Rates Increasing: How Much? & How Fast?

With interest rates now on the rise, 2 Questions: How much? & How fast?

Summary:

- Rates are up by 1.45% on the Variable already (Prime was 1.75% and is now 3.2%)

- There HAS BEEN a 1 x .25% increase and 1 x .5% increase so far = .75% so far

- Expected increases are 1 x .5% or .75%, and 1 x .25% still to come.

- so expect Prime to get to 3.95% from 3.20% today, April 25th.

- Insured variable rates are at Prime – 0.95% = 3.2 – .95% = 2.25% today

- and they are expected to increase to 3.95% – .95% = 3.00% and then hold and decrease in the Fall of 2022.

- these rates are lower than the current 5-year fixed rates of about 4% and are expected to come down in the Fall, 2022.

DETAILS:

Traditionally the Bank of Canada has used 0.25% as the standard increment for any interest rate move up, or down. Occasionally the Bank will move its trendsetting Policy Rate by .50%, as it did at its last setting on April 13.

The last time the central bank boosted the, so-called, overnight rate by ½% was 20 years ago. Now the Bank seems to be laying the ground work for an even bigger increase of .75% at its next setting in June. There has not been a three-quarter point increase since the late 1990s.

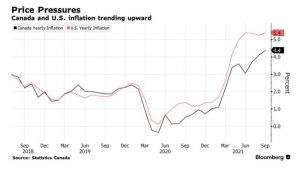

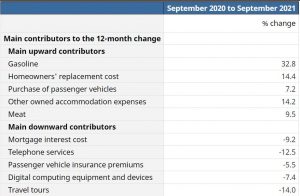

Inflation remains the key concern for the BoC. In March the inflation rate hit 6.7%, a 30-year high. The central bank wants to see inflation at around 2.0%. But it does not expect that to happen until sometime late next year.

Bank of Canada Governor will “not rule anything out” when it comes to interest rates and taming inflation. “We’re prepared to be as forceful as needed and I’m really going to let those words speak for themselves.”

While higher inflation was not unexpected as the economy recovered from the pandemic, it is lingering longer than anticipated. The Bank says this is largely due to:

- on-going waves of COVID-19, particularly in China, that have disrupted manufacturing and the supply chain;

- the Russian invasion of Ukraine; and

- spending fuelled by those rock-bottom interest rates that were designed to keep the economy moving during the pandemic.

The Bank is thought to be aiming for a Policy Rate of between 2% and 3%. That is considered a “neutral” rate that neither stimulates nor restrains the economy.

At the current pace, that could be reached by the fall of 2022.

Canadian Economic Data Points Affecting Mortgages

Below are the Bank of Canada’s updated comments on the state of the economy, the Bank and singled out the unprovoked invasion of Ukraine by Russia as a “major new source of uncertainty” that will add to inflation “around the world,” and have negative impacts on confidence that could weigh on global growth.

These are the other highlights.

Canadian economy and the housing market

- Economic growth in Canada was very strong in the fourth quarter of 2021 at 6.7%, which is stronger than the Bank’s previous projection and confirms its view that economic slack has been absorbed

- Both exports and imports have picked up, consistent with solid global demand

- In January 2022, the recovery in Canada’s labour market suffered a setback due to the Omicron variant, with temporary layoffs in service sectors and elevated employee absenteeism, however, the rebound from Omicron now appears to be “well in train”

- Household spending is proving resilient and should strengthen further with the lifting of public health restrictions

- Housing market activity is “more elevated,” adding further pressure to house prices

- First-quarter 2022 growth is “now looking more solid” than previously projected

Canadian inflation and the impact of the invasion of Ukraine

- CPI inflation is currently at 5.1%, as the BoC expected in January, and remains well above the Bank’s target range

- Price increases have become “more pervasive,” and measures of core inflation have all risen

- Poor harvests and higher transportation costs have pushed up food prices

- The invasion of Ukraine is putting further upward pressure on prices for both energy and food-related commodities

- Inflation is now expected to be higher in the near term than projected in January

