New Housing Rules for 1st First-Time Buyers and New Builds

If you’re a first-time home buyer or looking to purchase a new build, this affects you.

Here’s a quick summary of the changes coming in December 2024:

What’s New?

30-Year Amortizations Now Available for First-Time Buyers and New Build Purchases

- First-time home buyers can now access 30-year amortizations for insured mortgages.

- This increases the amount you qualify for by about 9% or lowers your monthly payment about the same.

- 30-Year Amortization for New Builds – Technically, this took effect on August 1, 2024, and is available to everyone, not just First-Time Homebuyers.

Price Cap Increase for Insured Mortgages

- The price cap (purchase price) for insured mortgages has been raised from $999,999 to $1,499,999 million.

- EG: if you were to purchase a home today priced at $1.1 million, your minimum down payment to qualify for a mortgage would be 20% or $220,000. After December 15th, the minimum down payment required decreases to $85,000.

- If that $1.1 million dollar home also has a self contained suite, you can use the rent or “potential” rent that suite will generate to help qualify for a bit more of a mortgage too.

The Fine Print

Down payment – Great news, minimum requirements stay the same:

- 5% on the portion up to $500,000

- 10% on the portion between $500,000 and $1.5 million

* Previously, the down payment on a $1.5 million home for a First-Time Home buyer was $300,000.

FTHB’s can now get into that same home with $125,000.

This will undoubtedly take some pressure off the Bank of Mom and Dad.

Effective Date

These changes will apply to mortgage insurance applications submitted on or after December 15, 2024. The key word here is ‘submitted.’ Your offer will need to be timed just right if you wish to take advantage of the new 30-year amortization.

Potential Impacts on the Housing Market:

We are in an interesting position right now. On one hand, lenders are competing for new business in what could be described as a ‘rate war.’

Additionally, with First-Time Home Buyers (FTHB) set to qualify for 30-year amortizations after December 15th, we can expect an uptick in demand.

Historically, higher demand leads to higher prices and rate decreases cause an equal and opposite increase in home prices.

Buy or Sell – Now or Later?

While there’s no crystal ball, consider these possibilities:

- Buy Now: Prices are expected to rise once the new rules take effect, so purchasing before December could mean less competition and potentially lower prices.

- Sell Later: If your home is priced between $1 million and $1.5 million, waiting until after December 15th could attract more qualified buyers and possibly higher offers.

More details will emerge as lenders and insurers prepare to offer the new 30-year amortization, such as how lenders will view the minimum down payment.

If you want to discuss how these changes might impact your plans to buy or sell, feel free to reach out!

Variable Rate Beats BOTH 3-year & 5-year Fixed Terms

The Variable is the best way to go right now and this blue link has all the details in PDF: VARIABLE RATE beats both 3-year fixed & 5-year fixed terms

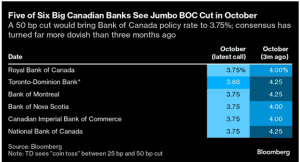

Data point 1: Variable rates should be coming down 2% in the next 13.5 months, with a “jumbo reduction” of 0.5% (1/2%) expected on Wednesday, Oct 23rd – by 5 of the 6 Big Banks.

Data point 2: Historically, fixed rates only go down about 40% of the reductions to Prime, so fixed rates will not be going down anywhere near as much or as fast as the Variable.

Data point 3: Just a 1% rate reduction is expected to “reactivate” at least half of buyers who previously stopped shopping due to “buyer fatigue.”

Data point 4: As interest rates come down, prices INCREASE because most buyer’s need to go to their max mortgage when buying.

Graphic details of expected rate reductions and the dates of expected changes, in PDF: VARIABLE RATE beats both 3-year fixed & 5-year fixed terms

Our favorite customer quote so far in October:

I am not locking in 3-year money nor 5-year money today, when the Bank of Canada has made it clear rates are coming down 2% in the next 15 months.

Mortgage Mark Herman, Top Calgary Alberta Mortgage Broker near me.

GIFTed down Payment now possible for New-to-Canada home buyers!!

For New to Canada buyers – Expanded “GIFT-ing” is now possible for close family members!

That’s right! As of now, May 23, 2024, buyers who are New to Canada – in Canada for less than 2 years – ARE now allowed to use /receive GIFTS for down payment from “close family members.”

This is a big deal because it now includes; aunts, uncles, nephews, and cousins; all were not allowed to provide a “GIFT for down payment” before.

