond yields have recently surged higher in response to the release of the Fed’s minutes from its December meeting, which revealed that it may tighten more quickly than previously forecast. GoC bond yields have risen in sympathy.

That said, all the pandemic-related news since then has been worse than expected, and that should soon put an end to the current run up. In the meantime, however, the five-year GoC bond yield has recovered to near its previous high, and if it continues its current trajectory, five-year fixed mortgage rates could move higher over at least the short term.

Five-year variable rate discounts have recently widened a little, and for the reasons outlined above, I don’t expect the BoC to increase at nearly the pace bond-market investors are currently pricing in over the year ahead.

Nov 2021; Mortgage Rates & Inflation Report

This just in data is when mortgage interest rates are expected to rise.

DATA JUST IN

Canada’s latest employment and inflation numbers have triggered new expectations about the next steps by the Bank of Canada and the arrival of interest rate increases.

BoC Governor Tiff Macklem continues to offer soothing words about inflation, which is current running at 4.1%. That is an 18 year high and more than double the central bank’s 2.0% target.

Macklem has repeatedly said high inflation is temporary; the result of low prices during the pandemic lock-downs, and supply chain problems that have cropped-up as the economy reopens.

Macklem points out that a key factor in long term inflation – wage growth – has not materialized. That is despite Canada returning to pre-pandemic employment levels with the addition of 157,000 jobs in September. It should be noted that the growth of Canada’s labour force during the pandemic means the country is still 276,000 jobs short of full employment. Last week however, Macklem did concede that this temporary inflation may linger for longer than initially expected.

Several prominent economists have weighed-in. Benjamin Tal cautions that inflation is a lagging economic indicator. He says the risks for long-term inflation are present and the Bank of Canada would be better to start raising rates earlier to help mitigate those risks. Doug Porter says there is a growing chance rate increases will come earlier. He expects they will happen quarterly rather than every six months. And, Derek Holt would like to see a rate hike by the end of the year, given that emergency levels of stimulus are in place while inflation is well above target.

Look for mortgage interest rates to start going up close to the end of 2021 and continue until they are back close to PRE-Covid Rates of about 3.35% for the 5-year fixed.

Mortgage Mark Herman, best Calgary mortgage broker for the masses!

Canadian Mortgage Rates: Higher Soon, How High?

A normal English article with predictions of Canadian Mortgage Interest Rate Predictions, September 2021.

We think these rates are going to happen but ON A LONGER TIME RANGE that what they think.

Summary of Expected Rates*

- 2.55% – 2.65% in October, 2021

- 2.60% – 2.85% in December, 2021, reduction in buying power of 7%

- 3.10% – 3.30% in October, 2021, reduction in buying power of 8% – 14%

*These rates can totally happen, and are still lower than Pre-Covid rates, but also consider these things that would delay economic recovery/ keep rates low: Iraq – any thing, a 4th and 5th wave of Covid, new variants, USA droughts/ wild weather.

Mortgage Mark Herman, top Calgary Alberta mortgage broker, for new buyers

And a Renewal Surprise:

You may be surprised by the cost of a renewal. A $500,000 mortgage with a 5-year fixed rate of 2.0% would pay around $46,080 in interest over the term. If that rises to 3.1% next year, the cost of interest over the same period would be $72,183. That is an extra $26,000 if interest a year. ANSWER: look at renewing early. We can help you out with that.

OK … on with the news:

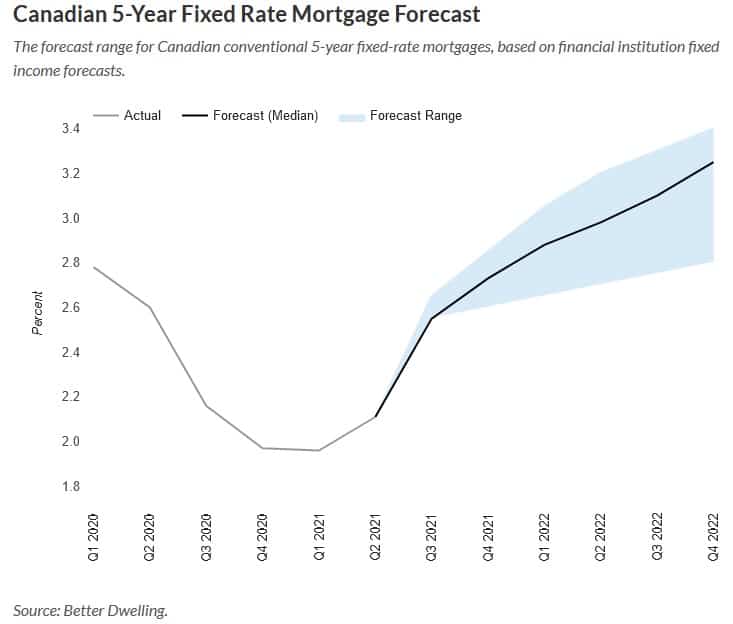

The Canadian economy is improving, excluding some minor hiccups like this morning’s GDP. An improved economy needs less stimulus, and that means higher mortgage rates. To see what Canada is in for, we modeled a forecast range for 5-year fixed-rate mortgages. If Canada doesn’t go into a double-dip recession, much higher mortgage rates are coming.

