Approved: Mortgage with U.S. Income, Remote Work & Gifted Down Payment (CMHC Deal)

Cross-Border Mortgage Approved: U.S. Income + Gift Funds + CMHC

This Mortgage Deal Looked Impossible (But CMHC Approved It Anyway)

We recently completed a mortgage deal that even I assumed is impossible.

We got it done — and now that we’ve successfully navigated the process, we’re ready to help more buyers in similar situations.

This file was a great example of how the right strategy, documentation, and lender experience can turn a complicated deal into a clean approval.

Mortgage Mark Herman, Best Alberta, Canada mortgage broker for Americans buying in Canada.

The Buyers

This purchase involved two applicants:

-

Buyer #1: Canadian citizen, stay-at-home mom, currently with no income

-

Buyer #2: Permanent resident (PR), employed as a lawyer for a U.S. company, paid in U.S. dollars

Files like this can get tricky quickly, especially when one borrower has no income and the other is employed outside of Canada.

The Property

This was a primary residence purchase.

The buyers also had no other properties, which helped strengthen the application and simplify insurer review.

The Biggest Challenge: U.S. Income + Remote Work

The income-earning borrower worked for an American employer and was able to work 100% remotely.

The key detail? Their employment letter confirmed remote work was permanent, not temporary.

The documentation included:

-

Employment letter confirming permanent remote work status

-

U.S. income documents (W-2 and 1040)

-

A clear written narrative summarizing income and filing history

When borrowers are paid in U.S. dollars, lenders and insurers need to clearly understand consistency, deductions, and income stability. Presentation matters.

Down Payment Structure

The buyers had a 15% down payment, structured as follows:

-

5% from their own funds

-

10% gifted from a family member in the United States

Gifted down payments are common, but cross-border gifted funds require extra documentation and clean sourcing. We made sure everything was properly verified and acceptable for insurer guidelines.

CMHC Approval (Including an American Credit Report)

This mortgage was approved through CMHC, and one of the most interesting parts of the deal was that CMHC accepted an American Equifax credit bureau report.

That’s something many buyers don’t realize is even possible — but in the right scenario, it can absolutely work.

Why This Deal Was Unique

This was not a typical mortgage approval.

It required:

-

Cross-border income verification

-

Review of U.S. tax documents

-

Confirmation of permanent remote employment

-

Gifted down payment verification from the U.S.

-

Credit review using an American credit bureau report

-

Proper structuring and presentation for insurer underwriting

But in the end, the deal was approved — and the buyers are now homeowners.

The Takeaway

If you’re a Canadian citizen or PR earning U.S. income, working remotely, or receiving gifted funds from outside Canada, you may still qualify for a mortgage — even if your situation feels complicated.

A bank “no” doesn’t always mean the deal is dead. It often just means it needs the right approach.

Need Help With a Complex Mortgage File?

If you’re buying in Canada but your income, credit, or down payment involves the U.S., I can help you structure it properly from the start.

Mark(at)MaMaRv.ca

Or call/text directly to discuss your options.

Advice on Mortgage Renewals Before April 2026 from an MBA

Questions on what product to pick for your upcoming mortgage renewal.

Here are the reasons that we like the 5 year fixed for Canadian mortgage renewals over the next few months.

(renewals from now, February 2nd until April 1st.)

This data is recent and should be good for the next few months.

