Bank of Canada lowers benchmark interest rate to 3%

The Bank of Canada opened its monetary policy playbook for 2025 with a 0.25% reduction in its overnight rate. The 6th since June of last year.

In issuing its January Monetary Policy Report, the Bank also noted that its projections are subject to “more-than-usual uncertainty” because of the rapidly evolving policy landscape, particularly the threat of trade tariffs by the new administration in the United States.

Variable rates win, but can you handle some possibly sleepless nights if Trump’s tariffs increase fixed rates as much as 3%?

(Click to see the link to the report showing this.)

If Canada does a full retaliation to Trump’s 25% tariffs our Canadian interest rates could go up by 3%; and if there is no retaliation at all, Canadian interest rates could go down by up to 3% as well!

Mortgage Mark Herman, 20+ years of mortgage experience with an MBA from a top school & Top Calgary Alberta Mortgage Broker

Below, we summarize the Bank’s commentary.

Canadian economic performance and housing

- Past interest rate reductions have started to boost the Canadian economy

- Recent strengthening in both consumption and housing activity is expected to continue

- Business investment, however, remains weak

- The outlook for exports is supported by new export capacity for oil and gas

Canadian inflation and outlook

- Inflation measured by the Consumer Price Index (CPI) remains close to 2%, with some volatility due to the temporary suspension of the GST/HST on some consumer products

- Shelter price inflation is still elevated but it is easing gradually, as expected

- A broad range of indicators, including surveys of inflation expectations and the distribution of price changes among components of the CPI, suggest that underlying inflation is close to 2%

- The Bank forecasts CPI inflation will be around the 2% target over the next two years

Canadian labour market

- Canada’s labour market remains soft, with the unemployment rate at 6.7% in December

- Job growth, however, has strengthened in recent months, after lagging growth in the labour force for more than a year

- Wage pressures, which have proven sticky, are showing some signs of easing

Global economic performance, bond yields and the Canadian dollar

- The global economy is expected to continue growing by about 3% over the next two years

- Growth in the United States has been revised upward, mainly due to stronger consumption

- Growth in the euro area is likely to be subdued as the region copes with competitiveness pressures

- In China, recent policy actions are boosting demand and supporting near-term growth, although structural challenges remain

- Since October, financial conditions have diverged across countries with bond yields rising in the US, supported by strong growth and more persistent inflation, and bond yields in Canada down slightly

- The Canadian dollar has depreciated materially against the US dollar, largely reflecting trade uncertainty and broader strength in the US currency

- Oil prices have been volatile and in recent weeks have been about $5 higher than was assumed in the Bank’s October Monetary Policy Report

Other comments

The Bank also announced its plan to complete the normalization of its balance sheet, which puts an end to quantitative tightening. The Bank said it will restart asset purchases in early March 2025, beginning gradually so that its balance sheet stabilizes and then grows modestly, in line with growth in the economy.

It also offered further rationale for today’s decisions by saying that with inflation around 2% and the economy in excess supply, the Bank’s Governing Council decided to reduce its policy rate. It also noted that cumulative reduction in the policy rate since last June is “substantial.” Lower interest rates are boosting household spending and, in the outlook it published (see below), the economy is expected to strengthen gradually and inflation to stay close to target.

Outlook

In today’s announcement, the Bank laid out its forecast for Canadian GDP growth to strengthen in 2025. However, it was quick to also point out that with slower population growth because of reduced immigration targets, both GDP and potential growth will be “more moderate” than what the Bank previously forecast in October 2024.

To put numbers on that forecast, the Bank now projects GDP will grow by 1.8% in both 2025 and 2026. As a result, excess supply in the Canadian economy is expected to be “gradually absorbed” over the Bank’s projection horizon.

Setting aside threatened US tariffs, the Bank reasons that the upside and downside risks in its outlook are “reasonably balanced.” However, it also acknowledged that a protracted trade conflict would most likely lead to weaker GDP and higher prices in Canada and test the resilience of Canada’s economy.