- Persistently elevated inflation is increasing the risk that longer-run inflation expectations could drift upwards

- The Bank will use its monetary policy tools to return inflation to the 2% target and “keep inflation expectations well-anchored”

Global economy

- Global economic data has come in broadly in line with projections in the Bank’s January Monetary Policy Report

- Economies are emerging from the impact of the Omicron variant of COVID-19 more quickly than expected, although the virus continues to circulate and the possibility of new variants remains a concern

- Demand is robust, particularly in the United States

- Global supply bottlenecks remain challenging, “although there are indications that some constraints have eased”

Looking ahead

As the economy continues to expand and inflation pressures remain elevated, the Bank’s Governing Council made a clear point of telling Canadians to expect interest rates to rise further.

More on Food Security – Interesting data points on the War in Ukraine

Prices for food commodities like grains and vegetable oils reached their highest levels ever last month largely because of Russia’s war in Ukraine and the “massive supply disruptions” it is causing, threatening millions of people in Africa, the Middle East elsewhere with hunger and malnourishment, the United Nations said Friday.

The UN Food and Agriculture Organization said its Food Price Index, which tracks monthly changes in international prices for a basket of commodities, averaged 159.3 points last month, up 12.6% from February. As it is, the February index was the highest level since its inception in 1990.

FAO said the war in Ukraine was largely responsible for the 17.1% rise in the price of grains, including wheat and others like oats, barley and corn. Together, Russia and Ukraine account for around 30% and 20% of global wheat and corn exports, respectively.

While predictable given February’s steep rise, “this is really remarkable,” said Josef Schmidhuber, deputy director of FAO’s markets and trade division. “Clearly, these very high prices for food require urgent action.”

The biggest price increases were for vegetable oils: that price index rose 23.2%, driven by higher quotations for sunflower seed oil that is used for cooking. Ukraine is the world’s leading exporter of sunflower oil, and Russia is No. 2.

Rates and Prices Trending Up Due to Inflation and War

Mid-March Commentary: Rates and Prices Trending Up Due to Inflation! and War!!

On March 2nd, 2022, the Bank of Canada made its most anticipated decision on interest rates since the pandemic began. After weeks of speculation and anticipation of an increase, central bankers finally pulled the trigger and moved their overnight rate higher.

For the 1st time since the pandemic began to hurt the economy in March 2020, the Bank raised its overnight benchmark rate by .25% and the knock-on effect is that borrowing costs for Canadians will rise modestly although by historical norms, remain low.

In its updated comments on the state of the economy, the Bank and singled out the unprovoked invasion of Ukraine by Russia as a “major new source of uncertainty” that will add to inflation “around the world,” and have negative impacts on confidence that could weigh on global growth.

Below are the other highlights…

Canadian economy and the housing market

- Economic growth in Canada was very strong in the fourth quarter of 2021 at 6.7%, which is stronger than the Bank’s previous projection and confirms its view that economic slack has been absorbed

- Both exports and imports have picked up, consistent with solid global demand

- In January 2022, the recovery in Canada’s labour market suffered a setback due to the Omicron variant, with temporary layoffs in service sectors and elevated employee absenteeism, however, the rebound from Omicron now appears to be “well in train”

- Household spending is proving resilient and should strengthen further with the lifting of public health restrictions

- Housing market activity is “more elevated,” adding further pressure to house prices

- First-quarter 2022 growth is “now looking more solid” than previously projected

Canadian inflation and the impact of the invasion of Ukraine

- CPI inflation is currently at 5.1%, as the BoC expected in January, and remains well above the Bank’s target range

- Price increases have become “more pervasive,” and measures of core inflation have all risen

- Poor harvests and higher transportation costs have pushed up food prices

- The invasion of Ukraine is putting further upward pressure on prices for both energy and food-related commodities

- Inflation is now expected to be higher in the near term than projected in January

- Persistently elevated inflation is increasing the risk that longer-run inflation expectations could drift upwards

- The Bank will use its monetary policy tools to return inflation to the 2% target and “keep inflation expectations well-anchored”

Global economy

- Global economic data has come in broadly in line with projections in the Bank’s January Monetary Policy Report

- Economies are emerging from the impact of the Omicron variant of COVID-19 more quickly than expected, although the virus continues to circulate, and the possibility of new variants remains a concern

- Demand is robust, particularly in the United States

- Global supply bottlenecks remain challenging, “although there are indications that some constraints have eased”

Looking ahead

As the economy continues to expand and inflation pressures remain elevated, the Bank made a clear point of telling Canadians “To expect interest rates to rise further.”

