Advice on Mortgage Renewals Before April 2026 from an MBA

Questions on what product to pick for your upcoming mortgage renewal.

Here are the reasons that we like the 5 year fixed for Canadian mortgage renewals over the next few months.

(renewals from now, February 2nd until April 1st.)

This data is recent and should be good for the next few months.

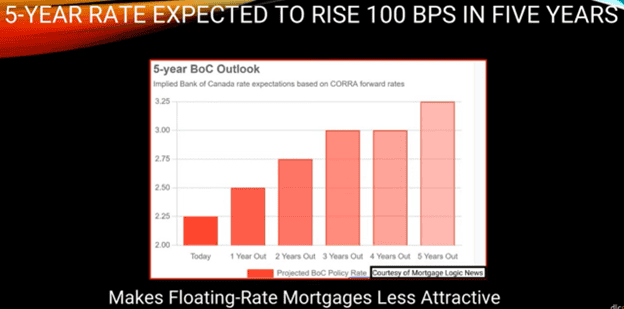

Below are the graphs that show that rates are trending up and are on the increase.

Q: Why are rates trending up?

A: Because Trump policy is generally inflationary, and add in the “cost of uncertainty” due to changing tariffs and other world political issues we have an increasing rate environment.

Big Picture Perspective

I also look at from this perspective, rates were close to 4% BEFORE Covid in 2020, and we are now back to about the same; 3.99% for a 3-year fixed and 4.25% to 4.54% for a 5 year fixed rate term.

- Comparing these rates, there is not much room for rates to go down; maybe .5%, half a percent.

- But there is lots of room for them to go up.

What if things get out of hand and rates are at 6% or 7%?

When I started out in 2004, my first customer’s rate was 8.99% and they were happy it did not start with a 9. (You always remember your first deal.)

Summary

The rates for the 3 year fixed and the 5 year fixed are similar so take the 5 year and know you are getting a good rate at the bottom of the rate cycle.

If you take the 3 year and rates DO go up, and you then renew 2 years sooner into what could be 6% or 7% rate environment (when you could have had 2 more years at 4.zz%.) You will be pretty upset as your new monthly payment would now be higher even though your balance is lower.

If you take the 3 year fixed and the rates stay low then you gain a slightly lower payment ($25/ month) over the first 3 years.

Most of our customers agree the safer bet is less expensive when you factor in how sound you will sleep at night.

Mortgage Mark Herman, best Calgary broker for mortgage renewals and advice.

Variable Rate or Fixed Rate for Renewals in 2026?

Here is what a math-based, mortgage broker with 21 years of experience and an MBA in finance looks at when deciding what to do for my own mortgage renewal.

This is a super common question as there are still 1,800,000 Canadian mortgage renewals to come before summer 2027, with the same 1.8M renewals completed since 2025.

Numbers at the top, words at the bottom.

Numbers

Variable Rate in 2024 = 6.20%

(Prime – .90% = 7.2% – .9% = 6.2% rate.)

-2.75% rate drops = 3.45% today, Jan 2026.

Variable Rate in 2026 = 3.75% today

(Prime – .70% = 4.45% – .7% = 3.75% rate.)

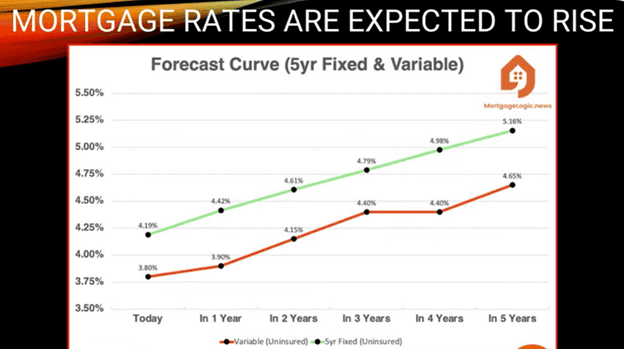

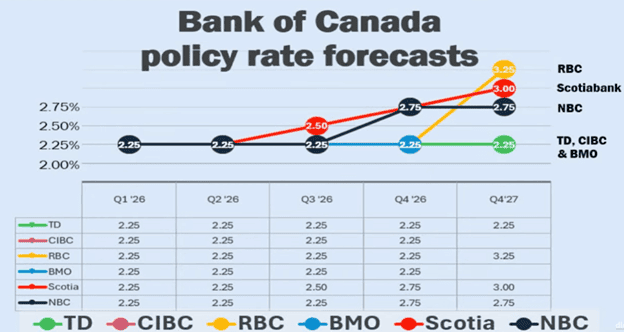

No rate drops expected, 2x .25% increases expected = 3.75% + .5 = 4.25% by the end of 2026.

