Mortgage Tips for Canadian Buyers

Buying a home should be exciting – not exhausting.

Mortgage Checklist

1. Determine your Budget

Determine what your monthly budget is for the following:

– Mortgage payment

– Property taxes and Condo fees (if applicable)

– Utilities, maintenance and repair

2. Pre- Qualification

You will be asked to provide information about yourself and whoever is going to be on the mortgage with you. All of the information that is relayed is strictly confidential. You will be provided with a Mortgage Disclosure and Consent document to review and sign. Next, your Mortgage Broker will pull your credit bureau and review your overall situation and start the document collection process so they can determine your maximum purchase price and min down payment. A rate hold can be obtained once documents have been reviewed.

3. Document Preparation

Income for Salary or Hourly Employees

– Most recent Pay Stub

– Letter of employment – must be on company letterhead and state your name, position, length of employment. Guaranteed min # of hours and rate of pay or annual salary. It also must have contact information for the lender to call to verify employment once an offer has been made.

– Last 2 years Notice of Assessments (NOAs), T1 Generals and T4 slips for any hourly overtime, commission or bonus income

Income for Self-Employed:

– Last two years Notice of Assessments and T1 generals + confirmation no CRA tax in arrears

– Last 2 years statement of business activities for Sole Proprietors

– Articles of incorporation and Last 2 years company financials for Corporations/Partnerships

Down Payment/Closing Costs

– Anti Money Laundering Laws require the lender to review your 90 day Bank or Investment account histories to verif funds in account for down payment. Any frequent or large deposits and transfers must be verified. Online statements are acceptable, but smartphone screenshots are not.

– Gift letter + gift funds deposited to account, proof of Line of Credit available or sale of existing home proceeds (if applicable)

– You are required to have 1% to 1.5% of the purchase price on top of your down payment for costs relating to the closing of your new home purchase such as home inspection, property tax adjustments, appraisal fees, title insurance, moving expenses, utility hook ups and home fire insurance.

4. Find a realtor and start looking at houses

If you do not already have one, we can highly recommended you to one of our realtor connections. You can the proceed to look for a home that is within your pre-determine price. When you have found a house that you want to purchase, make sure your realtor makes it conditional on obtaining satisfactory financing. It is best to specify 7 to 10 days. It is also recommended to include the condition of a satisfactory house inspection.

5. Mortgage Approval

Once you have a confirmed Offer to Purchase on a house, notify your Mortgage Broker right away so they can start to work on getting the mortgage approved. At this time you will need to give your Mortgage Broker the following documents:

– Updated paystub, job letter and down payment account histories if they are more than 30 days old

– Completed & signed Offer to Purchase

– MLS listing (fact sheet) of the property, if private sale – old MLS listing or appraisal to confirm details

– Lawyer Information (Including the firm and solicitor’s name, address, phone and fax)

– Copy of void cheque for mortgage payments

6. Commitment Signing

A mortgage commitment is provided to your Mortgage Broker by the lender after your deal is approved. Your Mortgage Broker will spend time to review your mortgage commitment with you and let you know about any other lender requirements that need to be fulfilled. You then need to submit those requirements in order to get a final mortgage approval.

7. House Appraisal and Inspection

If required, your Mortgage Broker will order and schedule an appraisal. The mortgage lender determines th requirement of this. This is also the time where you should arrange to have an inspection performed on the home by a certified house inspector. The main purpose of a home inspection is to determine if the home has any existing major defects or any major repairs coming up in the near future. A home inspector will determine structural and mechanical soundness, identify any problem areas, provide cost estimates for any work required and provide you with a report.

8. Condition Removal

Once the lender has confirmed they have all the required documents and the deal is approved you can contact your realtor and have the financing condition removed. At the same time, if the home inspector’s report came back satisfactory, that condition can be removed as well. Do not remove conditions until all amendments to your real estate contract have been reviewed and accepted by the lender as it could affect your financing.

9. Meet with Lawyer

Once all of the conditions for the mortgage are verified and approved, the lender will package your mortgage up and send it to your lawyer whereupon your lawyer will call you in for a meeting one to two weeks before your possession date to go over the legal matters of the mortgage. You will review and sign documents relating to the mortgage, the property you are buying, the ownership of the property and the conditions of the purchase. Your lawyer will also ask you to bring a certified cheque or bank draft to cover closing costs and any other outstanding costs. Avoid signing up for duplicate Mortgage Life/Disability insurance at lawyers.

10. Possession Day

Once the transfer of money has occurred between your lawyer and the seller’s lawyer, you will officially own your new home. Your realtor will arrange to meet with you at your new home and do a walk through to make sure everything is as it should be and also to give you the keys. Congratulations!

Creating happy homeowners by providing personal bespoke mortgages solutions with uncompromising service.

Mortgage Mark Herman

Mortgage Broker & Overall Happiness Creator

Mortgages Are Marvellous

Mark@MortgagesAreMarvellous.ca

Serving Clients In: Calgary, Okotoks, Airdrie, Strathmore, Cochrane, Lethbridge, Red Deer,= & Medicine Hat.

Also Serving: All areas of Alberta including: Edmonton, Sherwood Park, Fort Saskatchewan, Leduc, Nisku, Stony Plain, Spruce Grove, Beaumont and St. Albert. Wood Buffalo / Fort McMurray, Grande Prairie, Airdrie, Lloydminster AB, Okotoks, Cochrane, Camrose, Chestermere, Sylvan Lake, Brooks, Strathmore, High River, Wetaskiwin, Lacombe, Canmore, Morinville, Whitecourt, Hinton, Olds, Blackfalds, Taber, Coaldale, Edson, Banff, Grand Centre, Innisfail, Ponoka, Drayton Valley, Cold Lake, Devon, Drumheller, Rocky Mountain House, Slave Lake, Wainwright, Stettler, St. Paul, Vegreville, Didsbury, Bonnyville, Westlock, Barrhead.

How sudden job loss affects your mortgage pre-approval or approval

If you’ve been thinking about buying a house, you’ve probably considered how much you can afford in mortgage payments. Have you also thought about what would happen if you lost your source of income?

While the sudden loss of employment is always a possibility, the current uncertainty of our economy has made more people think about the stability of their income. Whether you’ve already made an offer on a home or you’ve just started looking, here is how job loss could affect your mortgage approval.

What role does employment play in mortgage approval?

