Canadian Economic Forecast – Nov- Mortgage related use

Bank of Canada holds its interest rate steady, publishes updated economic forecasts

On October 25th, the Bank of Canada announced that it would maintain its Canadian Prime Rate stays at 7.3% – stating that there is “growing evidence” that past interest rate increases are dampening economic activity and relieving price pressures.

This decision provides some comfort to borrowers who have seen their mortgage costs rise steadily since March of 2022. As for real relief – in the form of rate cuts – the Bank demurred, noting that its preferred measures of core inflation show “little downward momentum.” Consequently, the Bank said it is holding this policy rate and continuing its current policy of quantitative tightening.

We capture the Bank’s observations and its latest economic forecasts in the summary below.

Inflation facts and outlook

- In Canada, inflation measured by the Consumer Price Index (“CPI”) has been volatile in recent months: 2.8% in June, 4.0% in August, and 3.8% in September

- Higher interest rates are moderating inflation in many goods that people buy on credit, and this is spreading to services

- Food inflation is easing from very high rates; however, in addition to elevated mortgage interest costs, inflation in rent and other housing costs remains high

- Near-term inflation expectations and corporate pricing behavior are normalizing only gradually, and wages are still growing around 4% to 5%

- The Bank’s preferred measures of core inflation show little downward momentum

Canadian housing and economic performance

- There is growing evidence that past interest rate increases are dampening economic activity and relieving price pressures

- Consumption has been subdued, with softer demand for housing, durable goods and many services

- Weaker demand and higher borrowing costs are weighing on business investment

- A surge in Canada’s population is easing labour market pressures in some sectors while adding to housing demand and consumption

- In the labour market, recent job gains have been below labour force growth and job vacancies have continued to ease; however, the labour market remains “on the tight side” and wage pressures persist

- Overall, a range of indicators suggest that supply and demand in the economy are now “approaching balance”

Global economic performance and outlook

- The global economy is slowing and growth is forecast to moderate further as past increases in policy interest rates and the recent surge in global bond yields weigh on demand

- The Bank projects global GDP growth of 2.9% this year, 2.3% in 2024 and 2.6% in 2025. While this outlook is little changed from the Bank’s July Monetary Policy Report, the composition has shifted, with the US economy proving stronger and economic activity in China weaker than expected

- Growth in the Euro area has “slowed further”

- Inflation has been easing in most economies, as supply bottlenecks resolve and weaker demand relieves price pressures but underlying inflation is persisting, meaning central banks must “continue to be vigilant”

- Oil prices are higher than the BoC assumed in July, and the war in Israel and Gaza is a new source of geopolitical uncertainty

Summary and Outlook

The BoC noted that after averaging 1% over the past year, economic growth is expected to remain “weak” for the next year before increasing in late 2024 and through 2025. Near-term weakness in growth reflects both the broadening impact of past increases in interest rates and slower foreign demand. The subsequent economic “pickup” will be driven by household spending as well as stronger exports and business investment in response to improving fore

ign demand. Spending by governments contributes materially to growth over the forecast horizon. Overall, the Bank expects the Canadian economy to grow by 1.2% this year, 0.9% in 2024 and 2.5% in 2025.

In the Bank’s October projection, CPI inflation is expected to average about 3.5% through the middle of next year before gradually easing to 2% in 2025. Inflation is expected to return to the Bank’s target about the same time as policymakers forecast in their July 2023 projection, “but the near-term path is higher because of energy prices and ongoing persistence in core inflation.”

As for what to expect going forward, the Bank had this to say about interest rates: “With clearer signs that monetary policy is moderating spending and relieving price pressures, Governing Council decided to hold the policy rate at 5% and to continue to normalize the Bank’s balance sheet. However, Governing Council is concerned that progress towards price stability is slow and inflationary risks have increased, and is prepared to raise the policy rate further if needed.”

The message is therefore clear: the Bank wants to see downward momentum in core inflation before it changes tack, and continues to be focused on the “balance between demand and supply in the economy, inflation expectations, wage growth and corporate pricing behaviour.”

Once again, the Bank ended its communique with a familiar phrase: it remains “resolute in its commitment to restoring price stability for Canadians.”

What’s next?

The Bank’s final (scheduled) interest rate announcement of 2023 takes place December 6th and we will follow immediately after with our next executive summary.

Canadian Prime Rate is now 5.95% – Mortgage Rate Analysis to End of 2022

Bank of Canada increased benchmark interest rate to 3.75%

Today, the Bank of Canada increased its overnight benchmark interest rate 50 basis point to 3.75% from 3.25% in September. This is the sixth time this year that the Bank has tightened money supply to quell inflation, so far with limited results.