The resulting quantitative tightening (which central bankers framed as “QT” rather than the previous term “QE” for quantitative easing) would complement increases in the Bank’s policy-setting interest rate. The timing and pace of further increases in the policy rate, and the start of QT, will be guided by the Bank’s ongoing assessment of the economy and its commitment to achieving a 2% inflation target.

BoC’s next scheduled policy announcement is April 13, 2022. We will update you following that announcement as always.

Rising rates: fixed or variable?

The Bank of Canada pulled the trigger on an interest rate increase, the first since October 2018 and the Bank has made it clear more increases are coming.

The upward move and the Bank’s messaging have rekindled the perennial mortgage debate: fixed or variable. The answer remains the perennial: it depends.

It depends on the borrower’s end goals, finances and their desire for stability. That last point, stability, is what leads most Canadian home buyers to opt for a 5-year, fixed-rate mortgage. But in purely financial terms – and saving money – variable-rate mortgages tend to be cheaper, and they do not have to be volatile.

In a rising rate environment, many borrowers worry about the cost of their debt going up. But right now, variable-rates are notably lower than fixed-rates and it will take several Bank of Canada increases to close the gap. In the meantime, that amounts to savings for the borrower.

Those savings – often hundreds of dollars a month – could be applied against principal. As rates rise the amount can be adjusted, thereby keeping total monthly payments the same and evening-out any volatility.

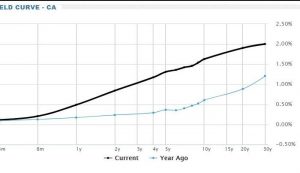

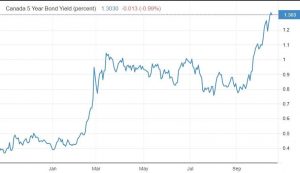

It should be remembered that fixed-rates are rising as well. They are tied to Government of Canada 5-year bond yields. Those yields have been increasing, and at least some of that is tied to increases in U.S. government bond yields. Canadian bonds tend to move in sync with American bonds, but those changes do not necessarily reflect the Canadian economy. In other words, the changes are not completely within our control.

A Few More Words on Russia Invading Ukraine

Markets were thrown into a tizzy. They plunged. But the frenzy was short lived. By the end of the day markets were back in the black.

Canada’s economic exposure to Russia and Ukraine is relatively small. Canada imported $1.2 billion from Russia in 2020; Russia imported roughly the same from Canada – less than a week’s worth of commercial traffic across the Ambassador Bridge.

The key factor in the conflict, for Canada, will likely be the price of oil, which has climbed past $100 a barrel. Rising oil prices and higher fuel costs have been a principal driver of inflation here, and inflation is the main concern of the Bank of Canada. It is currently running at 5.1%, a 30 year high, and the central bank is under growing pressure to bring it under control.

Oil is also an important part of Canada’s resource economy. Higher prices will likely lead to more production. Any embargo of Russian oil will create demand for Canadian product. That, in turn, would put more load onto Canada’s economic recovery, which is strong but hampered by pandemic labour shortages and supply-chain problems which, again, are adding to inflation pressures.

None the less, war creates uncertainty, and uncertainty triggers caution among central bankers. A recent Reuters poll of 25 economists suggests the Bank of Canada will go ahead with a quarter-point rate hike this week.