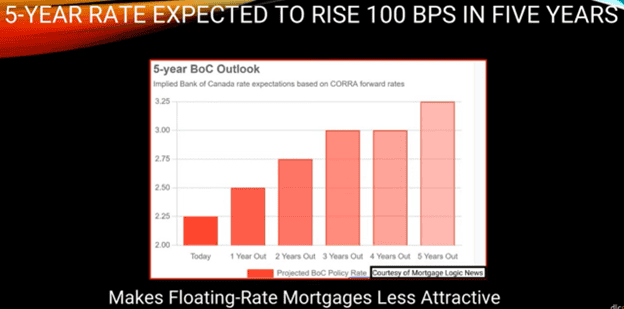

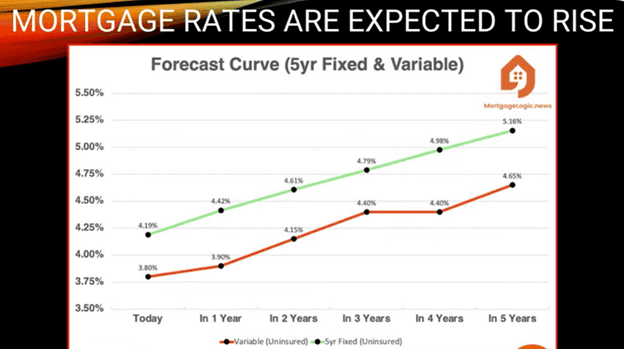

Below are the graphs that show that rates are trending up and are on the increase.

Q: Why are rates trending up?

A: Because Trump policy is generally inflationary, and add in the “cost of uncertainty” due to changing tariffs and other world political issues we have an increasing rate environment.

Big Picture Perspective

I also look at from this perspective, rates were close to 4% BEFORE Covid in 2020, and we are now back to about the same; 3.99% for a 3-year fixed and 4.25% to 4.54% for a 5 year fixed rate term.

- Comparing these rates, there is not much room for rates to go down; maybe .5%, half a percent.

- But there is lots of room for them to go up.

What if things get out of hand and rates are at 6% or 7%?

When I started out in 2004, my first customer’s rate was 8.99% and they were happy it did not start with a 9. (You always remember your first deal.)

Summary

The rates for the 3 year fixed and the 5 year fixed are similar so take the 5 year and know you are getting a good rate at the bottom of the rate cycle.

If you take the 3 year and rates DO go up, and you then renew 2 years sooner into what could be 6% or 7% rate environment (when you could have had 2 more years at 4.zz%.) You will be pretty upset as your new monthly payment would now be higher even though your balance is lower.

If you take the 3 year fixed and the rates stay low then you gain a slightly lower payment ($25/ month) over the first 3 years.

Most of our customers agree the safer bet is less expensive when you factor in how sound you will sleep at night.

Mortgage Mark Herman, best Calgary broker for mortgage renewals and advice.

Stress Test Continues; Was Almost Abolished

Yes, the Stress Test was almost done away with but it continues.

It seems to be a good thing that all the mortgages since 2018 have been “stress tested” at 5.25%. Now that we are in the middle of 3.6 million mortgages renewing over an 18 month period we find that most everyone is able to make their new mortgage payments after renewal.

Mortgage Mark Herman, MBA in Finance and 22 years experience as a mortgage broker in Western Canada

Nerd alert here!!

OSFI has also determined that loan-to-income (LTI) limits on each institution’s mortgage portfolio will remain in place, alongside the existing stress test.

LTI limits have been in place since each institution’s 2025 fiscal year start and are reported on a quarterly basis.

This is a limit on the volume of newly originated uninsured mortgage loans, at that financial institution, that exceed a 4.5x loan-to-income multiple. This is not a limit on each individual loan.

This measure was introduced in an effort to lessen the build-up of highly leveraged residential mortgage borrowers.

Background

Canada’s federal mortgage stress test began on January 1, 2018, when the Office of the Superintendent of Financial Institutions (OSFI) introduced it for uninsured mortgages.

Key Details of the Stress Test

- Introduced: January 1, 2018

- Regulator: OSFI (Office of the Superintendent of Financial Institutions)

- Applies to: Uninsured mortgages (20%+ down payment) at federally regulated lenders

- Purpose: Ensure borrowers can afford payments at a higher qualifying rate than their contract rate

Buying a Home with a Basement Suite – Some Details

Buying a home with a basement suite can be a powerful way to increase affordability, improve cash flow, and build long-term wealth — but not all suites (or lenders) are treated the same. If you’re considering a home with a suite, here are four important things to think about before you buy.

1) The type of suite matters.