Some economists had assumed the increase this time around would be higher, but the BoC decided differently based on its expert economic analysis. We summarize the Bank’s observations below, including its all-important outlook:

Inflation at home and abroad

- Inflation around the world remains high and broadly based reflecting the strength of the global recovery from the pandemic, a series of global supply disruptions, and elevated commodity prices

- Energy prices particularly have inflated due to Russia’s attack on Ukraine

- The strength of the US dollar is adding to inflationary pressures in many countries

- In Canada, two-thirds of Consumer Price Index (CPI) components increased more than 5% over the past year

- Near-term inflation expectations remain high, increasing the risk that elevated inflation becomes entrenched

Economic performance at home and abroad

- Tighter monetary policies aimed at controlling inflation are weighing on economic activity around the world

- In Canada, the economy continues to operate in excess demand and labour markets remain tight while Canadian demand for goods and services is “still running ahead of the economy’s ability to supply them,” putting upward pressure on domestic inflation

- Canadian businesses continue to report widespread labour shortages and, with the full reopening of the economy, strong demand has led to a sharp rise in the price of services

- Domestic economic growth is “expected to stall” through the end of this year and the first half of next year as the effects of higher interest rates spread through the economy

- The Bank projects GDP growth will slow from 3.25% this year to just under 1% next year and 2% in 2024

- In the United States, labour markets remain “very tight” even as restrictive financial conditions are slowing economic activity

- The Bank projects no growth in the US economy “through most of next year”

- In the euro area, the economy is forecast to contract in the quarters ahead, largely due to acute energy shortages

- China’s economy appears to have picked up after the recent round of pandemic lockdowns, “although ongoing challenges related to its property market will continue to weigh on growth”

- The Bank projects global economic growth will slow from 3% in 2022 to about 1.5% in 2023, and then pick back up to roughly 2.5% in 2024 – a slower pace than was projected in the Bank’s July Monetary Policy Report

Canadian housing market

- The effects of recent policy rate increases by the Bank are becoming evident in interest-sensitive areas of the economy including housing

- Housing activity has “retreated sharply,” and spending by households and businesses is softening

Outlook

The Bank noted that its “preferred measures of core inflation” are not yet showing “meaningful evidence that underlying price pressures are easing.” It did however offer the observation that CPI inflation is projected to move down to about 3% by the end of 2023, and then return to its 2% target by the end of 2024. This presumably would be achieved as “higher interest rates help re-balance demand and supply, price pressures from global supply chain disruptions fade and the past effects of higher commodity prices dissipate.”

As a consequence of elevated inflation and current inflation expectations, as well as ongoing demand pressures in the economy, the Bank’s Governing Council said to expect that “the policy interest rate will need to rise further.”

The level of such future rate increases will be influenced by the Bank’s assessments of “how tighter monetary policy is working to slow demand, how supply challenges are resolving, and how inflation and inflation expectations are responding.”

In case there was any doubt, the Bank also reiterated its “resolute commitment” to restore price stability for Canadians and said it will continue to take action as required to achieve its 2% inflation target.

NEXT RATE INCREASE

December 7, 2022 is the BoC’s next scheduled policy interest rate announcement. We will follow the Bank’s commentary and outlook closely and provide an executive summary here the same day.

1 Graph Shows Why Mortgage Rates Are Lower in Jan 2015

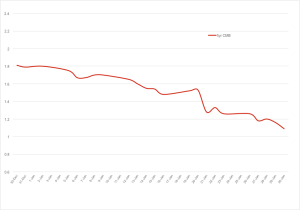

The graph below shows why rates have found what we think is a short term low. This will not last forever so be sdure to get a rate hold now!

30 day Canadian Mortgage Bond (CMB) trend – below

Graph Summary

The banks get their money for mortgages from the CMB … this is a short term oddity right now. This trend will change soon and is from:

- the quick drop in oil prices

- the surprise rate cut from the Bank of Canada on Prime

- and other world economic activity.

Market Summary

The Bank of Canada has certainly shaken things up with its surprise 0.25 bps rate cut. Even more so because Governor Stephen Poloz has left the door open for a further cut.

Poloz explained that the BoC trimmed its rate as “insurance” for the broader economy in light of the fallout from falling oil prices. He went on to say the Bank was prepared to take out more insurance.

Concerns about unemployment, slowing economic growth and deflation have obviously trumped past worries about record high household debt-to-income ratios.

However, it is not a sure bet that the lower central bank rate will inflate the Canadian real estate bubble. Canadians have established a history of using lower rates to pay down debt, rather than adding to it.

All this from Calgary’s top mortgage broker, Mark Herman

Tricky changes to the mortge rules

Here is one of the changes of the mortgage rules that is now in effect – called the B21 Rules.

It will be sure to cause surprise for some customers that have large Line of Credits – LOCs

How the banks are now calculating monthly payments for secured lines of credit:

- The outstanding balance (not the limit) will now be amortized over 25 years using the Bank of Canada 5-year benchmark rate to determine the monthly payment

What that means …

For the calculation of your QUALFYING INCOME – as in, the way the government says your mortgage math is done – your total balance on your LOC is now treated:

- as a mortgage

- with a 25 year amortization and

- the rate used to calculate the monthly payment is the government’s “benchmark rate” which is about 5%.

This number is now used as your payment, not what the payment actually is.

Downtown living the ‘new normal’

This is more support for central/ down town condos in Calgary supporting their prices as more people move to the core to avoid the commute.

Mark Herman, Calgary Alberta mortgage broker

Downtown living the ‘new normal,’ report says

Employers move to urban cores to attract qualified workers, retail follows.