Continued instability will lead to more rate increases later.

5-year Fixed Rates

5.09% in 2024

4.24% today – 2026

Analysis

Variable wins by .5% today, but fully expect 2 x o.25% increase in 2026 to make the rate the same as fixed rates are today, Jan 2026.

Fixed rates are now, and will continue to slowly rise, as Trump policy is highly inflationary.

If you take a variable now, and then go to lock it in later, when variable rates / prime rates start to increase, the rate you lock in at will be higher than today.

Summary

Rates look to have bottomed out right now, from looking many data points.

Fixed rates are ½% higher than the variable rates today – Jan 2026.

Then what? In 2024 I was able to precisely layout the next 18 months and predicted every rate increase exactly as it played out. Right now it is not possible to guess what will happen next month so Variable has higher risk and will probably pay more later as the rates increase as expected.

200 Word Summary

Canada’s variable-rate mortgage borrowers have enjoyed significant relief since the Bank of Canada (BoC) began cutting interest rates in 2024, but that momentum is expected to slow—and probably reverse – in 2026.

The BoC delivered 2.75% of rate cuts through 2024–2025, bringing the policy rate down to 2.25%. This helped push insured variable mortgage rates below 4%, down from around 7% in mid-2024.

However, the BoC now views inflation risks as too elevated to justify further cuts, and rate relief for variable-rate borrowers is “mostly behind us.”

The bank’s baseline forecast suggests the BoC’s policy rate could rise back toward its long-term neutral level of 2.75%, which would push variable mortgage rates up by roughly 0.5% in 2026, with additional increases probable in 2027.

Meanwhile, fixed mortgage rates have fallen less dramatically because they are tied to longer-term bond yields, which rebounded in late 2025. Borrowers have increasingly favored 3-year fixed and 5-year fixed terms, anticipating improved renewal conditions ahead when they renew later.

Bottom line: 2026 could prove challenging for variable-rate borrowers. The era of large variable-rate relief seems to be ending, and 2026 may test borrowers who relied on those lower rates — especially if the BoC keeps rates steady or reverses course

Looking at all of this, in March, I will be renewing into the 5-year fixed so I can sleep at night.

Mortgage Mark Herman, MBA, Top Calgary mortgage broker for 21 years.

The Bank of Canada maintains interest rate policy to end 2025

The Bank of Canada announced today that it is keeping its benchmark interest rate at 2.25%. This hold-the-line approach reflects the Bank’s expert interpretation of macroeconomic data.

We summarize the Bank’s observations and its outlook below.

Know this, fixed rates are trending up due to multiple factors, but mostly long term government debts, especially in the USA.

Now is a great time to buy while prices are soft, there are lots of listings, and rates are around the 4% mark

Mortgage Mark Herman, MBA; 1st time home buying specialist, and move-up mortgage broker

Canadian Economic Performance and Near-Term Outlook

- The Canadian economy grew by a “surprisingly” strong 2.6% in the third quarter, even as final domestic demand was flat

- The BoC notes that the increase in GDP largely reflected volatility in trade

- The Bank expects final domestic demand will grow in the fourth quarter, but with an anticipated decline in net exports, GDP will likely be “weak”

- Growth is forecast to pick up in 2026, although uncertainty remains high and large swings in trade may continue to cause quarterly volatility

Canadian Labor Market

- Canada’s labour market is showing “some signs” of improvement

- Employment has shown solid gains in the past three months and the unemployment rate declined to 6.5% in November

- Nevertheless, job markets in trade-sensitive sectors remain weak and economy-wide hiring intentions continue to be subdued