In addition to ensuring you earn enough to afford a mortgage payment; mortgage lenders want to see that you have a history of consistent income and are likely to in the future. Consistent employment is the best way to demonstrate that.

To qualify for any mortgage, you’ll need proof of sufficient, reliable income. Your mortgage broker will walk you through the income documents your lender will need to verify you’re employed and earning enough income. So, if your employment situation is questionable, you may want to reconsider a home purchase until your employment is more secure.

Should you continue with your home purchase after you’ve lost your job?

What if you’ve already qualified for a mortgage, and your employment circumstances change? Simply put, you must tell your lender. Hiding that information might be considered fraud, and your lender will find out when they verify your information prior to closing. If we are aware of this change we may be able to work it out with the lender.

What if you don’t tell the lender or us – your broker – and hope the lender does not find out?

The lender will probably “pull your financing” if they find out on their own, and this can happen right up to the minute before possession, like 11:59 am on possession day.

At best, you may “close late” and there are fees for that, at worst, you could both:

· Lose your deposit that you gave and

· Be sued for “specific performance” of completing a legal and binding contract to buy the home. If the sellers need the funds to close on another house, they could “fire sale” the home for say $50,000 less and sue you for that to. And you will probably lose.

If you’ve already gone through the approval process, then you know that your lender is looking for steady income and employment.

Here are some possible scenarios where you may be able to continue with your purchase:

- If you secure another job right away and the job is in the same field as your previous employment at a direct competitor. You will still have to requalify, and it may end up being for less than the original loan, but you may be able to continue with your home purchase. Be aware, if your new employer has a probationary period (usually three months), you might not be approved.

- TIP: ask if you can have probation waived or be hired without probation.

- If you have a co-signer on your mortgage, and that person earns enough to qualify on their own, you may be able to move forward. Be sure your co-signer is aware of your employment situation.

- If you have other sources of income that do not come from employment, they may be considered. The key factors are the amount and consistency of the income. Income from retirement plans, rentals, investments, and even spousal or child support payments may be considered if we have not used that income to qualify you please tell us.

Can you use your unemployment income when applying for a mortgage?

Generally, Employment Insurance income can’t be used to qualify for a mortgage. The exceptions for most financial institutions are seasonal workers or people with cyclical employment in industries such as fishing or construction. In this situation, you’ll be asked to show at least a 2-year cycle of employment followed by Employment Insurance benefits.

Also if you are in an apprenticeship, then you are on EI when you are in your “school term” and that is totally fine.

What happens if you’re furloughed (temporary leave of absence)?

Not all job losses are permanent. As we’ve seen during the COVID-19 pandemic, many workers were put on temporary leave. If you’ve already been approved for a mortgage and are closing on a house, your lender might take a “wait-and-see” approach and delay the closing if you can demonstrate you’ve only been furloughed. In these cases, you’ll need a letter from your employer that has a return-to-work date on it. Keep in mind, if you don’t return to work before your closing date, your lender will likely cancel the approval and ask for a resubmission later.

If you haven’t started the application process, it would be wise to wait until you are back to work for at least 3-months to demonstrate consistent employment.

Your credit score and debt servicing ratios may change because of lost income, which means you may no longer meet your lender’s qualifications for a mortgage. While it may not be possible, try to avoid accumulating debt or missing any payments while unemployed.

Talk to your mortgage broker.

You don’t want to get locked into a mortgage you can’t afford. You also don’t want to lose a deposit on a home because you lost your financing. When trying to assess if it’s better to move forward or walk away, we should be your first call.

Data on July 1, 2022 Prime Increase to 3.7%

Today, the Bank of Canada showed once again that it is seriously concerned about inflation by raising its overnight benchmark rate to 1.50% – making Consumer Prime 3.70%

This latest 50 basis point increase follows a similar-sized move in April and is considered the fastest rate hike cycle in over two decades.

Everyone STAY COOL!

Says Mortgage Mark Herman, top Calgary Alberta Mortgage Broker.

With it, the Bank brings its policy rate closer to its pre-pandemic level.

In rationalizing its 3rd increase of 2022, the Bank cited several factors, most especially that “the risk of elevated inflation becoming entrenched has risen.” As a result, the BoC will use its monetary policy tools to return inflation to target and keep inflation expectations well anchored.

These are the highlights of today’s announcement.

Inflation at home and abroad

- Largely driven by higher prices for food and energy, the Bank noted that CPI inflation reached 6.8% for the month of April, well above its forecast and “will likely move even higher in the near term before beginning to ease”

- As “pervasive” input pressures feed through into consumer prices, inflation continues to broaden, with core measures of inflation ranging between 3.2% and 5.1%

- Almost 70% of CPI categories now show inflation above 3%

- The increase in global inflation is occurring as the global economy slows

- The Russian invasion of Ukraine, China’s COVID-related lockdowns, and ongoing supply disruptions are all weighing on activity and boosting inflation

- The war has increased uncertainty, is putting further upward pressure on prices for energy and agricultural commodities and “dampening the outlook, particularly in Europe”

- U.S. labour market strength continues, with wage pressures intensifying, while private domestic U.S. demand remains robust despite the American economy “contracting in the first quarter of 2022”

- Global financial conditions have tightened and markets have been volatile

Canadian economy and the housing market

- Economic growth is strong and the economy is clearly “operating in excess demand,” a change in the language the Bank used in April when it said our economy was “moving into excess demand”

- National accounts data for the first quarter of 2022 showed GDP growth of 3.1%, in line with the Bank’s April Monetary Policy Report projection

- Job vacancies are elevated, companies are reporting widespread labour shortages, and wage growth has been “picking up and broadening across sectors”

- Housing market activity is moderating from exceptionally high levels

- With consumer spending in Canada remaining robust and exports anticipated to strengthen, growth in the second quarter is expected to be “solid”

Looking ahead

With inflation persisting well above target and “expected to move higher in the near term,” the Bank used today’s announcement to again forewarn that “interest rates will need to rise further.”

The pace of future increases in its policy rate will be guided by the Bank’s ongoing assessment of the economy and inflation.

In case there was any doubt, the Bank’s message today was clear: it is prepared to act more forcefully if needed to meet its commitment to achieve its 2% inflation target.

July 13, 2022 is the date of the BoC’s next scheduled policy announcement.

Rates Increasing: How Much? & How Fast?

With interest rates now on the rise, 2 Questions: How much? & How fast?

