Data on those negative amortization mortgages

Queston 1: What about all these (negative amortizing) mortgages that will now take 71 years to pay off?

Answer:

Yes, they are called VRMs – Variable rate Mortgages – and we don’t really offer/sell /even talk about them for that exact reason – what if the rates rates jump? And they did.

We do offer ARMs – Adjustable Rate Mortgage – and we do recommend as of August 2023 because:

- Rates have topped and are slowly on the way down right now so the rate will go down

- The current rate starts lower than the 1, 2, 3, and 4 year fixed right now; and ARM rates should be below the 5-year fixed by Fall of 2024.

Question 2: What is the difference between VRM and ARM?

- With an ARM – adjustable rate mortgage – the amount of your payment will go up and down based on the changes of the prime lending rate

- The VRM – Variable rate mortgage – your mortgage payment amount always remains the same. It does not go up and down with changes in the prime lending rate. And when rates jump to 4x what they were when your loan started, then you are not even paying interest any more, and end up at 70 years left to pay it off.

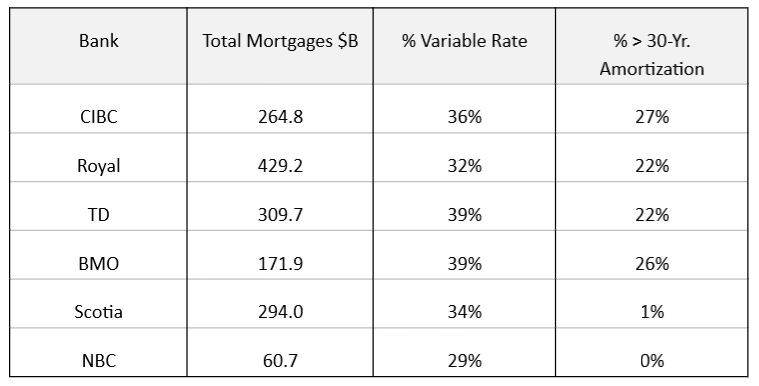

As the article below states, VRMs are mostly from BMO, CIBC, Royal Bank and TD.

ARMs – Adjustable rate mortgages – are what we offer, they can’t have a negative amortiztion and we don’t have any customers that were affected with negative loans.

Mortgage Mark Herman, best top Calgary mortgage broker

Concern over rise in negative amortization mortgages

On October 30th, the Bank also highlighted concern over negatively amortizing mortgages. Negative amortization occurs when a borrower’s monthly mortgage payment is less than the interest due on the loan and the outstanding mortgage balance grows over time rather than declining. This phenomenon is mostly associated with variable rate mortgages.

Those who bought or refinanced homes during the pandemic, when interest rates were at their lowest, heavily opted for variable rate mortgages (VRMs). In Canada, most VRMs come with fixed payments, where the interest portion is determined by the prevailing prime lending rate, while the rest is used to repay the principal. As a result, the Bank of Canada’s series of rate hikes – from 0.25% to 5% – has propelled growth in negative amortization mortgages with terms exceeding 30 years.

As of July 31, negative amortization mortgages were 24% of total mortgage portfolios (insured and uninsured) for BMO, CIBC, Royal and TD. This is equivalent to $277 billion in mortgages – up from virtually nil a year ago. National and Scotia mainly offer adjustable-rate mortgages – as rates change the mortgage payment changes to keep the amortization period fixed – so both banks have negligible exposure to negative amortization within their mortgage portfolios.

Variable Rate Exposure (as of July 31, 2023)

Source: Fitch Ratings

Canada’s banking regulator, the Office of the Superintendent of Financial Institutions (OFSI), has announced regulatory changes to address risks related to mortgages in negative amortization. Effective early next year, banks will be required to maintain a higher amount of capital, reflecting the elevated risk associated with mortgages in negative amortization when the loan-to-value ratio (LTV) surpasses 65% (i.e. when the outstanding mortgage balance is 65% or more of the value of the underlying property). The proposed changes are designed to incentivize banks to reduce the volume of mortgages that could potentially go into negative amortization.

Mortgage repayment trends

To assess how borrowers are reacting to the increase in rates, the prepayment report for floating rate 5-year mortgage-backed securities (MBS) pools, published by CMHC, serves as a valuable tool. Although it doesn’t pinpoint individual issuers, the report offers a comprehensive look at trends within the banks’ variable-rate mortgage (VRM) portfolio.