The Bank ended its statement with its usual refrain: it is committed to maintaining price stability for Canadians.

2025 will bring more BoC news

The Bank is scheduled to make its second policy interest rate decision of 2025 on March 12th. I will provide an executive summary immediately following that announcement.

Summary of Mortgage Rule Changes

Key Mortgage Rule Updates

30-year amortization for insured mortgages

Starting December 15, 2024, 30-year amortizations will be available for insured mortgages. This option is open to first-time homebuyers and those purchasing newly built homes, including condos.

Higher insured mortgage limits

Applications for insured mortgages will now be accepted for properties valued under $1.5 million, giving more buyers access to high-value homes with lower down payment requirements.

Stress test simplification

In line with OSFI’s guidance, current stress test requirements will continue for insurable, uninsurable, and uninsured applications. Eligible insured transfers and switches will remain qualified at the contract rate.

How these changes benefit you

✔️ Reduced monthly payments

Extending amortizations to 30 years will lower monthly payments, helping clients manage affordability amidst rising living costs and fluctuating interest rates.

It usually works out to reduce your payment by 9% or lets yo buy 9% more home (increases the mortgage amount but about 9%.)

✔️ Expanded opportunities for buyers

Higher insured mortgage limits make it possible for more Canadians to purchase homes in competitive urban markets like Toronto and Vancouver for up to $1,500,000 with 5% down on the 1st 500k and 10% down payment on the balance.

This set of mortgage rule changes should make it easier for buyers to get into a home now.

More importantly, it lets buyers purchase up to $1.5M with $125k down, where before they would have topped out at $1m with $75k down payment.

- Mortgage Mark Herman, top best Calgary mortgage broker,

- 403,681-4376

New Housing Rules for 1st First-Time Buyers and New Builds

If you’re a first-time home buyer or looking to purchase a new build, this affects you.

Here’s a quick summary of the changes coming in December 2024:

What’s New?

30-Year Amortizations Now Available for First-Time Buyers and New Build Purchases

- First-time home buyers can now access 30-year amortizations for insured mortgages.

- This increases the amount you qualify for by about 9% or lowers your monthly payment about the same.

- 30-Year Amortization for New Builds – Technically, this took effect on August 1, 2024, and is available to everyone, not just First-Time Homebuyers.

Price Cap Increase for Insured Mortgages

- The price cap (purchase price) for insured mortgages has been raised from $999,999 to $1,499,999 million.

- EG: if you were to purchase a home today priced at $1.1 million, your minimum down payment to qualify for a mortgage would be 20% or $220,000. After December 15th, the minimum down payment required decreases to $85,000.

- If that $1.1 million dollar home also has a self contained suite, you can use the rent or “potential” rent that suite will generate to help qualify for a bit more of a mortgage too.

The Fine Print

Down payment – Great news, minimum requirements stay the same:

- 5% on the portion up to $500,000

- 10% on the portion between $500,000 and $1.5 million

* Previously, the down payment on a $1.5 million home for a First-Time Home buyer was $300,000.

FTHB’s can now get into that same home with $125,000.

This will undoubtedly take some pressure off the Bank of Mom and Dad.

Effective Date

These changes will apply to mortgage insurance applications submitted on or after December 15, 2024. The key word here is ‘submitted.’ Your offer will need to be timed just right if you wish to take advantage of the new 30-year amortization.

Potential Impacts on the Housing Market:

We are in an interesting position right now. On one hand, lenders are competing for new business in what could be described as a ‘rate war.’

Additionally, with First-Time Home Buyers (FTHB) set to qualify for 30-year amortizations after December 15th, we can expect an uptick in demand.

Historically, higher demand leads to higher prices and rate decreases cause an equal and opposite increase in home prices.

Buy or Sell – Now or Later?

While there’s no crystal ball, consider these possibilities:

- Buy Now: Prices are expected to rise once the new rules take effect, so purchasing before December could mean less competition and potentially lower prices.