Canadian Inflation and Outlook

- Inflation measured by the Consumer Price Index (CPI) slowed to 2.2% in October, as gasoline prices fell and food prices rose more slowly

- CPI inflation has been close to the Bank’s 2% target for more than a year, while measures of core inflation remain in the range of 2.5% to 3%

- The Bank assesses that underlying inflation is still around 2.5%

- In the near term, CPI inflation is likely to be higher due to the effects of last year’s GST/HST holiday on the prices of some goods and services

- Looking through this “choppiness,” the Bank expects ongoing economic slack to roughly offset cost pressures associated with the “reconfiguration” of trade, keeping CPI inflation close to the 2% target

Global Economic Performance

- Major economies around the world continue to show resilience to US trade protectionism, but uncertainty is still high

- In the United States, economic growth is being supported by strong consumption and a surge in AI investment

- The US government shutdown caused volatility in quarterly growth and delayed the release of some key economic data

- Tariffs are causing some upward pressure on US inflation

- In the euro area, economic growth has been stronger than expected, with the services sector showing particular resilience

- In China, soft domestic demand, including more weakness in the housing market, is weighing on growth

- Global financial conditions, oil prices, and the Canadian dollar are all “roughly unchanged” since the Bank’s Monetary Policy Report in October

Outlook

The Bank offers that if inflation and economic activity evolve broadly in line with its October projection, it sees its current policy interest rate “at about the right level” to keep inflation close to 2% while helping the economy through this period of structural adjustment.

However, the Bank also says that if uncertainty remains elevated and its outlook changes, “we are prepared to respond.”

#1 Mortgage Rate SPECIAL in Canada ⚡

|

|

|

Probably the end of Mortgage Rate Reductions for Canada

Expert opinions on Bank of Canada interest rate cuts are shifting. A growing number of market watchers are backing away from their predictions of two more reductions this year. Several are now saying the Bank has likely reached the end of the current trimming cycle.

Back in April we said that Prime is probably going to stay where it is now; discounting the expected 4 more reduction to 0.

that looks to have come true.

5-year fixed is the way to go to side-step all the world’s recent happenings .

Mortgage Mark Herman, best Calgary mortgage broker near me.

The central bank held its trend-setting Policy Rate at 2.75% for a second time in its decision on June 4. Since then, inflation numbers and Gross Domestic Product readings have given the BoC reasonable grounds to stand pat.

Statistics Canada’s latest figures for GDP show it declined by 0.1% in April compared to March. Much of that decline was led by the manufacturing sector, which is falling victim to U.S. tariffs and trade uncertainty. A similar reduction is forecast for May. While many economists admit the slowdown shows the economy is softening, they say it is not on the verge of collapse. GDP is 1.3% higher that it was a year earlier.

The other key factor in the Bank’s rate decisions, inflation, held steady at 1.7% in May. That headline number is actually below the Bank’s target of 2.0% and would normally suggest there is room for a further rate cut. However, that is a little deceiving.

Headline inflation (aka the Consumer Price Index) continued to be skewed by the elimination of the consumer carbon tax. As well, core inflation, which is the BoC’s preferred measure, remains stuck at 3.0%, which is the high end of the Bank’s desired inflation range.

The Bank finds itself trying to balance economic growth against the risk of rising inflation. The Bank’s next interest rate announcement is set for July 30.

BMO & CIBC: Not on list of Top-11 banks in Canada

Wow hey??

Who would guess that 2 of Big-6 banks that millions of Canadians “think they have a financial relationship with” did not even make the list of the Top-11 banks in Canada.

It is surprising the amount of customers that call us looking to “beat their bank’s mortgage rate” when they should be looking at if they should even be doing mortgage business at their main personal bank.

Mortgage Mark Herman, Calgary Alberta new home buyer and mortgage renewal specialist of 21 years.

We recommend that they also look at the T’s & C’s – Terms and Conditions – to their own bank’s mortgages to find:

- Payout penalties that are 500% to 800% – yes, 5x to 8x the amount of payout penalties at broker banks.

