TD Canada Trust releases 2011 Home Buyers Report

TORONTO (March 7, 2011) – When homebuyers browse the listings and hit the open houses this spring, will they be looking for brand-new homes that won’t need any work or fixer-uppers that they can renovate to suit their taste? According to the 2011 TD Canada Trust Home Buyers Report, Canadians are divided with men and women sitting on opposite sides of the fence.

Half of Canadians would prefer a new home because everything will work perfectly (25%) and it hasn’t been lived in before (24%), while the other half prefer older homes, which they feel offer better quality (34%) or have more character (17%). The TD Canada Trust Home Buyers Report found that men are more likely than women to prefer a fixer-upper because it is more affordable (14% versus 8%) and because they can renovate to their taste (37% versus 29%).

Half of Canadians would prefer a new home because everything will work perfectly (25%) and it hasn’t been lived in before (24%), while the other half prefer older homes, which they feel offer better quality (34%) or have more character (17%). The TD Canada Trust Home Buyers Report found that men are more likely than women to prefer a fixer-upper because it is more affordable (14% versus 8%) and because they can renovate to their taste (37% versus 29%).

“If you are willing to do the renovations or upgrades, buying a home that needs some work can give you the ability to transform the space into your dream home,” says Farhaneh Haque, Regional Manager, Mobile Mortgage Specialists, TD Canada Trust. “However, if you decide to go the renovation route, it’s important to understand the costs of the upgrades you intend to make and factor those in when deciding on the price range for a home that is realistic for you.”

The most important factors in deciding what home to buy:

Whether it’s brand new or older with charm, Canadians say the most important consideration when buying a home is cost (97%). Women are more likely to say this is a very important consideration (82% versus 70% of men). Other important factors are features of the home (94%), size (93%), security and safety (92%) and location (91%).

“When house-hunting there are some factors, like the features of the home, which can be adjusted once you’ve made your purchase. Other factors, like the location, cannot be changed. Finding the right home is about getting the right balance – and at a price you can afford,” says Haque. “Canadians wisely say that that cost is the number one consideration for a home purchase, evidence that Canadians realize that in order to truly be comfortable in their home, they need to comfortably be able to afford it!”

About the Home Buyers Report:

TD Canada Trust commissioned Environics Research Group to conduct a custom online survey of Canadians who had either purchased a home within the last two years or intend to purchase one in the next two years. Between December 22 – 29, 2010, a total of 1,001 interviews were completed.

Reno coach –

What a great idea this is. Note below that the coach actually recommended that they move and not try to renovate.

Reno coach keeps projects in the ballpark

Planning her first major home renovation in the summer of 2009, Tina Davies felt like she was awaiting her first baby: excited, nervous and not sure what to expect.

The project would plunge the Toronto makeup artist’s household into chaos for five months, but once it was done, her family of three would have a new kitchen and bathrooms, updated plumbing and electrical systems and upgrades to the entire interior, from new floors to freshly plastered ceilings.

With $350,000 on the line, however, Ms. Davies wasn’t impressed by the vague quotes and sparse details being offered by the first three contractors she approached, whose contracts were so unprofessional, they looked as though they’d been drawn up “on paper napkins.”

Was this normal? She wasn’t sure. She’d never done this before.

“As a homeowner, you’re just really at the mercy of these contractors and you don’t know their language or what is the proper way to have something done,” Ms. Davies said. “You’re so overwhelmed and confused and you want to make sure you don’t do the wrong thing.”

She figured she needed help from someone knowledgeable and impartial, who understood how the industry worked. Then she heard about reno coaching, a relatively new service where, for $75-$100 an hour, a project manager would come to her house and help her draw up a budget and advise her whether her project was practical and affordable – think Mike Holmes meets Gail Vaz-Oxlade, but with the aim of preventing expensive mistakes.

The reno adviser she hired, Jay Charendoff of House Calls Project Management, “was really good about advising us about what to do before you get into it,” said Ms. Davies, adding that once she found a reputable contractor, he went through the contract line by line and highlighted problem areas.

“It’s just nice to know that there’s somebody on your side,” she said.

