BMO & CIBC: Not on list of Top-11 banks in Canada

Wow hey??

Who would guess that 2 of Big-6 banks that millions of Canadians “think they have a financial relationship with” did not even make the list of the Top-11 banks in Canada.

It is surprising the amount of customers that call us looking to “beat their bank’s mortgage rate” when they should be looking at if they should even be doing mortgage business at their main personal bank.

Mortgage Mark Herman, Calgary Alberta new home buyer and mortgage renewal specialist of 21 years.

We recommend that they also look at the T’s & C’s – Terms and Conditions – to their own bank’s mortgages to find:

- Payout penalties that are 500% to 800% – yes, 5x to 8x the amount of payout penalties at broker banks.

- Their renewal rates are usually always at rates higher than what Broker Banks offer – because Broker Banks know the broker that placed you there will jump at the chance to move them to a different bank, for a better/ market rate, and then we get paid again. Big-6 banks don’t have to worry about that because you are usually not aware of market rates.

- SELF-employed mortgage holders are often “worked over by the Big-6 banks” whereas, Broker Banks are more than happy doing tons for self-employed business owners.

Here’s the full list of Canada’s best banks for 2025, according to Forbes:

- Tangerine

- Simplii Financial

- RBC

- PC Financial

- Vancity

- EQ Bank

- TD

- Scotiabank

- National Bank

- Desjardins

- ATB Financial

footnote: link action here https://www.narcity.com/best-banks-in-canada-forbes-2025

RBC Mortgage Payout Penalties Skyrocket in 2025

Details of the recent actions RBC has taken to INCREASE THE PAYOUT PENALTY for their own customers.It shows that Big-6 Banks are not your best -mortgage- friend. Brokers Are!Mortgage Mark Herman, Top Calgary Alberta mortgage broker

If you’re seeking a textbook case of banks giving consumers the short end of the stick, look no further.

The nation’s biggest mortgage lender, RBC, just slashed its posted rates.