The standard used to be only: mother, father, brother, sister, grandparent and legal guardian; and that was it.

From our data that we have on on our own customers, this will help about 20% of our New to Canada files to buy a home, where they would have been shut out before.

Mortgage Mark Herman, top best fantastic Calgary Alberta mortgage broker, specializing in First Time Buyers.

We view that the Expanded Gift-er Options ARE needed due to the average new home price being 500k+, it is super tough for newcomers to save enough to buy a home. GIFTS are relied on all the time by 1st time home buyers.

Divorce & Mortgage Buy-Out Details, Canada, May 2024

Important data for separating / divorcing partners, this may help with “Buying the ex-spouse out” of a divorce, when some debts need to be rolled in.

The way most lawyers and Big-6 banks do it:

as a refinance, max loan is 80% of the appraised value of the home,

and you get refi rates – the highest – today:

- 3 year fixed 5.76%, 5 year fixed 5.59%

and usually NO debts can be rolled into the mortgage past that 80% of the home value.

with OUR WAY/ Broker way…

we do it as “a purchase after marital breakdown” which allows

max loan of 95% LTV (of the home value) – which usually makes ALL THE DIFFERENCE in a buyout situation.

- BEST RATES again: 3 year fixed 5.39%, 5 year fixed 4.99%

and usually Most/ All/ some debts can be rolled into the mortgage – at no extra cost, depending on your lending ratios.

Data from a similar file –

As long as the deal IS insurable (meaning it conforms to CMHC rules and guidelines) to get that lower rate – actually 0.6% LOWER as of today – then we need an offer to purchase too. Most lawyers do not want also write an “offer to purchase,”

If the Big-6 bank is doing it as a conventional refinance then an offer to purchase is not needed.

Banks don’t have substantially different rates for insurable and conventional like we do. (o.4 to o.9% rate difference makes a huge difference.)

So yes, we can get a separation done without an Offer to Purchase as long as at least 20% of the value stays in the home and we use refinance rates at 0.6% higher than broker best rates today.

Considering customers will leave us for 0.05% and this is 0.6% – that is >10x multiple of what customers consider “worth leaving us for” this is an important way to get divorce deals to work better for everyone.

Mortgage Mark Herman, top/ best Calgary Alberta Mortgage Broker

Prime Rate Holding, July 1st Expected Reduction & Real Estate Economic Data

The Bank of Canada cited the ongoing risk of inflation for its decision to maintain its overnight benchmark interest rate at 5.0%.

Below are the Bank of Canada’s observations, including its forward-looking comments on the state of the economy, inflation and interest rates.

Canadian inflation

- CPI inflation ended the year at 3.4% and the Bank expects inflation to remain close to 3% during the first half of 2024 “before gradually easing” and returning to the Bank’s 2% target in 2025

- Shelter costs remain “the biggest contributor to above-target inflation”

- While a slowdown in demand is said by the Bank to be reducing price pressures in a broader number of CPI components and corporate pricing behavior continues to normalize, core measures of inflation are not showing sustained declines.

Canadian economic performance and outlook

- The Bank notes that the Canadian economy has “stalled” since the middle of 2023 and believes growth will likely remain close to zero through the first quarter of 2024

- Consumers have pulled back their spending in response to higher prices and interest rates, and business investment has contracted

- With weak growth, supply has caught up with demand and the economy now looks to be operating in modest excess supply

- Labour market conditions have eased, with job vacancies returning to near pre-pandemic levels and new jobs being created at a slower rate than population growth. However, wages are still rising around 4% to 5%

Global economic performance and outlook

- Global economic growth continues to slow, with inflation easing “gradually” across most economies

- While growth in the United States has been stronger than expected, it is anticipated to slow in 2024, with weakening consumer spending and business investment

- In the euro area, the economy looks to be in a mild contraction

- In China, low consumer confidence and policy uncertainty will likely restrain activity

- Oil prices are about $10 per barrel lower than was assumed in the Bank’s October Monetary Policy Report (MPR)

- Financial conditions have eased, largely reversing the tightening that occurred last autumn

- The Bank now forecasts global GDP growth of 2.5% in 2024 and 2.75% in 2025 compared to 2023’s 3% pace

- With softer growth this year, inflation rates in most advanced economies are expected to come down slowly, reaching central bank targets in 2025

Outlook

The Bank believes that Canadian economic growth will strengthen gradually “around the middle of 2024.” Furthermore, it expects household spending will likely “pick up” in the second half of 2024, and exports and business investment should get a boost from recovering foreign demand.

