Data on July 1, 2022 Prime Increase to 3.7%

Today, the Bank of Canada showed once again that it is seriously concerned about inflation by raising its overnight benchmark rate to 1.50% – making Consumer Prime 3.70%

This latest 50 basis point increase follows a similar-sized move in April and is considered the fastest rate hike cycle in over two decades.

Everyone STAY COOL!

Says Mortgage Mark Herman, top Calgary Alberta Mortgage Broker.

With it, the Bank brings its policy rate closer to its pre-pandemic level.

In rationalizing its 3rd increase of 2022, the Bank cited several factors, most especially that “the risk of elevated inflation becoming entrenched has risen.” As a result, the BoC will use its monetary policy tools to return inflation to target and keep inflation expectations well anchored.

These are the highlights of today’s announcement.

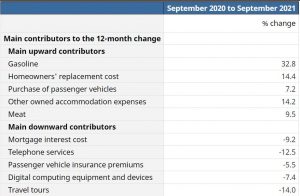

Inflation at home and abroad

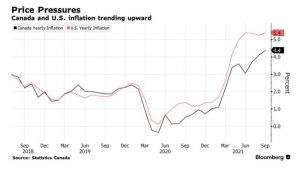

- Largely driven by higher prices for food and energy, the Bank noted that CPI inflation reached 6.8% for the month of April, well above its forecast and “will likely move even higher in the near term before beginning to ease”

- As “pervasive” input pressures feed through into consumer prices, inflation continues to broaden, with core measures of inflation ranging between 3.2% and 5.1%

- Almost 70% of CPI categories now show inflation above 3%

- The increase in global inflation is occurring as the global economy slows

- The Russian invasion of Ukraine, China’s COVID-related lockdowns, and ongoing supply disruptions are all weighing on activity and boosting inflation

- The war has increased uncertainty, is putting further upward pressure on prices for energy and agricultural commodities and “dampening the outlook, particularly in Europe”

- U.S. labour market strength continues, with wage pressures intensifying, while private domestic U.S. demand remains robust despite the American economy “contracting in the first quarter of 2022”

- Global financial conditions have tightened and markets have been volatile

Canadian economy and the housing market

- Economic growth is strong and the economy is clearly “operating in excess demand,” a change in the language the Bank used in April when it said our economy was “moving into excess demand”

- National accounts data for the first quarter of 2022 showed GDP growth of 3.1%, in line with the Bank’s April Monetary Policy Report projection

- Job vacancies are elevated, companies are reporting widespread labour shortages, and wage growth has been “picking up and broadening across sectors”

- Housing market activity is moderating from exceptionally high levels

- With consumer spending in Canada remaining robust and exports anticipated to strengthen, growth in the second quarter is expected to be “solid”

Looking ahead

With inflation persisting well above target and “expected to move higher in the near term,” the Bank used today’s announcement to again forewarn that “interest rates will need to rise further.”

The pace of future increases in its policy rate will be guided by the Bank’s ongoing assessment of the economy and inflation.

In case there was any doubt, the Bank’s message today was clear: it is prepared to act more forcefully if needed to meet its commitment to achieve its 2% inflation target.

July 13, 2022 is the date of the BoC’s next scheduled policy announcement.

Rates Increasing: How Much? & How Fast?

With interest rates now on the rise, 2 Questions: How much? & How fast?

Summary:

- Rates are up by 1.45% on the Variable already (Prime was 1.75% and is now 3.2%)

- There HAS BEEN a 1 x .25% increase and 1 x .5% increase so far = .75% so far

- Expected increases are 1 x .5% or .75%, and 1 x .25% still to come.

- so expect Prime to get to 3.95% from 3.20% today, April 25th.

- Insured variable rates are at Prime – 0.95% = 3.2 – .95% = 2.25% today

- and they are expected to increase to 3.95% – .95% = 3.00% and then hold and decrease in the Fall of 2022.

- these rates are lower than the current 5-year fixed rates of about 4% and are expected to come down in the Fall, 2022.

DETAILS:

Traditionally the Bank of Canada has used 0.25% as the standard increment for any interest rate move up, or down. Occasionally the Bank will move its trendsetting Policy Rate by .50%, as it did at its last setting on April 13.

The last time the central bank boosted the, so-called, overnight rate by ½% was 20 years ago. Now the Bank seems to be laying the ground work for an even bigger increase of .75% at its next setting in June. There has not been a three-quarter point increase since the late 1990s.

Inflation remains the key concern for the BoC. In March the inflation rate hit 6.7%, a 30-year high. The central bank wants to see inflation at around 2.0%. But it does not expect that to happen until sometime late next year.

Bank of Canada Governor will “not rule anything out” when it comes to interest rates and taming inflation. “We’re prepared to be as forceful as needed and I’m really going to let those words speak for themselves.”