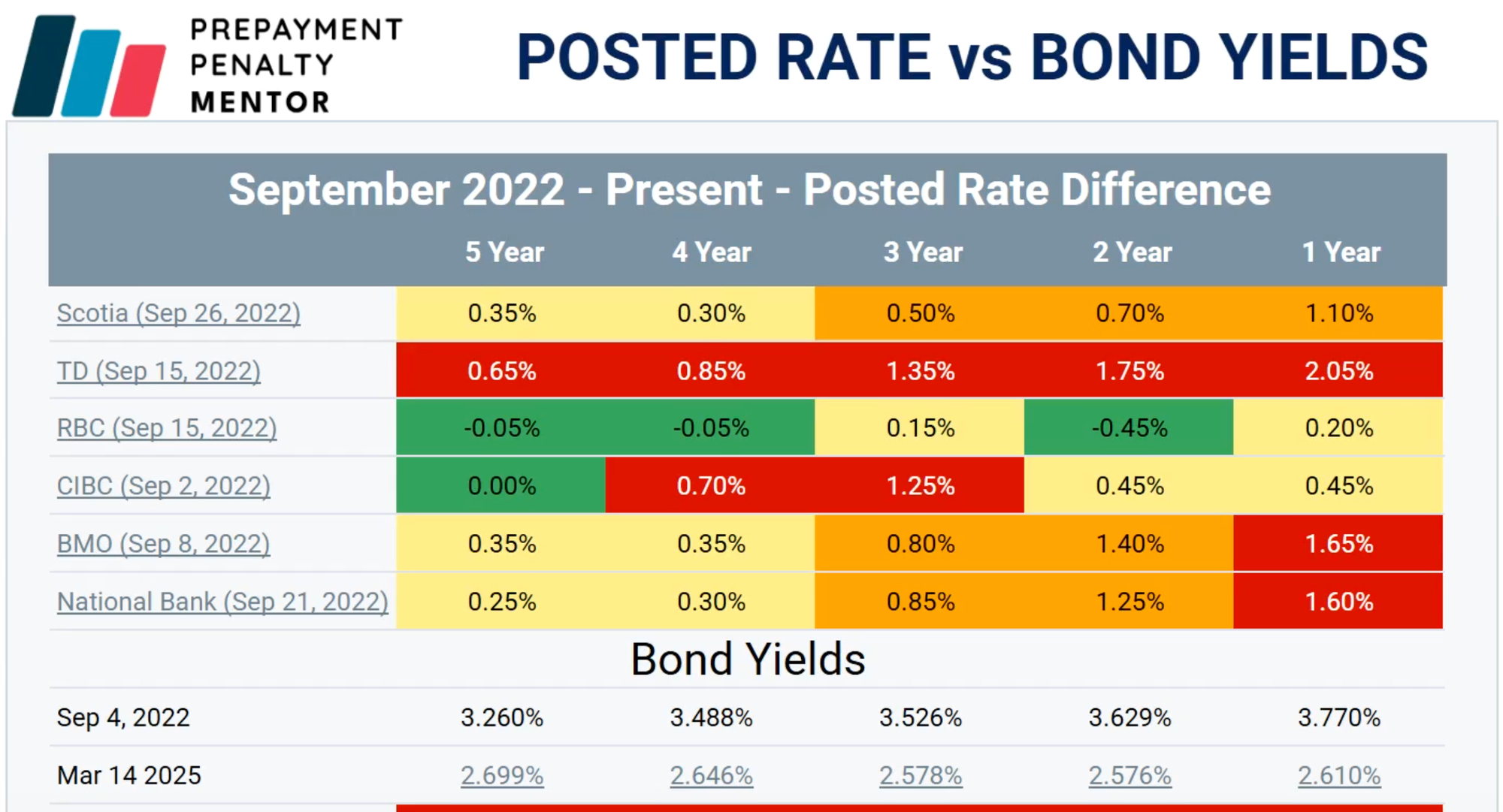

“RBC’s move is the biggest move to increase penalties (IRDs) since its posted rates peaked on September 20, 2023,” says Matt Imhoff, founder of Prepayment Penalty Mentor.

For those fluent in the dark arts of interest rate differential (IRD) charges, this spells disaster for anyone daring to escape their RBC mortgage shackles early. Here’s precisely how grim it gets…

This is what RBC did to its posted rates today (Friday):

- 5 Year: -30 bps

- 4 Year: -25 bps

- 3 Year: -35 bps

- 2 Year: -85 bps

- 1 Year: -55 bps

- 6 Month: -55 bps

Anyone attempting to break a 2, 5, 7, or 10-year RBC mortgage now is potentially in for a world of penalty hurt due to these changes.