Canadian 5 Year Fixed-Rate Mortgage Forecast

Today we’re looking at 5-year fixed-rate mortgage interest, and where it’s heading. More specifically, we’ll be focusing on conventional (aka uninsured) mortgage rates. These are for homeowners with a decent amount of equity, and a loan to value ratio below 80%. Insured and variable rate mortgages follow a different path. However, they’ll generally follow the same trend.

This model is based on fixed income forecasts created by major financial institutions. Since they’re forecasting how much investors will make, we can forecast how much you’ll pay. Just a couple of quick notes for the nerds, and aspiring nerds.

The strength of the economy and the recovery are going to be big factors in determining how high these go. A stronger economy means a faster recovery, and along with that is higher mortgage rates. Weaker economic performance will generally mean lower rates to stimulate borrowing. As economic conditions change, so will these forecasts.

Credit liquidity will also play a role in the direction of mortgage rates. If there’s excess capital to lend, mortgage lenders tend to accept smaller margins. This helps to lower the cost of borrowing since they’ll make it up on revenue. If capital for mortgages becomes scarce, mortgage rates rise to adjust to demand.

Today’s chart assumes a medium level of credit liquidity. That is, not much excess, but it’s not scarce either. That’s how the mortgage market was pre-pandemic, and we’ll assume it goes back to that.

Canadian Mortgage Rates Are Going To Climb

Mortgage borrowing costs are likely to reach pre-pandemic levels soon. Our median 5-year fixed-rate forecast is 2.55% by the end of Q3 2021. Based on the most bullish yield forecast, it would rise to 2.65%. The downside yield forecast is the same as the median.

Most institutions have consistent near-term expectations. That sounds weird, but it makes sense. Near-term forecasts are the most visible, with the least number of variables compounding. As forecasts are further out, we’ll see the gap widen as their difference in outlook is magnified.

Canadian 5-Year Fixed Rate Mortgage Forecast

The forecast range for Canadian conventional 5-year fixed-rate mortgages, based on financial institution fixed income forecasts.

Mortgage Interest Rates Can Increase Substantially By Year-End

By the end of this year, we start to really see the potential for these rates to climb. By Q4 2021, the median forecast would put a typical 5-year fixed-rate mortgage at 2.73%. The forecast range becomes wider, going from 2.6% (low) to 2.85% (high). It may not sound like much, but it can have a big impact.

The rate of change is much more important than the actual number. If you go from a 2% rate to a 2.73% rate, your cost of interest rises 36.5%. If we exclude the stress test, buying power sees a 7.84% decline. Since recent buyers are mostly stress-tested, default isn’t much of an issue. However, the cost and size of debt can be.

Mortgages Rates May Rise More Than A Point By Next Year

Next year is going to be a big one for mortgage rates if the economy recovers as expected. The median 5-year fixed-rate forecast works out to 3.10% by the end of Q3 2022, which can lead to an 11.5% reduction in buying power. On the low end, the rate still comes in at 2.7%, reducing buying power by 8.0% outside of a stress test. The high range would see it climb all the way to 3.30%, pulling maximum mortgage credit 14.3% lower. Keep in mind the stress test rate may also adjust higher as well. It depends on how comfortable OSFI is with rates rising closer to their stress test number.

Another factor to consider here is the cost of the renewal. A $500,000 mortgage with a 5-year fixed rate of 2.0% would pay around $46,080 in interest over the term. If that rises to 3.1% next year, the cost of interest over the same period would be $72,183. I don’t know about you, but $26,000 is a decent chunk of money to spend over a year.

Existing mortgage holders close to renewal may want to text their mortgage broker. If you see the economy improving, locking in rates might save you a little money. It might not though, depending on whether you have prepayment penalties. It’s always best to run the numbers with a broker on various scenarios though.

Pending a double-dip recession doesn’t occur, higher mortgage rates are coming. Maybe not as high as the Desjardins forecast, but definitely higher than it is now. Those supersized mortgages with short terms are going to divert more capital from the economy on renewal. The takeaway isn’t how high mortgage rates can climb though. It’s how absurdly cheap mortgage debt has been during the pandemic.

