Bank of Canada Lowers Consumer Prime to 4.95%

The Bank of Canada lowers its benchmark interest rate to 2.75%

In the face of significant geopolitical tensions, the Bank of Canada announced today that it has lowered its policy interest rate by 25 basis points. This marks the seventh reduction since June of 2024.

Below, we summarize the Bank’s commentary.

Canadian Economic Performance and Housing

- Canada’s economy grew by 2.6% in the fourth quarter of 2024 following upwardly revised growth of 2.2% in the third quarter

- This “growth path” is stronger than was expected when the Bank last reported in January 2025

- Past cuts to interest rates have boosted economic activity, particularly consumption and housing

- However, economic growth in the first quarter of 2025 will likely slow as the intensifying trade conflict weighs on sentiment and activity

- Recent surveys suggest a sharp drop in consumer confidence and a slowdown in business spending as companies postpone or cancel investments

- The negative impact of slowing domestic demand has been partially offset by a surge in exports in advance of tariffs being imposed

- The Canadian dollar is broadly unchanged against the US dollar but weaker against other currencies

Canadian Inflation and Outlook

- Inflation remains close to the Bank’s 2% target

- The temporary suspension of the GST/HST lowered some consumer prices, but January’s Consumer Price Index was “slightly firmer” than expected at 1.9%

- Inflation is expected to increase to about 2.5% in March with the end of the tax break

- The Bank’s preferred measures of core inflation remain above 2%, mainly because of the persistence of shelter price inflation

- Short-term inflation expectations have risen in light of fears about the impact of tariffs on prices

Canadian Labour Market

- Employment growth strengthened in November through January and the unemployment rate declined to 6.6%

- In February, job growth stalled

- While past interest rate cuts have boosted demand for labour in recent months, there are warning signs that heightened trade tensions could disrupt the recovery in the jobs market

- Meanwhile, wage growth has shown signs of moderation

Global Economic Performance, Bond Yields and the Canadian Dollar

- After a period of solid growth, the US economy looks to have slowed in recent months, but US inflation remains slightly above target

- Economic growth in the euro zone was modest in late 2024

- China’s economy has posted strong gains, supported by government policies

- Equity prices have fallen and bond yields have eased on market expectations of weaker North American growth

- Oil prices have been volatile and are trading below the assumptions in the Bank’s January Monetary Policy Report

Rationale for a rate cut

While the Bank offered that economic growth came in stronger than it expected, the pervasive uncertainty created by continuously changing US tariff threats is restraining consumers’ spending intentions and businesses’ plans to hire and invest. Against this background, and with inflation close to the 2% target, the Bank decided to reduce its policy rate by 25 basis points.

Outlook

The Bank notes that the Canadian economy entered 2025 “in a solid position,” with inflation close to its 2% target and “robust” GDP growth. However, heightened trade tensions and tariffs imposed by the United States will likely slow the pace of economic activity and increase inflationary pressures in Canada. The economic outlook continues to be subject to more-than-usual uncertainty because of the rapidly evolving policy landscape.

Final comments

The Bank noted that monetary policy “cannot offset the impacts of a trade war.” What monetary policy “can and must do” is ensure that higher prices do not lead to ongoing inflation.

The Bank said it will carefully assess: i) the timing and strength of both the downward pressures on inflation from a weaker economy and ii) the upward pressures on inflation from higher costs. It will also closely monitor inflation expectations.

It ended its statement by saying it is committed to maintaining price stability for Canadians.

More scheduled BoC news

The Bank is scheduled to make its third policy interest rate decision of 2025 on April 16th.

Prime to be 2% LOWER in 15 months, Dates of drops, Variable rate wins: Fall 2024

Yes, with the writing on the wall for the coming Prime rate decreases the Variable rate is the way to go.

Variable rates are based on Consumer Prime, which moves the exact same as the Bank of Canada’s “overnight rate.” The decreases in the overnight rate will be the same for Consumer Prime and they are below.

So Sept 4, 2024, Prime will go from 6.7% to 6.45%

Canadian Consumer Prime – what Variable Rates are based on – will be these rates here.

If your “discount is Prime – 0.95%” then your rate would be this number below – 0.95%. And as you can see, this is way better than the 3-year fixed at 4.84% or the 5- year fixed at 4.69% today.