While higher inflation was not unexpected as the economy recovered from the pandemic, it is lingering longer than anticipated. The Bank says this is largely due to:

- on-going waves of COVID-19, particularly in China, that have disrupted manufacturing and the supply chain;

- the Russian invasion of Ukraine; and

- spending fuelled by those rock-bottom interest rates that were designed to keep the economy moving during the pandemic.

The Bank is thought to be aiming for a Policy Rate of between 2% and 3%. That is considered a “neutral” rate that neither stimulates nor restrains the economy.

At the current pace, that could be reached by the fall of 2022.

Investment Mortgages WILL Be Harder to Get in 2023!

Its true! This thing called Basel 3 will make it harder to get an investment mortgage in 2023!

Lots of junk below, the short version is:

Canadian banks will need to apply more risk to investor mortgages and to lower that risk they may:

- Increase the down payment needed from 20% to a higher amount … maybe 25% or 30%

- Lend to fewer investors – which already make up 25% to 30% of the Canadian market.

- New Zealand already started 40% down payment for investment properties!

“Avoid the new rules by buying your investment property in 2022!

Mortgage Mark Herman, top Calgary, Alberta mortgage broker.”

DETAILS: Canadian Bank Regulator Confirms Investor Mortgage Reduction Coming Next Year

Canadian real estate investors are about to face higher hurdles to enter the market. The Office of the Superintendent of Financial Institutions (OSFI), Canada’s bank regulator, confirmed new rules being rolled out in Q2 2023. The rules are a part of international Basel III guidelines, designed to reduce risk in the system. One critical change for real estate will be raising the risk weight for investor mortgages. This will reduce their leverage, which OSFI cites as a key response to housing risk. It’s still early, but here’s what we could dig up.

The Basel Trilogy and Global Financial Risk Reduction

The Basel reforms are a global set of measures for prudential bank regulation. They were developed by the Basel Committee On Banking Supervision (BCBS). The BCBS is a 45-country group hosted by the Bank of International Settlements (BIS). The BIS is often called, “the central bank for central banks.” It’s also jokingly called the “final boss” by Bitcoin investors.

We know, it’s a lot of banking jargon and acronyms, but what they do is straightforward. Their job is creating non-partisan risk reduction standards for the global financial system. Since the world’s financial system is now interdependent, problems spill across borders. They stepped up their game after a housing bubble in the US caused a global financial crisis (GFC).

The Basel Accords are a trilogy of policy where the common goals were set. The original happened before many of you were born (1988), but Basel II and III occur after the 2007-2008 GFC. No, circle back. GFC doesn’t stand for Gesus F*cking Christ, we just explained it’s the Global Financial Crisis. We’re also worried about your spelling skills.

The Second Accord primarily addressed minimum capital adequacy requirements. In other words, how much financial institutions had on hand compared to what they lend. Basel III was held in 2010, and mostly just improves the recognition of risk.

A good chunk of BASEL III reforms have already been implemented. Increasing Common Equity Tier 1 (CET) to 4.5% of risk-weighted assets (RWAs) from 2% in BASEL II, is one example. It happened in 2015 and almost no one heard a sound. The measures have been gradually introduced to create as little noise as possible. Though real estate investors might make some noise with the next update.

Basel III Will Land In Q2 2023, and It Will Lower Investor Mortgage Leverage

Basel III will increase the capital requirements for investor mortgages. “as part of the domestic implementation of Basel 3 reform package” in banks’ fiscal Q2-2023, we are increasing the risk weights, and thus capital required, for investor mortgages compared to the risk weights for owner-occupied properties,” said OSFI this morning.

That only tells us a reduction in leverage by Q2 2023 is coming, but not how much. OSFI said they’ll get back to us with what that means for down payments soon. We’ll update as soon as they do, but in the meantime we can get an idea of what we’re in for, from Basel III guidelines.

New standardized credit risk assigns a 30% risk weight to residential real estate. Next year income producing properties with a loan-to-value between 60% and 80% will have a risk weight of 45%. A bank will assume 50% more risk weight for an investor mortgage than an owner occupied home. i.e. owner-occupied mortgages with 20% down have similar risk to investor mortgages with 30% down.

There’s no direct translation of how that’s mitigated. They could want 10 points more for a mortgage, or they can offset risk in various other ways. Raising the risk premium on interest or lending less would be two methods to deal with it. None of those are particularly great for investors, now between 25% and 30% of home sales in Canada. It will slow demand though, which is probably needed.

Raising the down payment is already occurring in other countries like New Zealand. Last year the country increased the minimum downpayment for investors to 40% of the value. Mortgage Professionals Canada (MPC) recently suggested a similar arrangement for Canada. Yup! The organization that represents mortgage brokers suggested it as just a cooling measure. Not even a Basel III mitigation.

The Federal Government has yet to address the issue, probably since most don’t know it’s coming. That means we don’t know if they’ll help reduce the leverage for political points or it’ll come from the banks. One thing’s for sure though — it’s coming next year.

