BMO & CIBC: Not on list of Top-11 banks in Canada

Wow hey??

Who would guess that 2 of Big-6 banks that millions of Canadians “think they have a financial relationship with” did not even make the list of the Top-11 banks in Canada.

It is surprising the amount of customers that call us looking to “beat their bank’s mortgage rate” when they should be looking at if they should even be doing mortgage business at their main personal bank.

Mortgage Mark Herman, Calgary Alberta new home buyer and mortgage renewal specialist of 21 years.

We recommend that they also look at the T’s & C’s – Terms and Conditions – to their own bank’s mortgages to find:

- Payout penalties that are 500% to 800% – yes, 5x to 8x the amount of payout penalties at broker banks.

- Their renewal rates are usually always at rates higher than what Broker Banks offer – because Broker Banks know the broker that placed you there will jump at the chance to move them to a different bank, for a better/ market rate, and then we get paid again. Big-6 banks don’t have to worry about that because you are usually not aware of market rates.

- SELF-employed mortgage holders are often “worked over by the Big-6 banks” whereas, Broker Banks are more than happy doing tons for self-employed business owners.

Here’s the full list of Canada’s best banks for 2025, according to Forbes:

- Tangerine

- Simplii Financial

- RBC

- PC Financial

- Vancity

- EQ Bank

- TD

- Scotiabank

- National Bank

- Desjardins

- ATB Financial

footnote: link action here https://www.narcity.com/best-banks-in-canada-forbes-2025

Canada’s New Capital Gains Tax Rules and Mortgages

Next pressing issue after 25% tariffs is the Canadian Federal Government’s decision to delay the implementation of its new capital gains tax rules until 2026.

In the 2024 budget Ottawa was set to increase the capital gains inclusion rate – the portion of gains that is taxable – from 50% to 66.7% for individuals earning over $250,000 in annual capital gains, as well as for corporations and most types of trusts.

- That plan has now been pushed back to January 1, 2026.

- For average Canadians this would mainly affect those selling a second residence, such as a cottage.

- The delay could see some properties come onto the market with owners hoping to take advantage of the tax saving.

The government caused panic-selling of Cottage Country Cabins in Ontario, and has now paused the capital gains tax.

We hope this pause will allow a normal sales cycle to take place.

Mortgage Mark Herman, Calgary Alberta mortgage broker near me

Variable Rate Beats BOTH 3-year & 5-year Fixed Terms

The Variable is the best way to go right now and this blue link has all the details in PDF: VARIABLE RATE beats both 3-year fixed & 5-year fixed terms

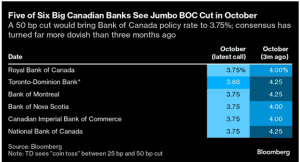

Data point 1: Variable rates should be coming down 2% in the next 13.5 months, with a “jumbo reduction” of 0.5% (1/2%) expected on Wednesday, Oct 23rd – by 5 of the 6 Big Banks.

Data point 2: Historically, fixed rates only go down about 40% of the reductions to Prime, so fixed rates will not be going down anywhere near as much or as fast as the Variable.

Data point 3: Just a 1% rate reduction is expected to “reactivate” at least half of buyers who previously stopped shopping due to “buyer fatigue.”

Data point 4: As interest rates come down, prices INCREASE because most buyer’s need to go to their max mortgage when buying.

Graphic details of expected rate reductions and the dates of expected changes, in PDF: VARIABLE RATE beats both 3-year fixed & 5-year fixed terms

Our favorite customer quote so far in October:

I am not locking in 3-year money nor 5-year money today, when the Bank of Canada has made it clear rates are coming down 2% in the next 15 months.

Mortgage Mark Herman, Top Calgary Alberta Mortgage Broker near me.

Prime to be 2% LOWER in 15 months, Dates of drops, Variable rate wins: Fall 2024

Yes, with the writing on the wall for the coming Prime rate decreases the Variable rate is the way to go.