Mr. Charendoff, who has a degree in architecture and is a LEED-affiliated professional, launched his business four years ago and is among a handful of professionals offering reno advice in Canada.

It’s a service that is starting to catch on due to a new consumer awareness about the financial risks of renovating, says Carl Mascarenhas, president of eRenovate Inc. With the housing market cooling, he says, it’s no longer a given that property values will rise and homeowners will recoup their costs; they are more cautious now.

As with any new industry, Mr. Mascarenhas says it’s buyer beware when hiring a renovation adviser. As demand for the service increases, opportunists will emerge, he says. “There’s still a bit of caution for consumers to really weigh out the role the professional is playing and that they have the right credentials or experience to do so.”

Home renovations are big business in Canada. According to a survey by the Canada Mortgage and Housing Corp., Canadians spent $25.8-billion on home renovations in 2009, with the average project costing about $12,100. Of those 2.1 million households, 35 per cent said they went over budget.

“People don’t really know how much things are going to cost,” Mr. Charendoff says. “People sometimes have a general idea of what they want to do, but in this business, it’s really about the details.”

In addition to budgeting advice, Mr. Charendoff also looks at housing market conditions and gives homeowners straight talk if he thinks they are not making a good investment.

Such was the case for Karen Weinthall, who asked for advice while planning a major kitchen renovation on her 1920s Toronto home. After inspecting the property, Mr. Charendoff told Ms. Weinthall that her house, which was built on top of a steep hill, was slowly sinking into the ground.

He looked at the kitchen and looked at the floor and said you really are not going to be able to do that without a huge structural job. So I moved,” Ms. Weinthall said with a laugh.

“If we had just gone ahead and hired a contractor to do the kitchen, at what point in that proceeding would we have found out what a big problem it was?”

Mr. Charendoff says a reno adviser acts as a middleman between the homeowner and the contractor, whose main objective is sales. “The hat that I wear is really a different hat – it’s what advice and guidance can I offer to this owner that’s going to be a wise financial decision.”

Lisa Rapoport, a partner at Plant Architect Inc. in Toronto, is skeptical of the reno coaching trend and says any good designer or contractor will offer the same advice, and will be able to help clients find savings to match their budgets. “Just providing that kind of middleman service sounds like an extra cost, and I guess if you’re going to pay the extra cost, I’d rather put it into a good contractor,” she said.

Finding a good contractor requires a bit of homework, says Mr. Mascarenhas. He recommends consumers begin by doing some research on the CHMC and Better Business Bureau websites, and read consumer reviews on sites like HomeStars.com and casaGURU.com.

For Ron Singer, hiring a reno adviser was certainly a wise financial decision. In the midst of constructing a $30,000 art studio for his wife, he began to have some doubts about whether the contractor was putting in adequate insulation. The adviser confirmed his doubts, and he was able to have the contractor fix the problem on the spot.

“As far as I’m concerned, hiring someone for a couple of hundred in order to ultimately save down the road in terms of either repairs or things that go wrong, is certainly worth it,” Mr. Singer said. “We now have without a doubt the best constructed, best insulated studio one can have.”

The pre-reno checklist

1. Know the rules. Building codes and local by-laws may limit what and how you renovate. There’s nothing worse than discovering the project you’ve painstakingly planned is not allowed. Talk to your municipal building department and find out about zoning and permits.

2. Know what’s possible. Your home’s heating, plumbing and electrical systems will also affect how you can renovate. For big projects, it’s wise to check with an architect, home inspector or contractor before you begin.

3. Create a budget. Doing a detailed financial analysis of your project in advance of the physical design allows you to evaluate your situation and study a variety of options well before you get to the construction stage. It’s a low-cost exercise that allows you to clarify your needs versus your wants.

4. Do the math. Get quotes from at least two reputable local renovators, architectural firms or material suppliers. Take the most reasonable quote and add 10 to 15 per cent for unexpected costs.

5. Spend wisely. If you need financing, you may be able to renegotiate your mortgage or apply for a personal loan to cover the cost of the reno. You may even be eligible for assistance, as some utilities and governments offer incentive programs for energy-efficiency upgrades.