Taking all of these factors and forecasts into account, the Bank’s Governing Council decided to hold its policy rate at 5% and to continue to “normalize” the Bank’s balance sheet.

The Bank’s statement went on to note that Council “is still concerned about risks to the outlook for inflation, particularly the persistence in underlying inflation” and wants to see “further and sustained easing in core inflation.” The Bank also said it continues to focus on the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behaviour.

As it has said consistently over the past year, the Bank will remain “resolute in its commitment to restoring price stability for Canadians.”

Although the Bank did not say it, the bottom line is we will have to wait and see what comes next.

Next touchpoint

March 6, 2024 is the Bank’s next scheduled policy interest rate announcement.

The End of Prime Rate Increases, January, 2024, Canada

Horray, today The Bank of Canada didn’t just put rate hikes on the back burner today; it unplugged the stove!

The Bank is now “confident enough” that inflation is on the right track to not publicly dwell on rate hike risk any longer. That was today’s message from Senior Deputy Governor Carolyn Rogers after the BoC left its overnight rate at 5%.

Instead, the Bank says it’s now shifting its focus to “how long” the overnight rate needs to marinate “at the current level.”

Summary:

No more increases to the Canadian Prime Rate of Interest – at 7.2% today, after 10 increases in 2023.

Back in August I said Prime should start to come down in June – still the best guess – and

will come down by o.25% every 3 months, so one-quarter-percent decrease every calendar / fiscal quarter (3 months)

for a total of 2% less than today so … Prime should end up at 5.2% in 30 months, which is June 2026.

Mortgage Mark Herman, top Calgary Alberta and BC mortgage broker

“We need to give these higher interest rates time to do their work,” Macklem said, offering no clues on how long he’ll let the rate hike stew simmer. The forward market thinks it’ll take another 4 – 6 months. Historically, rates have plateaued at peak levels for anywhere from a few months to 17 months. So far, it’s been only 6.

The Bank says that higher rates can’t be completely ruled out, but it’s very rare for the Bank of Canada to hike a bunch, pause 5+ months, hike more, pause 5+ months more, and then hike again.

When Will Canadian Mortgage Rates Begin to Fall?

Last week, the Bank of Canada held its policy rate at 5%. The decision was expected given slowing in the economy and modest improvement to core inflation measures.

The Bank is likely at the end of its tightening cycle. How soon it eases rates – and how low will rates go in the near to medium term – is the question #1

ANSWER: The general view from market economists is that we could see some easing of the overnight rate by mid-2024.

Question #2: How low. how far will Prime come down?

ANSWER: Prime is expected to come down a total of 2%.

DETAILS of Prime Cuts

- Prime is 7.2% now / November 2nd, 2023,

- Prime is expected to get down to to 5.2% or a bit lower, like 4.75% – 5.25% range by the end 2025; which looks like this:

- June/ July 2024, 1st Prime cuts = 6 months

- Prime reduction by o.25% every quarter = 1% less / year for the next 2 years = 24 months

- so these together = 30 months.

With Prime coming down, now is the time for you to take advantage of the Variable Rate reductions.

Variable Rates via brokers are at Prime – o.9%, while the Big-6 banks rates are Prime – o.15%.

YES, broker rates are 6x better than at the Big-6 lenders, o.9 – o.15 = o.75% better. It’s true!

Mortgage Mark Herman; Best Top Calgary Mortgage Broker for first time home buyers.

When might rates begin to fall?

The Bank’s latest Monetary Policy Report (MPR) also provides signals that we can monitor to gauge when rates could start declining.

When interest rates rise, one of the main ways monetary policy affects the economy is through reduced consumer spending on durable goods, like appliances, furniture and cars. Prices for durable goods, except for cars, have dropped from 5.4% to -0.4%, while prices for semi-durable goods, like food and clothing, have decreased from 4.3% to 2.1%. We’re still experiencing delays in delivering cars. As a result, manufacturers are concentrating on selling more expensive vehicles with higher margins and are offering fewer discounts from list prices.

Inflation in service prices, excluding shelter, has slowed from 5.1% to 1.5%. If bond rates begin to drop, we will see a gradual decline in mortgage costs. The challenge will be rental costs, which are soaring due to the very limited availability of rentals and the continuous influx of newcomers. Increasing housing supply is key to reducing rental prices. However, that is a problem that will take years to resolve given the significant shortage of housing.