Variable rates are based on Consumer Prime, which moves the exact same as the Bank of Canada’s “overnight rate.” The decreases in the overnight rate will be the same for Consumer Prime and they are below.

So Sept 4, 2024, Prime will go from 6.7% to 6.45%

Canadian Consumer Prime – what Variable Rates are based on – will be these rates here.

If your “discount is Prime – 0.95%” then your rate would be this number below – 0.95%. And as you can see, this is way better than the 3-year fixed at 4.84% or the 5- year fixed at 4.69% today.

- September 4, 2024: 6.45%

- October 23, 2024: 6.20%

- December 11, 2024: 5.95%

- January 2025: 5.70%

- March 2025: 5.45%

- April 2025: 5.20%

- June 2025: 4.95%

- September 2025: 4.70%

- October 2025: 4.45%

- December 2025: 4.20%

Article is here: Bank of Canada’s policy interest rate could dip to 2.75% by late 2025:

forecast:: https://dailyhive.com/vancouver/bank-of-canada-policy-interest-rate-forecast-2025-credit-1

Predictions of the article for the rate drops: Credit 1’s Bank of Canada policy interest rate forecast, as updated on August 26, 2024:

-

- September 4, 2024: 4.25%

- October 23, 2024: 4.0%

- December 11, 2024: 3.75%

- January 2025: 3.5%

- March 2025: 3.5%

- April 2025: 3.25%

- June 2025: 3.25%

- September 2025: 3.0%

- October 2025: 2.75%

- December 2025: 2.75%

Canadian Prime Rate Drops to 4.5%

Horray – the rates are dropping.

We expect to see a total of 2 MORE rate reductions of 0.25% each in 2024.

5 x o.25% reductions are expected in 2025 making the variable the better way to go right now.

Mortgage Mark Herman

DATA

Encouraged by underling trends in the Canadian economy, the Bank of Canada today cut its overnight policy interest rate by 0.25% to 4.50%.

This is the second incremental reduction we’ve seen in as many months and while both cuts have been modest, they are moving Canada toward less restrictive monetary policy.

We summarize the Bank’s rationale for this decision by summarizing its observations below, including its forward-looking comments for signs of what may happen next.

Canadian inflation including shelter inflation

- Inflation measured by the Consumer Price Index moderated to 2.7% in June after increasing in May

- Broad inflationary pressures are easing, and the Bank’s preferred measures of core inflation have been below 3% for several months and the breadth of price increases across components of the CPI is now near its historical norm

- Shelter price inflation remains high, driven by rent and mortgage interest costs, and is still the biggest contributor to total inflation

- Inflation is also elevated in services that are closely affected by wages, such as restaurants and personal care

Canadian economic performance and outlook

- Economic growth “likely” picked up to about 1.5% through the first half of 2024, however, with robust population growth of about 3%, the economy’s potential output is still growing faster than GDP, which means excess supply has increased

- Household spending, including both consumer purchases and housing, has been “weak”

- There are signs of slack in the labour market with the unemployment rate rising to 6.4% and with employment continuing to grow more slowly than the labour force and job seekers taking longer to find work

- Wage growth is showing some signs of moderating, but remains elevated

- GDP growth is forecast to increase in the second half of 2024 and through 2025, reflecting stronger exports and a recovery in household spending and business investment as borrowing costs ease

- Residential investment is expected to grow robustly

- With new government limits on admissions of non-permanent residents, population growth should slow in 2025

Global economic performance and outlook

- The global economy is expected to continue expanding at an annual rate of about 3% through 2026

- While inflation is still above central bank targets in most advanced economies, it is forecast to ease gradually

- In the United States, an anticipated economic slowdown is materializing, with consumption growth moderating and US inflation appearing to resume its downward path

- In the euro area, growth is picking up following a weak 2023

- China’s economy is growing modestly, with weak domestic demand partially offset by strong exports

- Global financial conditions have eased, with lower bond yields, buoyant equity prices, and robust corporate debt issuances

- The Canadian dollar has been relatively stable and oil prices are around the levels assumed in the Bank’s April’s Monetary Policy Report

Summary comments and outlook

The Bank forecasts that Canadian GDP will grow at 1.2% in 2024, 2.1% in 2025, and 2.4% in 2026 and that a strengthening economy will gradually absorb excess supply through 2025 and into 2026.