- Sell Later: If your home is priced between $1 million and $1.5 million, waiting until after December 15th could attract more qualified buyers and possibly higher offers.

More details will emerge as lenders and insurers prepare to offer the new 30-year amortization, such as how lenders will view the minimum down payment.

If you want to discuss how these changes might impact your plans to buy or sell, feel free to reach out!

Variable Rate Beats BOTH 3-year & 5-year Fixed Terms

The Variable is the best way to go right now and this blue link has all the details in PDF: VARIABLE RATE beats both 3-year fixed & 5-year fixed terms

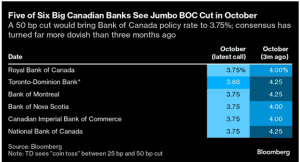

Data point 1: Variable rates should be coming down 2% in the next 13.5 months, with a “jumbo reduction” of 0.5% (1/2%) expected on Wednesday, Oct 23rd – by 5 of the 6 Big Banks.

Data point 2: Historically, fixed rates only go down about 40% of the reductions to Prime, so fixed rates will not be going down anywhere near as much or as fast as the Variable.

Data point 3: Just a 1% rate reduction is expected to “reactivate” at least half of buyers who previously stopped shopping due to “buyer fatigue.”

Data point 4: As interest rates come down, prices INCREASE because most buyer’s need to go to their max mortgage when buying.

Graphic details of expected rate reductions and the dates of expected changes, in PDF: VARIABLE RATE beats both 3-year fixed & 5-year fixed terms

Our favorite customer quote so far in October:

I am not locking in 3-year money nor 5-year money today, when the Bank of Canada has made it clear rates are coming down 2% in the next 15 months.

Mortgage Mark Herman, Top Calgary Alberta Mortgage Broker near me.

New Canadian Mortgage Rules; Sept 2024

Great news from Ottawa today on the new rules for Canadian mortgages:

- An Increase to the Insured Mortgage Price Cap: The government will raise the price cap from $1 million to $1.5 million, reflecting the realities of today’s housing market. This change, effective December 15, 2024, will help more Canadians qualify for insured mortgages and make homeownership more attainable, especially for younger Canadians.

- Expanded Eligibility for 30-Year Amortizations: First-time homebuyers and all buyers of new builds will now be eligible for 30-year insured mortgage amortizations. This is a crucial step in reducing monthly mortgage payments and helping more Canadians, particularly Millennials and Gen Z, achieve the dream of owning a home.

- Increased Mortgage Competition: The strengthened Canadian Mortgage Charter now enables insured mortgage holders to switch lenders at renewal without being subject to another stress test. This will foster greater competition and ensure Canadians have access to the best mortgage deals.

All 3 of these changes will help New Buyers / 1st Time Buyers afford to get into a home of their own.

Most of our First Time Buyers need gifts or co-signing from parents to be able to buy. The 30 year amortization and increase of CMHC insurance will totally help.

Mortgage Mark Herman, Best top Calgary Alberta mortgage broker specializing in 1st time buyers for 20 years.

Typical income documentation requirements – Canadian mortgage

Below are the typical income documentation requirements for each type of income.

-

Salaried employees & commission income

Salaried

Salaried and hourly employees may need to supply:

- A job letter and a recent pay stub to show consistent salary

If your hours aren’t guaranteed or if there is a lot of overtime, you may also be asked for a 2-year income history.

Commissioned

Commissioned salespeople typically need the same documents as a salaried employee except they may also need to provide:

- 2 years of T1 Generals with corresponding NOA’s – Notice of Assessments to establish a 2-year income average.

-

Self-employed: Incorporated & Sole Proprietor

Incorporated

Self-employed clients who are incorporated and can provide traditional income verification may need to supply:

- Most current T1 General including statements of business activities. To establish a stable income, but also so a lender can see your sources of income.

- Confirmation of no taxes owed

- Accountant prepared company financials supported by business bank statements. To establish your company is in good financial standing and to compare the income level being pulled out of the company is sustainable.