Report data indicates that borrowers with VRMs have been effectively managing impacts of rising rates by making partial principal payments or transitioning to fixed-rate mortgages. Enforcement activity, which is undertaken when a borrower is unable to make mortgage payments, has been minimal, which suggests that despite the rise in rates, defaults have remained low.

Also, the majority of non-amortizing mortgages, where payments are covering interest only, were recorded between November 2022 and February 2023. This is a positive sign that banks have taken measures to limit the growth of these mortgages.

One caution is around borrowers whose mortgage rates have exceeded the trigger point – that is, the rate at which the regular payment is no longer enough to cover the full amount of interest accrued since the last payment. These borrowers might encounter payment shock when their loans mature and are re-underwritten based on the original amortization but at higher rates and with larger principal amounts.

Those who were first-time homebuyers with high loan-to-value ratios, purchasing at or close to peak prices in 2020 or 2021, could face significant challenges during renewal, particularly if their equity position has been significantly eroded. Similar to Fitch, we anticipate that delinquency rates will not rise in 2024, remaining within the expected range of 0.2-0.25%.

Interest rate predictions are tough

I found this in a retirment planning post ….

Every year since 2009, experts have predicted that “rates have nowhere to go but up,” only to be confronted with what seems to be perpetually low rates.

Most pundits predict rates will finally start to rise again in mid 2015, but the recent surprise rate cut by the Bank of Canada (from 1% to 0.75%) suggests how futile trying to predict the timing of such a change can be.

Central banks’ zero interest rate policies have resulted in “real” (net of inflation) returns of zero or even less-than-zero after income tax, except for outliers like Russia.

In December, Switzerland even began charging savers for the right to deposit funds!

This post from 2013

http://blog.markherman.ca/2013/07/11/how-low-are-interest-rates-really-here-is-the-big-picture/

Now for the big picture…

Short version: rates are the lowest of all time … like a 496 year low. Is that low enough?

“in July 2012, 10-year yields in the US thus reached with 1.39% the lowest level since the beginning of records in the year 1790.

In the Netherlands – which provide the longest available time series for bond prices – interest rates fell to a 496 year low.

In the UK, ‘base rates’ are currently at the lowest level since the founding of the Bank of England in 1694.

In numerous countries (Germany, Switzerland), short term interest rates even fell into negative territory.”

Mark Herman, Mortgage Alliance, Top Calgary Alberta Mortgage Broker, and #1 mortgage brokerage in Canada for 2013 AND 2014!!!

Variable rate mortgage – how payments will change for the new rate

We are getting many calls on this so here is how it works for MOST of the banks.

The Bank of Canada (BofC) reduced their Prime rate by 1/4 % or .25% last week to 0.75% from 1% where it has been for about 3 years.

The banks took a while to decide ifthey were going to lower their rates as well. 3 times before the banks have either not passed on the entire rate reduction to customers or not moved at all and kep the savings to themselves.

Now that most banks have lowered their rate by .15% this is how payments are impacted:

a. If they have an Adjustable Rate Mortgage – ARM mortgage – then the rate will be the new rate starting on the “effective date.”

b. The payment after the next payment will change to reflect this new rate. (So if you pay monthly on the 1st, the Feb 1st payment will be your current payment, but the March 1st Payment will be the new payment, If you pay weekly every Friday, this Friday will be the same payment but the next Friday will be the new payment)

c. Because the rate has gone down, your payment will decrease.

d. Because the interest rate has gone down, the next payment that is still at your existing payment amount will apply a little more to your principal.

e. Customer will receive a letter with their new payment amounts in the snail-mail.

Hope that clears things up a bit.

Call if you have questions.

Mark Herman, Top Calgary Alberta Mortgage Broker.

32 Mortgage Experts Give their Top Tips for Home Buying

Joe Samson & Associates of CIR Realty asked 32 top mortgage experts our tips for home buying. The results are interesting for sure. And I do agree with most all of what they say.

A great set of top mortgage tips for sure.

Here is a link to the post: http://www.joesamson.com/blog/canadas-top-mortgage-experts-give-away-their-best-mortgage-tips.html

Joe Samson

Web: www.JoeSamson.com

I sent back 3 tips for each part of the question … they are below.