Currently, the Bank is concerned about inflation expectations, corporate pricing behaviour, and wage growth. As noted in its Monetary Policy Report, “As excess demand eases, inflation is expected to slow. At the same time, inflation expectations should also fall, businesses’ pricing behaviour should normalize, and wage growth should moderate. So far, progress has occurred but somewhat more slowly than anticipated.”

The Bank will be careful to ensure that inflation expectations inconsistent with its 2% target are not embedded in corporate pricing and wage expectations. A slowing economy should help to lower those expectations.

The general view from market economists is that we could see some easing of the overnight rate by mid-2024.

NERD STUFF: Maintaining a restrictive rate policy

The Bank can maintain a restrictive policy even without increasing rates any further, simply by keeping rates at their current level. With the overnight rate at 5% and an inflation rate of 3.8%, the real policy rate is 1.2%. This rate is restrictive, since it is higher than the neutral real rate of interest, which the Bank estimates to be between 0 and 1%.

The neutral real rate of interest is the level of interest that neither stimulates nor restrains economic growth. In other words, it is the rate at which the economy is in balance, with stable prices and full employment. Therefore, when the real rate of interest is restrictive, we would expect GDP to slow.

In its recent Monetary Policy Report (MPR), the Bank is forecasting economic growth to average less than 1% over the next few quarters, while potential output growth is expected to average 2%, mainly due to population growth and increased labor productivity. This should lead to a negative output gap (low demand and a surplus of products) and lower inflation.

New Mortgage Rules 2023: Expanding the “Stress Test” to Everything?

This is from the Desk of Dr. Cooper, our Economist, and this data is 1 of the reason we are at Dominion Lending – to get this data.

Below is the details of the government expanding the STRESS TEST, or other mechanisms, to make it harder to buy a home.

OSFI Is Concerned About Federally Insured Lender Exposure to Mortgage Risk.

Late last week, the Office of the Superintendent for Financial Institutions (OSFI) announced it was concerned about the risks associated with the large and rising number of highly indebted borrowers, especially those with floating-rate mortgages, which stands at a record proportion of outstanding mortgage loans.

With the economy in danger of entering a recession and the Bank of Canada warning of potentially more rate hikes to counter persistent inflation, the housing market may face continued pressure in the coming months.

A record number of buyers used floating-rate debt for purchases during Canada’s pandemic-era real estate boom. Those borrowers may come under increasing strain if mortgage costs remain high. Job losses from an economic slowdown also would make it harder for people to keep up with loan payments and stay in their homes.

Superintendent of Financial Institutions Peter Routledge said a review of the country’s mortgage-underwriting rules that starts later this week would look beyond its current main measure — a stress test requiring borrowers to qualify for higher interest rates than what their banks are offering.

“The question in our minds is, is it sufficient?” Routledge said of the current stress test. “So we will look at a broader range of debt-serviceability tools, including debt-to-income constraints, debt-service constraints, as well as the current interest-rate stress test tool.”

The proposed rules—subject to public consultation—include loan-to-income and debt-to-income restrictions, new interest rate affordability stress tests and debt-service coverage restrictions.

Highly Indebted Borrowers

OSFI is particularly concerned about the rise in mortgage originations to households with a loan-to-income ratio of 450% or more, which the Bank of Canada has long asserted is the sector most at risk of delinquency and default. This risk has repeatedly been highlighted in the Bank’s financial risk analysis–the Governing Council’s Financial System Review. The latest report says, “Those with high debt are more vulnerable to a decline in income and will face more financial strain when they renew their mortgages at higher rates.”

This vulnerability relates to households’ ability to continue servicing their debt if incomes decline or interest rates rise without significantly reducing their consumption. The Bank staff estimate that the most highly indebted households have generally seen the smallest increases in liquid assets. At the same time, alongside higher house prices, many households have taken out sizable mortgages to purchase a house, adding to the already large share of highly indebted households.

The chart below shows that the average share of high loan-to-income borrowers before the pandemic was 23.8%. The average since the pandemic onset has risen to 33.7%.

Proposals for Comment

To date, mortgage delinquency rates at federally regulated financial institutions (FRFIs) are at a record low. The large FRFIs have worked closely with borrowers who have reached their trigger points. TD, CIBC, and BMO have allowed some negative amortizations until renewal. As a result, the proportion of their mortgages having remaining amortizations has risen sharply (see second chart below). Questions remain regarding how they will deal with this at renewal time. Will the new mortgage be amortized at 25 years at renewal, raising the monthly payments dramatically and increasing the risk of delinquency or default, especially among highly indebted households?