- September 4, 2024: 6.45%

- October 23, 2024: 6.20%

- December 11, 2024: 5.95%

- January 2025: 5.70%

- March 2025: 5.45%

- April 2025: 5.20%

- June 2025: 4.95%

- September 2025: 4.70%

- October 2025: 4.45%

- December 2025: 4.20%

Article is here: Bank of Canada’s policy interest rate could dip to 2.75% by late 2025:

forecast:: https://dailyhive.com/vancouver/bank-of-canada-policy-interest-rate-forecast-2025-credit-1

Predictions of the article for the rate drops: Credit 1’s Bank of Canada policy interest rate forecast, as updated on August 26, 2024:

-

- September 4, 2024: 4.25%

- October 23, 2024: 4.0%

- December 11, 2024: 3.75%

- January 2025: 3.5%

- March 2025: 3.5%

- April 2025: 3.25%

- June 2025: 3.25%

- September 2025: 3.0%

- October 2025: 2.75%

- December 2025: 2.75%

Prime Rate Holding, July 1st Expected Reduction & Real Estate Economic Data

The Bank of Canada cited the ongoing risk of inflation for its decision to maintain its overnight benchmark interest rate at 5.0%.

Below are the Bank of Canada’s observations, including its forward-looking comments on the state of the economy, inflation and interest rates.

Canadian inflation

- CPI inflation ended the year at 3.4% and the Bank expects inflation to remain close to 3% during the first half of 2024 “before gradually easing” and returning to the Bank’s 2% target in 2025

- Shelter costs remain “the biggest contributor to above-target inflation”

- While a slowdown in demand is said by the Bank to be reducing price pressures in a broader number of CPI components and corporate pricing behavior continues to normalize, core measures of inflation are not showing sustained declines.

Canadian economic performance and outlook

- The Bank notes that the Canadian economy has “stalled” since the middle of 2023 and believes growth will likely remain close to zero through the first quarter of 2024

- Consumers have pulled back their spending in response to higher prices and interest rates, and business investment has contracted

- With weak growth, supply has caught up with demand and the economy now looks to be operating in modest excess supply

- Labour market conditions have eased, with job vacancies returning to near pre-pandemic levels and new jobs being created at a slower rate than population growth. However, wages are still rising around 4% to 5%

Global economic performance and outlook

- Global economic growth continues to slow, with inflation easing “gradually” across most economies

- While growth in the United States has been stronger than expected, it is anticipated to slow in 2024, with weakening consumer spending and business investment

- In the euro area, the economy looks to be in a mild contraction

- In China, low consumer confidence and policy uncertainty will likely restrain activity

- Oil prices are about $10 per barrel lower than was assumed in the Bank’s October Monetary Policy Report (MPR)

- Financial conditions have eased, largely reversing the tightening that occurred last autumn

- The Bank now forecasts global GDP growth of 2.5% in 2024 and 2.75% in 2025 compared to 2023’s 3% pace

- With softer growth this year, inflation rates in most advanced economies are expected to come down slowly, reaching central bank targets in 2025

Outlook

The Bank believes that Canadian economic growth will strengthen gradually “around the middle of 2024.” Furthermore, it expects household spending will likely “pick up” in the second half of 2024, and exports and business investment should get a boost from recovering foreign demand.

Taking all of these factors and forecasts into account, the Bank’s Governing Council decided to hold its policy rate at 5% and to continue to “normalize” the Bank’s balance sheet.

The Bank’s statement went on to note that Council “is still concerned about risks to the outlook for inflation, particularly the persistence in underlying inflation” and wants to see “further and sustained easing in core inflation.” The Bank also said it continues to focus on the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behaviour.

As it has said consistently over the past year, the Bank will remain “resolute in its commitment to restoring price stability for Canadians.”

Although the Bank did not say it, the bottom line is we will have to wait and see what comes next.

Next touchpoint

March 6, 2024 is the Bank’s next scheduled policy interest rate announcement.

Details of Canadian Economic & Housing Market Performance, as at Dec 7, 2022

Bank of Canada increased Consumer Prime to 6.45% – exactly as expected for the last 5 months. January 25th is the next BoC interest rate announcement & I hope it is a 0.25% increase and then holds there for all of 2023. We will see…

Mortgage Mark Herman, Best Calgary mortgage broker with a Master’s degree in Finance.

Today, the Bank of Canada increased its overnight benchmark interest rate 50 basis point to 4.25% from 3.75% in October. This is the 7th time this year that the Bank has addressed inflation and means the policy rate is now as high as it has been in 15 years.