Sources: Dianne Nice, CMHC, House Calls Project Management

‘Window closing’ on ultra-low mortgage rates

Essentially we are in artificially low interest rates and the government is expecting rates to come up to normal levels in the near future. Bond yields are continuing to put pressure on long term mortgage rates and we will continue to see the rates moving upward this year. The government is also trying to make it more difficult for individuals to qualify for insured mortgages. This article, from the Financial Post, speculates rates will increase rates by May.

Enjoy the Read!

Amid the noise of volatile-but-improving economic indicators, mortgage rate hikes are likely to repeat like a chorus in the coming months.

Canadian banks are raising interest rates on mortgages, marking the beginning of a trend as they correlate with rising bond yields and expected monetary tightening.

That’s making a strong case for borrowers to lock into fixed rates before it’s too late, said Benjamin Tal, deputy chief economist with CIBC World Markets. “The window is closing.”

TD Canada Trust and CIBC both announced Monday hikes to their residential mortgage rates, the first increases since changes to the rules of borrowing were announced by the federal government last month. The other big banks where expected to follow the moves shortly.

Effective Feb. 8, the interest rate on the banks’ benchmark five-year closed fixed rate mortgage will increase 25 basis points to 5.44%. The country’s other major lenders are expected to soon follow suit.

Toronto mortgage broker Paula Roberts said rising borrowing costs will compel more of her clients to abandon ultra-low variable rates in favour of higher, fixed-rate mortgages.

That can be a tough decision for borrowers to accept higher payments, but not one that should strain a mortgagee’s finances, she said.

“If you can’t afford [your payments] … that’s a problem,” Ms. Roberts said. “That’s why the government has changed the rules.”

In two stages over the past year the federal government announced changes to the conditions of mortgage lending — shortening the maximum amortization from 35 years to 30 years and requiring borrowers to qualify for a fixed-rate plan, even if they are opting for a variable rate.

Many who only qualify under the old rules, however, will try to secure mortgages before the shorter maximum amortization periods come into effect next month, Ms. Roberts said.

“There are going to be a lot of people that will enter into their agreements by March 18.”

Much of the momentum in mortgage rates can be attributed to a bond selloff and rising yields across the board. That effect is partly a reflection of building global inflationary pressures as well as a global economy that is proving more robust than expected.

“In my opinion, the bond market will not be the place to be over the next six months, and if that’s the case, you will see mortgage rates continue to rise,” Mr. Tal said.

In addition, anticipation of increases to the Bank of Canada’s benchmark lending rates is building, also contributing to rising yields, which puts pressure on fixed-income mortgages.

If there was any lingering doubt that the Bank will soon raise rates, last week’s jobs report erased them. The report showed Canada added four times more jobs than expected in January.

“[It] creates a fairly powerful story for the Bank of Canada, which is clearly concerned on the domestic front,” said Camilla Sutton, chief currency strategist at the Bank of Nova Scotia. “I think there’s a material change.”

So do investors. The probability that the central bank will boost its key policy rate by May, as measured by overnight index swaps, jumped to almost 75% after the jobs data.

Source: Financial Post

Info your banks would prefer you didn’t know

What your Bank doesn’t want you to know

| Monday, 28 February 2011 22:47 |

A list of some pertinent information your banks would prefer you didn’t know:

|

ALBERTA HOUSING MARKET MOST AFFORDABLE IN CANADA: RBC ECONOMICS

TORONTO, Feb. 24 /CNW/ – Alberta’s housing market officially became the most affordable in Canada in the fourth quarter of 2010, according to the latest Housing Trends and Affordability report released today by RBC.

Thanks to lower mortgage rates and further softening in home prices, RBC’s Affordability Measures for Alberta fell yet again in the fourth quarter, by 1.0 to 2.4 percentage points, extending their long strings of declines since late 2007.