Earlier last week, CEOs of the Big 5 banks weighed in on vulnerable mortgage clients. None were quite as forthcoming as Scotiabank’s new President and CEO, Scott Thomson, who said the bank has about 20,000 borrowers that it considers “vulnerable.” These are borrowers with a high loan-to-value (LTV) mortgage, a low credit score, lower deposits in their checking accounts and those with home valuations that are susceptible to market conditions.

“So, as you think about the tail risk, we have about 20,000 vulnerable customers, which would be 2.5% [of the total portfolio],” he said Monday during the RBC Capital Markets Canadian Bank CEO Conference.

However, he added this represents a “manageable-type situation for us on mortgages.” Scotiabank’s floating-rate mortgages are not fixed payment. They adjust monthly payments every time the central bank changes the overnight rate.

According to Steve Huebl at Canadian Mortgage Trends, RBC President and CEO Dave McKay said that his bank is “keeping a watchful eye on its mortgage clients, turning to AI and various types of modelling to forecast clients’ cash flow.”

“We look at incomes, we look at the stress of inflation on expenses in a household, and we monitor cash flow to interest payments, as you would in any corporation,” McKay said during the conference. “We do that [for] every single consumer in our portfolio because over 80% of our clients have their core checking and core cash management with us.”

Looking at the bank’s variable-rate mortgage portfolio, which totals between $100 and $120 billion, McKay said the bank has been able to segment that group of clients, keeping tabs on when they reach their trigger rates and when they’ll be coming up for rate resets in the next several years.

Through modelling, the bank can then predict which clients with upcoming renewals “will or will not have a cash flow challenge” should the economy enter a moderate or severe recession, he said. “We have a pretty clear view of that.”

For clients who have difficulties making their payments, mortgage lenders have several options to try and assist borrowers before the situation progresses to the point of them needing to sell their homes.

“You have skip-a-payment deferrals, you have maturity extensions, whatever it happens to be, you have a lot of ways to work with that client,” McKay said.

In terms of clients with cash flow challenges in addition to a collateral problem, where the property sale wouldn’t cover their mortgage and could result in default, McKay said it’s a much smaller group but one the bank is actively monitoring.

“That bucket, I can tell you, is in the low single-digit percentages of our portfolio,” he said. “And that’s the bucket we’re managing”.

Bottom Line

To the extent these measures are implemented, further pressure on mortgage growth is likely. Mortgage brokers can access lenders not impacted by OSFI B-20 rule changes. More than ever, brokers could add value to borrowers turned away from the banks. In these uncertain times, existing and new clients need advice from a trained and caring professional.

Nov 2021; Mortgage Rates & Inflation Report

This just in data is when mortgage interest rates are expected to rise.

DATA JUST IN

Canada’s latest employment and inflation numbers have triggered new expectations about the next steps by the Bank of Canada and the arrival of interest rate increases.

BoC Governor Tiff Macklem continues to offer soothing words about inflation, which is current running at 4.1%. That is an 18 year high and more than double the central bank’s 2.0% target.

Macklem has repeatedly said high inflation is temporary; the result of low prices during the pandemic lock-downs, and supply chain problems that have cropped-up as the economy reopens.

Macklem points out that a key factor in long term inflation – wage growth – has not materialized. That is despite Canada returning to pre-pandemic employment levels with the addition of 157,000 jobs in September. It should be noted that the growth of Canada’s labour force during the pandemic means the country is still 276,000 jobs short of full employment. Last week however, Macklem did concede that this temporary inflation may linger for longer than initially expected.

Several prominent economists have weighed-in. Benjamin Tal cautions that inflation is a lagging economic indicator. He says the risks for long-term inflation are present and the Bank of Canada would be better to start raising rates earlier to help mitigate those risks. Doug Porter says there is a growing chance rate increases will come earlier. He expects they will happen quarterly rather than every six months. And, Derek Holt would like to see a rate hike by the end of the year, given that emergency levels of stimulus are in place while inflation is well above target.

Look for mortgage interest rates to start going up close to the end of 2021 and continue until they are back close to PRE-Covid Rates of about 3.35% for the 5-year fixed.

Mortgage Mark Herman, best Calgary mortgage broker for the masses!