As a result of an easing in broad price pressures, the Bank expects inflation to move closer to 2%, its long-stated goal. As a result, the Bank’s Governing Council decided to reduce the policy interest rate by 25 basis points.

It further noted that while ongoing excess supply is lowering inflationary pressures, price pressures in some important parts of the economy—notably shelter and some other services—are “holding inflation up.”

Accordingly, the Bank said it is carefully assessing these “opposing forces.” Monetary policy decisions therefore will be guided by incoming information and the Bank’s assessment of the implications for the inflation outlook.

Once again, the statement noted in conclusion that the Bank remains “resolute in its commitment to restoring price stability for Canadians.”

Next Up

The Bank returns on September 4th with its next monetary policy announcement.

Prime now 6.95% from 7.20%: BoC reduces its benchmark interest rate to 4.75%

Today, the Bank of Canada reduced its overnight policy interest rate by 0.25% to 4.75%. This welcome and widely expected decision comes on the heels of evidence pointing to a deceleration of the rate of inflation.

SUMMARY:

The “overnight rate” being quoted is the rate that Banks borrow from each other at, not consumer Prime, which is confusing.

Canadian Consumer Prime has just been reduced from 7.20% to 6.95% – this only affects Variable Rate mortgages.

Fixed rates remain unchanged because they track the Canadian Mortgage Bond Rates which are different, and similar.

There has also been about 40 “silent” fixed rate reductions of o.o5% each in 2024 that the press did not cover.

Mortgage Mark Herman, Top best Calgary Alberta mortgage broker specializing in 1st time buyers

Below we examine the Bank’s rationale for this move by summarizing its observations below, including its all-important outlook comments that are sure to shape market expectations for the remainder of the year.

Canadian inflation

- Inflation measured by the Consumer Price Index (CPI) eased further in April to 2.7%

- The Bank’s preferred measures of core inflation also slowed and three-month indicators suggest continued downward momentum

- Indicators of the breadth of price increases across components of the CPI have moved down further and are near their historical average, however, shelter price inflation remains high

Canadian economic performance and housing

- Economic growth resumed in the first quarter of 2024 after stalling in the second half of last year

- At 1.7%, first-quarter GDP growth was slower than the Bank previously forecast with weaker inventory investment dampening activity

- Consumption growth was solid at about 3%, and business investment and housing activity also increased

- Labour market data show Canadian businesses continue to hire, although employment has been growing at a slower pace than the working-age population

- Wage pressures remain but look to be moderating gradually

- Overall, recent data suggest the economy is still operating in excess supply

Global economic performance and bond yields

- The global economy grew by about 3% in the first quarter of 2024, broadly in line with the Bank’s April Monetary Policy Report projection

- The U.S. economy expanded more slowly than was expected, as weakness in exports and inventories weighed on activity

- In the euro area, activity picked up in the first quarter of 2024 while China’s economy was also stronger in the first quarter, buoyed by exports and industrial production, although domestic demand remained weak

- Inflation in most advanced economies continues to ease, although progress towards price stability is “bumpy” and is proceeding at different speeds across regions

- Oil prices have averaged close to the Bank’s assumptions, and financial conditions are little changed since April

Summary comments and outlook

The Bank cited continued evidence that underlying inflation is easing for its decision to change its policy interest rate. More specifically, it said that “monetary policy no longer needs to be as restrictive.”

Also welcome was the Bank’s statement that “recent data” have “increased our confidence that inflation will continue to move towards” its 2% target.

However, it also added this to its outlook: “Nonetheless, risks to the inflation outlook remain. Governing Council is closely watching the evolution of core inflation and remains particularly focused on the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behaviour.”

And has it has been doing for some time, it said the Bank “remains resolute in its commitment to restoring price stability for Canadians.”