- Their renewal rates are usually always at rates higher than what Broker Banks offer – because Broker Banks know the broker that placed you there will jump at the chance to move them to a different bank, for a better/ market rate, and then we get paid again. Big-6 banks don’t have to worry about that because you are usually not aware of market rates.

- SELF-employed mortgage holders are often “worked over by the Big-6 banks” whereas, Broker Banks are more than happy doing tons for self-employed business owners.

Here’s the full list of Canada’s best banks for 2025, according to Forbes:

- Tangerine

- Simplii Financial

- RBC

- PC Financial

- Vancity

- EQ Bank

- TD

- Scotiabank

- National Bank

- Desjardins

- ATB Financial

footnote: link action here https://www.narcity.com/best-banks-in-canada-forbes-2025

Canada’s New Capital Gains Tax Rules and Mortgages

Next pressing issue after 25% tariffs is the Canadian Federal Government’s decision to delay the implementation of its new capital gains tax rules until 2026.

In the 2024 budget Ottawa was set to increase the capital gains inclusion rate – the portion of gains that is taxable – from 50% to 66.7% for individuals earning over $250,000 in annual capital gains, as well as for corporations and most types of trusts.

- That plan has now been pushed back to January 1, 2026.

- For average Canadians this would mainly affect those selling a second residence, such as a cottage.

- The delay could see some properties come onto the market with owners hoping to take advantage of the tax saving.

The government caused panic-selling of Cottage Country Cabins in Ontario, and has now paused the capital gains tax.

We hope this pause will allow a normal sales cycle to take place.

Mortgage Mark Herman, Calgary Alberta mortgage broker near me

Variable Rate Beats BOTH 3-year & 5-year Fixed Terms

The Variable is the best way to go right now and this blue link has all the details in PDF: VARIABLE RATE beats both 3-year fixed & 5-year fixed terms

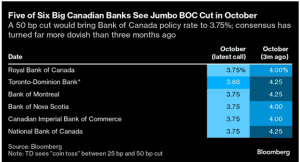

Data point 1: Variable rates should be coming down 2% in the next 13.5 months, with a “jumbo reduction” of 0.5% (1/2%) expected on Wednesday, Oct 23rd – by 5 of the 6 Big Banks.

Data point 2: Historically, fixed rates only go down about 40% of the reductions to Prime, so fixed rates will not be going down anywhere near as much or as fast as the Variable.

Data point 3: Just a 1% rate reduction is expected to “reactivate” at least half of buyers who previously stopped shopping due to “buyer fatigue.”

Data point 4: As interest rates come down, prices INCREASE because most buyer’s need to go to their max mortgage when buying.

Graphic details of expected rate reductions and the dates of expected changes, in PDF: VARIABLE RATE beats both 3-year fixed & 5-year fixed terms

Our favorite customer quote so far in October:

I am not locking in 3-year money nor 5-year money today, when the Bank of Canada has made it clear rates are coming down 2% in the next 15 months.

Mortgage Mark Herman, Top Calgary Alberta Mortgage Broker near me.

Prime to be 2% LOWER in 15 months, Dates of drops, Variable rate wins: Fall 2024

Yes, with the writing on the wall for the coming Prime rate decreases the Variable rate is the way to go.

Variable rates are based on Consumer Prime, which moves the exact same as the Bank of Canada’s “overnight rate.” The decreases in the overnight rate will be the same for Consumer Prime and they are below.

So Sept 4, 2024, Prime will go from 6.7% to 6.45%

Canadian Consumer Prime – what Variable Rates are based on – will be these rates here.

If your “discount is Prime – 0.95%” then your rate would be this number below – 0.95%. And as you can see, this is way better than the 3-year fixed at 4.84% or the 5- year fixed at 4.69% today.

