Inverted Yield Curves, Impacts on Prime Rate Changes and Variable Rate Mortgages

Summary:

For the 2nd time in 50 years the “Yield Curve” has inverted – meaning that long term rates are now lower than short term rates. This can signal a recession is on the way.

This Means …

- Alberta will look better comparatively to Canada’s hot housing markets which should finally cool down.

- Canada’s Prime rate increases look to be on hold until Spring. This makes the variable rates now look MUCH Better. There were 3 rate increases expected and these may not materialize – making the VARIABLE rate look better.

- Broker lender’s have VARIABLE rates that range between .1% and .65% BETTER than the banks do. If you are looking at variable rates we should look further into this in more detail.

DATA BELOW …

- More on the predictions on rate increases

- WTF is an inverted Yield Curve – lifted from “the Hustle”

-

Predictions on Prime

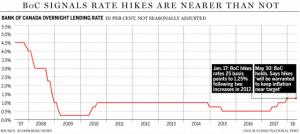

Three interest rate hikes in 2019 — that’s what economists have been predicting for months, as part of the Bank of Canada’s ongoing strategy to keep the country’s inflation levels in check. But, according to one economist, that plan may have changed.

The BoC held the overnight rate at 1.75 percent yesterday, and released a statement a senior economist at TD, believes hints that the next hike may not come until next spring.

“We no longer expect the Bank of Canada to hike its policy interest rate in January,” he writes, in a recent note examining the BoC’s decision. “Spring 2019 now appears to be the more likely timing.”

Meanwhile the Canadian rates and macro strategist at BMO, puts the odds of a rate hike in January at 50 percent.

“While the Bank reiterated its desire to get policy rates to neutral, the path to neutral is clearly more uncertain than just a couple of months ago,” he writes, in his most recent note. “Looking ahead to January, the BoC will likely need to be convinced to hike (rather than not).”

A VIDEO ON WHY VARIABLE RATE MAY BE THE WAY TO GO FOR YOUR PLANS

- https://vimeo.com/279581066

- This video is from my colleague Dustin Woodhouse and he perfectly presents the story on the variable. He also ONLY works in the BC Lower Mainland; if you live there HE should be doing your mortgage, if you don’t WE should be.

2. WTF is an ‘inverted yield curve,’ and what does it mean for the economy?

For the first time since 2007, the 2- to 5-year US Treasury yield curve has inverted. Historically, this has served as a somewhat reliable indicator of economic downturn, which means people are freaking out, which means…

OK, hold up: What exactly is a yield curve, and why is it inverting?

‘Lend long and prosper’ (so say the banks)

In short, a yield curve is a way to gauge the difference between interest rates and the return investors will get from buying shorter- or longer-term debt. Most of the time, banks demand higher interest for longer periods of time (cuz who knows when they’re gonna see that money again?!).

A yield curve goes flat when the premium for longer-term bonds drops to zero. If the spread turns negative (meaning shorter-term yields are higher than longer maturity debt), the curve is inverted…

Which is what is happening now

So what caused this? It’s hard to say — but we prefer this explanation: Since December 2015, the Fed has implemented a series of 6 interest rate hikes and simultaneously cut its balance sheet by $50B a month.

According to Forbes, the Fed has played a major part in suppressing long-term interest rates while raising short-term interest rates.

Yield curve + inversion = economic downturn (sometimes)

The data don’t lie. A yield curve inversion preceded both the first tech bubble and the 2008 market crash.

Though, this theory has had some notable “false positives” in its lifetime — so it’s not exactly a foolproof fortune teller.

Heck, IBM found the size of high heels tends to spike during hard times. As of now, the experts who believe the sky to be falling remain in the minority.

There is lots to digest in the data above. Please feel free to contact me to discuss in more detail.

Mark Herman, 403-681-4376

Top Calgary Alberta Mortgage Broker

Brokers vs. Banks – The Differences

Love it when the newspapers do the telling for us.