Canadian Economic Data Points Affecting Mortgages

Below are the Bank of Canada’s updated comments on the state of the economy, the Bank and singled out the unprovoked invasion of Ukraine by Russia as a “major new source of uncertainty” that will add to inflation “around the world,” and have negative impacts on confidence that could weigh on global growth.

These are the other highlights.

Canadian economy and the housing market

- Economic growth in Canada was very strong in the fourth quarter of 2021 at 6.7%, which is stronger than the Bank’s previous projection and confirms its view that economic slack has been absorbed

- Both exports and imports have picked up, consistent with solid global demand

- In January 2022, the recovery in Canada’s labour market suffered a setback due to the Omicron variant, with temporary layoffs in service sectors and elevated employee absenteeism, however, the rebound from Omicron now appears to be “well in train”

- Household spending is proving resilient and should strengthen further with the lifting of public health restrictions

- Housing market activity is “more elevated,” adding further pressure to house prices

- First-quarter 2022 growth is “now looking more solid” than previously projected

Canadian inflation and the impact of the invasion of Ukraine

- CPI inflation is currently at 5.1%, as the BoC expected in January, and remains well above the Bank’s target range

- Price increases have become “more pervasive,” and measures of core inflation have all risen

- Poor harvests and higher transportation costs have pushed up food prices

- The invasion of Ukraine is putting further upward pressure on prices for both energy and food-related commodities

- Inflation is now expected to be higher in the near term than projected in January

- Persistently elevated inflation is increasing the risk that longer-run inflation expectations could drift upwards

- The Bank will use its monetary policy tools to return inflation to the 2% target and “keep inflation expectations well-anchored”

Global economy

- Global economic data has come in broadly in line with projections in the Bank’s January Monetary Policy Report

- Economies are emerging from the impact of the Omicron variant of COVID-19 more quickly than expected, although the virus continues to circulate and the possibility of new variants remains a concern

- Demand is robust, particularly in the United States

- Global supply bottlenecks remain challenging, “although there are indications that some constraints have eased”

Looking ahead

As the economy continues to expand and inflation pressures remain elevated, the Bank’s Governing Council made a clear point of telling Canadians to expect interest rates to rise further.

More on Food Security – Interesting data points on the War in Ukraine

Prices for food commodities like grains and vegetable oils reached their highest levels ever last month largely because of Russia’s war in Ukraine and the “massive supply disruptions” it is causing, threatening millions of people in Africa, the Middle East elsewhere with hunger and malnourishment, the United Nations said Friday.

The UN Food and Agriculture Organization said its Food Price Index, which tracks monthly changes in international prices for a basket of commodities, averaged 159.3 points last month, up 12.6% from February. As it is, the February index was the highest level since its inception in 1990.

FAO said the war in Ukraine was largely responsible for the 17.1% rise in the price of grains, including wheat and others like oats, barley and corn. Together, Russia and Ukraine account for around 30% and 20% of global wheat and corn exports, respectively.

While predictable given February’s steep rise, “this is really remarkable,” said Josef Schmidhuber, deputy director of FAO’s markets and trade division. “Clearly, these very high prices for food require urgent action.”

The biggest price increases were for vegetable oils: that price index rose 23.2%, driven by higher quotations for sunflower seed oil that is used for cooking. Ukraine is the world’s leading exporter of sunflower oil, and Russia is No. 2.

2022 Canadian Mortgage Rate Forecast

Why five-year variable rates will likely save money versus their fixed-rate equivalents in 2022 (and beyond).

