Probably the end of Mortgage Rate Reductions for Canada

Expert opinions on Bank of Canada interest rate cuts are shifting. A growing number of market watchers are backing away from their predictions of two more reductions this year. Several are now saying the Bank has likely reached the end of the current trimming cycle.

Back in April we said that Prime is probably going to stay where it is now; discounting the expected 4 more reduction to 0.

that looks to have come true.

5-year fixed is the way to go to side-step all the world’s recent happenings .

Mortgage Mark Herman, best Calgary mortgage broker near me.

The central bank held its trend-setting Policy Rate at 2.75% for a second time in its decision on June 4. Since then, inflation numbers and Gross Domestic Product readings have given the BoC reasonable grounds to stand pat.

Statistics Canada’s latest figures for GDP show it declined by 0.1% in April compared to March. Much of that decline was led by the manufacturing sector, which is falling victim to U.S. tariffs and trade uncertainty. A similar reduction is forecast for May. While many economists admit the slowdown shows the economy is softening, they say it is not on the verge of collapse. GDP is 1.3% higher that it was a year earlier.

The other key factor in the Bank’s rate decisions, inflation, held steady at 1.7% in May. That headline number is actually below the Bank’s target of 2.0% and would normally suggest there is room for a further rate cut. However, that is a little deceiving.

Headline inflation (aka the Consumer Price Index) continued to be skewed by the elimination of the consumer carbon tax. As well, core inflation, which is the BoC’s preferred measure, remains stuck at 3.0%, which is the high end of the Bank’s desired inflation range.

The Bank finds itself trying to balance economic growth against the risk of rising inflation. The Bank’s next interest rate announcement is set for July 30.

Bank of Canada Lowers Consumer Prime to 4.95%

The Bank of Canada lowers its benchmark interest rate to 2.75%

In the face of significant geopolitical tensions, the Bank of Canada announced today that it has lowered its policy interest rate by 25 basis points. This marks the seventh reduction since June of 2024.

Below, we summarize the Bank’s commentary.

Canadian Economic Performance and Housing

- Canada’s economy grew by 2.6% in the fourth quarter of 2024 following upwardly revised growth of 2.2% in the third quarter

- This “growth path” is stronger than was expected when the Bank last reported in January 2025

- Past cuts to interest rates have boosted economic activity, particularly consumption and housing

- However, economic growth in the first quarter of 2025 will likely slow as the intensifying trade conflict weighs on sentiment and activity

- Recent surveys suggest a sharp drop in consumer confidence and a slowdown in business spending as companies postpone or cancel investments

- The negative impact of slowing domestic demand has been partially offset by a surge in exports in advance of tariffs being imposed

- The Canadian dollar is broadly unchanged against the US dollar but weaker against other currencies

Canadian Inflation and Outlook

- Inflation remains close to the Bank’s 2% target

- The temporary suspension of the GST/HST lowered some consumer prices, but January’s Consumer Price Index was “slightly firmer” than expected at 1.9%

- Inflation is expected to increase to about 2.5% in March with the end of the tax break

- The Bank’s preferred measures of core inflation remain above 2%, mainly because of the persistence of shelter price inflation

- Short-term inflation expectations have risen in light of fears about the impact of tariffs on prices

Canadian Labour Market

- Employment growth strengthened in November through January and the unemployment rate declined to 6.6%

- In February, job growth stalled

- While past interest rate cuts have boosted demand for labour in recent months, there are warning signs that heightened trade tensions could disrupt the recovery in the jobs market

- Meanwhile, wage growth has shown signs of moderation

Global Economic Performance, Bond Yields and the Canadian Dollar

- After a period of solid growth, the US economy looks to have slowed in recent months, but US inflation remains slightly above target

- Economic growth in the euro zone was modest in late 2024

- China’s economy has posted strong gains, supported by government policies

- Equity prices have fallen and bond yields have eased on market expectations of weaker North American growth

- Oil prices have been volatile and are trading below the assumptions in the Bank’s January Monetary Policy Report

Rationale for a rate cut

While the Bank offered that economic growth came in stronger than it expected, the pervasive uncertainty created by continuously changing US tariff threats is restraining consumers’ spending intentions and businesses’ plans to hire and invest. Against this background, and with inflation close to the 2% target, the Bank decided to reduce its policy rate by 25 basis points.

