Canadian Prime Rate Drops to 4.5%

Horray – the rates are dropping.

We expect to see a total of 2 MORE rate reductions of 0.25% each in 2024.

5 x o.25% reductions are expected in 2025 making the variable the better way to go right now.

Mortgage Mark Herman

DATA

Encouraged by underling trends in the Canadian economy, the Bank of Canada today cut its overnight policy interest rate by 0.25% to 4.50%.

This is the second incremental reduction we’ve seen in as many months and while both cuts have been modest, they are moving Canada toward less restrictive monetary policy.

We summarize the Bank’s rationale for this decision by summarizing its observations below, including its forward-looking comments for signs of what may happen next.

Canadian inflation including shelter inflation

- Inflation measured by the Consumer Price Index moderated to 2.7% in June after increasing in May

- Broad inflationary pressures are easing, and the Bank’s preferred measures of core inflation have been below 3% for several months and the breadth of price increases across components of the CPI is now near its historical norm

- Shelter price inflation remains high, driven by rent and mortgage interest costs, and is still the biggest contributor to total inflation

- Inflation is also elevated in services that are closely affected by wages, such as restaurants and personal care

Canadian economic performance and outlook

- Economic growth “likely” picked up to about 1.5% through the first half of 2024, however, with robust population growth of about 3%, the economy’s potential output is still growing faster than GDP, which means excess supply has increased

- Household spending, including both consumer purchases and housing, has been “weak”

- There are signs of slack in the labour market with the unemployment rate rising to 6.4% and with employment continuing to grow more slowly than the labour force and job seekers taking longer to find work

- Wage growth is showing some signs of moderating, but remains elevated

- GDP growth is forecast to increase in the second half of 2024 and through 2025, reflecting stronger exports and a recovery in household spending and business investment as borrowing costs ease

- Residential investment is expected to grow robustly

- With new government limits on admissions of non-permanent residents, population growth should slow in 2025

Global economic performance and outlook

- The global economy is expected to continue expanding at an annual rate of about 3% through 2026

- While inflation is still above central bank targets in most advanced economies, it is forecast to ease gradually

- In the United States, an anticipated economic slowdown is materializing, with consumption growth moderating and US inflation appearing to resume its downward path

- In the euro area, growth is picking up following a weak 2023

- China’s economy is growing modestly, with weak domestic demand partially offset by strong exports

- Global financial conditions have eased, with lower bond yields, buoyant equity prices, and robust corporate debt issuances

- The Canadian dollar has been relatively stable and oil prices are around the levels assumed in the Bank’s April’s Monetary Policy Report

Summary comments and outlook

The Bank forecasts that Canadian GDP will grow at 1.2% in 2024, 2.1% in 2025, and 2.4% in 2026 and that a strengthening economy will gradually absorb excess supply through 2025 and into 2026.

As a result of an easing in broad price pressures, the Bank expects inflation to move closer to 2%, its long-stated goal. As a result, the Bank’s Governing Council decided to reduce the policy interest rate by 25 basis points.

It further noted that while ongoing excess supply is lowering inflationary pressures, price pressures in some important parts of the economy—notably shelter and some other services—are “holding inflation up.”

Accordingly, the Bank said it is carefully assessing these “opposing forces.” Monetary policy decisions therefore will be guided by incoming information and the Bank’s assessment of the implications for the inflation outlook.

Once again, the statement noted in conclusion that the Bank remains “resolute in its commitment to restoring price stability for Canadians.”

Next Up

The Bank returns on September 4th with its next monetary policy announcement.

Prime now 6.95% from 7.20%: BoC reduces its benchmark interest rate to 4.75%

Today, the Bank of Canada reduced its overnight policy interest rate by 0.25% to 4.75%. This welcome and widely expected decision comes on the heels of evidence pointing to a deceleration of the rate of inflation.

SUMMARY:

The “overnight rate” being quoted is the rate that Banks borrow from each other at, not consumer Prime, which is confusing.

Canadian Consumer Prime has just been reduced from 7.20% to 6.95% – this only affects Variable Rate mortgages.

Fixed rates remain unchanged because they track the Canadian Mortgage Bond Rates which are different, and similar.

There has also been about 40 “silent” fixed rate reductions of o.o5% each in 2024 that the press did not cover.