“Alberta saw a notable downswing in demand for housing last spring and early summer, giving buyers the upper hand and pushing prices down,” said Robert Hogue, senior economist, RBC. “Alberta’s reign as the most affordable housing market may be short lived, however. Demand has shown more vigour in recent months, alongside a provincial economy that is gaining more traction, and Alberta’s market has become better balanced. We expect that this will stem price declines this year and erase a potential offset to the negative effect of a projected rise in interest rates on affordability.”

The RBC Housing Affordability Measures for Alberta, which capture the province’s proportion of pre-tax household income needed to service the costs of owning a home, eased across all housing categories in the fourth quarter. The measure for the benchmark detached bungalow moved down to 30.9 per cent (a drop of 2.4 percentage points from the previous quarter), the standard condominium to 20.3 per cent (down 1.0 percentage points) and the standard two-storey home to 34.4 per cent (down 2.2 percentage points).

The RBC report notes that gradual and steady improvements in Calgary’s housing demand have recently started to bolster market conditions as home resales increased appreciably since June which helped trim down the slack that kept buyers in the driver’s seat.

A return to more balanced market conditions in Calgary, however, did not succeed in reversing the tide in the fourth quarter of 2010 as home prices continued to weaken for the most part in the fourth quarter. Nonetheless, this contributed to further material improvement in affordability. The RBC Measures for Calgary again fell the most among Canada’s largest urban markets, declining by 0.9 to 3.1 percentage points.

“Affordability in the Calgary area is now the best in almost six years and this attractive level of affordability will support further increases in demand as the local economy picks up steam in the year ahead,” added Hogue.

Elsewhere in the country, a majority of provinces saw improvements in affordability in the fourth quarter. Only the standard two-storey benchmark became less affordable in Ontario and Quebec, as did the standard condominium apartment in Quebec and the Atlantic region.

The RBC Housing Affordability Measure, which has been compiled since 1985, is based on the costs of owning a detached bungalow, a reasonable property benchmark for the housing market in Canada. Alternative housing types are also presented including a standard two-storey home and a standard condominium. The higher the reading, the more costly it is to afford a home. For example, an affordability reading of 50 per cent means that homeownership costs, including mortgage payments, utilities and property taxes, take up 50 per cent of a typical household’s monthly pre-tax income.

CANADIAN HOMEOWNERSHIP COSTS EASE FOR SECOND CONSECUTIVE QUARTER: RBC ECONOMICS

This is great news.

TORONTO, Feb. 24 /CNW/ – Canada’s housing affordability continued to improve in the fourth quarter of 2010, thanks in part to slight decreases in five-year fixed mortgage rates and minimal home price appreciation across the country, according to the latest Housing Trends and Affordability report released today by RBC Economics Research.

“Some of the stress that had been building in the housing market between 2009 and the first half of 2010 has been relieved, but tensions persist overall and the recent improvement in affordability is likely to be short-lived,” said Robert Hogue, senior economist, RBC. “We expect that the Bank of Canada will resume its rate hike campaign this spring and with borrowing costs set to climb further in the next two years, housing affordability will erode across the country. That said, we don’t expect this to derail the housing market because of rising household income and job creation from the sustained economic recovery.”

The RBC Housing Affordability Measure captures the proportion of pre-tax household income needed to service the costs of owning a specified category of home. During the fourth quarter of 2010, measures at the national level fell between 0.4 and 0.8 percentage points across the housing types tracked by RBC (a decrease represents an improvement in affordability).

The detached bungalow benchmark measure eased by 0.8 of a percentage point to 39.9 per cent, the standard condominium measure declined by 0.4 of a percentage point to 27.6 per cent and the standard two-storey home decreased 0.4 percentage points to 46.0 per cent.

“We expect affordability measures will rise gradually in the next three years or so while monetary policy is readjusted, but will land softly thereafter once interest rates stabilize at higher levels,” added Hogue. “This pattern would be consistent with moderate yet sustained stress on Canada’s housing market. Overall, the era of rapid home price appreciation of the past 10 years has likely run its course and we believe that Canada has entered a period of very modest increases.”

A majority of provinces saw improvements in affordability in the fourth quarter, most notably in Alberta where falling home prices once again contributed to lower the bar for affording a home. Only the standard two-storey benchmark became less affordable in Ontario and Quebec, as did the standard condominium apartment in Quebec and the Atlantic region.