UPDATE: NHBI Canada

Here is an UPDATE to the Canadian New First Time Home Buyer Incentive Program

A Calgary lawyer recently had an opportunity to review the program and attend a basic seminar. He said he would not recommend the “down payment equity share” program to a first time home buyer for the following reasons – BUT here are our replies … and the Program DOES make sense to do.

NEGATIVE POINTS and the reasons FOR the program are below:

- It will take much longer to be approved for this program than for a normal mortgage loan and sellers may not accommodate the longer condition time.

- We normally pre-approve buyers with these files and this program in advance so there is no extra time needed at the lenders for conditions.

- The math for this program is complicated and buyers that use this program need to be pre-approved as they need the mortgage to match the affordability guidelines and to shop in the right price range.

- The extra time is at closing when 2 sets of documents are needed by the lawyer. As long as this is known in advance, the closing date can be long enough to allow for the extra paperwork to be requested and completed.

- Higher legal and appraisal costs will result as two separate mortgages have to be prepared and registered (one for the lender and one for the equity share) and an extra appraisal will have to be obtained and paid for by the owner if paying out the incentive mortgage prior to the ultimate sale of the property.

- A 1st and 2nd mortgages go on title at the same time as closing.

- Appraisal on purchase is not involved as it has to be a CMHC approved mortgage (CMHC is responsible for the appraisal in this case) and the program is based on the purchase price.

- If the owner wants to pay it off / back sooner, then an appraisal is needed at buyer cost ~$350.

- This would happen if the owner wanted to do extensive renovations to the home.

- An appraisal should not be needed on a bonafide sale, to a 3rd party, via a realtor, and when listed on MLS.

- An appraisal MAY be needed – as the owners cost – if the sale if it is a “private sale” and/ or believed to be below market value.

- (This is to stop the owner from selling the home to a family member for $1.00 and then attempt to repay the loan with $0.05.)

- The buyer has already saved many times the extra costs, savings are about $100 – $150/ month, from day 1. Paying-out at 10, 15, 20 years later … they have already saved $100 x 12 x 10 years = $12,000, in the bank, already.

- A disincentive to improve/renovate the property will exist as any appreciated value is shared with the government notwithstanding that they don’t contribute to the renovation costs.

- True.

- Upon repayment, improvements will be included when determining the market value, therefore the Homebuyer will have to consider the cost and benefit of the planned renovations, and decide whether to repay the Incentive prior to making any home improvements.

- IMPORTANT: It may be beneficial to the Homebuyer to repay the Incentive prior to conducting any major renovations to the home.

- A potential trap is being created for non-permanent residents who are legally authorized to work in Canada who can qualify to buy under this program but will have extreme difficulty in selling when their work permit expires as they will not have sufficient equity to satisfy the required withholding requirements under the Income Tax Act

- We have been the largest Mortgage Alliance brokerage in Canada for 6 years in a row, and we do about 20 deals a year for 9xx SIN buyers; 99% of our customers are unaffected by this.

- Again, this program is surgical in for who it works for. The program is not for everyone.

- It may be more difficult to refinance the property (it is not clear whether the Government will permit refinancing of the first mortgage and postpone their security to the new financing)

Updated rules have been released:

- The home CAN be refinanced without triggering repayment of the incentive, however, the shared equity mortgage will only be postponed to the outstanding balance that would otherwise be owing under the first ranking mortgage (i.e. no equity take-out will be permitted ahead of the shared equity mortgage).

Note:

- The combination of all charges on a refinance must not exceed 80%.

- This program DOES allow Assumption of the mortgage. Standard rules apply: full requalification by the parties assuming the mortgage directly with the lender. The standard on-going ramifications to the seller still apply.

- This program does NOT allow a PORT of the mortgage to another property. It would have to be paid out at that time.

- If refinancing of the first mortgage will not be possible without paying out the government’s equity share, then the first mortgage lender will have a captive borrower. The lender will have no incentive to reduce posted mortgage rates on renewal resulting in substantially higher interest rates in the second and subsequent mortgage terms for the homeowner.

- As above, the rules do allow the home to be refinanced without triggering repayment of the incentive.

- The renewal rate offered by the lender is independent of the 2nd charge on title.

Side note: We see that lenders are already applying the “Stress Test” under-the-covers on renewals when calculating the renewal rates. More on my blog here: http://markherman.ca/2019/06/

We love this New Home Buyer Incentive Program – NHBI

Mortgage Mark Herman; Best, Top Calgary Mortgage Broker