Link to the actual article: https://betterdwelling.com/canadian-mortgage-rates-will-rip-higher-soon-heres-how-high/#_

Mortgage Tip: Where are Canadian Mortgage Rates Going in 2021

SUMMARY:

There is LOTS of room for rates to go up, and very little for rates to go down or even hold steady.

Fixed mortgage rates are predicted to rise by 40% and go back to Pre-Covid rates or higher:

- 2.9% (from 2.09% now) for less than 20% down; CMHC insured

- 3.10% (from 2.24% now) for more than 20% down; conventional / not insured.

Prime – what variable rates are based on:

- The Bank of Canada has moved their target for Prime increase from 2023 to 2022.

- The US Fed has moved their target for Prime increase from 2024 to 2023, and the market expects that to move to 2022 as well.

- Prime is 2.45% today, it was 3.95% just before Covid (Feb, 2020) and will be trending back that way soon.

- Prime – 1% is the rates for today. 2.45% – 1% = 1.45% which is a great rate but how soon and how much will it move?

This article is awesome, and clear on what the changes mean. The summary above is all you need but you love this data, then read on …

Canadian Mortgage Rates Forecast To Rise Over 40%, Posted Rate Can Hit 7%

Canadian inflation is marching higher, and so are the expectations for mortgage rates. One bank sees the 5-year posted rate having more room to rise than fall in the future.

The institution has forecast the posted 5-year fixed-rate mortgage can rise up to 40% by 2024.

While the posted rate is rarely the rate paid by mortgage borrowers, it does impact a number of things. More importantly, it reflects an environment where credit is tightening.

The Posted Mortgage Rate Vs What You Really Pay

The posted mortgage rate is an unusually high mortgage rate that’s kind of like the sticker price of a car. It’s unreasonably high, few people will use it, and it’s mostly to help buyers feel like they’re getting a deal. The spread between the posted rate and a lender’s best available rate is usually between 220 to 250 bps. This means the rate borrows often pay is a full 2.2 to 2.5 percentage points lower than the posted rate. That doesn’t mean the posted rate is useless though.

The two biggest impacts it has are on payment penalties and the stress test. If you were to break your fixed-rate mortgage early, for say refinancing at a lower rate, you have to pay a penalty. That penalty is usually 3-months of interest, or the interest rate differential (IRD). The IRD is the difference between your rate and the posted rate closest to your remaining term. Then subtract any discount you received at origination. It’s pretty much what banks use to make sure you pay a big ole’ penalty for changing plans.

The stress test rate is also likely to be influenced by the posted rate, but maybe not directly. Originally the Bank of Canada benchmark rate was used to determine the stress test rate. This was based on the posted rate at various banks. OSFI, the bank regulator, found it wasn’t very responsive to risk though. Rather than rely on the benchmark, they established a rate floor — the minimum rate that can be used. The criteria for how the floor can evolve can change a lot from now until 2024. However, it’s unlikely the stress test rate would ever fall below the posted rate. The stress test rate is currently around 50bps higher than the posted rate.

Canadian 5-Year Fixed-Rate Mortgages Have More Upside Risk Than Downside

There’s uncertainty, but Canada’s faster than expected recovery shows more upside than down. The five-year posted fixed rate is 4.74% currently. In a downside scenario, they see this falling to 4.40% by the fourth quarter of 2021. The upside scenario sees it rising up to 5.25% in the same quarter. Higher inflation expectations are also contributing to a stronger upside scenario.

Canadian Posted 5-Year Fixed Rate Forecast

By next year, the posted 5-year fixed rate is forecast for an even higher maximum — breaching the 6 point mark. Rates are forecast to have a downside of 4.6% in 2022, and an upside of 6.20%. In 2023, the range rises to 4.70% to 6.60% for the full year. In 2023, it gets a little more uncertain with the range widening from 4.55% to 6.95%. While the latter range is wider, it has a lot more upside than downside. The probability of it falling would likely require a substantial economic slowdown.

Since a number of factors go into a forecast, the longer the date, the more uncertainty it faces. Economic conditions would have to worsen and inflation drop for rates to fall. For rates to rise, Canada would have to continue a strong recovery, and/or see higher levels of inflation. Canada is so dependent on housing now, we likely have many people cheering on a crash to keep rates low.

Link to the full article is here: https://betterdwelling.com/canadian-mortgage-rates-forecast-to-rise-over-40-posted-rate-can-hit-7-desjardins/

2021: here Are Mortgage Rates Going?

|

|

Prime Rate Cut; Dec 4, 2019

With the latest developments the Bank of Canada (BoC) has clear path to reduce the Prime rate from 3.95 to probably 3.70%

The Bank of Canada is feeling the pressure to get back into the game with a rate reduction and one obstacle has now been removed.

