The Bank of Canada maintains interest rate policy to end 2025

The Bank of Canada announced today that it is keeping its benchmark interest rate at 2.25%. This hold-the-line approach reflects the Bank’s expert interpretation of macroeconomic data.

We summarize the Bank’s observations and its outlook below.

Know this, fixed rates are trending up due to multiple factors, but mostly long term government debts, especially in the USA.

Now is a great time to buy while prices are soft, there are lots of listings, and rates are around the 4% mark

Mortgage Mark Herman, MBA; 1st time home buying specialist, and move-up mortgage broker

Canadian Economic Performance and Near-Term Outlook

- The Canadian economy grew by a “surprisingly” strong 2.6% in the third quarter, even as final domestic demand was flat

- The BoC notes that the increase in GDP largely reflected volatility in trade

- The Bank expects final domestic demand will grow in the fourth quarter, but with an anticipated decline in net exports, GDP will likely be “weak”

- Growth is forecast to pick up in 2026, although uncertainty remains high and large swings in trade may continue to cause quarterly volatility

Canadian Labor Market

- Canada’s labour market is showing “some signs” of improvement

- Employment has shown solid gains in the past three months and the unemployment rate declined to 6.5% in November

- Nevertheless, job markets in trade-sensitive sectors remain weak and economy-wide hiring intentions continue to be subdued

Canadian Inflation and Outlook

- Inflation measured by the Consumer Price Index (CPI) slowed to 2.2% in October, as gasoline prices fell and food prices rose more slowly

- CPI inflation has been close to the Bank’s 2% target for more than a year, while measures of core inflation remain in the range of 2.5% to 3%

- The Bank assesses that underlying inflation is still around 2.5%

- In the near term, CPI inflation is likely to be higher due to the effects of last year’s GST/HST holiday on the prices of some goods and services

- Looking through this “choppiness,” the Bank expects ongoing economic slack to roughly offset cost pressures associated with the “reconfiguration” of trade, keeping CPI inflation close to the 2% target

Global Economic Performance

- Major economies around the world continue to show resilience to US trade protectionism, but uncertainty is still high

- In the United States, economic growth is being supported by strong consumption and a surge in AI investment

- The US government shutdown caused volatility in quarterly growth and delayed the release of some key economic data

- Tariffs are causing some upward pressure on US inflation

- In the euro area, economic growth has been stronger than expected, with the services sector showing particular resilience

- In China, soft domestic demand, including more weakness in the housing market, is weighing on growth

- Global financial conditions, oil prices, and the Canadian dollar are all “roughly unchanged” since the Bank’s Monetary Policy Report in October

Outlook

The Bank offers that if inflation and economic activity evolve broadly in line with its October projection, it sees its current policy interest rate “at about the right level” to keep inflation close to 2% while helping the economy through this period of structural adjustment.

However, the Bank also says that if uncertainty remains elevated and its outlook changes, “we are prepared to respond.”

#1 Mortgage Rate SPECIAL in Canada ⚡

|

|

|

Prime to be 2% LOWER in 15 months, Dates of drops, Variable rate wins: Fall 2024

Yes, with the writing on the wall for the coming Prime rate decreases the Variable rate is the way to go.

Variable rates are based on Consumer Prime, which moves the exact same as the Bank of Canada’s “overnight rate.” The decreases in the overnight rate will be the same for Consumer Prime and they are below.

So Sept 4, 2024, Prime will go from 6.7% to 6.45%

Canadian Consumer Prime – what Variable Rates are based on – will be these rates here.

If your “discount is Prime – 0.95%” then your rate would be this number below – 0.95%. And as you can see, this is way better than the 3-year fixed at 4.84% or the 5- year fixed at 4.69% today.