RBC’s Housing Affordability Measure for a detached bungalow in Canada’s largest cities is as follows: Vancouver 68.7 per cent (down 0.4 percentage points from the last quarter), Toronto 46.8 per cent (down 0.5 percentage points), Montreal 41.3 per cent (down 0.4 percentage points), Ottawa 38.7 per cent (up 0.5 percentage points), Calgary 34.9 per cent (down 3.1 percentage points) and Edmonton 31.0 per cent (down 2.4 percentage points).

The RBC Housing Affordability Measure, which has been compiled since 1985, is based on the costs of owning a detached bungalow, a reasonable property benchmark for the housing market in Canada. Alternative housing types are also presented including a standard two-storey home and a standard condominium. The higher the reading, the more costly it is to afford a home. For example, an affordability reading of 50 per cent means that homeownership costs, including mortgage payments, utilities and property taxes, take up 50 per cent of a typical household’s monthly pre-tax income.

Highlights from across Canada:

- British Columbia: Buying a home in B.C. became slightly more affordable in the fourth quarter of 2010, due primarily to a small drop in mortgage rates. After experiencing some declines in the previous quarter, home prices rose modestly for most housing categories; condominium apartments bucked the trend, however, and depreciated slightly. Prices were supported by a tightening in market conditions with home resales picking up smartly following substantial cooling in the spring and summer that saw sellers lose their edge in setting property values. Demand and supply in the province are judged to be quite balanced at this point. RBC’s Affordability Measures fell between 0.8 and 1.0 percentage points in the fourth quarter which came on the heels of much more substantial drops (1.7 to 4.8 percentage points) in the third quarter. Notwithstanding these declines, affordability remains poor and will weigh on housing demand going forward.

- Alberta: Alberta officially became the most affordable provincial market in the country in the fourth quarter, according to the RBC Measures which fell once again by 1.0 to 2.4 percentage points, extending their declines since late-2007. In addition to the lower mortgage rates, the further depreciation of home prices contributed to lowering homeownership costs. Property values were negatively affected by a substantial downswing in demand in the spring and early summer, which put buyers in the drivers’ seat. The significant improvement in affordability is near the end of its line, however, as demand has shown more vigour in recent months – alongside a provincial economy that is gaining more traction – and the market has become better balanced. RBC expects that this will stem price declines this year, thereby removing a potential offset to the negative effect of projected rise in interest rates on affordability.