Mortgage Mark Herman, Top best Calgary Alberta mortgage broker specializing in 1st time buyers

Below we examine the Bank’s rationale for this move by summarizing its observations below, including its all-important outlook comments that are sure to shape market expectations for the remainder of the year.

Canadian inflation

- Inflation measured by the Consumer Price Index (CPI) eased further in April to 2.7%

- The Bank’s preferred measures of core inflation also slowed and three-month indicators suggest continued downward momentum

- Indicators of the breadth of price increases across components of the CPI have moved down further and are near their historical average, however, shelter price inflation remains high

Canadian economic performance and housing

- Economic growth resumed in the first quarter of 2024 after stalling in the second half of last year

- At 1.7%, first-quarter GDP growth was slower than the Bank previously forecast with weaker inventory investment dampening activity

- Consumption growth was solid at about 3%, and business investment and housing activity also increased

- Labour market data show Canadian businesses continue to hire, although employment has been growing at a slower pace than the working-age population

- Wage pressures remain but look to be moderating gradually

- Overall, recent data suggest the economy is still operating in excess supply

Global economic performance and bond yields

- The global economy grew by about 3% in the first quarter of 2024, broadly in line with the Bank’s April Monetary Policy Report projection

- The U.S. economy expanded more slowly than was expected, as weakness in exports and inventories weighed on activity

- In the euro area, activity picked up in the first quarter of 2024 while China’s economy was also stronger in the first quarter, buoyed by exports and industrial production, although domestic demand remained weak

- Inflation in most advanced economies continues to ease, although progress towards price stability is “bumpy” and is proceeding at different speeds across regions

- Oil prices have averaged close to the Bank’s assumptions, and financial conditions are little changed since April

Summary comments and outlook

The Bank cited continued evidence that underlying inflation is easing for its decision to change its policy interest rate. More specifically, it said that “monetary policy no longer needs to be as restrictive.”

Also welcome was the Bank’s statement that “recent data” have “increased our confidence that inflation will continue to move towards” its 2% target.

However, it also added this to its outlook: “Nonetheless, risks to the inflation outlook remain. Governing Council is closely watching the evolution of core inflation and remains particularly focused on the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behaviour.”

And has it has been doing for some time, it said the Bank “remains resolute in its commitment to restoring price stability for Canadians.”

Next up

The Bank returns on July 24th with its next monetary policy announcement – I think they will do another 0.25% reduction at the next meeting and they will continue to reduce at every meeting for the next 3 meetings this year.

GIFTed down Payment now possible for New-to-Canada home buyers!!

For New to Canada buyers – Expanded “GIFT-ing” is now possible for close family members!

That’s right! As of now, May 23, 2024, buyers who are New to Canada – in Canada for less than 2 years – ARE now allowed to use /receive GIFTS for down payment from “close family members.”

This is a big deal because it now includes; aunts, uncles, nephews, and cousins; all were not allowed to provide a “GIFT for down payment” before.

The standard used to be only: mother, father, brother, sister, grandparent and legal guardian; and that was it.

From our data that we have on on our own customers, this will help about 20% of our New to Canada files to buy a home, where they would have been shut out before.

Mortgage Mark Herman, top best fantastic Calgary Alberta mortgage broker, specializing in First Time Buyers.

We view that the Expanded Gift-er Options ARE needed due to the average new home price being 500k+, it is super tough for newcomers to save enough to buy a home. GIFTS are relied on all the time by 1st time home buyers.

Current Risks to the Canadian Mortgage Market? May 15th, 2024

Summary:

May 21, 2024 is when the inflation a report comes out and it should be the determining factor if the Canadian PRIME RATE of INTEREST is reduced from 7.2% in June or not. Maybe July. Maybe later.

Nobody is buying anything big right now, which is the idea … to reduce inflation.

Which means now is the best time to buy a home before everyone waiting for rates to drop jumps in on the 1st Prime rate reduction.

Says Mortgage Mark Herman, Calgary Alberta best/ top/ mortgage broker for first time home buyers

DATA:

Mortgage holders have been anxiously waiting for the Bank of Canada to cut interest rates. The increase of 90,400 jobs in April – 5 times what analysts expected – has heightened concerns that the Bank will continue to wait before lowering rates. 🙁

While the economy has not slowed as much as expected, there’s growing economic slack, with the jobless rate up 1 percentage point over the past year and a 24% year-over-year increase in the number of unemployed individuals, which is slowing down wage growth. The crucial factor in determining whether a rate cut will occur in June or be postponed to later this year hinges on the April CPI release scheduled for May 21st.