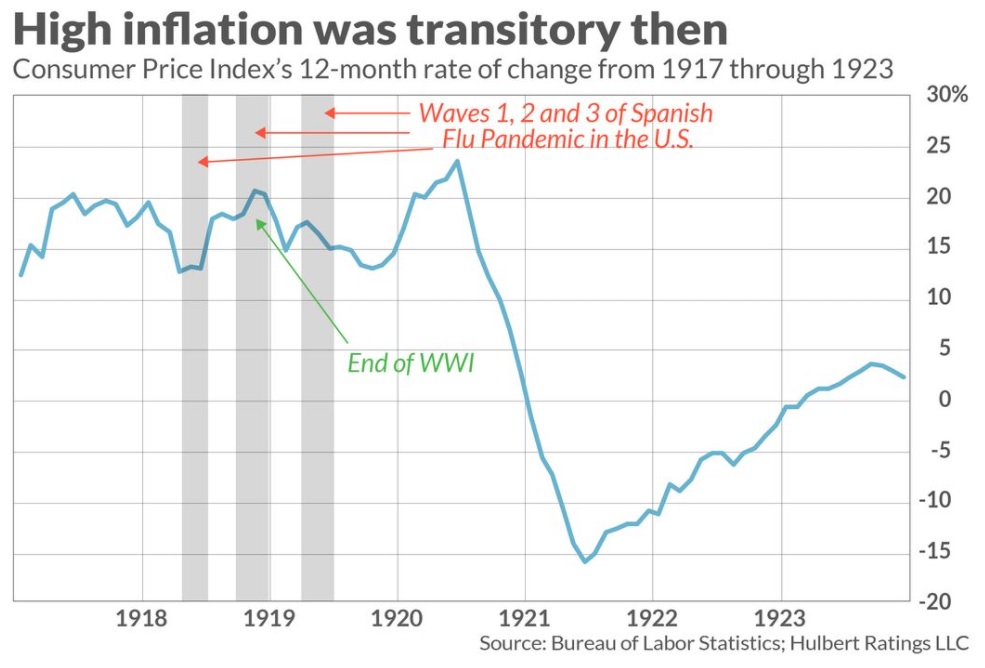

We begin 2022 with Canadian inflation at its highest level since 2003.

Prices have been driven higher by a combination of surging demand, fueled by generous government support payments, and supply shortages tied to the pandemic.

Both the Bank of Canada (BoC) and the US Federal Reserve have been predicting that these factors will have only a transitory impact on inflation.

The term transitory means “non-permanent”, which still appears to be the correct assessment, but it also means “of brief duration”, which hasn’t been the case.

The experience of hotter and stickier inflation has caused both bond-market investors and the wider public to lose confidence in our central bankers.

That is concerning because if people lose faith in their ability to keep inflation contained, they may start accelerating their purchase plans to avoid future price increases, and any such additional increase in demand would push prices still higher. The longer inflation persists, the more likely it becomes that workers will push for higher wages to compensate for their reduced purchasing power. This engenders a self-reinforcing cycle, where the fear of higher inflation causes it to materialize.

With public confidence waning, both the BoC and the Fed had no choice but to stop using the term transitory and to turn more hawkish on monetary-policy tightening. At this point, higher mortgage rates in 2022 appear all but inevitable. But how high will they go?

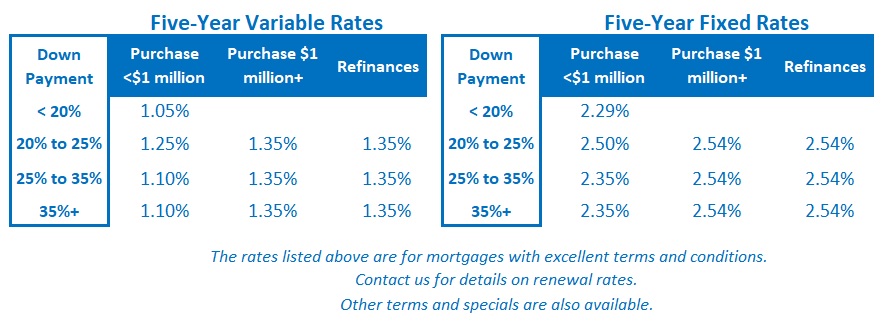

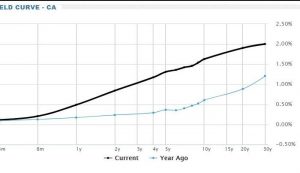

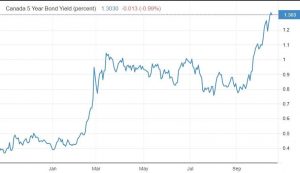

The five-year Government of Canada (GoC) bond yield, which our five-year fixed mortgage rates are priced on, has already surged higher in anticipation of five quarter-point BoC rate hikes in 2022 and two more in 2023. Those are some big moves that are already priced into five-year fixed rates if you lock in today.

Meanwhile, for at least a little while longer, the BoC’s policy rate stands at 0.25%, and that means five-year variable mortgage rates are still available in in the low 1% range, or about 1.25% below their fixed-rate equivalents. That is a much larger buffer than normal.

The futures market is expecting that spread to disappear by the end of the year, but I am skeptical for the following five reasons:

- Omicron’s Impact Is Being Underestimated

In their initial assessment of the Omicron variant, policy makers assumed that its economic impacts would, like its typical symptoms for the vaccinated, be relatively minor.

The Fed initially predicted that Omicron would exacerbate supply shortages and put more pressure on inflation over the short term, but thus far, Fed Chair Powell has said that Omicron will not have much impact on its plans.

I predicted (here) when he made that statement in December that he would regret it, and if he doesn’t already, I expect he will soon. While Omicron’s typical medical impact on the vaccinated has been minor compared to previous COVID variants, it has still caused hospitalizations to spike and is proving quite severe in the unvaccinated.

US vaccination rates and public safety measures have lagged those in Canada and most other developed countries, and that makes the country much more vulnerable to Omicron. If lockdowns are sworn off and US vaccination rates continue to lag, US hospitals may be overrun. That rising risk increases the likelihood that US economic momentum will slow and that the Fed will turn more dovish.

The approach of most Canadian provinces to Omicron has been more cautious. We have closed schools and reinstituted other lockdown restrictions to try to slow infection rates and keep our health-care system from becoming overwhelmed. That reduces our risk of health harm, but it also increases our risk of economic harm, and that, in turn, should turn the BoC more dovish.