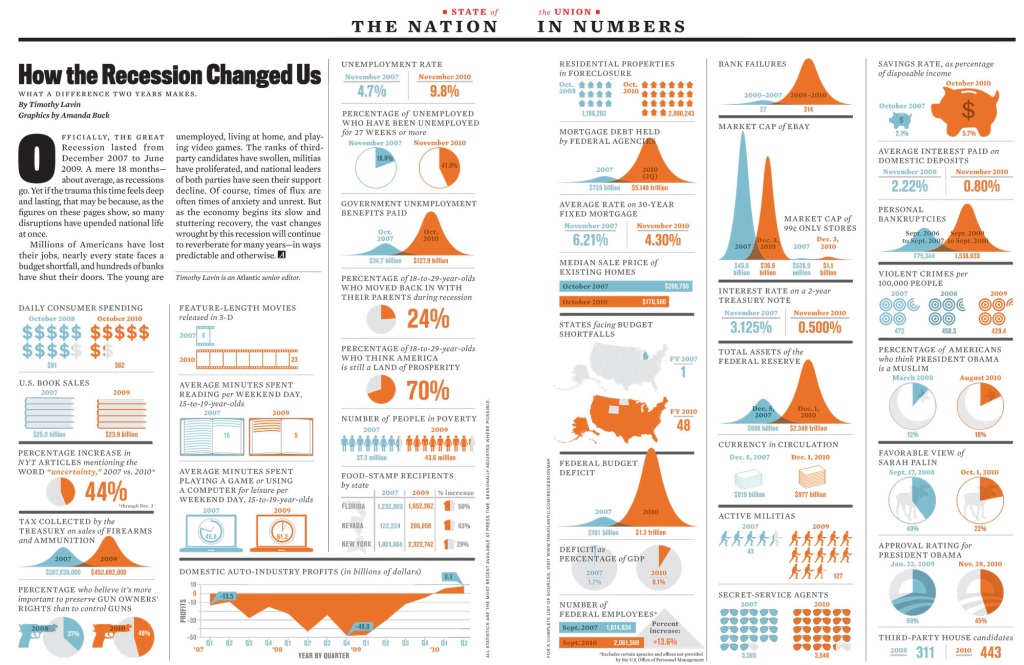

How the recession changed us

Below is a very cool graph on how the worst recession of our life times has changed the American life-style. Click on it to make it nice and big.

One guys thoughts on the Western Economies

If you are a student of economics then this is “interesting.” If not then it will make no sense at all.

I think he is accurate in summarizing where “hidden inflation” will come from at the end of the post.

Stephen Johnston; Partner & CIO – Agcapita Farmland Investment Partners

As Kierkegaard elegantly pointed out, “There are two ways to be fooled: One is to believe what isn’t so; the other is to refuse to believe what is so.”

The problem of being fooled “by believing what isn’t so” appears to be endemic in mainstream economic circles. Increasingly, we see the panic of central bankers and politicians in the thrall of the mistaken belief that the mere act of printing money can conjure wealth and sustainable growth into existence that this nostrum has stopped working.

In simple terms the powers that be in the west have been fooled by Keynesian dogma that:

– nominal increases in GDP represent growth;

– printing money increases nominal GDP; therefore

– printing money must generate growth.

Surely, this is to believe what isn’t so. A simple example of the fallacy this represents is Frederic Bastiat’s parable of the “broken window”. To paraphrase Bastiat, if all the windows in the country were suddenly broken there might be an increase in nominal GDP as the reconstruction took place but we should not be fooled into believing that this has made us wealthier.

Keynesians would argue that business activity has been stimulated, jobs were created and the economy benefited. In his own version of the “broken window” Keynes famously advocated burying newly printed money and paying people to dig it up as a way to stimulate the economy.

With all due respect to Lord Keynes, this belief is in the process of being exposed as the mirage it has always been. The true measure of the wealth of an economy is the pool of productive capital. Currency is merely the measuring stick. In our broken window example, the pool has been maintained but without the reconstruction it could have been increased – therefore the net effect, taking into account both “the seen and the unseen” in Bastiat’s words, is actually a loss of wealth.

If printing money does not create productive capital then how can you explain its perennial appeal amongst the banking and political classes?

For politicians, printing money is desirable for two reasons. Firstly, it acts as an unseen tax. One which few voters understand and for which even fewer are likely to blame the political class, at least in the beginning. Secondly, by reducing the value of the currency, the measuring stick I mentioned above, politicians are able to fool many of the voters that their wealth has increased, but of course no such thing has happened.

For members of the privileged banking class the appeal of printing money is that they are best positioned to take advantage of the confusion between the measurement of the pool of capital and the actual pool of capital itself. In simple terms, they can exchange the declining currency for productive assets while artificially low interest rates finance these activities at minimal cost.

So in general while printing money creates no new wealth in the form of productive capital, a significant amount of wealth can be misappropriated silently by the banking and political classes. For the rest of us, the relentless expansion of the money supply offers no true benefits and the very real danger that it is our wealth that is misappropriated.

In the spirit of Bastiat, ask yourself if the central banks increased the global money supply 20-fold overnight would we have more farmland, more oil wells, more factories, more of anything other than decimal places in our currency? The nominal price of all these things would likely increase but the size of the capital pool has not changed. How do the money printing programs currently underway differ from this in anything but magnitude?