Outlook

The Bank notes that the Canadian economy entered 2025 “in a solid position,” with inflation close to its 2% target and “robust” GDP growth. However, heightened trade tensions and tariffs imposed by the United States will likely slow the pace of economic activity and increase inflationary pressures in Canada. The economic outlook continues to be subject to more-than-usual uncertainty because of the rapidly evolving policy landscape.

Final comments

The Bank noted that monetary policy “cannot offset the impacts of a trade war.” What monetary policy “can and must do” is ensure that higher prices do not lead to ongoing inflation.

The Bank said it will carefully assess: i) the timing and strength of both the downward pressures on inflation from a weaker economy and ii) the upward pressures on inflation from higher costs. It will also closely monitor inflation expectations.

It ended its statement by saying it is committed to maintaining price stability for Canadians.

More scheduled BoC news

The Bank is scheduled to make its third policy interest rate decision of 2025 on April 16th.

Prime to be 2% LOWER in 15 months, Dates of drops, Variable rate wins: Fall 2024

Yes, with the writing on the wall for the coming Prime rate decreases the Variable rate is the way to go.

Variable rates are based on Consumer Prime, which moves the exact same as the Bank of Canada’s “overnight rate.” The decreases in the overnight rate will be the same for Consumer Prime and they are below.

So Sept 4, 2024, Prime will go from 6.7% to 6.45%

Canadian Consumer Prime – what Variable Rates are based on – will be these rates here.

If your “discount is Prime – 0.95%” then your rate would be this number below – 0.95%. And as you can see, this is way better than the 3-year fixed at 4.84% or the 5- year fixed at 4.69% today.

- September 4, 2024: 6.45%

- October 23, 2024: 6.20%

- December 11, 2024: 5.95%

- January 2025: 5.70%

- March 2025: 5.45%

- April 2025: 5.20%

- June 2025: 4.95%

- September 2025: 4.70%

- October 2025: 4.45%

- December 2025: 4.20%

Article is here: Bank of Canada’s policy interest rate could dip to 2.75% by late 2025:

forecast:: https://dailyhive.com/vancouver/bank-of-canada-policy-interest-rate-forecast-2025-credit-1

Predictions of the article for the rate drops: Credit 1’s Bank of Canada policy interest rate forecast, as updated on August 26, 2024:

-

- September 4, 2024: 4.25%

- October 23, 2024: 4.0%

- December 11, 2024: 3.75%

- January 2025: 3.5%

- March 2025: 3.5%

- April 2025: 3.25%

- June 2025: 3.25%

- September 2025: 3.0%

- October 2025: 2.75%

- December 2025: 2.75%

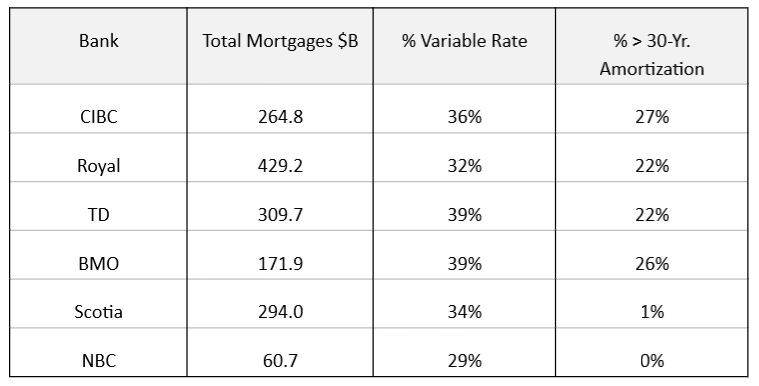

Data on those negative amortization mortgages

Queston 1: What about all these (negative amortizing) mortgages that will now take 71 years to pay off?

Answer:

Yes, they are called VRMs – Variable rate Mortgages – and we don’t really offer/sell /even talk about them for that exact reason – what if the rates rates jump? And they did.