Bank of Canada holds benchmark interest rate steady & updates 2022 economic outlook

Summary:

- Prime did not change today, Jan 26, and the Bank of Canada (BoC) clearly said they are planning on starting the needed rate increases at the next meeting in 6 weeks, on Wednesday March 2nd.

- The Market has “priced in” between 4 and 6 increases in 2022, each by .25%, and between 2 and 4 increases in 2023, each by .25%

- There may be fewer increases if inflation returns to the target of 2% from today’s 40 year high of about 5%.

- The USA is seeing record 7% inflation and Canada usually gets dragged along with the US numbers so that balances the possibility of fewer increases.

- Mortgage Strategy – secure a fully underwritten, pre-approval, with a 120- day rate hold, from a person, not an online “60-second-mortgage-app” as soon as you think you may be buying in the next 2 years.

- To start a mortgage application with us, click here, and we will call you with in 24-hours to get things going.

DETAILS:

This morning in its first scheduled policy decision of 2022, the Bank of Canada left its target overnight benchmark rate unchanged at what it describes as its “lower bound” of 0.25%. As a result, the Bank Rate stays at 0.5% and the knock-on effect is that borrowing costs for Canadians will remain low for the time being.

The Bank also updated its observations on the state of the economy, both in Canada and globally, leaving a strong impression that rates will rise this year.

More specifically, the Bank said that its Governing Council has decided to end its extraordinary commitment to hold its policy rate at the effective lower bound and that looking ahead, it expects “… interest rates will need to increase, with the timing and pace of those increases guided by the Bank’s commitment to achieving” its 2% inflation target.

These are the other highlights of today’s BoC announcement.

Canadian economy

- The economy entered 2022 with considerable momentum, and a broad set of measures are now indicating that economic slack is absorbed

- With strong employment growth, the labour market has tightened significantly with elevated job vacancies, strong hiring intentions, and a pick up in wage gains

- Elevated housing market activity continues to put upward pressure on house prices

- Omicron is “weighing on activity in the first quarter” and while its economic impact will depend on how quickly this wave passes, the impact is expected to be less severe than previous waves

- Economic growth is then expected to bounce back and remain robust over the Bank’s “projection horizon,” led by consumer spending on services, and supported by strength in exports and business investment

- After GDP growth of 4.5% in 2021, the Bank expects Canada’s economy to grow by 4% in 2022 and about 3.5% in 2023

Canadian inflation

- CPI inflation remains “well above” the Bank’s target range and core measures of inflation have edged up since October

- Persistent supply constraints are feeding through to a broader range of goods prices and, combined with higher food and energy prices, are expected to keep CPI inflation close to 5% in the first half of 2022

- As supply shortages diminish, inflation is expected to decline “reasonably quickly” to about 3% by the end of 2022 and then “gradually ease” towards the Bank’s target over the projection period

- Near-term inflation expectations have moved up, but longer-run expectations remain anchored on the 2% target

- The Bank will use its monetary policy tools to ensure that higher near-term inflation expectations do not become embedded in ongoing inflation

Global economy

- The recovery is strong but uneven with the US economy “growing robustly” while growth in some other regions appears more moderate, especially in China due to current weakness in its property sector

- Strong global demand for goods combined with supply bottlenecks that hinder production and transportation are pushing up inflation in most regions

- Oil prices have rebounded to well above pre-pandemic levels following a decline at the onset of the Omicron variant of COVID-19

- Financial conditions remain broadly accommodative but have tightened with growing expectations that monetary policy will normalize sooner than was anticipated, and with rising geopolitical tensions

- Overall, the Bank projects global GDP growth to moderate from 6.75% in 2021 to about 3.5% in 2022 and 2023

January Monetary Policy Report

The key messages found in the BoC’s Monetary Policy Report published today were consistent with the highlights noted above:

- A wide range of measures and indicators suggest that economic slack is now absorbed and estimates of the output gap are consistent with this evidence

- Public health measures and widespread worker absences related to the Omicron variant are slowing economic activity in the first quarter of 2022, but the economic impact is expected to be less severe than previous waves

- The impacts from global and domestic supply disruptions are currently exerting upward pressure on prices