Next up

The Bank returns on July 24th with its next monetary policy announcement – I think they will do another 0.25% reduction at the next meeting and they will continue to reduce at every meeting for the next 3 meetings this year.

Current Risks to the Canadian Mortgage Market? May 15th, 2024

Summary:

May 21, 2024 is when the inflation a report comes out and it should be the determining factor if the Canadian PRIME RATE of INTEREST is reduced from 7.2% in June or not. Maybe July. Maybe later.

Nobody is buying anything big right now, which is the idea … to reduce inflation.

Which means now is the best time to buy a home before everyone waiting for rates to drop jumps in on the 1st Prime rate reduction.

Says Mortgage Mark Herman, Calgary Alberta best/ top/ mortgage broker for first time home buyers

DATA:

Mortgage holders have been anxiously waiting for the Bank of Canada to cut interest rates. The increase of 90,400 jobs in April – 5 times what analysts expected – has heightened concerns that the Bank will continue to wait before lowering rates. 🙁

While the economy has not slowed as much as expected, there’s growing economic slack, with the jobless rate up 1 percentage point over the past year and a 24% year-over-year increase in the number of unemployed individuals, which is slowing down wage growth. The crucial factor in determining whether a rate cut will occur in June or be postponed to later this year hinges on the April CPI release scheduled for May 21st.

In the background of these deliberations, the Bank of Canada also assesses various potential risks to the economy. Last week, the Bank released its Financial Stability Report, highlighting two key risks: debt serviceability and asset valuations.

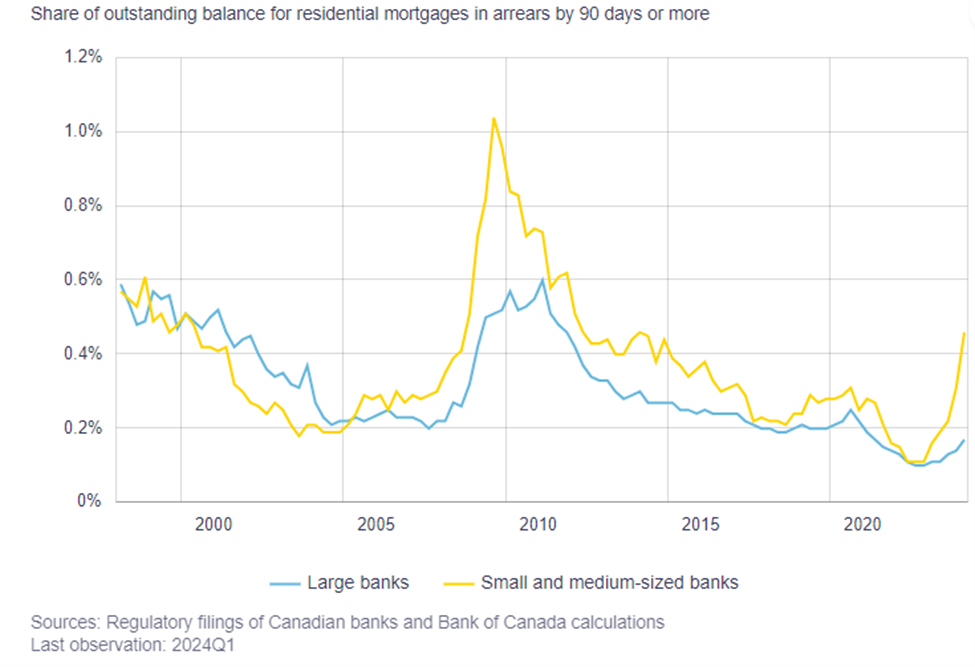

The report notes that the share of mortgage holders who are behind on their credit cards and auto loan payments, which had hit historic lows during the pandemic, has now returned to more normal levels. It also notes that smaller mortgage lenders are seeing an uptick in credit arrears. This increase isn’t surprising, given the run up in rates and the market segment that these lenders cater to. While the arrears rate is up, it remains relatively low compared to historical levels.