Unfortunately, the perverse consequences of printing money do not stop with the misappropriation of wealth from the inflatees to the inflators. A policy of artificially low interest rates serves to sustain or create additional mal-investments – investments that cannot generate sufficient returns, and in many cases over the last decade ANY returns, to justify their existence. The failure to liquidate mal-investments allows the economic problems they cause to multiply and the inevitable accounting to be that much more devastating. Artificially low interest rates also fool the market into believing that capital is plentiful and that consumption can continue at unsustainable levels with severe consequences for the real economy. The word consume means “to expend, to use up, to waste or squander”. Always remember that consumption represents the diversion of productive capital into non-productive uses – i.e. the destruction of capital. Savings, on the other hand, are the only source of capital to create productive assets.

I do not believe that the aggressive expansion of the money supply in the west will have a beneficial effect on the real economy – i.e. will not increase the pool of productive capital in any meaningful way. However, I do believe it will fuel inflation and speculative activities. Of course, more inflation and speculation are exactly the opposite of what western economies need. We cannot all make our livings selling condos, stocks and bonds to each other – someone has to produce something and production requires genuine capital.

But this Frankenstein, finance driven economy appears to be exactly what our governments and central bankers are trying to keep alive. The west has become a vast inflation-creating machine in order to support the impaired banking and housing sectors. According to data published by analyst Mike Hewitt, since the dot.com crash in 2001 and the onset of aggressive low interest policies, the global money (M0) supply has increased over 170%. Some, fooled by government inflation data ask – “but where is all the inflation?” Fortunately for us, the Renminbi peg and OPEC petro-dollar recycling have been escape routes for a large amount of western money/inflation creation and heavily massaged government inflation data has helped disguise the rest.

As fast as we have been creating money in the west, China and OPEC have been importing and storing it on their balance sheets in the form of developed world sovereign debt. Some observers even argue that China will indefinitely accumulate western debt in order to maintain its peg against our inherently weak currencies. I believe that this is wishful thinking and once again it is to be fooled into believing what isn’t so merely because something hasn’t happened to date. When the emerging economies are forced to take serious steps to check domestic inflation – which for example is already starting to happen in China – they will stop purchasing our debt and even start selling it, at which point decades of stored western inflation could be returned to us in a very short period of time indeed.

In general, my investment premise remains that sustained real growth is unlikely to take place in the developed world until we stop engaging in capital destroying activities. Worse, our depleted and declining capital pool, combined with an enormous expansion of the monetary base and expanding government is creating a high probability of an extended period of stagflation in the west.

This is not to say that I take a universally pessimistic view of possible future returns. I believe that exposure to inflation-hedging assets with strong macro fundamentals and underlying cash generating capability, ideally in sectors exposed to growth outside of developed markets, will continue to be a fruitful area to search for outperformance over the long-term. My personal preference remains agriculture and energy.

Kind Regards

Stephen Johnston

‘Window closing’ on ultra-low mortgage rates

Tim Shufelt, Financial Post · Monday, Feb. 7, 2011

Amid the noise of volatile-but-improving economic indicators, mortgage rate hikes are likely to repeat like a chorus in the coming months.

Canadian banks are raising interest rates on mortgages, marking the beginning of a trend as they correlate with rising bond yields and expected monetary tightening.

That’s making a strong case for borrowers to lock into fixed rates before it’s too late, said Benjamin Tal, deputy chief economist with CIBC World Markets. “The window is closing.”

TD Canada Trust and CIBC both announced Monday hikes to their residential mortgage rates, the first increases since changes to the rules of borrowing were announced by the federal government last month. The other big banks where expected to follow the moves shortly.

Effective Feb. 8, the interest rate on the banks’ benchmark five-year closed fixed rate mortgage will increase 25 basis points to 5.44%. The country’s other major lenders are expected to soon follow suit.

Toronto mortgage broker Paula Roberts said rising borrowing costs will compel more of her clients to abandon ultra-low variable rates in favour of higher, fixed-rate mortgages.

That can be a tough decision for borrowers to accept higher payments, but not one that should strain a mortgagee’s finances, she said.

“If you can’t afford [your payments] … that’s a problem,” Ms. Roberts said. “That’s why the government has changed the rules.”

In two stages over the past year the federal government announced changes to the conditions of mortgage lending — shortening the maximum amortization from 35 years to 30 years and requiring borrowers to qualify for a fixed-rate plan, even if they are opting for a variable rate.