- Inflationary pressures from strong demand, supply shortages and high energy prices should subside during the year

- Over the medium term, increased productivity is expected to boost supply growth, and demand growth is projected to moderate with inflation expected to decline gradually through 2023 and 2024 to close to 2%

- The Bank views the risks around this inflation outlook as roughly balanced, however, with inflation above the top of the Bank’s inflation-control range and expected to stay there for some time, the upside risks are of greater concern

Looking ahead

The Bank intends to keep its holdings of Government of Canada bonds on its balance sheet roughly constant “at least until” it begins to raise its policy interest rate. At that time, the BoC’s Governing Council will consider exiting what it calls its “reinvestment phase” and reducing the size of its balance sheet. It will do so by allowing the roll-off of maturing Government of Canada bonds.

While the Bank acknowledges that COVID-19 continues to affect economic activity unevenly across sectors, the Governing Council believes that overall slack in the economy is now absorbed, “thus satisfying the condition outlined in the Bank’s forward guidance on its policy interest rate” and setting the stage for increases in 2022.

Mortgage Rate Holds are the theme for buyers in 2022

Mortgage Mark Herman, your friendly Calgary Alberta mortgage broker & New Buyer Specialist.

Mortgage Rates Up Due to Inflation

|

|

|

|

|

|

|

|

Canadian Mortgage Rates: Higher Soon, How High?

A normal English article with predictions of Canadian Mortgage Interest Rate Predictions, September 2021.

We think these rates are going to happen but ON A LONGER TIME RANGE that what they think.

Summary of Expected Rates*

- 2.55% – 2.65% in October, 2021

- 2.60% – 2.85% in December, 2021, reduction in buying power of 7%

- 3.10% – 3.30% in October, 2021, reduction in buying power of 8% – 14%

*These rates can totally happen, and are still lower than Pre-Covid rates, but also consider these things that would delay economic recovery/ keep rates low: Iraq – any thing, a 4th and 5th wave of Covid, new variants, USA droughts/ wild weather.

Mortgage Mark Herman, top Calgary Alberta mortgage broker, for new buyers

And a Renewal Surprise:

You may be surprised by the cost of a renewal. A $500,000 mortgage with a 5-year fixed rate of 2.0% would pay around $46,080 in interest over the term. If that rises to 3.1% next year, the cost of interest over the same period would be $72,183. That is an extra $26,000 if interest a year. ANSWER: look at renewing early. We can help you out with that.

OK … on with the news:

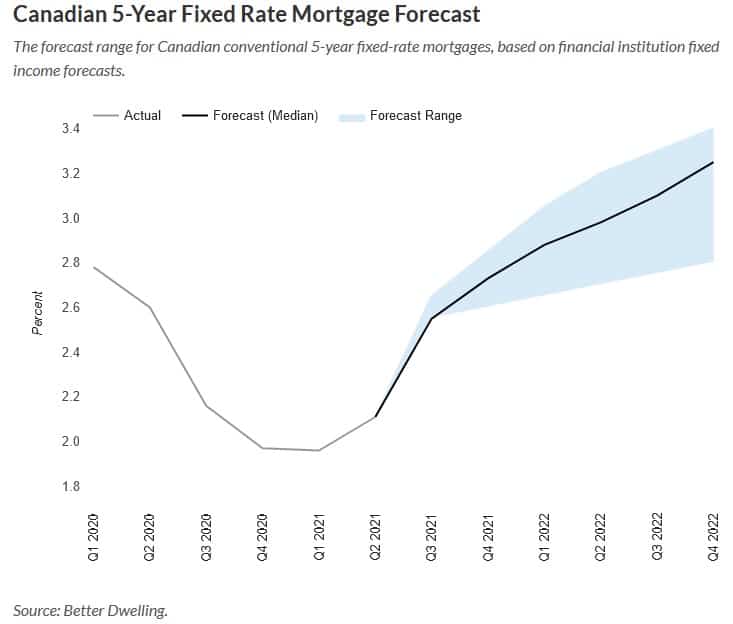

The Canadian economy is improving, excluding some minor hiccups like this morning’s GDP. An improved economy needs less stimulus, and that means higher mortgage rates. To see what Canada is in for, we modeled a forecast range for 5-year fixed-rate mortgages. If Canada doesn’t go into a double-dip recession, much higher mortgage rates are coming.