We do offer ARMs – Adjustable Rate Mortgage – and we do recommend as of August 2023 because:

- Rates have topped and are slowly on the way down right now so the rate will go down

- The current rate starts lower than the 1, 2, 3, and 4 year fixed right now; and ARM rates should be below the 5-year fixed by Fall of 2024.

Question 2: What is the difference between VRM and ARM?

- With an ARM – adjustable rate mortgage – the amount of your payment will go up and down based on the changes of the prime lending rate

- The VRM – Variable rate mortgage – your mortgage payment amount always remains the same. It does not go up and down with changes in the prime lending rate. And when rates jump to 4x what they were when your loan started, then you are not even paying interest any more, and end up at 70 years left to pay it off.

As the article below states, VRMs are mostly from BMO, CIBC, Royal Bank and TD.

ARMs – Adjustable rate mortgages – are what we offer, they can’t have a negative amortiztion and we don’t have any customers that were affected with negative loans.

Mortgage Mark Herman, best top Calgary mortgage broker

Concern over rise in negative amortization mortgages

On October 30th, the Bank also highlighted concern over negatively amortizing mortgages. Negative amortization occurs when a borrower’s monthly mortgage payment is less than the interest due on the loan and the outstanding mortgage balance grows over time rather than declining. This phenomenon is mostly associated with variable rate mortgages.

Those who bought or refinanced homes during the pandemic, when interest rates were at their lowest, heavily opted for variable rate mortgages (VRMs). In Canada, most VRMs come with fixed payments, where the interest portion is determined by the prevailing prime lending rate, while the rest is used to repay the principal. As a result, the Bank of Canada’s series of rate hikes – from 0.25% to 5% – has propelled growth in negative amortization mortgages with terms exceeding 30 years.

As of July 31, negative amortization mortgages were 24% of total mortgage portfolios (insured and uninsured) for BMO, CIBC, Royal and TD. This is equivalent to $277 billion in mortgages – up from virtually nil a year ago. National and Scotia mainly offer adjustable-rate mortgages – as rates change the mortgage payment changes to keep the amortization period fixed – so both banks have negligible exposure to negative amortization within their mortgage portfolios.

Variable Rate Exposure (as of July 31, 2023)

Source: Fitch Ratings

Canada’s banking regulator, the Office of the Superintendent of Financial Institutions (OFSI), has announced regulatory changes to address risks related to mortgages in negative amortization. Effective early next year, banks will be required to maintain a higher amount of capital, reflecting the elevated risk associated with mortgages in negative amortization when the loan-to-value ratio (LTV) surpasses 65% (i.e. when the outstanding mortgage balance is 65% or more of the value of the underlying property). The proposed changes are designed to incentivize banks to reduce the volume of mortgages that could potentially go into negative amortization.

Mortgage repayment trends

To assess how borrowers are reacting to the increase in rates, the prepayment report for floating rate 5-year mortgage-backed securities (MBS) pools, published by CMHC, serves as a valuable tool. Although it doesn’t pinpoint individual issuers, the report offers a comprehensive look at trends within the banks’ variable-rate mortgage (VRM) portfolio.

Report data indicates that borrowers with VRMs have been effectively managing impacts of rising rates by making partial principal payments or transitioning to fixed-rate mortgages. Enforcement activity, which is undertaken when a borrower is unable to make mortgage payments, has been minimal, which suggests that despite the rise in rates, defaults have remained low.

Also, the majority of non-amortizing mortgages, where payments are covering interest only, were recorded between November 2022 and February 2023. This is a positive sign that banks have taken measures to limit the growth of these mortgages.

One caution is around borrowers whose mortgage rates have exceeded the trigger point – that is, the rate at which the regular payment is no longer enough to cover the full amount of interest accrued since the last payment. These borrowers might encounter payment shock when their loans mature and are re-underwritten based on the original amortization but at higher rates and with larger principal amounts.

Those who were first-time homebuyers with high loan-to-value ratios, purchasing at or close to peak prices in 2020 or 2021, could face significant challenges during renewal, particularly if their equity position has been significantly eroded. Similar to Fitch, we anticipate that delinquency rates will not rise in 2024, remaining within the expected range of 0.2-0.25%.