- Inflation Will Cool More Rapidly Than the Market Expects

Our Consumer Price Index (CPI) captures price changes over the most recent twelve months.

Prices started to surge in the second half of 2021, and if inflation is going to maintain its current pace into the second half of 2022, it will take another fresh round of price spikes. This seems increasingly unlikely. Supply constraints are gradually being rectified and Omicron has already made consumers more cautious with their spending.

The consensus expects another demand-fueled price spike when we finally free ourselves from the pandemic’s clutches. The theory goes that consumers will spend the cash that they have built up, and that we will see a repeat of the Roaring 20s, when growth and demand surged after the Spanish flu ended.

I have already rebutted that prediction in previous posts. To summarize, the US population was much younger then, US government and household debt levels relative to GDP were miniscule compared to today, and World War I had devastated Europe’s manufacturing capacity, which made the US the world’s dominant exporter over that decade. Very different times.

But what if I’m wrong and we do see a return to the Roaring 20s? Does it follow that inflation will take off?

If past is prologue, the answer is still a firm no.

The chart below shows what happened to inflation when the Spanish Flu ended (and it went on to average less than 2% over the entire 1920s decade).

- There Will Be Much Less Stimulus in 2022

Our policy makers used record levels of fiscal stimulus to offset the pandemic’s initial economic shock.

Those stimuli created many positive short-term impacts that included elevating our GDP, increasing demand, and driving wage growth higher. But those benefits came with a cost. Both US and Canadian budget deficits have soared, driving our government debt levels still higher into the stratosphere.

In addition to being the main contributor to our economic growth in 2021, massive fiscal stimulus was also the primary driver of today’s demand-induced inflationary pressures. But that powerful stimulus has already been sharply reduced on both sides of the 49th parallel, and our governments simply cannot deploy the same largesse to offset any future shocks caused by the pandemic.

The BoC and the Fed are in the same boat as their respective federal governments. They slashed their policy rates to the floor and used quantitative easing (QE), first to flood financial markets with liquidity and then to push bond yields lower. Those moves stimulated financial markets and helped to avoid a repeat of the Great Depression, but they did so by causing asset values to soar, and thereby raising bubble risks across the economy.

Our central bankers now feel compelled to tighten monetary policy to maintain their inflation credibility and help stave off those bubble risks, but that tightening will likely exacerbate, not alleviate, the pandemic’s negative impacts over the year ahead.

If the aggressive rate cuts that have helped asset values surge higher since 2020 are reversed, asset prices would normally reverse direction as well. If that happens, the wealth effect that caused consumers to spend more last year because they were richer (on paper) would also dissipate and cause consumers to turn more cautious.

- The Impact of Rate Hikes Will Be Magnified

Caught between the devil (inflation expectations becoming unanchored) and the deep blue sea (negative economic shocks tied to the pandemic), the BoC and the Fed are reaffirming their commitments to maintain price stability above all else.

But with much less fiscal stimulus buoying economic activity (and exacerbating inflationary pressures), with Omicron’s impacts proving more substantial than first expected, and with elevated debt levels increasing the overall cost of each rate rise, the impact of each hike will be magnified.

All that makes it likely that fewer hikes will ultimately be required to bring inflationary pressures to heel.

If we see anything close to the five BoC rate hikes the consensus is betting on, I think it will prove to be a misstep that will drive our economy into recession. If that happens, rate cuts would almost certainly follow thereafter.

- Labour Costs Will Be Contained

Despite many anecdotes to the contrary, the hard data show that wages are still largely contained in both Canada and the US, even though our employment backdrops are quite different.

In the US, average wages have risen by 4.7% year over year, but they still haven’t kept pace with overall inflation. By the Fed’s own assessment, average wages were suppressed prior to the pandemic, and some of that increase is therefore a catch up. While US employers are still experiencing labour shortages, US workers are expected to return to the labour force now that emergency benefits have expired and they are burning through their built-up cash reserves.

US wages may continue to rise, but so too should the labour-force participation rate as workers start to re-engage out of necessity.

In Canada, our employment recovery has significantly outpaced our overall economic recovery. That’s good for the hiring data but seriously bad for our productivity levels. We are employing more people to do the same amount of work, and that helps explain why our average wages have only increased by 2.9% on a year-over-year basis and why they remain well below their pre-pandemic level with no signs of any imminent breakout.

Now let’s tie all the above commentary back to the key question of whether fixed or variable mortgage rates will prove cheaper in 2022 and over the next five years.

My crystal ball doesn’t come with any guarantees, but with that said, I fundamentally believe the following:

- Omicron’s greater-than-expected impact will make both the BoC and the Fed more dovish.

- Supply challenges will continue to be overcome in the year ahead, and inflation will subside more quickly than expected.

- Demand will moderate without the powerful tailwind of fiscal stimulus.