Almost 40% of all mortgages are via brokers now. Up from 25% 15 years ago. There is a reason to use a broker that has been in business for 15 years or longer, like Mortgage Mark Herman of Mortgages Are Marvellous.

https://www.thestar.com/life/advice/2018/07/31/mortgage-brokers-vs-banks-the-pros-and-cons.html

Prime rates should go up in July

This only affects variable rate mortgages and there are 2 increases to Prime expected for 2018, this one and one in December – depending on how the economy goes.

This only affects variable rate mortgages and there are 2 increases to Prime expected for 2018, this one and one in December – depending on how the economy goes.

- The Bank of Canada is expected to raise interest rates on July 11th.

- They normally increase Prime by 0.25% at a time, Prime is 3.45% now and should then go to 3.70%.

- The Central bank also emphasized that the increase will be needed to contain inflation.

This makes the 5-year fixed rates look much better as rates are slowly going back to 4% – the Theoretical Minimum

Mark Herman, Top Calgary Alberta Mortgage Broker

Some will wonder what stopped the Bank of Canada from raising interest rates today. It does seem likely that policy makers struggled with the decision, as they had little bad to say about the economy.

The reason for the delay is the same as it’s been since the start of the year: U.S. President Donald Trump. Canada’s central bank remains concerned that U.S. trade-and-tax policy will weigh on Canadian business investment, so much so that it is prepared to risk a little inflation by waiting for more clarity.

Few thought the central bank would raise interest rates on May 30. Poloz had been clear that he was comfortable with inflation running a little faster than the target rate of 2 per cent. He also said last month that hard evidence on investment would be a crucial variable and no such information has yet been published.

The central bank had been wary that its three interest-rate increases since last summer would choke domestic spending. But households seem to be coping just fine, which means the Bank of Canada can resume pushing interest rates higher.

Here is the link for the entire article: http://business.financialpost.com/news/economy/bank-of-canada-holds-interest-rate-at-1-25

A lesson from RBC’s mortgage rate increase

I love this article from the Globe as it explains why rates are going up a bit and what expectaions are for the near term.

Call for a rate hold if you are thinking of buying in the next 4 months!

“Borrowers who use a mortgage broker pay less …,” Bank of Canada.

See our reviews here: http://markherman.ca/CustomerREVIEWS.ubr

Mark Herman, Top best Calgary mortgage broker

The lesson home buyers should take from RBC’s mortgage rate hike

How the US may start to raise interest rates

This bite of an article is as interesting and as funny as US interest rate increase articles can be.

See why it is better to have your mortgage broker follow this stuff for you then to read it yourself!

Mark Herman, Top Calgary Alberta mortgage broker for home purchases and mortgage renewals

Bill Gross, the former Pimco “bond king” … believes the Federal Reserve could – and should – raise interest rates in September and then hold off on another rate hike for at least six months, a strategy he calls “one and done.”

The strategy adheres in principle if not specifics to numerous messages conveyed recently by influential Fed policy makers, including Fed Chair Janet Yellen, who have said rates will rise “gradually” after the initial rate hike is announced.

“The Fed … seems intent on raising (short-term interest rates) if only to prove that they can begin the journey to ‘normalization,’” Gross wrote in his September Investment Outlook. “They should, but their September meeting language must be so careful, that ‘one and done’ represents an increasing possibility – at least for the next six months.”

Gross, who has been calling for higher interest rates for months, suggested the Fed may have missed its opportunity to raise rates earlier this year when markets were rising steadily and the U.S. economy seemed to be humming along nicely.

In recent weeks, global turmoil has rocked U.S. markets, leading to volatility that pushed all three U.S. stock markets into correction territory last week. A strong bounce-back this week has raised optimism that the downturn was temporary but also led to concerns that markets could be in for a volatile run.