Summary:

- Rates are up by 1.45% on the Variable already (Prime was 1.75% and is now 3.2%)

- There HAS BEEN a 1 x .25% increase and 1 x .5% increase so far = .75% so far

- Expected increases are 1 x .5% or .75%, and 1 x .25% still to come.

- so expect Prime to get to 3.95% from 3.20% today, April 25th.

- Insured variable rates are at Prime – 0.95% = 3.2 – .95% = 2.25% today

- and they are expected to increase to 3.95% – .95% = 3.00% and then hold and decrease in the Fall of 2022.

- these rates are lower than the current 5-year fixed rates of about 4% and are expected to come down in the Fall, 2022.

DETAILS:

Traditionally the Bank of Canada has used 0.25% as the standard increment for any interest rate move up, or down. Occasionally the Bank will move its trendsetting Policy Rate by .50%, as it did at its last setting on April 13.

The last time the central bank boosted the, so-called, overnight rate by ½% was 20 years ago. Now the Bank seems to be laying the ground work for an even bigger increase of .75% at its next setting in June. There has not been a three-quarter point increase since the late 1990s.

Inflation remains the key concern for the BoC. In March the inflation rate hit 6.7%, a 30-year high. The central bank wants to see inflation at around 2.0%. But it does not expect that to happen until sometime late next year.

Bank of Canada Governor will “not rule anything out” when it comes to interest rates and taming inflation. “We’re prepared to be as forceful as needed and I’m really going to let those words speak for themselves.”

While higher inflation was not unexpected as the economy recovered from the pandemic, it is lingering longer than anticipated. The Bank says this is largely due to:

- on-going waves of COVID-19, particularly in China, that have disrupted manufacturing and the supply chain;

- the Russian invasion of Ukraine; and

- spending fuelled by those rock-bottom interest rates that were designed to keep the economy moving during the pandemic.

The Bank is thought to be aiming for a Policy Rate of between 2% and 3%. That is considered a “neutral” rate that neither stimulates nor restrains the economy.

At the current pace, that could be reached by the fall of 2022.

Investment Mortgages WILL Be Harder to Get in 2023!

Its true! This thing called Basel 3 will make it harder to get an investment mortgage in 2023!

Lots of junk below, the short version is:

Canadian banks will need to apply more risk to investor mortgages and to lower that risk they may:

- Increase the down payment needed from 20% to a higher amount … maybe 25% or 30%

- Lend to fewer investors – which already make up 25% to 30% of the Canadian market.

- New Zealand already started 40% down payment for investment properties!

“Avoid the new rules by buying your investment property in 2022!

Mortgage Mark Herman, top Calgary, Alberta mortgage broker.”

DETAILS: Canadian Bank Regulator Confirms Investor Mortgage Reduction Coming Next Year

Canadian real estate investors are about to face higher hurdles to enter the market. The Office of the Superintendent of Financial Institutions (OSFI), Canada’s bank regulator, confirmed new rules being rolled out in Q2 2023. The rules are a part of international Basel III guidelines, designed to reduce risk in the system. One critical change for real estate will be raising the risk weight for investor mortgages. This will reduce their leverage, which OSFI cites as a key response to housing risk. It’s still early, but here’s what we could dig up.

The Basel Trilogy and Global Financial Risk Reduction

The Basel reforms are a global set of measures for prudential bank regulation. They were developed by the Basel Committee On Banking Supervision (BCBS). The BCBS is a 45-country group hosted by the Bank of International Settlements (BIS). The BIS is often called, “the central bank for central banks.” It’s also jokingly called the “final boss” by Bitcoin investors.

We know, it’s a lot of banking jargon and acronyms, but what they do is straightforward. Their job is creating non-partisan risk reduction standards for the global financial system. Since the world’s financial system is now interdependent, problems spill across borders. They stepped up their game after a housing bubble in the US caused a global financial crisis (GFC).

The Basel Accords are a trilogy of policy where the common goals were set. The original happened before many of you were born (1988), but Basel II and III occur after the 2007-2008 GFC. No, circle back. GFC doesn’t stand for Gesus F*cking Christ, we just explained it’s the Global Financial Crisis. We’re also worried about your spelling skills.

The Second Accord primarily addressed minimum capital adequacy requirements. In other words, how much financial institutions had on hand compared to what they lend. Basel III was held in 2010, and mostly just improves the recognition of risk.

A good chunk of BASEL III reforms have already been implemented. Increasing Common Equity Tier 1 (CET) to 4.5% of risk-weighted assets (RWAs) from 2% in BASEL II, is one example. It happened in 2015 and almost no one heard a sound. The measures have been gradually introduced to create as little noise as possible. Though real estate investors might make some noise with the next update.

Basel III Will Land In Q2 2023, and It Will Lower Investor Mortgage Leverage

Basel III will increase the capital requirements for investor mortgages. “as part of the domestic implementation of Basel 3 reform package” in banks’ fiscal Q2-2023, we are increasing the risk weights, and thus capital required, for investor mortgages compared to the risk weights for owner-occupied properties,” said OSFI this morning.

That only tells us a reduction in leverage by Q2 2023 is coming, but not how much. OSFI said they’ll get back to us with what that means for down payments soon. We’ll update as soon as they do, but in the meantime we can get an idea of what we’re in for, from Basel III guidelines.

New standardized credit risk assigns a 30% risk weight to residential real estate. Next year income producing properties with a loan-to-value between 60% and 80% will have a risk weight of 45%. A bank will assume 50% more risk weight for an investor mortgage than an owner occupied home. i.e. owner-occupied mortgages with 20% down have similar risk to investor mortgages with 30% down.

There’s no direct translation of how that’s mitigated. They could want 10 points more for a mortgage, or they can offset risk in various other ways. Raising the risk premium on interest or lending less would be two methods to deal with it. None of those are particularly great for investors, now between 25% and 30% of home sales in Canada. It will slow demand though, which is probably needed.

Raising the down payment is already occurring in other countries like New Zealand. Last year the country increased the minimum downpayment for investors to 40% of the value. Mortgage Professionals Canada (MPC) recently suggested a similar arrangement for Canada. Yup! The organization that represents mortgage brokers suggested it as just a cooling measure. Not even a Basel III mitigation.

The Federal Government has yet to address the issue, probably since most don’t know it’s coming. That means we don’t know if they’ll help reduce the leverage for political points or it’ll come from the banks. One thing’s for sure though — it’s coming next year.