- Current corporate search to confirm business ownership.

Sole Proprietor

Self-employed clients who are sole proprietors and can provide traditional income verification may need to supply:

- Most current T1 General including statements of business activities. To establish a stable income, and so a lender can see their sources of income.

- Confirmation no taxes owed

- One of the following: Business license/registration, trade license, or GST registrations/returns to prove business ownership/partnership

Alternative provable income & other documentation

Alternative provable income verification

This is a proprietary, specialized approach using gross-ups and add-backs available.

Alternative verification of income can be provided via the following documents:

Sole proprietor/partnership

- Most current T1 General

- Confirmation no taxes owed

- Recent financial statements or statement of business activities to indicate a level of income

- One of the following: business license/registration, trade license, or GST registrations/returns to prove business ownership/partnership

Incorporated or limited company

- Most current accountant prepared financials or corporate T2s

- Most current T1 General and confirmation no taxes owed

- Corporate search/articles of incorporation – for business ownership

- Six months of bank statements

Gross-ups and add-backs approach is considered in this instance.

Other documentation

There are other income sources that can help your client’s application get approved.

-

-

- Canada Child Benefit (CCB)

- Alimony/child support

- Government and/or private pension

- Rental property income

- EI benefit for maternity leave

-

Buying a Rental property — this is the income documentation needed.

You can verify rental income via the following:

- Full T1 Generals showing net rental income

- If not reported in T1 General, market rent from an approved appraiser

Verified Income

- A job letter and recent paystub. If the client’s hours aren’t guaranteed, underwriter may also ask for a 2-year income history.

Alternative Proveable Income

Proprietary, specialized approach using gross-ups and add-backs.

Sole Proprieter

- Most current T1 General

- Confirmation no taxes owed

- Recent financial statements or statement of business activities supported by business bank statements

- One of the following: business license/registration, trade license or GST registration/returns

Incorporated or limited company

- Most current accountant prepared financials or corporate T2s

- Most current T1 Generals and confirmation no taxes owed

- Corporate search/articles of incorporation

- Six months bank statements

Prime to be 2% LOWER in 15 months, Dates of drops, Variable rate wins: Fall 2024

Yes, with the writing on the wall for the coming Prime rate decreases the Variable rate is the way to go.

Variable rates are based on Consumer Prime, which moves the exact same as the Bank of Canada’s “overnight rate.” The decreases in the overnight rate will be the same for Consumer Prime and they are below.

So Sept 4, 2024, Prime will go from 6.7% to 6.45%

Canadian Consumer Prime – what Variable Rates are based on – will be these rates here.

If your “discount is Prime – 0.95%” then your rate would be this number below – 0.95%. And as you can see, this is way better than the 3-year fixed at 4.84% or the 5- year fixed at 4.69% today.

- September 4, 2024: 6.45%

- October 23, 2024: 6.20%

- December 11, 2024: 5.95%

- January 2025: 5.70%

- March 2025: 5.45%

- April 2025: 5.20%

- June 2025: 4.95%

- September 2025: 4.70%

- October 2025: 4.45%

- December 2025: 4.20%

Article is here: Bank of Canada’s policy interest rate could dip to 2.75% by late 2025:

forecast:: https://dailyhive.com/vancouver/bank-of-canada-policy-interest-rate-forecast-2025-credit-1

Predictions of the article for the rate drops: Credit 1’s Bank of Canada policy interest rate forecast, as updated on August 26, 2024:

-

- September 4, 2024: 4.25%

- October 23, 2024: 4.0%

- December 11, 2024: 3.75%

- January 2025: 3.5%

- March 2025: 3.5%

- April 2025: 3.25%

- June 2025: 3.25%

- September 2025: 3.0%

- October 2025: 2.75%

- December 2025: 2.75%

Canadian Prime Rate Drops to 4.5%

Horray – the rates are dropping.