This overall positive portfolio performance is due to two key factors: 1) financial flexibility and 2) employment.

Canadian mortgage defaults tend to spike up during periods of rising unemployment. While the unemployment rate has risen, it remains relatively low. Additionally, mortgagors are holding higher levels of liquid assets. Before the pandemic, homeowners with a mortgage held 1.2 months of liquid reserves, which increased to 2.2 months during the pandemic and has since fallen to 1.8 months. These increased reserves provide a solid buffer for mortgagors to meet unexpected increases in expenses.

The Bank remains concerned that nearly half of all outstanding mortgages have yet to be renewed, leaving these borrowers at risk of payment shock due to the increase in interest rates. Scotiabank is an interesting case because, unlike other banks, it offers adjustable-rate mortgages (ARM) with variable payments instead of variable rate mortgages with fixed payments. Scotia has seen its 90+ days past due rate increase from 0.09% to 0.16%. During their fourth-quarter earnings call, Scotia noted that ARM borrowers have been cutting back on discretionary spending by 11% year-over-year, compared to a 5% reduction among fixed-rate clients.

The mortgage maturity profile in the Financial Stability Report suggests that we could see significant slowing in consumer discretionary spending over the next two years. While the rise in debt-servicing costs will be partially offset by income growth, we should expect to see belt tightening by mortgage holders. This poses less of a risk to the banking sector mortgage market than to the overall outlook for the economy.

Net Migration to Alberta – #’s here.

the CORE reason home prices in Calgary will be going up for the next 4 years, and are 100% supported and will not be coming down is summed up in this article right here.

https://www.cbc.ca/news/canada/calgary/alberta-population-records-2023-to-2024-data-1.7157110

Summary of the Main Reasons Home Prices are Supported:

- BC and Ontario home prices are DOUBLE Calgary home prices

- 4 million New Canadians on the way here in the next 5 years.

- We hatched the largest 20 – 29 year old population Canada has EVER had, and they are moving out of their parent’s basements and buying their own homes.

- Alberta does NOT have PST

- Alberta does not have a 1% “welcome to the neighborhood tax” when buying property.

After researching the above data points we can confidently say all 5 of these stacked factors will cause home prices to increase is all price ranges for the next few years.

Mortgage Mark Herman, licensed as a top Alberta Mortgage Broker for 21 years and 1 year in BC

Using Business Income / Corporate Income to Qualify for a Mortgage in Canada, 2024

Are you self- employed and thinking about, or hopping to use your own business income or corporate income to help you qualify for a mortgage?

It is possible, but not very common, as it usually does not help as much as we hope it would.

Mortgage Mark Herman, best Calgary Alberta mortgage broker for self-employed buyers

For RESIDENTIAL Purposes:

Very few lenders (like 3 out of 40+) will consider using business income that is not on personal taxes.

- When they will allow the business income added in, they only use between 40-60% of the net business income after dividends paid.

- They wouldn’t allow the operating company to actually be on mortgage/title;

- it would be in personal name or

- Hold Co name (with full personal guarantee, for the full mortgage amount – with full recourse. Meaning they can/ do/ will sue you into bankruptcy if they need to foreclose.)

Docs Needed

They do need to review more data than usual if trying to use business financials. I addition to the regular documents needed (2 years of T1 Generals, and NOAs and T4’s if there is T4 income), add in these docs:

For the Business:

- 2 years of professional accountant prepared financial statements

- including a signed ‘Notice to Reader’ and

- Need a compilation of all billing engagements for the fiscal periods

Catch – there are always a few:

If the property in question has a large shop – it is usually not allowed in determining the value so a higher mortgage amount is usually required.

They also have a hard time if there is any income to be derived from the property.

Acreage Details

Max land is limited to 4, 8, or 10 acres – depending on lender

- Only the home, de/attached garage and 4 acres are used for valuation by lender.

- NO value is attributed to: out-buildings, sheds, riding rings, stables, storage, nor fences

- Many of which could be valued at 200k+, like fences and buildings.