Canadian Economic Data Points Affecting Mortgages

Below are the Bank of Canada’s updated comments on the state of the economy, the Bank and singled out the unprovoked invasion of Ukraine by Russia as a “major new source of uncertainty” that will add to inflation “around the world,” and have negative impacts on confidence that could weigh on global growth.

These are the other highlights.

Canadian economy and the housing market

- Economic growth in Canada was very strong in the fourth quarter of 2021 at 6.7%, which is stronger than the Bank’s previous projection and confirms its view that economic slack has been absorbed

- Both exports and imports have picked up, consistent with solid global demand

- In January 2022, the recovery in Canada’s labour market suffered a setback due to the Omicron variant, with temporary layoffs in service sectors and elevated employee absenteeism, however, the rebound from Omicron now appears to be “well in train”

- Household spending is proving resilient and should strengthen further with the lifting of public health restrictions

- Housing market activity is “more elevated,” adding further pressure to house prices

- First-quarter 2022 growth is “now looking more solid” than previously projected

Canadian inflation and the impact of the invasion of Ukraine

- CPI inflation is currently at 5.1%, as the BoC expected in January, and remains well above the Bank’s target range

- Price increases have become “more pervasive,” and measures of core inflation have all risen

- Poor harvests and higher transportation costs have pushed up food prices

- The invasion of Ukraine is putting further upward pressure on prices for both energy and food-related commodities

- Inflation is now expected to be higher in the near term than projected in January

- Persistently elevated inflation is increasing the risk that longer-run inflation expectations could drift upwards

- The Bank will use its monetary policy tools to return inflation to the 2% target and “keep inflation expectations well-anchored”

Global economy

- Global economic data has come in broadly in line with projections in the Bank’s January Monetary Policy Report

- Economies are emerging from the impact of the Omicron variant of COVID-19 more quickly than expected, although the virus continues to circulate and the possibility of new variants remains a concern

- Demand is robust, particularly in the United States

- Global supply bottlenecks remain challenging, “although there are indications that some constraints have eased”

Looking ahead

As the economy continues to expand and inflation pressures remain elevated, the Bank’s Governing Council made a clear point of telling Canadians to expect interest rates to rise further.

More on Food Security – Interesting data points on the War in Ukraine

Prices for food commodities like grains and vegetable oils reached their highest levels ever last month largely because of Russia’s war in Ukraine and the “massive supply disruptions” it is causing, threatening millions of people in Africa, the Middle East elsewhere with hunger and malnourishment, the United Nations said Friday.

The UN Food and Agriculture Organization said its Food Price Index, which tracks monthly changes in international prices for a basket of commodities, averaged 159.3 points last month, up 12.6% from February. As it is, the February index was the highest level since its inception in 1990.

FAO said the war in Ukraine was largely responsible for the 17.1% rise in the price of grains, including wheat and others like oats, barley and corn. Together, Russia and Ukraine account for around 30% and 20% of global wheat and corn exports, respectively.

While predictable given February’s steep rise, “this is really remarkable,” said Josef Schmidhuber, deputy director of FAO’s markets and trade division. “Clearly, these very high prices for food require urgent action.”

The biggest price increases were for vegetable oils: that price index rose 23.2%, driven by higher quotations for sunflower seed oil that is used for cooking. Ukraine is the world’s leading exporter of sunflower oil, and Russia is No. 2.

Rates and Prices Trending Up Due to Inflation and War

Mid-March Commentary: Rates and Prices Trending Up Due to Inflation! and War!!

On March 2nd, 2022, the Bank of Canada made its most anticipated decision on interest rates since the pandemic began. After weeks of speculation and anticipation of an increase, central bankers finally pulled the trigger and moved their overnight rate higher.

For the 1st time since the pandemic began to hurt the economy in March 2020, the Bank raised its overnight benchmark rate by .25% and the knock-on effect is that borrowing costs for Canadians will rise modestly although by historical norms, remain low.

In its updated comments on the state of the economy, the Bank and singled out the unprovoked invasion of Ukraine by Russia as a “major new source of uncertainty” that will add to inflation “around the world,” and have negative impacts on confidence that could weigh on global growth.

Below are the other highlights…

Canadian economy and the housing market

- Economic growth in Canada was very strong in the fourth quarter of 2021 at 6.7%, which is stronger than the Bank’s previous projection and confirms its view that economic slack has been absorbed

- Both exports and imports have picked up, consistent with solid global demand

- In January 2022, the recovery in Canada’s labour market suffered a setback due to the Omicron variant, with temporary layoffs in service sectors and elevated employee absenteeism, however, the rebound from Omicron now appears to be “well in train”

- Household spending is proving resilient and should strengthen further with the lifting of public health restrictions

- Housing market activity is “more elevated,” adding further pressure to house prices

- First-quarter 2022 growth is “now looking more solid” than previously projected

Canadian inflation and the impact of the invasion of Ukraine

- CPI inflation is currently at 5.1%, as the BoC expected in January, and remains well above the Bank’s target range

- Price increases have become “more pervasive,” and measures of core inflation have all risen

- Poor harvests and higher transportation costs have pushed up food prices

- The invasion of Ukraine is putting further upward pressure on prices for both energy and food-related commodities

- Inflation is now expected to be higher in the near term than projected in January

- Persistently elevated inflation is increasing the risk that longer-run inflation expectations could drift upwards

- The Bank will use its monetary policy tools to return inflation to the 2% target and “keep inflation expectations well-anchored”

Global economy

- Global economic data has come in broadly in line with projections in the Bank’s January Monetary Policy Report

- Economies are emerging from the impact of the Omicron variant of COVID-19 more quickly than expected, although the virus continues to circulate, and the possibility of new variants remains a concern

- Demand is robust, particularly in the United States

- Global supply bottlenecks remain challenging, “although there are indications that some constraints have eased”

Looking ahead

As the economy continues to expand and inflation pressures remain elevated, the Bank made a clear point of telling Canadians “To expect interest rates to rise further.”

The resulting quantitative tightening (which central bankers framed as “QT” rather than the previous term “QE” for quantitative easing) would complement increases in the Bank’s policy-setting interest rate. The timing and pace of further increases in the policy rate, and the start of QT, will be guided by the Bank’s ongoing assessment of the economy and its commitment to achieving a 2% inflation target.

BoC’s next scheduled policy announcement is April 13, 2022. We will update you following that announcement as always.

Rising rates: fixed or variable?

The Bank of Canada pulled the trigger on an interest rate increase, the first since October 2018 and the Bank has made it clear more increases are coming.