Canadian 5 Year Fixed-Rate Mortgage Forecast

Today we’re looking at 5-year fixed-rate mortgage interest, and where it’s heading. More specifically, we’ll be focusing on conventional (aka uninsured) mortgage rates. These are for homeowners with a decent amount of equity, and a loan to value ratio below 80%. Insured and variable rate mortgages follow a different path. However, they’ll generally follow the same trend.

This model is based on fixed income forecasts created by major financial institutions. Since they’re forecasting how much investors will make, we can forecast how much you’ll pay. Just a couple of quick notes for the nerds, and aspiring nerds.

The strength of the economy and the recovery are going to be big factors in determining how high these go. A stronger economy means a faster recovery, and along with that is higher mortgage rates. Weaker economic performance will generally mean lower rates to stimulate borrowing. As economic conditions change, so will these forecasts.

Credit liquidity will also play a role in the direction of mortgage rates. If there’s excess capital to lend, mortgage lenders tend to accept smaller margins. This helps to lower the cost of borrowing since they’ll make it up on revenue. If capital for mortgages becomes scarce, mortgage rates rise to adjust to demand.

Today’s chart assumes a medium level of credit liquidity. That is, not much excess, but it’s not scarce either. That’s how the mortgage market was pre-pandemic, and we’ll assume it goes back to that.

Canadian Mortgage Rates Are Going To Climb

Mortgage borrowing costs are likely to reach pre-pandemic levels soon. Our median 5-year fixed-rate forecast is 2.55% by the end of Q3 2021. Based on the most bullish yield forecast, it would rise to 2.65%. The downside yield forecast is the same as the median.

Most institutions have consistent near-term expectations. That sounds weird, but it makes sense. Near-term forecasts are the most visible, with the least number of variables compounding. As forecasts are further out, we’ll see the gap widen as their difference in outlook is magnified.

Canadian 5-Year Fixed Rate Mortgage Forecast

The forecast range for Canadian conventional 5-year fixed-rate mortgages, based on financial institution fixed income forecasts.

Mortgage Interest Rates Can Increase Substantially By Year-End

By the end of this year, we start to really see the potential for these rates to climb. By Q4 2021, the median forecast would put a typical 5-year fixed-rate mortgage at 2.73%. The forecast range becomes wider, going from 2.6% (low) to 2.85% (high). It may not sound like much, but it can have a big impact.

The rate of change is much more important than the actual number. If you go from a 2% rate to a 2.73% rate, your cost of interest rises 36.5%. If we exclude the stress test, buying power sees a 7.84% decline. Since recent buyers are mostly stress-tested, default isn’t much of an issue. However, the cost and size of debt can be.

Mortgages Rates May Rise More Than A Point By Next Year

Next year is going to be a big one for mortgage rates if the economy recovers as expected. The median 5-year fixed-rate forecast works out to 3.10% by the end of Q3 2022, which can lead to an 11.5% reduction in buying power. On the low end, the rate still comes in at 2.7%, reducing buying power by 8.0% outside of a stress test. The high range would see it climb all the way to 3.30%, pulling maximum mortgage credit 14.3% lower. Keep in mind the stress test rate may also adjust higher as well. It depends on how comfortable OSFI is with rates rising closer to their stress test number.

Another factor to consider here is the cost of the renewal. A $500,000 mortgage with a 5-year fixed rate of 2.0% would pay around $46,080 in interest over the term. If that rises to 3.1% next year, the cost of interest over the same period would be $72,183. I don’t know about you, but $26,000 is a decent chunk of money to spend over a year.