We expect to see a total of 2 MORE rate reductions of 0.25% each in 2024.

5 x o.25% reductions are expected in 2025 making the variable the better way to go right now.

Mortgage Mark Herman

DATA

Encouraged by underling trends in the Canadian economy, the Bank of Canada today cut its overnight policy interest rate by 0.25% to 4.50%.

This is the second incremental reduction we’ve seen in as many months and while both cuts have been modest, they are moving Canada toward less restrictive monetary policy.

We summarize the Bank’s rationale for this decision by summarizing its observations below, including its forward-looking comments for signs of what may happen next.

Canadian inflation including shelter inflation

- Inflation measured by the Consumer Price Index moderated to 2.7% in June after increasing in May

- Broad inflationary pressures are easing, and the Bank’s preferred measures of core inflation have been below 3% for several months and the breadth of price increases across components of the CPI is now near its historical norm

- Shelter price inflation remains high, driven by rent and mortgage interest costs, and is still the biggest contributor to total inflation

- Inflation is also elevated in services that are closely affected by wages, such as restaurants and personal care

Canadian economic performance and outlook

- Economic growth “likely” picked up to about 1.5% through the first half of 2024, however, with robust population growth of about 3%, the economy’s potential output is still growing faster than GDP, which means excess supply has increased

- Household spending, including both consumer purchases and housing, has been “weak”

- There are signs of slack in the labour market with the unemployment rate rising to 6.4% and with employment continuing to grow more slowly than the labour force and job seekers taking longer to find work

- Wage growth is showing some signs of moderating, but remains elevated

- GDP growth is forecast to increase in the second half of 2024 and through 2025, reflecting stronger exports and a recovery in household spending and business investment as borrowing costs ease

- Residential investment is expected to grow robustly

- With new government limits on admissions of non-permanent residents, population growth should slow in 2025

Global economic performance and outlook

- The global economy is expected to continue expanding at an annual rate of about 3% through 2026

- While inflation is still above central bank targets in most advanced economies, it is forecast to ease gradually

- In the United States, an anticipated economic slowdown is materializing, with consumption growth moderating and US inflation appearing to resume its downward path

- In the euro area, growth is picking up following a weak 2023

- China’s economy is growing modestly, with weak domestic demand partially offset by strong exports

- Global financial conditions have eased, with lower bond yields, buoyant equity prices, and robust corporate debt issuances

- The Canadian dollar has been relatively stable and oil prices are around the levels assumed in the Bank’s April’s Monetary Policy Report

Summary comments and outlook

The Bank forecasts that Canadian GDP will grow at 1.2% in 2024, 2.1% in 2025, and 2.4% in 2026 and that a strengthening economy will gradually absorb excess supply through 2025 and into 2026.

As a result of an easing in broad price pressures, the Bank expects inflation to move closer to 2%, its long-stated goal. As a result, the Bank’s Governing Council decided to reduce the policy interest rate by 25 basis points.

It further noted that while ongoing excess supply is lowering inflationary pressures, price pressures in some important parts of the economy—notably shelter and some other services—are “holding inflation up.”

Accordingly, the Bank said it is carefully assessing these “opposing forces.” Monetary policy decisions therefore will be guided by incoming information and the Bank’s assessment of the implications for the inflation outlook.

Once again, the statement noted in conclusion that the Bank remains “resolute in its commitment to restoring price stability for Canadians.”

Next Up

The Bank returns on September 4th with its next monetary policy announcement.

Prime now 6.95% from 7.20%: BoC reduces its benchmark interest rate to 4.75%

Today, the Bank of Canada reduced its overnight policy interest rate by 0.25% to 4.75%. This welcome and widely expected decision comes on the heels of evidence pointing to a deceleration of the rate of inflation.

SUMMARY:

The “overnight rate” being quoted is the rate that Banks borrow from each other at, not consumer Prime, which is confusing.

Canadian Consumer Prime has just been reduced from 7.20% to 6.95% – this only affects Variable Rate mortgages.