We summarize the Bank’s observations below, including its forward-looking comments on the need/likelihood of future rate increases below:

Canadian inflation

- CPI inflation remained at 6.9% in October, with many of the goods and services Canadians regularly buy showing large price increases

- Measures of core inflation “remain around 5%”

- Three-month rates of change in core inflation have come down, “an early indicator that price pressures may be losing momentum”

Canadian Economic and housing market performance

- GDP growth in the third quarter was stronger than expected, and the economy continued to operate “in excess demand”

- The labor market remains “tight” with unemployment near historic lows

- While commodity exports have been strong, there is growing evidence that tighter monetary policy is restraining domestic demand: consumption moderated in the third quarter

- Housing market activity continues to decline

- Data since the October Monetary Policy Report supports the Bank’s outlook that growth will essentially stall” through the end of this year and the first half of 2023

Global inflation and economic performance

- Inflation around the world remains high and broadly based

- Global economic growth is slowing, although it is proving more resilient than was expected at the time of the Bank’s October Monetary Policy Report

- In the United States, the economy is weakening but consumption continues to be solid and the labor market remains “overheated”

- The gradual easing of global supply bottlenecks continues, although further progress could be disrupted by geopolitical events

Outlook

Although the Bank’s commentary noted that price pressures that are driving high inflation may be losing momentum, it went on to say that inflation is “still too high” and that short-term “inflation expectations remain elevated.” In the Bank’s view, the longer that Canadian consumers and businesses expect inflation to be above the Bank’s 2% target, “the greater the risk that elevated inflation becomes entrenched.”

Given these economic signals, the Bank’s Governing Council stated that it “will be considering whether the policy interest rate needs to rise further to bring supply and demand back into balance and return inflation to target.”

It concluded its statement with a familiar refrain: “We are resolute in our commitment to achieving the 2% inflation target and restoring price stability for Canadians.”

Analysts and commentators will seek to interpret those outlook comments for signs that the Bank has reached or believes it is close to reaching the terminal point in its current rate-hike cycle. For now, that remains a question of debate and speculation that will turn on future economic signals.

Next Touchpoint

January 25th is the next BoC interest rate announcement. I hope it is a 0.25% increase and then holds there for all of 2023. We will see…

Canadian Prime Rate is now 5.95% – Mortgage Rate Analysis to End of 2022

Bank of Canada increased benchmark interest rate to 3.75%

Today, the Bank of Canada increased its overnight benchmark interest rate 50 basis point to 3.75% from 3.25% in September. This is the sixth time this year that the Bank has tightened money supply to quell inflation, so far with limited results.

Some economists had assumed the increase this time around would be higher, but the BoC decided differently based on its expert economic analysis. We summarize the Bank’s observations below, including its all-important outlook:

Inflation at home and abroad

- Inflation around the world remains high and broadly based reflecting the strength of the global recovery from the pandemic, a series of global supply disruptions, and elevated commodity prices

- Energy prices particularly have inflated due to Russia’s attack on Ukraine

- The strength of the US dollar is adding to inflationary pressures in many countries

- In Canada, two-thirds of Consumer Price Index (CPI) components increased more than 5% over the past year

- Near-term inflation expectations remain high, increasing the risk that elevated inflation becomes entrenched

Economic performance at home and abroad

- Tighter monetary policies aimed at controlling inflation are weighing on economic activity around the world

- In Canada, the economy continues to operate in excess demand and labour markets remain tight while Canadian demand for goods and services is “still running ahead of the economy’s ability to supply them,” putting upward pressure on domestic inflation

- Canadian businesses continue to report widespread labour shortages and, with the full reopening of the economy, strong demand has led to a sharp rise in the price of services

- Domestic economic growth is “expected to stall” through the end of this year and the first half of next year as the effects of higher interest rates spread through the economy

- The Bank projects GDP growth will slow from 3.25% this year to just under 1% next year and 2% in 2024

- In the United States, labour markets remain “very tight” even as restrictive financial conditions are slowing economic activity

- The Bank projects no growth in the US economy “through most of next year”

- In the euro area, the economy is forecast to contract in the quarters ahead, largely due to acute energy shortages

- China’s economy appears to have picked up after the recent round of pandemic lockdowns, “although ongoing challenges related to its property market will continue to weigh on growth”

- The Bank projects global economic growth will slow from 3% in 2022 to about 1.5% in 2023, and then pick back up to roughly 2.5% in 2024 – a slower pace than was projected in the Bank’s July Monetary Policy Report

Canadian housing market

- The effects of recent policy rate increases by the Bank are becoming evident in interest-sensitive areas of the economy including housing

- Housing activity has “retreated sharply,” and spending by households and businesses is softening

Outlook

The Bank noted that its “preferred measures of core inflation” are not yet showing “meaningful evidence that underlying price pressures are easing.” It did however offer the observation that CPI inflation is projected to move down to about 3% by the end of 2023, and then return to its 2% target by the end of 2024. This presumably would be achieved as “higher interest rates help re-balance demand and supply, price pressures from global supply chain disruptions fade and the past effects of higher commodity prices dissipate.”