- September 4, 2024: 6.45%

- October 23, 2024: 6.20%

- December 11, 2024: 5.95%

- January 2025: 5.70%

- March 2025: 5.45%

- April 2025: 5.20%

- June 2025: 4.95%

- September 2025: 4.70%

- October 2025: 4.45%

- December 2025: 4.20%

Article is here: Bank of Canada’s policy interest rate could dip to 2.75% by late 2025:

forecast:: https://dailyhive.com/vancouver/bank-of-canada-policy-interest-rate-forecast-2025-credit-1

Predictions of the article for the rate drops: Credit 1’s Bank of Canada policy interest rate forecast, as updated on August 26, 2024:

-

- September 4, 2024: 4.25%

- October 23, 2024: 4.0%

- December 11, 2024: 3.75%

- January 2025: 3.5%

- March 2025: 3.5%

- April 2025: 3.25%

- June 2025: 3.25%

- September 2025: 3.0%

- October 2025: 2.75%

- December 2025: 2.75%

Canadian Prime Rate Drops to 4.5%

Horray – the rates are dropping.

We expect to see a total of 2 MORE rate reductions of 0.25% each in 2024.

5 x o.25% reductions are expected in 2025 making the variable the better way to go right now.

Mortgage Mark Herman

DATA

Encouraged by underling trends in the Canadian economy, the Bank of Canada today cut its overnight policy interest rate by 0.25% to 4.50%.

This is the second incremental reduction we’ve seen in as many months and while both cuts have been modest, they are moving Canada toward less restrictive monetary policy.

We summarize the Bank’s rationale for this decision by summarizing its observations below, including its forward-looking comments for signs of what may happen next.

Canadian inflation including shelter inflation

- Inflation measured by the Consumer Price Index moderated to 2.7% in June after increasing in May

- Broad inflationary pressures are easing, and the Bank’s preferred measures of core inflation have been below 3% for several months and the breadth of price increases across components of the CPI is now near its historical norm

- Shelter price inflation remains high, driven by rent and mortgage interest costs, and is still the biggest contributor to total inflation

- Inflation is also elevated in services that are closely affected by wages, such as restaurants and personal care

Canadian economic performance and outlook

- Economic growth “likely” picked up to about 1.5% through the first half of 2024, however, with robust population growth of about 3%, the economy’s potential output is still growing faster than GDP, which means excess supply has increased

- Household spending, including both consumer purchases and housing, has been “weak”

- There are signs of slack in the labour market with the unemployment rate rising to 6.4% and with employment continuing to grow more slowly than the labour force and job seekers taking longer to find work

- Wage growth is showing some signs of moderating, but remains elevated

- GDP growth is forecast to increase in the second half of 2024 and through 2025, reflecting stronger exports and a recovery in household spending and business investment as borrowing costs ease

- Residential investment is expected to grow robustly

- With new government limits on admissions of non-permanent residents, population growth should slow in 2025

Global economic performance and outlook

- The global economy is expected to continue expanding at an annual rate of about 3% through 2026

- While inflation is still above central bank targets in most advanced economies, it is forecast to ease gradually

- In the United States, an anticipated economic slowdown is materializing, with consumption growth moderating and US inflation appearing to resume its downward path

- In the euro area, growth is picking up following a weak 2023

- China’s economy is growing modestly, with weak domestic demand partially offset by strong exports

- Global financial conditions have eased, with lower bond yields, buoyant equity prices, and robust corporate debt issuances

- The Canadian dollar has been relatively stable and oil prices are around the levels assumed in the Bank’s April’s Monetary Policy Report

Summary comments and outlook

The Bank forecasts that Canadian GDP will grow at 1.2% in 2024, 2.1% in 2025, and 2.4% in 2026 and that a strengthening economy will gradually absorb excess supply through 2025 and into 2026.

As a result of an easing in broad price pressures, the Bank expects inflation to move closer to 2%, its long-stated goal. As a result, the Bank’s Governing Council decided to reduce the policy interest rate by 25 basis points.

It further noted that while ongoing excess supply is lowering inflationary pressures, price pressures in some important parts of the economy—notably shelter and some other services—are “holding inflation up.”

Accordingly, the Bank said it is carefully assessing these “opposing forces.” Monetary policy decisions therefore will be guided by incoming information and the Bank’s assessment of the implications for the inflation outlook.

Once again, the statement noted in conclusion that the Bank remains “resolute in its commitment to restoring price stability for Canadians.”

Next Up

The Bank returns on September 4th with its next monetary policy announcement.