- The impact of each rate hike will be magnified, and as such, we will need fewer of them.

- Wage growth will not push inflationary pressures materially higher.

Against that backdrop, I expect that variable mortgage rates will save money over their fixed-rate alternatives over the year ahead, and, true to their usual form, are a good bet to do so over the next five years.

It won’t be as easy for variable-rate borrowers this year, because I do expect some rate hikes to ensue, but the gap of about 1.25% over the available five-year fixed rate alternatives provides a large and significant buffer that I don’t think that will close in 2022 as the consensus predicts.

Meanwhile, GoC bond yields have spiked in anticipation of five BoC rate hikes in the year ahead, with two more the year after, and I expect these rates to move lower if and as it becomes clear that the Bank’s raising schedule will be both more gradual and less severe than the consensus forecast.

The Bottom Line: US bond yields have recently surged higher in response to the release of the Fed’s minutes from its December meeting, which revealed that it may tighten more quickly than previously forecast. GoC bond yields have risen in sympathy.

That said, all the pandemic-related news since then has been worse than expected, and that should soon put an end to the current run up. In the meantime, however, the five-year GoC bond yield has recovered to near its previous high, and if it continues its current trajectory, five-year fixed mortgage rates could move higher over at least the short term.

Five-year variable rate discounts have recently widened a little, and for the reasons outlined above, I don’t expect the BoC to increase at nearly the pace bond-market investors are currently pricing in over the year ahead.

Mortgage Rates Up Due to Inflation

|

|

|

|

|

|

|

|

Canadian Mortgage Rates: Higher Soon, How High?

A normal English article with predictions of Canadian Mortgage Interest Rate Predictions, September 2021.

We think these rates are going to happen but ON A LONGER TIME RANGE that what they think.

Summary of Expected Rates*

- 2.55% – 2.65% in October, 2021

- 2.60% – 2.85% in December, 2021, reduction in buying power of 7%

- 3.10% – 3.30% in October, 2021, reduction in buying power of 8% – 14%

*These rates can totally happen, and are still lower than Pre-Covid rates, but also consider these things that would delay economic recovery/ keep rates low: Iraq – any thing, a 4th and 5th wave of Covid, new variants, USA droughts/ wild weather.

Mortgage Mark Herman, top Calgary Alberta mortgage broker, for new buyers

And a Renewal Surprise:

You may be surprised by the cost of a renewal. A $500,000 mortgage with a 5-year fixed rate of 2.0% would pay around $46,080 in interest over the term. If that rises to 3.1% next year, the cost of interest over the same period would be $72,183. That is an extra $26,000 if interest a year. ANSWER: look at renewing early. We can help you out with that.

OK … on with the news:

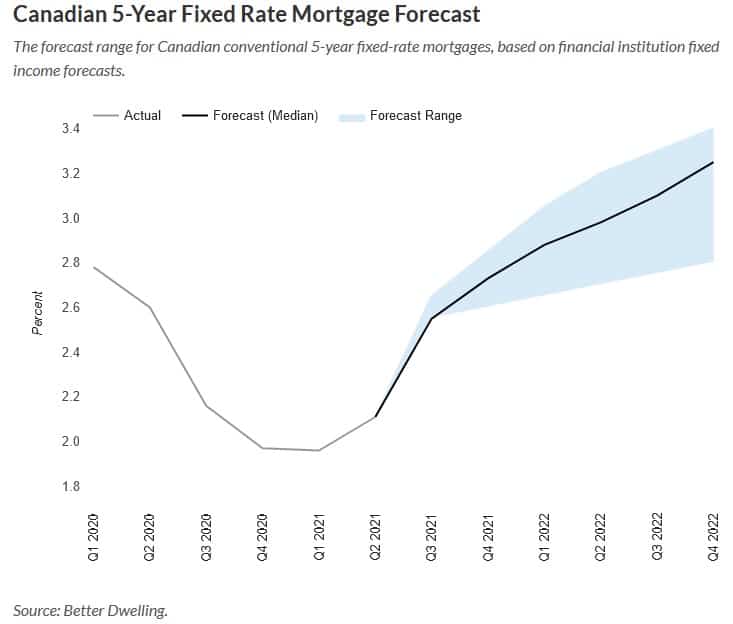

The Canadian economy is improving, excluding some minor hiccups like this morning’s GDP. An improved economy needs less stimulus, and that means higher mortgage rates. To see what Canada is in for, we modeled a forecast range for 5-year fixed-rate mortgages. If Canada doesn’t go into a double-dip recession, much higher mortgage rates are coming.

Canadian 5 Year Fixed-Rate Mortgage Forecast

Today we’re looking at 5-year fixed-rate mortgage interest, and where it’s heading. More specifically, we’ll be focusing on conventional (aka uninsured) mortgage rates. These are for homeowners with a decent amount of equity, and a loan to value ratio below 80%. Insured and variable rate mortgages follow a different path. However, they’ll generally follow the same trend.