Persistent inflation leads the Bank of Canada to increase benchmark interest rate

UGH! The BoC whacks borrowers again.

Mark Herman, Top Calgary Alberta Mortgage Broker

Yesterday, the Bank of Canada increased its overnight interest rate to 5.00% (+0.25% from June) because of the “accumulation of evidence” that excess demand and elevated core inflation are both proving more persistent and after taking into account its “revised outlook for economic activity and inflation.”

This decision was not unexpected by analysts but is disconcerting – as is the Bank’s pledge to continue its policy of quantitative tightening.

To understand today’s decision and the Bank’s current thinking on inflation, interest rates and the economy, we highlight its latest observations below:

Inflation facts and outlook

- In Canada, Consumer Price Index (CPI) inflation eased to 3.4% in May, a “substantial and welcome drop from its peak of 8.1% last summer”

- While CPI inflation has come down largely as expected so far this year, the downward momentum has come more from lower energy prices, and less from an easing of “underlying inflation”

- With the large price increases of last year removed from the annual data, there will be less near-term “downward momentum” in CPI inflation

- Moreover, with three-month rates of core inflation running around 3.5% to 4% since last September, “underlying price pressures appear to be more persistent than anticipated”, an outcome that is reinforced by the Bank’s business surveys, which found businesses are “still increasing their prices more frequently than normal”

- Global inflation is easing, with lower energy prices and a decline in goods price inflation; however, robust demand and tight labour markets are causing persistent inflationary pressures in services

Canadian housing and economic performance

- Canada’s economy has been stronger than expected, with more momentum in demand

- Consumption growth was “surprisingly strong” at 5.8% in the first quarter

- While the Bank expects consumer spending to slow in response to the cumulative increase in interest rates, recent retail trade and other data suggest more persistent excess demand in the economy

- The housing market has seen some pickup

- New construction and real estate listings are lagging demand, which is adding pressure to prices

- In the labour market, there are signs of more availability of workers, but conditions remain tight, and wage growth has been around 4-5%

- Strong population growth from immigration is adding both demand and supply to the economy: newcomers are helping to ease the shortage of workers while also boosting consumer spending and adding to demand for housing

Global economic performance and outlook

- Economic growth has been stronger than expected, especially in the United States, where consumer and business spending has been “surprisingly” resilient

- After a surge in early 2023, China’s economic growth is softening, with slowing exports and ongoing weakness in its property sector

- Growth in the euro area is effectively stalled: while the service sector continues to grow, manufacturing is contracting

- Global financial conditions have tightened, with bond yields up in North America and Europe as major central banks signal further interest rate increases may be needed to combat inflation

- The Bank’s July Monetary Policy Report projects the global economy will grow by “around 2.8% this year and 2.4% in 2024, followed by 2.7% growth in 2025”

Summary and Outlook

As higher interest rates continue to work their way through the economy, the BoC expects economic growth to slow, averaging around 1% through the second half of 2023 and the first half of next year. This implies real GDP growth of 1.8% in 2023 and 1.2% in 2024. The Canadian economy will then move into “modest excess supply” early next year before growth picks up to 2.4% in 2025.

In its July Monetary Policy Report, the Bank noted that CPI inflation is forecast to “hover” around 3% for the next year before gradually declining to 2% in the middle of 2025. This is a slower return to target than was forecast in its January and April projections. As a result, the Bank’s Governing Council remains concerned that progress towards its 2% inflation target “could stall, jeopardizing the return to price stability.”

In terms of what Canadians can expect in the near term, the Bank had this to say: “Quantitative tightening is complementing the restrictive stance of monetary policy and normalizing the Bank’s balance sheet. Governing Council will continue to assess the dynamics of core inflation and the outlook for CPI inflation. In particular, we will be evaluating whether the evolution of excess demand, inflation expectations, wage growth and corporate pricing behaviour are consistent with achieving the 2% inflation target. The Bank remains resolute in its commitment to restoring price stability for Canadians.”

Stay tuned

September 6th, 2023 is the Bank’s next scheduled policy rate announcement. Will there be 1x more increase?