#1 tip in the buying process: use a top broker with at least 5 year experience because we have more pull, get more exceptions, and get better standard rates for your mortgage. Ensure you send in all the documents ahead of time BEFORE shopping so they can all be reviewed to ensure the purchase goes smoothly. People lose sleep due to the bank making them run around like crazy getting all the docs after they buy and the entire file may not work. Getting all the data in before shopping ensures a smooth purchase and ensure you are shopping in the right price range. There is nothing more disappointing than looking at 350k condos, putting in an offer and getting a decline and then having to buy for 200k. Of course all the 200k condos are nowhere as good as the 350k ones … that is why they cost almost 2 times as much!

#1 tip for the actual property: I would rather have the smallest/ least attractive home in a great community than the best home in a poor location/ area/ community. With the great community you get all the great amenities – family skating rinks, good friendly neighbors, etc.

#1 tip for the mortgage: Biweekly accelerated payments cuts the effective amortization down by few years. That is a huge difference by doing nothing other than paying every time you get a pay check. (It is not worth doing weekly payments as the cash budgeting will always leave you short at least 2 times a year and the $100 NSF fee will put you father behind than ahead.) And paying even a little bit more in the first 5 years of your mortgage will end up saving you 3 times that in the end. So that $5000 now will end up saving you $15,000 over the life of the mortgage in interest! And remember to take a holiday, not just pay that mortgage down!

Please feel free to call or reply with comments or questions.

Mark Herman, AMP, B. Comm., CAM, MBA-Finance

WINNER: #1 Franchise for Funded $ Mortgage Volume at Mortgage Alliance Canada, 2013 and 2014!

Direct: 403-681-4376

Accredited Mortgage Professional | Mortgage Alliance | Mortgages are Marvelous

Toll Free Secure E-Fax: 1-866-823-1279 | E-mail: mark.herman@shaw.ca |Web: http://markherman.ca/

2014: #1 Mortgage Brokerage in ALL of Canada! AGAIN!

Yeah!

Mortgages are Marvellous just won the #1 mortgage brokerage for all of Canada, based on total value of funded mortgages at Mortgage Alliance, Canada’s largest SuperBrokerage with more than 100 offices and 1,800 agents from coast to coast.We also won this in 2013 so this is 2 years in a row.

Congratulations to all of our team.

We think it is becuase of our process – ensuring your deal will work BEFORE you buy and getting all the docs in and duscussing your deal with the bank BEFORE you buy!

It works!

Mark Herman, Top Calgary Alberta mortgage broker.

Property Tax assessments – add 6% to average home value

Your Calgary property tax assessment is probably going to go up by 6%.

Mark Herman

—

City assessment finds values of residential properties in Calgary up 6% between 2013 and 2014

By Jenna McMurray ,Calgary Sun

First posted: Friday, January 03, 2014 07:59 PM MST | Updated: Friday, January 03, 2014 08:08 PM MST

Property values for both single family homes and condos are up in Calgary, according to the city’s assessment findings.

Based on market value on July 1, 2013 and the physical condition as of Dec. 31, 2013, the numbers were released Friday, the same day property and business assessment notices were mailed out.

The typical residential property assessment change is 6% between 2013 and 2014.

“We have certainly seen a really strong increase and sort of a re-setting of some of those values back before some of the financial crisis happened,” said city assessor Nelson Karpa.

Though it was considered a strong year, the highest market value shift was 43% between 2006 and 2007, reports the city.

This year, about 96% of residential properties’ revenue neutral taxes — pre-2014 tax rate changes — will stay within ±10% of last year’s taxes.

Though the percentage of change varies from community to community, those in the 0% to -10% are most heavily clustered on Calgary’s west side, in the inner city and in the deep south, while the northeast is dense with neighbourhoods in the 0% to 10% range.

“You’ll generally find properties that are lower in value typically will increase faster than properties that are higher value,” said Karpa, adding there’s a larger pool of people able to afford the less expensive homes….

Prime says at 1%. Probably till 2015.

Don’t read this entire thing. It is a sample of the stuff we read to keep you up on what is happening in mortgage land. Summary: Prime is to stay the same till about 2015. That means variable rates are a good idea now that they are at Prime – .5%. Consumer Prime is 3% so that is then 2.5% for a mortgage.

Mark Herman, Calgary, Alberta Mortgage Broker.

Bank of Canada keeps key interest rate unchanged at one per cent

The Bank of Canada is keeping its trendsetting overnight interest rate at one per cent.