This model is based on fixed income forecasts created by major financial institutions. Since they’re forecasting how much investors will make, we can forecast how much you’ll pay. Just a couple of quick notes for the nerds, and aspiring nerds.

The strength of the economy and the recovery are going to be big factors in determining how high these go. A stronger economy means a faster recovery, and along with that is higher mortgage rates. Weaker economic performance will generally mean lower rates to stimulate borrowing. As economic conditions change, so will these forecasts.

Credit liquidity will also play a role in the direction of mortgage rates. If there’s excess capital to lend, mortgage lenders tend to accept smaller margins. This helps to lower the cost of borrowing since they’ll make it up on revenue. If capital for mortgages becomes scarce, mortgage rates rise to adjust to demand.

Today’s chart assumes a medium level of credit liquidity. That is, not much excess, but it’s not scarce either. That’s how the mortgage market was pre-pandemic, and we’ll assume it goes back to that.

Canadian Mortgage Rates Are Going To Climb

Mortgage borrowing costs are likely to reach pre-pandemic levels soon. Our median 5-year fixed-rate forecast is 2.55% by the end of Q3 2021. Based on the most bullish yield forecast, it would rise to 2.65%. The downside yield forecast is the same as the median.

Most institutions have consistent near-term expectations. That sounds weird, but it makes sense. Near-term forecasts are the most visible, with the least number of variables compounding. As forecasts are further out, we’ll see the gap widen as their difference in outlook is magnified.

Canadian 5-Year Fixed Rate Mortgage Forecast

The forecast range for Canadian conventional 5-year fixed-rate mortgages, based on financial institution fixed income forecasts.

Mortgage Interest Rates Can Increase Substantially By Year-End

By the end of this year, we start to really see the potential for these rates to climb. By Q4 2021, the median forecast would put a typical 5-year fixed-rate mortgage at 2.73%. The forecast range becomes wider, going from 2.6% (low) to 2.85% (high). It may not sound like much, but it can have a big impact.

The rate of change is much more important than the actual number. If you go from a 2% rate to a 2.73% rate, your cost of interest rises 36.5%. If we exclude the stress test, buying power sees a 7.84% decline. Since recent buyers are mostly stress-tested, default isn’t much of an issue. However, the cost and size of debt can be.

Mortgages Rates May Rise More Than A Point By Next Year

Next year is going to be a big one for mortgage rates if the economy recovers as expected. The median 5-year fixed-rate forecast works out to 3.10% by the end of Q3 2022, which can lead to an 11.5% reduction in buying power. On the low end, the rate still comes in at 2.7%, reducing buying power by 8.0% outside of a stress test. The high range would see it climb all the way to 3.30%, pulling maximum mortgage credit 14.3% lower. Keep in mind the stress test rate may also adjust higher as well. It depends on how comfortable OSFI is with rates rising closer to their stress test number.

Another factor to consider here is the cost of the renewal. A $500,000 mortgage with a 5-year fixed rate of 2.0% would pay around $46,080 in interest over the term. If that rises to 3.1% next year, the cost of interest over the same period would be $72,183. I don’t know about you, but $26,000 is a decent chunk of money to spend over a year.

Existing mortgage holders close to renewal may want to text their mortgage broker. If you see the economy improving, locking in rates might save you a little money. It might not though, depending on whether you have prepayment penalties. It’s always best to run the numbers with a broker on various scenarios though.

Pending a double-dip recession doesn’t occur, higher mortgage rates are coming. Maybe not as high as the Desjardins forecast, but definitely higher than it is now. Those supersized mortgages with short terms are going to divert more capital from the economy on renewal. The takeaway isn’t how high mortgage rates can climb though. It’s how absurdly cheap mortgage debt has been during the pandemic.

Link to the actual article: https://betterdwelling.com/canadian-mortgage-rates-will-rip-higher-soon-heres-how-high/#_

EXPLAINER: Why & Where Inflation and Canadian Mortgage Interest Rates

Best answer I have seen yet is below … it still makes the 5-year fixed the better option right now (for most people)Mortgage Mark Herman, Top Calgary Mortgage Broker

The latest significant news was good, but modest. Canada’s unemployment rate dipped to 7.5% with the creation of 94,000 jobs in July. Most of those are full-time and in the private sector.

Employment levels are linked to inflation, which is a key factor watched by the Bank of Canada in setting interest rate policy which, in turn, can affect mortgage rates.

As the labour market tightens up, employers tend to offer higher wages to attract workers. That increases the cost of producing goods and services, driving inflation. As well, as more people get work and earn more money demand for goods and services increases. If that demand outpaces supply, inflation can also result.

Canada finds itself in this position now. Inflation is running high chiefly because of supply constraints caused by the pandemic. At the same time, more and more people are heading back to work.

That has some analysts forecasting the Bank of Canada will be raising rates to calm inflation. The Bank, however, has been saying otherwise.

