Payout Penalties: Nasty tricks of the Big-6 Banks – Example 1

Payout penalties – how the Big-6 banks get you, Example 1

Payout penalties – how the Big-6 banks get you, Example 1

Below is a great example of how the Big-6 banks get you on an early mortgage payout.

“The rate is the rate, but the details are the details!” said Grandma Herman.

Mark Herman

Top Alberta mortgage broker for home purchases and mortgage renewals

As you can see from the example below, the banks “discount rate recapture policy” can result in some pretty hefty added costs —$6,048 in the scenario here!

Example:

On July 31, 2015, you buy your first home and sign a five-year, fixed-term mortgage. As your family grows, you start looking at a bigger home, and after a few months of searching, you find the perfect one—on August 1, 2017.

Because of this unexpected upgrade, you now have to break your mortgage three years before it matures (you have $320,000 left on your mortgage). When you signed your current mortgage, you weren’t concerned about prepayment penalties, but as you can see below, prepayment penalties can have a significant financial impact on your bottom line.

| Your situation | |

|---|---|

| Mortgage date | July 21, 2015 |

| Date you break your mortgage | August 1, 2017 |

| How much you have left owing on your mortgage | $320, 000 |

| Your original mortgage term | 5 years |

| How many years left you have on your term | 3 years |

| Comparison | ||

|---|---|---|

| Mortgage breakage fee at the Big-5 banks | Mortgage breakage fee with Broker Banks |

|

| 5-year posted rate when you got your mortgage | 5.39% | Not applicable for the IRD calculation |

| Your actual contract rate | 4.00% | 4.00% |

| Discount | 1.39% | N/A |

| 3-year posted rate on August 1, 2013 (the day you break your mortgage) | 3.75% | 2.99% |

| IRD formula | (Contract rate – [Posted rate for remaining term – Discount from original mortgage]) x Principal outstanding x Remaining term | (Contract rate – Posted rate for remaining term) x Principal outstanding x Remaining term |

| IRD payment | $15,744 | $9,696 |

| Difference in fees | $6,048 | |

For a free mortgage check-up, or pre-approval, or compare what we can do vs. your bank, call Mark at 403-681-4376

• There is no cost to you for our services as the banks pay us for doing their work,

• You get our professional, un-biased advice & expertise on your mortgage,

• We answer our phones and emails, 7 days a week, from 9 – 9, including holidays,

• Your rate is lower with us as we deal through “broker services” at the banks.

Calgary Housing Market Still Strong

Below is an article that notes Calgary’s home prices are still supported.

Mark Herman, top Calgary mortgage broker for purchases and mortgage renewals

Calgary’s housing market is not under threat of a correction despite a downturn in the local economy, Canada Mortgage and Housing Corp. said in an analysis Thursday.

Its assessment of 15 metro markets lists Calgary as “low risk” while Toronto, Regina and Winnipeg were rated “high risk.” The review considered four factors — overheating; acceleration in house prices; overvaluation; and overbuilding — as of the end of March.

“The low price of oil has affected many different sectors of the economy, affecting employment and income growth, and increasing the unemployment rate. Weaker labour market conditions have also slowed migration to the region,” CMHC said of the Calgary-area market.

…

Meanwhile, Vancouver — one of the country’s priciest real estate markets — was deemed low risk, even as home prices there continue to soar. The benchmark price of a detached home in metropolitan Vancouver hit $1.1 million in July, up 16.2 per cent from a year ago, the Real Estate Board of Greater Vancouver said last week.

… Statistics Canada said Thursday that new home prices in the Calgary area rose 0.1 per cent in June.

“Higher land prices were largely offset by builders reducing prices because of market conditions,” the federal agency said. Prices were up 0.7 per cent year-over-year.

In its latest report, the Calgary Real Estate Board said the average MLS sale price for July was $476,446, down about 1 per cent from a year ago while the median price of $435.000 grew by 2.35 per cent. The benchmark price, which CREB identifies as a typical property sold in the market, was largely unchanged at $455,400.

With files from The Canadian Press

4 Reasons Canadian Mortgage Rates Are Going to go up Soon

Here is a great summary of what is causing mortgage rates to be nosing up in the near future. They really should have gone up by now but the anticipated “Spring housing market rush” competition with the banks is holding them down.

Mark Herman, top Calgary, Alberta mortgage broker for home purchases and mortgage renewals

The latest round of economic data has real-estate watchers returning their focus to interest rates.

- Activity in the bond market and the latest employment numbers are fueling predictions there will be a bump in fixed-rate borrowing costs in the near future.

- Employment improvements are generally seen as a harbinger of inflation. That, along with other domestic and international considerations, is pushing up government bond yields, which in turn drive fixed mortgage rates.