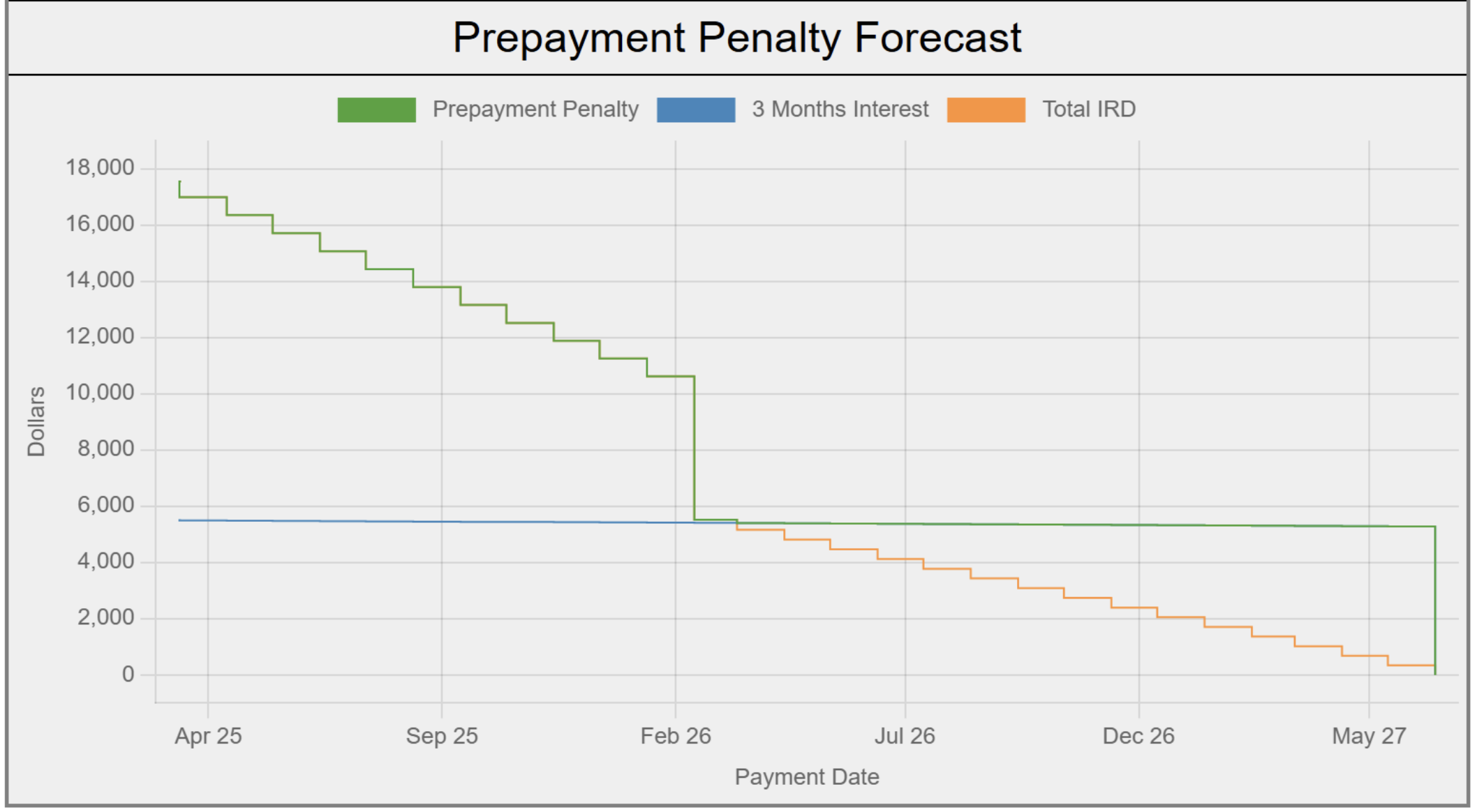

By way of example, if you’re an originator poaching a $500,000 RBC 4.4% 3-year fixed originated in July 2024, that client would be staring down a penalty of approximately $17,500, Imhoff says.

That’s up almost $10,000 in one day—simply because RBC slashed the comparison rate (its 2-year posted rate in this case).

In other words, the 255 bps “discount” from posted that this customer got in 2024 is now like a financial boomerang, coming back to hit them hard Imhoff says.

“This IRD is significantly higher than it should be, and that’s the risk of going with a bank where posted rates are elevated.”

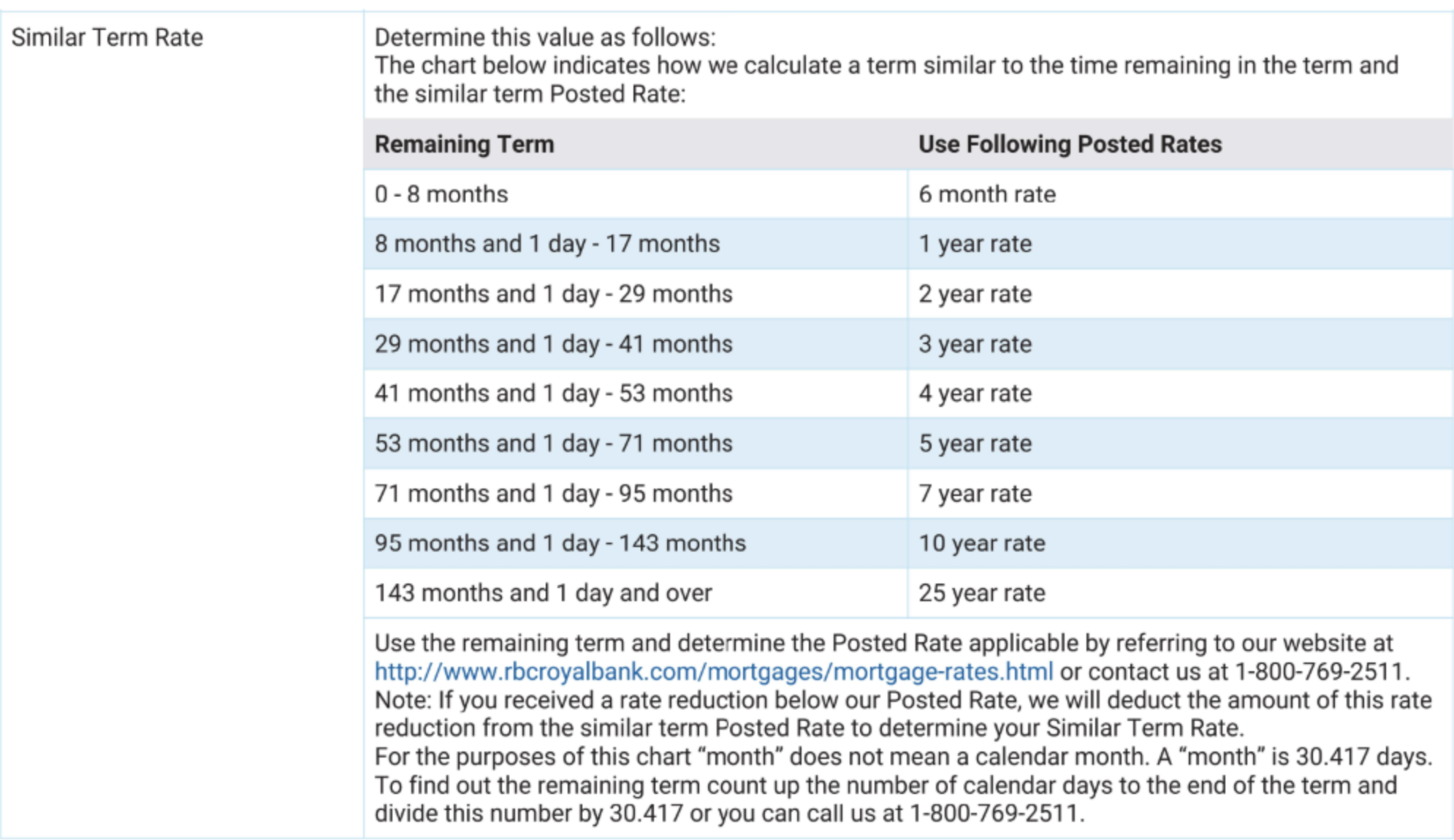

In the above example, the client’s only option to avoid more than a three-month interest penalty would be to ride out their RBC term until they have just 1.41 years remaining (per the chart below).