Variable rates to hold steady for 2019

Here is the latest on changes to the Prime rate for variable mortgages. The news is good as Prime is now expected to stay the same for the balance of 2019!

Remember:

- Variable rates can be locked in at any time for what the rates are on the day you lock in on.

- The maximum payout fee for is 3 months of interest

Rate hike disappears over the horizon

The likelihood of a Bank of Canada interest rate increase appears to be getting pushed further and further beyond the horizon.

The Bank is expected to remain on the sidelines again this week when it makes its scheduled rate announcement on Wednesday.

A recent survey by Reuters suggests economists have had a significant change of heart about the Bank’s plans. Just last month forecasters were calling for quarter-point increase in the third quarter with another hike next year. Now the betting is for no change until early 2020. There is virtually no expectation there will any rate cut before the end of next year.

The findings put the Bank of Canada in line with the U.S. Federal Reserve and other major central banks. World economies have hit a soft spot largely due to trade uncertainties between China and the United States.

This is good news for variables

Mark Herman, Top Calgary Mortgage Broker

Inverted Yield Curves, Impacts on Prime Rate Changes and Variable Rate Mortgages

Summary:

For the 2nd time in 50 years the “Yield Curve” has inverted – meaning that long term rates are now lower than short term rates. This can signal a recession is on the way.

This Means …

- Alberta will look better comparatively to Canada’s hot housing markets which should finally cool down.

- Canada’s Prime rate increases look to be on hold until Spring. This makes the variable rates now look MUCH Better. There were 3 rate increases expected and these may not materialize – making the VARIABLE rate look better.

- Broker lender’s have VARIABLE rates that range between .1% and .65% BETTER than the banks do. If you are looking at variable rates we should look further into this in more detail.

DATA BELOW …

- More on the predictions on rate increases

- WTF is an inverted Yield Curve – lifted from “the Hustle”

-

Predictions on Prime

Three interest rate hikes in 2019 — that’s what economists have been predicting for months, as part of the Bank of Canada’s ongoing strategy to keep the country’s inflation levels in check. But, according to one economist, that plan may have changed.

The BoC held the overnight rate at 1.75 percent yesterday, and released a statement a senior economist at TD, believes hints that the next hike may not come until next spring.

“We no longer expect the Bank of Canada to hike its policy interest rate in January,” he writes, in a recent note examining the BoC’s decision. “Spring 2019 now appears to be the more likely timing.”

Meanwhile the Canadian rates and macro strategist at BMO, puts the odds of a rate hike in January at 50 percent.

“While the Bank reiterated its desire to get policy rates to neutral, the path to neutral is clearly more uncertain than just a couple of months ago,” he writes, in his most recent note. “Looking ahead to January, the BoC will likely need to be convinced to hike (rather than not).”

A VIDEO ON WHY VARIABLE RATE MAY BE THE WAY TO GO FOR YOUR PLANS

- https://vimeo.com/279581066

- This video is from my colleague Dustin Woodhouse and he perfectly presents the story on the variable. He also ONLY works in the BC Lower Mainland; if you live there HE should be doing your mortgage, if you don’t WE should be.

2. WTF is an ‘inverted yield curve,’ and what does it mean for the economy?

For the first time since 2007, the 2- to 5-year US Treasury yield curve has inverted. Historically, this has served as a somewhat reliable indicator of economic downturn, which means people are freaking out, which means…

OK, hold up: What exactly is a yield curve, and why is it inverting?

‘Lend long and prosper’ (so say the banks)

In short, a yield curve is a way to gauge the difference between interest rates and the return investors will get from buying shorter- or longer-term debt. Most of the time, banks demand higher interest for longer periods of time (cuz who knows when they’re gonna see that money again?!).

A yield curve goes flat when the premium for longer-term bonds drops to zero. If the spread turns negative (meaning shorter-term yields are higher than longer maturity debt), the curve is inverted…

Which is what is happening now

So what caused this? It’s hard to say — but we prefer this explanation: Since December 2015, the Fed has implemented a series of 6 interest rate hikes and simultaneously cut its balance sheet by $50B a month.