The upward move and the Bank’s messaging have rekindled the perennial mortgage debate: fixed or variable. The answer remains the perennial: it depends.

It depends on the borrower’s end goals, finances and their desire for stability. That last point, stability, is what leads most Canadian home buyers to opt for a 5-year, fixed-rate mortgage. But in purely financial terms – and saving money – variable-rate mortgages tend to be cheaper, and they do not have to be volatile.

In a rising rate environment, many borrowers worry about the cost of their debt going up. But right now, variable-rates are notably lower than fixed-rates and it will take several Bank of Canada increases to close the gap. In the meantime, that amounts to savings for the borrower.

Those savings – often hundreds of dollars a month – could be applied against principal. As rates rise the amount can be adjusted, thereby keeping total monthly payments the same and evening-out any volatility.

It should be remembered that fixed-rates are rising as well. They are tied to Government of Canada 5-year bond yields. Those yields have been increasing, and at least some of that is tied to increases in U.S. government bond yields. Canadian bonds tend to move in sync with American bonds, but those changes do not necessarily reflect the Canadian economy. In other words, the changes are not completely within our control.

A Few More Words on Russia Invading Ukraine

Markets were thrown into a tizzy. They plunged. But the frenzy was short lived. By the end of the day markets were back in the black.

Canada’s economic exposure to Russia and Ukraine is relatively small. Canada imported $1.2 billion from Russia in 2020; Russia imported roughly the same from Canada – less than a week’s worth of commercial traffic across the Ambassador Bridge.

The key factor in the conflict, for Canada, will likely be the price of oil, which has climbed past $100 a barrel. Rising oil prices and higher fuel costs have been a principal driver of inflation here, and inflation is the main concern of the Bank of Canada. It is currently running at 5.1%, a 30 year high, and the central bank is under growing pressure to bring it under control.

Oil is also an important part of Canada’s resource economy. Higher prices will likely lead to more production. Any embargo of Russian oil will create demand for Canadian product. That, in turn, would put more load onto Canada’s economic recovery, which is strong but hampered by pandemic labour shortages and supply-chain problems which, again, are adding to inflation pressures.

None the less, war creates uncertainty, and uncertainty triggers caution among central bankers. A recent Reuters poll of 25 economists suggests the Bank of Canada will go ahead with a quarter-point rate hike this week.

What Are the Risks Of Unconditional Offers When Buying A Home?

The process of buying a home and completing a real estate transaction typically centers on the offer. After finding the home you want to buy, you’ll need to submit an offer, which the seller will review before signing off on it.

But in addition to the typical clauses that are included in an offer, buyers have the option to insert “conditions” to the offer. Without these conditions, the offer will be deemed “unconditional,” and in this case, the contract will be legally binding for both parties.

There are some inherent risks with unconditional offers that buyers should be aware of. Let’s review what unconditional offers are, and how they may leave you vulnerable in some cases.

SUMMARY:

- We recommend “no condition offers” if you have the cash to buy as “Plan B.”

- We do recommend the Financing Conditions to be at least:

- “subject to lender approval of appraisal value and lender approval of property standards” and

- if less than 20% down, subject to CMHC/default insurer acceptance.

Why?

-

-

- Any of these could stop a mortgage at a specific lender: preserved wood foundations, near a busy commercial location, too near flood zone or flood fringe for the lender, aluminum wiring, Poly B plumbing, condo docs not accepted -if condo.

-

Common House Offer Conditions

There are dozens of examples of conditions that buyers can insert into their offers, but many are not often used. That said, there are certain conditions that are very commonly added to offers, including the following:

Financing Condition

Most home purchases require some form of financing to help buyers come up with the money to buy a home. But getting a mortgage requires an application and approval process. Before buyers seal the deal on a contract, they should ensure that they are able to secure a mortgage to finance the purchase.

Financing conditions are among the more common ones inserted into offers and give buyers and their mortgage lenders some time to work through the mortgage process. If they cannot get approved for financing, the buyer will be able to back out of the deal.

Home Inspection Condition

A home inspection is another common condition, which provides the buyer with a certain amount of time to have the subject property inspected by a professional home inspector. If there are any major issues that are discovered, the buyer can address them with the seller. Otherwise, the buyer can back out of the deal if they find the home inspection report unsatisfactory.

Condo Doc Review of Condo Corp. Financial Statements

In the case of a condo purchase, a review of the condo corporation’s Status Certificate is very important. The Status Certificate will detail the financial and legal health of the condo corporation.

The buyer’s lawyer will review the Status Certificate and look for any potential red flags. And if there are any, the buyer will have the opportunity to kill the deal before the condition expires if they so choose.

Sale Of Another Property

In some cases, buyers may want to make the purchase of a home conditional upon the sale of their own current home. This is more commonly seen in buyer’s markets where there is a lot of supply and not as much demand. In this case, it may take buyers a little longer to sell their homes.

Buyers who insert these conditions in their offers want to make sure that they are able to find a buyer of their own and not get stuck with two homes and two mortgages.

That said, many sellers don’t like to see these types of conditions, as it can put them at risk of the deal falling through. The time spent waiting for this condition to be filled could have been spent entertaining other potential offers that many have otherwise come through.

What Is An Unconditional Offer?

An unconditional offer is one that does not come with any conditions. There are no additional checks to be made aside from the clauses that already come with a purchase of sale agreement. Once the contract is signed off by both parties — and before the expiry date — the deal is firm and neither the buyer nor the seller can back out.

Benefits Of An Unconditional Offer

While it’s generally advised that buyers insert conditions such as a home inspection, financing, or Status Certificate review, in some cases it may be a good idea to make a “clean” offer, or one that is void of conditions. For instance, in the case of a bidding war where there are multiple buyers bidding for the same house at the same time, all buyers will want to go in with their best foot forward.

This might mean putting in an unconditional offer. These offers are more attractive to sellers because there is no waiting game that needs to take place to fulfill conditions. In some cases, sellers may even favour an unconditional offer with a slightly lower offer price than an offer with a higher offer price that has a couple of conditions that would need to be dealt with.

Risks Of Unconditional Offers

As you might imagine, there are some risks that come with unconditional offers. You’ll be left unprotected if you sign off on the contract with no opportunity to ensure all your bases are covered.

Here are a few of the risks associated with a condition-free offer:

Your Bank May Not Approve Financing

If you are unable to secure financing, you’ll be stuck with a massive financial obligation to pay for a home you do not have the money for. If you do not insert a financing condition, you won’t have the chance to make certain that you can get approved for a mortgage needed to finance the purchase.

