Details of Canadian Economic & Housing Market Performance, as at Dec 7, 2022

Bank of Canada increased Consumer Prime to 6.45% – exactly as expected for the last 5 months. January 25th is the next BoC interest rate announcement & I hope it is a 0.25% increase and then holds there for all of 2023. We will see…

Mortgage Mark Herman, Best Calgary mortgage broker with a Master’s degree in Finance.

Today, the Bank of Canada increased its overnight benchmark interest rate 50 basis point to 4.25% from 3.75% in October. This is the 7th time this year that the Bank has addressed inflation and means the policy rate is now as high as it has been in 15 years.

We summarize the Bank’s observations below, including its forward-looking comments on the need/likelihood of future rate increases below:

Canadian inflation

- CPI inflation remained at 6.9% in October, with many of the goods and services Canadians regularly buy showing large price increases

- Measures of core inflation “remain around 5%”

- Three-month rates of change in core inflation have come down, “an early indicator that price pressures may be losing momentum”

Canadian Economic and housing market performance

- GDP growth in the third quarter was stronger than expected, and the economy continued to operate “in excess demand”

- The labor market remains “tight” with unemployment near historic lows

- While commodity exports have been strong, there is growing evidence that tighter monetary policy is restraining domestic demand: consumption moderated in the third quarter

- Housing market activity continues to decline

- Data since the October Monetary Policy Report supports the Bank’s outlook that growth will essentially stall” through the end of this year and the first half of 2023

Global inflation and economic performance

- Inflation around the world remains high and broadly based

- Global economic growth is slowing, although it is proving more resilient than was expected at the time of the Bank’s October Monetary Policy Report

- In the United States, the economy is weakening but consumption continues to be solid and the labor market remains “overheated”

- The gradual easing of global supply bottlenecks continues, although further progress could be disrupted by geopolitical events

Outlook

Although the Bank’s commentary noted that price pressures that are driving high inflation may be losing momentum, it went on to say that inflation is “still too high” and that short-term “inflation expectations remain elevated.” In the Bank’s view, the longer that Canadian consumers and businesses expect inflation to be above the Bank’s 2% target, “the greater the risk that elevated inflation becomes entrenched.”

Given these economic signals, the Bank’s Governing Council stated that it “will be considering whether the policy interest rate needs to rise further to bring supply and demand back into balance and return inflation to target.”

It concluded its statement with a familiar refrain: “We are resolute in our commitment to achieving the 2% inflation target and restoring price stability for Canadians.”

Analysts and commentators will seek to interpret those outlook comments for signs that the Bank has reached or believes it is close to reaching the terminal point in its current rate-hike cycle. For now, that remains a question of debate and speculation that will turn on future economic signals.

Next Touchpoint

January 25th is the next BoC interest rate announcement. I hope it is a 0.25% increase and then holds there for all of 2023. We will see…

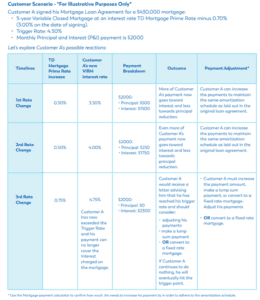

Trigger Point for Canadian Variable Rate Mortgages Explained, with Example

You have likely heard – or will soon be hearing – a lot of talk about “trigger rates” and “trigger points”. More importantly, you are probably hearing “trigger point” together along with more changes in the Bank of Canada rate and you need expert guidance.

Let’s start with a few definitions:

- Variable Rate Mortgage (VRM) – prime changes, rate changes. When interest rates change, typically, your mortgage payment will stay the same.

- Adjustable Rate Mortgage (ARM) – prime changes, rate changes. Unlike variable rate, your mortgage payment will change when interest rates change.

- Trigger Rate – When interest rates increase to the point that regular principal and interest payments no longer cover the interest charged, interest is deferred, and the principal balance (total cost) can increase until it hits the trigger point.

- Trigger Point – When the outstanding principal amount (including any deferred interest) exceeds the original principal amount. The lender will notify the customer and inform them of how much the principal amount exceeds the excess amount (Trigger Point). The client then typically has 30 days to make a lumpsum payment; increase the amount of the principal and interest payment; or convert to a fixed rate term.

NOW, WHICH MORTGAGES WILL BE AFFECTED FIRST?

Quick answer, VRMs from March 2020 to March 2022.

During the month of March 2020, the prime rate dropped three times in quick succession from 3.95% to 2.45%, and variable-rate mortgages arranged while prime was 2.45% have the lowest payments. The lower the interest rate was, the lower the trigger rate, and the faster your client may hit this negative amortization.

WHAT TO DO

When this happens, customers are contacted by the lender and generally have three ways they can proceed:

- Make a lump-sum payment against the loan amount

- Convert with a new loan at a fixed-rate term

- Increase their monthly payment amount to pay off their outstanding principal balance within their remaining original amortization period

Below is a customer scenario so you can see how this could play out.

Data on July 1, 2022 Prime Increase to 3.7%

Today, the Bank of Canada showed once again that it is seriously concerned about inflation by raising its overnight benchmark rate to 1.50% – making Consumer Prime 3.70%

This latest 50 basis point increase follows a similar-sized move in April and is considered the fastest rate hike cycle in over two decades.