In the background of these deliberations, the Bank of Canada also assesses various potential risks to the economy. Last week, the Bank released its Financial Stability Report, highlighting two key risks: debt serviceability and asset valuations.

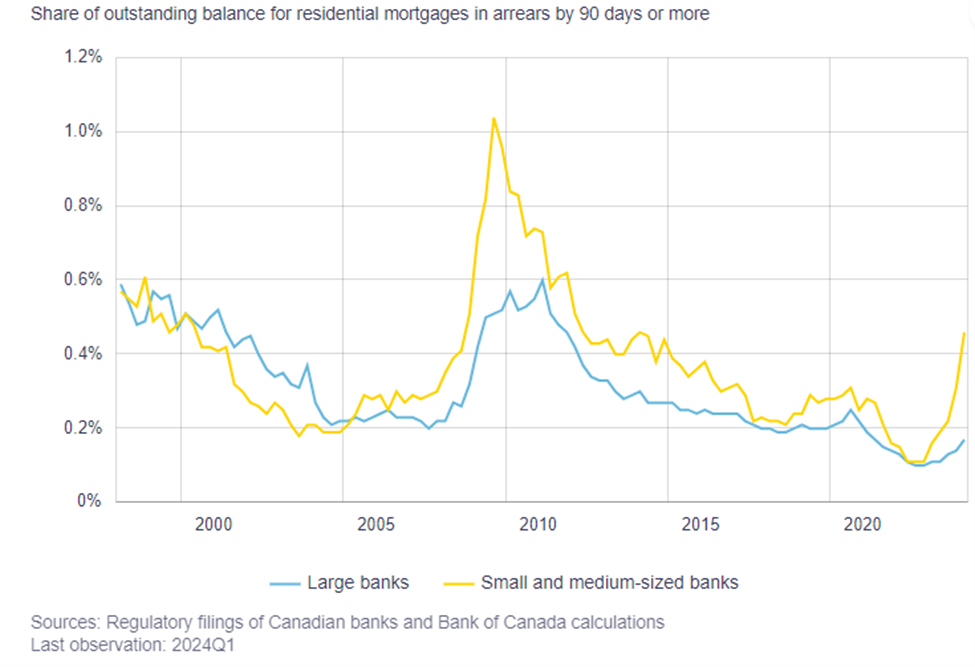

The report notes that the share of mortgage holders who are behind on their credit cards and auto loan payments, which had hit historic lows during the pandemic, has now returned to more normal levels. It also notes that smaller mortgage lenders are seeing an uptick in credit arrears. This increase isn’t surprising, given the run up in rates and the market segment that these lenders cater to. While the arrears rate is up, it remains relatively low compared to historical levels.

This overall positive portfolio performance is due to two key factors: 1) financial flexibility and 2) employment.

Canadian mortgage defaults tend to spike up during periods of rising unemployment. While the unemployment rate has risen, it remains relatively low. Additionally, mortgagors are holding higher levels of liquid assets. Before the pandemic, homeowners with a mortgage held 1.2 months of liquid reserves, which increased to 2.2 months during the pandemic and has since fallen to 1.8 months. These increased reserves provide a solid buffer for mortgagors to meet unexpected increases in expenses.

The Bank remains concerned that nearly half of all outstanding mortgages have yet to be renewed, leaving these borrowers at risk of payment shock due to the increase in interest rates. Scotiabank is an interesting case because, unlike other banks, it offers adjustable-rate mortgages (ARM) with variable payments instead of variable rate mortgages with fixed payments. Scotia has seen its 90+ days past due rate increase from 0.09% to 0.16%. During their fourth-quarter earnings call, Scotia noted that ARM borrowers have been cutting back on discretionary spending by 11% year-over-year, compared to a 5% reduction among fixed-rate clients.

The mortgage maturity profile in the Financial Stability Report suggests that we could see significant slowing in consumer discretionary spending over the next two years. While the rise in debt-servicing costs will be partially offset by income growth, we should expect to see belt tightening by mortgage holders. This poses less of a risk to the banking sector mortgage market than to the overall outlook for the economy.

