Newly increased fees for home buyers – comments

The new fees are not that big a deal. It will add a bit but not much. All the news is just noise by the press looking to turn out an easy article. Below are my comments that will be in the Calgary Sun this week.

Medical Doctor Mortgage Program – mortgage financing on your projected income!!

UPDATED!

ATTENTION soon-to-be-Doctors – FINALLY a program that acknowledges that you will be earing lots of money – soon, but not just yet.

Medical Doctors still in school or residency can qualify for financing with 20% down payment (up to 80% LTV) using projected income.

How the new math on LOC’s is calculated.

Below are how the banks now have to take your debts into account for doing the qualifying math for your purchase. A bit complicated and not intuitive at all!

Mark Herman, Top Calgary, Alberta mortgage broker for renewals.

Divorce and Mortgages

We do lots of mortgages for divorces – because they are complicated. Both people want to buy after or one buys out the other. BUT, you have to set the seperation agreement up correctly so this can happen.

New to Canada Mortgage Program and Stats

Below are some interesting numbers of New to Canada residents.

We specialize in New to Canada programs as there are many in’s and out’s with the details.

Because New to Canada people do not have the standard 2 years of Canadian credit history here to buy a home, there are special programs that help them buy as soon as they have a full-time, perminant job.

Slight mortgage rate increase on the way?

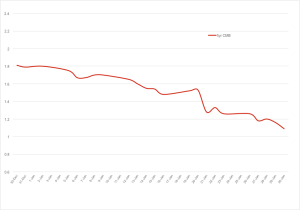

We watch lots of technial things to see where rates are going. One of those is the CMB – Canadain Mortgage Bond.

Today, the benchmark government of Canada five year bond yield ended the week at 0.79%, up from 0.73% the previous week.

More bad news about collateral loans

More collateral info in the press. As we have been saying for more than a year now; collateral loans can trap you later. Leverage the expertise of a person who has dealt with mortgages all day for more than 10 years when deciding what is best for you.

Short version of the article below: it is going to cost you about $2,500 to get out of a mortgage with a collateral charge when the term is done. That is not a “payout penalty” but the cost to re-register your mortgage later at a different bank when they try to renew you at a higher rate at the end of your term.

Data on why oil prices collapsed

Below is the entire Forbes article and link it.

Summary is there was too much oil and the prices came down. Prices should slowly go back to about $70 a barrel – which is just fine. This is great news!

Interest rate predictions are tough

I found this in a retirment planning post ….

Every year since 2009, experts have predicted that “rates have nowhere to go but up,” only to be confronted with what seems to be perpetually low rates.