Updated: Using Disability Income to Qualify for a Canadian Mortgage: 2024

NOTE: this post has been updated in August 2024.

CAN DISABILITY INCOME BE USED TO QUALIFY FOR A CANADIAN MORTGAGE?

YES, it is possible to use disability income to qualify for a pre-approval or a full mortgage approval.

IMPORTANT:

We are ONLY able to use disability income AS A “TOP UP” WHEN YOU ARE BUYING WITH ANOTHER PERSON

- who has standard/ T4 employment income OR qualifies as SELF-EMPLOYED

- AND your file needs more income to “top-up” the qualification amount to get to your target mortgage amount.

Unfortunately, we are not able to use:

- Disability income where it is more than 50% of the income needed to qualify for the mortgage.

- AISH income – the lenders deem provincial supplements as to “risky” and only use “federal programs.”

- If either of these are your situation, we recommend going to an ATB Branch, not online but a BRANCH.

Below are a few clarifications on the typical disability incomes that the banks can use.

- Not all banks accept all types of disability income so we use a few different lenders to ensure we have all your bases covered.

NEXT STEP

Call or send me an email with your contact data so we can have a chat on the phone if you are needing to use a “TOP-UP” via disability income for your purchase.

- I answer from 9-9 x 363, am in the office from 10 – 6:30 most days, best time to call is between 11 am – 3 pm.

- No need to pre-book, just call!

- (How different is that?)

Long-term & Short-term Disability Pension/Insurance

If the borrower has a non-taxable income, the Bank, CMHC and Sagen allow the income to be grossed-up.

- Less than $30,000, this income may be increased by 25%

- At least $30,000, this income may be increased by 35%

Long-term disability: 100% of long-term disability income can be used.

Provide one of the following:

- Letter from the organization or from QPP confirming long-term or permanent disability. If the letter is outdated (over 120 days), current bank statements confirming the deposits are being made to the borrower’s account are also needed

- T4A(P) confirming disability income.

Short-term disability: 100% of the employment income can be used for short-term disability.

Provide the following:

- A letter from the employer confirming the borrower’s return date, position and salary with a verbal confirmation from the employer to ensure the date on the letter is correct. If the return date cannot be confirmed, the disability income can be used for qualifications.

Pension & Retirement Income/Life Annuity

Retirement pensions are fixed incomes, CPP (Canada Pension Plan), OAS (Old Age Security), GIS (Guaranteed Income Supplement), provincial pension plans and private/corporate pensions and must be Canadian pension and evident on Canadian tax return.

IF you are Splitting Retirement Income: In the case where the pension income is shared for tax purposes, the transferring spouse/common-law partner must be on file and only the amount that has not been transferred/split is admissible.

Provide the most recent two documents of the following depending on the source of the declared retirement income:

- Most recent NOA supported by T1 General

- RL-2 Slip

- T4A, T4A(P)

- Letter from the initiating party confirming the yearly pension amount

- Letter from the organization confirming income and permanency of income

- Copy of current bank statement showing the automatic deposit

- Copy of current monthly cheque stub

For CPP, OAS, QPP and GIS, only one relevant document for each source is required from the list above.

RRIF

Income from a RRIF is admissible if there is proof that the portfolio generates a sustainable income amount for the length of the term.

This is a tough one to nail down as the portfolio has to be sustainable and not “drained” over the term of the loan, as in, there will still be a substantial balance in 5 years, if the mortgage is a 5-year term.

Provide the following:

- The most recent NOA supported by T1 General

- Recent RRIF statement to show that the borrower has sufficient assets to support the indicated income for the length of the term

First Nations

This is a non-taxable income. The income can be grossed-up as follows:

- Less than $30,000, this income may be increased by 25%

- At least $30,000, this income may be increased by 35%

Provide the following:

- Copy of the status card needed.

“We use disability income all the time in our practice to top-up mortgage amounts and have access to the banks and lenders that allow it’s use.

Mortgage Mark Herman, top Calgary Alberta and BC mortgage broker, for 21 years.