2021: here Are Mortgage Rates Going?

|

|

Why CoronaVirus = Lower Mortgage Rates

This link does a great job explaining why rates are coming down right now for mortgages.

https://www.cbc.ca/news/business/coronavirus-mortgage-rates-canada-1.5443071

Summary:

- Events that could cause a stock market crash tend to also cause a “flee to safety” and the 5-year Canadian Mortgage Bond is that safety net.

- When investors buy these bonds the demand goes up so the bonds pay less as everyone wants them.

- The lower cost of the bond means a lower interest rate on your mortgage

This should be a short term blip, so if you are buying a home take advantage of it quickly

Mark Herman, top Calgary mortgage broker

TD adds interest on interest

TD is/ was the 1st and only bank to charge higher mortgage prime rate for their mortgages.

TD is now the 1st of the big banks to now charge interest on their late-interest-owed:

https://globalnews.ca/news/6451352/td-credit-cards-compound-interest/

Prime Rate Cut; Dec 4, 2019

With the latest developments the Bank of Canada (BoC) has clear path to reduce the Prime rate from 3.95 to probably 3.70%

The Bank of Canada is feeling the pressure to get back into the game with a rate reduction and one obstacle has now been removed.

The bank held its rate the same for an 8th straight meeting on October 30th.

At the same time it has clearly signaled it may not be able to hold that line much longer.

The bank pointed directly at trade conflicts (such as the U.S. – China tariff war) as the key cause of a global economic slowdown and around the world more than 35 other central banks have already cut rates in an effort to keep growth up.

The U.S. Federal Reserve has made three cuts in the past several months. That has boosted the strength of the Canadian dollar which makes the country’s exports more expensive on the world market which is unwelcome.

Great news that the Bank is not concerned that a drop in interest rates will trigger a renewed frenzy of debt-funded consumer spending. It is satisfied that the biggest component of household debt – mortgages – have been stabilized by the B-20 regulations. And another big obstruction has been removed. The federal election is over so the bank can operate without risking the appearance of political favoritism.

Fixed rates are still the way to go right now.

They are close to the all time 119-year lows right now.

Mortgage Mark Herman

Why you don’t want your mortgage at your main bank

The Big-5 banks do not love you, they love your money, and now they can “trap” you in their mortgages if you fail the Stress Test.

Highlights of the last post are below. The post from January is here: http://markherman.ca/how-the-big-5-banks-trap-you-in-their-mortgages/

The new mortgage rules – called the B20 – allow the banks to renew you at almost any rate they want – or at least not a competitive one – if your credit, income, or debts should mean you can’t change banks.

If your mortgage is at your main bank they can see:

- your pay and income going into your accounts

- debt balances on your credit report

- what your credit score is

- your debt payments

- your home/ rental addresses so they can accurately guess at your home value.

ALL THIS MEANS they can calculate if you can pass the new “Stress Test.”

If you can’t pass it then they know you can’t change banks, are you are now totally locked into them for your renewal. They can renew you at POSTED RATES … 5.34%, not actual discounted rates they offer everyone, today (June 2019) about 2.99%.

The GOOD NEWS is broker banks do not do any of this … so having your mortgage at your main bank only helps them “grind you” later on. …. so how convenient is having your mortgage at your bank now?

Highlights of the article link below are:

Canada’s biggest banks are tightening their grip … as new rules designed to cut out risky lending make it harder for borrowers to switch lenders … the country’s biggest five banks … are reporting higher rates of renewals by existing customers concerned they will not qualify for a mortgage with another bank.

“B-20 has created higher renewal rates for the big banks, driving volumes and goosing their growth rates,” said an analyst. “It’s had the unintended consequence of reducing competition.”

Royal Bank of Canada (RBC), said last month that mortgage renewal rates [are up …] due in part to the B-20 regulations.

Ron Butler said, “Even if they are up-to-date with their repayments, borrowers may find they don’t qualify with other lenders so they’re stuck with their bank at whatever rate it offers,” he said.

Senior Canadian bankers such as RBC … and TD … voiced their support for the new rules prior to their introduction, saying rising prices were a threat to Canada’s economy.

While analysts say RBC and TD are expected to benefit from higher-than-normal retention rates in 2019, not everyone is sure borrowers will benefit.

“The banks are becoming more sophisticated in targeting borrowers who would fail the stress test and they can charge them higher rates at renewal knowing they can’t move elsewhere,” Butler said.

the WORST: Mortgages @ Big-6 Banks

This blog summarizes why getting a mortgage from 1 of the Big-6 banks is the worst idea:

- Rates are higher; ranging form .25% to .55% higher

- Terms & Conditions are no where near as good:

- Collateral charges: http://markherman.ca/?s=collateral

- payout penalties: http://markherman.ca/?s=payout+penalties

Here is the article that is fully correct:

Big Banks vs. Broker Lenders:

Always talk to a mortgage broker before buying, or renewing or refinancing your mortgage

Mark Herman; Top Calgary, Alberta Mortgage Broker

Inverted Yield Curves, Impacts on Prime Rate Changes and Variable Rate Mortgages

Summary:

For the 2nd time in 50 years the “Yield Curve” has inverted – meaning that long term rates are now lower than short term rates. This can signal a recession is on the way.

This Means …

- Alberta will look better comparatively to Canada’s hot housing markets which should finally cool down.

- Canada’s Prime rate increases look to be on hold until Spring. This makes the variable rates now look MUCH Better. There were 3 rate increases expected and these may not materialize – making the VARIABLE rate look better.

- Broker lender’s have VARIABLE rates that range between .1% and .65% BETTER than the banks do. If you are looking at variable rates we should look further into this in more detail.