- September 4, 2024: 6.45%

- October 23, 2024: 6.20%

- December 11, 2024: 5.95%

- January 2025: 5.70%

- March 2025: 5.45%

- April 2025: 5.20%

- June 2025: 4.95%

- September 2025: 4.70%

- October 2025: 4.45%

- December 2025: 4.20%

Article is here: Bank of Canada’s policy interest rate could dip to 2.75% by late 2025:

forecast:: https://dailyhive.com/vancouver/bank-of-canada-policy-interest-rate-forecast-2025-credit-1

Predictions of the article for the rate drops: Credit 1’s Bank of Canada policy interest rate forecast, as updated on August 26, 2024:

-

- September 4, 2024: 4.25%

- October 23, 2024: 4.0%

- December 11, 2024: 3.75%

- January 2025: 3.5%

- March 2025: 3.5%

- April 2025: 3.25%

- June 2025: 3.25%

- September 2025: 3.0%

- October 2025: 2.75%

- December 2025: 2.75%

Underlying Economic data on BoC holding Prime rate the same, December 5, 2023

Bank of Canada holds its policy interest rate steady, updates its outlook

Against the backdrop of a decelerating economy and growing calls for less restrictive monetary policy, the Bank of Canada made its final scheduled interest rate decision of the year today.

That decision – to keep its overnight policy interest rate at 5.00% – was broadly expected. What was not entirely expected (or welcome) was the Bank’s statement that it is “still concerned” about risks to the outlook for inflation and “remains prepared to raise” its policy rate “further” if needed.

The Bank’s observations are captured in the summary below.

Since August, we have been saying the VARIABLE RATE mortgage is the way to go, and this proves we were right on the money.

Mortgage Mark Herman, top Calgary Alberta and Victoria BC mortgage broker

Inflation facts and housing market commentary

- A slowdown in the Canadian economy is reducing inflationary pressures in a “broadening range” of goods and services prices

- Combined with a drop in gasoline prices, this contributed to easing of CPI inflation to 3.1% in October

- However, “shelter price inflation” picked up, reflecting faster growth in rent and other housing costs along with the continued contribution from elevated mortgage interest costs

- In recent months, the Bank’s preferred measures of core inflation have been around 3.5-4%, with the October data coming in towards the lower end of this range

- Wages are still rising by 4-5%

Canadian economic performance

- Economic growth “stalled through the middle quarters of 2023 with real GDP contracting at a rate of 1.1% in the third quarter, following growth of 1.4% in the second quarter

- Higher interest rates are clearly restraining spending: consumption growth in the last two quarters was close to zero, and business investment has been volatile but essentially flat over the past year

- Exports and inventory adjustment “subtracted” from GDP growth in the third quarter, while government spending and new home construction provided a boost

- The labour market continues to ease: job creation has been slower than labour force growth, job vacancies have declined further, and the unemployment rate has risen modestly

- Overall, these data and indicators for the fourth quarter suggest the economy is “no longer in excess demand”

Global economic performance and outlook

- The global economy continues to slow and inflation has eased further

- In the United States, growth has been stronger than expected, led by robust consumer spending, but is “likely to weaken in the months ahead” as past policy rate increases work their way through the economy

- Growth in the euro area has weakened and, combined with lower energy prices, has reduced inflationary pressures

- Oil prices are about $10-per-barrel lower than was assumed in the Bank’s October Monetary Policy Report

- Financial conditions have also eased, with long-term interest rates “unwinding” some of the sharp increases seen earlier in the autumn. The US dollar has weakened against most currencies, including Canada’s

Summary and Outlook

Despite (or in the Bank’s view because of) further signs that monetary policy is moderating spending and relieving price pressures, it decided to hold its policy rate at 5% and to continue to normalize its balance sheet.

The Bank also noted that it remains “concerned” about risks to the outlook for inflation and remains prepared to raise its policy rate further if needed. The Bank’s Governing Council also indicated it wants to see further and sustained easing in core inflation, and continues to focus on the balance between demand and supply in the economy, inflation expectations, wage growth, and “corporate pricing behaviour.”

Once again, the Bank repeated its mantra that it “remains resolute in its commitment to restoring price stability for Canadians.” As a result, we will have to wait until next year for any sign of rate relief.

What’s next?

The Bank’s next interest rate announcement lands on January 24, 2024.