Many who only qualify under the old rules, however, will try to secure mortgages before the shorter maximum amortization periods come into effect next month, Ms. Roberts said.

“There are going to be a lot of people that will enter into their agreements by March 18.”

Much of the momentum in mortgage rates can be attributed to a bond selloff and rising yields across the board. That effect is partly a reflection of building global inflationary pressures as well as a global economy that is proving more robust than expected.

“In my opinion, the bond market will not be the place to be over the next six months, and if that’s the case, you will see mortgage rates continue to rise,” Mr. Tal said.

In addition, anticipation of increases to the Bank of Canada’s benchmark lending rates is building, also contributing to rising yields, which puts pressure on fixed-income mortgages.

If there was any lingering doubt that the Bank will soon raise rates, last week’s jobs report erased them. The report showed Canada added four times more jobs than expected in January.

“[It] creates a fairly powerful story for the Bank of Canada, which is clearly concerned on the domestic front,” said Camilla Sutton, chief currency strategist at the Bank of Nova Scotia. “I think there’s a material change.”

So do investors. The probability that the central bank will boost its key policy rate by May, as measured by overnight index swaps, jumped to almost 75% after the jobs data. http://www.financialpost.com/news/Window+closing+ultra+mortgage+rates/4239243/story.html#ixzz1DMwQzyWP

ALBERTA’S ECONOMY SET FOR STRONG GROWTH IN 2011 WITH BOOST FROM ENERGY SECTOR: RBC ECONOMICS

Comment – this is some of the data that was used in my MARKet Update / Buyers Report. Feel free to download it for free on my site here: http://markherman.ca/Rate2.ubr

ALBERTA’S ECONOMY SET FOR STRONG GROWTH IN 2011 WITH BOOST FROM ENERGY SECTOR: RBC ECONOMICS

TORONTO, Dec. 15 /CNW/ – Alberta’s economy continues to recover from its severe recession with real GDP set to grow 3.4 per cent in 2010 and then galloping to a solid 4.3 per cent in 2011, according to the latest Provincial Outlook report from RBC Economics. In 2011, RBC projects that Alberta’s economic growth will be second only to Saskatchewan, representing the fastest growth in the province since 2006.

Alberta’s strong forecast is owed to improvements in a number of areas, particularly the booming energy sector and increased job creation since spring which helped to bring down the stubbornly high unemployment rate.

“Improvements in the employment market helped reverse the net migration outflow to other provinces that earlier slowed population growth to the lowest rate in 15 years,” said Craig Wright, senior vice-president and chief economist, RBC. “These are the kinds of turnarounds that will spread the recovery more widely throughout Alberta’s economy next year.”

The RBC report notes Alberta’s employment sector is expected to lead the country with a rise of 2.3 per cent in 2011, up significantly from a scant 0.5 per cent in 2010. The anticipated increase represents the creation of 37,000 jobs and will usher in the highest total of new employment opportunities since 2007 which should ultimately contribute to a boost in population growth.

“With interest in developing Alberta’s oil sands growing ever higher, the gush of capital spending on megaprojects is expected to continue next year and beyond. This will pump tremendous activity into the provincial economy and act as a catalyst for both faster job growth and stronger migration from outside the province,” added Wright.

According to the RBC Economics Provincial Outlook, the impact of Alberta’s strengthening demographics will be especially positive for consumer spending in 2011 as retail sales are expected to soar to a rate of 5.6 per cent, higher than any other province. This, along with the 5.1 per cent increase in consumer spending expected this year, will go along way toward reversing the massive 8.4 per cent decline experienced in 2009.

Looking ahead to 2012, the rising tide of energy-related spending and the expanding of non-conventional oil production will continue to exert powerful lifting forces throughout the Alberta economy. RBC forecasts the province will sustain a solid pace of growth with GDP of 3.8 per cent which will keep the province near the top of Canada’s growth rankings.

The RBC Economics Provincial Outlook assesses the provinces according to economic growth, employment growth, unemployment rates, retail sales, housing stars and consumer price indexes.