As a consequence of elevated inflation and current inflation expectations, as well as ongoing demand pressures in the economy, the Bank’s Governing Council said to expect that “the policy interest rate will need to rise further.”

The level of such future rate increases will be influenced by the Bank’s assessments of “how tighter monetary policy is working to slow demand, how supply challenges are resolving, and how inflation and inflation expectations are responding.”

In case there was any doubt, the Bank also reiterated its “resolute commitment” to restore price stability for Canadians and said it will continue to take action as required to achieve its 2% inflation target.

NEXT RATE INCREASE

December 7, 2022 is the BoC’s next scheduled policy interest rate announcement. We will follow the Bank’s commentary and outlook closely and provide an executive summary here the same day.

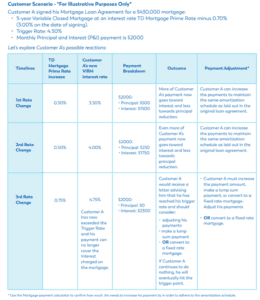

Trigger Point for Canadian Variable Rate Mortgages Explained, with Example

You have likely heard – or will soon be hearing – a lot of talk about “trigger rates” and “trigger points”. More importantly, you are probably hearing “trigger point” together along with more changes in the Bank of Canada rate and you need expert guidance.

Let’s start with a few definitions:

- Variable Rate Mortgage (VRM) – prime changes, rate changes. When interest rates change, typically, your mortgage payment will stay the same.

- Adjustable Rate Mortgage (ARM) – prime changes, rate changes. Unlike variable rate, your mortgage payment will change when interest rates change.

- Trigger Rate – When interest rates increase to the point that regular principal and interest payments no longer cover the interest charged, interest is deferred, and the principal balance (total cost) can increase until it hits the trigger point.

- Trigger Point – When the outstanding principal amount (including any deferred interest) exceeds the original principal amount. The lender will notify the customer and inform them of how much the principal amount exceeds the excess amount (Trigger Point). The client then typically has 30 days to make a lumpsum payment; increase the amount of the principal and interest payment; or convert to a fixed rate term.

NOW, WHICH MORTGAGES WILL BE AFFECTED FIRST?

Quick answer, VRMs from March 2020 to March 2022.

During the month of March 2020, the prime rate dropped three times in quick succession from 3.95% to 2.45%, and variable-rate mortgages arranged while prime was 2.45% have the lowest payments. The lower the interest rate was, the lower the trigger rate, and the faster your client may hit this negative amortization.

WHAT TO DO

When this happens, customers are contacted by the lender and generally have three ways they can proceed:

- Make a lump-sum payment against the loan amount

- Convert with a new loan at a fixed-rate term

- Increase their monthly payment amount to pay off their outstanding principal balance within their remaining original amortization period

Below is a customer scenario so you can see how this could play out.

Nov 2021; Mortgage Rates & Inflation Report

This just in data is when mortgage interest rates are expected to rise.

DATA JUST IN

Canada’s latest employment and inflation numbers have triggered new expectations about the next steps by the Bank of Canada and the arrival of interest rate increases.

BoC Governor Tiff Macklem continues to offer soothing words about inflation, which is current running at 4.1%. That is an 18 year high and more than double the central bank’s 2.0% target.

Macklem has repeatedly said high inflation is temporary; the result of low prices during the pandemic lock-downs, and supply chain problems that have cropped-up as the economy reopens.

Macklem points out that a key factor in long term inflation – wage growth – has not materialized. That is despite Canada returning to pre-pandemic employment levels with the addition of 157,000 jobs in September. It should be noted that the growth of Canada’s labour force during the pandemic means the country is still 276,000 jobs short of full employment. Last week however, Macklem did concede that this temporary inflation may linger for longer than initially expected.

Several prominent economists have weighed-in. Benjamin Tal cautions that inflation is a lagging economic indicator. He says the risks for long-term inflation are present and the Bank of Canada would be better to start raising rates earlier to help mitigate those risks. Doug Porter says there is a growing chance rate increases will come earlier. He expects they will happen quarterly rather than every six months. And, Derek Holt would like to see a rate hike by the end of the year, given that emergency levels of stimulus are in place while inflation is well above target.