In the meantime, please feel free to call me and discuss financing options that will empower you in this economic cycle, and the ones ahead.

Winning Variable Rate Strategy: end-2023

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Details of Canadian Economic & Housing Market Performance, as at Dec 7, 2022

Bank of Canada increased Consumer Prime to 6.45% – exactly as expected for the last 5 months. January 25th is the next BoC interest rate announcement & I hope it is a 0.25% increase and then holds there for all of 2023. We will see…

Mortgage Mark Herman, Best Calgary mortgage broker with a Master’s degree in Finance.

Today, the Bank of Canada increased its overnight benchmark interest rate 50 basis point to 4.25% from 3.75% in October. This is the 7th time this year that the Bank has addressed inflation and means the policy rate is now as high as it has been in 15 years.

We summarize the Bank’s observations below, including its forward-looking comments on the need/likelihood of future rate increases below:

Canadian inflation

- CPI inflation remained at 6.9% in October, with many of the goods and services Canadians regularly buy showing large price increases

- Measures of core inflation “remain around 5%”

- Three-month rates of change in core inflation have come down, “an early indicator that price pressures may be losing momentum”

Canadian Economic and housing market performance

- GDP growth in the third quarter was stronger than expected, and the economy continued to operate “in excess demand”

- The labor market remains “tight” with unemployment near historic lows

- While commodity exports have been strong, there is growing evidence that tighter monetary policy is restraining domestic demand: consumption moderated in the third quarter

- Housing market activity continues to decline

- Data since the October Monetary Policy Report supports the Bank’s outlook that growth will essentially stall” through the end of this year and the first half of 2023

Global inflation and economic performance

- Inflation around the world remains high and broadly based

- Global economic growth is slowing, although it is proving more resilient than was expected at the time of the Bank’s October Monetary Policy Report

- In the United States, the economy is weakening but consumption continues to be solid and the labor market remains “overheated”

- The gradual easing of global supply bottlenecks continues, although further progress could be disrupted by geopolitical events

Outlook

Although the Bank’s commentary noted that price pressures that are driving high inflation may be losing momentum, it went on to say that inflation is “still too high” and that short-term “inflation expectations remain elevated.” In the Bank’s view, the longer that Canadian consumers and businesses expect inflation to be above the Bank’s 2% target, “the greater the risk that elevated inflation becomes entrenched.”

Given these economic signals, the Bank’s Governing Council stated that it “will be considering whether the policy interest rate needs to rise further to bring supply and demand back into balance and return inflation to target.”

It concluded its statement with a familiar refrain: “We are resolute in our commitment to achieving the 2% inflation target and restoring price stability for Canadians.”

Analysts and commentators will seek to interpret those outlook comments for signs that the Bank has reached or believes it is close to reaching the terminal point in its current rate-hike cycle. For now, that remains a question of debate and speculation that will turn on future economic signals.

Next Touchpoint

January 25th is the next BoC interest rate announcement. I hope it is a 0.25% increase and then holds there for all of 2023. We will see…

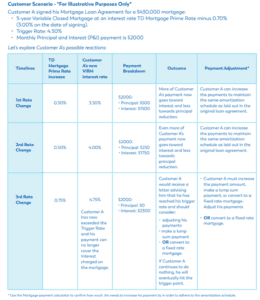

Trigger Point for Canadian Variable Rate Mortgages Explained, with Example

You have likely heard – or will soon be hearing – a lot of talk about “trigger rates” and “trigger points”. More importantly, you are probably hearing “trigger point” together along with more changes in the Bank of Canada rate and you need expert guidance.

Let’s start with a few definitions:

- Variable Rate Mortgage (VRM) – prime changes, rate changes. When interest rates change, typically, your mortgage payment will stay the same.

- Adjustable Rate Mortgage (ARM) – prime changes, rate changes. Unlike variable rate, your mortgage payment will change when interest rates change.

- Trigger Rate – When interest rates increase to the point that regular principal and interest payments no longer cover the interest charged, interest is deferred, and the principal balance (total cost) can increase until it hits the trigger point.