Any mention now by the Fed of returning interest rates to a more normal level of say 2% “cannot be approached without spooking markets further and creating self-inflicted ‘financial instability,’” Gross wrote.

from Fox Business – I know it’s Fox but it’s true: http://www.foxbusiness.com/economy-policy/2015/09/03/bill-gross-fed-likely-eyeing-one-and-done-hike-strategy/

Payout penalties – how the Big-5 banks get you

Below is a great example of how the Big-5 banks get you on a mortgage payout.

Always talk to a broker about your mortgage because Grandma used to say, “the rate is the rate, but the details are the details!”

Mark Herman

Top Alberta mortgage broker for home purchases and mortgage renewals

As you can see from the example below, the banks “discount rate recapture policy” can result in some pretty hefty added costs —$6,048 in the scenario here!

Example:

On July 31, 2011, you buy your first home and sign a five-year, fixed-term mortgage. As your family grows, you start looking at a bigger home, and after a few months of searching, you find the perfect one—on August 1, 2013.

Because of this unexpected upgrade, you now have to break your mortgage three years before it matures (you have $320,000 left on your mortgage). When you signed your current mortgage, you weren’t concerned about prepayment penalties, but as you can see below, prepayment penalties can have a significant financial impact on your bottom line.

| Your situation | |

|---|---|

| Mortgage date | July 21, 2011 |

| Date you break your mortgage | August 1, 2013 |

| How much you have left owing on your mortgage | $320, 000 |

| Your original mortgage term | 5 years |

| How many years left you have on your term | 3 years |

| Comparison | ||

|---|---|---|

| Mortgage breakage fee at the Big-5 banks | Mortgage breakage fee with Broker Banks |

|

| 5-year posted rate when you got your mortgage | 5.39% | Not applicable for the IRD calculation |

| Your actual contract rate | 4.00% | 4.00% |

| Discount | 1.39% | N/A |

| 3-year posted rate on August 1, 2013 (the day you break your mortgage) | 3.75% | 2.99% |

| IRD formula | (Contract rate – [Posted rate for remaining term – Discount from original mortgage]) x Principal outstanding x Remaining term | (Contract rate – Posted rate for remaining term) x Principal outstanding x Remaining term |

| IRD payment | $15,744 | $9,696 |

| Difference in fees | $6,048 | |

For a free mortgage check-up, or pre-approval, or compare what we can do vs. your bank, call Mark at 403-681-4376

• There is no cost to you for our services as the banks pay us for doing their work,

• You get our professional, un-biased advice & expertise on your mortgage,

• We answer our phones and emails, 7 days a week, from 9 – 9, including holidays,

• Your rate will be lower with us as we deal through “broker services” at the banks.

1 Graph Shows Why Mortgage Rates Are Lower in Jan 2015

The graph below shows why rates have found what we think is a short term low. This will not last forever so be sdure to get a rate hold now!

30 day Canadian Mortgage Bond (CMB) trend – below

Graph Summary

The banks get their money for mortgages from the CMB … this is a short term oddity right now. This trend will change soon and is from:

- the quick drop in oil prices

- the surprise rate cut from the Bank of Canada on Prime

- and other world economic activity.

Market Summary

The Bank of Canada has certainly shaken things up with its surprise 0.25 bps rate cut. Even more so because Governor Stephen Poloz has left the door open for a further cut.

Poloz explained that the BoC trimmed its rate as “insurance” for the broader economy in light of the fallout from falling oil prices. He went on to say the Bank was prepared to take out more insurance.

Concerns about unemployment, slowing economic growth and deflation have obviously trumped past worries about record high household debt-to-income ratios.

However, it is not a sure bet that the lower central bank rate will inflate the Canadian real estate bubble. Canadians have established a history of using lower rates to pay down debt, rather than adding to it.

All this from Calgary’s top mortgage broker, Mark Herman

Interest rate predictions are tough

I found this in a retirment planning post ….

Every year since 2009, experts have predicted that “rates have nowhere to go but up,” only to be confronted with what seems to be perpetually low rates.

Most pundits predict rates will finally start to rise again in mid 2015, but the recent surprise rate cut by the Bank of Canada (from 1% to 0.75%) suggests how futile trying to predict the timing of such a change can be.

