Data on those negative amortization mortgages

Queston 1: What about all these (negative amortizing) mortgages that will now take 71 years to pay off?

Answer:

Yes, they are called VRMs – Variable rate Mortgages – and we don’t really offer/sell /even talk about them for that exact reason – what if the rates rates jump? And they did.

We do offer ARMs – Adjustable Rate Mortgage – and we do recommend as of August 2023 because:

- Rates have topped and are slowly on the way down right now so the rate will go down

- The current rate starts lower than the 1, 2, 3, and 4 year fixed right now; and ARM rates should be below the 5-year fixed by Fall of 2024.

Question 2: What is the difference between VRM and ARM?

- With an ARM – adjustable rate mortgage – the amount of your payment will go up and down based on the changes of the prime lending rate

- The VRM – Variable rate mortgage – your mortgage payment amount always remains the same. It does not go up and down with changes in the prime lending rate. And when rates jump to 4x what they were when your loan started, then you are not even paying interest any more, and end up at 70 years left to pay it off.

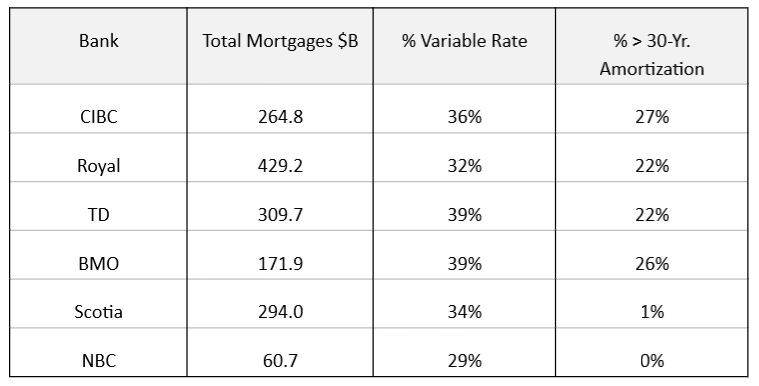

As the article below states, VRMs are mostly from BMO, CIBC, Royal Bank and TD.

ARMs – Adjustable rate mortgages – are what we offer, they can’t have a negative amortiztion and we don’t have any customers that were affected with negative loans.

Mortgage Mark Herman, best top Calgary mortgage broker

Concern over rise in negative amortization mortgages

On October 30th, the Bank also highlighted concern over negatively amortizing mortgages. Negative amortization occurs when a borrower’s monthly mortgage payment is less than the interest due on the loan and the outstanding mortgage balance grows over time rather than declining. This phenomenon is mostly associated with variable rate mortgages.

Those who bought or refinanced homes during the pandemic, when interest rates were at their lowest, heavily opted for variable rate mortgages (VRMs). In Canada, most VRMs come with fixed payments, where the interest portion is determined by the prevailing prime lending rate, while the rest is used to repay the principal. As a result, the Bank of Canada’s series of rate hikes – from 0.25% to 5% – has propelled growth in negative amortization mortgages with terms exceeding 30 years.

As of July 31, negative amortization mortgages were 24% of total mortgage portfolios (insured and uninsured) for BMO, CIBC, Royal and TD. This is equivalent to $277 billion in mortgages – up from virtually nil a year ago. National and Scotia mainly offer adjustable-rate mortgages – as rates change the mortgage payment changes to keep the amortization period fixed – so both banks have negligible exposure to negative amortization within their mortgage portfolios.

Variable Rate Exposure (as of July 31, 2023)

Source: Fitch Ratings

Canada’s banking regulator, the Office of the Superintendent of Financial Institutions (OFSI), has announced regulatory changes to address risks related to mortgages in negative amortization. Effective early next year, banks will be required to maintain a higher amount of capital, reflecting the elevated risk associated with mortgages in negative amortization when the loan-to-value ratio (LTV) surpasses 65% (i.e. when the outstanding mortgage balance is 65% or more of the value of the underlying property). The proposed changes are designed to incentivize banks to reduce the volume of mortgages that could potentially go into negative amortization.

Mortgage repayment trends

To assess how borrowers are reacting to the increase in rates, the prepayment report for floating rate 5-year mortgage-backed securities (MBS) pools, published by CMHC, serves as a valuable tool. Although it doesn’t pinpoint individual issuers, the report offers a comprehensive look at trends within the banks’ variable-rate mortgage (VRM) portfolio.

Report data indicates that borrowers with VRMs have been effectively managing impacts of rising rates by making partial principal payments or transitioning to fixed-rate mortgages. Enforcement activity, which is undertaken when a borrower is unable to make mortgage payments, has been minimal, which suggests that despite the rise in rates, defaults have remained low.

Also, the majority of non-amortizing mortgages, where payments are covering interest only, were recorded between November 2022 and February 2023. This is a positive sign that banks have taken measures to limit the growth of these mortgages.

One caution is around borrowers whose mortgage rates have exceeded the trigger point – that is, the rate at which the regular payment is no longer enough to cover the full amount of interest accrued since the last payment. These borrowers might encounter payment shock when their loans mature and are re-underwritten based on the original amortization but at higher rates and with larger principal amounts.

Those who were first-time homebuyers with high loan-to-value ratios, purchasing at or close to peak prices in 2020 or 2021, could face significant challenges during renewal, particularly if their equity position has been significantly eroded. Similar to Fitch, we anticipate that delinquency rates will not rise in 2024, remaining within the expected range of 0.2-0.25%.

Should you look at 7 and 10 year terms?

With rates on the rise, is it worth a 2nd look at longer term mortgages?

Data:

- Rates have substantially increased over the last 6 of months. We have seen 3 prime rate increases with more on the horizon.

- Fixed rate mortgages have also followed suit due to bond market instability and the increases are noticeable.

- Consumer sentiment has rapidly moved from Variables rates to longer term Fixed rates of 5, 7, and 10 years.

The long-term trend for rates is up!

The advantage of Fixed rates is that they provide clients with added security and stability against this recent storm of volatility. This storm doesn’t seem to have an end in sight either with many questions still to be answered in the coming months. When will bond rates stabilize? Will global pressures continue to drive increases? Will we see a return to historical norms? What will be the impact of recent events on the Canadian economy?

Some clients are more concerned with rate trends these days it’s with good reason. Perhaps the interim answer to all this instability and volatility is to start looking long “term”. 7 & 10 year terms to be specific.

Longer term mortgages like a 7 & 10 year term help insulate clients against potential increases in the short to long-term as well as provide safety and consistency with mortgage payments that won’t fluctuate with the markets volatility.

We don’t have to go back very far (6-7yrs) to a time when 10 year mortgages were a very popular and attractive option. During that period of time many case studies show this product didn’t work out for those borrowers who selected those 10 year terms, however there was a major difference between that period of time and today. 6-7 years ago we were in a more stable rate environment and there was very little difference between the 5 & 10 year rates at the time. Shortly after this period, rates quickly dropped to even further all-time lows.

Compare those details to our current market situation where rates have now bottomed, and it becomes quickly apparent rates have been continually rising with more sustained increases forecasted.

If security is your top key, lets talk about a 7 or 10 year mortgage option today.

Mortgage Mark Herman

Top Calgary Alberta Mortgage Broker

403-681-4376