Existing mortgage holders close to renewal may want to text their mortgage broker. If you see the economy improving, locking in rates might save you a little money. It might not though, depending on whether you have prepayment penalties. It’s always best to run the numbers with a broker on various scenarios though.

Pending a double-dip recession doesn’t occur, higher mortgage rates are coming. Maybe not as high as the Desjardins forecast, but definitely higher than it is now. Those supersized mortgages with short terms are going to divert more capital from the economy on renewal. The takeaway isn’t how high mortgage rates can climb though. It’s how absurdly cheap mortgage debt has been during the pandemic.

Link to the actual article: https://betterdwelling.com/canadian-mortgage-rates-will-rip-higher-soon-heres-how-high/#_

TD adds interest on interest

TD is/ was the 1st and only bank to charge higher mortgage prime rate for their mortgages.

TD is now the 1st of the big banks to now charge interest on their late-interest-owed:

https://globalnews.ca/news/6451352/td-credit-cards-compound-interest/

History of Economic Bubbles

This is a most interesting info graphic

https://fortunly.com/infographics/historical-financial-bubbles-infographic/

Economic Bubbles: The History, Causes, and Effects

You don’t need to be an expert to understand what economic bubbles are and how they happen. The simplest definition is the rapid and unrealistic inflation of asset prices without any basis in the intrinsic value of the given asset.

Despite the fact that financial bubbles (also known as speculative bubbles) are not rare, people repeatedly fail to recognize speculative trading as it’s happening. Too often, those involved only identify these risky activities in the autopsy. Once the bubble bursts, it’s already too late.

One of the crucial reasons for this is that bubbles are often driven by strong emotions, blurring people’s ability to make rational decisions. When gung-ho traders who are willing to take huge risks start operating in that environment, you have a recipe for disaster.

Investors’ greed (believing that someone will pay more for something than they paid themselves) is accompanied by strong feelings of euphoria (“wow, this investment will be so profitable, let’s buy!”), but also anxiety. Buyers go into denial when prices start to fall (“this is just a temporary reversal, my investment is long-term”). Then, finally, panic sets in, causing a domino effect: everyone starts to sell, ultimately leading to a crash.

A bubble burst can have a devastating effect on the economy, even on a global scale. The most recent example is the Great Recession after the market crash in 2008. However, depending on the economic sector or industry, bubbles can also have some positive effects.

Just consider the dot-com bubble, which forced the information technology industry to consolidate. Although people lost a lot of capital at the time, that money has since been invested many times over in infrastructure, software, servers, and databases. Pretty much every American house and business is now connected to the internet, which has changed how we live and work for good.

The best way to prevent an asset bubble from happening is strategic, common-sense investing. Unfortunately, humans don’t always act sensibly. Bearing that in mind, chances are economic bubbles will continue to occur in the future.

To help you notice these patterns early, we at Fortunly have created an infographic detailing how some of the biggest financial bubbles in history have formed and then burst. Check it out to make sure you don’t fall victim to the hype of “the next big thing.”

Very coolMark Herman, Best Calgary Alberta Mortgage Broker

Inverted Yield Curves, Impacts on Prime Rate Changes and Variable Rate Mortgages

Summary:

For the 2nd time in 50 years the “Yield Curve” has inverted – meaning that long term rates are now lower than short term rates. This can signal a recession is on the way.

This Means …

- Alberta will look better comparatively to Canada’s hot housing markets which should finally cool down.

- Canada’s Prime rate increases look to be on hold until Spring. This makes the variable rates now look MUCH Better. There were 3 rate increases expected and these may not materialize – making the VARIABLE rate look better.

- Broker lender’s have VARIABLE rates that range between .1% and .65% BETTER than the banks do. If you are looking at variable rates we should look further into this in more detail.

DATA BELOW …

- More on the predictions on rate increases

- WTF is an inverted Yield Curve – lifted from “the Hustle”

-

Predictions on Prime

Three interest rate hikes in 2019 — that’s what economists have been predicting for months, as part of the Bank of Canada’s ongoing strategy to keep the country’s inflation levels in check. But, according to one economist, that plan may have changed.