If a suite is legal (fully permitted and meets municipal bylaws), all lenders will accept the rental income for qualification. If it’s not legal, make sure it’s at least fully self-contained, meaning it has its own entrance, its own kitchen, and its own bathroom. Many lenders will still consider rental income from these types of suites, but not all.

2) Your lender choice can change how much you qualify for.

Different lenders treat rental income very differently. Some will only allow 50% of the rental income to be used, while others allow up to 100%. Some lenders make you debt-service property taxes and heat, while others do not. These differences can have a huge impact on your approval amount, which is why working with a broker who understands rental income policy is so important.

3) Whether the suite is already rented or not DOES matter.

If the suite is currently rented, you should obtain a copy of the lease, make sure the purchase contract clearly states that the tenant is staying, and ensure the monthly rent amount is documented. If the suite is not already rented when you purchase the home, lenders will typically require an appraisal to confirm market rent. It’s very important to be conservative about what you expect the suite to rent for — especially if that rental income is crucial to comfortably affording the home.

What about adding a basement suite OR Mother-in-Law suite to the home I am buying?

Great idea, adding a suite to the home that you are buying AND at the same time, using the expected rental income from that same suite to qualify for the mortgage IS possible. There are a few lenders that allow this to happen and we do deals like this all the time. (No shortcuts though, as the final step is a final inspection and also providing the lender a copy of the occupancy permit from the City before the funds can be released.

Obviously there are some details involved but adding a suite and using the expected rental income to qualify for the mortgage is a huge helper for buyers looking to push a bit higher and get a “mortgage helper.”

Mortgage Mark Herman, 1st time home buying mortgage specialist

Variable Rate or Fixed Rate for Renewals in 2026?

Here is what a math-based, mortgage broker with 21 years of experience and an MBA in finance looks at when deciding what to do for my own mortgage renewal.

This is a super common question as there are still 1,800,000 Canadian mortgage renewals to come before summer 2027, with the same 1.8M renewals completed since 2025.

Numbers at the top, words at the bottom.

Numbers

Variable Rate in 2024 = 6.20%

(Prime – .90% = 7.2% – .9% = 6.2% rate.)

-2.75% rate drops = 3.45% today, Jan 2026.

Variable Rate in 2026 = 3.75% today

(Prime – .70% = 4.45% – .7% = 3.75% rate.)

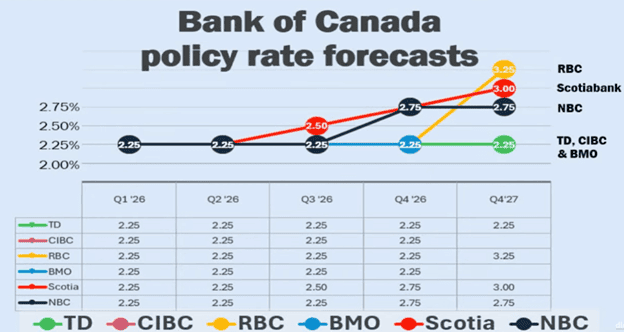

No rate drops expected, 2x .25% increases expected = 3.75% + .5 = 4.25% by the end of 2026.

Continued instability will lead to more rate increases later.

5-year Fixed Rates

5.09% in 2024

4.24% today – 2026

Analysis

Variable wins by .5% today, but fully expect 2 x o.25% increase in 2026 to make the rate the same as fixed rates are today, Jan 2026.

Fixed rates are now, and will continue to slowly rise, as Trump policy is highly inflationary.

If you take a variable now, and then go to lock it in later, when variable rates / prime rates start to increase, the rate you lock in at will be higher than today.

Summary

Rates look to have bottomed out right now, from looking many data points.

Fixed rates are ½% higher than the variable rates today – Jan 2026.

Then what? In 2024 I was able to precisely layout the next 18 months and predicted every rate increase exactly as it played out. Right now it is not possible to guess what will happen next month so Variable has higher risk and will probably pay more later as the rates increase as expected.