According to Forbes, the Fed has played a major part in suppressing long-term interest rates while raising short-term interest rates.

Yield curve + inversion = economic downturn (sometimes)

The data don’t lie. A yield curve inversion preceded both the first tech bubble and the 2008 market crash.

Though, this theory has had some notable “false positives” in its lifetime — so it’s not exactly a foolproof fortune teller.

Heck, IBM found the size of high heels tends to spike during hard times. As of now, the experts who believe the sky to be falling remain in the minority.

There is lots to digest in the data above. Please feel free to contact me to discuss in more detail.

Mark Herman, 403-681-4376

Top Calgary Alberta Mortgage Broker

Variable rate mortgage – how payments will change for the new rate

We are getting many calls on this so here is how it works for MOST of the banks.

The Bank of Canada (BofC) reduced their Prime rate by 1/4 % or .25% last week to 0.75% from 1% where it has been for about 3 years.

The banks took a while to decide ifthey were going to lower their rates as well. 3 times before the banks have either not passed on the entire rate reduction to customers or not moved at all and kep the savings to themselves.

Now that most banks have lowered their rate by .15% this is how payments are impacted:

a. If they have an Adjustable Rate Mortgage – ARM mortgage – then the rate will be the new rate starting on the “effective date.”

b. The payment after the next payment will change to reflect this new rate. (So if you pay monthly on the 1st, the Feb 1st payment will be your current payment, but the March 1st Payment will be the new payment, If you pay weekly every Friday, this Friday will be the same payment but the next Friday will be the new payment)

c. Because the rate has gone down, your payment will decrease.

d. Because the interest rate has gone down, the next payment that is still at your existing payment amount will apply a little more to your principal.

e. Customer will receive a letter with their new payment amounts in the snail-mail.

Hope that clears things up a bit.

Call if you have questions.

Mark Herman, Top Calgary Alberta Mortgage Broker.

The upside of higher rates

We all know interest rates are going to go up. Even after reading this the big hit we all know is coming is that variable rate mortgage payments go up right away. The rest mentioned below may come later.

Jason Heath Mar 31, 2012 – 7:00 AM ET | Last Updated: Mar 30, 2012 9:09 AM ET

For three years, the word on the street has been that interest rates have nowhere to go but up. But few Canadian commentators – other than David Rosenberg – got the call on rates right. Although the prime rate has risen since dropping to an all-time low of 2.25% in April 2009, the increase to the current 3% rate that has remained stable since September 2010 has been modest to say the least. Long-term rates, like fixed mortgage rates, have gone up and come back down during that time, such that one can currently lock in fixed rates under 3%.

York University’s Moshe Milevsky did a study in 2001, which he revised in 2007, and determined that borrowers are better off going with a variable rate mortgage instead of a fixed rate mortgage approximately 9 times out of 10. That said, we have to be close to if not already in that 10% sweet spot where fixed beats variable.

Despite the opportunity to lock in low rates today, it could actually be beneficial for the average Canadian for rates to rise. Conditions need to warrant rate increases and the Bank of Canada (which directly governs the prime rate) and the bond market (which indirectly governs fixed mortgage rates) won’t raise rates until the time is right. How soon that time comes depends partially on domestic influences, but also on our neighbours to the south and the current eurozone debt debacle.

Greece is a perfect example of why rates should rise. Greek participation in the European Union gave them access to cheap credit and helped facilitate some of the excess spending that has them where they are today. Despite bond markets demanding higher interest rates on Greek and some other European government bonds, market intervention by the EU has helped keep rates artificially low.

The U.S. Federal Reserve has been doing the same thing, buying up U.S. government treasury bills to keep U.S. rates artificially low as well.

It’s hard to justify how artificially low interest rates for an extended period are good for anything other than delaying the inevitable for some market participants.

Higher rates would have a negative impact on those of us with outstanding debt, as higher interest charges would follow. But Canadian debt levels have moved ever higher in recent years, likely a response to the low rates that have been in place in part to stimulate spending. Higher mortgage rates could protect us from ourselves by making higher debt levels more punitive and less tempting.