You’ll Have to Cover Any Shortfalls in Down Payment

In the case of a bidding war, you may offer a price that’s higher than the market value of the subject property. When the property is appraised, the mortgage lender will discover that the home is not worth as much as you agreed to pay for it. As such, the lender may not approve the initial loan amount you requested.

In this case, you’ll need to bump up your down payment amount in order to make up for the difference. If your offer was not subject to a financing condition and you are not able to cover the shortfall in the extra down payment, you could risk losing your deposit and even be sued for damages.

You Could Get Stuck With A Faulty Home

If you neglect to give yourself some time to scope out the property with a professional by your side, you could inadvertently buy a “money pit” that will require a ton of money to repair.

During your initial visit to the home before you put in an offer, you may not have noticed any issues. A home inspection will give you a few hours with a home inspector to check out if there are any major problems with the home before you commit to buying it. If any are discovered, you’ll have the chance to either renegotiate a lower price with the seller, ask the seller to make the repairs, request a credit so you can make the repairs yourself, or back out of the deal altogether. But without a home inspection condition, you’ll be stuck with the house regardless.

You Could Get Stuck With A Condo That’s In Disarray

Some condo corporations may have legal issues and be in the midst of lawsuits, have reserve funds that are not enough to cover the cost of major repairs that can arise in the near future, or be poorly run. You don’t want to get stuck with a condo corporation that is mismanaged, but this is exactly what can happen if you don’t insert a Status Certificate review condition.

Bank of Canada holds benchmark interest rate steady & updates 2022 economic outlook

Summary:

- Prime did not change today, Jan 26, and the Bank of Canada (BoC) clearly said they are planning on starting the needed rate increases at the next meeting in 6 weeks, on Wednesday March 2nd.

- The Market has “priced in” between 4 and 6 increases in 2022, each by .25%, and between 2 and 4 increases in 2023, each by .25%

- There may be fewer increases if inflation returns to the target of 2% from today’s 40 year high of about 5%.

- The USA is seeing record 7% inflation and Canada usually gets dragged along with the US numbers so that balances the possibility of fewer increases.

- Mortgage Strategy – secure a fully underwritten, pre-approval, with a 120- day rate hold, from a person, not an online “60-second-mortgage-app” as soon as you think you may be buying in the next 2 years.

- To start a mortgage application with us, click here, and we will call you with in 24-hours to get things going.

DETAILS:

This morning in its first scheduled policy decision of 2022, the Bank of Canada left its target overnight benchmark rate unchanged at what it describes as its “lower bound” of 0.25%. As a result, the Bank Rate stays at 0.5% and the knock-on effect is that borrowing costs for Canadians will remain low for the time being.

The Bank also updated its observations on the state of the economy, both in Canada and globally, leaving a strong impression that rates will rise this year.

More specifically, the Bank said that its Governing Council has decided to end its extraordinary commitment to hold its policy rate at the effective lower bound and that looking ahead, it expects “… interest rates will need to increase, with the timing and pace of those increases guided by the Bank’s commitment to achieving” its 2% inflation target.

These are the other highlights of today’s BoC announcement.

Canadian economy

- The economy entered 2022 with considerable momentum, and a broad set of measures are now indicating that economic slack is absorbed

- With strong employment growth, the labour market has tightened significantly with elevated job vacancies, strong hiring intentions, and a pick up in wage gains

- Elevated housing market activity continues to put upward pressure on house prices

- Omicron is “weighing on activity in the first quarter” and while its economic impact will depend on how quickly this wave passes, the impact is expected to be less severe than previous waves

- Economic growth is then expected to bounce back and remain robust over the Bank’s “projection horizon,” led by consumer spending on services, and supported by strength in exports and business investment

- After GDP growth of 4.5% in 2021, the Bank expects Canada’s economy to grow by 4% in 2022 and about 3.5% in 2023

Canadian inflation

- CPI inflation remains “well above” the Bank’s target range and core measures of inflation have edged up since October

- Persistent supply constraints are feeding through to a broader range of goods prices and, combined with higher food and energy prices, are expected to keep CPI inflation close to 5% in the first half of 2022

- As supply shortages diminish, inflation is expected to decline “reasonably quickly” to about 3% by the end of 2022 and then “gradually ease” towards the Bank’s target over the projection period

- Near-term inflation expectations have moved up, but longer-run expectations remain anchored on the 2% target

- The Bank will use its monetary policy tools to ensure that higher near-term inflation expectations do not become embedded in ongoing inflation

Global economy

- The recovery is strong but uneven with the US economy “growing robustly” while growth in some other regions appears more moderate, especially in China due to current weakness in its property sector

- Strong global demand for goods combined with supply bottlenecks that hinder production and transportation are pushing up inflation in most regions

- Oil prices have rebounded to well above pre-pandemic levels following a decline at the onset of the Omicron variant of COVID-19

- Financial conditions remain broadly accommodative but have tightened with growing expectations that monetary policy will normalize sooner than was anticipated, and with rising geopolitical tensions

- Overall, the Bank projects global GDP growth to moderate from 6.75% in 2021 to about 3.5% in 2022 and 2023

January Monetary Policy Report

The key messages found in the BoC’s Monetary Policy Report published today were consistent with the highlights noted above:

- A wide range of measures and indicators suggest that economic slack is now absorbed and estimates of the output gap are consistent with this evidence

- Public health measures and widespread worker absences related to the Omicron variant are slowing economic activity in the first quarter of 2022, but the economic impact is expected to be less severe than previous waves

- The impacts from global and domestic supply disruptions are currently exerting upward pressure on prices

- Inflationary pressures from strong demand, supply shortages and high energy prices should subside during the year

- Over the medium term, increased productivity is expected to boost supply growth, and demand growth is projected to moderate with inflation expected to decline gradually through 2023 and 2024 to close to 2%

- The Bank views the risks around this inflation outlook as roughly balanced, however, with inflation above the top of the Bank’s inflation-control range and expected to stay there for some time, the upside risks are of greater concern

Looking ahead

The Bank intends to keep its holdings of Government of Canada bonds on its balance sheet roughly constant “at least until” it begins to raise its policy interest rate. At that time, the BoC’s Governing Council will consider exiting what it calls its “reinvestment phase” and reducing the size of its balance sheet. It will do so by allowing the roll-off of maturing Government of Canada bonds.