But markets did not read the statement as neutral, apparently interpreting the bank’s caution that “downside risks to inflation appear to be greater” as a signal governor Stephen Poloz intends to keep interest rates low for an extended period — likely well into 2015 — and raising the possibility, although slim, of a rate cut next year.

The Canadian dollar dropped 0.31 of a cent to 93.6 cents U.S. — its lowest level since May 2010 — on the announcement.

Analysts said that may be just what governor intended, as he continued to emphasize the need for Canada to pick up its exports performance before it can create self-sustaining growth. A weak currency helps exporters compete in foreign markets.

“I think it’s quite telling that since the last meeting we’ve got better than expected growth and lower than expected inflation, and what does the bank focus on but the lower than expected inflation,” noted Doug Porter, chief economist with BMO Capital Markets.

“I would almost think, if I didn’t know better, there’s a drive here to push the Canadian even lower. Let’s just say they are not unhappy about the weakness of the currency.”

In October, Poloz unexpectedly dropped a tightening bias that had been in place for 18 months, with the result that the loonie fell immediately almost a full cent.

The bank has repeatedly insisted it is not targeting a weak dollar, but Porter noted that other central banks, particularly in Australia and some other economies that lean on exports, have taken the direct route in openly talking their currencies down.

RBC economist Dawn Desjardins said the weakening loonie versus the U.S. greenback provides additional support for Canadian exporters to take advantage of what is expected to be a long-awaited rise in demand in the United States.

“Increased demand for exports will be a key factor in boosting the economy’s growth rate above its potential in 2014 and reducing the amount of excess capacity,” she said in a note to clients, while adding that the downside risks to inflation will ease.

Statistics Canada said Wednesday the country’s trade balance with the world came to a surplus of $75 million compared with a deficit of $303 million in September.

The shift came as imports slipped 1.2 per cent while exports decreased 0.3 per cent in October.

The central bank announcement Wednesday, read as a whole, suggested the bank has not materially changed its mind about the trend of the economy since October’s rather gloomy monetary policy report, despite the fact that third-quarter growth was far stronger than it estimated.

Porter said if the bank had said “ditto October” rather than emphasizing inflation Wednesday, it would have gotten no arguments from economists.

In its analysis, the central bank acknowledged third-quarter growth, which was reported at 2.7 per cent last month, was better than the 1.7 it had pencilled in in October, but essentially looked through the improvement.

It said underlying conditions were weaker than it appeared, noting sustainable growth requires a rotation from domestic activity — in particular housing and consumer spending — to more export growth and businesses spending. That has not happened yet, it said.

“Real GDP growth in the third quarter … was stronger than the bank was projecting, but its composition does not yet indicate a rebalancing towards exports and investment,” it said. “Business investment spending is up from previous low levels, but is still recovering more slowly than anticipated.”

It also said it was encouraged that U.S. growth as stronger than expected, although it pointed out that some of that was due to temporary factors also.

As Poloz emphasized in October and at recent appearances before House of Commons and Senate committees, the bank’s governing council is particularly focused on the low inflation rate, as an indicator of “significant excess supply” in the economy.

Heightened competition in the retail sector, a likely reference to new entrants in the Canadian market, such as the Target chain, and lower gas prices, are also playing a role in low inflationary pressures, the statement said.

Given the counter-balancing factors, the statement concluded that “on balance, the bank sees no reason to adjust its expectation of a gradual return to full production capacity around the end of 2015.”

That assessment is unlikely to significantly change the opinion of most economists and markets that Poloz expects to stay on the sidelines as far as adjusting interest rates throughout 2014, and that the first change will be a 25-basis point increase in the overnight rate sometime in 2015, with a slim chance of a rate cut if conditions deteriorate.

But that is not the bank’s baseline scenario. Particularly regarding the key U.S. economy, the statement notes that the improved data of late “are consistent with the bank’s view of a gathering momentum in the U.S. economy.”

Poloz appears sanguine about what is occurring in the Canadian housing market, even if some analysts fear a sharp correction. He took note of the recent resurgence in sales, but said it was “consistent with updated demographic data” and the view that some buyers jumped into the market to get ahead of expected mortgage rate increases.

“The bank continues to expect a soft landing in the housing market,” it said.

As for the global economy, it notes that it is expanding “at a modest rate” as expected.