Central banks’ zero interest rate policies have resulted in “real” (net of inflation) returns of zero or even less-than-zero after income tax, except for outliers like Russia.

In December, Switzerland even began charging savers for the right to deposit funds!

This post from 2013

http://blog.markherman.ca/2013/07/11/how-low-are-interest-rates-really-here-is-the-big-picture/

Now for the big picture…

Short version: rates are the lowest of all time … like a 496 year low. Is that low enough?

“in July 2012, 10-year yields in the US thus reached with 1.39% the lowest level since the beginning of records in the year 1790.

In the Netherlands – which provide the longest available time series for bond prices – interest rates fell to a 496 year low.

In the UK, ‘base rates’ are currently at the lowest level since the founding of the Bank of England in 1694.

In numerous countries (Germany, Switzerland), short term interest rates even fell into negative territory.”

Mark Herman, Mortgage Alliance, Top Calgary Alberta Mortgage Broker, and #1 mortgage brokerage in Canada for 2013 AND 2014!!!

Variable rate mortgage – how payments will change for the new rate

We are getting many calls on this so here is how it works for MOST of the banks.

The Bank of Canada (BofC) reduced their Prime rate by 1/4 % or .25% last week to 0.75% from 1% where it has been for about 3 years.

The banks took a while to decide ifthey were going to lower their rates as well. 3 times before the banks have either not passed on the entire rate reduction to customers or not moved at all and kep the savings to themselves.

Now that most banks have lowered their rate by .15% this is how payments are impacted:

a. If they have an Adjustable Rate Mortgage – ARM mortgage – then the rate will be the new rate starting on the “effective date.”

b. The payment after the next payment will change to reflect this new rate. (So if you pay monthly on the 1st, the Feb 1st payment will be your current payment, but the March 1st Payment will be the new payment, If you pay weekly every Friday, this Friday will be the same payment but the next Friday will be the new payment)

c. Because the rate has gone down, your payment will decrease.

d. Because the interest rate has gone down, the next payment that is still at your existing payment amount will apply a little more to your principal.

e. Customer will receive a letter with their new payment amounts in the snail-mail.

Hope that clears things up a bit.

Call if you have questions.

Mark Herman, Top Calgary Alberta Mortgage Broker.

My bank REALLY REALLY REALLY wants my mortgage! Really?

Does your bank really, really, really want your mortgage that badly?

Do you know why?

NOT because they make lots of money on mortgages.

NOT because the bank rep needs to fill their mortgage quota this month (this happens too.)

BECAUSE the banks have studies that if they can get you to have 3 or more products with them, your odds of leaving to go to another bank fall by 75%.

This means 2 things:

- If they can get you to have the mortgage in addition to your existing checking and savings accounts and or credit card then you will probably not leave for another bank and their cost of customer acquisition is very high.

- Then they can cross-sell you the products they really, really make money on:

- LOCs – line of credits – and more credit cards both with overdraft protection and insurance for the minimum payments if you are injured or laid-off.

- mortgage insurance – a huge profit for them as they try very hard later not to pay claims in their post-claim underwriting process

- mutual funds

- long distance phone plans

- travel insurance

- all the rest.

And 1 more VERY important thing:

Banks know that 86% of people will stay with their existing bank at mortgage renewal time. AND if you have the magic 3 products will you move your mortgage somewhere else then?

Banks expect you to chisel them down now, and when you renew they renew you at rates that are typically .25% to .75% higher than they should be. And 86% of people just sign the renewal docs and send them back. (More data from studies.)

This does NOT happen with mortgages via mortgage brokers as the banks know they have to renew you at the best possible rates or the very same broker that took the customer to that bank will be the very same broker that moves the customer to a new bank if for a better rate on renewal.

Do you want to play this game with the banks or just skip it all together?

All this advice from the top mortgage broker in Calgary Alberta, Mark Herman.