To virtually ensure a three-month interest penalty, a customer needs to be just eight months shy of their mortgage’s maturity, as illustrated in the RBC table below.

Watch out for TD customers

As Matt’s table below shows, TD’s posted rates are well above where they typically reside relative to bond yields. As a result, “I believe this sets the stage for what TD will inevitably do,” he says.

In cases where a client needs to refi, he adds that the risk of imminent posted rate changes at TD makes it too risky for brokers to get the deal approved elsewhere and then request discharge from TD. Time is money in this case.

“If a broker tries to get a payout order from TD today, TD can wait up to five business days,” Imhoff notes, adding that during that time, the penalty can go up.

In the event that early discharge makes clear sense, he says, “I am advising brokers to have their TD clients go to the branch, break the mortgage, pay the penalty while it is still on sale, and switch into an open.”

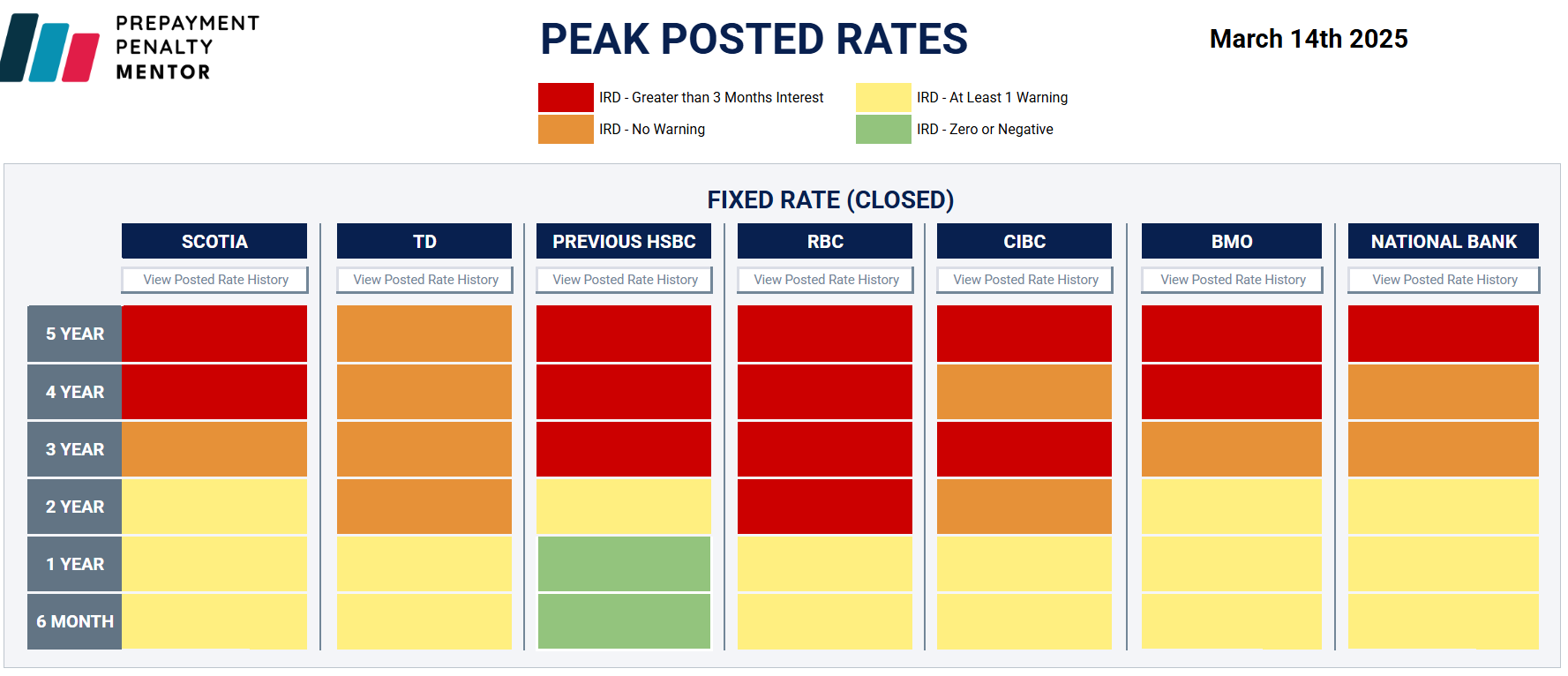

PPM has a great table (below) that also shows which terms at which banks are most prone to IRD penalties. Terms in red face IRD charges now, based on the assumptions the user enters. Terms in orange are at risk of being charged IRDs on the next posted rate drop.