- Trigger Point – When the outstanding principal amount (including any deferred interest) exceeds the original principal amount. The lender will notify the customer and inform them of how much the principal amount exceeds the excess amount (Trigger Point). The client then typically has 30 days to make a lumpsum payment; increase the amount of the principal and interest payment; or convert to a fixed rate term.

NOW, WHICH MORTGAGES WILL BE AFFECTED FIRST?

Quick answer, VRMs from March 2020 to March 2022.

During the month of March 2020, the prime rate dropped three times in quick succession from 3.95% to 2.45%, and variable-rate mortgages arranged while prime was 2.45% have the lowest payments. The lower the interest rate was, the lower the trigger rate, and the faster your client may hit this negative amortization.

WHAT TO DO

When this happens, customers are contacted by the lender and generally have three ways they can proceed:

- Make a lump-sum payment against the loan amount

- Convert with a new loan at a fixed-rate term

- Increase their monthly payment amount to pay off their outstanding principal balance within their remaining original amortization period

Below is a customer scenario so you can see how this could play out.

Prime Rate Cut; Dec 4, 2019

With the latest developments the Bank of Canada (BoC) has clear path to reduce the Prime rate from 3.95 to probably 3.70%

The Bank of Canada is feeling the pressure to get back into the game with a rate reduction and one obstacle has now been removed.

The bank held its rate the same for an 8th straight meeting on October 30th.

At the same time it has clearly signaled it may not be able to hold that line much longer.

The bank pointed directly at trade conflicts (such as the U.S. – China tariff war) as the key cause of a global economic slowdown and around the world more than 35 other central banks have already cut rates in an effort to keep growth up.

The U.S. Federal Reserve has made three cuts in the past several months. That has boosted the strength of the Canadian dollar which makes the country’s exports more expensive on the world market which is unwelcome.

Great news that the Bank is not concerned that a drop in interest rates will trigger a renewed frenzy of debt-funded consumer spending. It is satisfied that the biggest component of household debt – mortgages – have been stabilized by the B-20 regulations. And another big obstruction has been removed. The federal election is over so the bank can operate without risking the appearance of political favoritism.

Fixed rates are still the way to go right now.

They are close to the all time 119-year lows right now.

Mortgage Mark Herman

A lesson from RBC’s mortgage rate increase

I love this article from the Globe as it explains why rates are going up a bit and what expectaions are for the near term.

Call for a rate hold if you are thinking of buying in the next 4 months!

“Borrowers who use a mortgage broker pay less …,” Bank of Canada.

See our reviews here: http://markherman.ca/CustomerREVIEWS.ubr

Mark Herman, Top best Calgary mortgage broker

The lesson home buyers should take from RBC’s mortgage rate hike

Variable rate mortgage – how payments will change for the new rate

We are getting many calls on this so here is how it works for MOST of the banks.

The Bank of Canada (BofC) reduced their Prime rate by 1/4 % or .25% last week to 0.75% from 1% where it has been for about 3 years.

The banks took a while to decide ifthey were going to lower their rates as well. 3 times before the banks have either not passed on the entire rate reduction to customers or not moved at all and kep the savings to themselves.

Now that most banks have lowered their rate by .15% this is how payments are impacted:

a. If they have an Adjustable Rate Mortgage – ARM mortgage – then the rate will be the new rate starting on the “effective date.”

b. The payment after the next payment will change to reflect this new rate. (So if you pay monthly on the 1st, the Feb 1st payment will be your current payment, but the March 1st Payment will be the new payment, If you pay weekly every Friday, this Friday will be the same payment but the next Friday will be the new payment)

c. Because the rate has gone down, your payment will decrease.

d. Because the interest rate has gone down, the next payment that is still at your existing payment amount will apply a little more to your principal.

e. Customer will receive a letter with their new payment amounts in the snail-mail.

Hope that clears things up a bit.

Call if you have questions.

Mark Herman, Top Calgary Alberta Mortgage Broker.