The BoC held the overnight rate at 1.75 percent yesterday, and released a statement a senior economist at TD, believes hints that the next hike may not come until next spring.

“We no longer expect the Bank of Canada to hike its policy interest rate in January,” he writes, in a recent note examining the BoC’s decision. “Spring 2019 now appears to be the more likely timing.”

Meanwhile the Canadian rates and macro strategist at BMO, puts the odds of a rate hike in January at 50 percent.

“While the Bank reiterated its desire to get policy rates to neutral, the path to neutral is clearly more uncertain than just a couple of months ago,” he writes, in his most recent note. “Looking ahead to January, the BoC will likely need to be convinced to hike (rather than not).”

A VIDEO ON WHY VARIABLE RATE MAY BE THE WAY TO GO FOR YOUR PLANS

- https://vimeo.com/279581066

- This video is from my colleague Dustin Woodhouse and he perfectly presents the story on the variable. He also ONLY works in the BC Lower Mainland; if you live there HE should be doing your mortgage, if you don’t WE should be.

2. WTF is an ‘inverted yield curve,’ and what does it mean for the economy?

For the first time since 2007, the 2- to 5-year US Treasury yield curve has inverted. Historically, this has served as a somewhat reliable indicator of economic downturn, which means people are freaking out, which means…

OK, hold up: What exactly is a yield curve, and why is it inverting?

‘Lend long and prosper’ (so say the banks)

In short, a yield curve is a way to gauge the difference between interest rates and the return investors will get from buying shorter- or longer-term debt. Most of the time, banks demand higher interest for longer periods of time (cuz who knows when they’re gonna see that money again?!).

A yield curve goes flat when the premium for longer-term bonds drops to zero. If the spread turns negative (meaning shorter-term yields are higher than longer maturity debt), the curve is inverted…

Which is what is happening now

So what caused this? It’s hard to say — but we prefer this explanation: Since December 2015, the Fed has implemented a series of 6 interest rate hikes and simultaneously cut its balance sheet by $50B a month.

According to Forbes, the Fed has played a major part in suppressing long-term interest rates while raising short-term interest rates.

Yield curve + inversion = economic downturn (sometimes)

The data don’t lie. A yield curve inversion preceded both the first tech bubble and the 2008 market crash.

Though, this theory has had some notable “false positives” in its lifetime — so it’s not exactly a foolproof fortune teller.

Heck, IBM found the size of high heels tends to spike during hard times. As of now, the experts who believe the sky to be falling remain in the minority.

There is lots to digest in the data above. Please feel free to contact me to discuss in more detail.

Mark Herman, 403-681-4376

Top Calgary Alberta Mortgage Broker

Your Banking Relationship: They leverage your mortgage to rake in credit cards profits.

Below is part of an article where the bank is sad their mortgages are down 500% from last year. At the same time they made 16% more from ramming credit cards and Lines of Credits down their mortgage customer’s throats so it’s all okay in the end. For them… and how about for you?

The blue part shows that mortgage is the key to create what customers feel is a “relationship” with the bank so they can then sell you all their high margin products.

Broker lenders only “sell” 1 thing, mortgages, so consider separating your banking and your mortgage and get the best mortgage possible – through a broker lender.

“Having your mortgage at your bank is only convenient for them to rake it in off of your credit card fees.”

Mark Herman, top Calgary mortgage broker

Here is the article:

Bloomberg News, Doug Alexander, August 23, 2018 …

Canadian Imperial Bank of Commerce’s prediction of a mortgage slowdown has come true…

Despite the mortgage slowdown, CIBC posted a 16% jump in Canadian personal and commercial banking earnings due to a “significant” expansion … and growth in credit cards and unsecured loans amid rising interest rates, Chief Financial Officer Kevin Glass said.

“Those would be the major offsets in terms of mortgage growth declining,” Glass said in a phone interview. “Mortgages are a key product for us — it’s very important from a client relationship perspective — but it’s not a high margin product, so if mortgages come off it has a far smaller impact than rate increases do, for instance.”