It pays to know in advance when penalties make a refinance uneconomical. “There are brokers working on deals today that will never fund—all that wasted time, effort, money, just to get a payout that kills the deal.”

Bank of Canada Lowers Consumer Prime to 4.95%

The Bank of Canada lowers its benchmark interest rate to 2.75%

In the face of significant geopolitical tensions, the Bank of Canada announced today that it has lowered its policy interest rate by 25 basis points. This marks the seventh reduction since June of 2024.

Below, we summarize the Bank’s commentary.

Canadian Economic Performance and Housing

- Canada’s economy grew by 2.6% in the fourth quarter of 2024 following upwardly revised growth of 2.2% in the third quarter

- This “growth path” is stronger than was expected when the Bank last reported in January 2025

- Past cuts to interest rates have boosted economic activity, particularly consumption and housing

- However, economic growth in the first quarter of 2025 will likely slow as the intensifying trade conflict weighs on sentiment and activity

- Recent surveys suggest a sharp drop in consumer confidence and a slowdown in business spending as companies postpone or cancel investments

- The negative impact of slowing domestic demand has been partially offset by a surge in exports in advance of tariffs being imposed

- The Canadian dollar is broadly unchanged against the US dollar but weaker against other currencies

Canadian Inflation and Outlook

- Inflation remains close to the Bank’s 2% target

- The temporary suspension of the GST/HST lowered some consumer prices, but January’s Consumer Price Index was “slightly firmer” than expected at 1.9%

- Inflation is expected to increase to about 2.5% in March with the end of the tax break

- The Bank’s preferred measures of core inflation remain above 2%, mainly because of the persistence of shelter price inflation

- Short-term inflation expectations have risen in light of fears about the impact of tariffs on prices

Canadian Labour Market

- Employment growth strengthened in November through January and the unemployment rate declined to 6.6%

- In February, job growth stalled

- While past interest rate cuts have boosted demand for labour in recent months, there are warning signs that heightened trade tensions could disrupt the recovery in the jobs market

- Meanwhile, wage growth has shown signs of moderation

Global Economic Performance, Bond Yields and the Canadian Dollar

- After a period of solid growth, the US economy looks to have slowed in recent months, but US inflation remains slightly above target

- Economic growth in the euro zone was modest in late 2024

- China’s economy has posted strong gains, supported by government policies

- Equity prices have fallen and bond yields have eased on market expectations of weaker North American growth

- Oil prices have been volatile and are trading below the assumptions in the Bank’s January Monetary Policy Report

Rationale for a rate cut

While the Bank offered that economic growth came in stronger than it expected, the pervasive uncertainty created by continuously changing US tariff threats is restraining consumers’ spending intentions and businesses’ plans to hire and invest. Against this background, and with inflation close to the 2% target, the Bank decided to reduce its policy rate by 25 basis points.

Outlook

The Bank notes that the Canadian economy entered 2025 “in a solid position,” with inflation close to its 2% target and “robust” GDP growth. However, heightened trade tensions and tariffs imposed by the United States will likely slow the pace of economic activity and increase inflationary pressures in Canada. The economic outlook continues to be subject to more-than-usual uncertainty because of the rapidly evolving policy landscape.

Final comments

The Bank noted that monetary policy “cannot offset the impacts of a trade war.” What monetary policy “can and must do” is ensure that higher prices do not lead to ongoing inflation.

The Bank said it will carefully assess: i) the timing and strength of both the downward pressures on inflation from a weaker economy and ii) the upward pressures on inflation from higher costs. It will also closely monitor inflation expectations.

It ended its statement by saying it is committed to maintaining price stability for Canadians.

More scheduled BoC news

The Bank is scheduled to make its third policy interest rate decision of 2025 on April 16th.

Mortgage renewal: Now switch lenders without re-taking the stress test

Great news as a few leading banks, soon to be followed by the rest of the pack, have DITCHED THE STRESS TEST for RENEWALS.

This means if you have extra debts or a debt level higher than when you got your mortgage, some banks can now overlook that and still get you the best rates.

there is now an option if you were concerned about renewing due to higher debt loads or if your financial situatoin has changed since you bought your home.

Technically, this means most conventional switch (more than 20% down payment) customers no longer need to prove they can afford a payment based on the minimum qualifying rate (MQR). That rate is at least 2% higher (or 200 bps where 100 bps = 1.oo%) than actual rates.

This news is just out today for BOTH High ratio/ insured (meaning you bought with less than 20% down payment) AND Conventional (meaning 20% or more down payment)

Note, however, that property values for insurable borrowers must be under $1 million unless grandfathered.