Everyone STAY COOL!

Says Mortgage Mark Herman, top Calgary Alberta Mortgage Broker.

With it, the Bank brings its policy rate closer to its pre-pandemic level.

In rationalizing its 3rd increase of 2022, the Bank cited several factors, most especially that “the risk of elevated inflation becoming entrenched has risen.” As a result, the BoC will use its monetary policy tools to return inflation to target and keep inflation expectations well anchored.

These are the highlights of today’s announcement.

Inflation at home and abroad

- Largely driven by higher prices for food and energy, the Bank noted that CPI inflation reached 6.8% for the month of April, well above its forecast and “will likely move even higher in the near term before beginning to ease”

- As “pervasive” input pressures feed through into consumer prices, inflation continues to broaden, with core measures of inflation ranging between 3.2% and 5.1%

- Almost 70% of CPI categories now show inflation above 3%

- The increase in global inflation is occurring as the global economy slows

- The Russian invasion of Ukraine, China’s COVID-related lockdowns, and ongoing supply disruptions are all weighing on activity and boosting inflation

- The war has increased uncertainty, is putting further upward pressure on prices for energy and agricultural commodities and “dampening the outlook, particularly in Europe”

- U.S. labour market strength continues, with wage pressures intensifying, while private domestic U.S. demand remains robust despite the American economy “contracting in the first quarter of 2022”

- Global financial conditions have tightened and markets have been volatile

Canadian economy and the housing market

- Economic growth is strong and the economy is clearly “operating in excess demand,” a change in the language the Bank used in April when it said our economy was “moving into excess demand”

- National accounts data for the first quarter of 2022 showed GDP growth of 3.1%, in line with the Bank’s April Monetary Policy Report projection

- Job vacancies are elevated, companies are reporting widespread labour shortages, and wage growth has been “picking up and broadening across sectors”

- Housing market activity is moderating from exceptionally high levels

- With consumer spending in Canada remaining robust and exports anticipated to strengthen, growth in the second quarter is expected to be “solid”

Looking ahead

With inflation persisting well above target and “expected to move higher in the near term,” the Bank used today’s announcement to again forewarn that “interest rates will need to rise further.”

The pace of future increases in its policy rate will be guided by the Bank’s ongoing assessment of the economy and inflation.

In case there was any doubt, the Bank’s message today was clear: it is prepared to act more forcefully if needed to meet its commitment to achieve its 2% inflation target.

July 13, 2022 is the date of the BoC’s next scheduled policy announcement.

Nov 2021; Mortgage Rates & Inflation Report

This just in data is when mortgage interest rates are expected to rise.

DATA JUST IN

Canada’s latest employment and inflation numbers have triggered new expectations about the next steps by the Bank of Canada and the arrival of interest rate increases.

BoC Governor Tiff Macklem continues to offer soothing words about inflation, which is current running at 4.1%. That is an 18 year high and more than double the central bank’s 2.0% target.

Macklem has repeatedly said high inflation is temporary; the result of low prices during the pandemic lock-downs, and supply chain problems that have cropped-up as the economy reopens.

Macklem points out that a key factor in long term inflation – wage growth – has not materialized. That is despite Canada returning to pre-pandemic employment levels with the addition of 157,000 jobs in September. It should be noted that the growth of Canada’s labour force during the pandemic means the country is still 276,000 jobs short of full employment. Last week however, Macklem did concede that this temporary inflation may linger for longer than initially expected.

Several prominent economists have weighed-in. Benjamin Tal cautions that inflation is a lagging economic indicator. He says the risks for long-term inflation are present and the Bank of Canada would be better to start raising rates earlier to help mitigate those risks. Doug Porter says there is a growing chance rate increases will come earlier. He expects they will happen quarterly rather than every six months. And, Derek Holt would like to see a rate hike by the end of the year, given that emergency levels of stimulus are in place while inflation is well above target.

Look for mortgage interest rates to start going up close to the end of 2021 and continue until they are back close to PRE-Covid Rates of about 3.35% for the 5-year fixed.

Mortgage Mark Herman, best Calgary mortgage broker for the masses!

EXPLAINER: Why & Where Inflation and Canadian Mortgage Interest Rates

Best answer I have seen yet is below … it still makes the 5-year fixed the better option right now (for most people)Mortgage Mark Herman, Top Calgary Mortgage Broker

The latest significant news was good, but modest. Canada’s unemployment rate dipped to 7.5% with the creation of 94,000 jobs in July. Most of those are full-time and in the private sector.

Employment levels are linked to inflation, which is a key factor watched by the Bank of Canada in setting interest rate policy which, in turn, can affect mortgage rates.

As the labour market tightens up, employers tend to offer higher wages to attract workers. That increases the cost of producing goods and services, driving inflation. As well, as more people get work and earn more money demand for goods and services increases. If that demand outpaces supply, inflation can also result.

Canada finds itself in this position now. Inflation is running high chiefly because of supply constraints caused by the pandemic. At the same time, more and more people are heading back to work.