- There is also the notion that the big, trend-setting lenders will be looking to move rates up to bolster profits.

- As well, Bank of Canada Governor Stephen Poloz has hinted he might be willing to let inflation run in order to avoid hiking the policy rate. That would also put upward pressure on government bond yields.

The graph we watch to show us this is here:

Variable Rates:

- As for variable-rate mortgages, the betting is there will not be a Bank of Canada increase until the middle of 2016, holding variable rates in place for the foreseeable future.

Canadian Reverse Mortgage – CHIP loans

Follow on Twitter: @RateSpy.com

Canada #3 Place to Live in the World

This is pretty interesting. I think we could be higher if the winters were not so long and cold.

Mark Herman; Calgary, Alberta Mortgage Broker

Canada Ranks #3 in Legatum Prosperity Index 2013

Published the Tuesday 26 November 2013 by Gwen at 15:00 in Business, Canada, Education, Health, News, | No comment .

The Legatum Prosperity IndexTM 2013 is out, and Canada ranks 3rd in the world for its overall prosperity, right behind Norway and Switzerland. The country’s ranking leaped from 6th to 3rd in just one year, thus confirming its position as the leader of the Americas region.

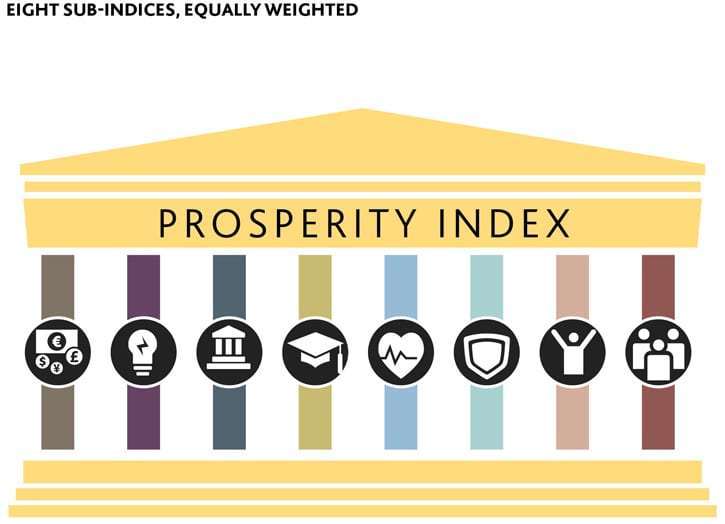

For five years now, the Legatum Institute has been compiling and comparing data of 142 countries in order to draw one of the most accurate and comprehensive portraits of prosperity around the world. Their vision is that prosperity should include not only objective economic indicators, but also subjective evaluations of well-being and development indicators as perceived by the population.

With an impressive balance between scientific rigor and user-friendly design (just play with the interactive map and shuffleboard), the website provides great insights on prosperity to both the expert and the neophyte.

In this changing, post 2008 economic crisis, post Arab Spring world, Canada’s prosperity is exemplary on economic stability and human development alike. Below is a digest of Canada’s data, grouped by LI sub-indexes and revealing the key elements that make Canada the third most prosperous country in the world.

Personal freedom: Canada ranks 1st

- 94.1% of the population believes it’s a good place to live for immigrants (and ethnic minorities)

- 91.8% is satisfied with their freedom of choice

Education: Canada ranks 3rd

- The teacher to pupils ratio is 1:12

- 79.1% of the population is satisfied with quality of education

Economy: Canada ranks 4th

- 1.5% inflation

- 74.6% of the population has confidence in financial institutions

- 89.4% has access to adequate food and shelter

- 86.5% is satisfied with their living standards

- 45.8% thinks it’s a good time to find a job

Social capital: Canada ranks 6th

- 42.2% of the population has volunteered in the past month

- 68.5% has donated money to charity

- 65% has helped a stranger

- 94.8% says they can rely on others in times of need

Safety & Security: Canada ranks 7th

- 12.3% of the population had property stolen last year

- 84.3% feels safe to walk alone at night

Governance: Canada ranks 8th

- 67.4% of the population has confidence in the honesty of elections

- 44% believes business/government corruption is widespread

Health: Canada ranks 11th

- Health expenditure is $4520 per capita

- Immunization rate against infectious diseases is 95%

- Life expectancy is 80.9 years

Entrepreneurship & Opportunity: Canada ranks 16th

- Business start-up costs 0.4% of GNI per capita

- 78.5% of population thinks it’s a good place for entrepreneurs to start a business

- Innovation: Canada earns twice as much in royalties than the world’s average

Adapted from The Legatum Institute website.