To find out more please call (best) 403-681-4376 or email to reach out for more data.

This is a BIG DEAL. For renewals we always had to do the math to ensure you could change banks and many with higher debts than they bought with were not able to change banks. The banks knew this and offered them renewal rates that were way to high, but the home owners had no option. Now you do!

20 year mortgage expert, Mortgage Mark Herman

YES!

Bank of Canada lowers benchmark interest rate to 3%

The Bank of Canada opened its monetary policy playbook for 2025 with a 0.25% reduction in its overnight rate. The 6th since June of last year.

In issuing its January Monetary Policy Report, the Bank also noted that its projections are subject to “more-than-usual uncertainty” because of the rapidly evolving policy landscape, particularly the threat of trade tariffs by the new administration in the United States.

Variable rates win, but can you handle some possibly sleepless nights if Trump’s tariffs increase fixed rates as much as 3%?

(Click to see the link to the report showing this.)

If Canada does a full retaliation to Trump’s 25% tariffs our Canadian interest rates could go up by 3%; and if there is no retaliation at all, Canadian interest rates could go down by up to 3% as well!

Mortgage Mark Herman, 20+ years of mortgage experience with an MBA from a top school & Top Calgary Alberta Mortgage Broker

Below, we summarize the Bank’s commentary.

Canadian economic performance and housing

- Past interest rate reductions have started to boost the Canadian economy

- Recent strengthening in both consumption and housing activity is expected to continue

- Business investment, however, remains weak

- The outlook for exports is supported by new export capacity for oil and gas

Canadian inflation and outlook

- Inflation measured by the Consumer Price Index (CPI) remains close to 2%, with some volatility due to the temporary suspension of the GST/HST on some consumer products

- Shelter price inflation is still elevated but it is easing gradually, as expected

- A broad range of indicators, including surveys of inflation expectations and the distribution of price changes among components of the CPI, suggest that underlying inflation is close to 2%

- The Bank forecasts CPI inflation will be around the 2% target over the next two years

Canadian labour market

- Canada’s labour market remains soft, with the unemployment rate at 6.7% in December

- Job growth, however, has strengthened in recent months, after lagging growth in the labour force for more than a year

- Wage pressures, which have proven sticky, are showing some signs of easing

Global economic performance, bond yields and the Canadian dollar

- The global economy is expected to continue growing by about 3% over the next two years

- Growth in the United States has been revised upward, mainly due to stronger consumption

- Growth in the euro area is likely to be subdued as the region copes with competitiveness pressures

- In China, recent policy actions are boosting demand and supporting near-term growth, although structural challenges remain

- Since October, financial conditions have diverged across countries with bond yields rising in the US, supported by strong growth and more persistent inflation, and bond yields in Canada down slightly

- The Canadian dollar has depreciated materially against the US dollar, largely reflecting trade uncertainty and broader strength in the US currency

- Oil prices have been volatile and in recent weeks have been about $5 higher than was assumed in the Bank’s October Monetary Policy Report

Other comments

The Bank also announced its plan to complete the normalization of its balance sheet, which puts an end to quantitative tightening. The Bank said it will restart asset purchases in early March 2025, beginning gradually so that its balance sheet stabilizes and then grows modestly, in line with growth in the economy.

It also offered further rationale for today’s decisions by saying that with inflation around 2% and the economy in excess supply, the Bank’s Governing Council decided to reduce its policy rate. It also noted that cumulative reduction in the policy rate since last June is “substantial.” Lower interest rates are boosting household spending and, in the outlook it published (see below), the economy is expected to strengthen gradually and inflation to stay close to target.

Outlook

In today’s announcement, the Bank laid out its forecast for Canadian GDP growth to strengthen in 2025. However, it was quick to also point out that with slower population growth because of reduced immigration targets, both GDP and potential growth will be “more moderate” than what the Bank previously forecast in October 2024.

To put numbers on that forecast, the Bank now projects GDP will grow by 1.8% in both 2025 and 2026. As a result, excess supply in the Canadian economy is expected to be “gradually absorbed” over the Bank’s projection horizon.

Setting aside threatened US tariffs, the Bank reasons that the upside and downside risks in its outlook are “reasonably balanced.” However, it also acknowledged that a protracted trade conflict would most likely lead to weaker GDP and higher prices in Canada and test the resilience of Canada’s economy.

The Bank ended its statement with its usual refrain: it is committed to maintaining price stability for Canadians.

2025 will bring more BoC news

The Bank is scheduled to make its second policy interest rate decision of 2025 on March 12th. I will provide an executive summary immediately following that announcement.

Summary of Mortgage Rule Changes

Key Mortgage Rule Updates

30-year amortization for insured mortgages

Starting December 15, 2024, 30-year amortizations will be available for insured mortgages. This option is open to first-time homebuyers and those purchasing newly built homes, including condos.