Fixed rates remain unchanged because they track the Canadian Mortgage Bond Rates which are different, and similar.

There has also been about 40 “silent” fixed rate reductions of o.o5% each in 2024 that the press did not cover.

Mortgage Mark Herman, Top best Calgary Alberta mortgage broker specializing in 1st time buyers

Below we examine the Bank’s rationale for this move by summarizing its observations below, including its all-important outlook comments that are sure to shape market expectations for the remainder of the year.

Canadian inflation

- Inflation measured by the Consumer Price Index (CPI) eased further in April to 2.7%

- The Bank’s preferred measures of core inflation also slowed and three-month indicators suggest continued downward momentum

- Indicators of the breadth of price increases across components of the CPI have moved down further and are near their historical average, however, shelter price inflation remains high

Canadian economic performance and housing

- Economic growth resumed in the first quarter of 2024 after stalling in the second half of last year

- At 1.7%, first-quarter GDP growth was slower than the Bank previously forecast with weaker inventory investment dampening activity

- Consumption growth was solid at about 3%, and business investment and housing activity also increased

- Labour market data show Canadian businesses continue to hire, although employment has been growing at a slower pace than the working-age population

- Wage pressures remain but look to be moderating gradually

- Overall, recent data suggest the economy is still operating in excess supply

Global economic performance and bond yields

- The global economy grew by about 3% in the first quarter of 2024, broadly in line with the Bank’s April Monetary Policy Report projection

- The U.S. economy expanded more slowly than was expected, as weakness in exports and inventories weighed on activity

- In the euro area, activity picked up in the first quarter of 2024 while China’s economy was also stronger in the first quarter, buoyed by exports and industrial production, although domestic demand remained weak

- Inflation in most advanced economies continues to ease, although progress towards price stability is “bumpy” and is proceeding at different speeds across regions

- Oil prices have averaged close to the Bank’s assumptions, and financial conditions are little changed since April

Summary comments and outlook

The Bank cited continued evidence that underlying inflation is easing for its decision to change its policy interest rate. More specifically, it said that “monetary policy no longer needs to be as restrictive.”

Also welcome was the Bank’s statement that “recent data” have “increased our confidence that inflation will continue to move towards” its 2% target.

However, it also added this to its outlook: “Nonetheless, risks to the inflation outlook remain. Governing Council is closely watching the evolution of core inflation and remains particularly focused on the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behaviour.”

And has it has been doing for some time, it said the Bank “remains resolute in its commitment to restoring price stability for Canadians.”

Next up

The Bank returns on July 24th with its next monetary policy announcement – I think they will do another 0.25% reduction at the next meeting and they will continue to reduce at every meeting for the next 3 meetings this year.

Current Risks to the Canadian Mortgage Market? May 15th, 2024

Summary:

May 21, 2024 is when the inflation a report comes out and it should be the determining factor if the Canadian PRIME RATE of INTEREST is reduced from 7.2% in June or not. Maybe July. Maybe later.

Nobody is buying anything big right now, which is the idea … to reduce inflation.

Which means now is the best time to buy a home before everyone waiting for rates to drop jumps in on the 1st Prime rate reduction.

Says Mortgage Mark Herman, Calgary Alberta best/ top/ mortgage broker for first time home buyers

DATA:

Mortgage holders have been anxiously waiting for the Bank of Canada to cut interest rates. The increase of 90,400 jobs in April – 5 times what analysts expected – has heightened concerns that the Bank will continue to wait before lowering rates. 🙁

While the economy has not slowed as much as expected, there’s growing economic slack, with the jobless rate up 1 percentage point over the past year and a 24% year-over-year increase in the number of unemployed individuals, which is slowing down wage growth. The crucial factor in determining whether a rate cut will occur in June or be postponed to later this year hinges on the April CPI release scheduled for May 21st.

In the background of these deliberations, the Bank of Canada also assesses various potential risks to the economy. Last week, the Bank released its Financial Stability Report, highlighting two key risks: debt serviceability and asset valuations.