Divorce & Mortgage Buy-Out Details, Canada, May 2024

Important data for separating / divorcing partners, this may help with “Buying the ex-spouse out” of a divorce, when some debts need to be rolled in.

The way most lawyers and Big-6 banks do it:

as a refinance, max loan is 80% of the appraised value of the home,

and you get refi rates – the highest – today:

- 3 year fixed 5.76%, 5 year fixed 5.59%

and usually NO debts can be rolled into the mortgage past that 80% of the home value.

with OUR WAY/ Broker way…

we do it as “a purchase after marital breakdown” which allows

max loan of 95% LTV (of the home value) – which usually makes ALL THE DIFFERENCE in a buyout situation.

- BEST RATES again: 3 year fixed 5.39%, 5 year fixed 4.99%

and usually Most/ All/ some debts can be rolled into the mortgage – at no extra cost, depending on your lending ratios.

Data from a similar file –

As long as the deal IS insurable (meaning it conforms to CMHC rules and guidelines) to get that lower rate – actually 0.6% LOWER as of today – then we need an offer to purchase too. Most lawyers do not want also write an “offer to purchase,”

If the Big-6 bank is doing it as a conventional refinance then an offer to purchase is not needed.

Banks don’t have substantially different rates for insurable and conventional like we do. (o.4 to o.9% rate difference makes a huge difference.)

So yes, we can get a separation done without an Offer to Purchase as long as at least 20% of the value stays in the home and we use refinance rates at 0.6% higher than broker best rates today.

Considering customers will leave us for 0.05% and this is 0.6% – that is >10x multiple of what customers consider “worth leaving us for” this is an important way to get divorce deals to work better for everyone.

Mortgage Mark Herman, top/ best Calgary Alberta Mortgage Broker

Bank of Canada Leaves Prime the Same, April 2024

As Expected, No change in Bank of Canada benchmark interest rate for April 2024.

As noted in August 2023, the 1st Prime Rate reduction is expected in July and then Prime should come down at o.25% every 90 days so … 1 quarter percent reduction, every calandar quarter, for the next 2 years.

Mortgage Mark Herman, best top Calgary Alberta mortgage broker.

Today, the Bank of Canada announced it is keeping its benchmark interest rate at 5.0%, unchanged from July of 2023. However, much has changed in the economy and in the world since then. For evidence, we parsed today’s announcement and present a summary of the Bank’s key observations below.

Canadian Inflation

- CPI inflation slowed to 2.8% in February, with easing in price pressures becoming more broad-based across goods and services. However, shelter price inflation is still very elevated, driven by growth in rent and mortgage interest costs

- Core measures of inflation, which had been running around 3.5%, slowed to just over 3% in February, and 3-month annualized rates are suggesting downward momentum

- The Bank expects CPI inflation to be close to 3% during the first half of 2024, move below 2.5% in the second half, and reach the 2% inflation target in 2025

Canadian Economic Performance and Housing

- Economic growth stalled in the second half of last year and the economy moved into excess supply

- A broad range of indicators suggest that labour market conditions continue to ease. Employment has been growing more slowly than the working-age population and the unemployment rate has risen gradually, reaching 6.1% in March. There are some recent signs that wage pressures are moderating

- Economic growth is forecast to pick up in 2024. This largely reflects both strong population growth and a recovery in spending by households

- Residential investment is strengthening, responding to continued robust demand for housing

- The contribution to growth from spending by governments has also increased. Business investment is projected to recover gradually after considerable weakness in the second half of last year. The Bank expects exports to continue to grow solidly through 2024

- Overall, the Bank forecasts GDP growth of 1.5% in 2024, 2.2% in 2025, and 1.9% in 2026. The strengthening economy will gradually absorb excess supply through 2025 and into 2026

Global Economic Performance and Bond Yields

- The Bank expects the global economy to continue growing at a rate of about 3%, with inflation in most advanced economies easing gradually

- The US economy has “again proven stronger than anticipated, buoyed by resilient consumption and robust business and government spending.” US GDP growth is expected to slow in the second half of this year, but remain stronger than forecast in January

- The euro area is projected to gradually recover from current weak growth. Global oil prices have moved up, averaging about $5 higher than the Bank assumed in its January Monetary Policy Report

- Since January, bond yields have increased but, with narrower corporate credit spreads and sharply higher equity markets, overall financial conditions have eased

- The Bank has revised up its forecast for global GDP growth to 2.75% in 2024 and about 3% in 2025 and 2026

- Inflation continues to slow across most advanced economies, although progress will likely be bumpy. Inflation rates are projected to reach central bank targets in 2025

Outlook

Based on the outlook, Governing Council said it decided to hold the Bank’s policy rate at 5% and to continue to “normalize” the Bank’s balance sheet. It also noted that while inflation is still too high and risks remain, CPI and core inflation have eased further in recent months.