Higher insured mortgage limits

Applications for insured mortgages will now be accepted for properties valued under $1.5 million, giving more buyers access to high-value homes with lower down payment requirements.

Stress test simplification

In line with OSFI’s guidance, current stress test requirements will continue for insurable, uninsurable, and uninsured applications. Eligible insured transfers and switches will remain qualified at the contract rate.

How these changes benefit you

✔️ Reduced monthly payments

Extending amortizations to 30 years will lower monthly payments, helping clients manage affordability amidst rising living costs and fluctuating interest rates.

It usually works out to reduce your payment by 9% or lets yo buy 9% more home (increases the mortgage amount but about 9%.)

✔️ Expanded opportunities for buyers

Higher insured mortgage limits make it possible for more Canadians to purchase homes in competitive urban markets like Toronto and Vancouver for up to $1,500,000 with 5% down on the 1st 500k and 10% down payment on the balance.

This set of mortgage rule changes should make it easier for buyers to get into a home now.

More importantly, it lets buyers purchase up to $1.5M with $125k down, where before they would have topped out at $1m with $75k down payment.

- Mortgage Mark Herman, top best Calgary mortgage broker,

- 403,681-4376

New Housing Rules for 1st First-Time Buyers and New Builds

If you’re a first-time home buyer or looking to purchase a new build, this affects you.

Here’s a quick summary of the changes coming in December 2024:

What’s New?

30-Year Amortizations Now Available for First-Time Buyers and New Build Purchases

- First-time home buyers can now access 30-year amortizations for insured mortgages.

- This increases the amount you qualify for by about 9% or lowers your monthly payment about the same.

- 30-Year Amortization for New Builds – Technically, this took effect on August 1, 2024, and is available to everyone, not just First-Time Homebuyers.

Price Cap Increase for Insured Mortgages

- The price cap (purchase price) for insured mortgages has been raised from $999,999 to $1,499,999 million.

- EG: if you were to purchase a home today priced at $1.1 million, your minimum down payment to qualify for a mortgage would be 20% or $220,000. After December 15th, the minimum down payment required decreases to $85,000.

- If that $1.1 million dollar home also has a self contained suite, you can use the rent or “potential” rent that suite will generate to help qualify for a bit more of a mortgage too.

The Fine Print

Down payment – Great news, minimum requirements stay the same:

- 5% on the portion up to $500,000

- 10% on the portion between $500,000 and $1.5 million

* Previously, the down payment on a $1.5 million home for a First-Time Home buyer was $300,000.

FTHB’s can now get into that same home with $125,000.

This will undoubtedly take some pressure off the Bank of Mom and Dad.

Effective Date

These changes will apply to mortgage insurance applications submitted on or after December 15, 2024. The key word here is ‘submitted.’ Your offer will need to be timed just right if you wish to take advantage of the new 30-year amortization.

Potential Impacts on the Housing Market:

We are in an interesting position right now. On one hand, lenders are competing for new business in what could be described as a ‘rate war.’

Additionally, with First-Time Home Buyers (FTHB) set to qualify for 30-year amortizations after December 15th, we can expect an uptick in demand.

Historically, higher demand leads to higher prices and rate decreases cause an equal and opposite increase in home prices.

Buy or Sell – Now or Later?

While there’s no crystal ball, consider these possibilities:

- Buy Now: Prices are expected to rise once the new rules take effect, so purchasing before December could mean less competition and potentially lower prices.

- Sell Later: If your home is priced between $1 million and $1.5 million, waiting until after December 15th could attract more qualified buyers and possibly higher offers.

More details will emerge as lenders and insurers prepare to offer the new 30-year amortization, such as how lenders will view the minimum down payment.

If you want to discuss how these changes might impact your plans to buy or sell, feel free to reach out!

New Canadian Mortgage Rules; Sept 2024

Great news from Ottawa today on the new rules for Canadian mortgages:

- An Increase to the Insured Mortgage Price Cap: The government will raise the price cap from $1 million to $1.5 million, reflecting the realities of today’s housing market. This change, effective December 15, 2024, will help more Canadians qualify for insured mortgages and make homeownership more attainable, especially for younger Canadians.

- Expanded Eligibility for 30-Year Amortizations: First-time homebuyers and all buyers of new builds will now be eligible for 30-year insured mortgage amortizations. This is a crucial step in reducing monthly mortgage payments and helping more Canadians, particularly Millennials and Gen Z, achieve the dream of owning a home.

- Increased Mortgage Competition: The strengthened Canadian Mortgage Charter now enables insured mortgage holders to switch lenders at renewal without being subject to another stress test. This will foster greater competition and ensure Canadians have access to the best mortgage deals.

All 3 of these changes will help New Buyers / 1st Time Buyers afford to get into a home of their own.

Most of our First Time Buyers need gifts or co-signing from parents to be able to buy. The 30 year amortization and increase of CMHC insurance will totally help.