While the Bank acknowledges that COVID-19 continues to affect economic activity unevenly across sectors, the Governing Council believes that overall slack in the economy is now absorbed, “thus satisfying the condition outlined in the Bank’s forward guidance on its policy interest rate” and setting the stage for increases in 2022.

Mortgage Rate Holds are the theme for buyers in 2022

Mortgage Mark Herman, your friendly Calgary Alberta mortgage broker & New Buyer Specialist.

2022 Canadian Mortgage Rate Forecast

Why five-year variable rates will likely save money versus their fixed-rate equivalents in 2022 (and beyond).

We begin 2022 with Canadian inflation at its highest level since 2003.

Prices have been driven higher by a combination of surging demand, fueled by generous government support payments, and supply shortages tied to the pandemic.

Both the Bank of Canada (BoC) and the US Federal Reserve have been predicting that these factors will have only a transitory impact on inflation.

The term transitory means “non-permanent”, which still appears to be the correct assessment, but it also means “of brief duration”, which hasn’t been the case.

The experience of hotter and stickier inflation has caused both bond-market investors and the wider public to lose confidence in our central bankers.

That is concerning because if people lose faith in their ability to keep inflation contained, they may start accelerating their purchase plans to avoid future price increases, and any such additional increase in demand would push prices still higher. The longer inflation persists, the more likely it becomes that workers will push for higher wages to compensate for their reduced purchasing power. This engenders a self-reinforcing cycle, where the fear of higher inflation causes it to materialize.

With public confidence waning, both the BoC and the Fed had no choice but to stop using the term transitory and to turn more hawkish on monetary-policy tightening. At this point, higher mortgage rates in 2022 appear all but inevitable. But how high will they go?

The five-year Government of Canada (GoC) bond yield, which our five-year fixed mortgage rates are priced on, has already surged higher in anticipation of five quarter-point BoC rate hikes in 2022 and two more in 2023. Those are some big moves that are already priced into five-year fixed rates if you lock in today.

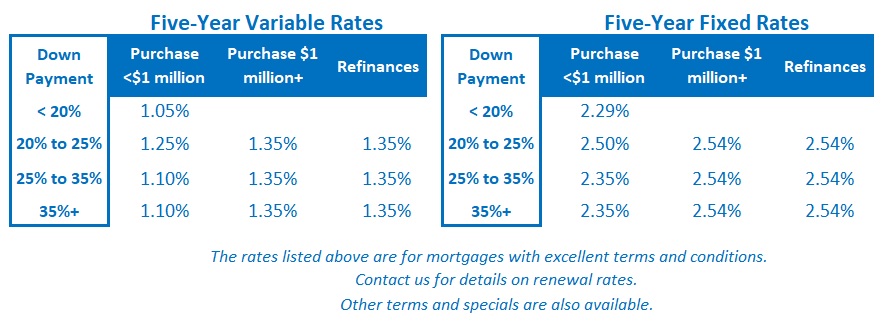

Meanwhile, for at least a little while longer, the BoC’s policy rate stands at 0.25%, and that means five-year variable mortgage rates are still available in in the low 1% range, or about 1.25% below their fixed-rate equivalents. That is a much larger buffer than normal.

The futures market is expecting that spread to disappear by the end of the year, but I am skeptical for the following five reasons:

- Omicron’s Impact Is Being Underestimated

In their initial assessment of the Omicron variant, policy makers assumed that its economic impacts would, like its typical symptoms for the vaccinated, be relatively minor.

The Fed initially predicted that Omicron would exacerbate supply shortages and put more pressure on inflation over the short term, but thus far, Fed Chair Powell has said that Omicron will not have much impact on its plans.

I predicted (here) when he made that statement in December that he would regret it, and if he doesn’t already, I expect he will soon. While Omicron’s typical medical impact on the vaccinated has been minor compared to previous COVID variants, it has still caused hospitalizations to spike and is proving quite severe in the unvaccinated.

US vaccination rates and public safety measures have lagged those in Canada and most other developed countries, and that makes the country much more vulnerable to Omicron. If lockdowns are sworn off and US vaccination rates continue to lag, US hospitals may be overrun. That rising risk increases the likelihood that US economic momentum will slow and that the Fed will turn more dovish.

The approach of most Canadian provinces to Omicron has been more cautious. We have closed schools and reinstituted other lockdown restrictions to try to slow infection rates and keep our health-care system from becoming overwhelmed. That reduces our risk of health harm, but it also increases our risk of economic harm, and that, in turn, should turn the BoC more dovish.

- Inflation Will Cool More Rapidly Than the Market Expects

Our Consumer Price Index (CPI) captures price changes over the most recent twelve months.

Prices started to surge in the second half of 2021, and if inflation is going to maintain its current pace into the second half of 2022, it will take another fresh round of price spikes. This seems increasingly unlikely. Supply constraints are gradually being rectified and Omicron has already made consumers more cautious with their spending.

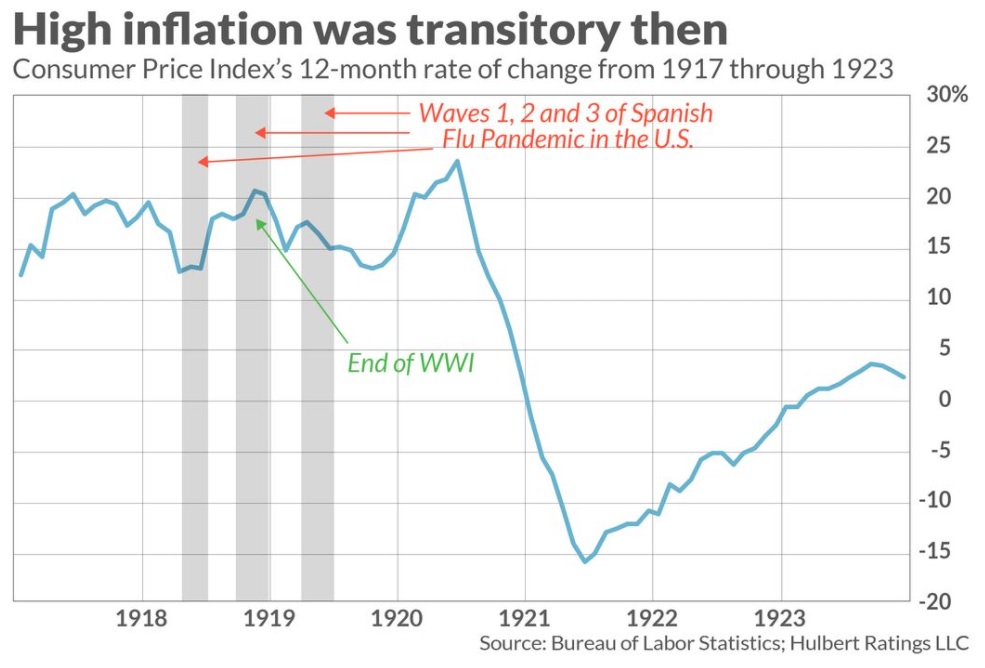

The consensus expects another demand-fueled price spike when we finally free ourselves from the pandemic’s clutches. The theory goes that consumers will spend the cash that they have built up, and that we will see a repeat of the Roaring 20s, when growth and demand surged after the Spanish flu ended.