That has some analysts forecasting the Bank of Canada will be raising rates to calm inflation. The Bank, however, has been saying otherwise.

It is also useful to watch what is happening in the United States. The two economies are tightly linked and actions in the U.S. can offer useful clues about what will happen here.

In its latest assessment of the American economy the U.S. Federal Reserve continued to down play inflation – which is running high there as well – as “transitory”. The Fed continues to look to the second half of 2023 as the most likely time for any possible rate hikes. While the Bank of Canada has said it expects rates could start rising as much as a year sooner than that, it would be unusual for the BoC to move before the Fed.

2021: here Are Mortgage Rates Going?

|

|

$37,000 Payout Penalty at CIBC

The latest in giant payout penalties, this one was $47,291.

Here is a person – one of my ACTUAL ALMOST-Customers who had to swallow a surprise at TD for $35,000. (We tried 3 times to get him to not take that mortgage.)

To make this even more mind blowing, at a 39% tax rate that is $65,700 the person has to pay … about the same as 1-year of income at a full time job, without tax taken off.

- Would you work for 1 year to give it all to your bank if you had to sell or move or close down the mortgage for any reason?

- Would you sign an agreement like that?

- Have you already signed an agreement like this without knowing you have?

EASY to AVOID …

You don’t need to add in this risk to your home purchase. It is easy to get around by taking a mortgage from a major Broker Bank.

Broker banks calculate the payouts the “old way” which was way more fair to you, the buyer. Click here for the posts about payout penalties.

Broker banks also have better Terms & Conditions than the Big-6.

Link to the article: https://toronto.ctvnews.ca/american-who-sold-home-in-toronto-shocked-by-47-000-mortgage-penalty-1.5212884

“Broker Banks have better T&C than all of the Big-6. Call a mortgage broker first.”

Mortgage Mark Herman, Top Rated Calgary Mortgage Broker

RBC: charged 15 month payout penalty

The Big-6 banks love your money, not your sparkling personality.

This article is old and still shows the same calculations.

RBC charges homeowner $8900 penalty, or 15 months interest charge!

We get calls on high payout penalties all the time. The answer is broker lenders have payouts that are about 30% as much as the Big-6 banks.

Mortgage Mark Herman, top Calgary mortgage broker.

Why CoronaVirus = Lower Mortgage Rates

This link does a great job explaining why rates are coming down right now for mortgages.

https://www.cbc.ca/news/business/coronavirus-mortgage-rates-canada-1.5443071

Summary:

- Events that could cause a stock market crash tend to also cause a “flee to safety” and the 5-year Canadian Mortgage Bond is that safety net.

- When investors buy these bonds the demand goes up so the bonds pay less as everyone wants them.

- The lower cost of the bond means a lower interest rate on your mortgage

This should be a short term blip, so if you are buying a home take advantage of it quickly

Mark Herman, top Calgary mortgage broker

Why you don’t want your mortgage at your main bank

The Big-5 banks do not love you, they love your money, and now they can “trap” you in their mortgages if you fail the Stress Test.

Highlights of the last post are below. The post from January is here: http://markherman.ca/how-the-big-5-banks-trap-you-in-their-mortgages/

The new mortgage rules – called the B20 – allow the banks to renew you at almost any rate they want – or at least not a competitive one – if your credit, income, or debts should mean you can’t change banks.

If your mortgage is at your main bank they can see:

- your pay and income going into your accounts

- debt balances on your credit report

- what your credit score is

- your debt payments

- your home/ rental addresses so they can accurately guess at your home value.

ALL THIS MEANS they can calculate if you can pass the new “Stress Test.”

If you can’t pass it then they know you can’t change banks, are you are now totally locked into them for your renewal. They can renew you at POSTED RATES … 5.34%, not actual discounted rates they offer everyone, today (June 2019) about 2.99%.

The GOOD NEWS is broker banks do not do any of this … so having your mortgage at your main bank only helps them “grind you” later on. …. so how convenient is having your mortgage at your bank now?

Highlights of the article link below are:

Canada’s biggest banks are tightening their grip … as new rules designed to cut out risky lending make it harder for borrowers to switch lenders … the country’s biggest five banks … are reporting higher rates of renewals by existing customers concerned they will not qualify for a mortgage with another bank.

“B-20 has created higher renewal rates for the big banks, driving volumes and goosing their growth rates,” said an analyst. “It’s had the unintended consequence of reducing competition.”

Royal Bank of Canada (RBC), said last month that mortgage renewal rates [are up …] due in part to the B-20 regulations.

Ron Butler said, “Even if they are up-to-date with their repayments, borrowers may find they don’t qualify with other lenders so they’re stuck with their bank at whatever rate it offers,” he said.

Senior Canadian bankers such as RBC … and TD … voiced their support for the new rules prior to their introduction, saying rising prices were a threat to Canada’s economy.

While analysts say RBC and TD are expected to benefit from higher-than-normal retention rates in 2019, not everyone is sure borrowers will benefit.

“The banks are becoming more sophisticated in targeting borrowers who would fail the stress test and they can charge them higher rates at renewal knowing they can’t move elsewhere,” Butler said.