Mortgage Mark Herman, Best top Calgary Alberta mortgage broker specializing in 1st time buyers for 20 years.

Typical income documentation requirements – Canadian mortgage

Below are the typical income documentation requirements for each type of income.

-

Salaried employees & commission income

Salaried

Salaried and hourly employees may need to supply:

- A job letter and a recent pay stub to show consistent salary

If your hours aren’t guaranteed or if there is a lot of overtime, you may also be asked for a 2-year income history.

Commissioned

Commissioned salespeople typically need the same documents as a salaried employee except they may also need to provide:

- 2 years of T1 Generals with corresponding NOA’s – Notice of Assessments to establish a 2-year income average.

-

Self-employed: Incorporated & Sole Proprietor

Incorporated

Self-employed clients who are incorporated and can provide traditional income verification may need to supply:

- Most current T1 General including statements of business activities. To establish a stable income, but also so a lender can see your sources of income.

- Confirmation of no taxes owed

- Accountant prepared company financials supported by business bank statements. To establish your company is in good financial standing and to compare the income level being pulled out of the company is sustainable.

- Current corporate search to confirm business ownership.

Sole Proprietor

Self-employed clients who are sole proprietors and can provide traditional income verification may need to supply:

- Most current T1 General including statements of business activities. To establish a stable income, and so a lender can see their sources of income.

- Confirmation no taxes owed

- One of the following: Business license/registration, trade license, or GST registrations/returns to prove business ownership/partnership

Alternative provable income & other documentation

Alternative provable income verification

This is a proprietary, specialized approach using gross-ups and add-backs available.

Alternative verification of income can be provided via the following documents:

Sole proprietor/partnership

- Most current T1 General

- Confirmation no taxes owed

- Recent financial statements or statement of business activities to indicate a level of income

- One of the following: business license/registration, trade license, or GST registrations/returns to prove business ownership/partnership

Incorporated or limited company

- Most current accountant prepared financials or corporate T2s

- Most current T1 General and confirmation no taxes owed

- Corporate search/articles of incorporation – for business ownership

- Six months of bank statements

Gross-ups and add-backs approach is considered in this instance.

Other documentation

There are other income sources that can help your client’s application get approved.

-

-

- Canada Child Benefit (CCB)

- Alimony/child support

- Government and/or private pension

- Rental property income

- EI benefit for maternity leave

-

Buying a Rental property — this is the income documentation needed.

You can verify rental income via the following:

- Full T1 Generals showing net rental income

- If not reported in T1 General, market rent from an approved appraiser

Verified Income

- A job letter and recent paystub. If the client’s hours aren’t guaranteed, underwriter may also ask for a 2-year income history.

Alternative Proveable Income

Proprietary, specialized approach using gross-ups and add-backs.

Sole Proprieter

- Most current T1 General

- Confirmation no taxes owed

- Recent financial statements or statement of business activities supported by business bank statements

- One of the following: business license/registration, trade license or GST registration/returns

Incorporated or limited company

- Most current accountant prepared financials or corporate T2s

- Most current T1 Generals and confirmation no taxes owed

- Corporate search/articles of incorporation

- Six months bank statements

Prime to be 2% LOWER in 15 months, Dates of drops, Variable rate wins: Fall 2024

Yes, with the writing on the wall for the coming Prime rate decreases the Variable rate is the way to go.

Variable rates are based on Consumer Prime, which moves the exact same as the Bank of Canada’s “overnight rate.” The decreases in the overnight rate will be the same for Consumer Prime and they are below.

So Sept 4, 2024, Prime will go from 6.7% to 6.45%

Canadian Consumer Prime – what Variable Rates are based on – will be these rates here.

If your “discount is Prime – 0.95%” then your rate would be this number below – 0.95%. And as you can see, this is way better than the 3-year fixed at 4.84% or the 5- year fixed at 4.69% today.

- September 4, 2024: 6.45%

- October 23, 2024: 6.20%

- December 11, 2024: 5.95%

- January 2025: 5.70%

- March 2025: 5.45%

- April 2025: 5.20%

- June 2025: 4.95%

- September 2025: 4.70%

- October 2025: 4.45%

- December 2025: 4.20%

Article is here: Bank of Canada’s policy interest rate could dip to 2.75% by late 2025:

forecast:: https://dailyhive.com/vancouver/bank-of-canada-policy-interest-rate-forecast-2025-credit-1

Predictions of the article for the rate drops: Credit 1’s Bank of Canada policy interest rate forecast, as updated on August 26, 2024:

-

- September 4, 2024: 4.25%

- October 23, 2024: 4.0%

- December 11, 2024: 3.75%

- January 2025: 3.5%

- March 2025: 3.5%

- April 2025: 3.25%

- June 2025: 3.25%

- September 2025: 3.0%

- October 2025: 2.75%

- December 2025: 2.75%