Furthermore, fixed income investors could benefit. The emphasis on “could” is key. Rising rates typically hurt those holding bonds because today’s bonds are that much more appealing than yesterday’s as rates go up. How much the hurt hurts is a matter of fact. But those renewing GICs or sitting on cash these days are desperately awaiting higher interest rates to help their savings grow. So higher rates could at least lead to higher returns for fixed income investors in some cases.

Higher rates could benefit stock investors. Once again, the emphasis on “could” is key. Higher rates usually mean the economy is improving and inflation is rising. This could be a good sign that corporate profits and corresponding stock prices are moving higher. That said, one has to wonder if low bond and GIC interest rates and cheap credit have pushed more money into the stock market than should otherwise be there. Rising rates could bring income investors back to the more traditional income investments like bonds and GICs from the blue chip stocks they’ve potentially flocked to in order to obtain yield.

Despite the purported uncertainty above on stocks and bonds, higher rates should at least contribute somewhat to restoring equilibrium to credit, debt and equity markets. Something seems wrong with near zero or negative real interest rates. That is, something seems wrong with a GIC investor earning 2%, paying 1% of that away in tax and 2% inflation resulting in an effective return of -1%. On that basis, something seems right about higher interest rates, whether we like it or not. What happens to mortgage debt, stocks and bonds remains to be seen.

Jason Heath is a fee-only Certified Financial Planner (CFP) and income tax professional for Objective Financial Partners Inc. in Toronto.

Rates, spreads and all the rest

This is an article that was sent to me. It is totally technical and I love it. This is the real reason behind what are the lowest rates we have ever seen.

It also explains why the days of Prime -.95% are GONE for what looks like a long time.

In between the lines is says rates are going to go up quickly as soon as there is a sniff of recovery.

—

In the last few days, RBC and Scotiabank have eliminated their advertised variable-rate discounts.

They’re now promoting variable mortgages at prime + 0.10%, twenty basis points more than their previous “special offers.”

Prime + 0.10% (i.e., 3.10%) is an interesting number. A few months ago consumers thought that fat variable-rate discounts were here to stay. Variables above prime will now come as a shock to some people.

The banks are well aware of that. They know that pricing above prime impacts consumer psychology.

They could have priced at prime. Spreads are not that horrendous. But pricing above prime makes more of an impact. It makes higher-profit fixed rates more appealing and it mentally prepares consumers for potentially higher VRM premiums down the road.

That said, banks are not just arbitrarily sticking it to borrowers. Far and away, the main reason variable rates are worsening is that banks’ costs are rising.

At the moment, there are multiple factors at play:

• Higher risk premiums are compressing margins.

O We have Europe to thank for the that.

O The TED spread, a measure of interbank credit risk, just made a new 2½ year high. As volatility increases, banks have to factor that into their funding models.

O Another reflection of risk is the most recent floating rate Canada Mortgage Bond (which some lenders use to fund variable-rate mortgages). It was issued at a 15 basis point premium over the prior issue in August.

• Margin balancing is an underlying bank motive.

O Banks have publicly stated their desire to even out margins between profitable fixed rates and low-margin variables, and they’re slowly doing just that.

O Back in September, RBC Bank exec David McKay put it this way: “…Given the dislocation between fixed and variable, the very, very thin margins (of variables), we felt we needed to move prices up in our variable rate book.”

• New regulations (e.g., IFRS) have boosted the amount of capital required for mortgage lending.

O That has lowered the return on capital for mortgages, and thus influenced rates higher.

• Status Quo for prime rate doesn’t help margins.

O Lenders partly rely on deposits (that money rotting in your chequing and savings accounts) to fund VRMs.

O Demand deposit rates rise slower than prime rate. So, when prime goes up, some lenders get wider margins temporarily.

O When expectations changed three months ago to suggest that prime rate will fall or stay flat (instead of rise like expected), it was bad news for some deposit-taking lenders. That’s because they now have no spread improvement to look forward to in the near-to-medium term.

O MBABC President Geoff Parkin says that until recently, “lenders have been prepared to accept low (VRM) profit margins with the knowledge that, as the prime rate inevitably rises, so too will their profit on variable mortgages.” As it turns out, the inevitable is taking longer than the market expected.

–