Homeowners choosing urban living over suburbia is a key trend in Canada’s real estate market and is helping drive both retail and commercial development in city cores, according to a report. …

“Younger workers in particular — though not exclusively — continue to flock to the urban core, preferring to work where they live, rather than take on long commutes,” the report says.

Members of the millennial generation are not the only ones giving up the more generous living space of suburbia for downtown living. Baby boomers with empty nests and the generation following the millennials, which the report calls “Generation Z,” are also joining the trend …

http://www.cbc.ca/news/business/downtown-living-the-new-normal-report-says-1.2815490

Interest rates expected to go up October 2015 says Bank of Canada

The Bank of Canada has updated when they plan to increase rates again … about a year from now – so next October? Expect rates to go up 1% then.

Mark Herman, top Calgary, Alberta mortgage broker

The central bank further pushed back the time frame for when it reckoned the economy would reach full capacity, to the second half of 2016 from the mid-2016 estimate in July. It also delayed by one quarter to the fourth quarter of 2016 the time when it expects total and core inflation to settle at its 2 percent target.

Here is the link: http://ca.reuters.com/article/businessNews/idCAKCN0IB1NY20141022

TD’s huge payout penalties in the news – $17,000!

Not only does TD have collateral mortgage registrations but they, and all the other banks love to gouge on the payout penalties.

http://www.cbc.ca/news/canada/edmonton/td-bank-client-devastated-by-17-000-mortgage-penalty-1.2790108

Calgary housing boom pushing prices to all-time high

Below in blue I have highlighted the most important part of this and paste it here too: “the Calgary numbers we’re seeing today show this is the strongest and healthiest housing market since the 2006 boom,” he said. “That said, this isn’t the boom — and that’s a good thing.”

As always, sustained growth – as high as China if Alberta were a country – has people moving here and they have to live somewhere. Check out my other blog posts for more on this topic. Mark Herman

Single-family homes average more than half a million dollars

CALGARY – Calgary’s booming housing market is pushing average prices to record levels as single-family home sales so far this year are averaging well above half a million dollars.

“The residential real estate market is holding strong for sellers,” said Grace Yan, a Calgary realtor with RE/MAX Real Estate (Central).

“It usually slows down for Christmas season but we are realizing that it remains at a steady rise. We are still finding a shortage of listings, lots of activity with shorter days on the market. We are finding from fixer uppers, inner-city properties to turnkey luxury high-end homes in demand. We anticipate the steady market to continue to heat up for the new year.”

As of Thursday, according to the Calgary Real Estate Board, the average MLS sale price for all residential property in the city so far this year has been $457,123. The annual record is $428,649 set last year. In 2004, average sale prices in the city were $227,269.

So far this year, the average MLS sale price for a single-family home is $517,598. The annual record price of $481,259 was set last year. In 2004, the average was $251,558.

On Friday the Canadian Real Estate Association released its latest MLS data for October showing that Calgary had the best year-over-year gain in the country in the MLS Home Price Index.

CREA said prices in Calgary, for homes tracked by the index, rose by 8.17 per cent from last year while the national average of 11 markets surveyed was up by 3.52 per cent.

Scott Bollinger, broker with the ComFree Commonsense Network, said there was a little softness in the market last year because of the introduction of tighter mortgage rules.

“But the Calgary numbers we’re seeing today show this is the strongest and healthiest housing market since the 2006 boom,” he said. “That said, this isn’t the boom — and that’s a good thing. 2006 was marked by some things we’re not seeing today — a massive inventory crunch, irrational exuberance and confidence that the market would stay strong indefinitely, and almost unthinkable economic growth. We saw six and seven per cent growth in 2006.

“Our economy today is growing at a nice, measured, healthy rate — three, three-and-a-half per cent. So we’re still seeing confidence, but it’s not the same extreme. There’s a collective memory in this city of the boom, so I think this strength we’re seeing is more sustainable. Houses are still selling quicker, but they’re nowhere near the frenzied pace we saw in 2006, when the average time on market dipped to 20 days.”

In October, Calgary had 2,510 MLS sales, up 19.3 per cent from last year. Alberta registered 5,588 sales, up 16.1 per cent, and Canada had 39,039 MLS sales for an annual hike of 8.3 per cent.

Average sale prices in October and their year-over-year increase were: Calgary, $436,216, 4.2 per cent; Alberta, $377,084, 3.8 per cent; and Canada, $391,820, 8.5 per cent.

Calgary’s real estate market is showing no signs of slowing down in November. Month-to-date including Thursday, there have been 830 MLS sales in the city, up 34.30 per cent from the same period a year ago, according to CREB. The average sale price has also climbed by 7.47 per cent to $463,126.

Doug Porter, chief economist with BMO Capital Markets, said there are two notable splits developing in Canada’ housing market – larger cities are hot, while smaller cities are generally not, and sales in the West are strong, but are weakening in much of the East.

“When judged by total sales volumes, a measure that combines both price changes and the number of units sold, the hottest markets this year are Calgary, Edmonton, and, against all expectations, Vancouver,” he said. “All three have reported double-digit volume increases, the only cities in that category.”