DATA BELOW …

- More on the predictions on rate increases

- WTF is an inverted Yield Curve – lifted from “the Hustle”

-

Predictions on Prime

Three interest rate hikes in 2019 — that’s what economists have been predicting for months, as part of the Bank of Canada’s ongoing strategy to keep the country’s inflation levels in check. But, according to one economist, that plan may have changed.

The BoC held the overnight rate at 1.75 percent yesterday, and released a statement a senior economist at TD, believes hints that the next hike may not come until next spring.

“We no longer expect the Bank of Canada to hike its policy interest rate in January,” he writes, in a recent note examining the BoC’s decision. “Spring 2019 now appears to be the more likely timing.”

Meanwhile the Canadian rates and macro strategist at BMO, puts the odds of a rate hike in January at 50 percent.

“While the Bank reiterated its desire to get policy rates to neutral, the path to neutral is clearly more uncertain than just a couple of months ago,” he writes, in his most recent note. “Looking ahead to January, the BoC will likely need to be convinced to hike (rather than not).”

A VIDEO ON WHY VARIABLE RATE MAY BE THE WAY TO GO FOR YOUR PLANS

- https://vimeo.com/279581066

- This video is from my colleague Dustin Woodhouse and he perfectly presents the story on the variable. He also ONLY works in the BC Lower Mainland; if you live there HE should be doing your mortgage, if you don’t WE should be.

2. WTF is an ‘inverted yield curve,’ and what does it mean for the economy?

For the first time since 2007, the 2- to 5-year US Treasury yield curve has inverted. Historically, this has served as a somewhat reliable indicator of economic downturn, which means people are freaking out, which means…

OK, hold up: What exactly is a yield curve, and why is it inverting?

‘Lend long and prosper’ (so say the banks)

In short, a yield curve is a way to gauge the difference between interest rates and the return investors will get from buying shorter- or longer-term debt. Most of the time, banks demand higher interest for longer periods of time (cuz who knows when they’re gonna see that money again?!).

A yield curve goes flat when the premium for longer-term bonds drops to zero. If the spread turns negative (meaning shorter-term yields are higher than longer maturity debt), the curve is inverted…

Which is what is happening now

So what caused this? It’s hard to say — but we prefer this explanation: Since December 2015, the Fed has implemented a series of 6 interest rate hikes and simultaneously cut its balance sheet by $50B a month.

According to Forbes, the Fed has played a major part in suppressing long-term interest rates while raising short-term interest rates.

Yield curve + inversion = economic downturn (sometimes)

The data don’t lie. A yield curve inversion preceded both the first tech bubble and the 2008 market crash.

Though, this theory has had some notable “false positives” in its lifetime — so it’s not exactly a foolproof fortune teller.

Heck, IBM found the size of high heels tends to spike during hard times. As of now, the experts who believe the sky to be falling remain in the minority.

There is lots to digest in the data above. Please feel free to contact me to discuss in more detail.

Mark Herman, 403-681-4376

Top Calgary Alberta Mortgage Broker

Brokers vs. Banks – The Differences

Love it when the newspapers do the telling for us.

Almost 40% of all mortgages are via brokers now. Up from 25% 15 years ago. There is a reason to use a broker that has been in business for 15 years or longer, like Mortgage Mark Herman of Mortgages Are Marvellous.

https://www.thestar.com/life/advice/2018/07/31/mortgage-brokers-vs-banks-the-pros-and-cons.html

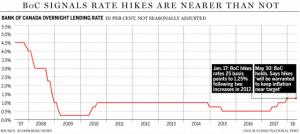

Prime rates should go up in July

This only affects variable rate mortgages and there are 2 increases to Prime expected for 2018, this one and one in December – depending on how the economy goes.

This only affects variable rate mortgages and there are 2 increases to Prime expected for 2018, this one and one in December – depending on how the economy goes.

- The Bank of Canada is expected to raise interest rates on July 11th.

- They normally increase Prime by 0.25% at a time, Prime is 3.45% now and should then go to 3.70%.

- The Central bank also emphasized that the increase will be needed to contain inflation.

This makes the 5-year fixed rates look much better as rates are slowly going back to 4% – the Theoretical Minimum

Mark Herman, Top Calgary Alberta Mortgage Broker

Some will wonder what stopped the Bank of Canada from raising interest rates today. It does seem likely that policy makers struggled with the decision, as they had little bad to say about the economy.

The reason for the delay is the same as it’s been since the start of the year: U.S. President Donald Trump. Canada’s central bank remains concerned that U.S. trade-and-tax policy will weigh on Canadian business investment, so much so that it is prepared to risk a little inflation by waiting for more clarity.

Few thought the central bank would raise interest rates on May 30. Poloz had been clear that he was comfortable with inflation running a little faster than the target rate of 2 per cent. He also said last month that hard evidence on investment would be a crucial variable and no such information has yet been published.

The central bank had been wary that its three interest-rate increases since last summer would choke domestic spending. But households seem to be coping just fine, which means the Bank of Canada can resume pushing interest rates higher.

Here is the link for the entire article: http://business.financialpost.com/news/economy/bank-of-canada-holds-interest-rate-at-1-25

A lesson from RBC’s mortgage rate increase

I love this article from the Globe as it explains why rates are going up a bit and what expectaions are for the near term.

Call for a rate hold if you are thinking of buying in the next 4 months!

“Borrowers who use a mortgage broker pay less …,” Bank of Canada.

See our reviews here: http://markherman.ca/CustomerREVIEWS.ubr

Mark Herman, Top best Calgary mortgage broker