I have already rebutted that prediction in previous posts. To summarize, the US population was much younger then, US government and household debt levels relative to GDP were miniscule compared to today, and World War I had devastated Europe’s manufacturing capacity, which made the US the world’s dominant exporter over that decade. Very different times.

But what if I’m wrong and we do see a return to the Roaring 20s? Does it follow that inflation will take off?

If past is prologue, the answer is still a firm no.

The chart below shows what happened to inflation when the Spanish Flu ended (and it went on to average less than 2% over the entire 1920s decade).

- There Will Be Much Less Stimulus in 2022

Our policy makers used record levels of fiscal stimulus to offset the pandemic’s initial economic shock.

Those stimuli created many positive short-term impacts that included elevating our GDP, increasing demand, and driving wage growth higher. But those benefits came with a cost. Both US and Canadian budget deficits have soared, driving our government debt levels still higher into the stratosphere.

In addition to being the main contributor to our economic growth in 2021, massive fiscal stimulus was also the primary driver of today’s demand-induced inflationary pressures. But that powerful stimulus has already been sharply reduced on both sides of the 49th parallel, and our governments simply cannot deploy the same largesse to offset any future shocks caused by the pandemic.

The BoC and the Fed are in the same boat as their respective federal governments. They slashed their policy rates to the floor and used quantitative easing (QE), first to flood financial markets with liquidity and then to push bond yields lower. Those moves stimulated financial markets and helped to avoid a repeat of the Great Depression, but they did so by causing asset values to soar, and thereby raising bubble risks across the economy.

Our central bankers now feel compelled to tighten monetary policy to maintain their inflation credibility and help stave off those bubble risks, but that tightening will likely exacerbate, not alleviate, the pandemic’s negative impacts over the year ahead.

If the aggressive rate cuts that have helped asset values surge higher since 2020 are reversed, asset prices would normally reverse direction as well. If that happens, the wealth effect that caused consumers to spend more last year because they were richer (on paper) would also dissipate and cause consumers to turn more cautious.

- The Impact of Rate Hikes Will Be Magnified

Caught between the devil (inflation expectations becoming unanchored) and the deep blue sea (negative economic shocks tied to the pandemic), the BoC and the Fed are reaffirming their commitments to maintain price stability above all else.

But with much less fiscal stimulus buoying economic activity (and exacerbating inflationary pressures), with Omicron’s impacts proving more substantial than first expected, and with elevated debt levels increasing the overall cost of each rate rise, the impact of each hike will be magnified.

All that makes it likely that fewer hikes will ultimately be required to bring inflationary pressures to heel.

If we see anything close to the five BoC rate hikes the consensus is betting on, I think it will prove to be a misstep that will drive our economy into recession. If that happens, rate cuts would almost certainly follow thereafter.

- Labour Costs Will Be Contained

Despite many anecdotes to the contrary, the hard data show that wages are still largely contained in both Canada and the US, even though our employment backdrops are quite different.

In the US, average wages have risen by 4.7% year over year, but they still haven’t kept pace with overall inflation. By the Fed’s own assessment, average wages were suppressed prior to the pandemic, and some of that increase is therefore a catch up. While US employers are still experiencing labour shortages, US workers are expected to return to the labour force now that emergency benefits have expired and they are burning through their built-up cash reserves.

US wages may continue to rise, but so too should the labour-force participation rate as workers start to re-engage out of necessity.

In Canada, our employment recovery has significantly outpaced our overall economic recovery. That’s good for the hiring data but seriously bad for our productivity levels. We are employing more people to do the same amount of work, and that helps explain why our average wages have only increased by 2.9% on a year-over-year basis and why they remain well below their pre-pandemic level with no signs of any imminent breakout.

Now let’s tie all the above commentary back to the key question of whether fixed or variable mortgage rates will prove cheaper in 2022 and over the next five years.

My crystal ball doesn’t come with any guarantees, but with that said, I fundamentally believe the following:

- Omicron’s greater-than-expected impact will make both the BoC and the Fed more dovish.

- Supply challenges will continue to be overcome in the year ahead, and inflation will subside more quickly than expected.

- Demand will moderate without the powerful tailwind of fiscal stimulus.

- The impact of each rate hike will be magnified, and as such, we will need fewer of them.

- Wage growth will not push inflationary pressures materially higher.

Against that backdrop, I expect that variable mortgage rates will save money over their fixed-rate alternatives over the year ahead, and, true to their usual form, are a good bet to do so over the next five years.

It won’t be as easy for variable-rate borrowers this year, because I do expect some rate hikes to ensue, but the gap of about 1.25% over the available five-year fixed rate alternatives provides a large and significant buffer that I don’t think that will close in 2022 as the consensus predicts.

Meanwhile, GoC bond yields have spiked in anticipation of five BoC rate hikes in the year ahead, with two more the year after, and I expect these rates to move lower if and as it becomes clear that the Bank’s raising schedule will be both more gradual and less severe than the consensus forecast.

The Bottom Line: US bond yields have recently surged higher in response to the release of the Fed’s minutes from its December meeting, which revealed that it may tighten more quickly than previously forecast. GoC bond yields have risen in sympathy.

That said, all the pandemic-related news since then has been worse than expected, and that should soon put an end to the current run up. In the meantime, however, the five-year GoC bond yield has recovered to near its previous high, and if it continues its current trajectory, five-year fixed mortgage rates could move higher over at least the short term.

Five-year variable rate discounts have recently widened a little, and for the reasons outlined above, I don’t expect the BoC to increase at nearly the pace bond-market investors are currently pricing in over the year ahead.