The bank held its rate the same for an 8th straight meeting on October 30th.

At the same time it has clearly signaled it may not be able to hold that line much longer.

The bank pointed directly at trade conflicts (such as the U.S. – China tariff war) as the key cause of a global economic slowdown and around the world more than 35 other central banks have already cut rates in an effort to keep growth up.

The U.S. Federal Reserve has made three cuts in the past several months. That has boosted the strength of the Canadian dollar which makes the country’s exports more expensive on the world market which is unwelcome.

Great news that the Bank is not concerned that a drop in interest rates will trigger a renewed frenzy of debt-funded consumer spending. It is satisfied that the biggest component of household debt – mortgages – have been stabilized by the B-20 regulations. And another big obstruction has been removed. The federal election is over so the bank can operate without risking the appearance of political favoritism.

Fixed rates are still the way to go right now.

They are close to the all time 119-year lows right now.

Mortgage Mark Herman

Variable rates to hold steady for 2019

Here is the latest on changes to the Prime rate for variable mortgages. The news is good as Prime is now expected to stay the same for the balance of 2019!

Remember:

- Variable rates can be locked in at any time for what the rates are on the day you lock in on.

- The maximum payout fee for is 3 months of interest

Rate hike disappears over the horizon

The likelihood of a Bank of Canada interest rate increase appears to be getting pushed further and further beyond the horizon.

The Bank is expected to remain on the sidelines again this week when it makes its scheduled rate announcement on Wednesday.

A recent survey by Reuters suggests economists have had a significant change of heart about the Bank’s plans. Just last month forecasters were calling for quarter-point increase in the third quarter with another hike next year. Now the betting is for no change until early 2020. There is virtually no expectation there will any rate cut before the end of next year.

The findings put the Bank of Canada in line with the U.S. Federal Reserve and other major central banks. World economies have hit a soft spot largely due to trade uncertainties between China and the United States.

This is good news for variables

Mark Herman, Top Calgary Mortgage Broker

Should you look at 7 and 10 year terms?

With rates on the rise, is it worth a 2nd look at longer term mortgages?

Data:

- Rates have substantially increased over the last 6 of months. We have seen 3 prime rate increases with more on the horizon.

- Fixed rate mortgages have also followed suit due to bond market instability and the increases are noticeable.

- Consumer sentiment has rapidly moved from Variables rates to longer term Fixed rates of 5, 7, and 10 years.

The long-term trend for rates is up!

The advantage of Fixed rates is that they provide clients with added security and stability against this recent storm of volatility. This storm doesn’t seem to have an end in sight either with many questions still to be answered in the coming months. When will bond rates stabilize? Will global pressures continue to drive increases? Will we see a return to historical norms? What will be the impact of recent events on the Canadian economy?

Some clients are more concerned with rate trends these days it’s with good reason. Perhaps the interim answer to all this instability and volatility is to start looking long “term”. 7 & 10 year terms to be specific.

Longer term mortgages like a 7 & 10 year term help insulate clients against potential increases in the short to long-term as well as provide safety and consistency with mortgage payments that won’t fluctuate with the markets volatility.

We don’t have to go back very far (6-7yrs) to a time when 10 year mortgages were a very popular and attractive option. During that period of time many case studies show this product didn’t work out for those borrowers who selected those 10 year terms, however there was a major difference between that period of time and today. 6-7 years ago we were in a more stable rate environment and there was very little difference between the 5 & 10 year rates at the time. Shortly after this period, rates quickly dropped to even further all-time lows.

Compare those details to our current market situation where rates have now bottomed, and it becomes quickly apparent rates have been continually rising with more sustained increases forecasted.

If security is your top key, lets talk about a 7 or 10 year mortgage option today.

Mortgage Mark Herman

Top Calgary Alberta Mortgage Broker

403-681-4376

July 2017, when Canadian interest rates are expected to increase

This is just in from TD Economics, a .75% Prime rate increase is expected to be phased in – probably in 1/4% increases – starting in July 2017 and being fully in by December.

The rates they show below are for corporate rates, consumer rates are a bit higher.

Consumer prime is at 2.7% today so that would be the same increase of .75% taking it from 2.70 to 3.45% by the end of 2017.

OBSERVATION

• Our current forecast is for the Bank of Canada to begin raising interest rates in July of 2017, increasing the policy rate to 1.25% (from its current level of 0.5%) by the end of 2017. It is possible that with additional infrastructure-led growth the Bank may choose to begin hiking rates earlier and perhaps more aggressively.

All this and more from Calgary, Alberta top mortgage broker, Mark Herman.