Look for mortgage interest rates to start going up close to the end of 2021 and continue until they are back close to PRE-Covid Rates of about 3.35% for the 5-year fixed.

Mortgage Mark Herman, best Calgary mortgage broker for the masses!

How the Big-5 Banks Trap You in Their Mortgages

- what your credit score is

- your pay and income going into your accounts

- your debt payments

- other debt balances on your credit report

- your home/ rental addresses so they can accurately guess at your home value.

Highlights of the article link below are:

Canada’s biggest banks are tightening their grip … as new rules designed to cut out risky lending make it harder for borrowers to switch lenders … the country’s biggest five banks … are reporting higher rates of renewals by existing customers concerned they will not qualify for a mortgage with another bank.

“B-20 has created higher renewal rates for the big banks, driving volumes and goosing their growth rates,” said Eight Capital analyst Steve Theriault. “It’s had the unintended consequence of reducing competition.”

Royal Bank of Canada (RBC), the country’s biggest lender, said last month that mortgage renewal rates [are up …] due in part to the B-20 regulations and also to improvements it has made to make it easier for customers to renew.

Ron Butler, owner of Toronto-based brokerage Butler Mortgage, said the changes leave borrowers with less choice.

“Even if they are up-to-date with their repayments, borrowers may find they don’t qualify with other lenders so they’re stuck with their bank at whatever rate it offers,” he said.

Senior Canadian bankers such as RBC … and TD … voiced their support for the new rules prior to their introduction, saying rising prices were a threat to Canada’s economy.

While analysts say RBC and TD are expected to benefit from higher-than-normal retention rates in 2019, not everyone is sure borrowers will benefit.

“The banks are becoming more sophisticated in targeting borrowers who would fail the stress test and they can charge them higher rates at renewal knowing they can’t move elsewhere,” Butler said.

Link to the full article is here: https://business.financialpost.com/news/fp-street/canadas-big-banks-tighten-grip-on-mortgage-market-after-rule-changes

We saw the “Mortgage Renewal Trap” coming long ago when the Stress Test was announced. It is more important than ever to consider Mortgage Broker Lenders for your mortgage now.

Mark Herman, Top Calgary Alberta Mortgage Broker.

A lesson from RBC’s mortgage rate increase

I love this article from the Globe as it explains why rates are going up a bit and what expectaions are for the near term.

Call for a rate hold if you are thinking of buying in the next 4 months!

“Borrowers who use a mortgage broker pay less …,” Bank of Canada.

See our reviews here: http://markherman.ca/CustomerREVIEWS.ubr

Mark Herman, Top best Calgary mortgage broker

The lesson home buyers should take from RBC’s mortgage rate hike

NO Condo Bubble in Calgary nor Toronto!

These comments below are in addition to the report last week that said that because Toronto has:

-

lots of in-migration,

-

New to Canada migration and

-

no other kinds of homes being built in the inner city

they do need all of these new condos and it is not a bubble. Interesting.

Economists to condo investors: Smile!

Written by Vernon Clement Jones

Condo investors in Toronto have every reason to be keep smiling, with two separate bank reports suggesting their assets are almost certain to retain their value at the same time their cash flow gets buoyed by rental demand.

“As CMHC… mentioned, capital return for investors who bought new condominiums and decided to rent them once the construction was complete, could earn superior returns than on other investment products,” reads Laurentian Banks’ July economic outlook. “Furthermore, condominiums rents are generally 40% more expensive than apartments of same dimensions in the Toronto CMA, the most important spread in the whole country.”

Smiling yet?

There’s more.

RBC is also weighing in on the future of Canada’s most controversial housing market, suggesting there’s no indication condos, despite what most see as a glut of inventory, are in a bubble.

Far from it.

“Based on market activity to date,” say economists for the heftiest of Canada’s big banks, “the total number of new housing units (condos) completed by builders has not exceeded the GTA’s demographic requirements and is unlikely to do so by any significant magnitude in the next few years.”

Phew!

That dual analysis effectively counters concerns that T.O.’s high-rise properties are primed to fall in value as renters find themselves spoiled for choice and investors are forced to slash prices. The naysayers are also worried that even new construction will be subjected to a major price correction and in the short-term, a phenomenon directly tied to mortgage rule changes making it harder to win financing.

That could, in fact, still happen, although not likely on the scale many analysts had predicted earlier this year, says Laurentian in its analysis.