The Council said it will be looking for evidence that this downward momentum is sustained. Governing Council is particularly watching the “evolution of core inflation,” and continues to focus on the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behaviour.

As it has said consistently over the past year, the Bank will remain “resolute in its commitment to restoring price stability for Canadians.”

Next Touchpoint

On June 5th, 2024, the Bank returns with another monetary policy announcement and economists are already lining up with predictions of a rate cut either then or in July.

Net Migration to Alberta – #’s here.

the CORE reason home prices in Calgary will be going up for the next 4 years, and are 100% supported and will not be coming down is summed up in this article right here.

https://www.cbc.ca/news/canada/calgary/alberta-population-records-2023-to-2024-data-1.7157110

Summary of the Main Reasons Home Prices are Supported:

- BC and Ontario home prices are DOUBLE Calgary home prices

- 4 million New Canadians on the way here in the next 5 years.

- We hatched the largest 20 – 29 year old population Canada has EVER had, and they are moving out of their parent’s basements and buying their own homes.

- Alberta does NOT have PST

- Alberta does not have a 1% “welcome to the neighborhood tax” when buying property.

After researching the above data points we can confidently say all 5 of these stacked factors will cause home prices to increase is all price ranges for the next few years.

Mortgage Mark Herman, licensed as a top Alberta Mortgage Broker for 21 years and 1 year in BC

Why Buy Your Home Today: Data Points, Alberta, Winter, 2024

|

Acceptable Sources of Down Payment for a home Canada, 2024

This seems to be the topic of this week … what can I use for down payment on my home?

All banks DO ACCEPT these approved methods to gather down payment for a home.

Acceptable Sources of Down Payment:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ineligible Sources of Down Payment

|

|

|

|

|

|

|

|

The new Tax-Free First Home Savings Account (FHSA) and the

FTHBI – First Time Home Buyer Incentive were the government matches your down payment up to 5% ARE both great ideas!

Mortgage Mark Herman, top Calgary Alberta Mortgage Broker since 2004!

Using Business Income / Corporate Income to Qualify for a Mortgage in Canada, 2024

Are you self- employed and thinking about, or hopping to use your own business income or corporate income to help you qualify for a mortgage?

It is possible, but not very common, as it usually does not help as much as we hope it would.

Mortgage Mark Herman, best Calgary Alberta mortgage broker for self-employed buyers

For RESIDENTIAL Purposes:

Very few lenders (like 3 out of 40+) will consider using business income that is not on personal taxes.

- When they will allow the business income added in, they only use between 40-60% of the net business income after dividends paid.

- They wouldn’t allow the operating company to actually be on mortgage/title;

- it would be in personal name or

- Hold Co name (with full personal guarantee, for the full mortgage amount – with full recourse. Meaning they can/ do/ will sue you into bankruptcy if they need to foreclose.)

Docs Needed

They do need to review more data than usual if trying to use business financials. I addition to the regular documents needed (2 years of T1 Generals, and NOAs and T4’s if there is T4 income), add in these docs:

For the Business:

- 2 years of professional accountant prepared financial statements

- including a signed ‘Notice to Reader’ and

- Need a compilation of all billing engagements for the fiscal periods

Catch – there are always a few:

If the property in question has a large shop – it is usually not allowed in determining the value so a higher mortgage amount is usually required.

They also have a hard time if there is any income to be derived from the property.

Acreage Details

Max land is limited to 4, 8, or 10 acres – depending on lender

- Only the home, de/attached garage and 4 acres are used for valuation by lender.

- NO value is attributed to: out-buildings, sheds, riding rings, stables, storage, nor fences

- Many of which could be valued at 200k+, like fences and buildings.