It is also useful to watch what is happening in the United States. The two economies are tightly linked and actions in the U.S. can offer useful clues about what will happen here.

In its latest assessment of the American economy the U.S. Federal Reserve continued to down play inflation – which is running high there as well – as “transitory”. The Fed continues to look to the second half of 2023 as the most likely time for any possible rate hikes. While the Bank of Canada has said it expects rates could start rising as much as a year sooner than that, it would be unusual for the BoC to move before the Fed.

Post-Covid Home Demand to Continue – Data

What is everyone doing with the money they saved during Covid?

- Eating out, travel, debt reduction and BUYING HOMES!

- Mortgage rates are low and home prices are close to 2005 levels!

Mortgage Mark Herman, Top Calgary Alberta Mortgage Broker

Latest Bank of Canada Survey:

As COVID-19 continues to be pushed down in Canada, consumer spending is expected to go up. The latest survey by the Bank of Canada suggests that will lead to an even greater demand for homes.

The Bank of Canada’s Survey of Consumer Expectations… indicates:

- 40% of respondents managed to save more money than usual during the pandemic.

- They expect to spend about 35% of those savings over the next 2 years on activities that have been restricted during the pandemic, such as dining out.

- Respondents plan to put 10% of their savings toward debt repayment and

- 10% toward a down payment on a home.

14% plan to buy a home soon, much of that was driven by renters, with 20% saying they want to get into the market.

80% of the respondents who have “worked from home” expect to continue with that and there is a consistent with the shift in demand for larger properties, away from city centres.

How a job loss affects your mortgage approval

If you’ve been thinking about buying a house, you’ve probably considered how much you can afford in mortgage payments. Have you also thought about what would happen if you lost your source of income?

While the sudden loss of employment is always a possibility, the current uncertainty of our economy has made more people think about the stability of their income. Whether you’ve already made an offer on a home or you’ve just started looking, here is how job loss could affect your mortgage approval.

What role does employment play in mortgage approval?

In addition to ensuring you earn enough to afford a mortgage payment; mortgage lenders want to see that you have a history of consistent income and are likely to in the future. Consistent employment is the best way to demonstrate that.

To qualify for any mortgage, you’ll need proof of sufficient, reliable income. Your mortgage broker will walk you through the income documents your lender will need to verify you’re employed and earning enough income. So, if your employment situation is questionable, you may want to reconsider a home purchase until your employment is more secure.

Should you continue with your home purchase after you’ve lost your job?

What if you’ve already qualified for a mortgage, and your employment circumstances change? Simply put, you must tell your lender. Hiding that information might be considered fraud, and your lender will find out when they verify your information prior to closing.

If you’ve already gone through the approval process, then you know that your lender is looking for steady income and employment.

Here are some possible scenarios where you may be able to continue with your purchase:

- If you secure another job right away and the job is in the same field as your previous employment. You will still have to requalify, and it may end up being for less than the original loan, but you may be able to continue with your home purchase. Be aware, if your new employer has a probationary period (usually three months), you might not be approved. Consult your broker.

- If you have a co-signer on your mortgage, and that person earns enough to qualify on their own, you may be able to move forward. Be sure your co-signer is aware of your employment situation.

- If you have other sources of income that do not come from employment, they may be considered. The key factors are the amount and consistency of the income. Income from retirement plans, rentals, investments, and even spousal or child support payments may be considered under the right circumstances.

Can you use your unemployment income when applying for a mortgage?

Generally, Employment Insurance income can’t be used to qualify for a mortgage. The exceptions for most financial institutions are seasonal workers or people with cyclical employment in industries such as fishing or construction. In this situation, you’ll be asked to show at least a two-year cycle of employment followed by Employment Insurance benefits.

However, it’s not the ideal situation and most lenders won’t be willing to approve your mortgage under those conditions.

What happens if you’re furloughed (temporary leave of absence)?

Not all job losses are permanent. As we’ve seen during the COVID-19 pandemic, many workers were put on temporary leave. If you’ve already been approved for a mortgage and are closing on a house, your lender might take a “wait-and-see” approach and delay the closing if you can demonstrate you’ve only been furloughed. In these cases, you’ll need a letter from your employer that has a return-to-work date on it. Keep in mind, if you don’t return to work before your closing date, your lender will likely cancel the approval and ask for a re-

submission later.

If you haven’t started the application process, it would be wise to wait until you are back to work for at least three months to demonstrate consistent employment.

Your credit score and debt servicing ratios may change because of lost income, which means you may no longer meet your lender’s qualifications for a mortgage. While it may not be possible, try to avoid accumulating debt or missing any payments while unemployed.

Talk to your mortgage broker.

“You don’t want to get locked into a mortgage you can’t afford.

You also don’t want to lose a deposit on a home because you lost your financing.

When trying to assess if it’s better to move forward or walk away, we should be your first call.”

Mortgage Mark Herman; Calgary Alberta Mortgage Broker