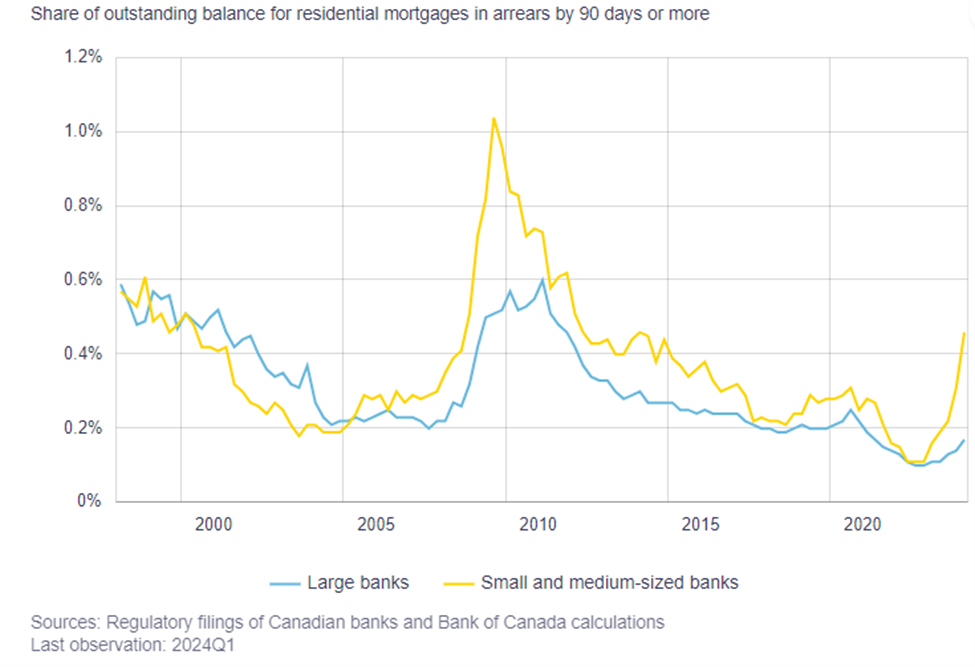

The report notes that the share of mortgage holders who are behind on their credit cards and auto loan payments, which had hit historic lows during the pandemic, has now returned to more normal levels. It also notes that smaller mortgage lenders are seeing an uptick in credit arrears. This increase isn’t surprising, given the run up in rates and the market segment that these lenders cater to. While the arrears rate is up, it remains relatively low compared to historical levels.

This overall positive portfolio performance is due to two key factors: 1) financial flexibility and 2) employment.

Canadian mortgage defaults tend to spike up during periods of rising unemployment. While the unemployment rate has risen, it remains relatively low. Additionally, mortgagors are holding higher levels of liquid assets. Before the pandemic, homeowners with a mortgage held 1.2 months of liquid reserves, which increased to 2.2 months during the pandemic and has since fallen to 1.8 months. These increased reserves provide a solid buffer for mortgagors to meet unexpected increases in expenses.

The Bank remains concerned that nearly half of all outstanding mortgages have yet to be renewed, leaving these borrowers at risk of payment shock due to the increase in interest rates. Scotiabank is an interesting case because, unlike other banks, it offers adjustable-rate mortgages (ARM) with variable payments instead of variable rate mortgages with fixed payments. Scotia has seen its 90+ days past due rate increase from 0.09% to 0.16%. During their fourth-quarter earnings call, Scotia noted that ARM borrowers have been cutting back on discretionary spending by 11% year-over-year, compared to a 5% reduction among fixed-rate clients.

The mortgage maturity profile in the Financial Stability Report suggests that we could see significant slowing in consumer discretionary spending over the next two years. While the rise in debt-servicing costs will be partially offset by income growth, we should expect to see belt tightening by mortgage holders. This poses less of a risk to the banking sector mortgage market than to the overall outlook for the economy.