200 Word Summary

Canada’s variable-rate mortgage borrowers have enjoyed significant relief since the Bank of Canada (BoC) began cutting interest rates in 2024, but that momentum is expected to slow—and probably reverse – in 2026.

The BoC delivered 2.75% of rate cuts through 2024–2025, bringing the policy rate down to 2.25%. This helped push insured variable mortgage rates below 4%, down from around 7% in mid-2024.

However, the BoC now views inflation risks as too elevated to justify further cuts, and rate relief for variable-rate borrowers is “mostly behind us.”

The bank’s baseline forecast suggests the BoC’s policy rate could rise back toward its long-term neutral level of 2.75%, which would push variable mortgage rates up by roughly 0.5% in 2026, with additional increases probable in 2027.

Meanwhile, fixed mortgage rates have fallen less dramatically because they are tied to longer-term bond yields, which rebounded in late 2025. Borrowers have increasingly favored 3-year fixed and 5-year fixed terms, anticipating improved renewal conditions ahead when they renew later.

Bottom line: 2026 could prove challenging for variable-rate borrowers. The era of large variable-rate relief seems to be ending, and 2026 may test borrowers who relied on those lower rates — especially if the BoC keeps rates steady or reverses course

Looking at all of this, in March, I will be renewing into the 5-year fixed so I can sleep at night.

Mortgage Mark Herman, MBA, Top Calgary mortgage broker for 21 years.

5 Car Loan Strategies That Can Boost Your Mortgage Approval — An MBA-Level Approach

Top 5 Car Loan Strategies We Used for Mortgage Clients in 2025

In today’s mortgage landscape, qualification isn’t just about income and credit—it’s about strategic debt management. With an MBA in Finance and 21 years in the industry, I approach mortgage qualification the same way I would evaluate a business balance sheet: identify inefficiencies, reduce liabilities, and optimize cash flow.

One of the most overlooked opportunities to a mortgage approval is your auto loan.

Car loan rates now at their lowest point in nearly five years—6.25% to 6.99%—the math has never worked better.Mortgage Mark Herman; Best Mortgage Broker for New Home Buyers in Calgary, Alberta.

Most clients are seeing sizeable reductions in their monthly payments, which directly improves affordability ratios and increases borrowing capacity. In other words, small changes on the car side can create big changes on the mortgage side.

Why Auto Loan Optimization Matters

Mortgage lenders don’t qualify you based on total debt—they focus on monthly obligations. So even if your auto loan balance is reasonable, the payment itself may be restricting your mortgage approval.

From a financial efficiency standpoint, this is low-hanging fruit. Reducing or restructuring this one line item can dramatically shift your debt-to-income (DTI) ratio and unlock far greater mortgage purchasing power.

Top 5 Car Loan Strategies We Used for Mortgage Clients in 2025

1. Commercial Auto Loans for the Self-Employed

By shifting the vehicle loan from personal to business liability, we remove the payment entirely from your mortgage ratios. This is financial restructuring 101—use the proper balance sheet for the proper asset.

2. Auto Loan Payment Reductions

With today’s lower rates and extended terms (up to 96 months on newer models), most clients see substantial monthly reductions.

This isn’t about stretching debt—it’s about reallocating cash flow to where it has the highest ROI: qualifying for a home.

3. Cash-Back Refinancing

Lower the payment and pull out equity from your vehicle.

This can fill down payment gaps or pay off high-interest debt—another strategic reshuffling of resources to strengthen your mortgage file.

4. “Free and Clear” Mortgage-First Strategy

Sometimes paying off a car is required to get a mortgage approved.

The sophisticated move? Refinance the vehicle after closing and reimburse yourself. You maintain mortgage eligibility and preserve liquidity—exactly the type of sequencing we analyze in financial planning.

5. Co-Signer Removal

If you’ve co-signed for someone else, you’re carrying a liability without receiving the benefit.

Removing yourself restores borrowing capacity and aligns your financial profile with your actual obligations.

The Bottom Line

Your auto loan isn’t just a monthly payment—it’s a strategic lever in your overall financial picture. By applying an analytical, MBA-driven approach to debt optimization, we can often increase mortgage qualification dramatically without changing income or credit.

If you’re planning to buy a home this year, let’s look at your auto loan the way a CFO looks at a balance sheet:

Find the inefficiencies, optimize the structure, and unlock the capacity you didn’t know you had.

Mortgage Renewals – 2.75 million Canadian Mortgage Renewals Before 2028!!

Mortgage Stress Test: Why It’s Protecting Homeowners Ahead of the 2026 Renewal Wave

If you locked in your mortgage around 2% five years ago, you probably remember grumbling about the federal “stress test.” At the time, qualifying at 5.25% felt unnecessary — almost punitive. Fast forward to today, and that very safeguard is proving to be one of the smartest policies in Canadian housing finance.

The Renewal Wave Is Coming

According to the latest CMHC report, Canada is heading into a busy period of mortgage renewals:

- 750,000 mortgages will renew in the second half of 2025

- Over 1 million more in 2026

- 940,000 in 2027

Even though the Bank of Canada has cut rates nine times since its peak tightening cycle, borrowing costs remain much higher than they were during the pandemic lows. In fact, the average five-year fixed uninsured mortgage rate in July 2025 was still 67% higher than five years earlier.

“Banks are ready for the almost 3 million mortgage renewals before 2028. Lets get you a strategy on how to get the best rates on your renewal. Its a quick 10 minute phone call and we usually send you back to your own bank with the data you need to get a better rate from them OR we can move you to a bank that does get you better rates.”

Mortgage Mark Herman, Top Calgary Mortgage Broker for renewal advice

Stress Test Success

Here’s the good news: borrowers who qualified at 5.25% back in 2020 are now proving resilient. The stress test ensured they could handle payments at rates much higher than what they actually received. That foresight is paying off:

- National mortgage delinquency rates fell in Q2 2025 — the first decline since 2022.

- While Ontario and BC saw arrears climb (reflecting higher property values and loan sizes), the overall system is holding steady.

- Fears of a “renewal cliff” have eased, thanks to both the stress test and recent rate cuts.

What This Means for You

If your mortgage is coming up for renewal in 2026, now is the time to plan. Options like refinancing, adjusting amortization, or exploring different products can help smooth the transition. The stress test gave you a buffer — but proactive planning will maximize your financial flexibility.

Call to Action: If your mortgage is set to renew in the next 12–18 months, let’s talk strategy. As a mortgage broker, I specialize in helping clients navigate renewals, refinances, and complex lending scenarios. Call me today to review your options and make sure you’re ready for what’s ahead.

Reverse Mortgage Specials: October 2025

The reverse mortgage market is surging yet remains undeserved by brokers that dabble in this product.

We have been doing Reverse Mortgages since 2005, and also did the largest Reverse Mortgage ever at the time (in 2014) for $720,000!!

With millions of Canadians approaching retirement and facing a savings shortfall, now’s the time to look into REVERSE MORTGAGE Options.

Mortgage Mark Herman, expert in Canadian Reverse Mortgages

The Numbers

3M

Canadian households retiring in the next 10 years

$1M

What most Canadians believe they need to retire

$272K

Average retirement savings for Canadians 65+

That’s a $728K gap—and reverse mortgages can help close it.

Right now 2 of the 3 big lenders have a special on.

- Available in AB, BC, ON, QC

- We’ll beat any posted rate for comparable reverse mortgages

HIGHLIGHTS of these lenders and their reverse mortgages:

- Tax-free cash for:

- Paying off an existing mortgage

- Debt consolidation

- Health care & renovations

- Living inheritance & gifts

- No monthly payments required

- No impact on federal retirement benefits

- 100% home ownership retained⁶

- Preserve investments & legacy while aging in place

Ready to start the conversation?

Reach out today to discover how reverse mortgages can grow your business—and help your clients thrive.

Reach me direct at 403- six81- 437six

I answer from 9-9 x 365.

#1 Mortgage Rate SPECIAL in Canada ⚡

|

|

|